Key Insights

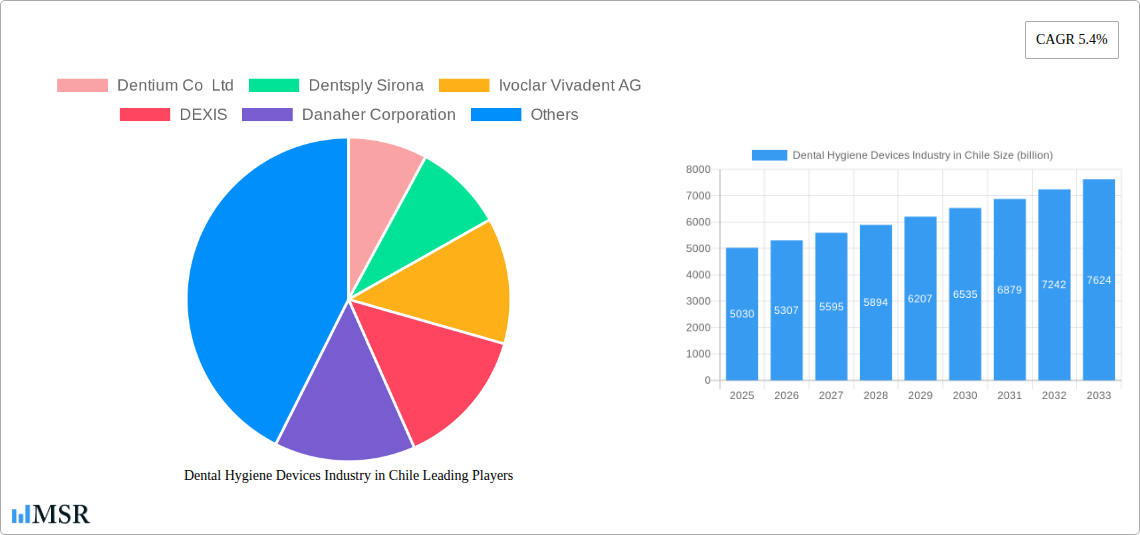

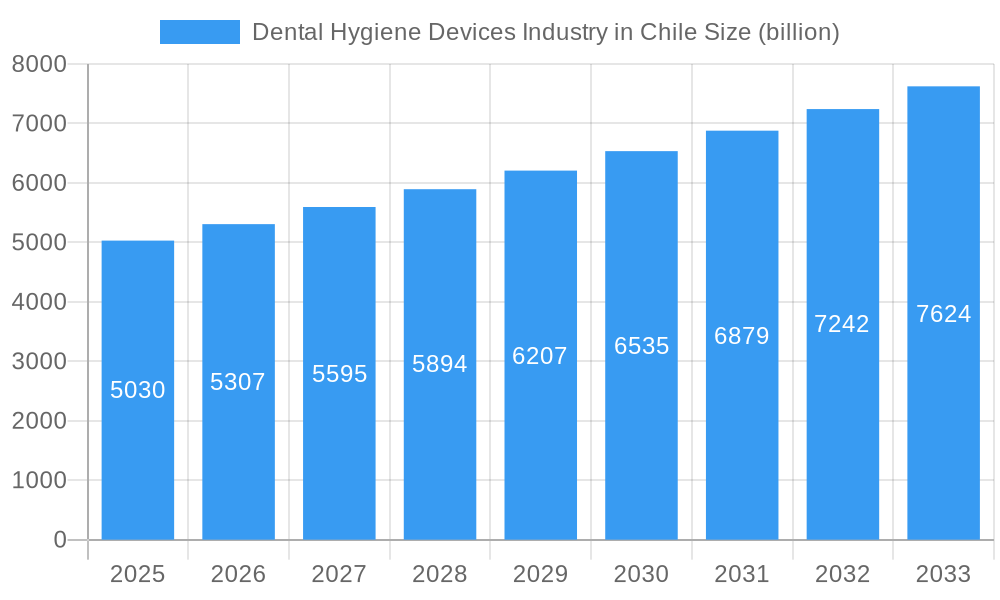

The Chilean dental hygiene devices market is poised for robust expansion, projected to reach USD 5.03 billion by 2025, with a significant CAGR of 5.4% anticipated through 2033. This growth is propelled by a confluence of factors, including an increasing focus on preventative dental care, rising disposable incomes, and a growing awareness among the Chilean population regarding the importance of oral health. Technological advancements in dental equipment, such as the adoption of advanced radiology equipment and innovative dental lasers, are further stimulating market demand. The expanding dental tourism sector in Chile also contributes to the overall market dynamism, attracting international patients seeking high-quality and affordable dental treatments. Furthermore, the rising prevalence of dental conditions necessitates sophisticated diagnostic and treatment solutions, thereby fueling the demand for a comprehensive range of dental hygiene devices and consumables.

Dental Hygiene Devices Industry in Chile Market Size (In Billion)

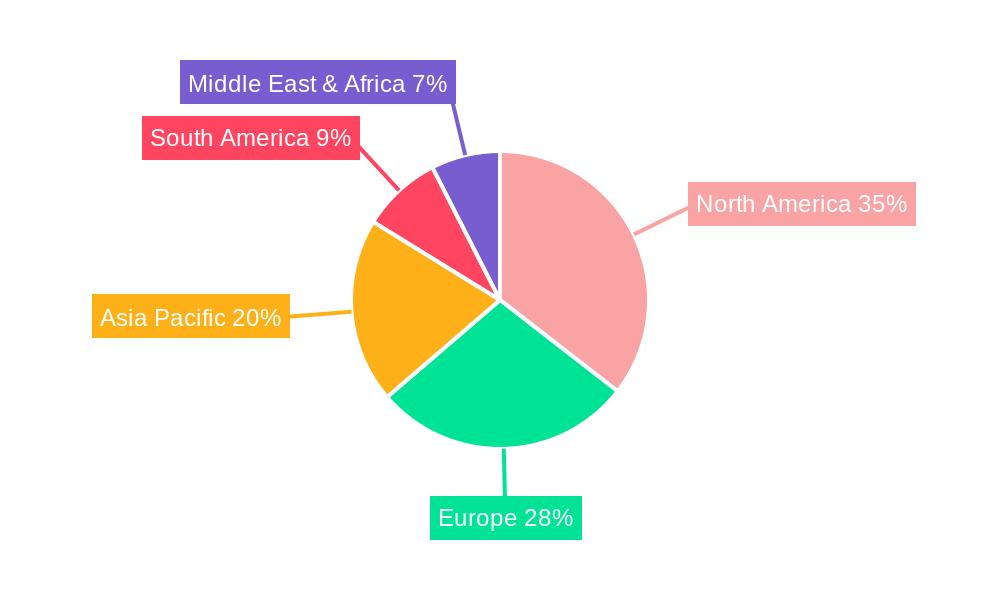

The market segmentation reveals strong performance across various product categories, with dental implants, crowns and bridges, and radiology equipment expected to lead the growth trajectory. The treatment segment is dominated by orthodontic and endodontic procedures, reflecting a societal shift towards aesthetic dentistry and the proactive management of dental issues. End-user analysis indicates a balanced demand from hospitals and clinics, with a growing contribution from other specialized dental facilities catering to specific patient needs. Key players like Dentium Co Ltd, Dentsply Sirona, and Straumann Holding AG are actively engaged in product innovation and strategic collaborations to capture market share. Geographically, North America is a dominant region, but the Asia Pacific, driven by economic growth and increasing healthcare expenditure, is emerging as a significant growth frontier. The market is well-positioned to address the evolving needs of dental professionals and patients, ensuring accessible and advanced oral healthcare solutions.

Dental Hygiene Devices Industry in Chile Company Market Share

This in-depth market research report provides an indispensable analysis of the Dental Hygiene Devices Industry in Chile. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report offers critical insights into market dynamics, key players, technological advancements, and emerging opportunities within the Chilean dental sector. With an estimated market size projected to reach USD XXX billion by 2033, driven by a robust CAGR of XX.XX%, this report is essential for manufacturers, distributors, investors, and regulatory bodies seeking to capitalize on the significant growth potential of this vital industry. We meticulously analyze segments including Dental Lasers, Radiology Equipment, Dental Chairs and Equipment, Dental Biomaterial, Dental Implants, Crowns and Bridges, and Other Dental Consumables, catering to Orthodontic, Endodontic, Peridontic, and Prosthodontic treatments utilized by Hospitals, Clinics, and Other End Users.

Dental Hygiene Devices Industry in Chile Market Concentration & Dynamics

The Dental Hygiene Devices Industry in Chile exhibits a moderate level of market concentration, with key global players like Dentsply Sirona, Ivoclar Vivadent AG, Danaher Corporation, and Straumann Holding AG holding significant market shares. The Chilean market is characterized by a dynamic ecosystem where innovation is increasingly driven by the adoption of digital technologies and advanced materials. Regulatory frameworks, overseen by entities such as the Chilean Ministry of Health, play a crucial role in ensuring product quality and patient safety, influencing market entry and competition. Substitute products, while present, are gradually being displaced by more advanced and efficient dental hygiene devices, particularly in areas like digital imaging and minimally invasive treatments. End-user trends are shifting towards a demand for more sophisticated and patient-centric solutions, driving investments in research and development. Mergers and acquisitions (M&A) activities are expected to shape the competitive landscape further, with an estimated XX M&A deals anticipated during the forecast period as larger entities seek to consolidate their market presence and acquire innovative technologies. Market share analysis indicates that Radiology Equipment and Dental Implants currently hold substantial portions of the market.

Dental Hygiene Devices Industry in Chile Industry Insights & Trends

The Dental Hygiene Devices Industry in Chile is poised for substantial expansion, driven by a confluence of factors including increasing oral health awareness, a growing aging population, and rising disposable incomes that enable greater expenditure on dental care. The market size in the base year of 2025 is estimated at USD XX billion. Technological disruptions are rapidly transforming the industry, with the integration of artificial intelligence in diagnostics, advanced 3D printing for prosthetics, and the proliferation of minimally invasive treatment options. Evolving consumer behaviors, influenced by global trends in aesthetics and preventive care, are creating a demand for advanced dental implant solutions, crowns and bridges, and high-quality dental biomaterials. The increasing adoption of digital dentistry, including radiology equipment and dental lasers, by clinics and hospitals is a significant growth catalyst. Furthermore, government initiatives aimed at improving healthcare infrastructure and access to dental services are creating a fertile ground for market growth. The forecast period of 2025-2033 is expected to witness consistent upward trajectory.

Key Markets & Segments Leading Dental Hygiene Devices Industry in Chile

The Dental Hygiene Devices Industry in Chile is witnessing dominant growth across several key markets and segments.

Product Segments:

- Dental Implants: This segment is experiencing robust growth, driven by an increasing demand for restorative dental solutions and the aging population's need for permanent tooth replacement. Economic growth and higher patient affordability contribute significantly to this segment's dominance.

- Radiology Equipment: The adoption of digital X-ray systems, CBCT scanners, and intraoral cameras is crucial for accurate diagnosis and treatment planning. Increased government investment in healthcare infrastructure and the rising prevalence of dental diseases fuel demand.

- Dental Chairs and Equipment: Modern, ergonomic dental chairs and integrated equipment systems are essential for providing advanced patient care. Investment in upgrading existing dental facilities and the establishment of new clinics are key drivers.

- Dental Biomaterial: High-quality biomaterials for fillings, bonding agents, and other restorative procedures are vital for successful dental treatments. Technological advancements in material science and increased emphasis on biocompatibility are propelling this segment.

- Crowns and Bridges: The demand for aesthetically pleasing and durable crowns and bridges, often manufactured using advanced CAD/CAM technology, continues to rise.

Treatment Segments:

- Prosthodontic: This segment is a major contributor due to the high prevalence of tooth loss and the demand for restorative solutions like implants, crowns, and bridges.

- Orthodontic: Increasing awareness about dental aesthetics and the availability of advanced orthodontic devices are driving growth in this segment, especially among younger demographics.

End User Segments:

- Clinics: Dental clinics, ranging from small private practices to large multi-specialty centers, represent the largest end-user segment, driving the demand for a wide array of dental hygiene devices.

- Hospitals: While a smaller segment, hospitals with dedicated dental departments are increasingly investing in advanced technologies, particularly for complex surgical procedures and implantology.

The dominance in these segments is underpinned by factors such as increasing disposable income, a growing emphasis on preventive and cosmetic dentistry, and the continuous introduction of innovative products by leading manufacturers.

Dental Hygiene Devices Industry in Chile Product Developments

Product development in the Dental Hygiene Devices Industry in Chile is characterized by a strong focus on digitalization, minimally invasive techniques, and enhanced patient comfort. Innovations in dental lasers offer precise and less invasive treatment options for various dental procedures. Advanced radiology equipment, including AI-powered diagnostic software, is revolutionizing diagnostics with improved accuracy and reduced radiation exposure. The development of next-generation dental biomaterials ensures better biocompatibility and longevity of restorations. Furthermore, advancements in materials and manufacturing for dental implants and crowns and bridges are leading to more aesthetic and functional outcomes, providing a competitive edge for companies investing in cutting-edge research.

Challenges in the Dental Hygiene Devices Industry in Chile Market

The Dental Hygiene Devices Industry in Chile faces several challenges that could impede its growth trajectory. Regulatory hurdles and the time-consuming approval processes for new medical devices can slow down market entry for innovative products. Supply chain disruptions, exacerbated by global economic uncertainties and logistical complexities, can lead to increased costs and delayed delivery of essential components and finished goods. Intense competition from both international and local players can put pressure on pricing and profit margins, particularly for generic or less differentiated products. High initial investment costs for advanced radiology equipment and dental chairs can also be a barrier for smaller clinics and practitioners, limiting the widespread adoption of cutting-edge technology.

Forces Driving Dental Hygiene Devices Industry in Chile Growth

Several key forces are propelling the Dental Hygiene Devices Industry in Chile forward. The escalating demand for advanced dental treatments, driven by an aging population and increased awareness of oral health, is a primary growth driver. Technological advancements, particularly in areas like digital imaging (radiology equipment), CAD/CAM technology for crowns and bridges, and dental lasers, are enhancing treatment efficacy and patient experience. Government initiatives and increasing healthcare expenditure in Chile are creating a more favorable environment for the expansion of dental services. Moreover, the growing popularity of cosmetic dentistry and the pursuit of aesthetic smiles are boosting the demand for high-value products like dental implants and advanced orthodontic solutions.

Long-Term Growth Catalysts in the Dental Hygiene Devices Industry in Chile Market

Long-term growth in the Dental Hygiene Devices Industry in Chile will be significantly shaped by continuous innovation in areas such as biomimetic materials for dental implants and crowns and bridges, and AI-driven diagnostic tools integrated with radiology equipment. Strategic partnerships between technology providers and dental institutions can accelerate the adoption of new technologies and training programs. Market expansions into underserved regions within Chile, coupled with increasing disposable incomes, will unlock new consumer bases. The growing focus on preventive dental care and personalized treatment plans will also fuel demand for advanced diagnostic and therapeutic devices.

Emerging Opportunities in Dental Hygiene Devices Industry in Chile

Emerging opportunities within the Dental Hygiene Devices Industry in Chile are diverse and promising. The increasing adoption of teledentistry presents an opportunity for manufacturers of remote diagnostic and monitoring equipment. Growth in the pediatric dentistry sector, with a focus on early intervention and preventative care, opens avenues for specialized child-friendly dental chairs and equipment. The rising demand for aesthetic dentistry also drives opportunities for advanced dental lasers, orthodontic solutions, and high-quality dental biomaterials. Furthermore, the development of more affordable and accessible dental implant systems could tap into a larger market segment, while the growing interest in sustainable dental practices could lead to demand for eco-friendly consumables.

Leading Players in the Dental Hygiene Devices Industry in Chile Sector

- Dentium Co Ltd

- Dentsply Sirona

- Ivoclar Vivadent AG

- DEXIS

- Danaher Corporation

- A-dec Inc

- Carestream Health Inc

- Straumann Holding AG

- Planmeca Oy

Key Milestones in Dental Hygiene Devices Industry in Chile Industry

- March 2022: Envista Holdings Corporation re-branded Envista's KaVo imaging business to DEXIS across the world, including Chile. This strategic move integrated high-quality digital imaging solutions under the DEXIS brand, enhancing its market presence and offering advanced diagnostic tools to the Chilean dental community.

- February 2022: The Chilean Ministry of Public Works, in collaboration with the Ministry of Health, awarded ACCIONA a 15-year concession for the La Serena Hospital in Coquimbo, Chile. This development includes the design, construction, and operation of a facility with various medical services, notably featuring dental consultations, signaling an expansion in healthcare infrastructure and potential for increased demand for dental hygiene devices.

Strategic Outlook for Dental Hygiene Devices Industry in Chile Market

The strategic outlook for the Dental Hygiene Devices Industry in Chile is exceptionally bright, characterized by sustained growth and innovation. Key accelerators include the continued integration of digital technologies across all segments, from AI-powered diagnostics with radiology equipment to advanced manufacturing of dental implants and crowns and bridges. The growing emphasis on preventive and personalized dental care will drive demand for sophisticated diagnostic and therapeutic devices. Strategic opportunities lie in expanding market penetration within both urban and rural areas, leveraging government healthcare initiatives, and fostering collaborations with dental educational institutions to ensure widespread adoption of new technologies and techniques. The market's trajectory suggests a robust future, driven by an increasing focus on oral health and the availability of cutting-edge solutions.

Dental Hygiene Devices Industry in Chile Segmentation

-

1. Product

- 1.1. Dental Lasers

- 1.2. Radiology Equipment

- 1.3. Dental Chairs and Equipment

- 1.4. Other General and Diagnostic Equipment

- 1.5. Dental Biomaterial

- 1.6. Dental Implants

- 1.7. Crowns and Bridges

- 1.8. Other Dental Consumables

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Peridontic

- 2.4. Prosthodontic

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

Dental Hygiene Devices Industry in Chile Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Hygiene Devices Industry in Chile Regional Market Share

Geographic Coverage of Dental Hygiene Devices Industry in Chile

Dental Hygiene Devices Industry in Chile REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Oral Diseases and Aging Population; Technological Advancements like the Use of CAD/CAM for Teeth Design

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Reimbursement Policies; Lack of Awareness in Some Developing Nations

- 3.4. Market Trends

- 3.4.1. Prosthodontics Segment May Register a High CAGR in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Hygiene Devices Industry in Chile Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Dental Lasers

- 5.1.2. Radiology Equipment

- 5.1.3. Dental Chairs and Equipment

- 5.1.4. Other General and Diagnostic Equipment

- 5.1.5. Dental Biomaterial

- 5.1.6. Dental Implants

- 5.1.7. Crowns and Bridges

- 5.1.8. Other Dental Consumables

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Peridontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Dental Hygiene Devices Industry in Chile Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Dental Lasers

- 6.1.2. Radiology Equipment

- 6.1.3. Dental Chairs and Equipment

- 6.1.4. Other General and Diagnostic Equipment

- 6.1.5. Dental Biomaterial

- 6.1.6. Dental Implants

- 6.1.7. Crowns and Bridges

- 6.1.8. Other Dental Consumables

- 6.2. Market Analysis, Insights and Forecast - by Treatment

- 6.2.1. Orthodontic

- 6.2.2. Endodontic

- 6.2.3. Peridontic

- 6.2.4. Prosthodontic

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Dental Hygiene Devices Industry in Chile Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Dental Lasers

- 7.1.2. Radiology Equipment

- 7.1.3. Dental Chairs and Equipment

- 7.1.4. Other General and Diagnostic Equipment

- 7.1.5. Dental Biomaterial

- 7.1.6. Dental Implants

- 7.1.7. Crowns and Bridges

- 7.1.8. Other Dental Consumables

- 7.2. Market Analysis, Insights and Forecast - by Treatment

- 7.2.1. Orthodontic

- 7.2.2. Endodontic

- 7.2.3. Peridontic

- 7.2.4. Prosthodontic

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Dental Hygiene Devices Industry in Chile Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Dental Lasers

- 8.1.2. Radiology Equipment

- 8.1.3. Dental Chairs and Equipment

- 8.1.4. Other General and Diagnostic Equipment

- 8.1.5. Dental Biomaterial

- 8.1.6. Dental Implants

- 8.1.7. Crowns and Bridges

- 8.1.8. Other Dental Consumables

- 8.2. Market Analysis, Insights and Forecast - by Treatment

- 8.2.1. Orthodontic

- 8.2.2. Endodontic

- 8.2.3. Peridontic

- 8.2.4. Prosthodontic

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Dental Hygiene Devices Industry in Chile Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Dental Lasers

- 9.1.2. Radiology Equipment

- 9.1.3. Dental Chairs and Equipment

- 9.1.4. Other General and Diagnostic Equipment

- 9.1.5. Dental Biomaterial

- 9.1.6. Dental Implants

- 9.1.7. Crowns and Bridges

- 9.1.8. Other Dental Consumables

- 9.2. Market Analysis, Insights and Forecast - by Treatment

- 9.2.1. Orthodontic

- 9.2.2. Endodontic

- 9.2.3. Peridontic

- 9.2.4. Prosthodontic

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Dental Hygiene Devices Industry in Chile Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Dental Lasers

- 10.1.2. Radiology Equipment

- 10.1.3. Dental Chairs and Equipment

- 10.1.4. Other General and Diagnostic Equipment

- 10.1.5. Dental Biomaterial

- 10.1.6. Dental Implants

- 10.1.7. Crowns and Bridges

- 10.1.8. Other Dental Consumables

- 10.2. Market Analysis, Insights and Forecast - by Treatment

- 10.2.1. Orthodontic

- 10.2.2. Endodontic

- 10.2.3. Peridontic

- 10.2.4. Prosthodontic

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Clinics

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dentium Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dentsply Sirona

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ivoclar Vivadent AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DEXIS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danaher Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 A-dec Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carestream Health Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Straumann Holding AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Planmeca Oy

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Dentium Co Ltd

List of Figures

- Figure 1: Global Dental Hygiene Devices Industry in Chile Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Dental Hygiene Devices Industry in Chile Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Dental Hygiene Devices Industry in Chile Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Dental Hygiene Devices Industry in Chile Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Dental Hygiene Devices Industry in Chile Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Dental Hygiene Devices Industry in Chile Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Dental Hygiene Devices Industry in Chile Revenue (billion), by Treatment 2025 & 2033

- Figure 8: North America Dental Hygiene Devices Industry in Chile Volume (K Unit), by Treatment 2025 & 2033

- Figure 9: North America Dental Hygiene Devices Industry in Chile Revenue Share (%), by Treatment 2025 & 2033

- Figure 10: North America Dental Hygiene Devices Industry in Chile Volume Share (%), by Treatment 2025 & 2033

- Figure 11: North America Dental Hygiene Devices Industry in Chile Revenue (billion), by End User 2025 & 2033

- Figure 12: North America Dental Hygiene Devices Industry in Chile Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Dental Hygiene Devices Industry in Chile Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Dental Hygiene Devices Industry in Chile Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Dental Hygiene Devices Industry in Chile Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Dental Hygiene Devices Industry in Chile Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Dental Hygiene Devices Industry in Chile Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Dental Hygiene Devices Industry in Chile Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Dental Hygiene Devices Industry in Chile Revenue (billion), by Product 2025 & 2033

- Figure 20: South America Dental Hygiene Devices Industry in Chile Volume (K Unit), by Product 2025 & 2033

- Figure 21: South America Dental Hygiene Devices Industry in Chile Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Dental Hygiene Devices Industry in Chile Volume Share (%), by Product 2025 & 2033

- Figure 23: South America Dental Hygiene Devices Industry in Chile Revenue (billion), by Treatment 2025 & 2033

- Figure 24: South America Dental Hygiene Devices Industry in Chile Volume (K Unit), by Treatment 2025 & 2033

- Figure 25: South America Dental Hygiene Devices Industry in Chile Revenue Share (%), by Treatment 2025 & 2033

- Figure 26: South America Dental Hygiene Devices Industry in Chile Volume Share (%), by Treatment 2025 & 2033

- Figure 27: South America Dental Hygiene Devices Industry in Chile Revenue (billion), by End User 2025 & 2033

- Figure 28: South America Dental Hygiene Devices Industry in Chile Volume (K Unit), by End User 2025 & 2033

- Figure 29: South America Dental Hygiene Devices Industry in Chile Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Dental Hygiene Devices Industry in Chile Volume Share (%), by End User 2025 & 2033

- Figure 31: South America Dental Hygiene Devices Industry in Chile Revenue (billion), by Country 2025 & 2033

- Figure 32: South America Dental Hygiene Devices Industry in Chile Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Dental Hygiene Devices Industry in Chile Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Dental Hygiene Devices Industry in Chile Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Dental Hygiene Devices Industry in Chile Revenue (billion), by Product 2025 & 2033

- Figure 36: Europe Dental Hygiene Devices Industry in Chile Volume (K Unit), by Product 2025 & 2033

- Figure 37: Europe Dental Hygiene Devices Industry in Chile Revenue Share (%), by Product 2025 & 2033

- Figure 38: Europe Dental Hygiene Devices Industry in Chile Volume Share (%), by Product 2025 & 2033

- Figure 39: Europe Dental Hygiene Devices Industry in Chile Revenue (billion), by Treatment 2025 & 2033

- Figure 40: Europe Dental Hygiene Devices Industry in Chile Volume (K Unit), by Treatment 2025 & 2033

- Figure 41: Europe Dental Hygiene Devices Industry in Chile Revenue Share (%), by Treatment 2025 & 2033

- Figure 42: Europe Dental Hygiene Devices Industry in Chile Volume Share (%), by Treatment 2025 & 2033

- Figure 43: Europe Dental Hygiene Devices Industry in Chile Revenue (billion), by End User 2025 & 2033

- Figure 44: Europe Dental Hygiene Devices Industry in Chile Volume (K Unit), by End User 2025 & 2033

- Figure 45: Europe Dental Hygiene Devices Industry in Chile Revenue Share (%), by End User 2025 & 2033

- Figure 46: Europe Dental Hygiene Devices Industry in Chile Volume Share (%), by End User 2025 & 2033

- Figure 47: Europe Dental Hygiene Devices Industry in Chile Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe Dental Hygiene Devices Industry in Chile Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Dental Hygiene Devices Industry in Chile Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Dental Hygiene Devices Industry in Chile Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue (billion), by Product 2025 & 2033

- Figure 52: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume (K Unit), by Product 2025 & 2033

- Figure 53: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue Share (%), by Product 2025 & 2033

- Figure 54: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume Share (%), by Product 2025 & 2033

- Figure 55: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue (billion), by Treatment 2025 & 2033

- Figure 56: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume (K Unit), by Treatment 2025 & 2033

- Figure 57: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue Share (%), by Treatment 2025 & 2033

- Figure 58: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume Share (%), by Treatment 2025 & 2033

- Figure 59: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue (billion), by End User 2025 & 2033

- Figure 60: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Dental Hygiene Devices Industry in Chile Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue (billion), by Product 2025 & 2033

- Figure 68: Asia Pacific Dental Hygiene Devices Industry in Chile Volume (K Unit), by Product 2025 & 2033

- Figure 69: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue Share (%), by Product 2025 & 2033

- Figure 70: Asia Pacific Dental Hygiene Devices Industry in Chile Volume Share (%), by Product 2025 & 2033

- Figure 71: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue (billion), by Treatment 2025 & 2033

- Figure 72: Asia Pacific Dental Hygiene Devices Industry in Chile Volume (K Unit), by Treatment 2025 & 2033

- Figure 73: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue Share (%), by Treatment 2025 & 2033

- Figure 74: Asia Pacific Dental Hygiene Devices Industry in Chile Volume Share (%), by Treatment 2025 & 2033

- Figure 75: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue (billion), by End User 2025 & 2033

- Figure 76: Asia Pacific Dental Hygiene Devices Industry in Chile Volume (K Unit), by End User 2025 & 2033

- Figure 77: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue Share (%), by End User 2025 & 2033

- Figure 78: Asia Pacific Dental Hygiene Devices Industry in Chile Volume Share (%), by End User 2025 & 2033

- Figure 79: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue (billion), by Country 2025 & 2033

- Figure 80: Asia Pacific Dental Hygiene Devices Industry in Chile Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Dental Hygiene Devices Industry in Chile Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Dental Hygiene Devices Industry in Chile Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Treatment 2020 & 2033

- Table 4: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 5: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Treatment 2020 & 2033

- Table 12: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 13: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Product 2020 & 2033

- Table 24: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Product 2020 & 2033

- Table 25: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Treatment 2020 & 2033

- Table 26: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 27: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Argentina Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Treatment 2020 & 2033

- Table 40: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 41: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by End User 2020 & 2033

- Table 42: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by End User 2020 & 2033

- Table 43: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Germany Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: France Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Italy Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Spain Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Russia Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Benelux Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Nordics Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Product 2020 & 2033

- Table 64: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Product 2020 & 2033

- Table 65: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Treatment 2020 & 2033

- Table 66: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 67: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by End User 2020 & 2033

- Table 68: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Turkey Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Israel Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: GCC Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: North Africa Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: South Africa Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Product 2020 & 2033

- Table 84: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Product 2020 & 2033

- Table 85: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Treatment 2020 & 2033

- Table 86: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 87: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by End User 2020 & 2033

- Table 88: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by End User 2020 & 2033

- Table 89: Global Dental Hygiene Devices Industry in Chile Revenue billion Forecast, by Country 2020 & 2033

- Table 90: Global Dental Hygiene Devices Industry in Chile Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: China Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: India Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 96: Japan Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 98: South Korea Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 102: Oceania Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Dental Hygiene Devices Industry in Chile Revenue (billion) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Dental Hygiene Devices Industry in Chile Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Hygiene Devices Industry in Chile?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Dental Hygiene Devices Industry in Chile?

Key companies in the market include Dentium Co Ltd, Dentsply Sirona, Ivoclar Vivadent AG, DEXIS, Danaher Corporation, A-dec Inc, Carestream Health Inc, Straumann Holding AG, Planmeca Oy.

3. What are the main segments of the Dental Hygiene Devices Industry in Chile?

The market segments include Product, Treatment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.03 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Oral Diseases and Aging Population; Technological Advancements like the Use of CAD/CAM for Teeth Design.

6. What are the notable trends driving market growth?

Prosthodontics Segment May Register a High CAGR in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Proper Reimbursement Policies; Lack of Awareness in Some Developing Nations.

8. Can you provide examples of recent developments in the market?

In March 2022, Envista Holdings Corporation re-branded Envista's KaVo imaging business to DEXIS across the world, along with Chile. DEXIS develops high-quality digital imaging solutions for the dental community.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Hygiene Devices Industry in Chile," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Hygiene Devices Industry in Chile report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Hygiene Devices Industry in Chile?

To stay informed about further developments, trends, and reports in the Dental Hygiene Devices Industry in Chile, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence