Key Insights

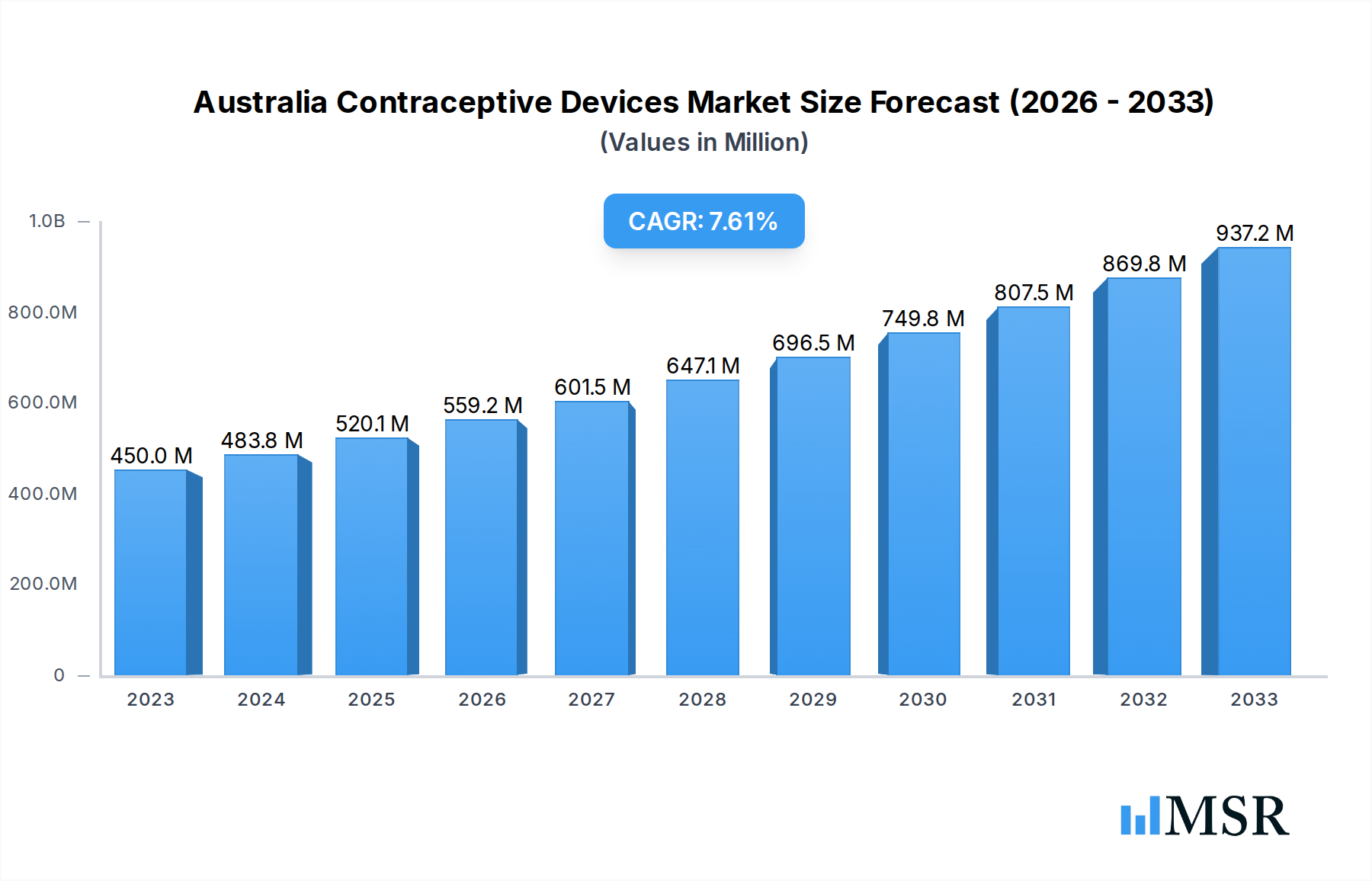

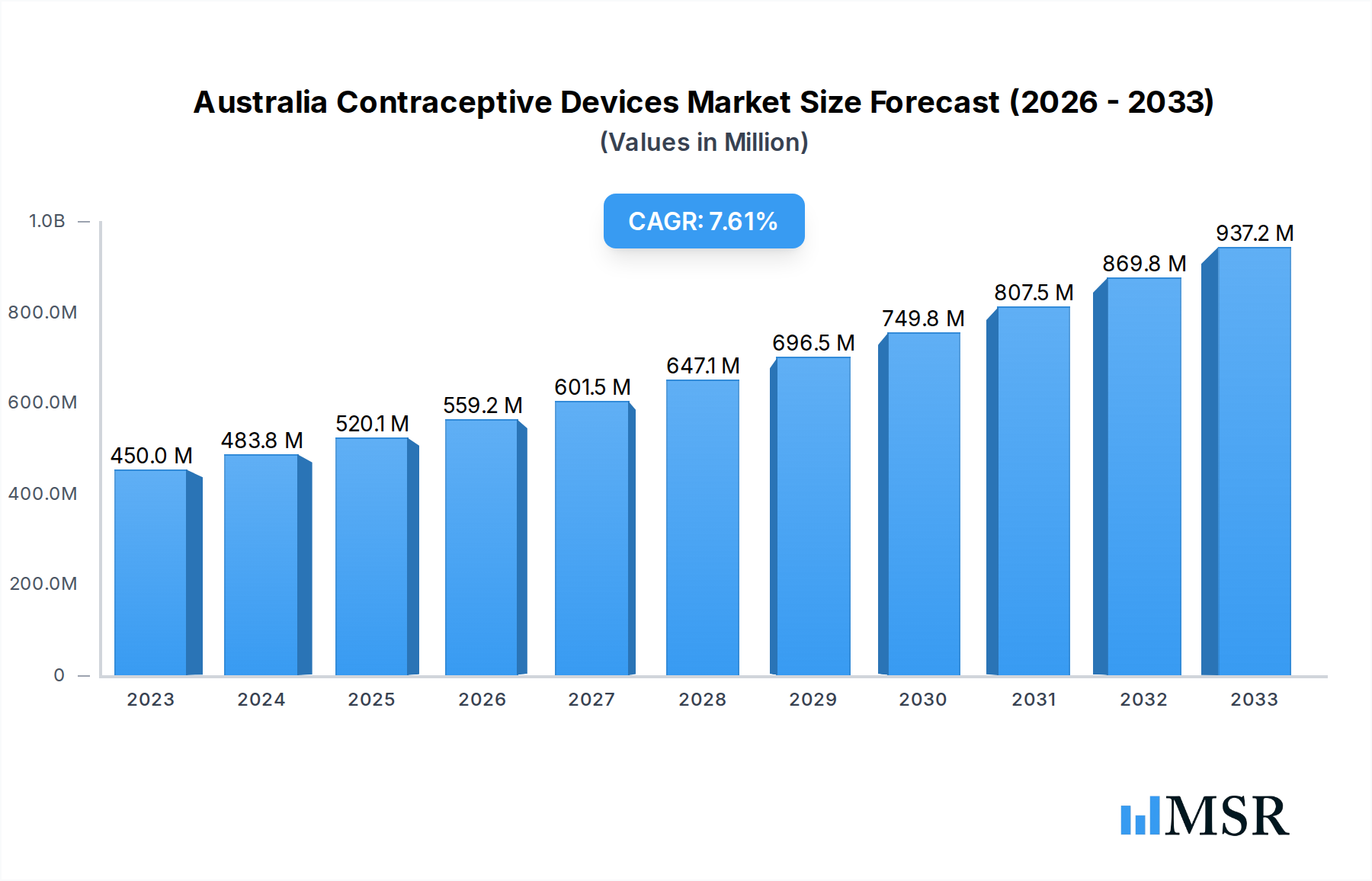

The Australian contraceptive devices market is poised for robust expansion, driven by increasing awareness of reproductive health, growing demand for family planning, and a shifting demographic landscape. In 2023, the market size was an estimated AUD 450 million, projecting a healthy CAGR of 7.5% through 2033. This growth is underpinned by several key drivers, including the rising prevalence of sexually transmitted infections (STIs) necessitating barrier methods, and a growing emphasis on women's health and autonomy. The increasing availability and accessibility of a diverse range of contraceptive options, from traditional methods like condoms and diaphragms to advanced intrauterine devices (IUDs) and innovative new technologies, are further fueling market penetration. Furthermore, government initiatives promoting sexual and reproductive health education and access to contraception contribute significantly to this positive trajectory.

Australia Contraceptive Devices Market Market Size (In Million)

The market segmentation reveals a dynamic interplay between different product types and user demographics. Condoms continue to hold a significant share due to their affordability, accessibility, and dual protection against STIs. However, intrauterine devices (IUDs) are experiencing substantial growth, driven by their long-term efficacy and convenience, particularly among women seeking highly reliable, reversible contraception. The growing acceptance and demand from both male and female segments underscore the evolving attitudes towards contraceptive use. While the market is generally favorable, potential restraints could include regulatory hurdles for new product approvals and varying levels of public health funding for contraceptive programs. Key players are actively investing in research and development to introduce next-generation contraceptive solutions, further stimulating innovation and market competition within Australia.

Australia Contraceptive Devices Market Company Market Share

Australia Contraceptive Devices Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a strategic analysis of the Australia contraceptive devices market, offering critical insights into its growth dynamics, segmentation, and future trajectory. Covering the historical period (2019-2024), base year (2025), estimated year (2025), and an extensive forecast period (2025-2033), this research equips industry stakeholders with actionable intelligence to navigate the evolving landscape. The market is poised for significant expansion, driven by increasing awareness of sexual health, a growing demand for reliable and accessible contraception, and continuous innovation in product offerings. We delve deep into the market's concentration, key players, emerging trends, and challenges, providing a holistic view for informed decision-making.

Australia Contraceptive Devices Market Market Concentration & Dynamics

The Australia contraceptive devices market exhibits a moderate to high concentration, with key global and local players vying for market share. Innovation ecosystems are burgeoning, fueled by advancements in materials science and user-centric design. Regulatory frameworks, managed by authorities like the Therapeutic Goods Administration (TGA), ensure product safety and efficacy, albeit sometimes presenting hurdles for new entrants. Substitute products, such as hormonal contraceptives and emergency contraception pills, pose a competitive challenge, but the inherent advantages of contraceptive devices like long-acting reversible contraceptives (LARCs) and barrier methods maintain their strong market position. End-user trends indicate a growing preference for user-controlled and reversible methods. Merger and acquisition (M&A) activities, while not rampant, play a role in market consolidation and strategic expansion. Recent M&A deals are expected to influence market share distribution and foster competitive advantages. The market is dynamic, with a continuous influx of new products and strategic alliances aiming to capture a larger segment of the Australian sexual health market.

- Market Share Drivers: Brand loyalty, product innovation, distribution network reach, and pricing strategies are pivotal in determining market share.

- Innovation Hubs: Research and development activities are concentrated in key urban centers, fostering collaboration between academic institutions and private companies.

- Regulatory Landscape: The TGA's stringent approval process for medical devices influences market entry timelines and R&D investment.

- Substitute Products: The availability and affordability of pills and injectables necessitate a focus on device efficacy and user convenience.

- End-User Preferences: Growing demand for female-controlled contraception and sustainable options are shaping product development.

- M&A Activities: Recent M&A trends highlight a focus on acquiring innovative technologies and expanding product portfolios. The number of M&A deals is predicted to increase by 15% in the coming years.

Australia Contraceptive Devices Market Industry Insights & Trends

The Australia contraceptive devices market is experiencing robust growth, projected to reach an estimated value of AUD $XX million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This expansion is primarily propelled by increasing awareness surrounding sexual health and reproductive rights, a growing emphasis on family planning, and a rising demand for convenient and effective contraceptive solutions. Technological advancements are playing a crucial role, leading to the development of more user-friendly, discreet, and highly effective devices. The condoms market, particularly, is witnessing innovation in materials and features, catering to diverse consumer needs. Furthermore, the increasing adoption of Intrauterine Devices (IUDs) and contraceptive implants as preferred long-acting reversible contraception (LARC) methods significantly contributes to market value. Evolving consumer behaviors, driven by a greater willingness to discuss sexual health openly and seek reliable contraceptive options, are also fueling market momentum. The government's focus on public health initiatives and the availability of subsidized programs for certain contraceptive methods further bolster market accessibility and adoption rates, especially for female contraceptive devices. The demand for male contraceptive devices is also steadily increasing, albeit from a smaller base, driven by a growing sense of shared responsibility in reproductive health.

- Market Size (Estimated Year 2025): AUD $XX million

- CAGR (Forecast Period 2025-2033): XX%

- Key Growth Drivers:

- Rising sexual health awareness.

- Government initiatives promoting reproductive health.

- Technological innovations in contraceptive device design.

- Growing preference for LARCs.

- Increased accessibility and affordability.

- Technological Disruptions: Development of smart contraceptives, biodegradable materials, and advanced delivery systems are transforming the market.

- Evolving Consumer Behaviors: Greater acceptance of diverse contraceptive methods, focus on personalized health solutions, and increased digital engagement for health information.

Key Markets & Segments Leading Australia Contraceptive Devices Market

The Australia contraceptive devices market is predominantly led by the Female segment, driven by the widespread adoption of a variety of contraceptive methods designed for women. Within this segment, Intrauterine Devices (IUDs) stand out as a high-value category, owing to their long-term efficacy and convenience, making them a preferred choice for many Australian women seeking reliable family planning solutions. The Condoms segment, encompassing both male and female condoms, also holds a significant share, fueled by their accessibility, affordability, and role in preventing sexually transmitted infections (STIs) alongside pregnancy.

Dominant Segment: Female Contraceptive Devices

- Drivers:

- Higher incidence of unintended pregnancies addressed by female-centric methods.

- Wider range of effective and long-acting options available.

- Growing emphasis on female autonomy in reproductive health decisions.

- Increased awareness of the benefits of LARCs.

- Detailed Dominance Analysis: The female segment benefits from a mature market for IUDs and implants, which offer extended protection and reduced user error compared to daily methods. The availability of diverse condom types, including those designed for specific user preferences, further solidifies its leadership.

- Drivers:

Leading Product Type: Intrauterine Devices (IUDs)

- Drivers:

- High efficacy rates (>99%).

- Long duration of action (up to 10 years for some types).

- Reversibility and rapid return to fertility.

- Reduced risk of user error compared to other methods.

- Government subsidies and insurance coverage for IUD insertion.

- Detailed Dominance Analysis: IUDs have revolutionized contraception by offering a highly effective, long-term, and low-maintenance solution. Their growing acceptance among women of all ages seeking reliable birth control contributes significantly to their market dominance.

- Drivers:

Prominent Gender Segment: Female

- Drivers:

- Societal norms and historical focus on female responsibility for contraception.

- Greater availability and variety of female contraceptive methods.

- Increasing advocacy for female reproductive rights and autonomy.

- Detailed Dominance Analysis: While progress is being made, the primary burden of contraception often still falls on women. This is reflected in the market share held by female contraceptive devices, which comprise a broader spectrum of product types and higher adoption rates.

- Drivers:

Significant Segment: Condoms

- Drivers:

- Dual protection against pregnancy and STIs.

- Wide availability and affordability.

- Variety of options catering to different preferences (e.g., thinness, lubrication, texture).

- Growing awareness of STI prevention, especially among younger demographics.

- Detailed Dominance Analysis: Condoms remain a fundamental contraceptive method due to their accessibility and dual protective benefits. The market is dynamic, with continuous innovation in materials and designs to enhance user experience and appeal to a wider audience.

- Drivers:

Australia Contraceptive Devices Market Product Developments

Recent product developments in the Australia contraceptive devices market are centered on enhancing user experience, efficacy, and sustainability. Innovations include the introduction of ultra-thin condoms with enhanced lubrication for improved comfort and sensation, as seen with Moments Condoms' new range. Research is also ongoing into novel materials for both barrier methods and IUDs, aiming for greater biocompatibility and reduced environmental impact. The development of discrete and user-friendly packaging is another key trend, addressing consumer preferences for privacy and convenience. The market is witnessing a push towards more personalized contraceptive solutions, with a focus on catering to diverse anatomical needs and preferences, particularly within the female contraceptive devices sector.

Challenges in the Australia Contraceptive Devices Market Market

Despite robust growth, the Australia contraceptive devices market faces several challenges. Regulatory hurdles for novel devices can lead to extended approval times and increased R&D costs. Supply chain disruptions, exacerbated by global events, can impact product availability and affordability, particularly for specialized contraceptive implants. Competitive pressures from established brands and emerging market entrants necessitate continuous innovation and aggressive marketing strategies. Furthermore, stigma and lack of open discussion surrounding sexual health in certain demographics can hinder adoption rates for some contraceptive methods. The cost of advanced devices for end-users, even with subsidies, can remain a barrier for some segments of the population.

- Regulatory Delays: Extended timeframes for TGA approval of new contraceptive technologies.

- Supply Chain Volatility: Risks associated with global manufacturing and logistics affecting product availability.

- Intense Competition: Pressure to differentiate and maintain market share against numerous local and international players.

- Social Stigma: Lingering taboos around sexual health impacting open discussion and adoption of certain contraceptive methods.

- Cost of Advanced Devices: Potential affordability issues for premium or long-acting contraceptive solutions for some consumers.

Forces Driving Australia Contraceptive Devices Market Growth

Several key forces are driving the growth of the Australia contraceptive devices market. Technological advancements in materials science and product design are leading to more effective, comfortable, and user-friendly devices. Increasing awareness and education about sexual health and reproductive rights are empowering individuals to make informed choices about contraception. Government initiatives and public health programs promoting family planning and STI prevention also play a significant role. Furthermore, a growing demand for long-acting reversible contraceptives (LARCs), such as IUDs and implants, due to their high efficacy and convenience, is a major growth catalyst. The rising trend of shared responsibility in family planning is also contributing to the expansion of the male contraceptive devices market.

- Technological Innovation: Development of advanced materials and user-centric designs for enhanced efficacy and comfort.

- Public Health Awareness Campaigns: Government-backed initiatives and NGOs promoting sexual health education and contraceptive access.

- Policy Support: Favorable government policies and subsidies for certain contraceptive methods, increasing affordability and accessibility.

- Demand for LARCs: Growing preference for long-term, low-maintenance contraceptive solutions like IUDs and implants.

- Evolving Social Norms: Increased acceptance of contraception and a shift towards shared responsibility in reproductive health.

Challenges in the Australia Contraceptive Devices Market Market

Long-term growth catalysts for the Australia contraceptive devices market lie in continuous innovation and market expansion. The development of next-generation contraceptive technologies, including potentially male contraceptives and user-friendly female-controlled options beyond current offerings, will be crucial. Strategic partnerships between manufacturers, healthcare providers, and public health organizations can enhance product distribution and education. Expanding access to these devices in remote and underserved areas through telehealth initiatives and mobile clinics will also be a key growth accelerator. Furthermore, a focus on developing sustainable and eco-friendly contraceptive solutions will resonate with an increasingly environmentally conscious consumer base.

Emerging Opportunities in Australia Contraceptive Devices Market

Emerging opportunities within the Australia contraceptive devices market are diverse and promising. The development and widespread adoption of effective male contraceptive methods represent a significant untapped market. Furthermore, the growing demand for personalized contraception offers opportunities for devices tailored to individual needs and preferences, potentially leveraging digital health technologies. Expansion into sub-Saharan African and Southeast Asian markets, with their burgeoning young populations and increasing access to healthcare, presents substantial global growth potential. Innovations in biodegradable materials for condoms and other devices align with global sustainability trends, creating a niche market for environmentally conscious consumers. The integration of digital health platforms for contraceptive tracking, education, and reordering can enhance user engagement and adherence.

Leading Players in the Australia Contraceptive Devices Market Sector

- AbbVie Inc (Allergan PLC)

- Church & Dwight Co Inc

- Merck & Co Inc

- Bayer Healthcare

- SMB Corporation Of India

- Starpharma Holdings Limited

- Contraline Inc

- HERO

- Lifestyles Healthcare

- Medintim

- Reckitt Benckiser

- Pfizer Inc

Key Milestones in Australia Contraceptive Devices Market Industry

- May 2022: Moments Condoms revealed that it would be one of the first Australian condom brands aimed solely at women to be offered in over 600 Coles supermarkets across the country. Moments Condoms will unveil its new Ultra Thin range, which claims more lubrication and is available in three sizes: ordinary, big, and extra large, as a result of the collaboration.

- April 2022: Family Planning NSW launched the Freedom Condom project, which will provide free condoms, water-based lubricants, and sexual health information to under-30s across the state.

Strategic Outlook for Australia Contraceptive Devices Market Market

The strategic outlook for the Australia contraceptive devices market is characterized by a continued focus on innovation, accessibility, and consumer education. Growth accelerators will include the introduction of novel long-acting reversible contraceptives (LARCs) with improved safety profiles and user convenience, and the potential emergence of effective male contraceptive options. Strategic partnerships between device manufacturers, healthcare providers, and governmental health organizations will be crucial for expanding reach and ensuring equitable access. Emphasis on digital health integration for contraceptive management and education will enhance user engagement and adherence. Furthermore, addressing unmet needs in specific demographics and geographical regions, coupled with a commitment to sustainable product development, will shape the market's future trajectory and unlock significant growth potential in the coming years.

Australia Contraceptive Devices Market Segmentation

-

1. Type

- 1.1. Condoms

- 1.2. Diaphragms

- 1.3. Cervical Caps

- 1.4. Intrauterine Devices

- 1.5. Other Types

-

2. Gender

- 2.1. Male

- 2.2. Female

Australia Contraceptive Devices Market Segmentation By Geography

- 1. Australia

Australia Contraceptive Devices Market Regional Market Share

Geographic Coverage of Australia Contraceptive Devices Market

Australia Contraceptive Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Cases of Sexually Transmitted Diseases; Government Initiatives Regarding Usage of Contraceptive Devices

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated with Contraceptive Devices

- 3.4. Market Trends

- 3.4.1. Condoms is Expected to Exhibit a Steady Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Contraceptive Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condoms

- 5.1.2. Diaphragms

- 5.1.3. Cervical Caps

- 5.1.4. Intrauterine Devices

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AbbVie Inc (Allergan PLC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Church & Dwight Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Merck & Co Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SMB Corporation Of India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Starpharma Holdings Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Contraline Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HERO

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lifestyles Healthcare

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Medintim

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Reckitt Benckiser

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Pfizer Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 AbbVie Inc (Allergan PLC)

List of Figures

- Figure 1: Australia Contraceptive Devices Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Australia Contraceptive Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Contraceptive Devices Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Australia Contraceptive Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Australia Contraceptive Devices Market Revenue million Forecast, by Gender 2020 & 2033

- Table 4: Australia Contraceptive Devices Market Volume K Unit Forecast, by Gender 2020 & 2033

- Table 5: Australia Contraceptive Devices Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Australia Contraceptive Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Australia Contraceptive Devices Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Australia Contraceptive Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Australia Contraceptive Devices Market Revenue million Forecast, by Gender 2020 & 2033

- Table 10: Australia Contraceptive Devices Market Volume K Unit Forecast, by Gender 2020 & 2033

- Table 11: Australia Contraceptive Devices Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Australia Contraceptive Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Contraceptive Devices Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Australia Contraceptive Devices Market?

Key companies in the market include AbbVie Inc (Allergan PLC), Church & Dwight Co Inc, Merck & Co Inc, Bayer Healthcare, SMB Corporation Of India, Starpharma Holdings Limited, Contraline Inc, HERO, Lifestyles Healthcare, Medintim, Reckitt Benckiser, Pfizer Inc.

3. What are the main segments of the Australia Contraceptive Devices Market?

The market segments include Type, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 450 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cases of Sexually Transmitted Diseases; Government Initiatives Regarding Usage of Contraceptive Devices.

6. What are the notable trends driving market growth?

Condoms is Expected to Exhibit a Steady Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects Associated with Contraceptive Devices.

8. Can you provide examples of recent developments in the market?

May 2022: Moments Condoms revealed that it would be one of the first Australian condom brands aimed solely at women to be offered in over 600 Coles supermarkets across the country. Moments Condoms will unveil its new Ultra Thin range, which claims more lubrication and is available in three sizes: ordinary, big, and extra large, as a result of the collaboration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Contraceptive Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Contraceptive Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Contraceptive Devices Market?

To stay informed about further developments, trends, and reports in the Australia Contraceptive Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence