Key Insights

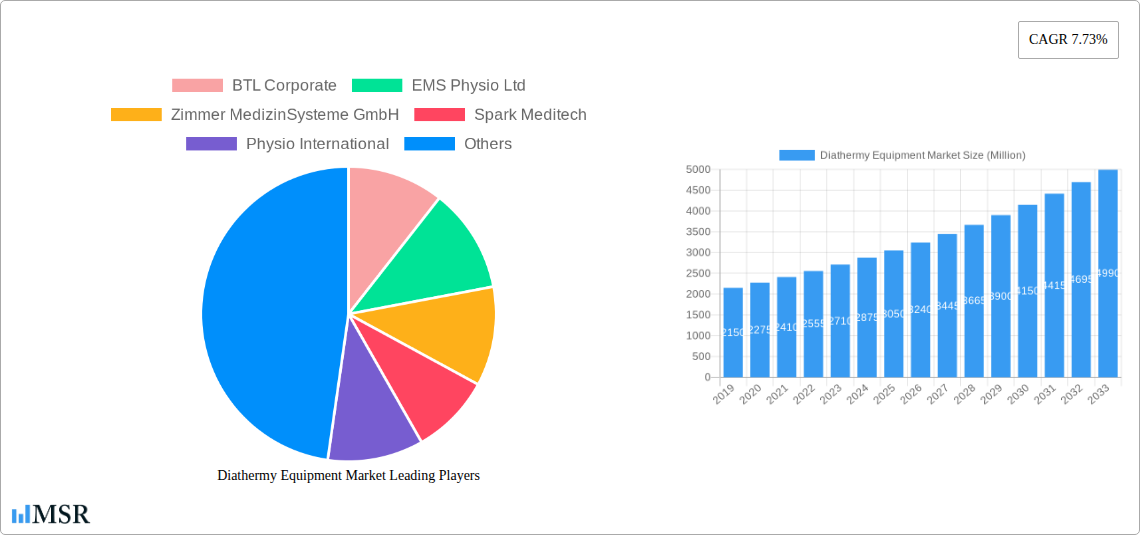

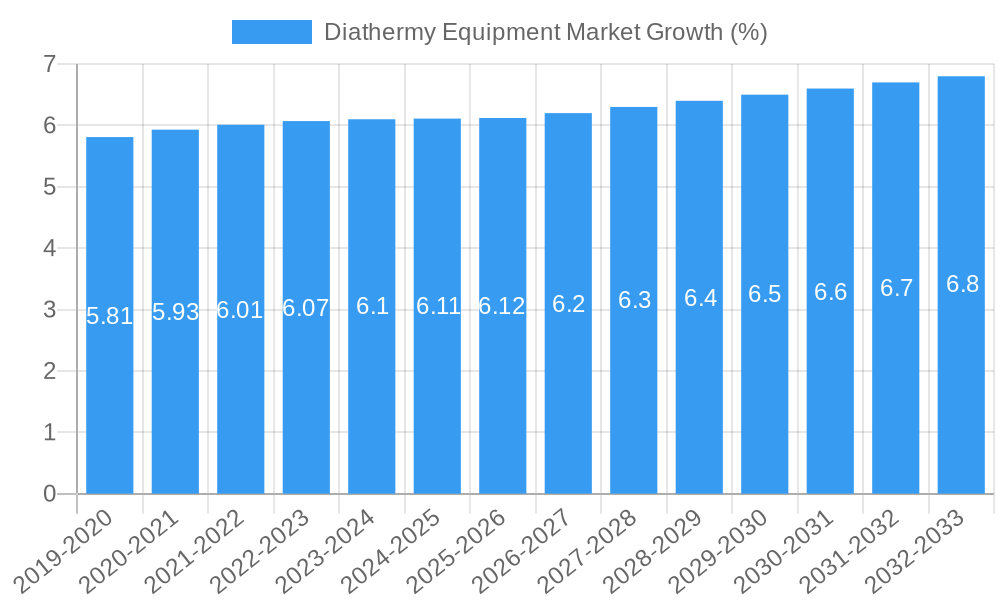

The global Diathermy Equipment Market is poised for substantial growth, projected to reach a significant valuation of approximately $3.25 billion in 2025. This expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 7.73%, indicating a dynamic and expanding sector within the healthcare industry. Key market drivers include the increasing prevalence of chronic pain conditions, musculoskeletal disorders, and sports-related injuries, all of which benefit from the therapeutic advantages of diathermy. Furthermore, the growing adoption of advanced physiotherapy techniques and the continuous innovation in diathermy equipment technology, leading to more precise and effective treatment modalities, are significant growth catalysts. The escalating demand for non-invasive treatment options also plays a crucial role in propelling market expansion as healthcare providers and patients seek alternatives to surgical interventions.

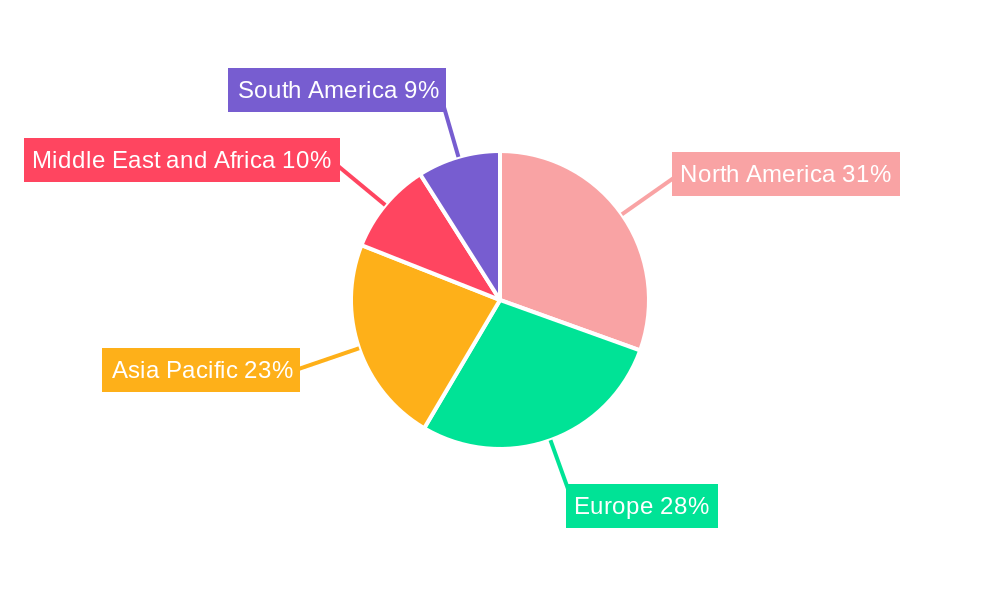

The market segmentation reveals diverse opportunities across various product types, applications, and end-users. Microwave Diathermy Equipment, Shortwave Diathermy Equipment, and Ultrasound Diathermy Equipment are the primary product categories, each catering to specific therapeutic needs. Applications span across Physical Therapy and Electrosurgery, highlighting the versatility of diathermy technology. The end-user landscape is dominated by Hospitals, Clinics, and Physiotherapy Centers, with a growing contribution from Other End Users. Geographically, North America and Europe are expected to maintain their significant market share due to advanced healthcare infrastructure, high disposable incomes, and a proactive approach to adopting new medical technologies. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, a burgeoning patient population, and rising awareness about advanced treatment options. Restraints such as the high initial cost of advanced equipment and the availability of alternative treatment modalities may pose challenges, but the overall market outlook remains strongly positive.

Gain unparalleled insights into the global Diathermy Equipment Market with our in-depth research report. This essential resource provides a detailed analysis of market dynamics, segmentation, key players, and future trends, equipping industry stakeholders with actionable intelligence. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, our report offers a robust forecast for the period 2025-2033, building upon historical data from 2019-2024. Discover the lucrative opportunities within the diathermy equipment market, driven by increasing demand for physical therapy devices, advancements in medical diathermy technology, and the rising prevalence of chronic pain.

Diathermy Equipment Market Market Concentration & Dynamics

The global diathermy equipment market exhibits a moderate level of concentration, with several key players vying for market share. Innovation ecosystems are flourishing, driven by continuous research and development in shortwave diathermy equipment and microwave diathermy equipment. Regulatory frameworks, while essential for patient safety, can influence market entry and product approvals. Substitute products, such as TENS units and ultrasound therapy devices, present a degree of competition, though diathermy's unique therapeutic benefits maintain its distinct market position. End-user trends are shifting towards more accessible and home-use solutions, particularly for chronic pain management. Mergers and acquisitions (M&A) activities, while not yet dominant, are anticipated to increase as companies seek to expand their product portfolios and geographical reach. The market is characterized by a balance between established manufacturers and innovative startups, fostering a dynamic competitive landscape.

- Market Share Distribution: Detailed analysis of market share held by leading diathermy equipment manufacturers.

- Innovation Ecosystem: Mapping of R&D hubs and collaborations within the medical diathermy device sector.

- Regulatory Landscape: Overview of FDA, CE, and other key regulatory body approvals for diathermy machines.

- Substitute Product Analysis: Comparative study of diathermy against alternative pain management modalities.

- End-User Preferences: Insights into the evolving needs of hospitals, clinics, and physiotherapy centers.

- M&A Activity: Tracking of recent and potential mergers and acquisitions impacting market consolidation.

Diathermy Equipment Market Industry Insights & Trends

The diathermy equipment market is projected to witness significant growth, driven by a confluence of compelling factors. The increasing global prevalence of chronic pain conditions, including back pain, joint disorders, and musculoskeletal injuries, directly fuels the demand for effective therapeutic solutions like diathermy. Advancements in medical diathermy technology are continuously enhancing device efficacy, safety, and user-friendliness, making them more attractive for both professional and home-use applications. The growing adoption of ultrasound diathermy equipment for targeted tissue healing and pain relief further contributes to market expansion. Moreover, the rising healthcare expenditure globally, coupled with an aging population prone to age-related ailments, is a substantial growth catalyst. The integration of sophisticated features, such as customizable treatment protocols and improved energy delivery systems, is enhancing the appeal of diathermy devices in physical therapy and rehabilitation settings. Furthermore, the expanding network of physiotherapy centers and the increasing recognition of non-pharmacological pain management strategies are bolstering market penetration. The market size is estimated to reach USD 950.2 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033. The shift towards evidence-based treatment modalities and the increasing preference for advanced medical diathermy machines in both acute and chronic care settings are key underlying trends. The global market is expected to reach USD 1,630.5 Million by 2033.

Key Markets & Segments Leading Diathermy Equipment Market

The diathermy equipment market is characterized by strong performance across various segments, with certain regions and product categories exhibiting notable dominance. North America and Europe currently lead the market, driven by high healthcare spending, well-established healthcare infrastructure, and a high prevalence of target conditions. The United States and Germany, in particular, represent significant markets due to advanced medical technologies and widespread adoption of physical therapy.

Product Segmentation:

- Shortwave Diathermy Equipment: This segment holds a substantial market share due to its broad application in treating deep tissue pain, inflammation, and muscle spasms. Its efficacy in accelerating healing processes makes it a cornerstone of physical therapy and rehabilitation.

- Drivers: Extensive clinical evidence supporting efficacy, versatility in treating various musculoskeletal conditions, integration with modern physiotherapy protocols.

- Microwave Diathermy Equipment: While often used for superficial heating, its targeted thermal effects make it a valuable tool for specific conditions, contributing to its market presence.

- Drivers: Precision heating capabilities, faster onset of therapeutic effects for certain applications.

- Ultrasound Diathermy Equipment: Gaining traction due to its ability to promote cellular repair and reduce inflammation, this segment is poised for significant growth. Its non-thermal effects are increasingly recognized for their therapeutic benefits.

- Drivers: Growing awareness of non-thermal therapeutic effects, advancements in pulsed ultrasound technology, application in sports medicine.

Application Segmentation:

- Physical Therapy: This remains the largest and most dominant application segment. The inherent benefits of diathermy in pain management, tissue healing, and improving joint mobility align perfectly with the goals of physical rehabilitation.

- Drivers: Increasing patient demand for non-invasive pain relief, expanding scope of physiotherapy services, rise in sports-related injuries.

- Electrosurgery: Diathermy's use in electrosurgery, particularly for hemostasis and tissue ablation, contributes to its market presence, though it represents a smaller segment compared to physical therapy.

End-User Segmentation:

- Hospitals: Hospitals are significant consumers of diathermy equipment, utilizing them in physiotherapy departments, surgical units, and pain management clinics.

- Drivers: Comprehensive healthcare facilities, diverse patient populations, availability of specialized medical professionals.

- Clinics: Outpatient clinics and specialized pain management centers are key end-users, relying on diathermy machines for a wide range of therapeutic interventions.

- Drivers: Growing number of specialized treatment centers, focus on outpatient care models.

- Physiotherapy Centers: This segment is a primary driver of growth, as physiotherapy centers heavily depend on diathermy equipment for their daily operations and patient treatments.

- Drivers: Increasing establishment of independent physiotherapy practices, rising awareness of physiotherapy benefits.

Diathermy Equipment Market Product Developments

The diathermy equipment market is witnessing continuous innovation, with manufacturers focusing on developing advanced diathermy machines that offer improved precision, user-friendliness, and therapeutic outcomes. Recent product developments include the introduction of portable and compact diathermy devices, enhancing accessibility for both clinicians and patients. Smart features, such as programmable treatment parameters, integrated user interfaces, and real-time monitoring capabilities, are becoming increasingly common. Innovations in shortwave diathermy equipment are focusing on pulsed shortwave diathermy (PSWD) technology for enhanced cellular regeneration and reduced thermal side effects. Similarly, advancements in microwave diathermy equipment are concentrating on precise energy delivery and improved safety mechanisms. The development of ultrasound diathermy equipment is exploring new frequency ranges and waveform designs to optimize therapeutic effects for a wider array of conditions. These product advancements are crucial for maintaining a competitive edge and addressing the evolving needs of the healthcare sector.

Challenges in the Diathermy Equipment Market Market

Despite its promising growth, the diathermy equipment market faces several challenges that could impede its full potential. Stringent regulatory approval processes for new medical diathermy devices can lead to extended development timelines and increased costs. While demand is high, the initial capital investment for advanced diathermy machines can be a barrier for smaller clinics and physiotherapy practices, especially in developing economies. Furthermore, the availability of alternative pain management therapies and the increasing preference for drug-based treatments in certain regions pose a competitive challenge. Ensuring consistent quality and reliability across a diverse range of manufacturers, particularly from emerging markets, is also a crucial aspect for market stability.

- Regulatory Hurdles: Lengthy and complex approval processes for new medical diathermy devices.

- High Initial Investment: Significant capital expenditure required for purchasing advanced diathermy equipment.

- Competition from Alternatives: Market penetration of other therapeutic modalities and pharmacological treatments.

- Price Sensitivity: Pressure on pricing due to cost-containment measures in healthcare systems.

- Lack of Awareness: Limited understanding of the full benefits of diathermy in some patient populations and healthcare settings.

Forces Driving Diathermy Equipment Market Growth

Several powerful forces are propelling the growth of the diathermy equipment market. The escalating global burden of chronic pain conditions, including arthritis, back pain, and sports injuries, necessitates effective non-pharmacological treatment options, making diathermy devices a sought-after solution. Continuous technological advancements are leading to the development of more sophisticated and user-friendly diathermy machines, enhancing their appeal and efficacy. The increasing global healthcare expenditure, particularly in emerging economies, is enabling greater access to advanced medical equipment. Furthermore, the growing awareness and acceptance of physical therapy as a primary treatment modality for a wide range of ailments are significantly contributing to market expansion. The aging global population, prone to degenerative musculoskeletal conditions, also presents a substantial and growing patient base for diathermy treatments.

Challenges in the Diathermy Equipment Market Market

Long-term growth catalysts for the diathermy equipment market are deeply rooted in ongoing innovation and strategic market expansion. The continued evolution of diathermy technology, particularly in areas like pulsed electromagnetic energy and focused ultrasound, promises to unlock new therapeutic applications and improve patient outcomes. Strategic partnerships between diathermy equipment manufacturers and healthcare institutions are crucial for fostering wider adoption and generating robust clinical evidence. Furthermore, exploring and penetrating emerging markets with growing healthcare needs and improving infrastructure presents significant opportunities for market expansion. The development of cost-effective and user-friendly diathermy devices tailored for home-use applications will also be a key factor in sustained long-term growth, democratizing access to these effective therapies.

Emerging Opportunities in Diathermy Equipment Market

Emerging opportunities in the diathermy equipment market are ripe for exploitation by forward-thinking companies. The increasing trend of remote patient monitoring and telehealth presents an opportunity for developing connected diathermy devices that can be managed and monitored remotely by healthcare professionals. The growing popularity of sports medicine and the rising incidence of sports-related injuries are creating a demand for specialized diathermy equipment designed for athletes and sports rehabilitation. Furthermore, the burgeoning field of regenerative medicine offers avenues for exploring the synergistic effects of diathermy with other advanced therapies. The development of targeted ultrasound diathermy equipment for specific tissue regeneration and wound healing applications is another promising area. Companies focusing on user-friendly, portable, and cost-effective diathermy machines for home-use will also tap into a significant and growing market segment.

Leading Players in the Diathermy Equipment Market Sector

- BTL Corporate

- EMS Physio Ltd

- Zimmer MedizinSysteme GmbH

- Spark Meditech

- Physio International

- Schiller Healthcare India Pvt Ltd

- Life Care Systems

- PHYSIOMED AG

- TechnoMed

- HMS Medical Systems

Key Milestones in Diathermy Equipment Market Industry

- March 2024: A new diathermy machine was installed in the Physiotherapy Department of Kasturba Hospital in Bhopal, India. This new diathermy machine helps diagnose back pain, cervical spondylitis, knee pain, frozen shoulder, and joint pain. Continuous efforts are being made to expand the facilities to treat patients in the hospital, highlighting the growing adoption of advanced diathermy equipment in public healthcare institutions.

- August 2023: Regenesis Biomedical, a medical device company focused on non-drug pain management, launched its new Reprieve. Reprieve is a home-use shortwave diathermy device based on Regenesis' core pulsed electromagnetic energy platform used for pain relief, signaling a significant trend towards the decentralization and home-use of diathermy technology.

Strategic Outlook for Diathermy Equipment Market Market

The strategic outlook for the diathermy equipment market is overwhelmingly positive, driven by a confluence of escalating demand for effective pain management solutions and continuous technological advancements. The market is poised for sustained growth, fueled by the increasing prevalence of chronic and musculoskeletal conditions, a growing emphasis on non-pharmacological treatment modalities, and expanding healthcare infrastructure globally. Key growth accelerators include the development of more sophisticated and user-friendly diathermy machines, particularly those incorporating pulsed shortwave diathermy (PSWD) and advanced ultrasound technologies. Strategic opportunities lie in expanding the application of diathermy equipment into home-use settings, leveraging telehealth capabilities, and forging strong partnerships with healthcare providers and research institutions. Companies that focus on innovation, cost-effectiveness, and robust clinical validation will be well-positioned to capitalize on the lucrative opportunities within this dynamic market.

Diathermy Equipment Market Segmentation

-

1. Product

- 1.1. Microwave Diathermy Equipment

- 1.2. Shortwave Diathermy Equipment

- 1.3. Ultrasound Diathermy Equipment

-

2. Application

- 2.1. Physical Therapy

- 2.2. Electrosurgery

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Physiotherapy Centers

- 3.4. Other End Users

Diathermy Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Diathermy Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Musculoskeletal Disorders; High Demand for Diathermy Treatment; Rise in Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalence of Musculoskeletal Disorders; High Demand for Diathermy Treatment; Rise in Geriatric Population

- 3.4. Market Trends

- 3.4.1. The Shortwave Diathermy Equipment Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Diathermy Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Microwave Diathermy Equipment

- 5.1.2. Shortwave Diathermy Equipment

- 5.1.3. Ultrasound Diathermy Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Physical Therapy

- 5.2.2. Electrosurgery

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Physiotherapy Centers

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Diathermy Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Microwave Diathermy Equipment

- 6.1.2. Shortwave Diathermy Equipment

- 6.1.3. Ultrasound Diathermy Equipment

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Physical Therapy

- 6.2.2. Electrosurgery

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Physiotherapy Centers

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Diathermy Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Microwave Diathermy Equipment

- 7.1.2. Shortwave Diathermy Equipment

- 7.1.3. Ultrasound Diathermy Equipment

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Physical Therapy

- 7.2.2. Electrosurgery

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Physiotherapy Centers

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Diathermy Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Microwave Diathermy Equipment

- 8.1.2. Shortwave Diathermy Equipment

- 8.1.3. Ultrasound Diathermy Equipment

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Physical Therapy

- 8.2.2. Electrosurgery

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Physiotherapy Centers

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Diathermy Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Microwave Diathermy Equipment

- 9.1.2. Shortwave Diathermy Equipment

- 9.1.3. Ultrasound Diathermy Equipment

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Physical Therapy

- 9.2.2. Electrosurgery

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.3.3. Physiotherapy Centers

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Diathermy Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Microwave Diathermy Equipment

- 10.1.2. Shortwave Diathermy Equipment

- 10.1.3. Ultrasound Diathermy Equipment

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Physical Therapy

- 10.2.2. Electrosurgery

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Clinics

- 10.3.3. Physiotherapy Centers

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BTL Corporate

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EMS Physio Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zimmer MedizinSysteme GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Spark Meditech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Physio International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schiller Healthcare India Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Life Care Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PHYSIOMED AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TechnoMed

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HMS Medical Systems*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BTL Corporate

List of Figures

- Figure 1: Global Diathermy Equipment Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Diathermy Equipment Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Diathermy Equipment Market Revenue (Million), by Product 2024 & 2032

- Figure 4: North America Diathermy Equipment Market Volume (Billion), by Product 2024 & 2032

- Figure 5: North America Diathermy Equipment Market Revenue Share (%), by Product 2024 & 2032

- Figure 6: North America Diathermy Equipment Market Volume Share (%), by Product 2024 & 2032

- Figure 7: North America Diathermy Equipment Market Revenue (Million), by Application 2024 & 2032

- Figure 8: North America Diathermy Equipment Market Volume (Billion), by Application 2024 & 2032

- Figure 9: North America Diathermy Equipment Market Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Diathermy Equipment Market Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Diathermy Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 12: North America Diathermy Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 13: North America Diathermy Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 14: North America Diathermy Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 15: North America Diathermy Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Diathermy Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 17: North America Diathermy Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Diathermy Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe Diathermy Equipment Market Revenue (Million), by Product 2024 & 2032

- Figure 20: Europe Diathermy Equipment Market Volume (Billion), by Product 2024 & 2032

- Figure 21: Europe Diathermy Equipment Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Diathermy Equipment Market Volume Share (%), by Product 2024 & 2032

- Figure 23: Europe Diathermy Equipment Market Revenue (Million), by Application 2024 & 2032

- Figure 24: Europe Diathermy Equipment Market Volume (Billion), by Application 2024 & 2032

- Figure 25: Europe Diathermy Equipment Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Diathermy Equipment Market Volume Share (%), by Application 2024 & 2032

- Figure 27: Europe Diathermy Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 28: Europe Diathermy Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 29: Europe Diathermy Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe Diathermy Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 31: Europe Diathermy Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Europe Diathermy Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Europe Diathermy Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Diathermy Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Pacific Diathermy Equipment Market Revenue (Million), by Product 2024 & 2032

- Figure 36: Asia Pacific Diathermy Equipment Market Volume (Billion), by Product 2024 & 2032

- Figure 37: Asia Pacific Diathermy Equipment Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: Asia Pacific Diathermy Equipment Market Volume Share (%), by Product 2024 & 2032

- Figure 39: Asia Pacific Diathermy Equipment Market Revenue (Million), by Application 2024 & 2032

- Figure 40: Asia Pacific Diathermy Equipment Market Volume (Billion), by Application 2024 & 2032

- Figure 41: Asia Pacific Diathermy Equipment Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Asia Pacific Diathermy Equipment Market Volume Share (%), by Application 2024 & 2032

- Figure 43: Asia Pacific Diathermy Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 44: Asia Pacific Diathermy Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 45: Asia Pacific Diathermy Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 46: Asia Pacific Diathermy Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 47: Asia Pacific Diathermy Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Pacific Diathermy Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia Pacific Diathermy Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Diathermy Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Middle East and Africa Diathermy Equipment Market Revenue (Million), by Product 2024 & 2032

- Figure 52: Middle East and Africa Diathermy Equipment Market Volume (Billion), by Product 2024 & 2032

- Figure 53: Middle East and Africa Diathermy Equipment Market Revenue Share (%), by Product 2024 & 2032

- Figure 54: Middle East and Africa Diathermy Equipment Market Volume Share (%), by Product 2024 & 2032

- Figure 55: Middle East and Africa Diathermy Equipment Market Revenue (Million), by Application 2024 & 2032

- Figure 56: Middle East and Africa Diathermy Equipment Market Volume (Billion), by Application 2024 & 2032

- Figure 57: Middle East and Africa Diathermy Equipment Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: Middle East and Africa Diathermy Equipment Market Volume Share (%), by Application 2024 & 2032

- Figure 59: Middle East and Africa Diathermy Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 60: Middle East and Africa Diathermy Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 61: Middle East and Africa Diathermy Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 62: Middle East and Africa Diathermy Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 63: Middle East and Africa Diathermy Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Middle East and Africa Diathermy Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 65: Middle East and Africa Diathermy Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Middle East and Africa Diathermy Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 67: South America Diathermy Equipment Market Revenue (Million), by Product 2024 & 2032

- Figure 68: South America Diathermy Equipment Market Volume (Billion), by Product 2024 & 2032

- Figure 69: South America Diathermy Equipment Market Revenue Share (%), by Product 2024 & 2032

- Figure 70: South America Diathermy Equipment Market Volume Share (%), by Product 2024 & 2032

- Figure 71: South America Diathermy Equipment Market Revenue (Million), by Application 2024 & 2032

- Figure 72: South America Diathermy Equipment Market Volume (Billion), by Application 2024 & 2032

- Figure 73: South America Diathermy Equipment Market Revenue Share (%), by Application 2024 & 2032

- Figure 74: South America Diathermy Equipment Market Volume Share (%), by Application 2024 & 2032

- Figure 75: South America Diathermy Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 76: South America Diathermy Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 77: South America Diathermy Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 78: South America Diathermy Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 79: South America Diathermy Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 80: South America Diathermy Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 81: South America Diathermy Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: South America Diathermy Equipment Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Diathermy Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Diathermy Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Diathermy Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Diathermy Equipment Market Volume Billion Forecast, by Product 2019 & 2032

- Table 5: Global Diathermy Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Diathermy Equipment Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Global Diathermy Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global Diathermy Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 9: Global Diathermy Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Diathermy Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global Diathermy Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: Global Diathermy Equipment Market Volume Billion Forecast, by Product 2019 & 2032

- Table 13: Global Diathermy Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Diathermy Equipment Market Volume Billion Forecast, by Application 2019 & 2032

- Table 15: Global Diathermy Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Global Diathermy Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 17: Global Diathermy Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Diathermy Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: United States Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United States Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Canada Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Mexico Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Global Diathermy Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 26: Global Diathermy Equipment Market Volume Billion Forecast, by Product 2019 & 2032

- Table 27: Global Diathermy Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Diathermy Equipment Market Volume Billion Forecast, by Application 2019 & 2032

- Table 29: Global Diathermy Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Global Diathermy Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 31: Global Diathermy Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Diathermy Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Germany Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: France Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Italy Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Spain Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Europe Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Global Diathermy Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 46: Global Diathermy Equipment Market Volume Billion Forecast, by Product 2019 & 2032

- Table 47: Global Diathermy Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Diathermy Equipment Market Volume Billion Forecast, by Application 2019 & 2032

- Table 49: Global Diathermy Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 50: Global Diathermy Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 51: Global Diathermy Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Diathermy Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 53: China Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: China Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Japan Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: India Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 59: Australia Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Australia Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: South Korea Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Korea Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Asia Pacific Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 65: Global Diathermy Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 66: Global Diathermy Equipment Market Volume Billion Forecast, by Product 2019 & 2032

- Table 67: Global Diathermy Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 68: Global Diathermy Equipment Market Volume Billion Forecast, by Application 2019 & 2032

- Table 69: Global Diathermy Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 70: Global Diathermy Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 71: Global Diathermy Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global Diathermy Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 73: GCC Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: GCC Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 75: South Africa Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: South Africa Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 77: Rest of Middle East and Africa Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of Middle East and Africa Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 79: Global Diathermy Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 80: Global Diathermy Equipment Market Volume Billion Forecast, by Product 2019 & 2032

- Table 81: Global Diathermy Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 82: Global Diathermy Equipment Market Volume Billion Forecast, by Application 2019 & 2032

- Table 83: Global Diathermy Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 84: Global Diathermy Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 85: Global Diathermy Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 86: Global Diathermy Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 87: Brazil Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Brazil Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 89: Argentina Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Argentina Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 91: Rest of South America Diathermy Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Rest of South America Diathermy Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diathermy Equipment Market?

The projected CAGR is approximately 7.73%.

2. Which companies are prominent players in the Diathermy Equipment Market?

Key companies in the market include BTL Corporate, EMS Physio Ltd, Zimmer MedizinSysteme GmbH, Spark Meditech, Physio International, Schiller Healthcare India Pvt Ltd, Life Care Systems, PHYSIOMED AG, TechnoMed, HMS Medical Systems*List Not Exhaustive.

3. What are the main segments of the Diathermy Equipment Market?

The market segments include Product, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Musculoskeletal Disorders; High Demand for Diathermy Treatment; Rise in Geriatric Population.

6. What are the notable trends driving market growth?

The Shortwave Diathermy Equipment Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Prevalence of Musculoskeletal Disorders; High Demand for Diathermy Treatment; Rise in Geriatric Population.

8. Can you provide examples of recent developments in the market?

March 2024: a new diathermy machine was installed in the Physiotherapy Department of Kasturba Hospital in Bhopal, India. This new diathermy machine helps diagnose back pain, cervical spondylitis, knee pain, frozen solder, and joint pain. Continuous efforts are being made to expand the facilities to treat patients in the hospital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diathermy Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diathermy Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diathermy Equipment Market?

To stay informed about further developments, trends, and reports in the Diathermy Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence