Key Insights

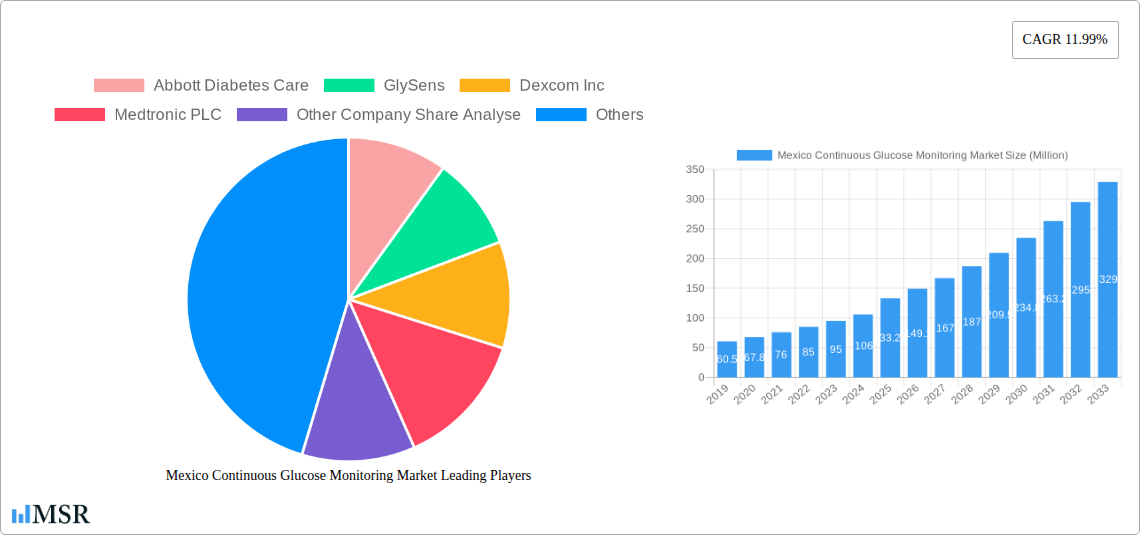

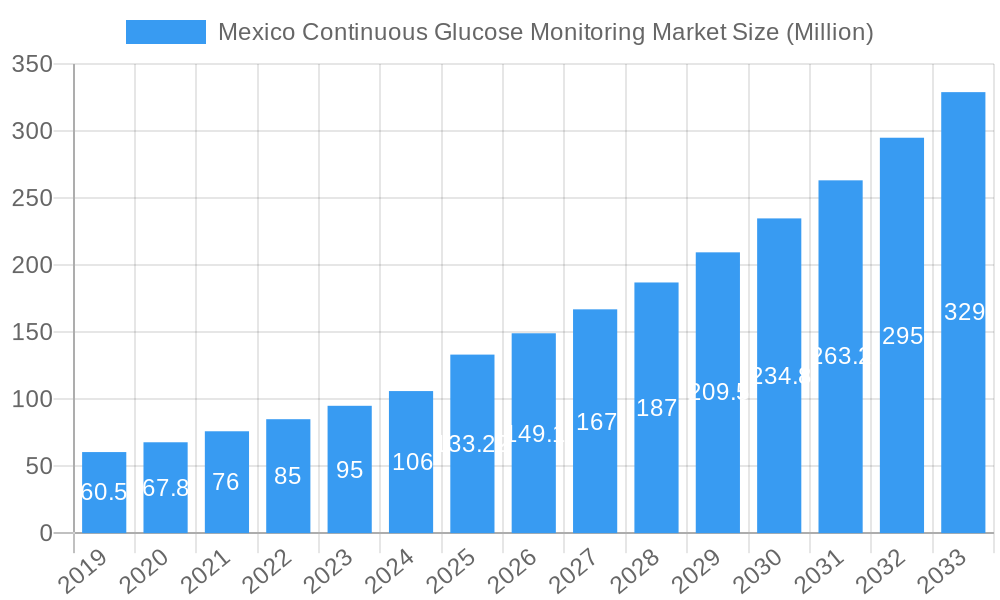

The Mexico Continuous Glucose Monitoring (CGM) market is poised for significant expansion, projected to reach 133.22 Million USD by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 11.99% throughout the forecast period of 2025-2033. This substantial growth is fueled by a confluence of critical factors. The increasing prevalence of diabetes in Mexico, coupled with growing awareness among patients and healthcare professionals regarding the benefits of real-time glucose monitoring for improved diabetes management and reduced complications, stands as a primary driver. Furthermore, advancements in CGM technology, including smaller, more user-friendly sensors and enhanced data analytics capabilities, are contributing to greater adoption. The expanding reimbursement landscape and initiatives aimed at increasing access to advanced diabetes care solutions within Mexico will also play a pivotal role in accelerating market penetration. The market is segmented into Components, with Sensors and Durables representing key product categories. Leading companies like Abbott Diabetes Care, Dexcom Inc., and Medtronic PLC are actively investing in product development and market expansion strategies, indicating a competitive yet growing ecosystem.

Mexico Continuous Glucose Monitoring Market Market Size (In Million)

Looking ahead, the Mexico CGM market is expected to witness sustained growth, propelled by the ongoing trend of personalized healthcare and the demand for proactive disease management tools. The integration of CGM data with other health platforms and wearable devices will further enhance its utility, offering a more holistic view of an individual's health. While the market benefits from strong demand, potential restraints such as the initial cost of devices and sensors, and the need for comprehensive patient education to ensure optimal utilization, are areas that manufacturers and healthcare providers will need to address. However, the overall outlook remains exceptionally positive, with the market poised to capture a larger share of the diabetes care segment in Mexico as technological innovations and accessibility continue to improve. The growing focus on preventative healthcare and the management of chronic diseases like diabetes underscores the vital role CGM devices will play in the nation's healthcare future.

Mexico Continuous Glucose Monitoring Market Company Market Share

Unlock critical insights into the burgeoning Mexico Continuous Glucose Monitoring (CGM) market with this comprehensive report. Designed for industry leaders, investors, and healthcare professionals, this analysis provides an in-depth understanding of market dynamics, technological advancements, and future growth trajectories. Our study covers the historical period (2019-2024), base year (2025), and extends to an extensive forecast period (2025-2033), offering a robust outlook for strategic decision-making.

Mexico Continuous Glucose Monitoring Market Market Concentration & Dynamics

The Mexico CGM market, while exhibiting moderate concentration, is characterized by an evolving innovation ecosystem driven by a few dominant players and emerging local innovators. Regulatory frameworks are increasingly aligning with international standards, facilitating the adoption of advanced CGM technologies. The rising prevalence of diabetes, coupled with a growing awareness of the benefits of real-time glucose monitoring, is significantly impacting end-user trends. Substitute products, such as traditional blood glucose meters, still hold a share but are gradually being eclipsed by the convenience and comprehensive data offered by CGM devices. Mergers and acquisitions (M&A) activities are anticipated to increase as larger international companies seek to expand their footprint in this promising Latin American market. While specific M&A deal counts are proprietary, strategic partnerships and collaborations are key indicators of market consolidation and expansion efforts.

Mexico Continuous Glucose Monitoring Market Industry Insights & Trends

The Mexico Continuous Glucose Monitoring (CGM) market is experiencing robust growth, projected to reach approximately $550 Million by the end of the forecast period in 2033. This expansion is underpinned by a compound annual growth rate (CAGR) of around 18.5% during the forecast period (2025-2033). Several pivotal factors are fueling this upward trajectory. The increasing incidence of diabetes mellitus, both Type 1 and Type 2, in Mexico presents a substantial patient pool demanding effective diabetes management solutions. Government initiatives aimed at improving healthcare access and chronic disease management further bolster market penetration. Technological advancements are at the forefront, with the development of smaller, more accurate, and user-friendly CGM sensors and systems. The integration of CGM data with insulin delivery systems, creating Automated Insulin Delivery (AID) systems, is revolutionizing diabetes care, offering patients greater control and potentially reducing the burden of diabetes management.

Consumer behavior is also shifting significantly. Patients and healthcare providers are becoming more educated about the benefits of CGM, including improved glycemic control, reduced HbA1c levels, fewer hypoglycemic events, and enhanced quality of life. The desire for convenience and the ability to make informed, data-driven decisions about diet, exercise, and insulin dosing are strong motivators for adoption. The growing adoption of smart devices and the increasing digital health consciousness within Mexico’s population further support the integration of CGM into daily life. Furthermore, the expanding healthcare infrastructure, including more specialized diabetes clinics and trained endocrinologists, plays a crucial role in driving the demand for advanced monitoring technologies. The affordability of some CGM systems, particularly factory-integrated models, is also becoming a more significant factor, making these technologies accessible to a broader segment of the Mexican population. The market’s growth is a testament to its potential to transform diabetes care in Mexico.

Key Markets & Segments Leading Mexico Continuous Glucose Monitoring Market

The Sensors segment is unequivocally leading the Mexico Continuous Glucose Monitoring (CGM) market, accounting for a significant majority of the market share. This dominance is attributed to the fundamental role of sensors as the core component of any CGM system.

- Drivers for Sensor Dominance:

- Technological Advancements: Continuous innovation in sensor technology, leading to improved accuracy, longer wear times, and greater patient comfort, is a primary driver. Manufacturers are constantly refining materials and electrochemical principles to enhance performance.

- High Replacement Rate: Sensors are disposable components with a limited lifespan, requiring regular replacement. This inherent characteristic ensures a consistent and high demand for sensor units, driving revenue within this segment.

- Integration with Newer Technologies: The increasing demand for integrated CGM systems and AID devices necessitates a steady supply of advanced sensors capable of seamless integration and real-time data transmission.

- Rising Diabetes Prevalence: As the number of individuals diagnosed with diabetes continues to grow in Mexico, so does the demand for effective glucose monitoring, directly impacting the sensor segment.

- Reimbursement Policies: While still evolving, any positive developments in reimbursement for CGM devices, particularly for sensors, will further stimulate demand.

The Durables segment, comprising the transmitter and receiver or reader components of CGM systems, also contributes significantly to the market, though it represents a smaller portion compared to sensors due to their longer lifespan. The growth in durables is closely tied to the uptake of new CGM systems and the replacement of older devices. As the market matures, the demand for durable components will be influenced by technological obsolescence and the introduction of next-generation systems with enhanced features and connectivity. The trend towards integrated systems where the reader is part of a smartphone app also impacts the traditional definition of "durables," shifting focus towards the transmitter's functionality and longevity.

Mexico Continuous Glucose Monitoring Market Product Developments

Product innovation is the lifeblood of the Mexico CGM market. Leading companies are continuously striving to enhance sensor accuracy, comfort, and wear duration, while also focusing on developing smarter algorithms for data analysis and predictive insights. The integration of CGM with automated insulin delivery (AID) systems represents a significant leap, offering closed-loop solutions for diabetes management. These advancements are not only improving patient outcomes by enabling better glycemic control and reducing complications but also providing a distinct competitive edge for companies that can offer seamless, intuitive, and data-rich experiences for both patients and healthcare providers.

Challenges in the Mexico Continuous Glucose Monitoring Market Market

Despite its promising growth, the Mexico CGM market faces several challenges. High cost of advanced CGM systems remains a significant barrier, limiting accessibility for a large segment of the population. Limited insurance coverage and reimbursement policies further exacerbate this issue, making out-of-pocket expenses a considerable hurdle. Awareness and education gaps among both patients and some healthcare professionals regarding the full benefits and proper utilization of CGM technology persist, impacting adoption rates. Supply chain disruptions and logistical challenges in a geographically diverse country like Mexico can also affect the consistent availability of devices and consumables.

Forces Driving Mexico Continuous Glucose Monitoring Market Growth

Several powerful forces are propelling the growth of the Mexico CGM market. The rising global and national prevalence of diabetes serves as the foundational driver. Technological advancements in sensor accuracy, miniaturization, and data analytics are making CGM more effective and user-friendly. Increasing health awareness and the demand for proactive health management among the Mexican population are encouraging the adoption of advanced monitoring tools. Furthermore, favorable government initiatives and growing investments in healthcare infrastructure are creating a supportive ecosystem for the penetration of diabetes management technologies. The transition towards value-based healthcare models also emphasizes the importance of technologies that can demonstrate improved patient outcomes and reduced long-term healthcare costs.

Challenges in the Mexico Continuous Glucose Monitoring Market Market

The long-term growth catalysts for the Mexico CGM market are deeply intertwined with ongoing innovation and strategic market penetration. Continued research and development in next-generation sensor technology, focusing on even greater accuracy, longer wear times, and potentially non-invasive monitoring, will be crucial. Strategic partnerships between CGM manufacturers, pharmaceutical companies, and healthcare providers can accelerate market access and patient education. Expansion of digital health platforms and telemedicine services will facilitate remote patient monitoring and support, further integrating CGM into routine care. The development of cost-effective CGM solutions and the expansion of insurance coverage will unlock substantial untapped market potential, making advanced diabetes management accessible to a much broader patient demographic.

Emerging Opportunities in Mexico Continuous Glucose Monitoring Market

Emerging opportunities in the Mexico CGM market are abundant and ripe for exploration. The growing demand for personalized diabetes management solutions presents a significant avenue for growth, where CGM data can be leveraged to tailor treatment plans. The integration of CGM with artificial intelligence (AI) and machine learning (ML) algorithms offers the potential for predictive analytics, enabling early detection of potential glycemic excursions and complications. Expansion into pediatric diabetes management and gestational diabetes monitoring represents further niche market potential. Additionally, the increasing use of CGM data for research purposes and clinical trials presents an opportunity for collaboration and data-driven insights. As digital health adoption accelerates, opportunities for direct-to-consumer sales and subscription models are also expected to rise.

Leading Players in the Mexico Continuous Glucose Monitoring Market Sector

Abbott Diabetes Care Dexcom Inc Medtronic PLC Ascensia Diabetes Care GlySens

Key Milestones in Mexico Continuous Glucose Monitoring Market Industry

- April 2023: The FDA approved the MiniMed 780G System for modifications to the SmartGuard (SG) Technology and for expanding the indications for use to include the Guardian 4 Sensor. The MiniMed 780G system is intended for continuous delivery of basal insulin (background insulin) at selectable rates and the administration of insulin boluses (a single large dose of medicine) at a selectable amount for the management of type 1 diabetes mellitus in persons seven years of age and older requiring insulin.

- March 2023: Abbott announced that the Food and Drug Administration (FDA) cleared its FreeStyle Libre 2 and FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system sensors for integration with automated insulin delivery (AID) systems.

Strategic Outlook for Mexico Continuous Glucose Monitoring Market Market

The strategic outlook for the Mexico Continuous Glucose Monitoring market is exceptionally positive, driven by a confluence of technological innovation, increasing healthcare expenditure, and a growing understanding of diabetes management. Key growth accelerators include the ongoing refinement of sensor accuracy and longevity, the expansion of AID systems, and the development of more accessible and affordable CGM solutions. Strategic focus on expanding market penetration through robust distribution networks, targeted patient education campaigns, and collaboration with healthcare providers will be paramount. Furthermore, leveraging digital health platforms and data analytics to offer personalized insights and support will be critical for sustained growth and market leadership.

Mexico Continuous Glucose Monitoring Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables

Mexico Continuous Glucose Monitoring Market Segmentation By Geography

- 1. Mexico

Mexico Continuous Glucose Monitoring Market Regional Market Share

Geographic Coverage of Mexico Continuous Glucose Monitoring Market

Mexico Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Mexico

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abbott Diabetes Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GlySens

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dexcom Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Other Company Share Analyse

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ascensia Diabetes Care

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Abbott Diabetes Care

List of Figures

- Figure 1: Mexico Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Continuous Glucose Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Mexico Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 3: Mexico Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Mexico Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Mexico Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Mexico Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 7: Mexico Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Mexico Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Continuous Glucose Monitoring Market?

The projected CAGR is approximately 11.99%.

2. Which companies are prominent players in the Mexico Continuous Glucose Monitoring Market?

Key companies in the market include Abbott Diabetes Care, GlySens, Dexcom Inc, Medtronic PLC, Other Company Share Analyse, Ascensia Diabetes Care.

3. What are the main segments of the Mexico Continuous Glucose Monitoring Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 133.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Mexico.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

April 2023: The FDA approved the MiniMed 780G System for modifications to the SmartGuard (SG) Technology and for expanding the indications for use to include the Guardian 4 Sensor. The MiniMed 780G system is intended for continuous delivery of basal insulin (background insulin) at selectable rates and the administration of insulin boluses (a single large dose of medicine) at a selectable amount for the management of type 1 diabetes mellitus in persons seven years of age and older requiring insulin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the Mexico Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence