Key Insights

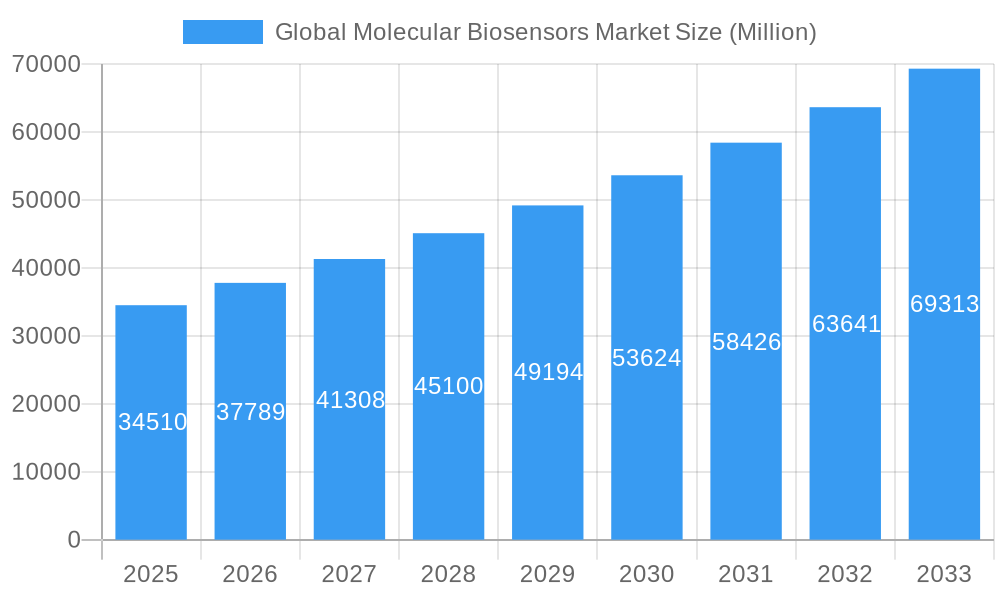

The Global Molecular Biosensors Market is poised for robust expansion, with a projected market size of $34.51 billion in 2025, exhibiting a significant compound annual growth rate (CAGR) of 9.5%. This dynamic growth is fueled by an increasing demand for rapid and accurate diagnostic tools in healthcare, the burgeoning need for stringent food safety regulations, and advancements in environmental monitoring technologies. The rising prevalence of chronic diseases, coupled with an aging global population, necessitates more sophisticated and accessible diagnostic solutions, placing molecular biosensors at the forefront of medical innovation. Furthermore, growing consumer awareness regarding food quality and safety, alongside increasing governmental initiatives to curb environmental pollution, are creating substantial opportunities for market players. The integration of nanotechnology and microfluidics with biosensing platforms is further enhancing sensitivity, specificity, and speed, driving the adoption of these advanced technologies across various sectors.

Global Molecular Biosensors Market Market Size (In Billion)

The market's trajectory is significantly influenced by key drivers such as the escalating healthcare expenditure globally, the growing emphasis on personalized medicine, and the continuous innovation in sensor technologies. The demand for point-of-care diagnostic devices, empowered by molecular biosensors, is rapidly increasing, allowing for quicker patient diagnosis and treatment. In the food and beverage sector, these biosensors are crucial for detecting contaminants, allergens, and spoilage, ensuring product integrity and consumer safety. Environmental safety applications are expanding due to the need for real-time monitoring of pollutants and pathogens. However, challenges such as high development costs for novel biosensors and the need for regulatory approvals can pose certain restraints. Despite these hurdles, the persistent drive for technological advancement, strategic collaborations among key industry players like Medtronic Inc., Siemens Healthcare, and Abbott Laboratories Inc., and the expanding application spectrum are expected to propel the molecular biosensors market to new heights in the coming years.

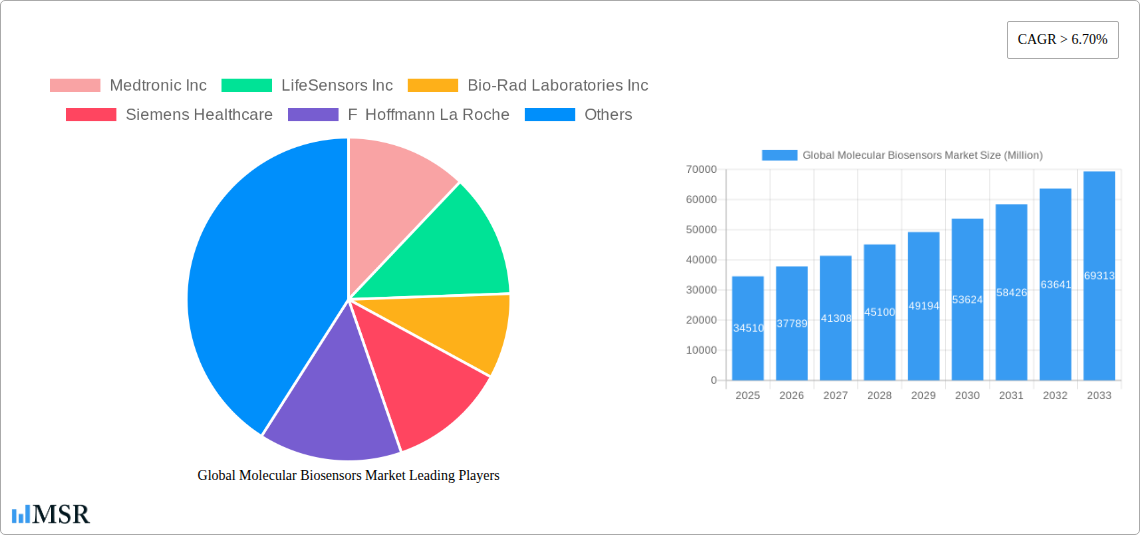

Global Molecular Biosensors Market Company Market Share

This in-depth report provides an exhaustive analysis of the global molecular biosensors market, a rapidly expanding sector driven by advancements in healthcare, food safety, and environmental monitoring. Spanning the study period of 2019–2033, with a base and estimated year of 2025, this report offers critical insights into market dynamics, key players, technological trends, and future growth trajectories. With a projected market size of over $10 billion by 2025, the molecular biosensor industry is poised for substantial expansion, fueled by innovations in electrochemical biosensors, optical biosensors, and their diverse applications.

Global Molecular Biosensors Market Market Concentration & Dynamics

The global molecular biosensors market exhibits moderate to high concentration, with key players like Medtronic Inc, LifeSensors Inc, Bio-Rad Laboratories Inc, Siemens Healthcare, and F Hoffmann La Roche dominating significant market share. The innovation ecosystem is vibrant, characterized by continuous R&D investments in developing more sensitive, selective, and portable biosensing technologies. Regulatory frameworks, such as those from the FDA and EMA, are crucial in shaping market entry and product approvals, particularly for medical diagnostics applications. Substitute products, including traditional laboratory testing methods, are being increasingly displaced by the rapid, on-site capabilities of molecular biosensors. End-user trends are leaning towards point-of-care diagnostics, personalized medicine, and real-time monitoring, propelling demand for advanced biosensing solutions. Mergers and acquisitions (M&A) are a significant factor in market consolidation and strategic expansion, with an estimated 30+ M&A deals observed in the historical period. The market share of leading players is estimated to be between 15% and 25% individually.

- Market Share of Top 5 Players: Approximately 60-70%

- M&A Deal Counts (Historical Period): 30+

- Innovation Ecosystem: Characterized by strong academic-industry collaboration and venture capital funding.

- Regulatory Impact: Stringent yet essential for ensuring product efficacy and patient safety.

- End-User Preferences: Shift towards portable, user-friendly, and rapid detection devices.

Global Molecular Biosensors Market Industry Insights & Trends

The global molecular biosensors market is experiencing robust growth, with an estimated market size exceeding $10 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of over 12% during the forecast period (2025–2033). This expansion is primarily driven by the escalating prevalence of chronic diseases, the growing demand for early disease detection and monitoring, and increasing investments in healthcare infrastructure globally. Technological disruptions, particularly in the realm of nanotechnology and microfluidics, are enabling the development of highly sensitive and multiplexed biosensing platforms. Evolving consumer behaviors are also playing a pivotal role, with individuals becoming more health-conscious and seeking personalized healthcare solutions, often facilitated by wearable biosensing devices and home diagnostic kits. The medical diagnostics segment is the largest application area, accounting for over 50% of the market revenue, owing to the critical need for rapid and accurate detection of various biomarkers for diseases such as cancer, diabetes, and infectious agents. The food and beverages industry is also a significant contributor, driven by the need for stringent quality control and pathogen detection to ensure consumer safety. Furthermore, increasing global concerns about environmental safety and security applications, such as the detection of pollutants and biological threats, are creating new avenues for market growth. The electrochemical biosensors technology is projected to hold the largest market share due to its cost-effectiveness, portability, and high sensitivity. The continuous integration of artificial intelligence (AI) and machine learning (ML) with biosensing platforms is further enhancing data analysis and predictive capabilities, opening up new frontiers for the molecular biosensor industry.

Key Markets & Segments Leading Global Molecular Biosensors Market

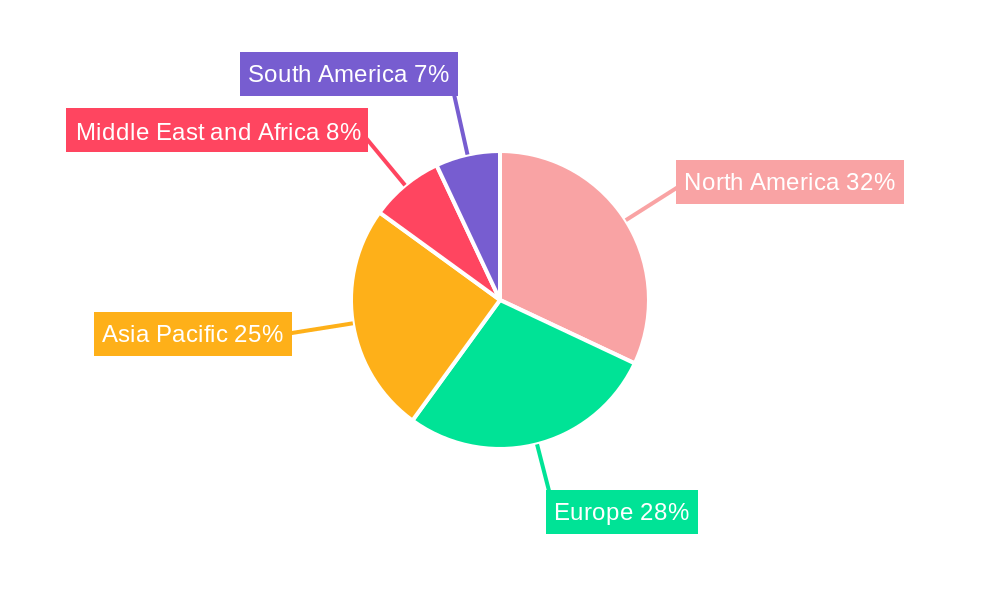

The global molecular biosensors market is witnessing dominant growth driven by specific regions and application segments. North America, particularly the United States, is a leading market due to its advanced healthcare infrastructure, high R&D expenditure, and early adoption of new technologies. The region's strong presence of leading companies like Medtronic Inc, Abbott Laboratories Inc, and Nova Biomedical Corporation further solidifies its position. The medical diagnostics application segment stands out as the primary revenue generator, projected to contribute over 50% to the global market value. This dominance is attributed to the rising incidence of chronic and infectious diseases, the increasing demand for point-of-care testing (POCT), and the growing preference for non-invasive diagnostic methods. Within the technology landscape, Electrochemical Biosensors are expected to command the largest market share. Their advantages in terms of cost-effectiveness, miniaturization, ease of use, and high sensitivity make them ideal for a wide range of applications, from glucose monitoring to pathogen detection. The optical biosensors segment also holds significant potential, particularly in areas requiring high specificity and real-time detection capabilities.

- Dominant Region: North America, driven by the United States.

- Drivers: High healthcare spending, robust R&D infrastructure, government initiatives promoting innovation.

- Economic Growth: Consistent economic expansion supports increased investment in advanced healthcare technologies.

- Infrastructure: Well-developed healthcare facilities and research institutions facilitate market penetration.

- Dominant Application: Medical Diagnostics.

- Drivers: Rising prevalence of chronic diseases (diabetes, cancer, cardiovascular diseases), demand for early detection and personalized medicine, increasing adoption of POCT devices.

- Consumer Behavior: Growing health consciousness and preference for convenient, at-home testing solutions.

- Technological Advancements: Development of sensitive and specific biomarkers for various diseases.

- Dominant Technology: Electrochemical Biosensors.

- Drivers: Cost-effectiveness, portability, miniaturization capabilities, high sensitivity and selectivity, wide range of analyte detection.

- Manufacturing Efficiency: Scalable production processes contribute to lower unit costs.

- Versatility: Adaptable for various applications across medical, food, and environmental sectors.

Global Molecular Biosensors Market Product Developments

Recent product developments in the global molecular biosensors market are centered around enhancing sensitivity, specificity, and portability. Innovations are focused on creating novel recognition elements, improving signal transduction mechanisms, and integrating advanced materials for more efficient detection. The market is witnessing a surge in the development of microfluidic-based biosensors and lab-on-a-chip devices, enabling rapid, multiplexed analysis with minimal sample volume. These advancements are crucial for expanding the applicability of molecular biosensors in diverse fields, from point-of-care diagnostics and drug discovery to food safety and environmental monitoring, thereby driving the molecular biosensor industry forward.

Challenges in the Global Molecular Biosensors Market Market

Despite its robust growth trajectory, the global molecular biosensors market faces several challenges. High development and manufacturing costs for novel biosensing technologies can hinder widespread adoption, particularly in price-sensitive markets. Stringent regulatory approvals for medical applications, though necessary for ensuring safety and efficacy, can lead to prolonged time-to-market. Issues related to the stability and shelf-life of biosensor components, particularly biological recognition elements, can impact their reliability and performance. Furthermore, the need for skilled personnel to operate and interpret results from complex biosensing systems presents a human resource challenge.

- High Development Costs: Significant R&D investment required for novel biosensor designs.

- Regulatory Hurdles: Lengthy approval processes for medical diagnostic devices.

- Stability and Shelf-Life Issues: Maintaining the integrity of biological recognition elements.

- Need for Skilled Workforce: Requirement for trained professionals for operation and data interpretation.

Forces Driving Global Molecular Biosensors Market Growth

The global molecular biosensors market is propelled by several key forces. The increasing prevalence of chronic diseases and the growing global demand for early and accurate diagnosis are fundamental drivers. Advancements in nanotechnology and materials science are enabling the creation of more sensitive, selective, and cost-effective biosensing technologies. Government initiatives promoting healthcare innovation and R&D funding further accelerate market expansion. The rising adoption of personalized medicine and the increasing consumer interest in home-based diagnostic tools are also significant growth catalysts.

- Rising Chronic Disease Burden: Driving demand for advanced diagnostic tools.

- Technological Innovations: Continuous improvements in sensitivity and specificity.

- Government Support: Increased funding for R&D and healthcare infrastructure.

- Personalized Medicine Trends: Tailoring healthcare based on individual needs.

Challenges in the Global Molecular Biosensors Market Market

Long-term growth catalysts for the global molecular biosensors market include the ongoing integration of artificial intelligence and machine learning for enhanced data analysis and predictive diagnostics. The development of novel, highly specific biorecognition elements through advancements in genetic engineering and synthetic biology will further improve sensor performance. Strategic partnerships between academic institutions and commercial entities are crucial for translating cutting-edge research into market-ready products. Expansion into emerging economies with growing healthcare needs and increasing disposable incomes also presents substantial long-term growth potential.

Emerging Opportunities in Global Molecular Biosensors Market

Emerging opportunities in the global molecular biosensors market lie in the expanding applications in food safety, environmental monitoring, and defense and security. The development of low-cost, portable biosensors for rapid on-site detection of pathogens, toxins, and environmental pollutants presents significant market potential. The increasing focus on precision agriculture and smart farming also creates demand for biosensors to monitor soil health and crop diseases. Furthermore, the growing concern for bioterrorism and biosecurity is driving investments in advanced biosensing technologies for rapid threat detection.

- Food Safety & Environmental Monitoring: Growing need for rapid, on-site detection solutions.

- Precision Agriculture: Biosensors for soil health and crop disease management.

- Defense & Security: Advancements in rapid threat detection technologies.

- Wearable Technology Integration: Enhanced consumer-focused health monitoring.

Leading Players in the Global Molecular Biosensors Market Sector

- Medtronic Inc

- LifeSensors Inc

- Bio-Rad Laboratories Inc

- Siemens Healthcare

- F Hoffmann La Roche

- Nova Biomedical Corporation

- Biacore

- Johnson and Johnson

- Acon Laboratories Inc

- LifeScan

- Sysmex Corporation

- Abbott Laboratories Inc

- Strategic Diagnostics Inc

- Molecular Devices Corp

- Dynamic Biosensors GmbH

Key Milestones in Global Molecular Biosensors Market Industry

- June 2022: The Wyss Institute for Biologically Inspired Engineering at Harvard University licensed its eRapid electrochemical biosensor technology to United States-based start-up StataDx, signaling potential for broader commercialization of advanced electrochemical biosensing.

- November 2021: Roswell Biotechnologies, Inc., the molecular electronics company, launched the first molecular electronics chip and the Roswell Molecular Electronics (ME) Platform for biosensing applications, marking a significant step in molecular electronics for biosensing.

Strategic Outlook for Global Molecular Biosensors Market Market

The strategic outlook for the global molecular biosensors market is highly optimistic, driven by continuous innovation and expanding applications. Growth accelerators include the increasing demand for personalized medicine, the development of multiplexed diagnostic platforms, and the integration of advanced data analytics. Strategic opportunities lie in forging partnerships for technology development and market penetration, particularly in emerging economies. The focus on creating more user-friendly, affordable, and connected biosensing solutions will be critical for sustained market leadership and capturing a larger share of the rapidly evolving molecular biosensor industry.

Global Molecular Biosensors Market Segmentation

-

1. Technology

- 1.1. Electrochemical Biosensors

- 1.2. Optical Biosensors

- 1.3. Thermal Biosensors

- 1.4. Others

-

2. Application

- 2.1. Medical Diagnostics

- 2.2. Food and Beverages

- 2.3. Environment Safety

- 2.4. Defense and Security

- 2.5. Others

Global Molecular Biosensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Molecular Biosensors Market Regional Market Share

Geographic Coverage of Global Molecular Biosensors Market

Global Molecular Biosensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Chronic and Lifestyle Induced Diseases; Increasing Demand for Point of Care Testing; Increasing Application of Biosensors in Various Industries

- 3.3. Market Restrains

- 3.3.1. Strict Regulatory Requirements for Biosensors; High Cost Involved in Research and Development

- 3.4. Market Trends

- 3.4.1. Electrochemical Biosensors Segment is Expected to Have a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Molecular Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Electrochemical Biosensors

- 5.1.2. Optical Biosensors

- 5.1.3. Thermal Biosensors

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical Diagnostics

- 5.2.2. Food and Beverages

- 5.2.3. Environment Safety

- 5.2.4. Defense and Security

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Global Molecular Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Electrochemical Biosensors

- 6.1.2. Optical Biosensors

- 6.1.3. Thermal Biosensors

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical Diagnostics

- 6.2.2. Food and Beverages

- 6.2.3. Environment Safety

- 6.2.4. Defense and Security

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Global Molecular Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Electrochemical Biosensors

- 7.1.2. Optical Biosensors

- 7.1.3. Thermal Biosensors

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical Diagnostics

- 7.2.2. Food and Beverages

- 7.2.3. Environment Safety

- 7.2.4. Defense and Security

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Global Molecular Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Electrochemical Biosensors

- 8.1.2. Optical Biosensors

- 8.1.3. Thermal Biosensors

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical Diagnostics

- 8.2.2. Food and Beverages

- 8.2.3. Environment Safety

- 8.2.4. Defense and Security

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Global Molecular Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Electrochemical Biosensors

- 9.1.2. Optical Biosensors

- 9.1.3. Thermal Biosensors

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Medical Diagnostics

- 9.2.2. Food and Beverages

- 9.2.3. Environment Safety

- 9.2.4. Defense and Security

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Global Molecular Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Electrochemical Biosensors

- 10.1.2. Optical Biosensors

- 10.1.3. Thermal Biosensors

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Medical Diagnostics

- 10.2.2. Food and Beverages

- 10.2.3. Environment Safety

- 10.2.4. Defense and Security

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Medtronic Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LifeSensors Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bio-Rad Laboratories Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F Hoffmann La Roche

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nova biomedical Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Biacore

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson and Johnson

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Acon Laboratories Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LifeScan

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sysmex Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Abbott Laboratories Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Strategic Diagnostics Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Molecular Devices Corp

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Dynamic Biosensors GmbH

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Medtronic Inc

List of Figures

- Figure 1: Global Global Molecular Biosensors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Global Molecular Biosensors Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Global Molecular Biosensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 4: North America Global Molecular Biosensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America Global Molecular Biosensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Global Molecular Biosensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Global Molecular Biosensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 8: North America Global Molecular Biosensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Global Molecular Biosensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Global Molecular Biosensors Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Global Molecular Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Global Molecular Biosensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Global Molecular Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Global Molecular Biosensors Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Global Molecular Biosensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 16: Europe Global Molecular Biosensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 17: Europe Global Molecular Biosensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Global Molecular Biosensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe Global Molecular Biosensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 20: Europe Global Molecular Biosensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Global Molecular Biosensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Global Molecular Biosensors Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Global Molecular Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Global Molecular Biosensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Global Molecular Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Global Molecular Biosensors Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Global Molecular Biosensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 28: Asia Pacific Global Molecular Biosensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 29: Asia Pacific Global Molecular Biosensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Pacific Global Molecular Biosensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia Pacific Global Molecular Biosensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 32: Asia Pacific Global Molecular Biosensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Global Molecular Biosensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Global Molecular Biosensors Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Global Molecular Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Global Molecular Biosensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Global Molecular Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Global Molecular Biosensors Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Global Molecular Biosensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 40: Middle East and Africa Global Molecular Biosensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Middle East and Africa Global Molecular Biosensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Middle East and Africa Global Molecular Biosensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Middle East and Africa Global Molecular Biosensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 44: Middle East and Africa Global Molecular Biosensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Global Molecular Biosensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Global Molecular Biosensors Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Global Molecular Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Global Molecular Biosensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Global Molecular Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Global Molecular Biosensors Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Global Molecular Biosensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 52: South America Global Molecular Biosensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 53: South America Global Molecular Biosensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: South America Global Molecular Biosensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: South America Global Molecular Biosensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 56: South America Global Molecular Biosensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Global Molecular Biosensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Global Molecular Biosensors Market Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Global Molecular Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Global Molecular Biosensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Global Molecular Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Global Molecular Biosensors Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Molecular Biosensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Global Molecular Biosensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global Molecular Biosensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Molecular Biosensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Molecular Biosensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Molecular Biosensors Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Molecular Biosensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Global Molecular Biosensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 9: Global Molecular Biosensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Molecular Biosensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Molecular Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Molecular Biosensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Molecular Biosensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 20: Global Molecular Biosensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: Global Molecular Biosensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Molecular Biosensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Molecular Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Molecular Biosensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Molecular Biosensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 38: Global Molecular Biosensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 39: Global Molecular Biosensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global Molecular Biosensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Molecular Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Molecular Biosensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Molecular Biosensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 56: Global Molecular Biosensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 57: Global Molecular Biosensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 58: Global Molecular Biosensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Molecular Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Molecular Biosensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Molecular Biosensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 68: Global Molecular Biosensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 69: Global Molecular Biosensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 70: Global Molecular Biosensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Molecular Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Molecular Biosensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Global Molecular Biosensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Global Molecular Biosensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Molecular Biosensors Market?

The projected CAGR is approximately 9.5%.

2. Which companies are prominent players in the Global Molecular Biosensors Market?

Key companies in the market include Medtronic Inc, LifeSensors Inc, Bio-Rad Laboratories Inc, Siemens Healthcare, F Hoffmann La Roche, Nova biomedical Corporation, Biacore, Johnson and Johnson, Acon Laboratories Inc , LifeScan, Sysmex Corporation, Abbott Laboratories Inc, Strategic Diagnostics Inc, Molecular Devices Corp, Dynamic Biosensors GmbH.

3. What are the main segments of the Global Molecular Biosensors Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Chronic and Lifestyle Induced Diseases; Increasing Demand for Point of Care Testing; Increasing Application of Biosensors in Various Industries.

6. What are the notable trends driving market growth?

Electrochemical Biosensors Segment is Expected to Have a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Strict Regulatory Requirements for Biosensors; High Cost Involved in Research and Development.

8. Can you provide examples of recent developments in the market?

In June 2022, The Wyss Institute for Biologically Inspired Engineering at Harvard University licensed its eRapid electrochemical biosensor technology to United States-based start-up StataDx.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Molecular Biosensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Molecular Biosensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Molecular Biosensors Market?

To stay informed about further developments, trends, and reports in the Global Molecular Biosensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence