Key Insights

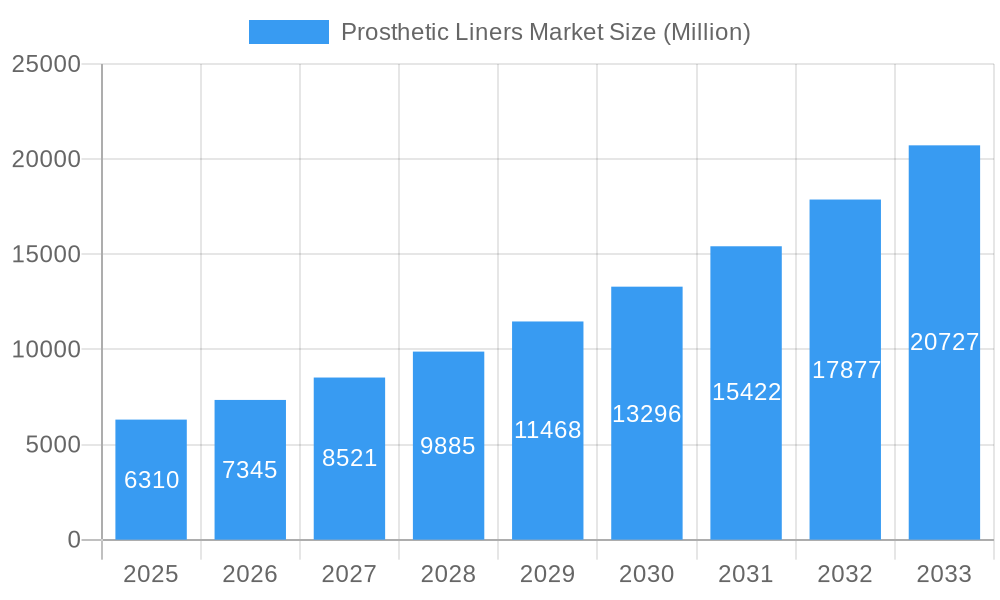

The global Prosthetic Liners Market is poised for significant expansion, projected to reach an estimated $6.31 billion in 2025. This robust growth is driven by an accelerating CAGR of 16.3% throughout the forecast period of 2025-2033. The increasing prevalence of amputations due to chronic diseases like diabetes and vascular conditions, coupled with a rising number of trauma-related injuries, forms the bedrock of this market's upward trajectory. Advancements in prosthetic liner technology, focusing on enhanced comfort, durability, and improved fit, are also playing a pivotal role. Innovations in materials like advanced silicone and thermoplastic elastomers are offering superior shock absorption and pressure distribution, directly benefiting end-users and encouraging wider adoption. The growing awareness of prosthetic limb benefits and increased healthcare expenditure, particularly in emerging economies, further fuels market demand. Key applications include both arm and leg prosthetic liners, catering to a diverse patient population.

Prosthetic Liners Market Market Size (In Billion)

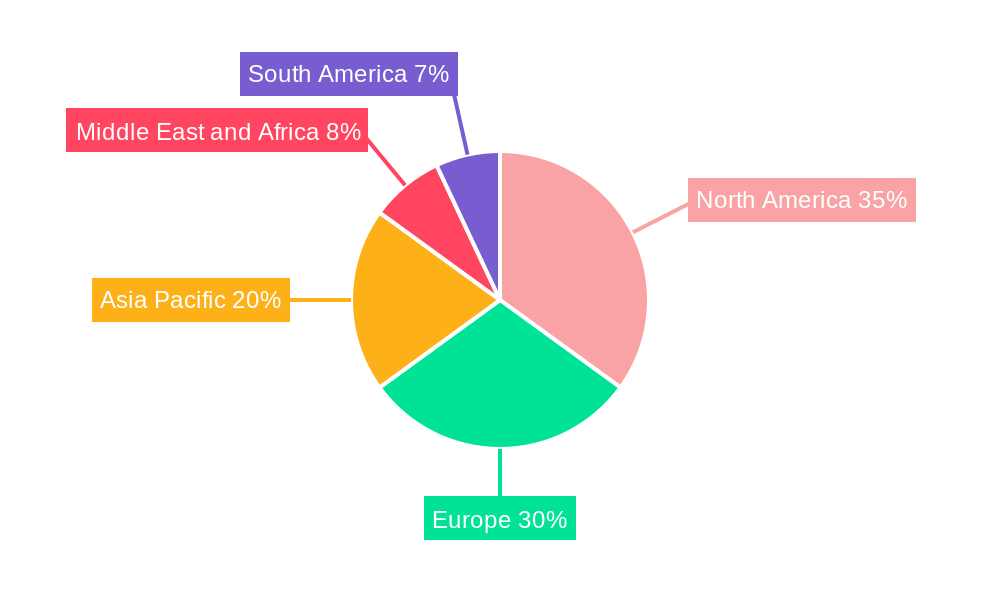

The market's dynamism is further shaped by several factors. Key drivers include the growing elderly population, which is more susceptible to conditions leading to amputation, and the continuous innovation in prosthetic technologies that enhances patient mobility and quality of life. The increasing integration of advanced materials like silicone and thermoplastic elastomers for improved comfort and patient compliance is a significant trend. However, the market also faces restraints such as the high cost of advanced prosthetic liners and the limited reimbursement policies in some regions, which can hinder widespread accessibility. The competitive landscape is characterized by the presence of established global players like Ottobock, Ossur, and WillowWood Global LLC, actively engaged in research and development to introduce next-generation products. Geographically, North America and Europe currently dominate the market, but the Asia Pacific region is expected to witness substantial growth due to its large population and improving healthcare infrastructure.

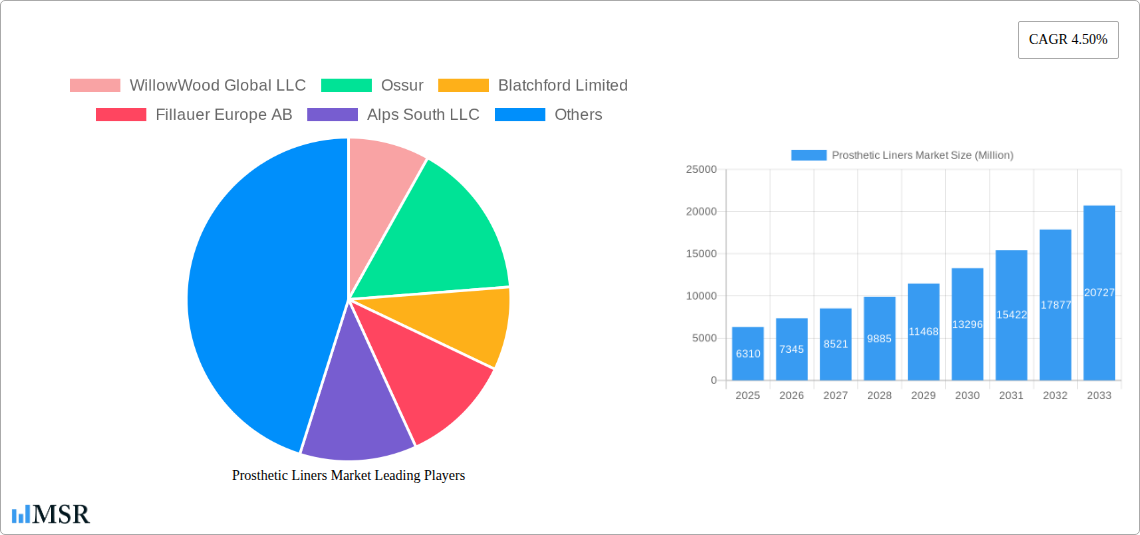

Prosthetic Liners Market Company Market Share

Prosthetic Liners Market: Navigating Innovation and Growth in Amputee Care (2019–2033)

This comprehensive report offers an in-depth analysis of the global prosthetic liners market, a critical segment within the orthopedic and assistive technology industry. Driven by increasing incidences of amputations, advancements in prosthetic technology, and a growing emphasis on patient comfort and functionality, the prosthetic liners market size is poised for substantial expansion. The report forecasts the prosthetic liners market to reach an estimated value of $2.5 billion by 2025, with a projected compound annual growth rate (CAGR) of 6.2% from 2025 to 2033. We meticulously analyze arm prosthetic liners and leg prosthetic liners, considering various material types including silicone, thermoplastic elastomer, and other material types, and explore the end user landscape encompassing hospitals, clinics, and other end users. Our extensive research covers the historical period (2019–2024) and provides actionable insights for the study period (2019–2033).

Prosthetic Liners Market Market Concentration & Dynamics

The prosthetic liners market exhibits a moderate to high degree of concentration, with key players like WillowWood Global LLC, Ossur, Blatchford Limited, Fillauer Europe AB, Alps South LLC, Ottobock, Knite Rite Inc, Ortho Europe, Silipos, and Streifeneder ortho production GmbH holding significant market shares. Innovation ecosystems are robust, fueled by continuous research and development in materials science and biomechanics aimed at enhancing comfort, durability, and user mobility. Regulatory frameworks, primarily governed by bodies like the FDA in the US and the EMA in Europe, ensure product safety and efficacy, though compliance adds to development costs. Substitute products, while limited in direct function, include advancements in direct limb attachment technologies. End-user trends highlight a demand for customizable, lightweight, and breathable liners, with a growing preference for silicone and advanced thermoplastic elastomer materials. Merger and acquisition (M&A) activities are sporadic but strategic, aimed at consolidating market presence and acquiring innovative technologies. M&A deal counts have seen approximately 5-7 significant deals in the past five years, indicating consolidation and strategic partnerships. Market share distribution shows the top 5 players holding an estimated 65% of the global market.

Prosthetic Liners Market Industry Insights & Trends

The prosthetic liners market is witnessing robust growth propelled by several interconnected factors. A primary driver is the escalating prevalence of amputations globally, attributed to the rising incidence of diabetes, peripheral vascular diseases, and traumatic injuries. This demographic shift directly translates to an increased demand for prosthetic devices, and consequently, for high-quality prosthetic liners. Technological disruptions are revolutionizing the market, with manufacturers investing heavily in research and development to create liners offering superior comfort, improved suspension, and enhanced shock absorption. Innovations in material science are particularly impactful, leading to the development of advanced silicone and thermoplastic elastomer formulations that are more durable, breathable, and hypoallergenic. These materials contribute significantly to reducing skin irritation and improving patient compliance, crucial factors for long-term prosthetic use.

Furthermore, evolving consumer behaviors are shaping market trends. Amputees are increasingly seeking prosthetic solutions that not only restore mobility but also enhance their quality of life. This includes a desire for lighter, more aesthetically pleasing, and highly personalized prosthetic liners. The growing awareness and accessibility of advanced prosthetic technologies, coupled with increased healthcare expenditure in emerging economies, are further fueling market expansion. The prosthetic liners market size is estimated to be approximately $1.8 billion in the base year of 2025, with a projected CAGR of 6.2% from 2025 to 2033, reaching an estimated $2.5 billion by 2033. This growth trajectory is supported by increasing governmental initiatives and insurance coverage for prosthetic devices in various regions. The prosthetic liners market is also experiencing a significant shift towards customized liner solutions, driven by the growing demand for personalized prosthetic fittings that cater to individual anatomical needs and activity levels. The development of digital prosthetic design and manufacturing technologies is further accelerating this trend, enabling quicker and more precise creation of custom liners.

Key Markets & Segments Leading Prosthetic Liners Market

The prosthetic liners market is primarily dominated by the leg prosthetic liners segment, which accounts for the largest share due to the higher incidence of lower limb amputations compared to upper limb amputations. Within this segment, silicone remains the preferred material type due to its excellent biocompatibility, cushioning properties, and durability, followed closely by thermoplastic elastomer which offers a balance of flexibility and cost-effectiveness. The hospitals and clinics are the leading end users, owing to their established infrastructure and direct patient engagement in prosthetic fitting and rehabilitation.

Dominance Analysis:

- Leg Prosthetic Liners: The significant prevalence of conditions like diabetes, peripheral artery disease, and trauma, which commonly lead to lower limb amputations, makes leg prosthetic liners the largest segment. Economic growth in developed and developing nations contributes to increased access to prosthetic care, further boosting demand for leg liners.

- Silicone Material Type: Silicone's superior biocompatibility, tear resistance, and skin-friendly properties make it the material of choice for prosthetic liners, offering unparalleled comfort and reducing the risk of skin breakdown. Its established track record and continuous refinement by manufacturers solidify its leading position.

- Hospitals and Clinics as End Users: These healthcare facilities are the primary points of care for amputees. They possess the specialized medical professionals (prosthetists, orthotists, surgeons) and equipment necessary for accurate diagnosis, prosthetic fitting, and rehabilitation, making them crucial distribution and consumption channels for prosthetic liners.

Emerging markets in Asia Pacific and Latin America are showing significant growth potential due to improving healthcare infrastructure, increasing disposable incomes, and a rising awareness of advanced prosthetic solutions. The demand for arm prosthetic liners is also on an upward trajectory, driven by technological advancements leading to more functional and lighter prosthetic arms, coupled with increasing adoption by individuals with upper limb loss. The other material types, including gel and foam-based liners, are carving out niches for specific applications requiring unique properties like enhanced shock absorption or cost-effectiveness.

Prosthetic Liners Market Product Developments

Product developments in the prosthetic liners market are heavily focused on enhancing patient comfort, functionality, and durability. Manufacturers are innovating with advanced materials, such as improved silicone and thermoplastic elastomer formulations, offering enhanced breathability, moisture-wicking capabilities, and superior shock absorption. Innovations also include liners with integrated antimicrobial properties to prevent skin infections and pressure relief features tailored for specific anatomical contours. The development of modular liner systems and customizable designs is gaining traction, allowing for a more personalized fit and improved suspension.

Challenges in the Prosthetic Liners Market Market

Despite robust growth, the prosthetic liners market faces several challenges. Regulatory hurdles and the stringent approval processes for new materials and designs can slow down product innovation and market entry. Supply chain disruptions, particularly for specialized raw materials, can impact production and availability, leading to increased costs. Intense competition among established players and emerging manufacturers can lead to price pressures, impacting profit margins. The high cost of advanced prosthetic liners can also be a barrier for some patient populations, limiting accessibility. Furthermore, the need for continuous training for prosthetists on new liner technologies and fitting techniques represents an ongoing investment requirement.

Forces Driving Prosthetic Liners Market Growth

Several key forces are driving the growth of the prosthetic liners market. The increasing global incidence of amputations, primarily due to chronic diseases like diabetes and vascular conditions, is a fundamental driver. Technological advancements in material science and manufacturing processes are leading to the development of more comfortable, durable, and functional liners, enhancing user experience and prosthetic performance. Growing awareness among amputees and healthcare providers regarding the benefits of advanced prosthetic liners, coupled with improved healthcare infrastructure and reimbursement policies in various regions, further fuels market expansion.

Challenges in the Prosthetic Liners Market Market

Long-term growth catalysts for the prosthetic liners market lie in continued innovation and strategic market expansion. The development of highly personalized and 3D-printed liners tailored to individual patient anatomy promises to revolutionize fit and comfort. Partnerships between liner manufacturers and prosthetic limb developers can lead to integrated solutions offering enhanced functionality. Expanding into emerging markets with growing healthcare expenditure and a rising number of amputees presents significant growth opportunities. Furthermore, research into novel biomaterials and smart technologies for prosthetic liners, such as those with integrated sensors for monitoring skin health or gait analysis, will shape the future of the market.

Emerging Opportunities in Prosthetic Liners Market

Emerging opportunities in the prosthetic liners market are abundant and diverse. The growing demand for lightweight, high-performance liners, particularly among active amputees, presents a significant niche. Advancements in 3D printing technology are opening avenues for on-demand, highly customized liner production, reducing lead times and improving patient satisfaction. The increasing adoption of advanced prosthetic knees and ankles necessitates specialized liners that can effectively transmit forces and optimize gait. Furthermore, the focus on geriatric amputees and their specific needs for comfort and ease of donning/doffing creates opportunities for specialized product development. The expansion of telehealth and remote monitoring services can also facilitate better liner fitting and management for amputees in underserved areas.

Leading Players in the Prosthetic Liners Market Sector

- WillowWood Global LLC

- Ossur

- Blatchford Limited

- Fillauer Europe AB

- Alps South LLC

- Ottobock

- Knite Rite Inc

- Ortho Europe

- Silipos

- Streifeneder ortho production GmbH

Key Milestones in Prosthetic Liners Market Industry

- May 2022: Liberating Technologies, Inc. sponsored a clinical study under the title "Clinical Outcomes With Passive MPKs vs. Powered Prosthetic Knees", with the purpose to collect community-based data from the K4-level Transfemoral Amputee (TFA) population to aid in the evidence-based prescribing of powered prosthetic knees. This study contributes valuable data towards understanding the efficacy of advanced prosthetic components and the role of liners in optimizing outcomes.

- January 2022: Steeper Group launched Limb-ART prosthetic leg covers, which come with four different models and over 20 different designs. While not directly prosthetic liners, these cosmetic covers enhance patient satisfaction and integration, indirectly impacting the overall prosthetic experience and demand for related components.

Strategic Outlook for Prosthetic Liners Market Market

The strategic outlook for the prosthetic liners market is characterized by sustained innovation, market expansion, and a focus on patient-centric solutions. Companies are expected to invest in research and development to create liners with enhanced functionalities, such as improved shock absorption, temperature regulation, and antimicrobial properties. The growing demand for personalized prosthetic solutions will drive the adoption of advanced manufacturing techniques like 3D printing. Strategic collaborations between material suppliers, liner manufacturers, and prosthetic device companies will be crucial for developing integrated and high-performance systems. Furthermore, expanding presence in emerging economies and catering to the unique needs of specific patient demographics, such as the elderly and active amputees, will be key growth accelerators. The market is poised for continued growth, driven by technological advancements and an increasing global demand for improved prosthetic care.

Prosthetic Liners Market Segmentation

-

1. Product Type

- 1.1. Arm Prosthetic Liners

- 1.2. Leg Prosthetic Liners

-

2. Material Type

- 2.1. Silicone

- 2.2. Thermoplastic Elastomer

- 2.3. Other Material Types

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

Prosthetic Liners Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Prosthetic Liners Market Regional Market Share

Geographic Coverage of Prosthetic Liners Market

Prosthetic Liners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Accidents; Government Initiatives Related to Prosthetic Liners

- 3.3. Market Restrains

- 3.3.1. Risks Associated with Prosthetic Liners

- 3.4. Market Trends

- 3.4.1. The Silicone Segment is Expected to Witness a Significant Growth in Prosthetic Liners Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prosthetic Liners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Arm Prosthetic Liners

- 5.1.2. Leg Prosthetic Liners

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Silicone

- 5.2.2. Thermoplastic Elastomer

- 5.2.3. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Prosthetic Liners Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Arm Prosthetic Liners

- 6.1.2. Leg Prosthetic Liners

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Silicone

- 6.2.2. Thermoplastic Elastomer

- 6.2.3. Other Material Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Prosthetic Liners Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Arm Prosthetic Liners

- 7.1.2. Leg Prosthetic Liners

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Silicone

- 7.2.2. Thermoplastic Elastomer

- 7.2.3. Other Material Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Prosthetic Liners Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Arm Prosthetic Liners

- 8.1.2. Leg Prosthetic Liners

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Silicone

- 8.2.2. Thermoplastic Elastomer

- 8.2.3. Other Material Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Prosthetic Liners Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Arm Prosthetic Liners

- 9.1.2. Leg Prosthetic Liners

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Silicone

- 9.2.2. Thermoplastic Elastomer

- 9.2.3. Other Material Types

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Prosthetic Liners Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Arm Prosthetic Liners

- 10.1.2. Leg Prosthetic Liners

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Silicone

- 10.2.2. Thermoplastic Elastomer

- 10.2.3. Other Material Types

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Clinics

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WillowWood Global LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ossur

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blatchford Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fillauer Europe AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alps South LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ottobock

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Knite Rite Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ortho Europe

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Silipos

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Streifeneder ortho production GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WillowWood Global LLC

List of Figures

- Figure 1: Global Prosthetic Liners Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Prosthetic Liners Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Prosthetic Liners Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Prosthetic Liners Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Prosthetic Liners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Prosthetic Liners Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Prosthetic Liners Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 8: North America Prosthetic Liners Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 9: North America Prosthetic Liners Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: North America Prosthetic Liners Market Volume Share (%), by Material Type 2025 & 2033

- Figure 11: North America Prosthetic Liners Market Revenue (undefined), by End User 2025 & 2033

- Figure 12: North America Prosthetic Liners Market Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Prosthetic Liners Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Prosthetic Liners Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Prosthetic Liners Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Prosthetic Liners Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Prosthetic Liners Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Prosthetic Liners Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Prosthetic Liners Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 20: Europe Prosthetic Liners Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Europe Prosthetic Liners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Prosthetic Liners Market Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Prosthetic Liners Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 24: Europe Prosthetic Liners Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 25: Europe Prosthetic Liners Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 26: Europe Prosthetic Liners Market Volume Share (%), by Material Type 2025 & 2033

- Figure 27: Europe Prosthetic Liners Market Revenue (undefined), by End User 2025 & 2033

- Figure 28: Europe Prosthetic Liners Market Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Prosthetic Liners Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Prosthetic Liners Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Prosthetic Liners Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Prosthetic Liners Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Prosthetic Liners Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Prosthetic Liners Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Prosthetic Liners Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Prosthetic Liners Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Prosthetic Liners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Prosthetic Liners Market Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Prosthetic Liners Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 40: Asia Pacific Prosthetic Liners Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 41: Asia Pacific Prosthetic Liners Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 42: Asia Pacific Prosthetic Liners Market Volume Share (%), by Material Type 2025 & 2033

- Figure 43: Asia Pacific Prosthetic Liners Market Revenue (undefined), by End User 2025 & 2033

- Figure 44: Asia Pacific Prosthetic Liners Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Prosthetic Liners Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Prosthetic Liners Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Prosthetic Liners Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Prosthetic Liners Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Prosthetic Liners Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Prosthetic Liners Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Prosthetic Liners Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Prosthetic Liners Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Prosthetic Liners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Prosthetic Liners Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Prosthetic Liners Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 56: Middle East and Africa Prosthetic Liners Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 57: Middle East and Africa Prosthetic Liners Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 58: Middle East and Africa Prosthetic Liners Market Volume Share (%), by Material Type 2025 & 2033

- Figure 59: Middle East and Africa Prosthetic Liners Market Revenue (undefined), by End User 2025 & 2033

- Figure 60: Middle East and Africa Prosthetic Liners Market Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Prosthetic Liners Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Prosthetic Liners Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Prosthetic Liners Market Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East and Africa Prosthetic Liners Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Prosthetic Liners Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Prosthetic Liners Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Prosthetic Liners Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 68: South America Prosthetic Liners Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: South America Prosthetic Liners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: South America Prosthetic Liners Market Volume Share (%), by Product Type 2025 & 2033

- Figure 71: South America Prosthetic Liners Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 72: South America Prosthetic Liners Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 73: South America Prosthetic Liners Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 74: South America Prosthetic Liners Market Volume Share (%), by Material Type 2025 & 2033

- Figure 75: South America Prosthetic Liners Market Revenue (undefined), by End User 2025 & 2033

- Figure 76: South America Prosthetic Liners Market Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America Prosthetic Liners Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Prosthetic Liners Market Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Prosthetic Liners Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: South America Prosthetic Liners Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Prosthetic Liners Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Prosthetic Liners Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Prosthetic Liners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Prosthetic Liners Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Prosthetic Liners Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 4: Global Prosthetic Liners Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 5: Global Prosthetic Liners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Prosthetic Liners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Prosthetic Liners Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Prosthetic Liners Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Prosthetic Liners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Prosthetic Liners Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Prosthetic Liners Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 12: Global Prosthetic Liners Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 13: Global Prosthetic Liners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Prosthetic Liners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Prosthetic Liners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Prosthetic Liners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Prosthetic Liners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 24: Global Prosthetic Liners Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 25: Global Prosthetic Liners Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 26: Global Prosthetic Liners Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 27: Global Prosthetic Liners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global Prosthetic Liners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Prosthetic Liners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Prosthetic Liners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: France Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Italy Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Spain Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Prosthetic Liners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global Prosthetic Liners Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 45: Global Prosthetic Liners Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 46: Global Prosthetic Liners Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 47: Global Prosthetic Liners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 48: Global Prosthetic Liners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Prosthetic Liners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Prosthetic Liners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: China Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: India Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Australia Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Korea Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Prosthetic Liners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 64: Global Prosthetic Liners Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 65: Global Prosthetic Liners Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 66: Global Prosthetic Liners Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 67: Global Prosthetic Liners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 68: Global Prosthetic Liners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Prosthetic Liners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Prosthetic Liners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: GCC Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: South Africa Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Prosthetic Liners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 78: Global Prosthetic Liners Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 79: Global Prosthetic Liners Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 80: Global Prosthetic Liners Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 81: Global Prosthetic Liners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 82: Global Prosthetic Liners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global Prosthetic Liners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 84: Global Prosthetic Liners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Brazil Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: Argentina Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Prosthetic Liners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Prosthetic Liners Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prosthetic Liners Market?

The projected CAGR is approximately 16.3%.

2. Which companies are prominent players in the Prosthetic Liners Market?

Key companies in the market include WillowWood Global LLC, Ossur, Blatchford Limited, Fillauer Europe AB, Alps South LLC, Ottobock, Knite Rite Inc, Ortho Europe, Silipos, Streifeneder ortho production GmbH.

3. What are the main segments of the Prosthetic Liners Market?

The market segments include Product Type, Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Accidents; Government Initiatives Related to Prosthetic Liners.

6. What are the notable trends driving market growth?

The Silicone Segment is Expected to Witness a Significant Growth in Prosthetic Liners Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risks Associated with Prosthetic Liners.

8. Can you provide examples of recent developments in the market?

In May 2022, Liberating Technologies, Inc. sponsored a clinical study under the title "Clinical Outcomes With Passive MPKs vs. Powered Prosthetic Knees", with the purpose to collect community-based data from the K4-level Transfemoral Amputee (TFA) population to aid in the evidence-based prescribing of powered prosthetic knees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prosthetic Liners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prosthetic Liners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prosthetic Liners Market?

To stay informed about further developments, trends, and reports in the Prosthetic Liners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence