Key Insights

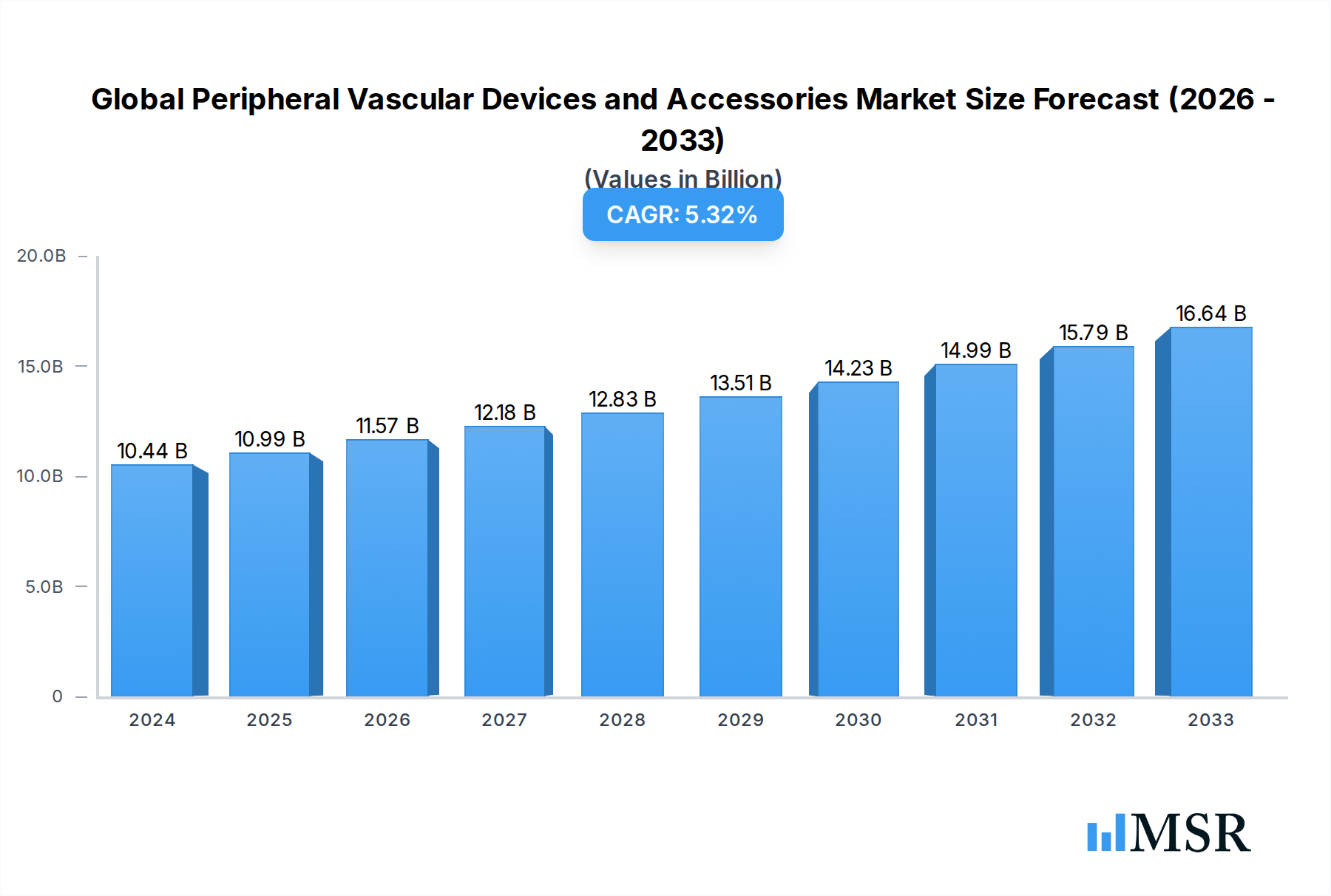

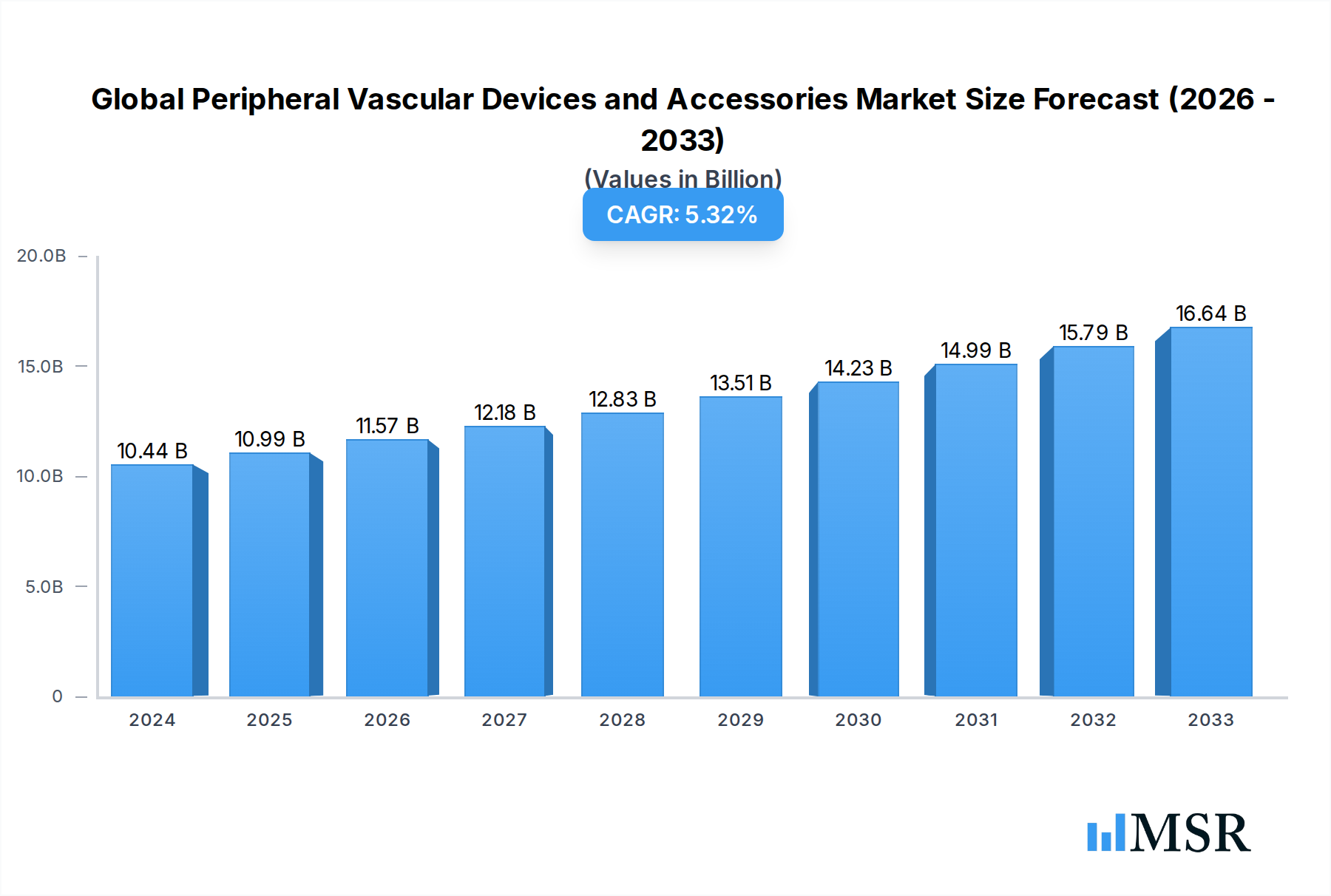

The Global Peripheral Vascular Devices and Accessories Market is poised for significant expansion, demonstrating robust growth driven by an increasing prevalence of peripheral vascular diseases (PVD) and a growing elderly population. Technological advancements in minimally invasive treatment options, such as advanced stenting technologies, angioplasty balloons, and atherectomy devices, are key catalysts. The market is estimated to have reached approximately $10.44 billion in 2024, with a projected Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period of 2025-2033. This sustained growth is underpinned by the rising demand for effective and less invasive treatments for conditions like peripheral artery disease (PAD), deep vein thrombosis (DVT), and venous insufficiency. The expanding product portfolio, encompassing a wide array of catheters, guidewires with innovative coating technologies (both hydrophobic and hydrophilic), vascular closure devices, and introducer sheaths, further fuels market penetration.

Global Peripheral Vascular Devices and Accessories Market Market Size (In Billion)

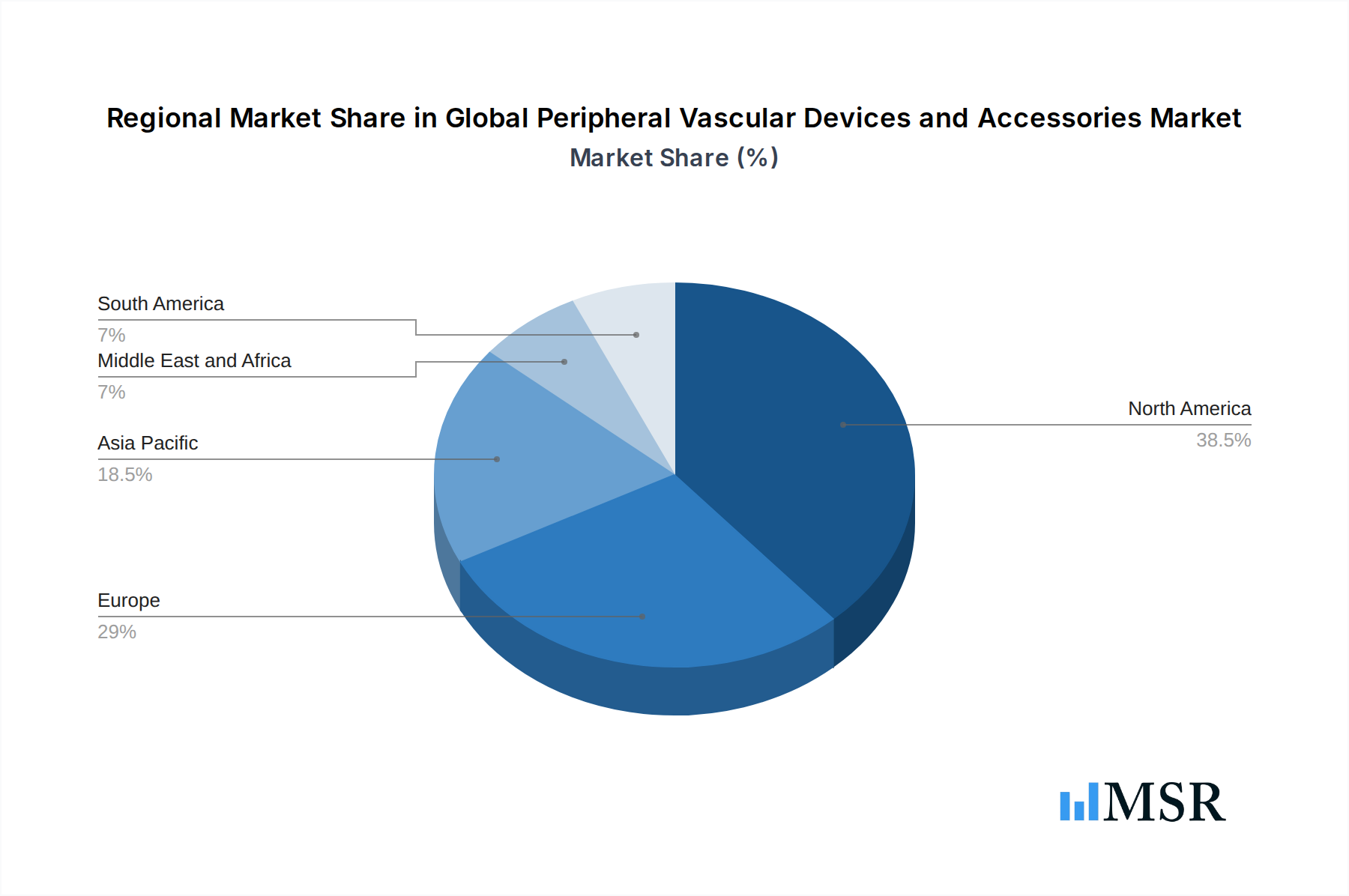

North America currently leads the market, driven by high healthcare expenditure, early adoption of new technologies, and a well-established regulatory framework. However, the Asia Pacific region is expected to witness the fastest growth due to increasing healthcare infrastructure development, rising disposable incomes, and a large, underserved patient population. Key market restraints include stringent regulatory approvals, the high cost of advanced devices, and the availability of alternative therapies. Despite these challenges, the market's trajectory remains upward, supported by ongoing research and development efforts by major industry players such as Abbott, Medtronic plc, Boston Scientific Corporation, and Becton Dickinson and Company, all of whom are actively innovating to address unmet clinical needs in peripheral vascular care.

Global Peripheral Vascular Devices and Accessories Market Company Market Share

Here is the SEO-optimized and engaging report description for the Global Peripheral Vascular Devices and Accessories Market, incorporating all your specified details without any placeholders or need for modification.

This in-depth report provides an exhaustive analysis of the global peripheral vascular devices and accessories market. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period extending from 2025 to 2033, this research delves into market dynamics, key segments, leading players, and future growth trajectories. It offers actionable insights for stakeholders including manufacturers, suppliers, investors, and healthcare providers navigating the complex landscape of peripheral vascular interventions.

This report meticulously examines the market size and CAGR of the peripheral vascular devices and accessories sector, driven by an aging global population, increasing prevalence of cardiovascular diseases like peripheral artery disease (PAD), and advancements in minimally invasive treatment options. We analyze the impact of technological disruptions such as next-generation stent designs, advanced catheter technologies, and novel guidewire coatings. Evolving consumer preferences towards less invasive procedures and improved patient outcomes are also thoroughly investigated, providing a holistic view of the market's current state and future potential.

Global Peripheral Vascular Devices and Accessories Market Market Concentration & Dynamics

The peripheral vascular devices and accessories market exhibits a dynamic concentration, characterized by a blend of large multinational corporations and innovative smaller players. Market concentration is influenced by substantial R&D investments, stringent regulatory approvals, and the need for specialized manufacturing capabilities. The innovation ecosystem is thriving, with continuous advancements in peripheral vascular stents, PTA balloons, catheters, and atherectomy devices. Regulatory frameworks, particularly from bodies like the FDA and EMA, play a pivotal role in shaping market entry and product lifecycles. Substitute products, while present, are largely outweighed by the efficacy of dedicated peripheral vascular interventions. End-user trends are strongly leaning towards minimally invasive techniques, driving demand for advanced peripheral accessories such as specialized guidewires and closure devices. Mergers and acquisitions (M&A) activities are prevalent, as larger companies seek to acquire innovative technologies and expand their product portfolios. For instance, significant M&A deal counts have been observed in recent years, consolidating market share and fostering strategic growth.

Global Peripheral Vascular Devices and Accessories Market Industry Insights & Trends

The global peripheral vascular devices and accessories market is experiencing robust growth, projected to reach an estimated market size of $XX billion by 2025 and is expected to grow at a significant CAGR of approximately XX% during the forecast period of 2025–2033. This expansion is primarily fueled by the escalating incidence of peripheral artery disease (PAD) and other vascular disorders, largely attributed to the increasing prevalence of lifestyle-related health issues such as diabetes, obesity, and hypertension. The global aging population further contributes to this growth, as the risk of vascular diseases escalates with age. Technological advancements are at the forefront of market evolution, with continuous innovation in peripheral vascular stents, including drug-eluting stents and bioresorbable scaffolds, offering improved treatment efficacy and reduced complications. The development of sophisticated catheters and atherectomy devices enables more precise and less invasive interventions, minimizing patient trauma and recovery times. Furthermore, the introduction of advanced peripheral accessories, such as hydrophilic-coated guidewires and advanced closure devices, enhances procedural success rates and patient comfort. The growing preference for minimally invasive surgical procedures over traditional open surgeries is a significant market driver. This shift is supported by favorable reimbursement policies and a growing awareness among patients and healthcare professionals about the benefits of these techniques, such as shorter hospital stays and faster return to daily activities. Emerging economies, with their rapidly developing healthcare infrastructure and increasing disposable incomes, present substantial untapped potential for market expansion. The rising demand for interventional cardiology and radiology services, coupled with increased healthcare expenditure, is creating a conducive environment for the growth of the peripheral vascular devices and accessories market.

Key Markets & Segments Leading Global Peripheral Vascular Devices and Accessories Market

The North America region, particularly the United States, is currently the dominant force in the global peripheral vascular devices and accessories market. This leadership is propelled by a combination of factors including high per capita healthcare spending, advanced healthcare infrastructure, widespread adoption of cutting-edge medical technologies, and a high prevalence of vascular diseases. The region's robust regulatory environment, while stringent, also fosters innovation and timely market access for novel products.

Within the product segment, Peripheral Vascular Stents are a cornerstone of the market, driven by the increasing need for revascularization procedures. Following closely are Catheters, essential for delivering various therapeutic devices to target lesions. The Peripheral Accessories segment, encompassing a wide array of crucial tools like Guidewires (including Workhorse, Frontline Finesse, Extra Support, and Specialty types), Peripheral Vascular Closure Devices, Introducer Sheaths, and Balloon Inflation Devices, is experiencing significant growth due to their indispensable role in facilitating complex interventional procedures.

- Product Dominance Drivers:

- Peripheral Vascular Stents: High prevalence of PAD, advancements in stent technologies (drug-eluting, bioresorbable), and an aging population.

- Catheters: Versatility in diagnostic and therapeutic applications, development of specialized catheters for complex anatomies.

- Peripheral Accessories: Increasing complexity of procedures, demand for enhanced precision and safety, and improved patient outcomes. Specifically, the evolution in Guidewire Coating Type, with Hydrophilic Coating Wires gaining prominence for their lubricity and maneuverability in tortuous vessels, significantly boosts this sub-segment.

The Guidewire Coating Type segment is increasingly witnessing a shift towards Hydrophilic Coating Wires due to their superior performance in navigating challenging vascular anatomies, thereby improving procedural success rates and reducing the risk of vessel trauma. Economic growth, rising disposable incomes, and increasing awareness about the benefits of minimally invasive treatments in emerging markets also contribute to the expansion of these segments. Government initiatives aimed at improving cardiovascular healthcare access and infrastructure development further bolster the growth of these key markets and segments, underpinning their leading position in the peripheral vascular devices and accessories market.

Global Peripheral Vascular Devices and Accessories Market Product Developments

Product innovation is a critical engine for growth in the peripheral vascular devices and accessories market. Recent advancements focus on enhancing device deliverability, efficacy, and patient safety. Examples include the development of advanced stent designs with improved flexibility and radial force, next-generation angioplasty balloons offering enhanced lesion crossing capabilities, and innovative atherectomy devices for efficient plaque removal. The peripheral accessories segment is particularly dynamic, with novel guidewires featuring advanced coatings for superior navigation and reduced friction, alongside improved vascular closure devices for faster hemostasis. These technological leaps are designed to address unmet clinical needs, facilitate more complex interventions, and ultimately improve patient outcomes in peripheral vascular treatments.

Challenges in the Global Peripheral Vascular Devices and Accessories Market Market

Despite its robust growth, the global peripheral vascular devices and accessories market faces several challenges. Stringent regulatory hurdles and lengthy approval processes for new devices can delay market entry and increase development costs. The high cost of advanced peripheral vascular devices and accessories can also be a barrier to adoption, especially in price-sensitive markets. Intense competition among manufacturers leads to price pressures, impacting profit margins. Furthermore, the need for specialized training and expertise among healthcare professionals for the effective use of complex interventional devices presents a continuous educational challenge. Supply chain disruptions and raw material sourcing complexities can also impact production and availability.

Forces Driving Global Peripheral Vascular Devices and Accessories Market Growth

Several powerful forces are driving the growth of the global peripheral vascular devices and accessories market. The increasing global burden of peripheral artery disease (PAD) and other vascular conditions, driven by an aging population and rising rates of diabetes and obesity, creates a consistent demand for effective treatments. Technological advancements, including the development of minimally invasive devices, improved stent technologies, and advanced catheter systems, are crucial enablers, offering better efficacy and patient outcomes. Favorable reimbursement policies for interventional procedures in many regions further incentivize the adoption of these devices. Growing healthcare expenditure globally and increasing awareness among patients and physicians about the benefits of peripheral vascular interventions also contribute significantly to market expansion.

Challenges in the Global Peripheral Vascular Devices and Accessories Market Market

Long-term growth catalysts for the global peripheral vascular devices and accessories market are rooted in continuous innovation and strategic market expansion. The development of next-generation technologies, such as bioresorbable scaffolds, advanced drug-delivery systems integrated into stents, and AI-powered imaging solutions for improved procedural planning, will be critical. Strategic partnerships and collaborations between device manufacturers, research institutions, and healthcare providers can accelerate the translation of novel technologies into clinical practice. Furthermore, expanding market access in emerging economies through localized manufacturing, targeted marketing, and adaptive product offerings will unlock significant future potential. The growing focus on value-based healthcare models will also drive the demand for devices that demonstrate superior long-term outcomes and cost-effectiveness.

Emerging Opportunities in Global Peripheral Vascular Devices and Accessories Market

Emerging opportunities in the global peripheral vascular devices and accessories market are vast and multifaceted. The expanding application of these devices in treating a wider range of vascular pathologies, including complex arterial and venous occlusive diseases, presents significant growth potential. The increasing adoption of minimally invasive techniques in emerging economies, driven by a growing middle class and improving healthcare infrastructure, offers substantial untapped markets. Furthermore, advancements in nanotechnology and biomaterials are paving the way for innovative devices with enhanced biocompatibility and therapeutic properties. The integration of digital health technologies, such as remote patient monitoring and AI-driven analytics, can create new service-based revenue streams and improve patient management throughout the treatment continuum, further diversifying opportunities within the market.

Leading Players in the Global Peripheral Vascular Devices and Accessories Market Sector

- Becton Dickinson and Company

- Cook Medical

- Biotronik SE & Co KG

- Koninklijke Philips N V

- AngioDynamics

- Edward Lifesciences

- Abbott

- B Braun Melsungen AG

- Boston Scientific Corporation

- Cordis Corporation

- Medtronic plc

- Terumo Medical Corporation

Key Milestones in Global Peripheral Vascular Devices and Accessories Market Industry

- March 2022: Cordis received the United States Food and Drug Administration (FDA) approval for the SMART RADIANZ Vascular Stent System, a self-expanding stent purposefully engineered for radial peripheral procedures.

- March 2022: Artio Medical, Inc. received clearance from the United States Food and Drug Administration (FDA) for its Solus Gold Embolization Device, a next-generation product for peripheral vascular occlusion.

Strategic Outlook for Global Peripheral Vascular Devices and Accessories Market Market

The strategic outlook for the global peripheral vascular devices and accessories market is characterized by sustained growth driven by innovation and market expansion. Key growth accelerators include the continued development of less invasive and more effective treatment options for peripheral vascular diseases, catering to the increasing demand for improved patient outcomes and reduced healthcare burdens. Strategic opportunities lie in targeting unmet clinical needs through advanced product development, such as enhanced guidewires and closure devices, and expanding presence in emerging markets with tailored product offerings and accessible pricing strategies. Collaborations with healthcare providers to promote the adoption of advanced interventional techniques and a focus on demonstrating the long-term economic value of peripheral vascular interventions will further solidify the market's trajectory.

Global Peripheral Vascular Devices and Accessories Market Segmentation

-

1. Product

- 1.1. Peripheral Vascular Stents

- 1.2. Peripheral Transluminal Angioplasty (PTA) Balloons

- 1.3. Catheters

- 1.4. Atherectomy Devices

-

1.5. Peripheral Accessories

-

1.5.1. Guidewires

- 1.5.1.1. Workhorse Guidewires

- 1.5.1.2. Frontline Finesse Guidewires

- 1.5.1.3. Extra support Guidewires

- 1.5.1.4. Specialty Guidewires

- 1.5.2. Peripheral Vascular Closure Devices

- 1.5.3. Introducer Sheaths

- 1.5.4. Balloon Inflation Devices

-

1.5.1. Guidewires

- 1.6. Others

-

2. Guidewire Coating Type

- 2.1. Hydrophobic Coating Wires

- 2.2. Hydrophilic Coating Wires

Global Peripheral Vascular Devices and Accessories Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Peripheral Vascular Devices and Accessories Market Regional Market Share

Geographic Coverage of Global Peripheral Vascular Devices and Accessories Market

Global Peripheral Vascular Devices and Accessories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally-invasive Procedures; Increase in Incidence of Peripheral Arterial Disease (PAD)

- 3.3. Market Restrains

- 3.3.1. Stringent Regulation Related to Peripheral Vascular Devices

- 3.4. Market Trends

- 3.4.1. Atherectomy Devices Segment is Expected to Account for the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Peripheral Vascular Devices and Accessories Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Peripheral Vascular Stents

- 5.1.2. Peripheral Transluminal Angioplasty (PTA) Balloons

- 5.1.3. Catheters

- 5.1.4. Atherectomy Devices

- 5.1.5. Peripheral Accessories

- 5.1.5.1. Guidewires

- 5.1.5.1.1. Workhorse Guidewires

- 5.1.5.1.2. Frontline Finesse Guidewires

- 5.1.5.1.3. Extra support Guidewires

- 5.1.5.1.4. Specialty Guidewires

- 5.1.5.2. Peripheral Vascular Closure Devices

- 5.1.5.3. Introducer Sheaths

- 5.1.5.4. Balloon Inflation Devices

- 5.1.5.1. Guidewires

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Guidewire Coating Type

- 5.2.1. Hydrophobic Coating Wires

- 5.2.2. Hydrophilic Coating Wires

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Peripheral Vascular Devices and Accessories Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Peripheral Vascular Stents

- 6.1.2. Peripheral Transluminal Angioplasty (PTA) Balloons

- 6.1.3. Catheters

- 6.1.4. Atherectomy Devices

- 6.1.5. Peripheral Accessories

- 6.1.5.1. Guidewires

- 6.1.5.1.1. Workhorse Guidewires

- 6.1.5.1.2. Frontline Finesse Guidewires

- 6.1.5.1.3. Extra support Guidewires

- 6.1.5.1.4. Specialty Guidewires

- 6.1.5.2. Peripheral Vascular Closure Devices

- 6.1.5.3. Introducer Sheaths

- 6.1.5.4. Balloon Inflation Devices

- 6.1.5.1. Guidewires

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Guidewire Coating Type

- 6.2.1. Hydrophobic Coating Wires

- 6.2.2. Hydrophilic Coating Wires

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Peripheral Vascular Devices and Accessories Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Peripheral Vascular Stents

- 7.1.2. Peripheral Transluminal Angioplasty (PTA) Balloons

- 7.1.3. Catheters

- 7.1.4. Atherectomy Devices

- 7.1.5. Peripheral Accessories

- 7.1.5.1. Guidewires

- 7.1.5.1.1. Workhorse Guidewires

- 7.1.5.1.2. Frontline Finesse Guidewires

- 7.1.5.1.3. Extra support Guidewires

- 7.1.5.1.4. Specialty Guidewires

- 7.1.5.2. Peripheral Vascular Closure Devices

- 7.1.5.3. Introducer Sheaths

- 7.1.5.4. Balloon Inflation Devices

- 7.1.5.1. Guidewires

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Guidewire Coating Type

- 7.2.1. Hydrophobic Coating Wires

- 7.2.2. Hydrophilic Coating Wires

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Peripheral Vascular Devices and Accessories Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Peripheral Vascular Stents

- 8.1.2. Peripheral Transluminal Angioplasty (PTA) Balloons

- 8.1.3. Catheters

- 8.1.4. Atherectomy Devices

- 8.1.5. Peripheral Accessories

- 8.1.5.1. Guidewires

- 8.1.5.1.1. Workhorse Guidewires

- 8.1.5.1.2. Frontline Finesse Guidewires

- 8.1.5.1.3. Extra support Guidewires

- 8.1.5.1.4. Specialty Guidewires

- 8.1.5.2. Peripheral Vascular Closure Devices

- 8.1.5.3. Introducer Sheaths

- 8.1.5.4. Balloon Inflation Devices

- 8.1.5.1. Guidewires

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Guidewire Coating Type

- 8.2.1. Hydrophobic Coating Wires

- 8.2.2. Hydrophilic Coating Wires

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Peripheral Vascular Stents

- 9.1.2. Peripheral Transluminal Angioplasty (PTA) Balloons

- 9.1.3. Catheters

- 9.1.4. Atherectomy Devices

- 9.1.5. Peripheral Accessories

- 9.1.5.1. Guidewires

- 9.1.5.1.1. Workhorse Guidewires

- 9.1.5.1.2. Frontline Finesse Guidewires

- 9.1.5.1.3. Extra support Guidewires

- 9.1.5.1.4. Specialty Guidewires

- 9.1.5.2. Peripheral Vascular Closure Devices

- 9.1.5.3. Introducer Sheaths

- 9.1.5.4. Balloon Inflation Devices

- 9.1.5.1. Guidewires

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Guidewire Coating Type

- 9.2.1. Hydrophobic Coating Wires

- 9.2.2. Hydrophilic Coating Wires

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Peripheral Vascular Devices and Accessories Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Peripheral Vascular Stents

- 10.1.2. Peripheral Transluminal Angioplasty (PTA) Balloons

- 10.1.3. Catheters

- 10.1.4. Atherectomy Devices

- 10.1.5. Peripheral Accessories

- 10.1.5.1. Guidewires

- 10.1.5.1.1. Workhorse Guidewires

- 10.1.5.1.2. Frontline Finesse Guidewires

- 10.1.5.1.3. Extra support Guidewires

- 10.1.5.1.4. Specialty Guidewires

- 10.1.5.2. Peripheral Vascular Closure Devices

- 10.1.5.3. Introducer Sheaths

- 10.1.5.4. Balloon Inflation Devices

- 10.1.5.1. Guidewires

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Guidewire Coating Type

- 10.2.1. Hydrophobic Coating Wires

- 10.2.2. Hydrophilic Coating Wires

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cook Medical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biotronik SE & Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koninklijke Philips N V

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AngioDynamics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Edward Lifesciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 B Braun Melsungen AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boston Scientific Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cordis Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Medtronic plc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Terumo Medical Corporation*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Global Peripheral Vascular Devices and Accessories Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Guidewire Coating Type 2025 & 2033

- Figure 5: North America Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Guidewire Coating Type 2025 & 2033

- Figure 6: North America Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Guidewire Coating Type 2025 & 2033

- Figure 11: Europe Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Guidewire Coating Type 2025 & 2033

- Figure 12: Europe Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Guidewire Coating Type 2025 & 2033

- Figure 17: Asia Pacific Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Guidewire Coating Type 2025 & 2033

- Figure 18: Asia Pacific Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Guidewire Coating Type 2025 & 2033

- Figure 23: Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Guidewire Coating Type 2025 & 2033

- Figure 24: Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Product 2025 & 2033

- Figure 27: South America Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Guidewire Coating Type 2025 & 2033

- Figure 29: South America Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Guidewire Coating Type 2025 & 2033

- Figure 30: South America Global Peripheral Vascular Devices and Accessories Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Global Peripheral Vascular Devices and Accessories Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Guidewire Coating Type 2020 & 2033

- Table 3: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Guidewire Coating Type 2020 & 2033

- Table 6: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Guidewire Coating Type 2020 & 2033

- Table 12: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Guidewire Coating Type 2020 & 2033

- Table 21: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Guidewire Coating Type 2020 & 2033

- Table 30: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Product 2020 & 2033

- Table 35: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Guidewire Coating Type 2020 & 2033

- Table 36: Global Peripheral Vascular Devices and Accessories Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Global Peripheral Vascular Devices and Accessories Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Peripheral Vascular Devices and Accessories Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Global Peripheral Vascular Devices and Accessories Market?

Key companies in the market include Becton Dickinson and Company, Cook Medical, Biotronik SE & Co KG, Koninklijke Philips N V, AngioDynamics, Edward Lifesciences, Abbott, B Braun Melsungen AG, Boston Scientific Corporation, Cordis Corporation, Medtronic plc, Terumo Medical Corporation*List Not Exhaustive.

3. What are the main segments of the Global Peripheral Vascular Devices and Accessories Market?

The market segments include Product, Guidewire Coating Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally-invasive Procedures; Increase in Incidence of Peripheral Arterial Disease (PAD).

6. What are the notable trends driving market growth?

Atherectomy Devices Segment is Expected to Account for the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulation Related to Peripheral Vascular Devices.

8. Can you provide examples of recent developments in the market?

In March 2022, Cordis received the United States Food and Drug Administration (FDA) approval for the SMART RADIANZ Vascular Stent System, a self-expanding stent purposefully engineered for radial peripheral procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Peripheral Vascular Devices and Accessories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Peripheral Vascular Devices and Accessories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Peripheral Vascular Devices and Accessories Market?

To stay informed about further developments, trends, and reports in the Global Peripheral Vascular Devices and Accessories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence