Key Insights

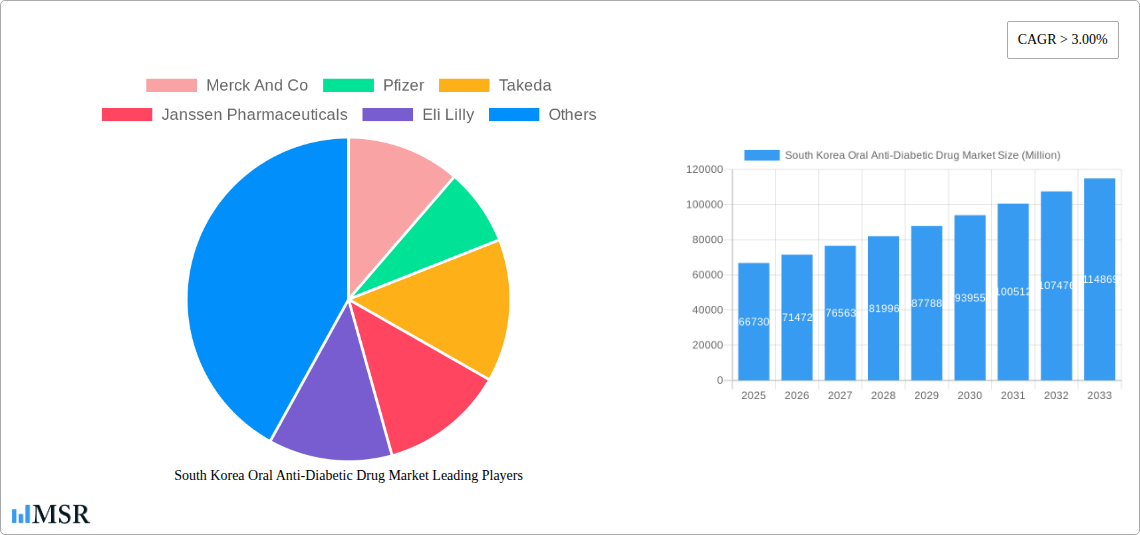

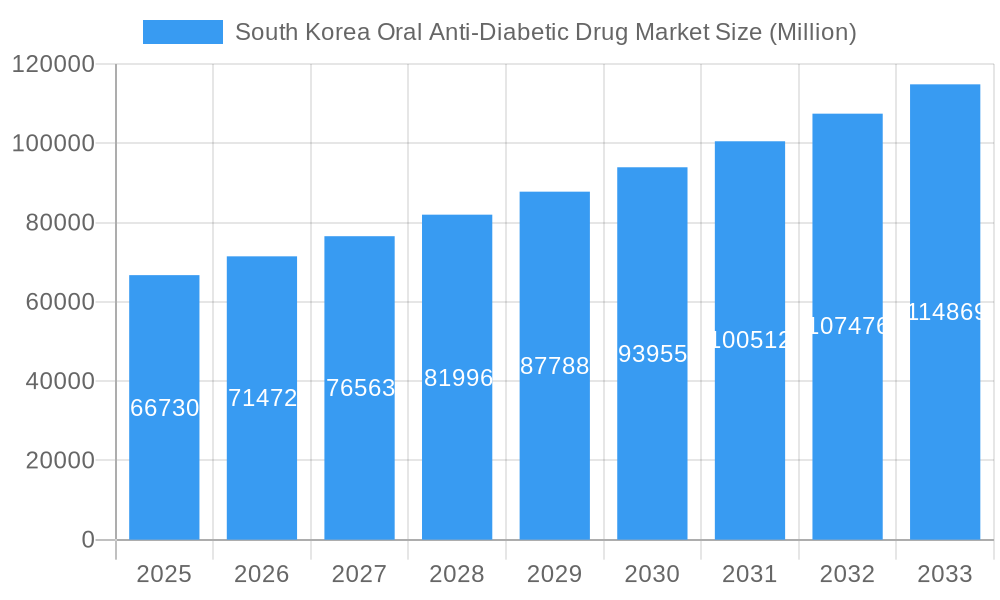

The South Korean oral anti-diabetic drug market is poised for significant expansion, projected to reach USD 66.73 billion by 2025. This robust growth is driven by a confluence of factors, including the escalating prevalence of diabetes within the nation, a growing aging population, and increasing awareness regarding effective diabetes management. The market is expected to witness a compound annual growth rate (CAGR) of 6.8% between 2025 and 2033, underscoring a sustained upward trajectory. Key therapeutic segments like SGLT-2 inhibitors and DPP-4 inhibitors are at the forefront of this expansion, driven by their demonstrated efficacy and favorable safety profiles in managing type 2 diabetes. Furthermore, advancements in drug discovery and the introduction of novel formulations are expected to fuel innovation and market penetration across all segments, including Biguanides, Sulfonylureas, Meglitinides, Thiazolidinediones, and Alpha-glucosidase inhibitors. The distribution landscape is also evolving, with online pharmacies gaining traction alongside established hospital and retail channels, offering greater accessibility to patients.

South Korea Oral Anti-Diabetic Drug Market Market Size (In Billion)

This dynamic market is characterized by intense competition among global pharmaceutical giants such as Merck & Co., Pfizer, Takeda, and Novo Nordisk, among others, all vying for market share through strategic product launches, research and development investments, and market access initiatives. Emerging trends point towards a greater emphasis on personalized medicine, combination therapies, and patient-centric approaches to diabetes care. While the market benefits from a favorable demographic outlook and increasing healthcare expenditure, potential restraints could include stringent regulatory approvals for new drugs, pricing pressures, and the availability of alternative treatment modalities. Nevertheless, the underlying drivers of diabetes prevalence and the continuous pursuit of better patient outcomes position the South Korean oral anti-diabetic drug market for sustained and promising growth throughout the forecast period.

South Korea Oral Anti-Diabetic Drug Market Company Market Share

Unlock the Lucrative South Korea Oral Anti-Diabetic Drug Market: Comprehensive Insights and Forecasts (2019-2033)

Gain a strategic advantage in the burgeoning South Korean market for oral anti-diabetic drugs. This in-depth report provides critical market intelligence, covering market dynamics, industry trends, segment analysis, product innovations, challenges, growth drivers, and key player strategies. Essential for pharmaceutical manufacturers, distributors, investors, and healthcare providers seeking to capitalize on the projected growth of this vital therapeutic area.

South Korea Oral Anti-Diabetic Drug Market Market Concentration & Dynamics

The South Korea oral anti-diabetic drug market exhibits a moderately concentrated landscape, with major global pharmaceutical players holding significant market share alongside growing domestic influence. Innovation remains a key driver, fueled by ongoing research and development into novel drug formulations and combination therapies designed to enhance glycemic control and patient outcomes. The regulatory framework, overseen by the Ministry of Food and Drug Safety (MFDS), plays a crucial role, influencing drug approvals, pricing, and market access. The increasing prevalence of type 2 diabetes, driven by lifestyle changes and an aging population, presents a persistent demand for effective oral anti-diabetic solutions. Substitute products, including injectable therapies and lifestyle interventions, also influence market dynamics, necessitating continuous innovation and differentiation among oral anti-diabetic drug manufacturers. Mergers and acquisitions (M&A) activities, while not as frequent as in larger markets, are anticipated to shape the competitive landscape further as companies seek to expand their portfolios and market reach. The market share of leading drugs and companies is constantly evolving, reflecting the impact of new product launches and clinical trial results.

- Market Share: Leading Biguanides and DPP-4 inhibitors currently hold the largest market share, with SGLT-2 inhibitors showing rapid growth.

- M&A Deal Counts: XX deals are anticipated in the forecast period, primarily focused on acquiring innovative pipelines and expanding market access.

- Innovation Ecosystems: Driven by academic research and corporate R&D, focusing on novel mechanisms of action and improved patient adherence.

- Regulatory Frameworks: MFDS approval pathways and post-market surveillance are critical determinants of market entry and success.

South Korea Oral Anti-Diabetic Drug Market Industry Insights & Trends

The South Korean oral anti-diabetic drug market is poised for robust expansion, driven by a confluence of demographic shifts, lifestyle evolutions, and advancements in pharmaceutical innovation. The escalating prevalence of type 2 diabetes, a direct consequence of changing dietary habits, sedentary lifestyles, and an increasing elderly population, serves as the primary catalyst for market growth. Projections indicate the market size will reach an estimated XX billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. Technological disruptions, particularly in the development of newer drug classes like SGLT-2 inhibitors and DPP-4 inhibitors, are reshaping treatment paradigms, offering improved efficacy, reduced side effects, and enhanced patient convenience. These novel agents are increasingly preferred for their synergistic effects when used in combination therapies, leading to better glycemic control and a reduction in diabetes-related complications. Evolving consumer behaviors, characterized by a greater emphasis on preventative healthcare, personalized medicine, and a demand for convenient treatment options, further fuel the market's upward trajectory. Patients and healthcare providers alike are actively seeking oral medications that offer not only effective blood sugar management but also contribute to cardiovascular and renal protection, aligning with the broader trend towards holistic patient care. The integration of digital health technologies, such as remote patient monitoring and adherence tracking applications, is also beginning to influence prescription patterns and patient engagement, paving the way for more personalized and data-driven diabetes management strategies.

Key Markets & Segments Leading South Korea Oral Anti-Diabetic Drug Market

The South Korean oral anti-diabetic drug market is characterized by the strong performance of specific drug types and distribution channels, driven by evolving clinical practices and patient needs. Among the drug types, DPP-4 inhibitors and SGLT-2 inhibitors are emerging as significant growth segments, owing to their favorable efficacy profiles, low risk of hypoglycemia, and additional cardiovascular and renal benefits. These classes are increasingly being adopted as first-line or early combination therapies, reflecting a shift towards more advanced treatment strategies. Biguanides, particularly Metformin, continue to hold a substantial market share due to their established safety profile, efficacy, and affordability, often serving as the cornerstone of initial therapy. Sulfonylureas and Thiazolidinediones, while still relevant, are facing increased competition from newer agents. The market's dominance is not solely defined by drug type but also by the distribution channels through which these medications reach patients.

Dominant Drug Type Segments:

- DPP-4 Inhibitors: Their market leadership is propelled by excellent glycemic control, minimal weight gain, and a low risk of hypoglycemia. Advancements in combination therapies involving DPP-4 inhibitors further solidify their position.

- SGLT-2 Inhibitors: This segment is experiencing rapid growth due to demonstrated benefits in reducing cardiovascular events, slowing kidney disease progression, and promoting modest weight loss. Increased clinical guideline recommendations are a key driver.

- Biguanides: Remain a foundational therapy due to cost-effectiveness and proven efficacy, often used in combination with other drug classes.

Dominant Distribution Channel Segments:

- Retail Pharmacies: These are the primary point of access for oral anti-diabetic medications, catering to a vast patient base and offering convenience. Economic growth and increased disposable income support the high volume of prescriptions dispensed through this channel.

- Hospital Pharmacies: Hospitals play a crucial role in managing complex diabetes cases and initiating treatment, especially for newly diagnosed patients or those with co-morbidities. The presence of specialized diabetes centers within hospitals further boosts this channel's importance.

- Online Pharmacies: While still a nascent segment, online pharmacies are gaining traction due to their convenience, competitive pricing, and accessibility, particularly for patients in remote areas or those seeking discreet purchasing options. Infrastructure development and increasing digital literacy are contributing to their growth.

South Korea Oral Anti-Diabetic Drug Market Product Developments

The South Korean oral anti-diabetic drug market is being reshaped by continuous product innovation. Recent developments, such as the approval of Mounjaro (tirzepatide) in May 2022, represent a significant advancement, demonstrating superior blood sugar control compared to existing therapies, with an emphasis on its role as an adjunct to diet and exercise. Furthermore, Daewoong Pharmaceutical's promising phase 3 results for Enavogliflozin, an SGLT-2 inhibitor developed for the first time in Korea, highlight the growing domestic focus on cutting-edge treatments. These advancements underscore a commitment to developing drugs with enhanced efficacy, improved safety profiles, and better patient outcomes, directly impacting treatment protocols and patient choice within the market.

Challenges in the South Korea Oral Anti-Diabetic Drug Market Market

The South Korean oral anti-diabetic drug market faces several challenges that could impede its growth trajectory. Regulatory hurdles, including stringent approval processes and pricing negotiations, can delay market entry for new drugs and limit their accessibility. The intense competition among established and emerging players necessitates substantial investment in research and development, marketing, and sales, which can strain profit margins. Supply chain disruptions, exacerbated by global events, pose a risk to the consistent availability of essential medications. Furthermore, the increasing prevalence of diabetes puts a strain on healthcare resources, potentially leading to cost containment measures that could impact drug pricing and reimbursement.

- Stringent regulatory approval timelines.

- Intense competition and pricing pressures.

- Potential for supply chain disruptions.

- Healthcare system resource constraints.

Forces Driving South Korea Oral Anti-Diabetic Drug Market Growth

Several powerful forces are propelling the growth of the South Korean oral anti-diabetic drug market. The rapidly increasing prevalence of type 2 diabetes, largely attributed to an aging population and evolving lifestyle factors like poor diet and reduced physical activity, creates a sustained and growing demand for effective treatments. Technological advancements in drug development have led to the introduction of novel oral anti-diabetic agents with improved efficacy, enhanced safety profiles, and reduced side effects, appealing to both patients and healthcare providers. Government initiatives focused on public health and chronic disease management also contribute to market expansion by promoting awareness and access to treatment.

Challenges in the South Korea Oral Anti-Diabetic Drug Market Market

Long-term growth catalysts for the South Korean oral anti-diabetic drug market are rooted in continued innovation and strategic market expansion. The ongoing development of combination therapies that offer synergistic benefits and address multiple facets of diabetes management will be crucial. Partnerships between pharmaceutical companies and technology providers to integrate digital health solutions for better patient monitoring and adherence will further enhance treatment outcomes and market penetration. Moreover, exploring opportunities in underserved patient populations and expanding the reach of advanced therapies through strategic market access initiatives will ensure sustained growth.

Emerging Opportunities in South Korea Oral Anti-Diabetic Drug Market

Emerging opportunities in the South Korean oral anti-diabetic drug market lie in the burgeoning demand for personalized medicine and combination therapies. The increasing focus on preventative healthcare and early intervention presents a significant opportunity for oral anti-diabetic drugs with demonstrated long-term benefits. The growing elderly population, prone to multiple comorbidities, creates a need for oral medications that can effectively manage diabetes while also addressing related health issues such as cardiovascular and renal protection. Furthermore, the increasing adoption of online pharmacies and telemedicine platforms opens new avenues for drug distribution and patient engagement, offering convenience and wider accessibility.

Leading Players in the South Korea Oral Anti-Diabetic Drug Market Sector

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Sanofi

- Astellas

Key Milestones in South Korea Oral Anti-Diabetic Drug Market Industry

- May 2022: Mounjaro (tirzepatide) injection approved to improve blood sugar control in adults with type 2 diabetes as an addition to diet and exercise, showing superior efficacy compared to other diabetes therapies.

- June 2022: Daewoong Pharmaceutical confirmed promising phase 3 topline results for Enavogliflozin monotherapy and combination therapy with Metformin, marking a significant development for an SGLT-2 inhibitor in Korea.

Strategic Outlook for South Korea Oral Anti-Diabetic Drug Market Market

The strategic outlook for the South Korean oral anti-diabetic drug market is exceptionally promising, driven by a persistent and growing patient base and a dynamic pharmaceutical innovation landscape. Key growth accelerators include the continued development and adoption of novel drug classes, particularly SGLT-2 inhibitors and DPP-4 inhibitors, which offer enhanced efficacy and multi-system benefits. The increasing trend towards combination therapies, designed for more comprehensive glycemic control and management of comorbidities, will further drive market expansion. Strategic partnerships, focused on research collaboration and market access, will be crucial for companies aiming to solidify their positions. Furthermore, leveraging digital health technologies for patient support and adherence programs will enhance treatment outcomes and create a competitive edge, paving the way for sustained market leadership and significant revenue generation in the coming years.

South Korea Oral Anti-Diabetic Drug Market Segmentation

-

1. Drug Type

- 1.1. Biguanides

- 1.2. Sulfonylureas

- 1.3. Meglitinides

- 1.4. Thiazolidinediones

- 1.5. Alpha-glucosidase inhibitors

- 1.6. DPP-4 inhibitors

- 1.7. SGLT-2 inhibitors

-

2. Distribution Channel

- 2.1. Hospital pharmacies

- 2.2. Retail pharmacies

- 2.3. Online pharmacies

South Korea Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. South Korea

South Korea Oral Anti-Diabetic Drug Market Regional Market Share

Geographic Coverage of South Korea Oral Anti-Diabetic Drug Market

South Korea Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. metformin Segment Occupied the Highest Market Share in the South Korea Oral Anti-Diabetic Drugs Market in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Biguanides

- 5.1.2. Sulfonylureas

- 5.1.3. Meglitinides

- 5.1.4. Thiazolidinediones

- 5.1.5. Alpha-glucosidase inhibitors

- 5.1.6. DPP-4 inhibitors

- 5.1.7. SGLT-2 inhibitors

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital pharmacies

- 5.2.2. Retail pharmacies

- 5.2.3. Online pharmacies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bristol Myers Squibb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novo Nordisk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Boehringer Ingelheim

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sanofi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: South Korea Oral Anti-Diabetic Drug Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South Korea Oral Anti-Diabetic Drug Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Oral Anti-Diabetic Drug Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 2: South Korea Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 3: South Korea Oral Anti-Diabetic Drug Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Oral Anti-Diabetic Drug Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South Korea Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: South Korea Oral Anti-Diabetic Drug Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 8: South Korea Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 9: South Korea Oral Anti-Diabetic Drug Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Oral Anti-Diabetic Drug Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: South Korea Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the South Korea Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Sanofi, Astellas.

3. What are the main segments of the South Korea Oral Anti-Diabetic Drug Market?

The market segments include Drug Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

metformin Segment Occupied the Highest Market Share in the South Korea Oral Anti-Diabetic Drugs Market in the current year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

May 2022: Mounjaro (tirzepatide) injection to improve blood sugar control in adults with type 2 diabetes was approved as an addition to diet and exercise. Mounjaro was effective at improving blood sugar and was more effective than the other diabetes therapies with which it was compared in clinical studies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the South Korea Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence