Key Insights

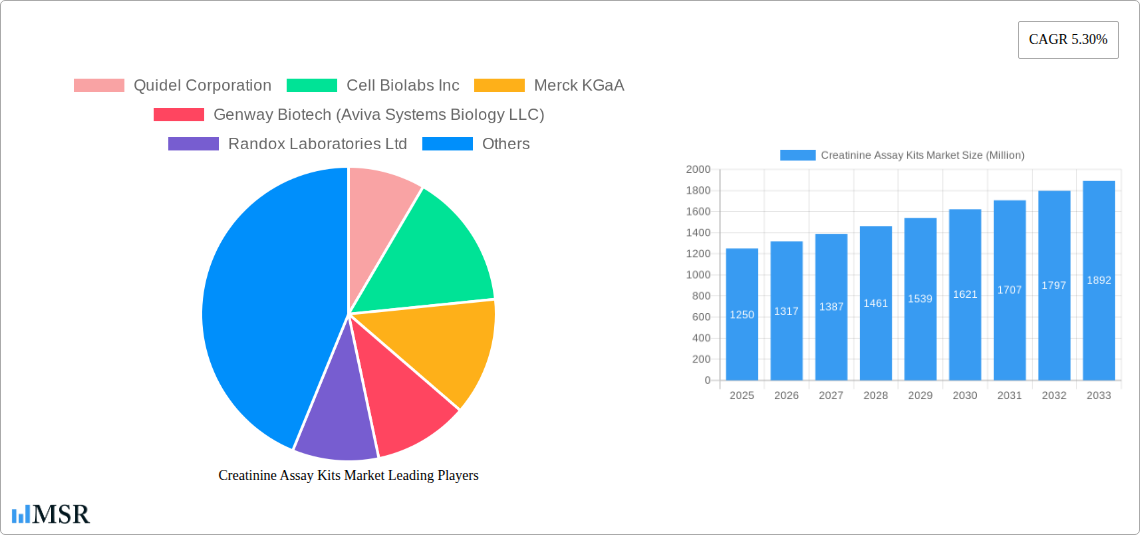

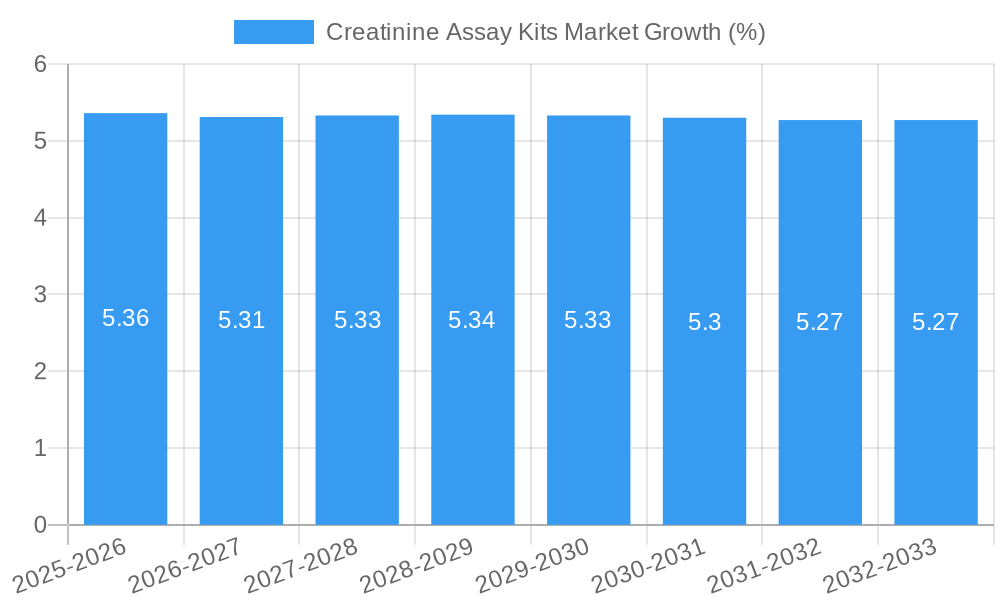

The global Creatinine Assay Kits market is poised for substantial growth, projected to reach a significant market size of approximately $1,250 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5.30% through 2033. This robust expansion is primarily driven by the increasing prevalence of kidney-related diseases, including chronic kidney disease (CKD) and acute kidney injury (AKI), which necessitate regular creatinine monitoring for early detection and management. Furthermore, the growing demand for point-of-care diagnostics and the advancements in immunoassay and enzymatic assay technologies are contributing significantly to market penetration. The rising awareness regarding kidney health, coupled with proactive government initiatives and increasing healthcare expenditure worldwide, is further bolstering the demand for these crucial diagnostic tools. The market is segmented into various test kit types, including Jaffe's Kinetic Test kits, Creatinine-PAP Test kits, and ELISA Test kits, each catering to specific diagnostic needs and laboratory settings. The Blood/Serum segment dominates, reflecting the most common sample type for creatinine analysis, with urine and other samples also representing significant portions of the market.

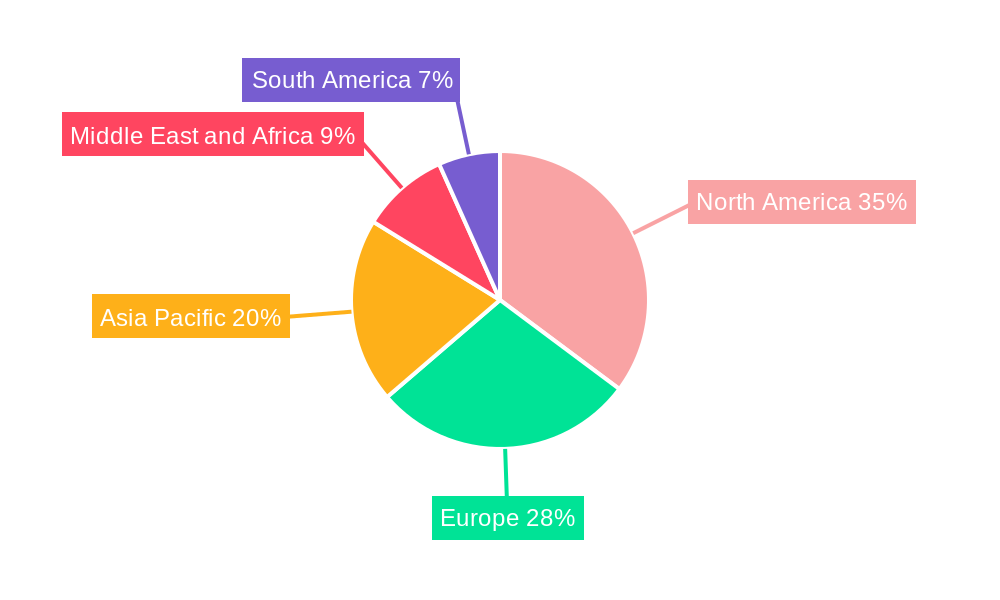

The competitive landscape is characterized by the presence of several key players, including Quidel Corporation, Merck KGaA, Abbott Laboratories, and Thermo Fisher Scientific, who are actively involved in research and development to introduce innovative and cost-effective creatinine assay solutions. Strategic collaborations, mergers, and acquisitions are also shaping the market, aiming to expand product portfolios and geographical reach. Geographically, North America, particularly the United States, currently holds a leading position due to high healthcare spending and a well-established diagnostic infrastructure. However, the Asia Pacific region is expected to witness the fastest growth, driven by an increasing patient population, rising disposable incomes, and improving healthcare accessibility in countries like China, India, and South Korea. Key market restraints include the stringent regulatory approval processes and the availability of alternative diagnostic methods. Despite these challenges, the growing imperative for early and accurate diagnosis of renal dysfunction ensures a promising future for the creatinine assay kits market.

Creatinine Assay Kits Market: Comprehensive Insights, Growth Drivers, and Competitive Landscape (2019–2033)

Unlock critical insights into the burgeoning Creatinine Assay Kits Market with this in-depth, SEO-optimized report. Discover market dynamics, technological advancements, and strategic opportunities shaping the future of kidney function diagnostics. Covering the period from 2019 to 2033, with a base year of 2025, this report offers a deep dive into the competitive landscape, key market segments, and crucial industry developments that are redefining the diagnosis and management of kidney diseases.

Creatinine Assay Kits Market Market Concentration & Dynamics

The global Creatinine Assay Kits Market exhibits a moderate to high level of concentration, driven by a blend of established diagnostic giants and innovative niche players. Companies like Thermo Fisher Scientific, Abbott Laboratories, and Sysmex Corporation command significant market share due to their extensive product portfolios, robust distribution networks, and strong brand recognition in clinical diagnostics. The innovation ecosystem is characterized by continuous research and development focused on improving assay sensitivity, specificity, and turnaround times. Regulatory frameworks, particularly those governed by the FDA in the US and the EMA in Europe, play a pivotal role in market entry and product approvals, ensuring the safety and efficacy of creatinine assay kits. Substitute products, while limited in direct competition for creatinine measurement, include alternative kidney function markers like cystatin C and various imaging techniques. End-user trends highlight a growing demand for point-of-care testing (POCT) solutions, driven by the need for rapid diagnosis and proactive kidney health management. Mergers and acquisitions (M&A) activities are observed as larger players seek to expand their diagnostic offerings and gain access to new technologies or geographical markets. For instance, in the historical period, there were approximately 3-5 significant M&A deals per year focused on diagnostic assay providers. The market share distribution is estimated to be: Thermo Fisher Scientific (15-20%), Abbott Laboratories (12-17%), Sysmex Corporation (10-15%), and other players collectively holding the remaining percentage.

Creatinine Assay Kits Market Industry Insights & Trends

The Creatinine Assay Kits Market is experiencing robust growth, propelled by a confluence of factors that underscore the increasing importance of kidney function assessment in global healthcare. The market size is projected to reach an estimated $750 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period of 2025–2033. This upward trajectory is fundamentally driven by the escalating prevalence of chronic kidney disease (CKD) worldwide, linked to the rise in lifestyle-related ailments such as diabetes and hypertension. Early and accurate detection of kidney dysfunction is paramount, and creatinine assays remain a cornerstone of routine kidney function screening. Technological advancements are continuously refining the performance of these kits. Innovations are focused on developing more sensitive and specific assays that can detect even subtle changes in creatinine levels, enabling earlier intervention. The shift towards multiplexed diagnostic platforms, allowing for the simultaneous measurement of multiple biomarkers, also presents a significant trend, offering greater efficiency and cost-effectiveness.

Furthermore, evolving consumer behaviors, particularly within healthcare, are contributing to market expansion. There's a growing awareness among both patients and healthcare providers regarding the significance of kidney health. This heightened awareness fuels the demand for accessible and reliable diagnostic tools. The decentralization of healthcare services, with an increasing emphasis on point-of-care testing (POCT) and home-based diagnostics, is another critical trend. POCT devices leveraging creatinine assay kits are becoming indispensable in primary care settings, emergency rooms, and remote areas, facilitating immediate diagnosis and reducing the burden on centralized laboratories. The increasing adoption of automated laboratory systems in hospitals and diagnostic centers also bolsters the demand for high-throughput and reliable creatinine assay kits. Economic growth in emerging markets, coupled with expanding healthcare infrastructure, is creating new avenues for market penetration. Government initiatives aimed at improving public health and reducing the burden of chronic diseases further stimulate the demand for diagnostic assays, including creatinine kits. The shift from curative to preventive healthcare models also positions creatinine assay kits as vital tools for proactive health management. The market is projected to witness continued innovation in reagent formulations and assay chemistries to minimize interferences and enhance accuracy across diverse sample types and patient populations.

Key Markets & Segments Leading Creatinine Assay Kits Market

The Creatinine Assay Kits Market is significantly influenced by regional dynamics and segment-specific preferences. North America, particularly the United States, currently leads the market in terms of revenue and adoption. This dominance is attributed to several key drivers:

- Advanced Healthcare Infrastructure: The presence of well-established healthcare systems, a high density of diagnostic laboratories, and widespread adoption of advanced medical technologies in the US and Canada contribute to a substantial demand for creatinine assay kits.

- High Prevalence of Kidney Diseases: The region exhibits a high prevalence of CKD, largely due to the significant patient populations suffering from diabetes and hypertension, making routine kidney function monitoring a necessity.

- Reimbursement Policies: Favorable reimbursement policies for diagnostic tests in these countries encourage frequent testing and the adoption of high-quality assay kits.

- Research and Development Investments: Significant investments in R&D by leading market players in North America lead to the development and commercialization of innovative creatinine assay solutions.

Within this leading region, specific market segments are also experiencing substantial growth:

- Type of Sample: Blood/Serum: Blood and serum samples remain the most preferred matrices for creatinine analysis due to their widespread availability and ease of collection. The demand for reliable and rapid blood-based creatinine assays is continuously high across clinical settings.

- Type: Jaffe's Kinetic Test kits: Despite the emergence of newer technologies, Jaffe's kinetic test kits continue to hold a significant market share owing to their established reliability, cost-effectiveness, and broad availability. They are widely used in numerous laboratories for routine creatinine testing.

- Type: Creatinine-PAP Test kits: These kits offer improved specificity compared to traditional Jaffe methods and are gaining traction, particularly in reference laboratories and for specific clinical applications where higher accuracy is critical.

- ELISA Test kits: Enzyme-Linked Immunosorbent Assay (ELISA) kits are also carving out a niche, especially in research settings and for specialized diagnostic purposes, offering high sensitivity and the potential for multiplexing.

The Asia-Pacific region is identified as the fastest-growing market, driven by increasing healthcare expenditure, a burgeoning patient population with non-communicable diseases, and improving diagnostic capabilities in countries like China and India. Economic growth, coupled with a rising awareness of preventive healthcare, is further fueling the demand for creatinine assay kits in these emerging economies. The expansion of laboratory infrastructure and the increasing number of diagnostic centers are also key contributors to this growth.

Creatinine Assay Kits Market Product Developments

Product development in the Creatinine Assay Kits Market is characterized by a strong focus on enhancing assay performance, reducing turnaround times, and improving user-friendliness. Innovations are leading to kits with higher sensitivity and specificity, minimizing interferences from common endogenous substances. Advancements in reagent formulations and assay chemistries are enabling faster results, crucial for timely clinical decision-making. The market is also witnessing the development of kits compatible with a wider range of automated analyzers and point-of-care devices, broadening their accessibility. Furthermore, there is a trend towards developing kits that offer multiplexing capabilities, allowing for the simultaneous measurement of creatinine alongside other kidney function markers, thereby improving diagnostic efficiency. These technological advancements are critical in meeting the growing demand for accurate and rapid kidney disease screening and management.

Challenges in the Creatinine Assay Kits Market Market

The Creatinine Assay Kits Market, while robust, faces several challenges that can impact its growth trajectory. Regulatory hurdles, including stringent approval processes by health authorities like the FDA and EMA, can prolong the time-to-market for new products. Supply chain disruptions, as witnessed globally in recent years, can affect the availability and cost of raw materials and finished kits. Intense competitive pressure among numerous players, both established and emerging, can lead to price wars and necessitate continuous investment in R&D to maintain a competitive edge. Furthermore, the market is sensitive to reimbursement rates for diagnostic tests, which can fluctuate and impact the profitability of manufacturers. The cost of developing and validating new, highly sensitive assays also presents a significant barrier, especially for smaller companies. These factors collectively create a complex operating environment for market participants.

Forces Driving Creatinine Assay Kits Market Growth

Several powerful forces are driving the growth of the Creatinine Assay Kits Market. The escalating global burden of chronic kidney disease (CKD), largely attributed to the rising incidence of diabetes and hypertension, is a primary catalyst. This demographic shift necessitates more frequent and accurate kidney function monitoring. Technological advancements in assay design, leading to improved sensitivity, specificity, and faster turnaround times, are making creatinine testing more efficient and reliable. The increasing demand for point-of-care testing (POCT) solutions, enabling decentralized diagnostics and early detection of kidney dysfunction, is another significant growth driver. Economic development in emerging markets, coupled with expanded healthcare infrastructure, is opening up new avenues for market penetration. Moreover, growing awareness among healthcare professionals and the public regarding kidney health and the importance of early diagnosis further fuels market expansion.

Challenges in the Creatinine Assay Kits Market Market

Long-term growth catalysts in the Creatinine Assay Kits Market are intrinsically linked to continuous innovation and strategic market expansion. The development of novel, highly specific assay technologies that can overcome limitations of current methods, such as interferences from certain drugs or conditions, will be crucial. Partnerships between assay kit manufacturers and manufacturers of diagnostic analyzers and POCT devices will accelerate the integration of advanced creatinine testing into diverse clinical workflows. Furthermore, expanding the reach of these kits into underserved or emerging markets, supported by targeted educational initiatives and accessible product offerings, presents significant growth potential. The increasing focus on personalized medicine and the need for more granular kidney function assessment may also spur the development of specialized creatinine assay kits.

Emerging Opportunities in Creatinine Assay Kits Market

Emerging opportunities in the Creatinine Assay Kits Market lie in several key areas. The burgeoning demand for advanced point-of-care testing (POCT) solutions offers a significant avenue for growth, enabling rapid and accessible kidney function screening outside traditional laboratory settings. The development of integrated diagnostic platforms that can simultaneously measure creatinine alongside other kidney biomarkers (e.g., eGFR, cystatin C) presents an opportunity for enhanced diagnostic efficiency. Growing awareness and proactive health management initiatives are creating a demand for at-home testing solutions, which could revolutionize kidney health monitoring. Furthermore, the application of artificial intelligence (AI) and machine learning in analyzing creatinine assay data to predict disease progression and personalize treatment plans is an emerging frontier. Expansion into emerging economies with improving healthcare infrastructure and a rising prevalence of chronic diseases also represents a substantial opportunity for market players.

Leading Players in the Creatinine Assay Kits Market Sector

- Thermo Fisher Scientific

- Quidel Corporation

- Cell Biolabs Inc

- Merck KGaA

- Genway Biotech (Aviva Systems Biology LLC)

- Randox Laboratories Ltd

- Nova Biomedical

- Abbott Laboratories

- Sysmex Corporation

- ACON Laboratories

Key Milestones in Creatinine Assay Kits Market Industry

- July 2022: Creative Enzymes, one of the leading diagnostic enzyme production companies, launched new enzymes for the production of creatinine assay kits, enhancing the performance and availability of components for assay manufacturers.

- June 2022: Nova Biomedical launched the CE-marked Nova Max Pro creatinine/eGFR meter system in the European market. Nova Max Pro was designed to improve kidney care through kidney function screening and early detection of kidney disease in point-of-care settings outside the hospital, demonstrating a significant advancement in POCT.

Strategic Outlook for Creatinine Assay Kits Market Market

The strategic outlook for the Creatinine Assay Kits Market is characterized by sustained growth driven by the increasing global prevalence of kidney diseases and advancements in diagnostic technologies. Key growth accelerators include the expanding adoption of point-of-care testing (POCT) solutions, the development of more sensitive and specific assay chemistries, and the growing demand for multiplexed diagnostic platforms. Strategic opportunities lie in leveraging these trends to penetrate emerging markets, forge partnerships with diagnostic equipment manufacturers, and invest in R&D for next-generation assay technologies. The market is poised for continued innovation, with a focus on improving diagnostic speed, accuracy, and accessibility to enhance patient outcomes and manage the global burden of kidney disease effectively.

Creatinine Assay Kits Market Segmentation

-

1. Type

- 1.1. Jaffe's Kinetic Test kits

- 1.2. Creatinine-PAP Test kits

- 1.3. ELISA Test kits

-

2. Type of Sample

- 2.1. Blood/Serum

- 2.2. Urine

- 2.3. Other Samples

Creatinine Assay Kits Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Creatinine Assay Kits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence of Renal and Other Chronic Disorders Impacting Renal Function; Technological Advancements in Biomedical Research Pertaining to Kidney Disorders; Increasing Research and Development Initiatives

- 3.3. Market Restrains

- 3.3.1. Identification of Novel Renal Dysfunction Biomarkers; Limited Usage of Creatinine Assay Kits in Invitro Diagnostic Device (IVD)

- 3.4. Market Trends

- 3.4.1. Blood/Serum Segment is Expected to Witness Rapid Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Jaffe's Kinetic Test kits

- 5.1.2. Creatinine-PAP Test kits

- 5.1.3. ELISA Test kits

- 5.2. Market Analysis, Insights and Forecast - by Type of Sample

- 5.2.1. Blood/Serum

- 5.2.2. Urine

- 5.2.3. Other Samples

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Jaffe's Kinetic Test kits

- 6.1.2. Creatinine-PAP Test kits

- 6.1.3. ELISA Test kits

- 6.2. Market Analysis, Insights and Forecast - by Type of Sample

- 6.2.1. Blood/Serum

- 6.2.2. Urine

- 6.2.3. Other Samples

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Jaffe's Kinetic Test kits

- 7.1.2. Creatinine-PAP Test kits

- 7.1.3. ELISA Test kits

- 7.2. Market Analysis, Insights and Forecast - by Type of Sample

- 7.2.1. Blood/Serum

- 7.2.2. Urine

- 7.2.3. Other Samples

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Jaffe's Kinetic Test kits

- 8.1.2. Creatinine-PAP Test kits

- 8.1.3. ELISA Test kits

- 8.2. Market Analysis, Insights and Forecast - by Type of Sample

- 8.2.1. Blood/Serum

- 8.2.2. Urine

- 8.2.3. Other Samples

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Jaffe's Kinetic Test kits

- 9.1.2. Creatinine-PAP Test kits

- 9.1.3. ELISA Test kits

- 9.2. Market Analysis, Insights and Forecast - by Type of Sample

- 9.2.1. Blood/Serum

- 9.2.2. Urine

- 9.2.3. Other Samples

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Jaffe's Kinetic Test kits

- 10.1.2. Creatinine-PAP Test kits

- 10.1.3. ELISA Test kits

- 10.2. Market Analysis, Insights and Forecast - by Type of Sample

- 10.2.1. Blood/Serum

- 10.2.2. Urine

- 10.2.3. Other Samples

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Creatinine Assay Kits Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Quidel Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cell Biolabs Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Merck KGaA

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Genway Biotech (Aviva Systems Biology LLC)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Randox Laboratories Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Nova Biomedical

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Abbott Laboratories

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sysmex Corporation*List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Thermo Fisher Scientific

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 ACON Laboratories

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Quidel Corporation

List of Figures

- Figure 1: Global Creatinine Assay Kits Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Creatinine Assay Kits Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Creatinine Assay Kits Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Creatinine Assay Kits Market Revenue (Million), by Type of Sample 2024 & 2032

- Figure 15: North America Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2024 & 2032

- Figure 16: North America Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Creatinine Assay Kits Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Creatinine Assay Kits Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Creatinine Assay Kits Market Revenue (Million), by Type of Sample 2024 & 2032

- Figure 21: Europe Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2024 & 2032

- Figure 22: Europe Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Creatinine Assay Kits Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Creatinine Assay Kits Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Creatinine Assay Kits Market Revenue (Million), by Type of Sample 2024 & 2032

- Figure 27: Asia Pacific Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2024 & 2032

- Figure 28: Asia Pacific Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Creatinine Assay Kits Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Middle East and Africa Creatinine Assay Kits Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Middle East and Africa Creatinine Assay Kits Market Revenue (Million), by Type of Sample 2024 & 2032

- Figure 33: Middle East and Africa Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2024 & 2032

- Figure 34: Middle East and Africa Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Creatinine Assay Kits Market Revenue (Million), by Type 2024 & 2032

- Figure 37: South America Creatinine Assay Kits Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: South America Creatinine Assay Kits Market Revenue (Million), by Type of Sample 2024 & 2032

- Figure 39: South America Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2024 & 2032

- Figure 40: South America Creatinine Assay Kits Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Creatinine Assay Kits Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Creatinine Assay Kits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type of Sample 2019 & 2032

- Table 4: Global Creatinine Assay Kits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type of Sample 2019 & 2032

- Table 33: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type of Sample 2019 & 2032

- Table 39: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type of Sample 2019 & 2032

- Table 48: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type of Sample 2019 & 2032

- Table 57: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global Creatinine Assay Kits Market Revenue Million Forecast, by Type of Sample 2019 & 2032

- Table 63: Global Creatinine Assay Kits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Creatinine Assay Kits Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Creatinine Assay Kits Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Creatinine Assay Kits Market?

Key companies in the market include Quidel Corporation, Cell Biolabs Inc, Merck KGaA, Genway Biotech (Aviva Systems Biology LLC), Randox Laboratories Ltd, Nova Biomedical, Abbott Laboratories, Sysmex Corporation*List Not Exhaustive, Thermo Fisher Scientific, ACON Laboratories.

3. What are the main segments of the Creatinine Assay Kits Market?

The market segments include Type, Type of Sample.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence of Renal and Other Chronic Disorders Impacting Renal Function; Technological Advancements in Biomedical Research Pertaining to Kidney Disorders; Increasing Research and Development Initiatives.

6. What are the notable trends driving market growth?

Blood/Serum Segment is Expected to Witness Rapid Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

Identification of Novel Renal Dysfunction Biomarkers; Limited Usage of Creatinine Assay Kits in Invitro Diagnostic Device (IVD).

8. Can you provide examples of recent developments in the market?

July 2022: Creative Enzymes, one of the leading diagnostic enzyme production companies, launched new enzymes for the production of creatinine assay kits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Creatinine Assay Kits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Creatinine Assay Kits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Creatinine Assay Kits Market?

To stay informed about further developments, trends, and reports in the Creatinine Assay Kits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence