Key Insights

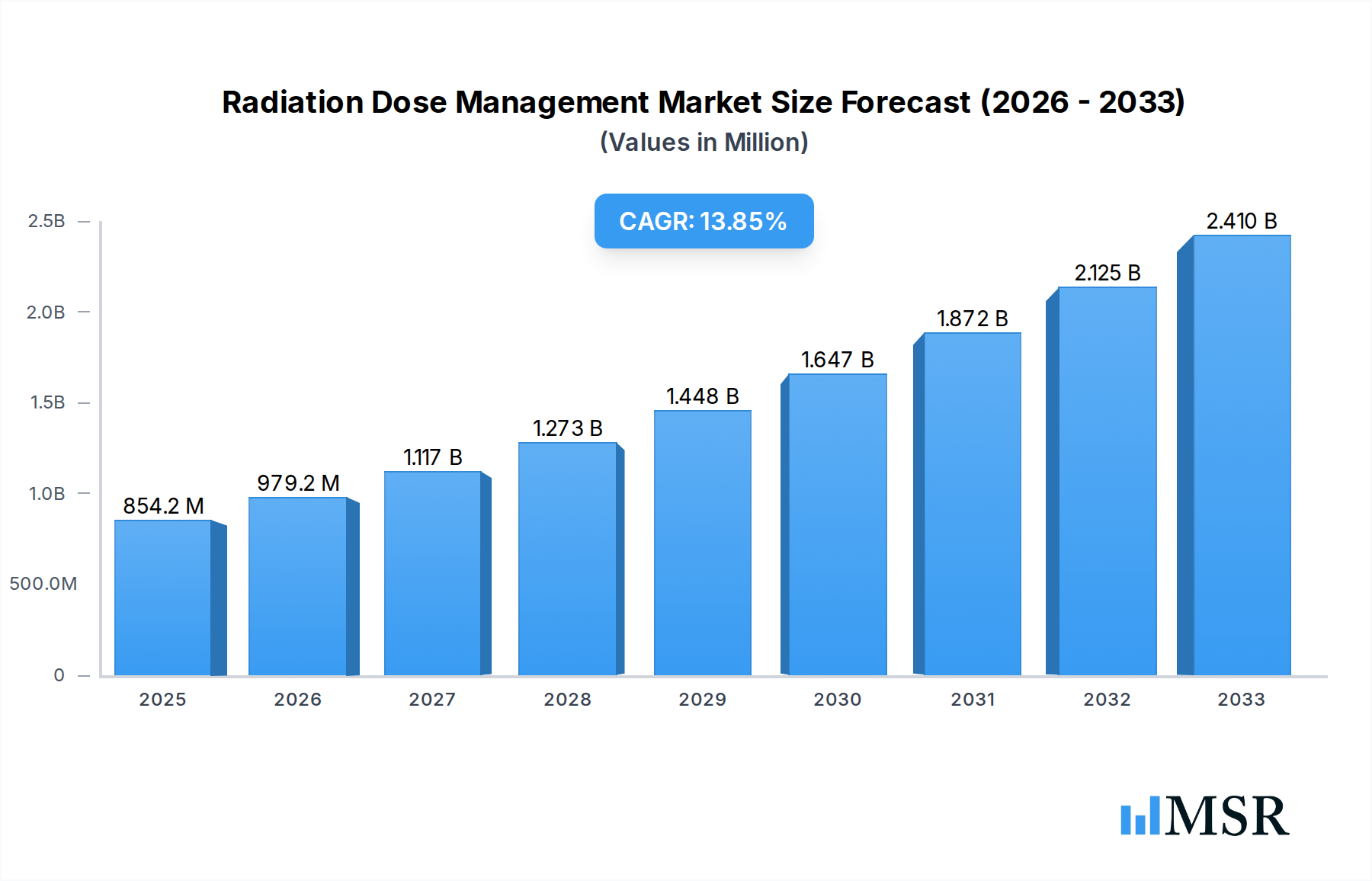

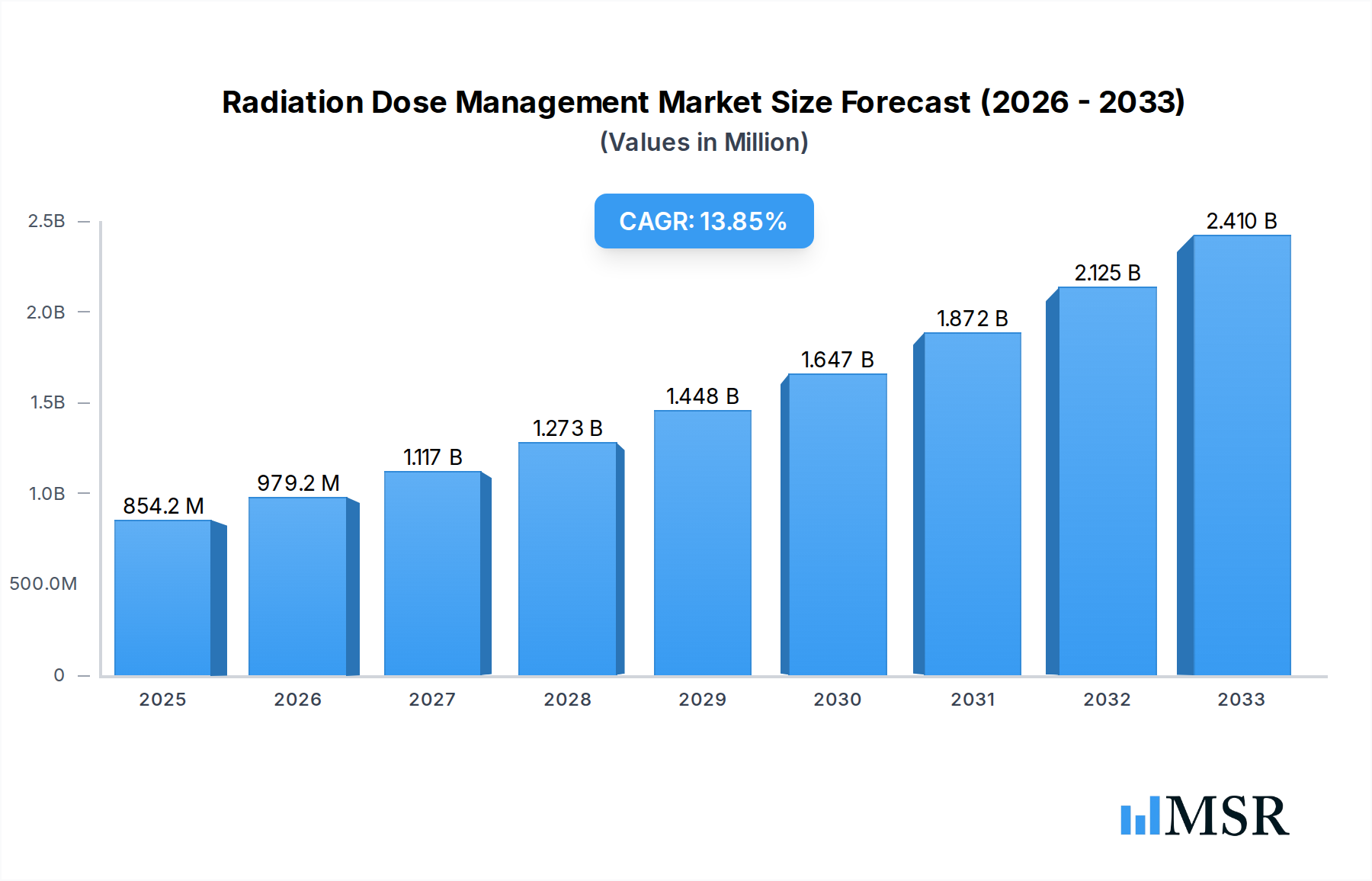

The global Radiation Dose Management Market is poised for significant expansion, projected to reach an estimated USD 854.2 million in 2025. This robust growth is fueled by a substantial Compound Annual Growth Rate (CAGR) of 14.7% expected over the forecast period. The increasing emphasis on patient safety, coupled with the growing adoption of advanced imaging modalities across various healthcare settings, are primary drivers for this market's upward trajectory. Regulatory mandates and the inherent need for healthcare providers to optimize radiation exposure while maintaining diagnostic accuracy are creating a fertile ground for radiation dose management solutions. This burgeoning market is witnessing a strong demand for both standalone and integrated solutions, catering to the diverse needs of hospitals, ambulatory care settings, and other healthcare providers. The widespread use of Computed Tomography (CT), Fluoroscopy, Nuclear Medicine, and Radiography underscores the pervasive application of these management systems across essential diagnostic procedures.

Radiation Dose Management Market Market Size (In Million)

The market's expansion is further propelled by technological advancements, including AI-powered analytics and cloud-based platforms that enhance the efficiency and effectiveness of radiation dose monitoring and control. While the market shows immense promise, certain restraints, such as the initial investment costs associated with implementing sophisticated dose management systems and the need for skilled personnel to operate them, could pose challenges. However, the long-term benefits of reduced radiation-related risks, improved patient outcomes, and potential cost savings through optimized imaging protocols are expected to outweigh these initial hurdles. Key players like GE Healthcare, Koninklijke Philips N.V., and Bayer AG are actively innovating and expanding their portfolios, contributing to market dynamism and driving competitive advancements. The strategic focus on developing user-friendly and comprehensive radiation dose management solutions will be crucial for sustained growth and market leadership.

Radiation Dose Management Market Company Market Share

Radiation Dose Management Market: Comprehensive Industry Report

This in-depth market research report provides an exhaustive analysis of the global Radiation Dose Management Market, offering critical insights and actionable intelligence for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report details market dynamics, key trends, leading players, and future opportunities. The report leverages a robust methodology to provide accurate market sizing, segmentation, and growth projections, making it an indispensable resource for strategic planning and investment decisions.

Radiation Dose Management Market Market Concentration & Dynamics

The global Radiation Dose Management Market exhibits a moderate to high level of concentration, driven by key players investing heavily in research and development and strategic acquisitions. Innovation ecosystems are thriving, with companies focusing on developing advanced software solutions and integrated platforms to enhance diagnostic imaging safety and efficiency. Regulatory frameworks, particularly those from bodies like the FDA and EMA, are continuously evolving to mandate stringent dose monitoring and reporting, thereby shaping market strategies and product development. Substitute products, such as advanced ultrasound and MRI techniques, pose a minor threat, as radiation-based imaging modalities remain indispensable for specific diagnostic needs. End-user trends highlight a growing demand for improved patient safety and cost-effectiveness in healthcare facilities, pushing the adoption of sophisticated dose management solutions. Merger and acquisition (M&A) activities are on the rise, with major players acquiring smaller, innovative companies to expand their product portfolios and market reach. For instance, the recent years have seen an increase in M&A deal counts, signaling a consolidation trend aimed at capturing a larger share of the growing market.

- Market Share Dynamics: Leading companies are actively competing for market share through product innovation and strategic partnerships.

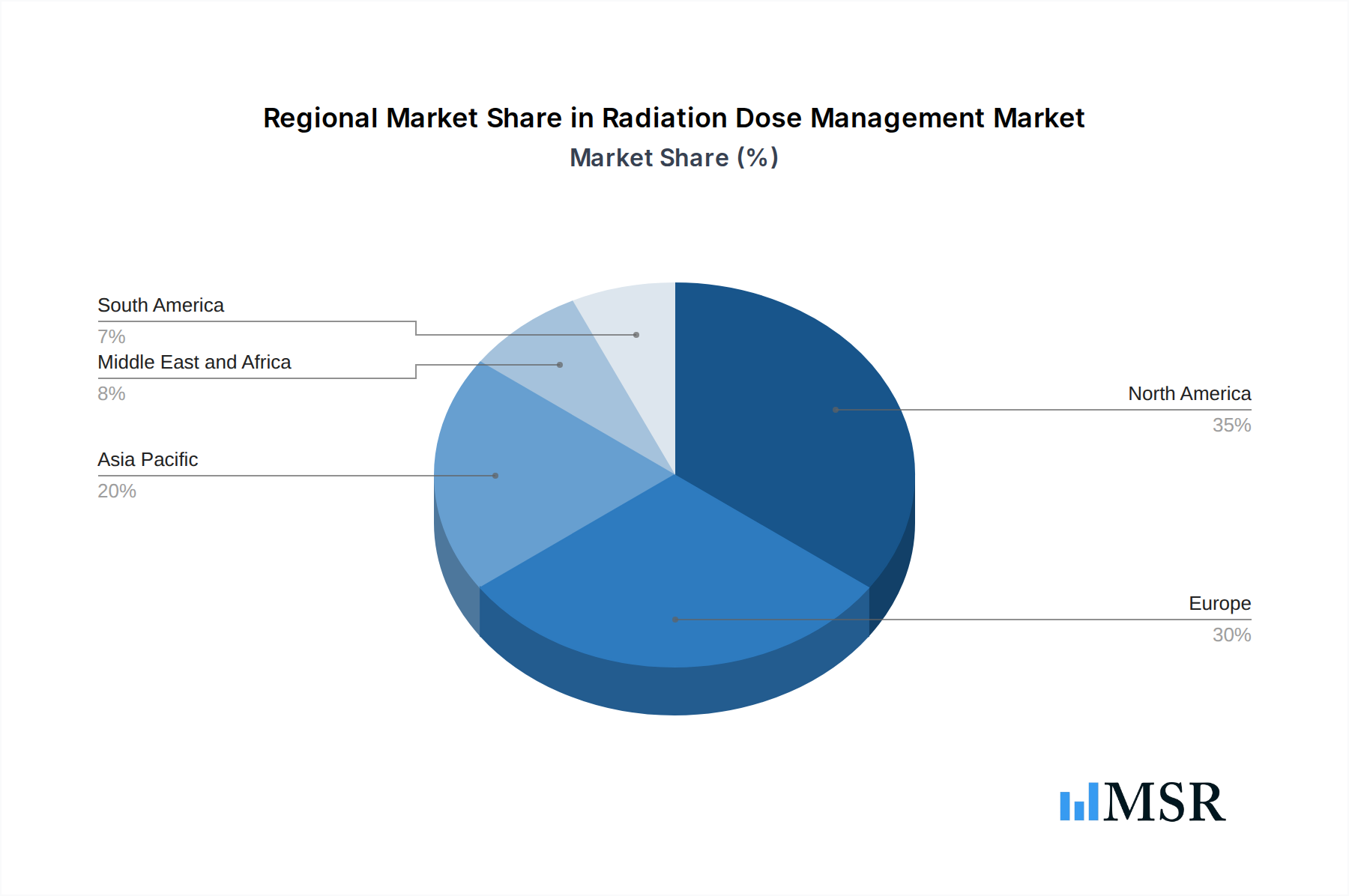

- Innovation Hubs: North America and Europe are key innovation hubs, fostering the development of cutting-edge radiation dose management technologies.

- Regulatory Influence: Stringent radiation safety regulations globally are a primary catalyst for market growth and product adoption.

- M&A Activity: A steady stream of acquisitions and partnerships is reshaping the competitive landscape, with approximately 10-15 significant M&A deals observed in the historical period.

Radiation Dose Management Market Industry Insights & Trends

The global Radiation Dose Management Market is poised for substantial growth, driven by an increasing awareness of radiation exposure risks in medical imaging and the subsequent demand for advanced safety solutions. The market size for radiation dose management solutions is estimated to reach approximately USD 3,500 million by 2025 and is projected to expand at a Compound Annual Growth Rate (CAGR) of roughly 12% during the forecast period of 2025–2033. This robust growth is fueled by several key factors. Firstly, the escalating prevalence of chronic diseases and an aging global population are leading to a higher volume of diagnostic imaging procedures, particularly in modalities like Computed Tomography (CT) and Fluoroscopy, which inherently involve higher radiation doses. This necessitates effective dose monitoring and optimization strategies. Secondly, technological advancements in medical imaging equipment, such as the introduction of higher resolution CT scanners and more sophisticated interventional radiology tools, are accompanied by a parallel advancement in dose management software that can adapt to these newer technologies. These systems not only track patient doses but also provide tools for dose optimization during image acquisition, reducing unnecessary exposure without compromising diagnostic image quality.

Furthermore, a growing emphasis on patient-centric healthcare and the increasing implementation of Quality Management Systems (QMS) within healthcare institutions are pushing the adoption of comprehensive radiation dose management solutions. Regulatory mandates and guidelines from international health organizations and national governing bodies, such as the ALARA (As Low As Reasonably Achievable) principle, are becoming more stringent, compelling healthcare providers to invest in robust dose management systems to ensure compliance and patient safety. The market is also witnessing a significant trend towards integrated solutions that seamlessly combine dose monitoring with other aspects of Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS), offering a holistic approach to radiology workflow optimization. The rising adoption of AI and machine learning in healthcare is also beginning to impact the radiation dose management market, with AI-powered algorithms being developed to predict optimal imaging protocols and automatically adjust radiation parameters for reduced dose. The increasing investment in healthcare infrastructure, particularly in emerging economies, is also opening up new avenues for market penetration.

Key Markets & Segments Leading Radiation Dose Management Market

The Radiation Dose Management Market is experiencing leadership from specific regions and segments due to a confluence of factors including healthcare expenditure, technological adoption, and regulatory adherence. North America currently holds a dominant position in the market, driven by its advanced healthcare infrastructure, high adoption rate of cutting-edge medical technologies, and stringent regulatory environment that mandates comprehensive radiation dose monitoring. The United States, in particular, represents a significant portion of this market share due to the high volume of diagnostic imaging procedures performed annually and the presence of leading healthcare providers and research institutions.

- Products & Services:

- Integrated Solutions are gaining significant traction, outpacing standalone solutions. This dominance is attributed to their ability to offer a streamlined workflow by embedding dose management functionalities directly into existing PACS and RIS, enhancing efficiency and data accuracy. Healthcare facilities are increasingly preferring these all-in-one solutions for better interoperability and comprehensive data management.

- Standalone Solutions still hold a considerable market share, particularly in smaller clinics or older facilities that may not have the resources for complete system overhauls. However, the trend is clearly shifting towards integration.

- Modality:

- Computed Tomography (CT) remains the leading modality in terms of radiation dose management solutions' application. The high volume of CT scans performed globally, coupled with the inherent radiation dose associated with CT imaging, makes it a primary focus for dose reduction and management strategies. Advancements in CT technology, including multi-detector CT (MDCT) and dual-energy CT, further increase the need for sophisticated dose monitoring.

- Fluoroscopy and Interventional Imaging is a rapidly growing segment. The increasing use of minimally invasive procedures, which often involve prolonged fluoroscopic guidance, necessitates precise dose tracking and optimization to protect both patients and healthcare professionals from cumulative radiation exposure.

- Nuclear Medicine and Radiography and Mammography are also significant segments, though they typically involve lower radiation doses compared to CT and interventional procedures. However, dedicated dose management solutions are crucial for ensuring patient safety and regulatory compliance even in these modalities.

- End User:

- Hospitals are the largest end-user segment for radiation dose management solutions. Their comprehensive imaging departments, high patient throughput, and the presence of advanced diagnostic imaging equipment necessitate robust dose management systems to ensure patient safety and comply with regulatory standards. The increasing complexity of patient cases and the need for precise diagnostic information further drive the demand in this segment.

- Ambulatory Care Settings represent a growing segment as outpatient diagnostic imaging services expand. These facilities are increasingly investing in dose management solutions to offer safe and efficient imaging services to a broader patient population.

Radiation Dose Management Market Product Developments

Recent product developments in the Radiation Dose Management Market are characterized by advancements in software intelligence and integration capabilities. Companies are focusing on developing AI-powered algorithms that can automatically optimize radiation parameters during image acquisition, predict patient organ doses more accurately, and provide real-time feedback to radiographers. Furthermore, there's a strong emphasis on seamless integration with existing PACS and RIS, creating unified platforms for comprehensive radiology workflow management. These innovations are crucial for enhancing diagnostic accuracy while minimizing patient and staff radiation exposure, thereby offering a competitive edge in the evolving market.

Challenges in the Radiation Dose Management Market Market

Despite the robust growth trajectory, the Radiation Dose Management Market faces several challenges that could impede its expansion. These include the significant initial investment required for implementing advanced dose management systems, especially for smaller healthcare facilities with limited budgets. The lack of standardized protocols across different regions and healthcare systems can also pose integration hurdles. Moreover, the shortage of trained personnel capable of operating and interpreting data from these sophisticated systems presents a barrier to widespread adoption. Cybersecurity concerns related to handling sensitive patient data within these integrated platforms also require continuous attention and investment.

- High Implementation Costs: The initial capital outlay for advanced software and hardware can be prohibitive for some healthcare providers.

- Interoperability Issues: Integrating new dose management systems with legacy IT infrastructure can be complex and time-consuming.

- Workforce Training: A scarcity of skilled professionals to manage and utilize dose management systems effectively.

- Data Security and Privacy: Ensuring the robust protection of sensitive patient data against cyber threats.

Forces Driving Radiation Dose Management Market Growth

The Radiation Dose Management Market is propelled by a powerful combination of technological, economic, and regulatory forces. The escalating demand for safer medical imaging procedures, driven by heightened awareness of the long-term effects of radiation exposure, is a primary catalyst. Technological advancements, including AI and machine learning, are enabling more precise dose monitoring and optimization, enhancing the efficacy of these solutions. Economically, increasing healthcare expenditure globally, particularly in emerging markets, is fostering greater investment in advanced medical technologies. Furthermore, stringent government regulations and guidelines mandating radiation safety protocols are compelling healthcare providers to adopt comprehensive dose management systems, thereby solidifying their market presence.

Challenges in the Radiation Dose Management Market Market

The long-term growth of the Radiation Dose Management Market is significantly influenced by ongoing innovations and strategic collaborations. The continuous development of more intelligent algorithms for dose prediction and optimization, coupled with the integration of these solutions into wider clinical decision-support systems, will be critical. Partnerships between technology providers and healthcare institutions will further accelerate the adoption of these advanced solutions. Market expansion into developing regions, where the adoption of advanced medical imaging is on the rise, presents a substantial long-term growth opportunity. Focused efforts on developing cost-effective and user-friendly solutions will also be key to sustaining momentum.

Emerging Opportunities in Radiation Dose Management Market

Emerging opportunities in the Radiation Dose Management Market are abundant, stemming from the increasing integration of AI and machine learning into imaging workflows. The development of predictive analytics to proactively identify patients at higher risk from radiation exposure and the creation of personalized imaging protocols based on individual patient characteristics represent significant advancements. Furthermore, the growing demand for remote dose monitoring solutions, driven by the trend towards telehealth and decentralized healthcare, presents a nascent but promising market segment. Exploring new applications for dose management data in clinical research and epidemiological studies also opens up novel avenues for market growth and value creation.

Leading Players in the Radiation Dose Management Market Sector

- Medsquare

- Bayer AG

- PACShealth LLC

- GE Healthcare

- Bracco Imaging SpA

- Koninklijke Philips N V

- Qaelum NV

- Sectra AB

- Novarad Corporation

- Fujifilm Holdings Corporation

Key Milestones in Radiation Dose Management Market Industry

- 2019: Launch of advanced AI-driven dose optimization software by a key industry player, improving real-time dose reduction capabilities.

- 2020: Several regulatory bodies intensified guidelines on radiation safety, prompting increased investment in dose management solutions.

- 2021: Acquisition of a specialized dose management software company by a major medical imaging equipment manufacturer, expanding its integrated offerings.

- 2022: Introduction of cloud-based dose management platforms, enhancing accessibility and data sharing for healthcare providers.

- 2023: Growing adoption of vendor-neutral dose management solutions, allowing hospitals to integrate data from diverse imaging equipment.

- 2024: Increased focus on mobile applications for dose tracking and reporting, improving convenience for healthcare professionals.

Strategic Outlook for Radiation Dose Management Market Market

The strategic outlook for the Radiation Dose Management Market is exceptionally positive, fueled by the persistent global emphasis on patient safety and diagnostic accuracy. Growth accelerators include the ongoing digital transformation in healthcare, the increasing sophistication of AI in medical imaging, and the expanding reach of telemedicine. Strategic opportunities lie in the development of comprehensive, interoperable dose management platforms that seamlessly integrate with existing hospital IT infrastructure. Furthermore, targeted market penetration into emerging economies, coupled with a focus on developing scalable and cost-effective solutions, will be crucial for capturing significant market share and driving sustained growth in the coming years.

Radiation Dose Management Market Segmentation

-

1. Products & Services

- 1.1. Standalone Solutions

- 1.2. Integrated Solutions

-

2. Modality

- 2.1. Computed Tomography

- 2.2. Fluoroscopy and Interventional Imaging

- 2.3. Nuclear Medicine

- 2.4. Radiography and Mammography

-

3. End User

- 3.1. Ambulatory Care Settings

- 3.2. Hospital

- 3.3. Other End Users

Radiation Dose Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Radiation Dose Management Market Regional Market Share

Geographic Coverage of Radiation Dose Management Market

Radiation Dose Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Cases of Chronic Diseases Demanding Radiation Therapy; Increasing Concerns over Radiation Overexposure; Rising Awareness and Industry Initiatives for Radiation Dose Management

- 3.3. Market Restrains

- 3.3.1. ; Low Adoption of radiation Dose Management Solutions in Emerging Countries

- 3.4. Market Trends

- 3.4.1. Computed Tomography is Expected to Register Highest CAGR in the Modality Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Dose Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products & Services

- 5.1.1. Standalone Solutions

- 5.1.2. Integrated Solutions

- 5.2. Market Analysis, Insights and Forecast - by Modality

- 5.2.1. Computed Tomography

- 5.2.2. Fluoroscopy and Interventional Imaging

- 5.2.3. Nuclear Medicine

- 5.2.4. Radiography and Mammography

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Ambulatory Care Settings

- 5.3.2. Hospital

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Products & Services

- 6. North America Radiation Dose Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products & Services

- 6.1.1. Standalone Solutions

- 6.1.2. Integrated Solutions

- 6.2. Market Analysis, Insights and Forecast - by Modality

- 6.2.1. Computed Tomography

- 6.2.2. Fluoroscopy and Interventional Imaging

- 6.2.3. Nuclear Medicine

- 6.2.4. Radiography and Mammography

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Ambulatory Care Settings

- 6.3.2. Hospital

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Products & Services

- 7. Europe Radiation Dose Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products & Services

- 7.1.1. Standalone Solutions

- 7.1.2. Integrated Solutions

- 7.2. Market Analysis, Insights and Forecast - by Modality

- 7.2.1. Computed Tomography

- 7.2.2. Fluoroscopy and Interventional Imaging

- 7.2.3. Nuclear Medicine

- 7.2.4. Radiography and Mammography

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Ambulatory Care Settings

- 7.3.2. Hospital

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Products & Services

- 8. Asia Pacific Radiation Dose Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products & Services

- 8.1.1. Standalone Solutions

- 8.1.2. Integrated Solutions

- 8.2. Market Analysis, Insights and Forecast - by Modality

- 8.2.1. Computed Tomography

- 8.2.2. Fluoroscopy and Interventional Imaging

- 8.2.3. Nuclear Medicine

- 8.2.4. Radiography and Mammography

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Ambulatory Care Settings

- 8.3.2. Hospital

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Products & Services

- 9. Middle East and Africa Radiation Dose Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products & Services

- 9.1.1. Standalone Solutions

- 9.1.2. Integrated Solutions

- 9.2. Market Analysis, Insights and Forecast - by Modality

- 9.2.1. Computed Tomography

- 9.2.2. Fluoroscopy and Interventional Imaging

- 9.2.3. Nuclear Medicine

- 9.2.4. Radiography and Mammography

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Ambulatory Care Settings

- 9.3.2. Hospital

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Products & Services

- 10. South America Radiation Dose Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products & Services

- 10.1.1. Standalone Solutions

- 10.1.2. Integrated Solutions

- 10.2. Market Analysis, Insights and Forecast - by Modality

- 10.2.1. Computed Tomography

- 10.2.2. Fluoroscopy and Interventional Imaging

- 10.2.3. Nuclear Medicine

- 10.2.4. Radiography and Mammography

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Ambulatory Care Settings

- 10.3.2. Hospital

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Products & Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Medsquare

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PACShealth LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bracco Imaging SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koninklijke Philips N V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qaelum NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sectra AB*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Novarad Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fujifilm Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Medsquare

List of Figures

- Figure 1: Global Radiation Dose Management Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Radiation Dose Management Market Revenue (undefined), by Products & Services 2025 & 2033

- Figure 3: North America Radiation Dose Management Market Revenue Share (%), by Products & Services 2025 & 2033

- Figure 4: North America Radiation Dose Management Market Revenue (undefined), by Modality 2025 & 2033

- Figure 5: North America Radiation Dose Management Market Revenue Share (%), by Modality 2025 & 2033

- Figure 6: North America Radiation Dose Management Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Radiation Dose Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Radiation Dose Management Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Radiation Dose Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Radiation Dose Management Market Revenue (undefined), by Products & Services 2025 & 2033

- Figure 11: Europe Radiation Dose Management Market Revenue Share (%), by Products & Services 2025 & 2033

- Figure 12: Europe Radiation Dose Management Market Revenue (undefined), by Modality 2025 & 2033

- Figure 13: Europe Radiation Dose Management Market Revenue Share (%), by Modality 2025 & 2033

- Figure 14: Europe Radiation Dose Management Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Radiation Dose Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Radiation Dose Management Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Radiation Dose Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Radiation Dose Management Market Revenue (undefined), by Products & Services 2025 & 2033

- Figure 19: Asia Pacific Radiation Dose Management Market Revenue Share (%), by Products & Services 2025 & 2033

- Figure 20: Asia Pacific Radiation Dose Management Market Revenue (undefined), by Modality 2025 & 2033

- Figure 21: Asia Pacific Radiation Dose Management Market Revenue Share (%), by Modality 2025 & 2033

- Figure 22: Asia Pacific Radiation Dose Management Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Radiation Dose Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Radiation Dose Management Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Radiation Dose Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Radiation Dose Management Market Revenue (undefined), by Products & Services 2025 & 2033

- Figure 27: Middle East and Africa Radiation Dose Management Market Revenue Share (%), by Products & Services 2025 & 2033

- Figure 28: Middle East and Africa Radiation Dose Management Market Revenue (undefined), by Modality 2025 & 2033

- Figure 29: Middle East and Africa Radiation Dose Management Market Revenue Share (%), by Modality 2025 & 2033

- Figure 30: Middle East and Africa Radiation Dose Management Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Middle East and Africa Radiation Dose Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Radiation Dose Management Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Radiation Dose Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Radiation Dose Management Market Revenue (undefined), by Products & Services 2025 & 2033

- Figure 35: South America Radiation Dose Management Market Revenue Share (%), by Products & Services 2025 & 2033

- Figure 36: South America Radiation Dose Management Market Revenue (undefined), by Modality 2025 & 2033

- Figure 37: South America Radiation Dose Management Market Revenue Share (%), by Modality 2025 & 2033

- Figure 38: South America Radiation Dose Management Market Revenue (undefined), by End User 2025 & 2033

- Figure 39: South America Radiation Dose Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Radiation Dose Management Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Radiation Dose Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radiation Dose Management Market Revenue undefined Forecast, by Products & Services 2020 & 2033

- Table 2: Global Radiation Dose Management Market Revenue undefined Forecast, by Modality 2020 & 2033

- Table 3: Global Radiation Dose Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Radiation Dose Management Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Radiation Dose Management Market Revenue undefined Forecast, by Products & Services 2020 & 2033

- Table 6: Global Radiation Dose Management Market Revenue undefined Forecast, by Modality 2020 & 2033

- Table 7: Global Radiation Dose Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Radiation Dose Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Radiation Dose Management Market Revenue undefined Forecast, by Products & Services 2020 & 2033

- Table 13: Global Radiation Dose Management Market Revenue undefined Forecast, by Modality 2020 & 2033

- Table 14: Global Radiation Dose Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Radiation Dose Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Radiation Dose Management Market Revenue undefined Forecast, by Products & Services 2020 & 2033

- Table 23: Global Radiation Dose Management Market Revenue undefined Forecast, by Modality 2020 & 2033

- Table 24: Global Radiation Dose Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Radiation Dose Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Radiation Dose Management Market Revenue undefined Forecast, by Products & Services 2020 & 2033

- Table 33: Global Radiation Dose Management Market Revenue undefined Forecast, by Modality 2020 & 2033

- Table 34: Global Radiation Dose Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global Radiation Dose Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Radiation Dose Management Market Revenue undefined Forecast, by Products & Services 2020 & 2033

- Table 40: Global Radiation Dose Management Market Revenue undefined Forecast, by Modality 2020 & 2033

- Table 41: Global Radiation Dose Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 42: Global Radiation Dose Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Radiation Dose Management Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Dose Management Market?

The projected CAGR is approximately 14.7%.

2. Which companies are prominent players in the Radiation Dose Management Market?

Key companies in the market include Medsquare, Bayer AG, PACShealth LLC, GE Healthcare, Bracco Imaging SpA, Koninklijke Philips N V, Qaelum NV, Sectra AB*List Not Exhaustive, Novarad Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the Radiation Dose Management Market?

The market segments include Products & Services, Modality, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Cases of Chronic Diseases Demanding Radiation Therapy; Increasing Concerns over Radiation Overexposure; Rising Awareness and Industry Initiatives for Radiation Dose Management.

6. What are the notable trends driving market growth?

Computed Tomography is Expected to Register Highest CAGR in the Modality Segment.

7. Are there any restraints impacting market growth?

; Low Adoption of radiation Dose Management Solutions in Emerging Countries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiation Dose Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiation Dose Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiation Dose Management Market?

To stay informed about further developments, trends, and reports in the Radiation Dose Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence