Key Insights

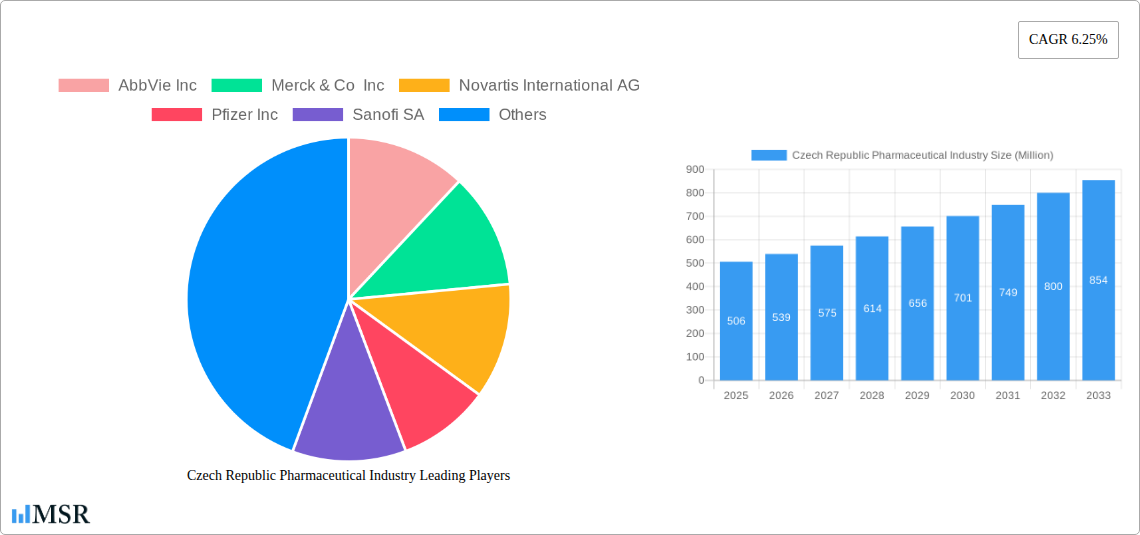

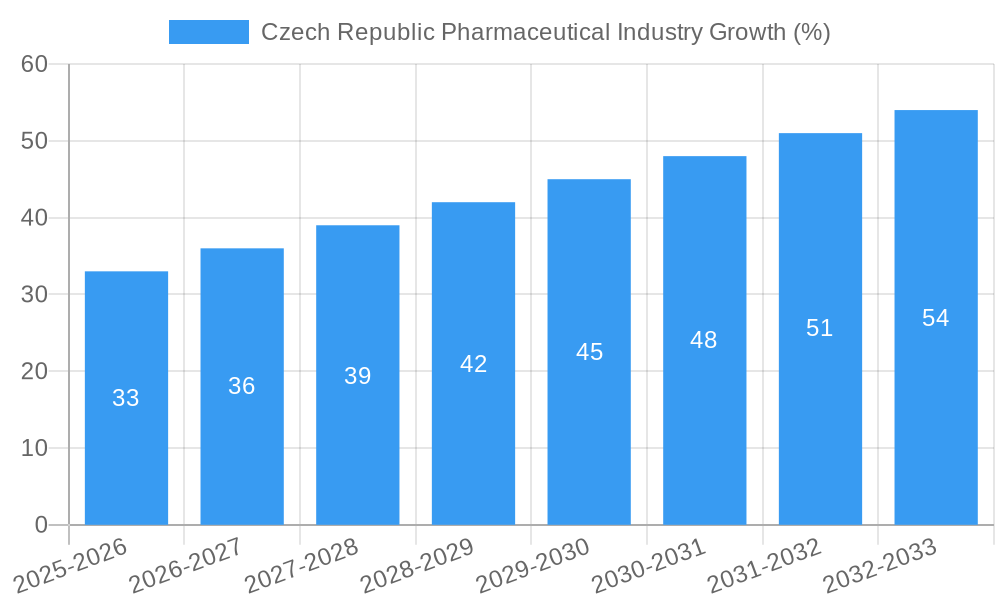

The Czech Republic's pharmaceutical market, valued at approximately €506 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033. This expansion is fueled by several key factors. An aging population necessitates increased demand for chronic disease management medications, driving sales of pharmaceuticals across various therapeutic areas. Furthermore, rising healthcare expenditure, coupled with increasing health awareness among citizens, contributes significantly to market growth. Government initiatives promoting affordable access to essential medicines and a favorable regulatory environment also stimulate market activity. However, price pressures from generic drug competition and potential fluctuations in healthcare spending remain as challenges. The market is highly concentrated, with major multinational pharmaceutical companies like AbbVie, Merck, Novartis, Pfizer, Sanofi, Roche, AstraZeneca, Eli Lilly, and GlaxoSmithKline holding substantial market share. These companies leverage their extensive research and development capabilities to introduce innovative therapies catering to unmet medical needs within the Czech Republic. Competition is likely to intensify with the introduction of biosimilars and further generic penetration. The market segmentation is largely determined by therapeutic areas, with cardiovascular drugs, oncology medications, and central nervous system treatments likely holding prominent positions. Successful players will need to adapt to shifting market dynamics by focusing on strategic partnerships, innovative product launches, and efficient supply chain management.

The forecast period (2025-2033) anticipates continued expansion, with projected market size exceeding €800 million by 2033. This growth trajectory is contingent upon sustained economic stability, continued government support for healthcare infrastructure, and the successful introduction of new and effective pharmaceutical treatments. The Czech pharmaceutical market presents a compelling investment opportunity, albeit one that demands close monitoring of regulatory changes, competitive landscape shifts, and evolving healthcare policies. A proactive approach to addressing challenges, while capitalizing on growth drivers, will be crucial for success within this dynamic market.

Czech Republic Pharmaceutical Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Czech Republic pharmaceutical industry, encompassing market dynamics, key players, emerging trends, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry stakeholders, investors, and researchers seeking actionable insights into this dynamic market.

Czech Republic Pharmaceutical Industry Market Concentration & Dynamics

The Czech Republic pharmaceutical market exhibits a moderately concentrated structure, with several multinational giants holding significant market share. Key players such as AbbVie Inc, Merck & Co Inc, Novartis International AG, Pfizer Inc, Sanofi SA, F Hoffmann-La Roche AG, AstraZeneca PLC, Eli Lilly and Company, and GlaxoSmithKline PLC dominate the landscape, although the exact market share distribution for each company remains xx. However, this is not an exhaustive list, and numerous smaller local and international players contribute to the market’s vibrancy.

- Market Concentration: xx% market share held by top 5 players (estimated).

- Innovation Ecosystems: The Czech Republic possesses a developing but promising innovation ecosystem, fostered by research institutions like Masaryk University and collaborations with multinational companies.

- Regulatory Frameworks: The State Institute for Drug Control (SUKL) plays a vital role in regulating the market, ensuring drug safety and efficacy. This regulatory framework is broadly aligned with EU standards.

- Substitute Products: The availability of generic drugs and over-the-counter medications influences market dynamics and pricing strategies.

- End-User Trends: Growing awareness of health and wellness fuels demand for innovative pharmaceutical products, particularly in chronic disease management.

- M&A Activities: The number of M&A deals in the Czech pharmaceutical sector averaged xx annually during the historical period (2019-2024), indicating moderate consolidation activity.

Czech Republic Pharmaceutical Industry Industry Insights & Trends

The Czech Republic pharmaceutical market is projected to experience robust growth during the forecast period (2025-2033). The market size in 2025 is estimated at USD xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Several factors contribute to this positive outlook. Increased government spending on healthcare, a burgeoning aging population requiring more medication, and the growing prevalence of chronic diseases like diabetes and cardiovascular conditions all fuel market expansion. Furthermore, technological advancements in drug discovery and delivery systems contribute to the market's dynamism. Evolving consumer behavior, with increasing demand for personalized medicine and convenient access to pharmaceuticals, further shapes the industry landscape.

Key Markets & Segments Leading Czech Republic Pharmaceutical Industry

The Czech Republic pharmaceutical market is geographically concentrated, with major cities like Prague and Brno accounting for a significant portion of sales. However, the market is relatively homogenous across the country, with no single region exhibiting disproportionate dominance.

- Growth Drivers:

- Steady economic growth in the Czech Republic.

- Government support for healthcare infrastructure development.

- Increasing health awareness among the population.

- Growing demand for innovative therapies.

The pharmaceutical market is segmented by therapeutic area, with segments like cardiovascular drugs, oncology drugs, and central nervous system drugs holding substantial shares. The dominance of these segments stems from the high prevalence of related diseases within the population.

Czech Republic Pharmaceutical Industry Product Developments

Recent years have witnessed significant product innovations, particularly in the areas of biosimilars and targeted therapies. Advancements in drug delivery technologies, such as sustained-release formulations, improve patient compliance and treatment outcomes. These developments enhance the competitive landscape and offer patients more effective treatment options, driving market growth.

Challenges in the Czech Republic Pharmaceutical Industry Market

The Czech Republic pharmaceutical market faces several challenges. Stringent regulatory requirements and lengthy approval processes can delay product launches. Supply chain disruptions, particularly exacerbated by global events, can impact the availability of essential medicines. Furthermore, price competition from generic drugs and increasing pressure to reduce healthcare costs pose significant challenges for manufacturers. The quantifiable impact of these challenges on market growth is estimated to be a xx% reduction in potential growth annually during the forecast period.

Forces Driving Czech Republic Pharmaceutical Industry Growth

Several factors drive growth in the Czech Republic’s pharmaceutical sector. Technological advancements in drug discovery and development contribute to innovation. Economic growth fuels increased healthcare spending, while favorable government policies support the industry's expansion. Moreover, growing awareness of health issues and the rising prevalence of chronic diseases increase demand for pharmaceutical products.

Long-Term Growth Catalysts in the Czech Republic Pharmaceutical Industry Market

Long-term growth catalysts include ongoing innovations in drug development, strategic partnerships between local and international companies, and expansion into new therapeutic areas. Increased investment in research and development, driven by both public and private sectors, will fuel future innovation and growth. The potential entry of new players and innovative business models further accelerates long-term growth.

Emerging Opportunities in Czech Republic Pharmaceutical Industry

Emerging opportunities lie in personalized medicine, telehealth, and the increasing demand for biosimilars. The growing use of digital technologies in healthcare provides avenues for innovation in drug delivery and patient monitoring. Furthermore, the increasing prevalence of chronic diseases creates opportunities for targeted therapies and innovative treatment solutions.

Leading Players in the Czech Republic Pharmaceutical Industry Sector

- AbbVie Inc

- Merck & Co Inc

- Novartis International AG

- Pfizer Inc

- Sanofi SA

- F Hoffmann-La Roche AG

- AstraZeneca PLC

- Eli Lilly and Company

- Novartis International AG

- GlaxoSmithKline PLC

- List Not Exhaustive

Key Milestones in Czech Republic Pharmaceutical Industry Industry

- October 2023: Motagon Cannabis secured approval to import medical cannabis to Prague, marking a significant step in the medical cannabis market's development.

- June 2023: Masaryk University's new biopharma hub received a building permit, promising enhanced research and production capabilities, paving the way for future product innovations.

Strategic Outlook for Czech Republic Pharmaceutical Industry Market

The Czech Republic pharmaceutical market presents significant long-term growth potential, driven by technological advancements, supportive regulatory frameworks, and increasing healthcare spending. Strategic opportunities exist for companies focusing on innovation, personalized medicine, and efficient supply chain management. The market’s future success hinges on adapting to evolving consumer preferences and leveraging technological advancements to improve patient care.

Czech Republic Pharmaceutical Industry Segmentation

-

1. Therapeutic Category

- 1.1. Anti-infectives

- 1.2. Cardiovascular

- 1.3. Gastrointestinal

- 1.4. Anti-diabetic

- 1.5. Respiratory

- 1.6. Dermatologicals

- 1.7. Musculoskeletal System

- 1.8. Nervous System

- 1.9. Other Therapeutic Categories

-

2. Drug Type

-

2.1. Prescription Drug

- 2.1.1. Branded Drugs

- 2.1.2. Generic Drugs

- 2.2. OTC Drugs

-

2.1. Prescription Drug

Czech Republic Pharmaceutical Industry Segmentation By Geography

- 1. Czech Republic

Czech Republic Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Healthcare Expenditure; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Rising Healthcare Expenditure; Rising Incidence of Chronic Disease

- 3.4. Market Trends

- 3.4.1. The Anti-diabetic Segment is Expected to Register Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Czech Republic Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 5.1.1. Anti-infectives

- 5.1.2. Cardiovascular

- 5.1.3. Gastrointestinal

- 5.1.4. Anti-diabetic

- 5.1.5. Respiratory

- 5.1.6. Dermatologicals

- 5.1.7. Musculoskeletal System

- 5.1.8. Nervous System

- 5.1.9. Other Therapeutic Categories

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Prescription Drug

- 5.2.1.1. Branded Drugs

- 5.2.1.2. Generic Drugs

- 5.2.2. OTC Drugs

- 5.2.1. Prescription Drug

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Czech Republic

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AbbVie Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novartis International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pfizer Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sanofi SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 F Hoffmann-La Roche AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eli Lilly and Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novartis International AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GlaxoSmithKline PLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AbbVie Inc

List of Figures

- Figure 1: Czech Republic Pharmaceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Czech Republic Pharmaceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 4: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Therapeutic Category 2019 & 2032

- Table 5: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 6: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Drug Type 2019 & 2032

- Table 7: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 10: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Therapeutic Category 2019 & 2032

- Table 11: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 12: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Drug Type 2019 & 2032

- Table 13: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Czech Republic Pharmaceutical Industry?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the Czech Republic Pharmaceutical Industry?

Key companies in the market include AbbVie Inc, Merck & Co Inc, Novartis International AG, Pfizer Inc, Sanofi SA, F Hoffmann-La Roche AG, AstraZeneca PLC, Eli Lilly and Company, Novartis International AG, GlaxoSmithKline PLC*List Not Exhaustive.

3. What are the main segments of the Czech Republic Pharmaceutical Industry?

The market segments include Therapeutic Category, Drug Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Healthcare Expenditure; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

The Anti-diabetic Segment is Expected to Register Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Healthcare Expenditure; Rising Incidence of Chronic Disease.

8. Can you provide examples of recent developments in the market?

October 2023: Motagon Cannabis (Motagon), a subsidiary of HEATON Group AS (Heaton), completed its import of medical cannabis flower to Prague, Czechia, after receiving approval from Czechia’s State Institute for Drug Control (SUKL) and the Ministry of Health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Czech Republic Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Czech Republic Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Czech Republic Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Czech Republic Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence