Key Insights

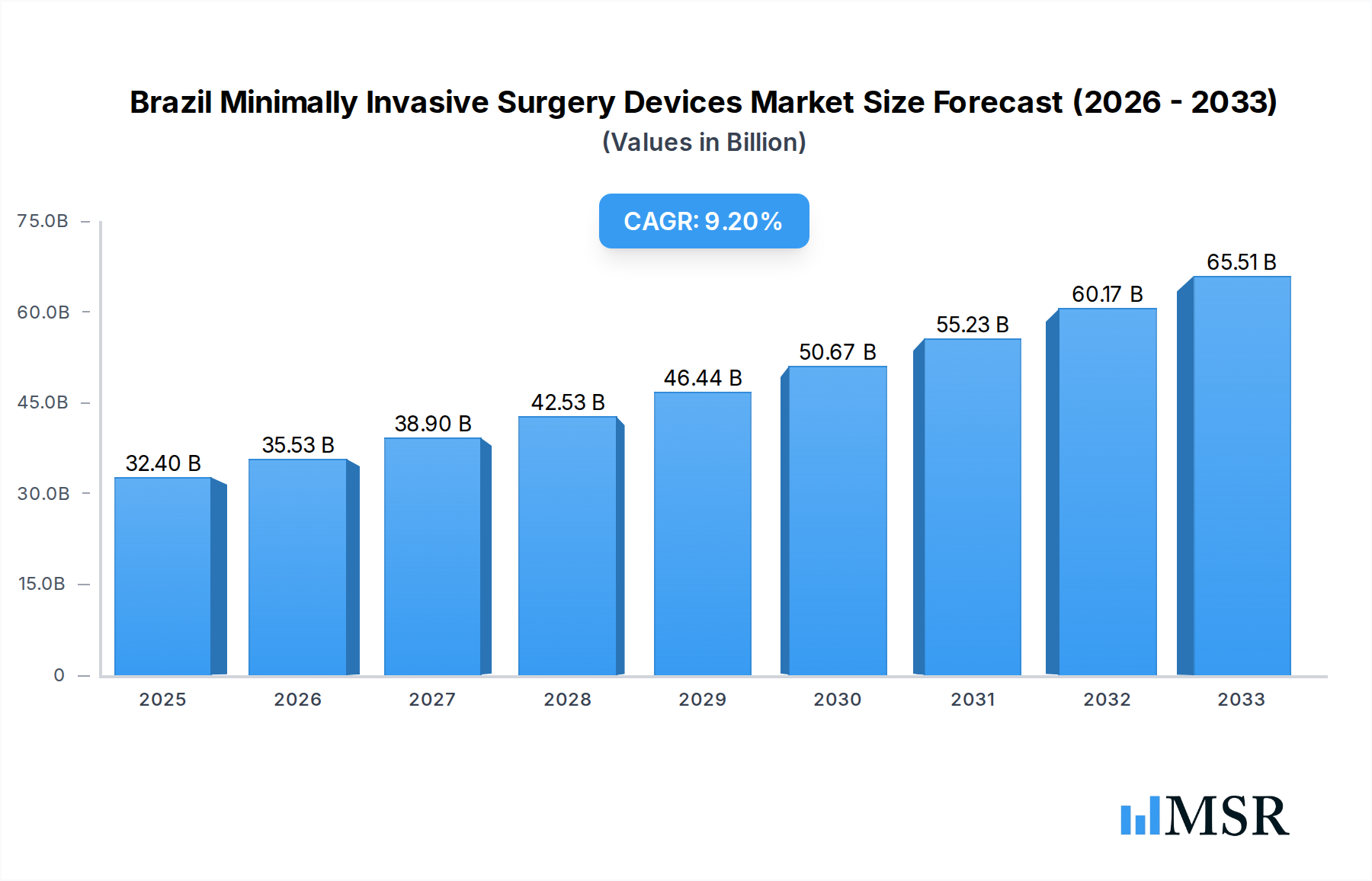

The Brazilian Minimally Invasive Surgery (MIS) Devices Market is poised for robust expansion, projected to reach an estimated USD 32.4 billion in 2025. This significant growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.7% during the forecast period of 2025-2033. Several pivotal factors are driving this upward trajectory. Increasing adoption of advanced surgical technologies, a growing awareness among healthcare professionals and patients regarding the benefits of MIS such as reduced recovery times, smaller incisions, and lower complication rates, are major catalysts. Furthermore, the rising prevalence of chronic diseases like cardiovascular and gastrointestinal disorders, which often necessitate surgical intervention, directly fuels demand for MIS devices. Government initiatives aimed at improving healthcare infrastructure and increasing access to sophisticated medical equipment in Brazil further bolster market expansion. The market is segmented across a diverse range of products, including Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic and Laparoscopic Devices, Monitoring and Visualization Devices, and Ablation and Laser Based Devices, catering to a wide array of applications such as Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, and Urological procedures.

Brazil Minimally Invasive Surgery Devices Market Market Size (In Billion)

The growth of the Brazilian MIS Devices Market is further influenced by evolving healthcare expenditure patterns and the increasing integration of digital technologies within surgical workflows. Investments in research and development by key global players like Medtronic, Abbott Laboratories, and Siemens Healthineers are continuously introducing innovative and more effective MIS solutions. While the market demonstrates strong growth potential, certain restraints such as the high initial cost of advanced MIS equipment and the need for specialized training for surgeons could present challenges. However, these are expected to be progressively overcome through technological advancements and increasing economies of scale. The strategic focus of leading companies on expanding their presence in emerging markets like Brazil, coupled with a growing preference for less invasive procedures, is set to sustain the market's healthy growth momentum throughout the forecast period, making Brazil a critical and dynamic landscape for minimally invasive surgery device innovation and adoption.

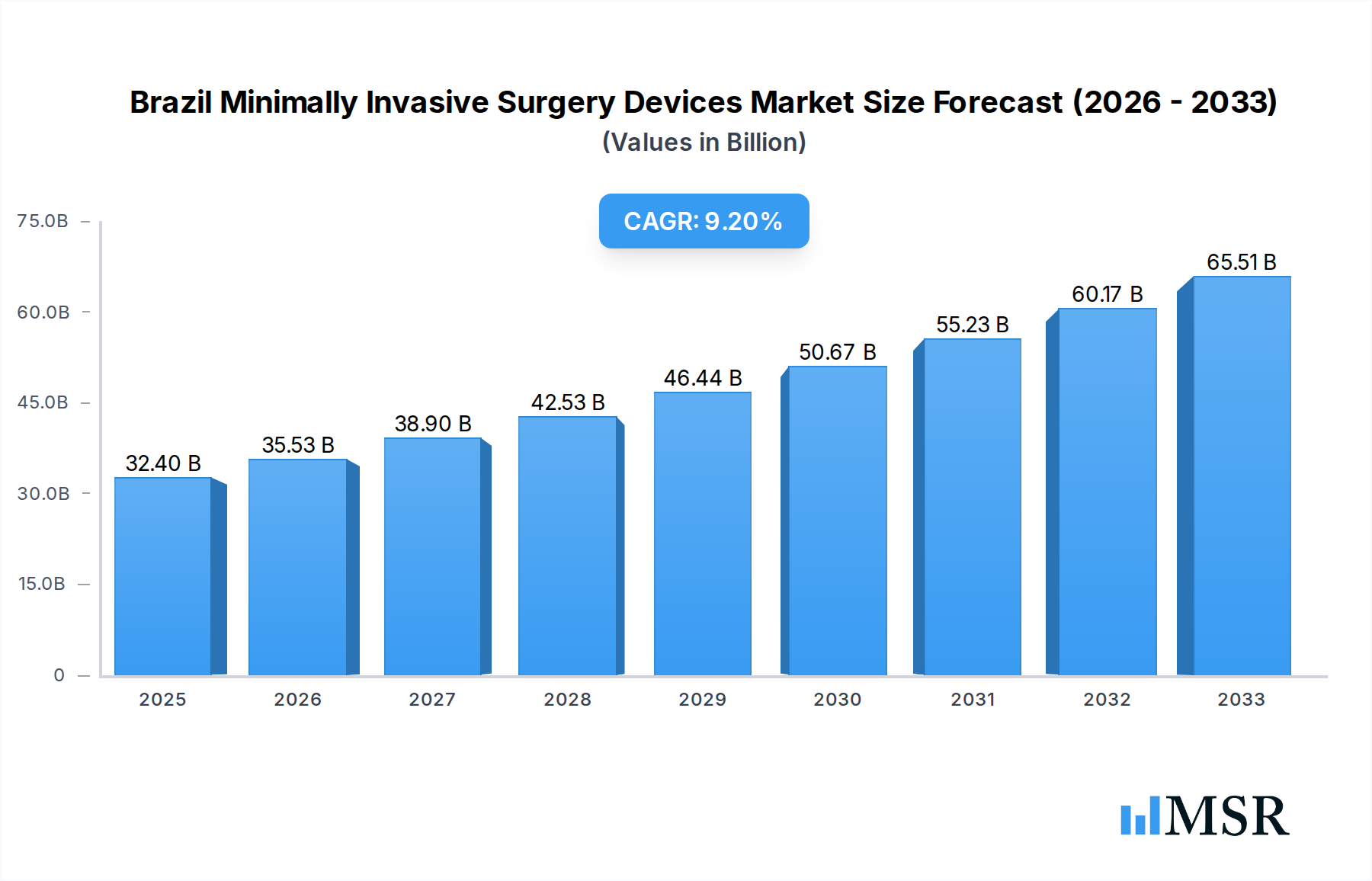

Brazil Minimally Invasive Surgery Devices Market Company Market Share

This in-depth report offers a definitive analysis of the Brazil minimally invasive surgery devices market, providing critical insights for stakeholders seeking to capitalize on this dynamic sector. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market size, growth drivers, technological advancements, competitive landscape, and future projections for minimally invasive surgery devices Brazil. Uncover actionable intelligence on surgical equipment Brazil, laparoscopic surgery Brazil, and endoscopic devices Brazil to inform your strategic decisions.

Brazil Minimally Invasive Surgery Devices Market Market Concentration & Dynamics

The Brazil minimally invasive surgery devices market exhibits a moderate to high level of concentration, with a few key global players dominating market share. These companies, including Smith & Nephew, Stryker Corporation, Koninklijke Philips NV, Intuitive Surgical Inc, Medtronic Plc, Siemens Healthineers, GE Healthcare, Zimmer Biomet, Olympus Corporation, and Abbott Laboratories, drive innovation and influence market trends through significant R&D investments and strategic partnerships. The innovation ecosystem in Brazil is fostered by the increasing adoption of advanced surgical techniques and a growing demand for less invasive procedures across various medical specialties. Regulatory frameworks, spearheaded by Agência Nacional de Vigilância Sanitária (ANVISA), play a crucial role in ensuring product safety and efficacy, albeit sometimes presenting a complex approval process. Substitute products, primarily traditional open surgery methods, are gradually being displaced by the superior outcomes and faster recovery associated with minimally invasive surgery. End-user trends are strongly influenced by patient preference for reduced scarring, shorter hospital stays, and quicker return to daily activities. Mergers and acquisitions (M&A) activities are a significant dynamic, with companies strategically acquiring smaller players or forming alliances to expand their product portfolios and market reach. M&A deal counts are expected to see a steady rise, indicating consolidation and strategic growth.

Brazil Minimally Invasive Surgery Devices Market Industry Insights & Trends

The Brazil minimally invasive surgery devices market is poised for substantial expansion, driven by a confluence of robust growth drivers, disruptive technological advancements, and evolving consumer behaviors. The market size for minimally invasive surgery devices in Brazil is projected to reach $4.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period of 2025–2033. This impressive growth trajectory is fueled by an increasing prevalence of chronic diseases, an aging population, and a growing awareness among both patients and healthcare professionals regarding the benefits of minimally invasive procedures. Technological disruptions are at the forefront, with advancements in robotics, artificial intelligence (AI), and high-definition imaging transforming surgical capabilities. The integration of these technologies is enabling surgeons to perform more complex procedures with greater precision and control, leading to improved patient outcomes and reduced complication rates. Evolving consumer behaviors are also playing a pivotal role. Patients are increasingly demanding less invasive treatment options that offer faster recovery times, minimal scarring, and reduced pain, thereby contributing to a higher adoption rate of MIS. Furthermore, the Brazilian government's focus on improving healthcare infrastructure and promoting advanced medical technologies is creating a conducive environment for market growth. The expanding healthcare expenditure and the increasing disposable income of the middle class are further augmenting the demand for sophisticated medical devices. The competitive landscape is characterized by intense innovation, with companies continuously investing in R&D to develop next-generation surgical instruments and systems. The market is also witnessing a rise in the adoption of robotic-assisted surgery systems, which are becoming increasingly accessible and affordable, further accelerating market growth.

Key Markets & Segments Leading Brazil Minimally Invasive Surgery Devices Market

The Brazil minimally invasive surgery devices market is characterized by strong performance across several key segments, with the Cardiovascular and Orthopedic applications demonstrating particularly significant dominance.

Dominant Applications:

- Cardiovascular: This segment leads due to the high prevalence of cardiovascular diseases in Brazil and the widespread adoption of minimally invasive techniques for procedures such as angioplasty, stenting, and valve repair/replacement. The increasing demand for less invasive heart surgeries to reduce recovery times and improve patient outcomes drives significant market share. Economic growth and improved healthcare infrastructure in major urban centers support the accessibility of advanced cardiovascular interventions.

- Orthopedic: The growing aging population, coupled with the rising incidence of orthopedic conditions like arthritis and sports injuries, fuels the demand for minimally invasive orthopedic surgeries. Procedures such as arthroscopy for knee, hip, and shoulder repairs are increasingly performed using minimally invasive approaches, contributing to substantial market growth. Technological advancements in orthopedic implants and surgical instruments further bolster this segment.

- Gastrointestinal: This segment benefits from the increasing diagnosis of gastrointestinal disorders and the preference for less invasive diagnostic and therapeutic procedures like endoscopy and laparoscopy for conditions such as appendicitis, gallbladder removal, and hernia repair.

Leading Product Segments:

- Endoscopic and Laparoscopic Devices: These devices are fundamental to the majority of minimally invasive procedures, covering a broad spectrum of applications. Their versatility and established efficacy make them a cornerstone of the MIS market in Brazil. The continuous innovation in camera technology, instrumentation, and disposables for these devices ensures their sustained dominance.

- Electrosurgical Devices: Crucial for cutting and coagulation during minimally invasive procedures, electrosurgical devices represent a significant market share due to their essential role in nearly all MIS interventions.

- Monitoring and Visualization Devices: With the increasing complexity of MIS, advanced visualization and monitoring systems are vital for surgical precision and safety, driving growth in this segment.

The dominance of these segments is underpinned by factors such as favorable reimbursement policies for MIS procedures, a growing number of trained surgeons proficient in these techniques, and strategic investments by leading medical device manufacturers in expanding their presence and product offerings within Brazil.

Brazil Minimally Invasive Surgery Devices Market Product Developments

The Brazil minimally invasive surgery devices market is continuously shaped by pioneering product developments. Innovations in robotic-assisted surgical systems are enhancing precision and control for complex procedures. Advancements in high-definition endoscopic cameras and 3D visualization technologies are providing surgeons with unparalleled visual clarity, leading to improved surgical outcomes. Furthermore, the development of smaller, more ergonomic handheld instruments and advanced energy devices is enabling surgeons to perform delicate maneuvers with greater ease and safety. The market is also witnessing the introduction of specialized devices for specific applications, such as advanced orthopedic implants designed for arthroscopic insertion and novel catheters and guidewires for cardiovascular interventions. These product developments are crucial for expanding the scope of minimally invasive surgery to treat a wider range of conditions and improve patient care.

Challenges in the Brazil Minimally Invasive Surgery Devices Market Market

Despite the robust growth, the Brazil minimally invasive surgery devices market faces several hurdles. High initial costs of advanced technologies, particularly robotic systems, can be a significant barrier to adoption for smaller healthcare facilities. The complex regulatory approval process by ANVISA, while essential for safety, can lead to delays in market entry for new devices. Limited reimbursement for certain advanced procedures can also restrict patient access and clinician adoption. Furthermore, shortages of trained surgical personnel proficient in utilizing these sophisticated devices and inadequate healthcare infrastructure in remote regions pose additional challenges to widespread market penetration. Supply chain disruptions, though less prevalent than in some other markets, can occasionally impact product availability.

Forces Driving Brazil Minimally Invasive Surgery Devices Market Growth

The Brazil minimally invasive surgery devices market is propelled by several powerful forces. Technological advancements, including robotics, AI-driven diagnostics, and sophisticated imaging, are continuously expanding the capabilities of MIS. Favorable demographic trends, such as an aging population and a rising incidence of chronic diseases, create a sustained demand for effective and less invasive treatment options. Government initiatives focused on improving healthcare access and quality, coupled with increasing healthcare expenditure, are creating a supportive market environment. The growing preference among patients for faster recovery, reduced pain, and minimal scarring is a significant market driver. Economic growth and a burgeoning middle class with enhanced purchasing power also contribute to the demand for advanced medical technologies.

Challenges in the Brazil Minimally Invasive Surgery Devices Market Market

Long-term growth catalysts for the Brazil minimally invasive surgery devices market lie in continuous innovation and strategic market expansion. The development of more affordable and user-friendly robotic surgery platforms will democratize access to these advanced technologies. Expanding the application of MIS to currently underserved medical specialties and geographical regions within Brazil will unlock new growth avenues. Furthermore, fostering strong partnerships between device manufacturers, healthcare providers, and research institutions will accelerate the development and adoption of next-generation surgical solutions. The ongoing efforts to enhance surgical training programs and streamline regulatory pathways are also critical for sustained market development and to overcome existing hurdles.

Emerging Opportunities in Brazil Minimally Invasive Surgery Devices Market

Emerging opportunities in the Brazil minimally invasive surgery devices market are abundant. The growing demand for aesthetic and reconstructive surgery presents a significant untapped potential. Expansion into smaller cities and rural areas through mobile surgical units or telemedicine-supported procedures offers new market segments. The development of disposable and single-use MIS devices can address concerns about infection control and reduce healthcare costs. Furthermore, the integration of virtual reality (VR) and augmented reality (AR) for surgical planning and training is an emerging trend that promises to revolutionize surgical education and execution. The increasing focus on outpatient surgical centers is also creating a demand for compact and efficient MIS equipment.

Leading Players in the Brazil Minimally Invasive Surgery Devices Market Sector

- Smith & Nephew

- Stryker Corporation

- Koninklijke Philips NV

- Intuitive Surgical Inc

- Medtronic Plc

- Siemens Healthineers

- GE Healthcare

- Zimmer Biomet

- Olympus Corporation

- Abbott Laboratories

Key Milestones in Brazil Minimally Invasive Surgery Devices Market Industry

- June 2022: GC Aesthetics, Inc. announced its expansion goals for the Brazilian market, planning to commercialize all its women's healthcare aesthetic and reconstructive solutions.

- January 2022: Spinologics Inc. and Importek launched Cervision, an upper-extremity patient positioning device for cervical spine surgery, in Brazil, following its approval by ANVISA in early January 2022.

Strategic Outlook for Brazil Minimally Invasive Surgery Devices Market Market

The strategic outlook for the Brazil minimally invasive surgery devices market is exceptionally positive, characterized by sustained growth driven by technological innovation and increasing healthcare adoption. Key growth accelerators include the continued expansion of robotic surgery adoption, further integration of AI and advanced imaging, and the development of specialized MIS devices for niche applications. Strategic opportunities lie in targeting underserved regions, collaborating with local healthcare providers for training and infrastructure development, and leveraging the growing patient demand for less invasive procedures. The market is well-positioned to benefit from ongoing investments in healthcare infrastructure and a commitment to adopting cutting-edge medical technologies, ensuring a robust future for minimally invasive surgery in Brazil.

Brazil Minimally Invasive Surgery Devices Market Segmentation

-

1. Products

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic and Laproscopic Devices

- 1.5. Monitoring and Visualization Devices

- 1.6. Ablation and Laser Based Devices

- 1.7. Others

-

2. Application

- 2.1. Aesthetic

- 2.2. Cardiovascular

- 2.3. Gastrointestinal

- 2.4. Gynecological

- 2.5. Orthopedic

- 2.6. Urological

- 2.7. Other Applications

Brazil Minimally Invasive Surgery Devices Market Segmentation By Geography

- 1. Brazil

Brazil Minimally Invasive Surgery Devices Market Regional Market Share

Geographic Coverage of Brazil Minimally Invasive Surgery Devices Market

Brazil Minimally Invasive Surgery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Lack of Experienced Professionals; Uncertain Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Aesthetics Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Minimally Invasive Surgery Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic and Laproscopic Devices

- 5.1.5. Monitoring and Visualization Devices

- 5.1.6. Ablation and Laser Based Devices

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic

- 5.2.2. Cardiovascular

- 5.2.3. Gastrointestinal

- 5.2.4. Gynecological

- 5.2.5. Orthopedic

- 5.2.6. Urological

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smith & Nephew

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stryker Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke Philips NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intuitive Surgical Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthineers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GE Healthcare

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zimmer Biomet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Olympus Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Abbott Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smith & Nephew

List of Figures

- Figure 1: Brazil Minimally Invasive Surgery Devices Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Minimally Invasive Surgery Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 2: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Products 2020 & 2033

- Table 3: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Application 2020 & 2033

- Table 5: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Region 2020 & 2033

- Table 7: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 8: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Products 2020 & 2033

- Table 9: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Application 2020 & 2033

- Table 11: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Minimally Invasive Surgery Devices Market?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Brazil Minimally Invasive Surgery Devices Market?

Key companies in the market include Smith & Nephew, Stryker Corporation, Koninklijke Philips NV, Intuitive Surgical Inc, Medtronic Plc, Siemens Healthineers, GE Healthcare, Zimmer Biomet, Olympus Corporation, Abbott Laboratories.

3. What are the main segments of the Brazil Minimally Invasive Surgery Devices Market?

The market segments include Products, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Technological Advancements.

6. What are the notable trends driving market growth?

Aesthetics Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Experienced Professionals; Uncertain Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In June 2022, GC Aesthetics, Inc., a privately-held medical technology company offering women's healthcare aesthetic and reconstructive solutions, announced its expansion goals for the Brazilian market. The company planned to commercialize all GC Aesthetics products and solutions in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Minimally Invasive Surgery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Minimally Invasive Surgery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Minimally Invasive Surgery Devices Market?

To stay informed about further developments, trends, and reports in the Brazil Minimally Invasive Surgery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence