Key Insights

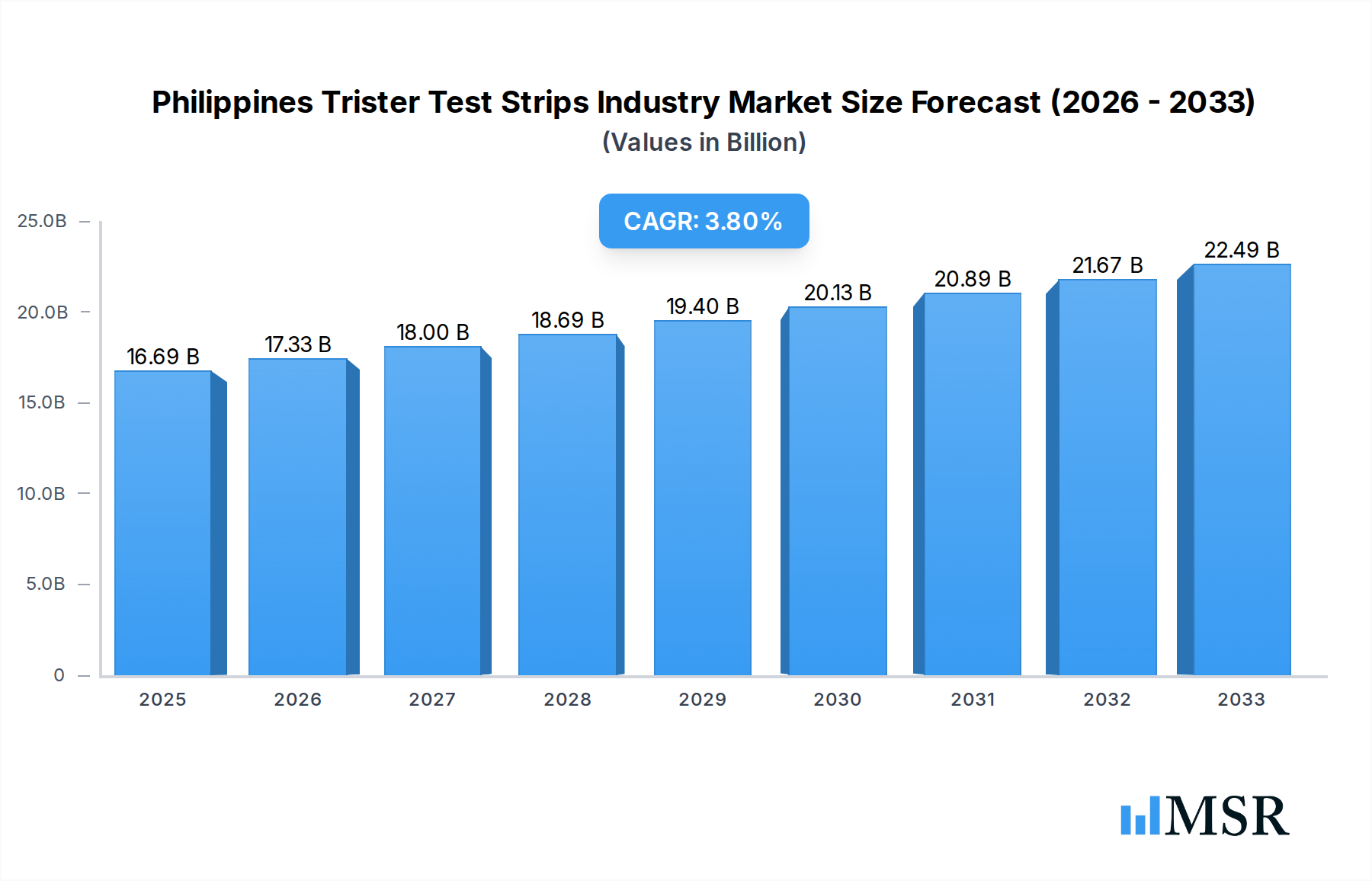

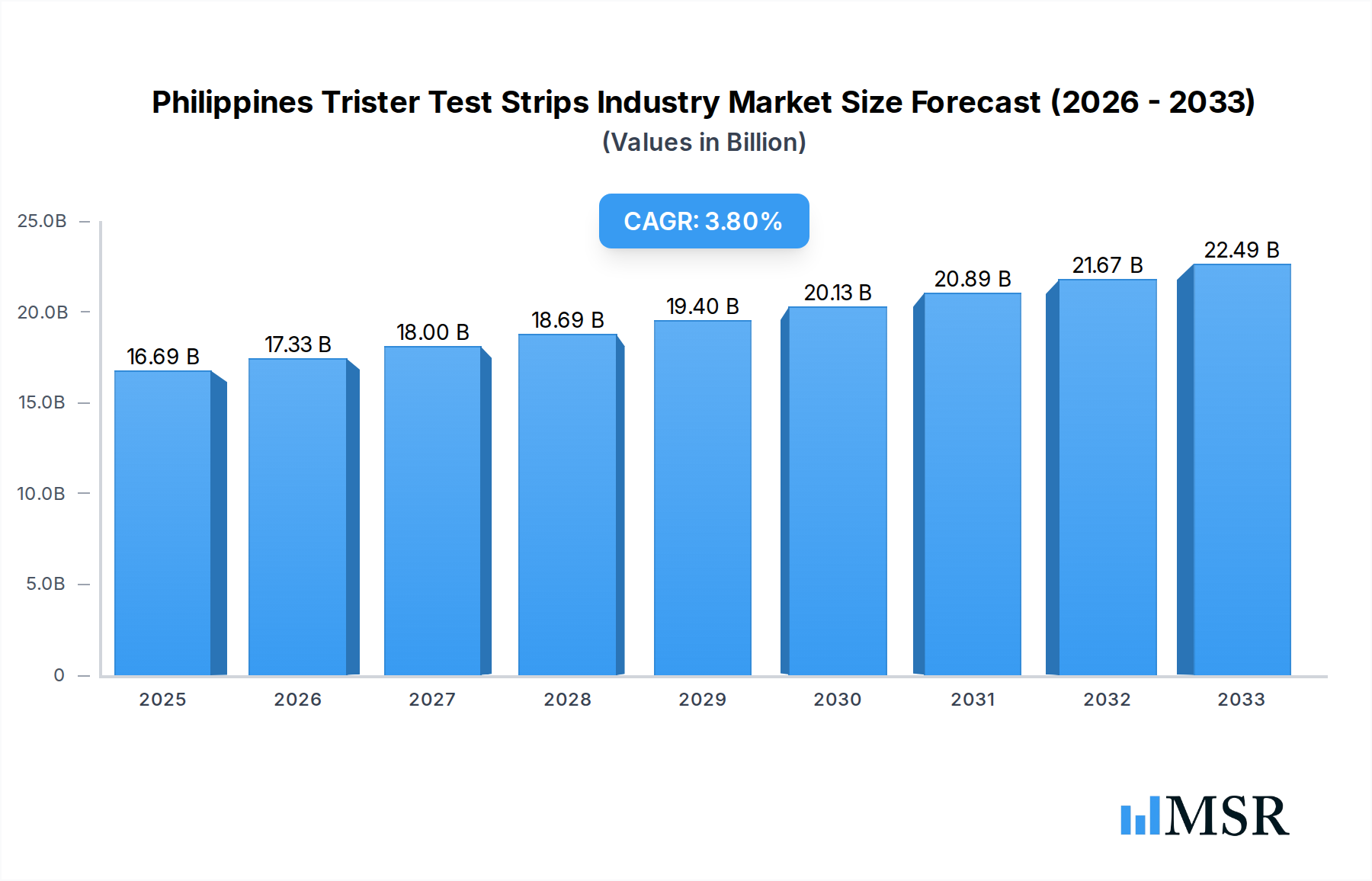

The Philippines Trister Test Strips Industry is poised for steady growth, with an estimated market size of $16.69 billion in 2025. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.87% during the forecast period of 2025-2033. This growth is primarily driven by the increasing prevalence of diabetes in the Philippines, a growing awareness among the population regarding blood glucose monitoring, and advancements in self-monitoring blood glucose devices. The rising demand for accurate and convenient blood glucose testing solutions, coupled with supportive government initiatives aimed at improving diabetes management, are significant catalysts for market expansion. Furthermore, the increasing accessibility and affordability of trister test strips, especially with the availability of both glucometer devices and the essential test strips, are contributing to a broader adoption among diabetic patients and healthcare providers.

Philippines Trister Test Strips Industry Market Size (In Billion)

The market's trajectory is also influenced by evolving trends such as the shift towards continuous blood glucose monitoring (CGM) systems, which offer a more comprehensive understanding of glucose fluctuations. While these advanced systems represent a future direction, traditional self-monitoring blood glucose devices, including glucometers and test strips, will continue to hold a substantial market share due to their established use and cost-effectiveness. However, certain restraints, such as the high cost of some advanced monitoring devices and potential reimbursement challenges, could moderate the pace of adoption for cutting-edge technologies. Despite these challenges, the fundamental driver of increasing diabetes incidence ensures a sustained demand for trister test strips, making the Philippines a dynamic market for manufacturers and suppliers.

Philippines Trister Test Strips Industry Company Market Share

Philippines Trister Test Strips Industry Market Concentration & Dynamics

The Philippines Trister Test Strips Industry exhibits a dynamic market concentration, characterized by the presence of global giants and emerging local players. While specific market share data for individual companies is proprietary, industry analysis indicates a market share analysis of approximately 7-7.5 billion Philippine Pesos for test strips alone in the base year 2025. Key competitors like Roche, Abbott, and Lifescan (Johnson & Johnson) hold significant influence due to their established product portfolios and extensive distribution networks. The innovation ecosystem is driven by advancements in glucose monitoring technology, pushing towards more accurate, user-friendly, and integrated solutions. Regulatory frameworks, primarily overseen by the Food and Drug Administration (FDA) of the Philippines, ensure product safety and efficacy, impacting new market entrants and product approvals. Substitute products, such as alternative diagnostic methods, pose a moderate threat, but the convenience and established familiarity of trister test strips ensure their continued dominance. End-user trends are shifting towards greater patient empowerment and self-management of diabetes, fueling demand for reliable and accessible testing solutions. Mergers and acquisitions (M&A) activities are observed, though not at a highly aggressive pace, with deal counts estimated at around 2-3 significant transactions within the historical period of 2019-2024, valued collectively in the range of 500-700 million Philippine Pesos, reflecting strategic consolidations and portfolio expansions.

Philippines Trister Test Strips Industry Industry Insights & Trends

The Philippines Trister Test Strips Industry is poised for robust growth, projected to reach an estimated market size of 12-15 billion Philippine Pesos by the end of the forecast period in 2033, with a Compound Annual Growth Rate (CAGR) of approximately 6-7%. This expansion is primarily fueled by a growing diabetes prevalence in the Philippines, estimated to affect over 2.5 billion people. Increasing awareness among patients and healthcare professionals regarding the importance of regular blood glucose monitoring for effective diabetes management is a significant growth driver. Technological disruptions are playing a pivotal role, with a clear trend towards the integration of continuous blood glucose monitoring (CGM) systems alongside traditional self-monitoring blood glucose (SMBG) devices. The development of more accurate, less invasive, and connected glucometer devices and their associated test strips is a key area of innovation. Evolving consumer behaviors reflect a demand for convenience, ease of use, and data accessibility. Patients are increasingly seeking solutions that can seamlessly integrate with their smartphones and provide actionable insights for personalized diabetes care. The rise of digital health platforms and telehealth services further amplifies the need for reliable and wirelessly connected diabetes test strips and monitoring devices. Government initiatives aimed at improving healthcare infrastructure and increasing access to diagnostic tools for non-communicable diseases also contribute to market expansion. The shift from reactive to proactive healthcare management, driven by lifestyle changes and increased health consciousness, is creating a sustained demand for diagnostic testing products. The increasing affordability and wider availability of advanced monitoring solutions are further democratizing access to essential diabetes care across the archipelago.

Key Markets & Segments Leading Philippines Trister Test Strips Industry

The Monitoring Devices segment, particularly Self-monitoring Blood Glucose Devices (SMBG), currently leads the Philippines Trister Test Strips Industry, driven by its established market presence and accessibility. Within SMBG, Test Strips represent a significant sub-segment, accounting for an estimated 60-70% of the SMBG market value.

- Economic Growth: The overall economic growth of the Philippines and the rising disposable incomes of the middle class directly contribute to increased healthcare spending, including the purchase of diabetes monitoring supplies.

- Infrastructure: Improvements in healthcare infrastructure, including the establishment of more clinics and pharmacies across both urban and rural areas, enhance the accessibility of trister test strips and glucometers.

- Diabetes Prevalence: The persistently high and growing prevalence of diabetes in the Philippines is the most fundamental driver of demand for all blood glucose monitoring devices and consumables.

The dominance of Monitoring Devices is further solidified by the widespread adoption of Glucometer Devices and their essential companion, Test Strips. These are indispensable for daily diabetes management for millions of Filipinos. While Continuous Blood Glucose Monitoring (CGM), encompassing Sensors and Durables, is a rapidly growing segment, its current market share is smaller due to higher initial costs and a more niche adoption rate compared to SMBG. However, the long-term trend points towards significant growth in CGM as technology advances and affordability improves. The Management Devices segment, including Insulin Pumps, Insulin Syringes, and Disposable Pens, also contributes to the overall market, but the primary focus and volume remain with monitoring technologies. The Philippines' healthcare system's structure, which often relies on point-of-care testing and home monitoring, naturally favors the SMBG segment. As the understanding of diabetes management evolves and technological barriers decrease, the Continuous Blood Glucose Monitoring segment is expected to witness substantial market penetration, challenging the current dominance of SMBG in the coming years.

Philippines Trister Test Strips Industry Product Developments

Product developments in the Philippines Trister Test Strips Industry are characterized by a relentless pursuit of enhanced accuracy, user-friendliness, and connectivity. Innovations focus on reducing blood sample size requirements, improving test strip stability, and developing smarter glucometer devices that offer data logging and smartphone integration. The integration of advanced algorithms within these devices is enabling more personalized insights for users. Furthermore, there is a growing emphasis on the development of continuous blood glucose monitoring systems, including the miniaturization and improved longevity of sensors and durables. These advancements are crucial for providing real-time glucose readings and reducing the need for frequent fingerstick tests, offering a significant competitive edge to companies at the forefront of technological innovation.

Challenges in the Philippines Trister Test Strips Industry Market

The Philippines Trister Test Strips Industry faces several challenges. Regulatory hurdles for new product approvals and the stringent quality control required for medical devices can slow down market entry for innovative products. Supply chain disruptions, exacerbated by global events and logistical complexities within the archipelago, can impact the availability and affordability of test strips. Intense competitive pressures from both multinational corporations and local distributors also necessitate constant innovation and competitive pricing strategies. Furthermore, the perceived high cost of advanced monitoring technologies like CGM can limit widespread adoption among a significant portion of the population.

Forces Driving Philippines Trister Test Strips Industry Growth

Several forces are propelling the growth of the Philippines Trister Test Strips Industry. The escalating prevalence of diabetes, fueled by lifestyle changes and an aging population, creates a sustained and expanding demand for glucose monitoring solutions. Technological advancements, particularly in the realm of continuous blood glucose monitoring (CGM) and smart glucometers, are driving innovation and consumer interest. Government initiatives aimed at improving public health outcomes and increasing access to diagnostic tools also play a crucial role. The increasing health consciousness among Filipinos and a greater emphasis on preventive healthcare are further contributing to market expansion.

Challenges in the Philippines Trister Test Strips Industry Market

Long-term growth catalysts for the Philippines Trister Test Strips Industry lie in strategic partnerships and market expansion. Increased collaborations between device manufacturers and healthcare providers can lead to wider adoption and better patient outcomes. Continued investment in research and development for more affordable and user-friendly diabetes test strips and monitoring systems will be critical. The expansion of digital health platforms and integration with telehealth services will further enhance market reach and patient engagement. Exploring innovative business models that improve accessibility and affordability for underserved populations will also be a key growth driver.

Emerging Opportunities in Philippines Trister Test Strips Industry

Emerging opportunities in the Philippines Trister Test Strips Industry are abundant, centered around the burgeoning demand for integrated diabetes management solutions. The growing interest in wearable technology and IoT-enabled healthcare devices presents a significant avenue for growth in advanced continuous blood glucose monitoring systems. The potential for personalized medicine, driven by AI-powered analytics of glucose data, offers a compelling future for the industry. Furthermore, the underserved rural populations represent a substantial untapped market for accessible and affordable diabetes testing solutions. Increased focus on patient education and support programs can foster greater adherence to monitoring protocols and drive demand for reliable test strips.

Leading Players in the Philippines Trister Test Strips Industry Sector

- Roche

- Dexcom

- Ypsomed

- Abbott

- Eli Lilly

- Sanofi

- Medtronic

- Tandem

- Insulet

- Lifescan (Johnson & Johnson)

- Becton and Dickenson

- Novo Nordisk

Key Milestones in Philippines Trister Test Strips Industry Industry

- September 2023: The Philippines public is being cautioned by the Department of Health (DOH) regarding misleading information pertaining to diabetes remedies. The DOH emphasizes that non-communicable diseases, including diabetes, can be averted by adopting a healthy lifestyle rather than relying on specific products available for purchase online. This milestone underscores the importance of accurate product information and the role of regulatory bodies in consumer protection.

- April 2022: Abbott, CamDiab, and Ypsomed announced the partnership to develop and commercialize an integrated automated insulin delivery (AID) system in European countries. The connected, smart wearable solution is designed to continuously monitor a person's glucose levels and automatically adjust and deliver the right amount of insulin at the right time, removing the guesswork of insulin dosing. This development signifies a major leap in integrated diabetes management technology, hinting at future trends and potential market integration in the Philippines.

Strategic Outlook for Philippines Trister Test Strips Industry Market

The strategic outlook for the Philippines Trister Test Strips Industry is exceptionally positive, driven by a confluence of demographic trends, technological advancements, and increasing healthcare awareness. The market is expected to witness accelerated growth, transitioning towards more sophisticated continuous blood glucose monitoring solutions. Strategic opportunities lie in forging stronger partnerships with local healthcare providers, investing in localized manufacturing or distribution to enhance accessibility, and leveraging digital health platforms to engage patients more effectively. Focusing on innovation that addresses the affordability and usability challenges for the wider Philippine population will be paramount for sustained market leadership and contributing to improved diabetes management outcomes across the nation.

Philippines Trister Test Strips Industry Segmentation

-

1. Device Type

-

1.1. Monitoring Devices

-

1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.1.1. Glucometer Devices

- 1.1.1.2. Test Strips

- 1.1.1.3. Lancets

-

1.1.2. Continuous Blood Glucose Monitoring

- 1.1.2.1. Sensors

- 1.1.2.2. Durables

-

1.1.1. Self-monitoring Blood Glucose Devices

-

1.2. Management Devices

- 1.2.1. Insulin Pump

- 1.2.2. Insulin Syringes

- 1.2.3. Disposable Pens

- 1.2.4. Others

-

1.1. Monitoring Devices

Philippines Trister Test Strips Industry Segmentation By Geography

- 1. Philippines

Philippines Trister Test Strips Industry Regional Market Share

Geographic Coverage of Philippines Trister Test Strips Industry

Philippines Trister Test Strips Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Management Devices Hold Highest Market Share in Philippines Diabetes Care Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Trister Test Strips Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1.1. Glucometer Devices

- 5.1.1.1.2. Test Strips

- 5.1.1.1.3. Lancets

- 5.1.1.2. Continuous Blood Glucose Monitoring

- 5.1.1.2.1. Sensors

- 5.1.1.2.2. Durables

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Disposable Pens

- 5.1.2.4. Others

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dexcom*List Not Exhaustive 7 2 Company Share Analysi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ypsomed

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbottt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sanofi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tandem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Insulet

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lifescan (Johnson &Johnson)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Becton and Dickenson

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: Philippines Trister Test Strips Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Philippines Trister Test Strips Industry Share (%) by Company 2025

List of Tables

- Table 1: Philippines Trister Test Strips Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 2: Philippines Trister Test Strips Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Philippines Trister Test Strips Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 4: Philippines Trister Test Strips Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Trister Test Strips Industry?

The projected CAGR is approximately 25.29%.

2. Which companies are prominent players in the Philippines Trister Test Strips Industry?

Key companies in the market include Roche, Dexcom*List Not Exhaustive 7 2 Company Share Analysi, Ypsomed, Abbottt, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson &Johnson), Becton and Dickenson, Novo Nordisk.

3. What are the main segments of the Philippines Trister Test Strips Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Management Devices Hold Highest Market Share in Philippines Diabetes Care Devices Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

September 2023: The Philippines public is being cautioned by the Department of Health (DOH) regarding misleading information pertaining to diabetes remedies. The DOH emphasizes that non-communicable diseases, including diabetes, can be averted by adopting a healthy lifestyle rather than relying on specific products available for purchase online.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Trister Test Strips Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Trister Test Strips Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Trister Test Strips Industry?

To stay informed about further developments, trends, and reports in the Philippines Trister Test Strips Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence