Key Insights

The global Antihistamine Market is projected for significant expansion, anticipated to reach $2,253.8 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4%. This growth is driven by the rising prevalence of allergic disorders and the increasing demand for effective management of related conditions. Growing consumer awareness of both Over-the-Counter (OTC) and prescription antihistamines, alongside convenient oral formulations and diverse dosage options, is fueling market penetration. An expanding distribution network, including hospital and retail pharmacies, as well as the burgeoning online pharmacy segment, enhances accessibility.

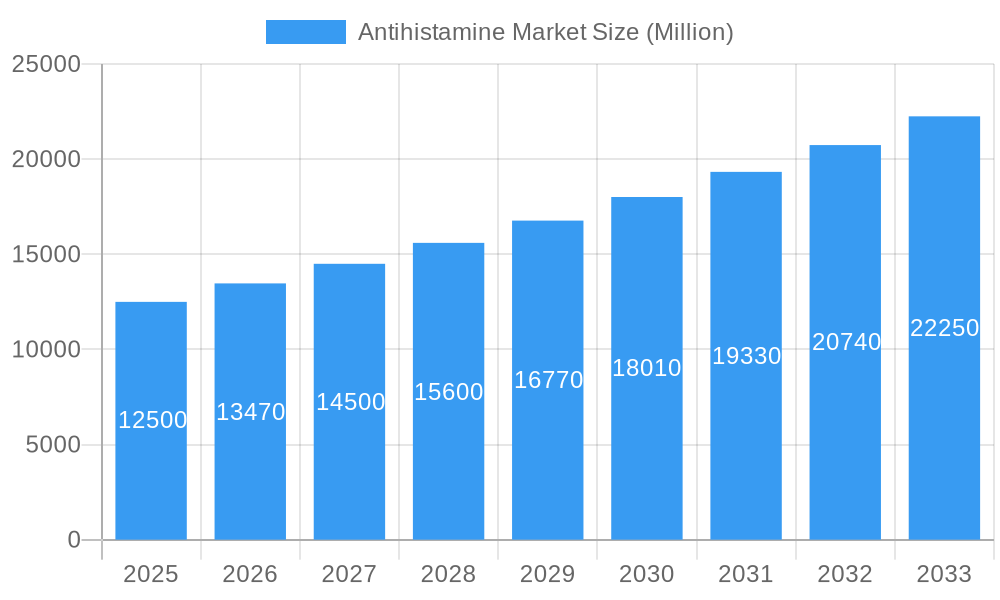

Antihistamine Market Market Size (In Billion)

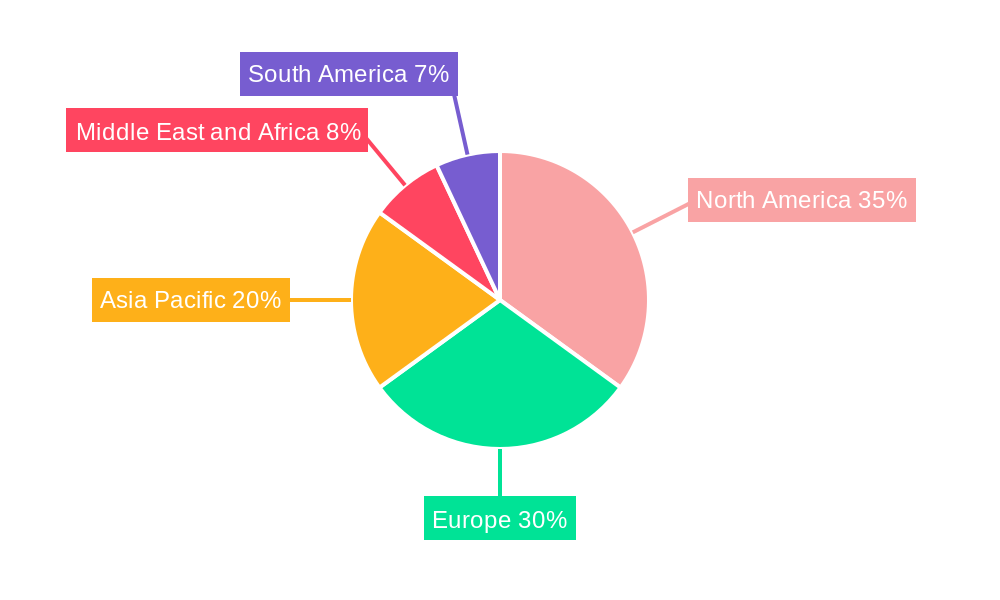

Leading market players like Pfizer, Sanofi, Novartis, Merck & Co., Teva Pharmaceutical, and Johnson & Johnson are driving innovation through significant investments in research and development. The competitive landscape focuses on portfolio expansion, strategic collaborations, and geographic reach. North America and Europe currently dominate, supported by robust healthcare infrastructure and high incidence of allergic conditions. The Asia Pacific region presents a substantial growth opportunity due to its large population and improving healthcare access. While potential side effects and alternative therapies may pose minor restraints, the sustained demand for effective allergy management ensures a positive market outlook.

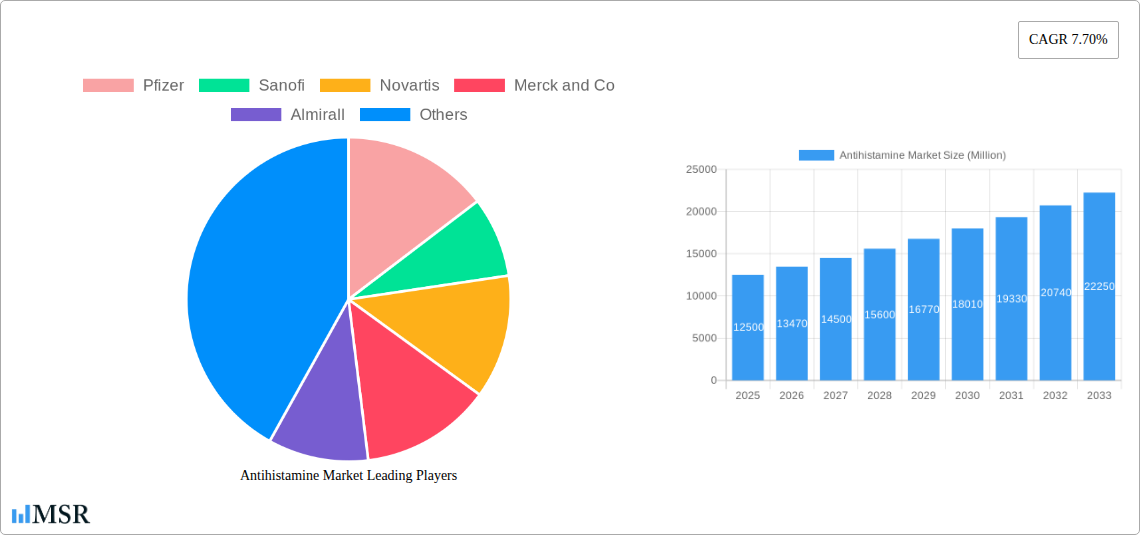

Antihistamine Market Company Market Share

Unveiling the Antihistamine Market: A Comprehensive Report for Stakeholders

Unlock critical insights into the global Antihistamine Market with this in-depth report. Analyzing historical data from 2019-2024 and projecting future growth through 2033, this study provides actionable intelligence for industry leaders, pharmaceutical manufacturers, and healthcare providers. With a base year of 2025 and estimated projections for the same year, this report offers a detailed understanding of market dynamics, key segments, and emerging opportunities. Explore the market size of xx Million in 2025 and anticipate its trajectory to xx Million by 2033, driven by a robust CAGR of xx%. This report is meticulously crafted to deliver essential knowledge without requiring further modification.

Antihistamine Market Market Concentration & Dynamics

The Antihistamine Market exhibits a moderate to high level of concentration, with a few key players dominating significant market shares. Leading companies such as Pfizer, Sanofi, Novartis, Merck and Co, Bayer, and Johnson and Johnson are at the forefront, leveraging extensive research and development capabilities and established distribution networks. The innovation ecosystem is characterized by a continuous drive for developing more effective, less sedating antihistamines and novel drug delivery systems. Regulatory frameworks, primarily governed by agencies like the FDA and EMA, play a crucial role in market entry and product approvals, ensuring safety and efficacy. Substitute products, including corticosteroids and immunotherapy, pose a competitive challenge, especially in treating severe allergic conditions. End-user trends are increasingly leaning towards over-the-counter (OTC) accessibility for milder allergies and a preference for non-drowsy formulations. Merger and acquisition (M&A) activities, though not overtly frequent, are strategic moves to consolidate market presence, acquire new technologies, and expand product portfolios. The number of M&A deals in the past five years is estimated to be between 5-10, indicating focused consolidation rather than widespread M&A. Market share is distributed with the top 5 players holding approximately 50-60% of the global market.

Antihistamine Market Industry Insights & Trends

The global Antihistamine Market is experiencing consistent growth, propelled by a confluence of factors including rising prevalence of allergic disorders, increased awareness, and advancements in pharmaceutical research. The market size was valued at approximately xx Million in 2024 and is projected to reach xx Million by 2025, demonstrating a steady expansion. This growth is underpinned by a compound annual growth rate (CAGR) of xx% from 2019 to 2033. Key market growth drivers include the escalating incidence of conditions like allergic rhinitis, conjunctivitis, and urticaria, often linked to environmental factors such as pollution and climate change, as well as increasing urbanization and lifestyle shifts. Technological disruptions are evident in the development of novel drug delivery methods, such as long-acting nasal sprays and sustained-release oral formulations, aiming to improve patient compliance and therapeutic outcomes. Evolving consumer behaviors are also shaping the market, with a growing demand for convenient, accessible, and effective treatments. The shift towards self-medication for mild to moderate allergy symptoms is fueling the growth of the Over-the-Counter (OTC) segment. Furthermore, advancements in understanding the underlying mechanisms of allergic reactions are paving the way for more targeted therapies and personalized medicine approaches, creating new avenues for market expansion and innovation. The focus on reducing side effects, particularly drowsiness associated with older generation antihistamines, is a significant trend driving research and development towards second-generation and non-sedating options. The expanding healthcare infrastructure in emerging economies and increasing disposable incomes are also contributing to greater access to antihistamine medications, thereby bolstering market growth.

Key Markets & Segments Leading Antihistamine Market

The Antihistamine Market is dynamically segmented across various drug classes, dosage forms, types, diseases, and distribution channels, with specific segments demonstrating significant leadership.

Dominant Regions and Countries: North America, particularly the United States, currently leads the Antihistamine Market due to its high prevalence of allergic diseases, advanced healthcare infrastructure, and strong consumer awareness regarding allergy management. Europe, with countries like Germany and the UK, also holds a substantial market share. Asia Pacific is an emerging powerhouse, driven by increasing healthcare expenditure, rising disposable incomes, and a growing patient pool susceptible to allergic conditions.

Key Segment Dominance:

Drug Class:

- H1 Antihistamines (Second Generation): This segment is the primary driver of the market, owing to their improved safety profiles, minimal sedative effects, and efficacy in managing a wide spectrum of allergic symptoms.

- Drivers: Superior efficacy compared to first-generation, reduced side effects, widespread availability.

- Dominance Analysis: Second-generation antihistamines have largely replaced first-generation drugs in mainstream treatment protocols due to their better tolerability, leading to significant market share.

- H1 Antihistamines (First Generation): While their market share is declining, they still hold relevance in specific therapeutic niches and are often more cost-effective.

- H2 Antihistamines: Primarily used for gastrointestinal disorders, they contribute to the overall market but are distinct from allergy-focused antihistamines.

- H3 Antihistamines: Currently more in the research and development phase, with limited commercial presence.

- H1 Antihistamines (Second Generation): This segment is the primary driver of the market, owing to their improved safety profiles, minimal sedative effects, and efficacy in managing a wide spectrum of allergic symptoms.

Dosage Form:

- Oral Route: This remains the most prevalent dosage form due to its ease of administration and patient preference.

- Drivers: Convenience, patient compliance, wide availability of formulations.

- Dominance Analysis: Tablets, capsules, and syrups for oral consumption are the go-to options for most allergy sufferers.

- Parenteral: Used in critical situations or when rapid onset is required.

- Other Dosage Forms: Nasal sprays and ophthalmic solutions are gaining traction for targeted relief.

- Oral Route: This remains the most prevalent dosage form due to its ease of administration and patient preference.

Type:

- OTC (Over-the-Counter): This segment is experiencing robust growth as consumers seek self-medication for common allergies.

- Drivers: Increased accessibility, affordability, growing self-care trend.

- Dominance Analysis: The ease of purchasing OTC antihistamines without a prescription fuels their widespread use for seasonal and mild allergic reactions.

- Prescription-based: Essential for managing severe allergies and chronic conditions, ensuring physician oversight.

- OTC (Over-the-Counter): This segment is experiencing robust growth as consumers seek self-medication for common allergies.

Disease:

- Allergic Disorders: This segment encompasses a vast range of conditions, including allergic rhinitis, allergic conjunctivitis, urticaria, and atopic dermatitis, making it the largest contributor to the antihistamine market.

- Drivers: High and increasing prevalence of allergies globally, environmental factors, lifestyle changes.

- Dominance Analysis: The sheer volume and widespread nature of allergic conditions directly translate to a dominant position for antihistamines used in their treatment.

- Stomach Disorders: Primarily addressed by H2 antihistamines.

- Central Nervous System Disorders: Certain antihistamines have applications here, but it's a niche segment.

- Allergic Disorders: This segment encompasses a vast range of conditions, including allergic rhinitis, allergic conjunctivitis, urticaria, and atopic dermatitis, making it the largest contributor to the antihistamine market.

Distribution Channels:

- Retail Pharmacies: Remain a cornerstone of antihistamine distribution, offering convenient access to both OTC and prescription medications.

- Drivers: Ubiquitous presence, established customer relationships, pharmacist recommendations.

- Dominance Analysis: The accessibility and familiarity of retail pharmacies make them the primary point of sale for a majority of antihistamine purchases.

- Online Pharmacies: Witnessing rapid growth due to convenience, competitive pricing, and wider product selection.

- Drivers: E-commerce boom, home delivery services, digital health adoption.

- Dominance Analysis: Online channels are steadily increasing their market share, especially for recurring purchases and a broader range of specialized products.

- Hospital Pharmacies: Primarily cater to inpatient needs and severe cases requiring professional administration.

- Retail Pharmacies: Remain a cornerstone of antihistamine distribution, offering convenient access to both OTC and prescription medications.

Antihistamine Market Product Developments

Product innovation in the Antihistamine Market is primarily focused on enhancing efficacy, improving safety profiles, and developing patient-centric delivery methods. The development of second-generation H1 antihistamines has significantly reduced the incidence of drowsiness and anticholinergic side effects associated with their predecessors, making them the preferred choice for chronic allergy management. Advancements in formulation technology have led to novel delivery systems such as long-acting nasal sprays and ophthalmic solutions, offering targeted relief and improved patient compliance. For instance, the submission of a new drug application for Zerviate (cetirizine ophthalmic solution), 0.24% in China for ocular itching associated with allergic conjunctivitis, signifies the ongoing innovation in topical antihistamine treatments, with an expected launch in China in 2024. Furthermore, research is exploring combination therapies and novel mechanisms of action to address complex allergic responses, promising more comprehensive treatment options and a competitive edge for developers in the evolving pharmaceutical landscape.

Challenges in the Antihistamine Market Market

The Antihistamine Market faces several challenges that can impede growth and profitability. Stringent regulatory hurdles and the lengthy approval processes for new drug development represent significant barriers, requiring substantial investment and time. Supply chain disruptions, particularly for active pharmaceutical ingredients (APIs) and excipients, can lead to manufacturing delays and product shortages, impacting market availability. Intense competition from both established players and emerging generic manufacturers puts pressure on pricing, potentially eroding profit margins. The rise of alternative therapies, such as immunotherapy and biologics for severe allergic conditions, also presents a competitive threat, diverting market share. Furthermore, evolving adverse event reporting requirements and pharmacovigilance obligations add to the compliance burden for pharmaceutical companies. The impact of these challenges can be quantified through potential delays in product launches, increased operational costs, and market share erosion by competitors offering more cost-effective or novel solutions.

Forces Driving Antihistamine Market Growth

The Antihistamine Market is propelled by a robust set of growth drivers. The escalating global prevalence of allergic disorders, driven by factors like urbanization, environmental pollution, and changing lifestyles, forms the fundamental basis for sustained demand. Technological advancements in drug discovery and development are leading to the creation of more effective, safer, and patient-friendly antihistamines, particularly second-generation and non-sedating options, which are highly sought after. Increased healthcare expenditure and improved access to medical facilities, especially in emerging economies, are expanding the patient pool that can afford and access these treatments. Growing consumer awareness regarding allergy management and the increasing preference for self-medication for mild to moderate symptoms further fuel the Over-the-Counter (OTC) segment. Supportive regulatory environments that facilitate the approval of innovative allergy treatments also contribute to market expansion.

Challenges in the Antihistamine Market Market

While the Antihistamine Market demonstrates considerable growth potential, long-term catalysts are crucial for sustained expansion. Continuous innovation in drug development, focusing on novel mechanisms of action and personalized medicine approaches to address the heterogeneity of allergic diseases, is a key long-term driver. Strategic partnerships and collaborations between pharmaceutical companies, research institutions, and biotechnology firms can accelerate the discovery and commercialization of new therapies. Market expansions into underserved geographic regions, particularly in developing countries with growing populations and rising healthcare infrastructure, offer significant growth opportunities. The development of combination therapies that target multiple pathways of allergic inflammation can provide superior therapeutic outcomes and capture a larger market share. Furthermore, investing in patient education and awareness campaigns about allergy management can lead to earlier diagnosis and treatment, thereby increasing the overall demand for antihistamines.

Emerging Opportunities in Antihistamine Market

Emerging opportunities in the Antihistamine Market are shaped by evolving consumer preferences, technological advancements, and the expanding understanding of allergic diseases. The increasing demand for convenient and targeted delivery systems presents a significant opportunity for the development and commercialization of novel formulations like long-acting nasal sprays, ophthalmic solutions, and even smart drug delivery devices. The growing trend of e-commerce and online pharmacies is creating new avenues for distribution, offering greater accessibility and convenience to consumers. Furthermore, the burgeoning field of personalized medicine offers opportunities to develop antihistamines tailored to individual patient profiles, improving treatment efficacy and reducing adverse effects. The increasing awareness and diagnosis of less common allergic conditions also open up niche markets for specialized antihistamine products. Strategic investments in research for the treatment of chronic and severe allergic conditions, including the exploration of new drug targets, can unlock substantial future growth.

Leading Players in the Antihistamine Market Sector

- Pfizer

- Sanofi

- Novartis

- Merck and Co

- Almirall

- Teva Pharmaceutical

- AstraZeneca

- Akorn

- Johnson and Johnson

- GlaxoSmithKline

- Sun Pharmaceutical Industries Limited

- Bayer

Key Milestones in Antihistamine Market Industry

- Apr 2023: Ocumension Therapeutics, an exclusive Chinese partner of Nicox SA, submitted a new drug application (NDA) for approval to commercialize Zerviate (cetirizine ophthalmic solution), 0.24% in China for ocular itching associated with allergic conjunctivitis. The product is expected to be launched in China in 2024, indicating expansion of ophthalmic antihistamine solutions.

- Mar 2023: Astepro Allergy entered a strategic partnership with Meghann Fahy to help patients suffering from allergies. Astepro is a long-lasting nasal spray that starts working in 30 minutes and can relieve allergy symptoms quickly, highlighting advancements in rapid-acting nasal allergy relief.

Strategic Outlook for Antihistamine Market Market

The strategic outlook for the Antihistamine Market is characterized by sustained growth driven by innovation and market expansion. Key growth accelerators include the continuous development of novel, non-sedating antihistamines with improved efficacy and fewer side effects, catering to the rising demand for patient comfort and compliance. The increasing penetration of Over-the-Counter (OTC) antihistamines, fueled by self-care trends and improved accessibility, will continue to be a significant growth engine. Strategic focus on expanding into emerging markets with burgeoning healthcare sectors and increasing disposable incomes presents substantial untapped potential. Furthermore, investments in research and development for targeted therapies addressing specific allergic pathways and the exploration of combination treatments for severe allergic conditions will unlock new therapeutic avenues and market leadership opportunities. The evolving landscape of drug delivery systems, with an emphasis on convenience and rapid onset of action, will also be a critical area for strategic development and market differentiation.

Antihistamine Market Segmentation

-

1. Drug Class

-

1.1. H1 Antihistamanics

- 1.1.1. First Generation

- 1.1.2. Second Generation

- 1.2. H2 Anti histamanics

- 1.3. H3 Anti histamanics

-

1.1. H1 Antihistamanics

-

2. Dosage Form

- 2.1. Oral route

- 2.2. Parenteral

- 2.3. Other Dosage Forms

-

3. Type

- 3.1. OTC

- 3.2. Prescription-based

-

4. Disease

- 4.1. Allergic Disorders

- 4.2. Stomach Disorders

- 4.3. Central Nervous System Disorders

- 4.4. Other Diseases

-

5. Distribution Channels

- 5.1. Hospital Pharmacies

- 5.2. Retail Pharmacies

- 5.3. Online Pharmacies

Antihistamine Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Antihistamine Market Regional Market Share

Geographic Coverage of Antihistamine Market

Antihistamine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Issues of Allergies and Stomach Disorders; Increase in R&D Activities Leading to Development of Novel Dosage Forms4.2.3

- 3.3. Market Restrains

- 3.3.1. Patent Expiry and Introduction of Generic Drugs; Adverse Effects Associated with Antihistamine Drugs

- 3.4. Market Trends

- 3.4.1. Allergic Disorders in Anticipated to Hold a Significant Share in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antihistamine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. H1 Antihistamanics

- 5.1.1.1. First Generation

- 5.1.1.2. Second Generation

- 5.1.2. H2 Anti histamanics

- 5.1.3. H3 Anti histamanics

- 5.1.1. H1 Antihistamanics

- 5.2. Market Analysis, Insights and Forecast - by Dosage Form

- 5.2.1. Oral route

- 5.2.2. Parenteral

- 5.2.3. Other Dosage Forms

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. OTC

- 5.3.2. Prescription-based

- 5.4. Market Analysis, Insights and Forecast - by Disease

- 5.4.1. Allergic Disorders

- 5.4.2. Stomach Disorders

- 5.4.3. Central Nervous System Disorders

- 5.4.4. Other Diseases

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.5.1. Hospital Pharmacies

- 5.5.2. Retail Pharmacies

- 5.5.3. Online Pharmacies

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Middle East and Africa

- 5.6.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Antihistamine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. H1 Antihistamanics

- 6.1.1.1. First Generation

- 6.1.1.2. Second Generation

- 6.1.2. H2 Anti histamanics

- 6.1.3. H3 Anti histamanics

- 6.1.1. H1 Antihistamanics

- 6.2. Market Analysis, Insights and Forecast - by Dosage Form

- 6.2.1. Oral route

- 6.2.2. Parenteral

- 6.2.3. Other Dosage Forms

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. OTC

- 6.3.2. Prescription-based

- 6.4. Market Analysis, Insights and Forecast - by Disease

- 6.4.1. Allergic Disorders

- 6.4.2. Stomach Disorders

- 6.4.3. Central Nervous System Disorders

- 6.4.4. Other Diseases

- 6.5. Market Analysis, Insights and Forecast - by Distribution Channels

- 6.5.1. Hospital Pharmacies

- 6.5.2. Retail Pharmacies

- 6.5.3. Online Pharmacies

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Antihistamine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. H1 Antihistamanics

- 7.1.1.1. First Generation

- 7.1.1.2. Second Generation

- 7.1.2. H2 Anti histamanics

- 7.1.3. H3 Anti histamanics

- 7.1.1. H1 Antihistamanics

- 7.2. Market Analysis, Insights and Forecast - by Dosage Form

- 7.2.1. Oral route

- 7.2.2. Parenteral

- 7.2.3. Other Dosage Forms

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. OTC

- 7.3.2. Prescription-based

- 7.4. Market Analysis, Insights and Forecast - by Disease

- 7.4.1. Allergic Disorders

- 7.4.2. Stomach Disorders

- 7.4.3. Central Nervous System Disorders

- 7.4.4. Other Diseases

- 7.5. Market Analysis, Insights and Forecast - by Distribution Channels

- 7.5.1. Hospital Pharmacies

- 7.5.2. Retail Pharmacies

- 7.5.3. Online Pharmacies

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Antihistamine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. H1 Antihistamanics

- 8.1.1.1. First Generation

- 8.1.1.2. Second Generation

- 8.1.2. H2 Anti histamanics

- 8.1.3. H3 Anti histamanics

- 8.1.1. H1 Antihistamanics

- 8.2. Market Analysis, Insights and Forecast - by Dosage Form

- 8.2.1. Oral route

- 8.2.2. Parenteral

- 8.2.3. Other Dosage Forms

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. OTC

- 8.3.2. Prescription-based

- 8.4. Market Analysis, Insights and Forecast - by Disease

- 8.4.1. Allergic Disorders

- 8.4.2. Stomach Disorders

- 8.4.3. Central Nervous System Disorders

- 8.4.4. Other Diseases

- 8.5. Market Analysis, Insights and Forecast - by Distribution Channels

- 8.5.1. Hospital Pharmacies

- 8.5.2. Retail Pharmacies

- 8.5.3. Online Pharmacies

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Antihistamine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. H1 Antihistamanics

- 9.1.1.1. First Generation

- 9.1.1.2. Second Generation

- 9.1.2. H2 Anti histamanics

- 9.1.3. H3 Anti histamanics

- 9.1.1. H1 Antihistamanics

- 9.2. Market Analysis, Insights and Forecast - by Dosage Form

- 9.2.1. Oral route

- 9.2.2. Parenteral

- 9.2.3. Other Dosage Forms

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. OTC

- 9.3.2. Prescription-based

- 9.4. Market Analysis, Insights and Forecast - by Disease

- 9.4.1. Allergic Disorders

- 9.4.2. Stomach Disorders

- 9.4.3. Central Nervous System Disorders

- 9.4.4. Other Diseases

- 9.5. Market Analysis, Insights and Forecast - by Distribution Channels

- 9.5.1. Hospital Pharmacies

- 9.5.2. Retail Pharmacies

- 9.5.3. Online Pharmacies

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Antihistamine Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. H1 Antihistamanics

- 10.1.1.1. First Generation

- 10.1.1.2. Second Generation

- 10.1.2. H2 Anti histamanics

- 10.1.3. H3 Anti histamanics

- 10.1.1. H1 Antihistamanics

- 10.2. Market Analysis, Insights and Forecast - by Dosage Form

- 10.2.1. Oral route

- 10.2.2. Parenteral

- 10.2.3. Other Dosage Forms

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. OTC

- 10.3.2. Prescription-based

- 10.4. Market Analysis, Insights and Forecast - by Disease

- 10.4.1. Allergic Disorders

- 10.4.2. Stomach Disorders

- 10.4.3. Central Nervous System Disorders

- 10.4.4. Other Diseases

- 10.5. Market Analysis, Insights and Forecast - by Distribution Channels

- 10.5.1. Hospital Pharmacies

- 10.5.2. Retail Pharmacies

- 10.5.3. Online Pharmacies

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sanofi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck and Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Almirall

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teva Pharmaceutical*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AstraZeneca

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Akorn

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson and Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GlaxoSmithKline

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sun Pharmaceutical Industries Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bayer

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Antihistamine Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Antihistamine Market Revenue (million), by Drug Class 2025 & 2033

- Figure 3: North America Antihistamine Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 4: North America Antihistamine Market Revenue (million), by Dosage Form 2025 & 2033

- Figure 5: North America Antihistamine Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 6: North America Antihistamine Market Revenue (million), by Type 2025 & 2033

- Figure 7: North America Antihistamine Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Antihistamine Market Revenue (million), by Disease 2025 & 2033

- Figure 9: North America Antihistamine Market Revenue Share (%), by Disease 2025 & 2033

- Figure 10: North America Antihistamine Market Revenue (million), by Distribution Channels 2025 & 2033

- Figure 11: North America Antihistamine Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 12: North America Antihistamine Market Revenue (million), by Country 2025 & 2033

- Figure 13: North America Antihistamine Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Antihistamine Market Revenue (million), by Drug Class 2025 & 2033

- Figure 15: Europe Antihistamine Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 16: Europe Antihistamine Market Revenue (million), by Dosage Form 2025 & 2033

- Figure 17: Europe Antihistamine Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 18: Europe Antihistamine Market Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Antihistamine Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Antihistamine Market Revenue (million), by Disease 2025 & 2033

- Figure 21: Europe Antihistamine Market Revenue Share (%), by Disease 2025 & 2033

- Figure 22: Europe Antihistamine Market Revenue (million), by Distribution Channels 2025 & 2033

- Figure 23: Europe Antihistamine Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 24: Europe Antihistamine Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Antihistamine Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Antihistamine Market Revenue (million), by Drug Class 2025 & 2033

- Figure 27: Asia Pacific Antihistamine Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 28: Asia Pacific Antihistamine Market Revenue (million), by Dosage Form 2025 & 2033

- Figure 29: Asia Pacific Antihistamine Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 30: Asia Pacific Antihistamine Market Revenue (million), by Type 2025 & 2033

- Figure 31: Asia Pacific Antihistamine Market Revenue Share (%), by Type 2025 & 2033

- Figure 32: Asia Pacific Antihistamine Market Revenue (million), by Disease 2025 & 2033

- Figure 33: Asia Pacific Antihistamine Market Revenue Share (%), by Disease 2025 & 2033

- Figure 34: Asia Pacific Antihistamine Market Revenue (million), by Distribution Channels 2025 & 2033

- Figure 35: Asia Pacific Antihistamine Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 36: Asia Pacific Antihistamine Market Revenue (million), by Country 2025 & 2033

- Figure 37: Asia Pacific Antihistamine Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East and Africa Antihistamine Market Revenue (million), by Drug Class 2025 & 2033

- Figure 39: Middle East and Africa Antihistamine Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 40: Middle East and Africa Antihistamine Market Revenue (million), by Dosage Form 2025 & 2033

- Figure 41: Middle East and Africa Antihistamine Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 42: Middle East and Africa Antihistamine Market Revenue (million), by Type 2025 & 2033

- Figure 43: Middle East and Africa Antihistamine Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East and Africa Antihistamine Market Revenue (million), by Disease 2025 & 2033

- Figure 45: Middle East and Africa Antihistamine Market Revenue Share (%), by Disease 2025 & 2033

- Figure 46: Middle East and Africa Antihistamine Market Revenue (million), by Distribution Channels 2025 & 2033

- Figure 47: Middle East and Africa Antihistamine Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 48: Middle East and Africa Antihistamine Market Revenue (million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Antihistamine Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Antihistamine Market Revenue (million), by Drug Class 2025 & 2033

- Figure 51: South America Antihistamine Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 52: South America Antihistamine Market Revenue (million), by Dosage Form 2025 & 2033

- Figure 53: South America Antihistamine Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 54: South America Antihistamine Market Revenue (million), by Type 2025 & 2033

- Figure 55: South America Antihistamine Market Revenue Share (%), by Type 2025 & 2033

- Figure 56: South America Antihistamine Market Revenue (million), by Disease 2025 & 2033

- Figure 57: South America Antihistamine Market Revenue Share (%), by Disease 2025 & 2033

- Figure 58: South America Antihistamine Market Revenue (million), by Distribution Channels 2025 & 2033

- Figure 59: South America Antihistamine Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 60: South America Antihistamine Market Revenue (million), by Country 2025 & 2033

- Figure 61: South America Antihistamine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Antihistamine Market Revenue million Forecast, by Drug Class 2020 & 2033

- Table 2: Global Antihistamine Market Revenue million Forecast, by Dosage Form 2020 & 2033

- Table 3: Global Antihistamine Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Global Antihistamine Market Revenue million Forecast, by Disease 2020 & 2033

- Table 5: Global Antihistamine Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 6: Global Antihistamine Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Global Antihistamine Market Revenue million Forecast, by Drug Class 2020 & 2033

- Table 8: Global Antihistamine Market Revenue million Forecast, by Dosage Form 2020 & 2033

- Table 9: Global Antihistamine Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: Global Antihistamine Market Revenue million Forecast, by Disease 2020 & 2033

- Table 11: Global Antihistamine Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 12: Global Antihistamine Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Antihistamine Market Revenue million Forecast, by Drug Class 2020 & 2033

- Table 17: Global Antihistamine Market Revenue million Forecast, by Dosage Form 2020 & 2033

- Table 18: Global Antihistamine Market Revenue million Forecast, by Type 2020 & 2033

- Table 19: Global Antihistamine Market Revenue million Forecast, by Disease 2020 & 2033

- Table 20: Global Antihistamine Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 21: Global Antihistamine Market Revenue million Forecast, by Country 2020 & 2033

- Table 22: Germany Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: France Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Italy Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Spain Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Antihistamine Market Revenue million Forecast, by Drug Class 2020 & 2033

- Table 29: Global Antihistamine Market Revenue million Forecast, by Dosage Form 2020 & 2033

- Table 30: Global Antihistamine Market Revenue million Forecast, by Type 2020 & 2033

- Table 31: Global Antihistamine Market Revenue million Forecast, by Disease 2020 & 2033

- Table 32: Global Antihistamine Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 33: Global Antihistamine Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: China Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Japan Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: India Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Australia Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: South Korea Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Global Antihistamine Market Revenue million Forecast, by Drug Class 2020 & 2033

- Table 41: Global Antihistamine Market Revenue million Forecast, by Dosage Form 2020 & 2033

- Table 42: Global Antihistamine Market Revenue million Forecast, by Type 2020 & 2033

- Table 43: Global Antihistamine Market Revenue million Forecast, by Disease 2020 & 2033

- Table 44: Global Antihistamine Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 45: Global Antihistamine Market Revenue million Forecast, by Country 2020 & 2033

- Table 46: GCC Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: South Africa Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Middle East and Africa Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: Global Antihistamine Market Revenue million Forecast, by Drug Class 2020 & 2033

- Table 50: Global Antihistamine Market Revenue million Forecast, by Dosage Form 2020 & 2033

- Table 51: Global Antihistamine Market Revenue million Forecast, by Type 2020 & 2033

- Table 52: Global Antihistamine Market Revenue million Forecast, by Disease 2020 & 2033

- Table 53: Global Antihistamine Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 54: Global Antihistamine Market Revenue million Forecast, by Country 2020 & 2033

- Table 55: Brazil Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: Argentina Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 57: Rest of South America Antihistamine Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antihistamine Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Antihistamine Market?

Key companies in the market include Pfizer, Sanofi, Novartis, Merck and Co, Almirall, Teva Pharmaceutical*List Not Exhaustive, AstraZeneca, Akorn, Johnson and Johnson, GlaxoSmithKline, Sun Pharmaceutical Industries Limited, Bayer.

3. What are the main segments of the Antihistamine Market?

The market segments include Drug Class, Dosage Form, Type, Disease, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 2253.8 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Issues of Allergies and Stomach Disorders; Increase in R&D Activities Leading to Development of Novel Dosage Forms4.2.3.

6. What are the notable trends driving market growth?

Allergic Disorders in Anticipated to Hold a Significant Share in the Market Studied.

7. Are there any restraints impacting market growth?

Patent Expiry and Introduction of Generic Drugs; Adverse Effects Associated with Antihistamine Drugs.

8. Can you provide examples of recent developments in the market?

Apr 2023: Ocumension Therapeutics, an exclusive Chinese partner of Nicox SA, submitted a new drug application (NDA) for approval to commercialize Zerviate (cetirizine ophthalmic solution), 0.24% in China for ocular itching associated with allergic conjunctivitis. The product is expected to be launched in China in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antihistamine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antihistamine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antihistamine Market?

To stay informed about further developments, trends, and reports in the Antihistamine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence