Key Insights

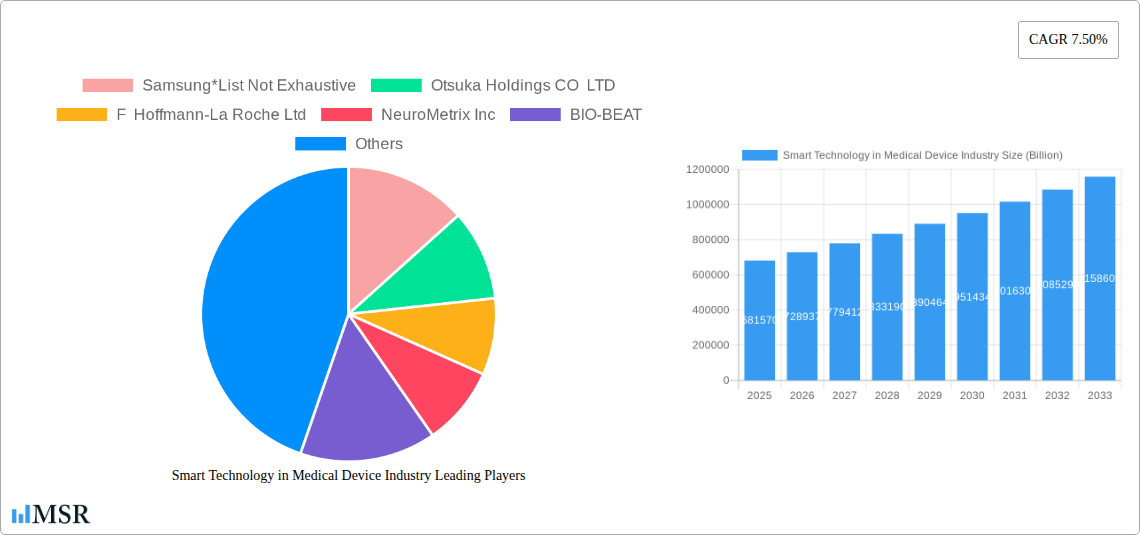

The global Smart Technology in Medical Device Industry is projected for substantial growth, reaching an estimated $681.57 billion by 2025 and expanding at a robust CAGR of 6.99% through 2033. This dynamic market is fueled by a confluence of escalating demand for remote patient monitoring, the increasing prevalence of chronic diseases, and the continuous technological advancements driving innovation in connected healthcare solutions. The diagnostic and monitoring segment, encompassing devices like blood glucose monitors, heart rate monitors, and pulse oximeters, is anticipated to lead market expansion due to their growing adoption in both clinical settings and home-care environments for proactive health management. Simultaneously, therapeutic devices, including portable oxygen concentrators, ventilators, and insulin pumps, are witnessing heightened demand driven by an aging global population and the need for more accessible and personalized treatment options.

Smart Technology in Medical Device Industry Market Size (In Billion)

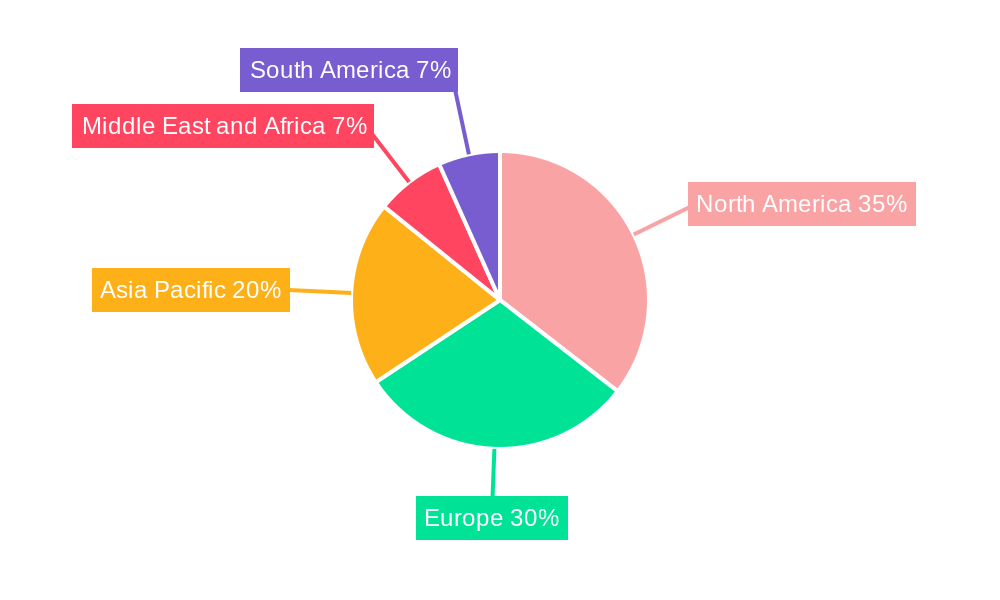

The proliferation of smart wearable devices and the increasing integration of AI and IoT in medical equipment are key drivers shaping the future of this industry. Companies are heavily investing in research and development to create more sophisticated, user-friendly, and data-driven medical devices. However, challenges such as stringent regulatory frameworks, data security concerns, and the initial cost of advanced technology may temper growth in certain areas. Nevertheless, the overarching trend towards preventative healthcare, coupled with the growing acceptance of telehealth and remote patient management, positions the Smart Technology in Medical Device Industry for sustained and significant expansion across all major geographic regions, with North America and Europe expected to remain dominant markets, while Asia Pacific shows promising growth potential.

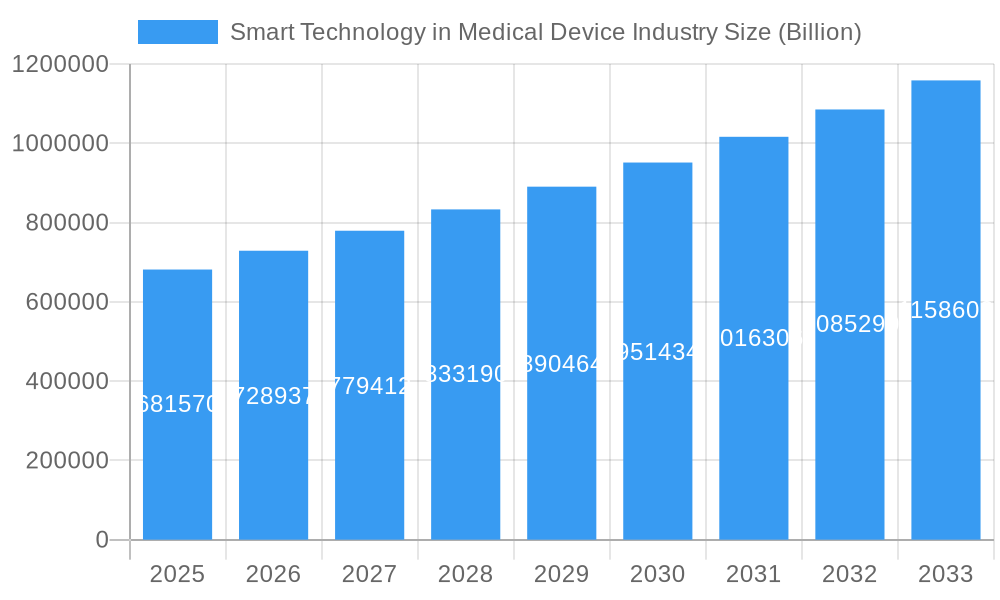

Smart Technology in Medical Device Industry Company Market Share

**Dive deep into the revolutionary landscape of smart technology within the medical device sector. This comprehensive report, spanning from 2019 to 2033 with a base year of 2025, offers unparalleled insights into market dynamics, technological advancements, and strategic opportunities. Covering key players like Samsung, Otsuka Holdings, F Hoffmann-La Roche, and Medtronic, this analysis is your essential guide to navigating the burgeoning *medical device innovation* ecosystem. Discover how wearable medical devices, remote patient monitoring, and AI in healthcare are reshaping patient care and driving billion-dollar growth.**

Smart Technology in Medical Device Industry Market Concentration & Dynamics

The smart technology in the medical device industry exhibits a dynamic market concentration influenced by rapid innovation and strategic collaborations. The innovation ecosystem thrives on continuous research and development, particularly in areas like digital health solutions and connected medical devices. Regulatory frameworks, while stringent, are adapting to accommodate the influx of novel technologies, ensuring patient safety and efficacy. Substitute products are becoming increasingly sophisticated, challenging traditional medical devices. End-user trends are shifting towards greater patient autonomy and proactive health management, fueling demand for home-use smart devices. Mergers and acquisitions (M&A) play a crucial role in shaping market share, with significant deal counts observed as larger players acquire innovative startups. For instance, the market share of leading players in connected diagnostic devices is estimated to be over 60% collectively. M&A activities are projected to exceed xx billion in value during the forecast period, reflecting the intense competition and consolidation within the sector.

- Innovation Ecosystems: Focus on R&D in AI-powered diagnostics and IoT-enabled therapeutics.

- Regulatory Frameworks: Adapting to new technologies, fostering growth in medical device cybersecurity.

- End-User Trends: Increasing demand for personalized telemedicine devices and digital therapeutics.

- M&A Activities: Strategic acquisitions to gain access to new technologies and expand market reach.

Smart Technology in Medical Device Industry Industry Insights & Trends

The smart technology in the medical device industry is experiencing an unprecedented surge, driven by a confluence of factors that promise sustained growth and transformative patient outcomes. The global market size is projected to reach over $450 billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period (2025–2033). This impressive expansion is propelled by escalating healthcare expenditure worldwide, an aging global population exhibiting a higher prevalence of chronic diseases, and a growing patient preference for convenient and accessible healthcare solutions. Technological disruptions, particularly in the realm of artificial intelligence (AI), machine learning (ML), and the Internet of Medical Things (IoMT), are revolutionizing the design, functionality, and application of medical devices. AI algorithms are enhancing diagnostic accuracy, predicting disease progression, and personalizing treatment plans, while IoMT devices facilitate seamless data exchange and remote patient monitoring. Evolving consumer behaviors are characterized by an increasing adoption of wearable health trackers and a proactive approach to wellness, creating a strong demand for smart devices that empower individuals to manage their health effectively. The shift towards value-based healthcare models also incentivizes the adoption of smart technologies that can demonstrate improved patient outcomes and reduced healthcare costs. Furthermore, the COVID-19 pandemic accelerated the adoption of digital health platforms and telehealth devices, a trend that is expected to continue, further solidifying the role of smart technology in the future of healthcare delivery. The integration of blockchain in healthcare for secure data management is another emerging trend that will influence the industry's trajectory. The market is witnessing significant investments in R&D for advanced biotechnology integration within medical devices.

Key Markets & Segments Leading Smart Technology in Medical Device Industry

The smart technology in the medical device industry is witnessing significant leadership from key regions and segments, driven by a complex interplay of economic, technological, and demographic factors.

Dominant Regions and Countries: North America, particularly the United States, consistently leads the market owing to its advanced healthcare infrastructure, substantial R&D investments, and a high rate of adoption for cutting-edge medical technologies. The presence of major medical device manufacturers and a strong regulatory environment conducive to innovation further solidify its dominance. Europe, with its well-established healthcare systems and increasing focus on preventative care and digital health adoption, also holds a significant market share. The Asia-Pacific region is emerging as a high-growth market, fueled by increasing disposable incomes, expanding healthcare access, and government initiatives promoting technological advancements in healthcare.

Product Type Dominance:

Diagnostic and Monitoring Devices: This segment is spearheading growth, largely due to the proliferation of remote patient monitoring devices and the increasing diagnosis and management of chronic conditions.

- Blood Glucose Monitors: Driven by the rising incidence of diabetes globally, this sub-segment sees high adoption rates, especially with the advent of continuous glucose monitoring (CGM) systems.

- Heart Rate Monitors: Their integration into wearable health trackers and smartwatches has made them ubiquitous for fitness and health tracking, contributing to substantial market share.

- Pulse Oximeters: Demand surged during the pandemic and remains strong for home-use and clinical applications in respiratory monitoring.

- Blood Pressure Monitors: The increasing prevalence of hypertension is driving the demand for smart, connected blood pressure monitors for home use.

- Breath Analyzer: Emerging technologies in breath analysis for early disease detection are gaining traction.

- Other Diagnostic Monitoring Products: Encompasses a broad range of smart devices for neurological monitoring, sleep tracking, and more.

Therapeutic Devices: This segment is also experiencing robust growth as smart technologies enhance treatment efficacy and patient compliance.

- Portable Oxygen Concentrators and Ventilators: Essential for home-based respiratory care, these devices are becoming more intelligent and user-friendly.

- Insulin Pumps: Advancements in smart insulin pumps with closed-loop systems are revolutionizing diabetes management.

- Hearing Aids: Modern smart hearing aids offer advanced features like noise reduction, Bluetooth connectivity, and personalized sound profiles, improving the quality of life for users.

- Other Therapeutic Devices: Includes smart drug delivery systems and advanced rehabilitation devices.

End User Dominance:

- Home-care Setting: This segment is witnessing the most rapid expansion. The desire for convenience, reduced healthcare costs, and the ability for patients to manage their health proactively at home are key drivers. Telehealth integration and the increasing prevalence of chronic diseases requiring continuous monitoring are accelerating this trend.

- Hospitals/Clinics: While still a major end-user, the focus is shifting towards integrated smart devices that facilitate efficient patient management, remote consultation, and data-driven decision-making. Hospital asset management using smart technology is also a growing area.

- Others: This includes research institutions, pharmaceutical companies, and individual users for wellness purposes, representing a growing niche.

Smart Technology in Medical Device Industry Product Developments

Product innovation in the smart technology medical device industry is characterized by a relentless pursuit of enhanced functionality, user-centric design, and seamless connectivity. Key advancements include the integration of AI for predictive diagnostics, the miniaturization of sensors for more discreet wearables, and the development of interoperable platforms that enable continuous health monitoring. Applications span from early disease detection and personalized treatment plans to remote rehabilitation and chronic disease management. Market relevance is driven by the ability of these products to improve patient outcomes, reduce healthcare costs, and empower individuals with greater control over their health. Technological advancements in areas such as biosensor technology and miniaturized electronics are creating competitive edges for companies offering highly sophisticated yet user-friendly devices.

Challenges in the Smart Technology in Medical Device Industry Market

Despite robust growth, the smart technology in the medical device industry faces significant hurdles. Regulatory hurdles, including lengthy approval processes for novel connected health devices and ensuring medical device cybersecurity compliance, pose a substantial challenge. Supply chain issues, particularly for specialized components and geopolitical disruptions, can impact manufacturing and timely delivery. Competitive pressures are intense, with established players and agile startups vying for market share, often leading to price wars and the need for continuous innovation. Quantifiable impacts include potential delays in market entry, increased operational costs, and the risk of intellectual property infringement.

- Regulatory Approval Delays: Impacting time-to-market and R&D investments.

- Cybersecurity Vulnerabilities: Requiring substantial investment in robust security protocols.

- Supply Chain Disruptions: Leading to increased manufacturing costs and potential product shortages.

- Intense Competition: Driving down profit margins and necessitating rapid innovation.

Forces Driving Smart Technology in Medical Device Industry Growth

The growth of the smart technology in the medical device industry is propelled by a powerful synergy of technological advancements, economic factors, and supportive regulatory shifts. The escalating prevalence of chronic diseases worldwide necessitates continuous and proactive health management, a need directly addressed by smart medical devices. Economic growth in emerging markets translates to increased healthcare spending and a greater demand for advanced medical solutions. Furthermore, favorable government initiatives and the growing emphasis on preventative healthcare are creating a fertile ground for innovation. The increasing adoption of telemedicine and remote patient monitoring platforms, further accelerated by recent global events, has cemented the importance of connected health devices. The development of sophisticated AI algorithms for diagnostics and personalized treatments is a significant technological catalyst.

Challenges in the Smart Technology in the Medical Device Industry Market

Long-term growth catalysts in the smart technology in the medical device industry are rooted in continued innovation and strategic market expansion. The persistent rise in the global burden of chronic diseases, such as diabetes, cardiovascular diseases, and respiratory ailments, will continue to drive demand for smart monitoring and therapeutic devices. Advances in AI and machine learning are poised to unlock new frontiers in personalized medicine, predictive diagnostics, and automated treatment delivery. Strategic partnerships between medical device manufacturers, technology companies, and healthcare providers will foster integrated ecosystems that enhance patient care and operational efficiency. Furthermore, the expansion of digital health infrastructure in developing economies presents significant untapped market potential.

Emerging Opportunities in Smart Technology in Medical Device Industry

Emerging opportunities in the smart technology medical device industry are abundant, driven by evolving consumer preferences and technological breakthroughs. The burgeoning field of personalized medicine, where smart devices can tailor treatments based on individual genetic makeup and real-time physiological data, represents a significant growth area. The development of advanced wearable biosensors capable of detecting a wider range of biomarkers non-invasively will unlock new diagnostic capabilities. The integration of virtual reality (VR) and augmented reality (AR) into medical devices for surgical training, patient education, and rehabilitation offers exciting new applications. Furthermore, the increasing focus on mental health is creating demand for smart devices that can monitor and manage psychological well-being. The demand for preventative healthcare solutions is also a major driver for smart devices.

Leading Players in the Smart Technology in Medical Device Industry Sector

- Samsung

- Otsuka Holdings CO LTD

- F Hoffmann-La Roche Ltd

- NeuroMetrix Inc

- BIO-BEAT

- Dexcom Inc

- Abbott Laboratories

- Koninklijke Philips N V

- Medtronic PLC

- Omron Corporation

- Fitbit Inc

- Apple Inc

- Vital Connect

Key Milestones in Smart Technology in Medical Device Industry Industry

- 2019: Launch of advanced AI-powered diagnostic imaging solutions.

- 2020: Significant surge in demand for remote patient monitoring devices due to the global pandemic.

- 2021: Major advancements in continuous glucose monitoring (CGM) technology, improving diabetes management.

- 2022: Increased M&A activity as larger corporations acquire innovative digital health startups.

- 2023: Introduction of next-generation smart hearing aids with enhanced connectivity and AI capabilities.

- 2024: Growing focus on medical device cybersecurity and data privacy regulations.

- 2025 (Estimated): Widespread adoption of AI in diagnostic algorithms and therapeutic device personalization.

- 2026-2033 (Forecast): Continued expansion of wearable medical devices and growth in home-care settings.

Strategic Outlook for Smart Technology in Medical Device Industry Market

The strategic outlook for the smart technology in the medical device industry is exceptionally positive, driven by sustained innovation and expanding market applications. Growth accelerators include the continued integration of AI and machine learning for predictive analytics and personalized therapies, the development of novel biosensor technologies, and the increasing demand for integrated digital health platforms. Strategic opportunities lie in expanding into emerging markets, forging partnerships with technology giants to leverage cutting-edge advancements, and focusing on user-centric design to enhance patient engagement and compliance. The shift towards preventative healthcare and value-based care models will further fuel the adoption of smart medical devices that demonstrate tangible improvements in patient outcomes and cost-effectiveness, securing robust market potential for the foreseeable future.

Smart Technology in Medical Device Industry Segmentation

-

1. Product Type

-

1.1. By Diagnostic and Monitoring

- 1.1.1. Blood Glucose Monitors

- 1.1.2. Heart Rate Monitors

- 1.1.3. Pulse Oximeters

- 1.1.4. Blood Pressure Monitors

- 1.1.5. Breath Analyzer

- 1.1.6. Other Diagnostic Monitoring Products

-

1.2. By Therapeutic Devices

- 1.2.1. Portable Oxygen Concentrators and Ventilators

- 1.2.2. Insulin Pumps

- 1.2.3. Hearing Aid

- 1.2.4. Other Therapeutic Devices

-

1.1. By Diagnostic and Monitoring

-

2. End User

- 2.1. Hospitals/Clinics

- 2.2. Home-care Setting

- 2.3. Others

Smart Technology in Medical Device Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Smart Technology in Medical Device Industry Regional Market Share

Geographic Coverage of Smart Technology in Medical Device Industry

Smart Technology in Medical Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Smartphone-compatible and Wireless Medical Devices; Technological Advancement in Devices; Rising Awareness and Focus on Fitness

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices; Patients Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Insulin Pumps are Expected to Witness Good Growth in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. By Diagnostic and Monitoring

- 5.1.1.1. Blood Glucose Monitors

- 5.1.1.2. Heart Rate Monitors

- 5.1.1.3. Pulse Oximeters

- 5.1.1.4. Blood Pressure Monitors

- 5.1.1.5. Breath Analyzer

- 5.1.1.6. Other Diagnostic Monitoring Products

- 5.1.2. By Therapeutic Devices

- 5.1.2.1. Portable Oxygen Concentrators and Ventilators

- 5.1.2.2. Insulin Pumps

- 5.1.2.3. Hearing Aid

- 5.1.2.4. Other Therapeutic Devices

- 5.1.1. By Diagnostic and Monitoring

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals/Clinics

- 5.2.2. Home-care Setting

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. By Diagnostic and Monitoring

- 6.1.1.1. Blood Glucose Monitors

- 6.1.1.2. Heart Rate Monitors

- 6.1.1.3. Pulse Oximeters

- 6.1.1.4. Blood Pressure Monitors

- 6.1.1.5. Breath Analyzer

- 6.1.1.6. Other Diagnostic Monitoring Products

- 6.1.2. By Therapeutic Devices

- 6.1.2.1. Portable Oxygen Concentrators and Ventilators

- 6.1.2.2. Insulin Pumps

- 6.1.2.3. Hearing Aid

- 6.1.2.4. Other Therapeutic Devices

- 6.1.1. By Diagnostic and Monitoring

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals/Clinics

- 6.2.2. Home-care Setting

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. By Diagnostic and Monitoring

- 7.1.1.1. Blood Glucose Monitors

- 7.1.1.2. Heart Rate Monitors

- 7.1.1.3. Pulse Oximeters

- 7.1.1.4. Blood Pressure Monitors

- 7.1.1.5. Breath Analyzer

- 7.1.1.6. Other Diagnostic Monitoring Products

- 7.1.2. By Therapeutic Devices

- 7.1.2.1. Portable Oxygen Concentrators and Ventilators

- 7.1.2.2. Insulin Pumps

- 7.1.2.3. Hearing Aid

- 7.1.2.4. Other Therapeutic Devices

- 7.1.1. By Diagnostic and Monitoring

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals/Clinics

- 7.2.2. Home-care Setting

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. By Diagnostic and Monitoring

- 8.1.1.1. Blood Glucose Monitors

- 8.1.1.2. Heart Rate Monitors

- 8.1.1.3. Pulse Oximeters

- 8.1.1.4. Blood Pressure Monitors

- 8.1.1.5. Breath Analyzer

- 8.1.1.6. Other Diagnostic Monitoring Products

- 8.1.2. By Therapeutic Devices

- 8.1.2.1. Portable Oxygen Concentrators and Ventilators

- 8.1.2.2. Insulin Pumps

- 8.1.2.3. Hearing Aid

- 8.1.2.4. Other Therapeutic Devices

- 8.1.1. By Diagnostic and Monitoring

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals/Clinics

- 8.2.2. Home-care Setting

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. By Diagnostic and Monitoring

- 9.1.1.1. Blood Glucose Monitors

- 9.1.1.2. Heart Rate Monitors

- 9.1.1.3. Pulse Oximeters

- 9.1.1.4. Blood Pressure Monitors

- 9.1.1.5. Breath Analyzer

- 9.1.1.6. Other Diagnostic Monitoring Products

- 9.1.2. By Therapeutic Devices

- 9.1.2.1. Portable Oxygen Concentrators and Ventilators

- 9.1.2.2. Insulin Pumps

- 9.1.2.3. Hearing Aid

- 9.1.2.4. Other Therapeutic Devices

- 9.1.1. By Diagnostic and Monitoring

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals/Clinics

- 9.2.2. Home-care Setting

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. By Diagnostic and Monitoring

- 10.1.1.1. Blood Glucose Monitors

- 10.1.1.2. Heart Rate Monitors

- 10.1.1.3. Pulse Oximeters

- 10.1.1.4. Blood Pressure Monitors

- 10.1.1.5. Breath Analyzer

- 10.1.1.6. Other Diagnostic Monitoring Products

- 10.1.2. By Therapeutic Devices

- 10.1.2.1. Portable Oxygen Concentrators and Ventilators

- 10.1.2.2. Insulin Pumps

- 10.1.2.3. Hearing Aid

- 10.1.2.4. Other Therapeutic Devices

- 10.1.1. By Diagnostic and Monitoring

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals/Clinics

- 10.2.2. Home-care Setting

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Samsung*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Otsuka Holdings CO LTD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 F Hoffmann-La Roche Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NeuroMetrix Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BIO-BEAT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dexcom Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott Laboratories

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke Philips N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Medtronic PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Omron Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fitbit Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Apple Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Vital Connect

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Samsung*List Not Exhaustive

List of Figures

- Figure 1: Global Smart Technology in Medical Device Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Smart Technology in Medical Device Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Smart Technology in Medical Device Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Smart Technology in Medical Device Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Smart Technology in Medical Device Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Smart Technology in Medical Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Technology in Medical Device Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Smart Technology in Medical Device Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Smart Technology in Medical Device Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Smart Technology in Medical Device Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Smart Technology in Medical Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Technology in Medical Device Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Smart Technology in Medical Device Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Smart Technology in Medical Device Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Smart Technology in Medical Device Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Technology in Medical Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Smart Technology in Medical Device Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Smart Technology in Medical Device Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Middle East and Africa Smart Technology in Medical Device Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Smart Technology in Medical Device Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Smart Technology in Medical Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Smart Technology in Medical Device Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Smart Technology in Medical Device Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: South America Smart Technology in Medical Device Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Smart Technology in Medical Device Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Smart Technology in Medical Device Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 21: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 35: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Global Smart Technology in Medical Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Smart Technology in Medical Device Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Technology in Medical Device Industry?

The projected CAGR is approximately 6.99%.

2. Which companies are prominent players in the Smart Technology in Medical Device Industry?

Key companies in the market include Samsung*List Not Exhaustive, Otsuka Holdings CO LTD, F Hoffmann-La Roche Ltd, NeuroMetrix Inc, BIO-BEAT, Dexcom Inc, Abbott Laboratories, Koninklijke Philips N V, Medtronic PLC, Omron Corporation, Fitbit Inc, Apple Inc, Vital Connect.

3. What are the main segments of the Smart Technology in Medical Device Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Smartphone-compatible and Wireless Medical Devices; Technological Advancement in Devices; Rising Awareness and Focus on Fitness.

6. What are the notable trends driving market growth?

Insulin Pumps are Expected to Witness Good Growth in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices; Patients Privacy Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Technology in Medical Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Technology in Medical Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Technology in Medical Device Industry?

To stay informed about further developments, trends, and reports in the Smart Technology in Medical Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence