Key Insights

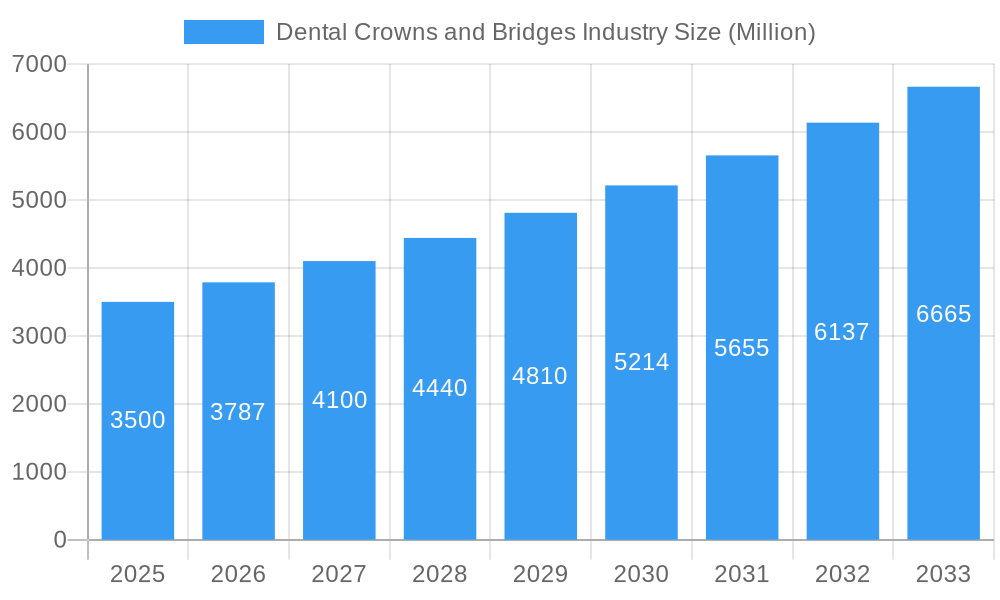

The global Dental Crowns and Bridges market is poised for significant expansion, projected to reach approximately $3.5 billion in 2025 and continue its upward trajectory with a robust Compound Annual Growth Rate (CAGR) of 8.1% through 2033. This growth is largely propelled by an increasing global emphasis on aesthetic dentistry, a rising prevalence of dental caries and tooth loss, and advancements in dental materials and manufacturing technologies, including CAD/CAM systems. The aging global population also contributes to demand, as age-related oral health issues become more common. Furthermore, growing disposable incomes in emerging economies are making advanced dental treatments, such as crowns and bridges, more accessible to a wider population. The market is also benefiting from increased patient awareness regarding oral hygiene and the availability of aesthetically superior and durable restorative options.

Dental Crowns and Bridges Industry Market Size (In Billion)

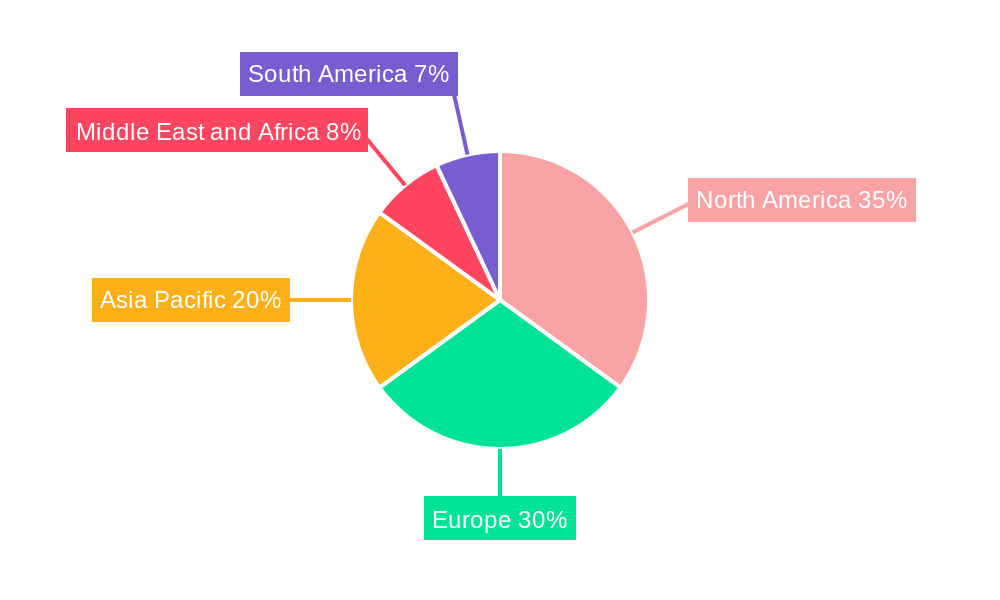

The market is segmented by material, with Ceramic materials, Metals, and Porcelain-Fused-to-Metal (PFM) dominating the landscape, each offering distinct advantages in terms of aesthetics, durability, and cost. By product, Crowns and Bridges represent the primary applications, addressing a broad spectrum of restorative needs. Key players like Henry Schein Inc., Straumann, Dentsply Sirona, and 3M Company are actively investing in research and development to introduce innovative solutions and expand their global reach. Geographically, North America and Europe currently lead the market due to well-established healthcare infrastructures and high patient spending, but the Asia Pacific region is emerging as a significant growth driver, fueled by rapid economic development and improving healthcare access. Emerging trends like the adoption of digital dentistry workflows and the development of biocompatible and highly aesthetic materials are expected to further shape the market dynamics in the coming years, creating opportunities for further innovation and market penetration.

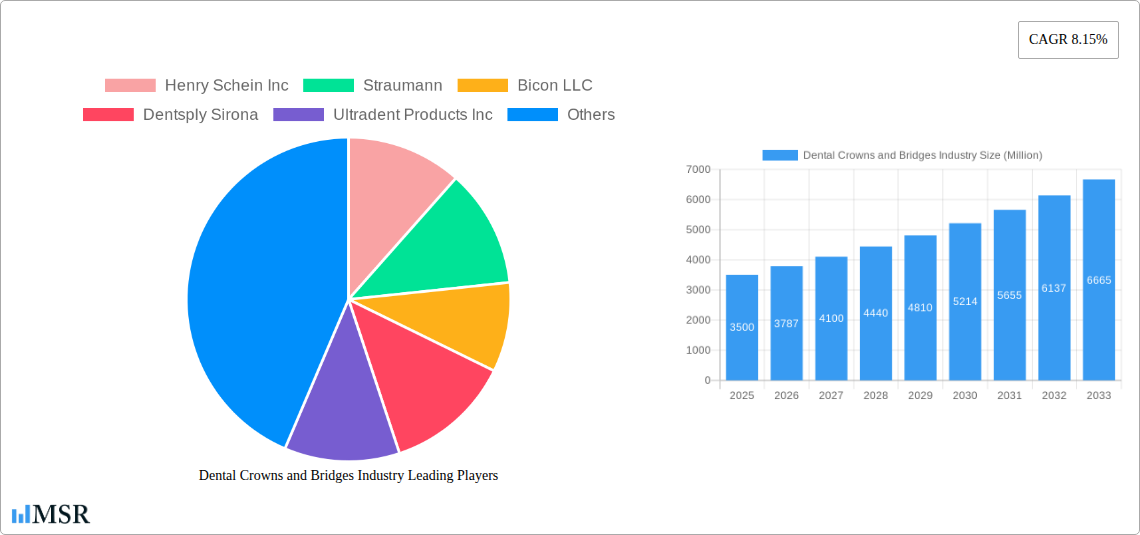

Dental Crowns and Bridges Industry Company Market Share

Gain critical insights into the burgeoning dental crowns and bridges industry with this definitive market report. Spanning the historical period of 2019–2024 and projecting through 2033, with a base and estimated year of 2025, this analysis provides an in-depth exploration of market dynamics, key trends, and strategic opportunities. Discover the forces shaping this multi-billion dollar sector, from material innovations and product advancements to regional dominance and competitive landscapes. Equip yourself with actionable intelligence to navigate the evolving demands of the dental restorative market.

This report delves into the global dental crowns and bridges market, valued at over $15 billion in 2025, with projections to exceed $25 billion by 2033. The market exhibits a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period.

Dental Crowns and Bridges Industry Market Concentration & Dynamics

The global dental crowns and bridges market is characterized by a moderate to high degree of concentration, with key players holding substantial market share. The innovation ecosystem is rapidly evolving, driven by advancements in material science, digital dentistry, and AI-powered design solutions. Regulatory frameworks, primarily focused on product safety and efficacy, are largely harmonized across major markets but can present varied compliance challenges. Substitute products, such as dental implants and veneers, offer alternative restorative solutions, influencing market dynamics. End-user trends indicate a growing preference for aesthetically pleasing and durable restorative options, with an increasing demand for minimally invasive procedures. Mergers and Acquisitions (M&A) are a significant aspect of market strategy, with approximately 15-20 M&A deals annually in the last five years, aimed at consolidating market presence, acquiring innovative technologies, and expanding product portfolios.

- Market Share Distribution: Top 5 players collectively hold over 60% of the market share.

- Innovation Ecosystem: Driven by digital CAD/CAM technologies and biomaterials.

- Regulatory Landscape: FDA, CE marking, and regional dental board approvals are crucial.

- Substitute Products: Dental implants, veneers, and dentures.

- End-User Preferences: Aesthetics, durability, patient comfort, and cost-effectiveness.

- M&A Activity: Focused on technology acquisition and market consolidation.

Dental Crowns and Bridges Industry Industry Insights & Trends

The dental crowns and bridges industry is experiencing robust growth, fueled by a confluence of factors including the rising prevalence of dental caries, periodontal diseases, and tooth loss globally. An aging population, coupled with increased oral hygiene awareness and a growing demand for aesthetic dental solutions, significantly contributes to market expansion. Technological disruptions are at the forefront, with the advent of digital dentistry, including CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems, enabling faster, more precise, and patient-specific restorations. The integration of Artificial Intelligence (AI) in dental design software, as demonstrated by Imagoworks' 3Dme Crown, is revolutionizing the workflow, reducing design time from hours to mere seconds and improving the accuracy of crown prosthesis fitting. Furthermore, advancements in material science have led to the development of highly biocompatible and aesthetically superior materials like all-ceramics and zirconia, which are increasingly replacing traditional metal-based restorations. The shift towards minimally invasive dentistry also plays a crucial role, as these techniques preserve more natural tooth structure, often requiring crowns for protection. Evolving consumer behaviors are characterized by a greater willingness to invest in advanced dental treatments, driven by aesthetic concerns and the desire for long-term oral health. The increasing accessibility of dental insurance and financing options further empowers individuals to seek necessary restorative procedures. The global market size, estimated at over $15 billion in 2025, is projected to witness sustained expansion throughout the forecast period, driven by these powerful trends. The CAGR of 5.2% reflects the market's inherent strength and its capacity to absorb technological advancements and shifting consumer demands.

Key Markets & Segments Leading Dental Crowns and Bridges Industry

North America currently leads the global dental crowns and bridges market, driven by high disposable incomes, advanced healthcare infrastructure, and a strong emphasis on cosmetic dentistry. The United States, in particular, represents a dominant country within this region, accounting for over 60% of the North American market share. Economic growth in the region, coupled with robust dental insurance coverage and a high rate of dental professional adoption of new technologies, further solidifies its leadership position.

Dominant Material Segment: Ceramic Materials

- Drivers: Superior aesthetics, biocompatibility, and metal-free restorations.

- Dominance Analysis: Ceramic materials, including zirconia and lithium disilicate, have witnessed significant market penetration due to their natural appearance and strength. The demand for aesthetically pleasing smiles has propelled ceramic-based crowns and bridges to the forefront, with dentists and patients alike preferring these options over traditional PFM restorations for anterior teeth. The continuous improvement in the strength and fracture resistance of ceramic materials is expanding their application to posterior teeth as well, further cementing their dominance. The market size for ceramic materials is estimated to be over $7 billion in 2025.

Dominant Product Segment: Crowns

- Drivers: Higher incidence of individual tooth damage and decay.

- Dominance Analysis: Crowns, designed to encase a single damaged tooth, represent the larger segment within the dental restorative market. The prevalence of dental caries, root canal treatments necessitating crowns, and tooth fractures contributes to the consistent demand for individual tooth restorations. The increasing adoption of digital workflows, enabling faster crown fabrication, also fuels this segment's growth. The market for dental crowns is projected to reach over $18 billion by 2033.

Emerging Market Trends: Asia-Pacific is anticipated to exhibit the highest growth rate due to increasing healthcare expenditure, a growing middle class, and rising dental awareness in countries like China and India.

Dental Crowns and Bridges Industry Product Developments

Product innovation in the dental crowns and bridges industry is rapidly advancing, focusing on enhancing material properties, streamlining fabrication processes, and improving patient outcomes. Recent developments include the launch of AI-powered design modules, such as Imagoworks' 3Dme Crown, which automates the design of crown prostheses in seconds, ensuring optimal fit within the patient's oral environment by utilizing 3D scan data. Concurrently, advancements in temporary dental materials, like Ultradent's UltraTemp REZ II, offer improved handling and stability for temporary crowns and bridges, facilitating seamless patient care during treatment phases. These innovations are driven by the pursuit of greater efficiency, enhanced precision, and superior patient comfort, solidifying competitive edges for manufacturers.

Challenges in the Dental Crowns and Bridges Industry Market

Despite robust growth, the dental crowns and bridges market faces several challenges. High manufacturing costs associated with advanced materials and digital technologies can limit accessibility for some patient populations. Stringent regulatory approvals for new materials and devices can lead to extended market entry timelines. Furthermore, the availability of skilled dental technicians proficient in digital workflows and the management of complex supply chains for specialized materials present ongoing hurdles. Intense competition among established players and emerging manufacturers also exerts downward pressure on pricing, impacting profitability.

- Cost of Advanced Materials: High price points of ceramics and zirconia.

- Regulatory Compliance: Lengthy and complex approval processes.

- Skilled Workforce Shortage: Need for trained dental technicians in digital dentistry.

- Supply Chain Volatility: Ensuring consistent availability of specialized materials.

- Price Competition: Pressure on profit margins due to intense market rivalry.

Forces Driving Dental Crowns and Bridges Industry Growth

Several key forces are propelling the dental crowns and bridges industry forward. The increasing global burden of oral diseases, including dental caries and periodontal issues, necessitates restorative treatments. An aging global population, more prone to tooth decay and loss, further amplifies demand. The growing emphasis on aesthetic dentistry, fueled by social media influence and a desire for improved self-image, drives the adoption of advanced and visually appealing restorative solutions. Moreover, continuous technological innovations in digital dentistry, such as intraoral scanners and CAD/CAM milling systems, are making treatments faster, more precise, and less invasive, thus enhancing patient experience and procedural efficiency.

Challenges in the Dental Crowns and Bridges Industry Market

Long-term growth catalysts for the dental crowns and bridges industry lie in continued material science innovation, leading to even stronger, more biocompatible, and aesthetically superior options. The expansion of digital dental workflows, including AI-driven diagnostics and treatment planning, will further streamline procedures and improve clinical outcomes. Strategic partnerships between dental material manufacturers and dental equipment providers will foster integrated solutions. Market expansion into developing economies, driven by increasing healthcare awareness and disposable incomes, presents significant untapped potential. The ongoing development of advanced implant-supported crown and bridge solutions will also contribute to sustained market growth.

Emerging Opportunities in Dental Crowns and Bridges Industry

Emerging opportunities within the dental crowns and bridges industry are abundant. The growing demand for personalized dentistry presents a significant avenue, with customized restorations tailored to individual patient needs and preferences. Advancements in 3D printing technology are poised to revolutionize the fabrication of complex dental prosthetics, offering greater design flexibility and potentially reduced costs. The increasing adoption of teledentistry platforms can facilitate remote consultations and treatment planning, expanding access to dental care and restorative services. Furthermore, the development of bio-integrative materials that promote tissue regeneration alongside tooth restoration holds immense future potential.

Leading Players in the Dental Crowns and Bridges Industry Sector

- Henry Schein Inc

- Straumann

- Bicon LLC

- Dentsply Sirona

- Ultradent Products Inc

- 3M Company

- IvoclarVivadent

- Patterson Companies Inc

- Nobel Biocare Services AG

- Avinent Implant System S L U

- CAMLOG Biotechnologies GmbH

- ZimVie Inc

Key Milestones in Dental Crowns and Bridges Industry Industry

- July 2022: Imagoworks launched its 3Dme Crown automatic crown design module, an AI-based digital CAD solution designed for optimal patient oral environment fit, creating prostheses in seconds.

- April 2022: Ultradent introduced UltraTemp REZ II temporary dental cement, enhancing the stability and application for temporary crowns, bridges, inlays, onlays, and small temporary fillings.

Strategic Outlook for Dental Crowns and Bridges Industry Market

The strategic outlook for the dental crowns and bridges industry remains exceptionally positive, driven by ongoing technological advancements and increasing global demand for oral healthcare. Manufacturers will focus on integrating AI and machine learning into their design and production processes to enhance efficiency and precision. Continued investment in research and development for novel biomaterials offering superior strength, aesthetics, and biocompatibility will be crucial. Strategic collaborations with dental educational institutions will be vital to train the next generation of dental professionals in digital workflows. Furthermore, market expansion into underserved regions and the development of cost-effective solutions will unlock significant future growth potential, ensuring sustained market relevance and profitability.

Dental Crowns and Bridges Industry Segmentation

-

1. Material

- 1.1. Ceramic materials

- 1.2. Metals

- 1.3. Porcelain-Fused-to-Metal (PFM)

-

2. Product

- 2.1. Crowns

- 2.2. Bridges

Dental Crowns and Bridges Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Dental Crowns and Bridges Industry Regional Market Share

Geographic Coverage of Dental Crowns and Bridges Industry

Dental Crowns and Bridges Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for Oral Healthcare and Preventive and Cosmetic Dentistry; Development of 3D Imaging and CAD/CAM Technologies

- 3.3. Market Restrains

- 3.3.1. Lack of Knowledge about Advanced Treatment Methods among Populations; Excessive Cost and Limited Reimbursement for Dental Crown and Bridges

- 3.4. Market Trends

- 3.4.1. Porcelain-Fused-to-Metal (PFM) Segment is Anticipated to Hold the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Crowns and Bridges Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Ceramic materials

- 5.1.2. Metals

- 5.1.3. Porcelain-Fused-to-Metal (PFM)

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Crowns

- 5.2.2. Bridges

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Dental Crowns and Bridges Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Ceramic materials

- 6.1.2. Metals

- 6.1.3. Porcelain-Fused-to-Metal (PFM)

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Crowns

- 6.2.2. Bridges

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Dental Crowns and Bridges Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Ceramic materials

- 7.1.2. Metals

- 7.1.3. Porcelain-Fused-to-Metal (PFM)

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Crowns

- 7.2.2. Bridges

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Dental Crowns and Bridges Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Ceramic materials

- 8.1.2. Metals

- 8.1.3. Porcelain-Fused-to-Metal (PFM)

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Crowns

- 8.2.2. Bridges

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East and Africa Dental Crowns and Bridges Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Ceramic materials

- 9.1.2. Metals

- 9.1.3. Porcelain-Fused-to-Metal (PFM)

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Crowns

- 9.2.2. Bridges

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. South America Dental Crowns and Bridges Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Ceramic materials

- 10.1.2. Metals

- 10.1.3. Porcelain-Fused-to-Metal (PFM)

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Crowns

- 10.2.2. Bridges

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henry Schein Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Straumann

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bicon LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dentsply Sirona

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ultradent Products Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IvoclarVivadent

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Patterson Companies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nobel Biocare Services AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Avinent Implant System S L U

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CAMLOG Biotechnologies GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ZimVie Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Henry Schein Inc

List of Figures

- Figure 1: Global Dental Crowns and Bridges Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Dental Crowns and Bridges Industry Revenue (undefined), by Material 2025 & 2033

- Figure 3: North America Dental Crowns and Bridges Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Dental Crowns and Bridges Industry Revenue (undefined), by Product 2025 & 2033

- Figure 5: North America Dental Crowns and Bridges Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Dental Crowns and Bridges Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Dental Crowns and Bridges Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Dental Crowns and Bridges Industry Revenue (undefined), by Material 2025 & 2033

- Figure 9: Europe Dental Crowns and Bridges Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe Dental Crowns and Bridges Industry Revenue (undefined), by Product 2025 & 2033

- Figure 11: Europe Dental Crowns and Bridges Industry Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Dental Crowns and Bridges Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Dental Crowns and Bridges Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Dental Crowns and Bridges Industry Revenue (undefined), by Material 2025 & 2033

- Figure 15: Asia Pacific Dental Crowns and Bridges Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific Dental Crowns and Bridges Industry Revenue (undefined), by Product 2025 & 2033

- Figure 17: Asia Pacific Dental Crowns and Bridges Industry Revenue Share (%), by Product 2025 & 2033

- Figure 18: Asia Pacific Dental Crowns and Bridges Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Dental Crowns and Bridges Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Dental Crowns and Bridges Industry Revenue (undefined), by Material 2025 & 2033

- Figure 21: Middle East and Africa Dental Crowns and Bridges Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Middle East and Africa Dental Crowns and Bridges Industry Revenue (undefined), by Product 2025 & 2033

- Figure 23: Middle East and Africa Dental Crowns and Bridges Industry Revenue Share (%), by Product 2025 & 2033

- Figure 24: Middle East and Africa Dental Crowns and Bridges Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Dental Crowns and Bridges Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Dental Crowns and Bridges Industry Revenue (undefined), by Material 2025 & 2033

- Figure 27: South America Dental Crowns and Bridges Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: South America Dental Crowns and Bridges Industry Revenue (undefined), by Product 2025 & 2033

- Figure 29: South America Dental Crowns and Bridges Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: South America Dental Crowns and Bridges Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Dental Crowns and Bridges Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 5: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 11: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 12: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 20: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 21: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: India Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: China Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Japan Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 29: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 30: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 35: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 36: Global Dental Crowns and Bridges Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Dental Crowns and Bridges Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Crowns and Bridges Industry?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Dental Crowns and Bridges Industry?

Key companies in the market include Henry Schein Inc, Straumann, Bicon LLC, Dentsply Sirona, Ultradent Products Inc, 3M Company, IvoclarVivadent, Patterson Companies Inc, Nobel Biocare Services AG, Avinent Implant System S L U, CAMLOG Biotechnologies GmbH, ZimVie Inc.

3. What are the main segments of the Dental Crowns and Bridges Industry?

The market segments include Material, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for Oral Healthcare and Preventive and Cosmetic Dentistry; Development of 3D Imaging and CAD/CAM Technologies.

6. What are the notable trends driving market growth?

Porcelain-Fused-to-Metal (PFM) Segment is Anticipated to Hold the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Knowledge about Advanced Treatment Methods among Populations; Excessive Cost and Limited Reimbursement for Dental Crown and Bridges.

8. Can you provide examples of recent developments in the market?

July 2022: Imagoworks, an artificial intelligence-based digital dental CAD solution company, launched a new software, the 3Dme Crown automatic crown design module of the company's 3Dme Solutions. According to Imagoworks, the crown prosthesis design is most suited for the patient's oral environment. Using data from the patient's 3D scan and AI technology, it is made automatically in a couple of seconds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Crowns and Bridges Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Crowns and Bridges Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Crowns and Bridges Industry?

To stay informed about further developments, trends, and reports in the Dental Crowns and Bridges Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence