Key Insights

The global aesthetic devices market is poised for significant expansion, projected to reach a substantial valuation by 2033. With a robust Compound Annual Growth Rate (CAGR) of 10.66%, this market is driven by a confluence of factors including increasing consumer demand for minimally invasive and non-invasive aesthetic procedures, a growing awareness of aesthetic treatments, and advancements in technology leading to more effective and safer devices. Key product segments such as Botulinum Toxin and Dermal Fillers are anticipated to witness sustained demand, fueled by their efficacy in addressing wrinkles, fine lines, and volume loss. The rising disposable incomes, coupled with a cultural shift towards prioritizing self-care and appearance, are further bolstering market growth. Aesthetic clinics and hospitals are expected to remain the primary end-user segments, investing in advanced technologies to cater to the evolving needs of their clientele.

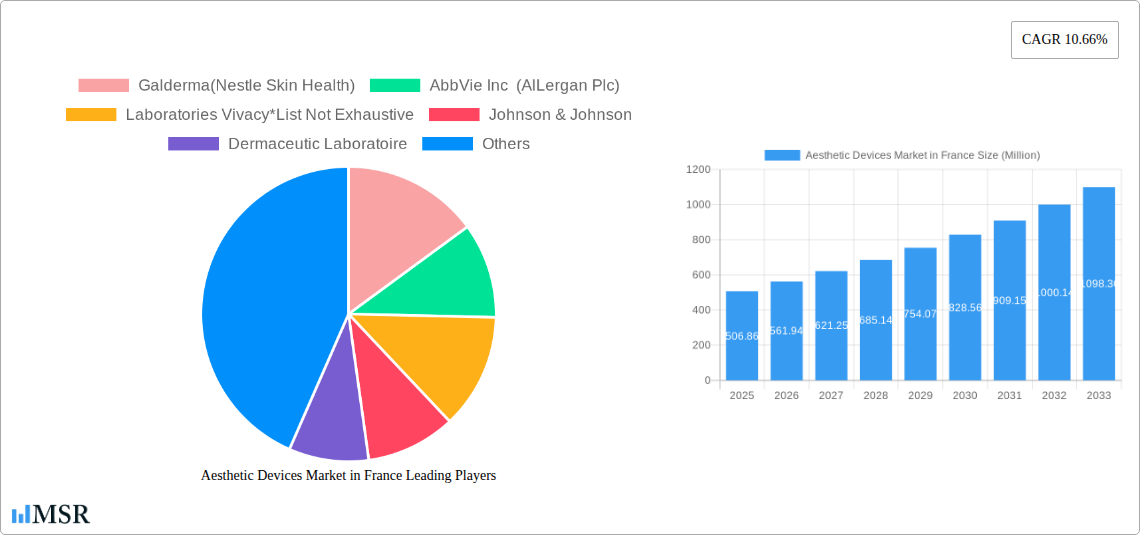

Aesthetic Devices Market in France Market Size (In Million)

Emerging trends within the aesthetic devices market include the rise of combination therapies, personalized treatment plans, and the integration of artificial intelligence for enhanced diagnostics and treatment planning. However, the market also faces certain restraints, such as the high cost of some advanced aesthetic devices and the potential for regulatory hurdles in certain regions. Despite these challenges, the overarching positive market sentiment, supported by a strong historical performance and promising future projections, indicates a dynamic and evolving landscape for aesthetic devices. Companies like Galderma, AbbVie Inc (Allergan Plc), and Johnson & Johnson are at the forefront of innovation, driving the development and adoption of novel aesthetic solutions. The Asia Pacific region is expected to emerge as a significant growth engine, driven by increasing disposable incomes and a burgeoning awareness of aesthetic procedures.

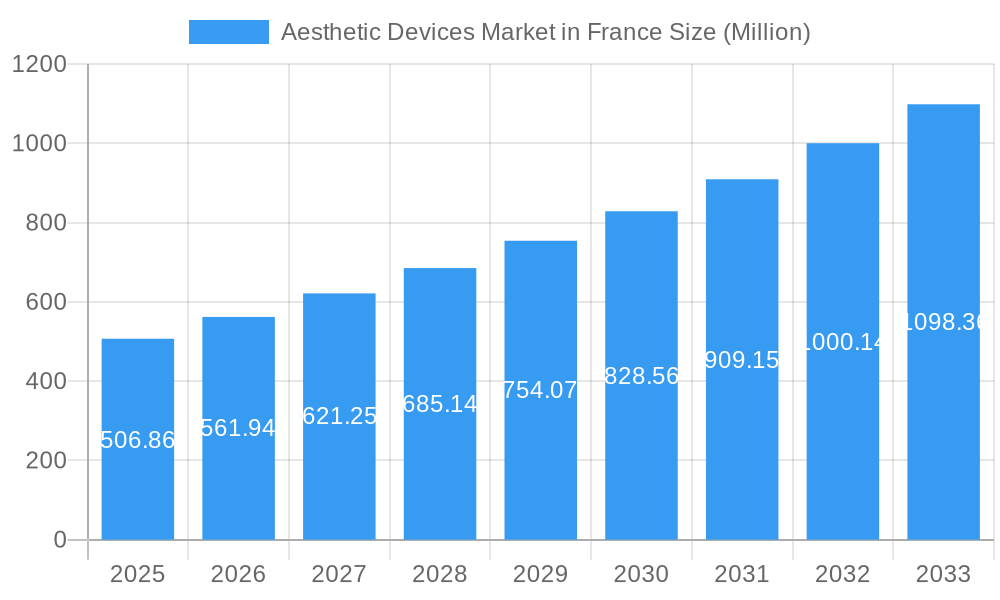

Aesthetic Devices Market in France Company Market Share

Unveiling the Lucrative Aesthetic Devices Market in France: A Comprehensive Market Analysis & Forecast (2019-2033)

Dive deep into the thriving French aesthetic devices market with this indispensable report. Spanning from 2019 to 2033, with a base year of 2025 and an extensive forecast period of 2025-2033, this analysis provides critical insights into market dynamics, growth drivers, product innovations, and key players shaping the future of cosmetic procedures in France. Discover the intricate interplay of technological advancements, evolving consumer demands, and regulatory landscapes that are propelling the market forward. With an estimated market size of XXX Million in 2025 and a projected CAGR of XX%, this report is your definitive guide to identifying lucrative opportunities and navigating the competitive intricacies of the French aesthetic devices sector.

Aesthetic Devices Market in France Market Concentration & Dynamics

The French aesthetic devices market exhibits a moderate to high concentration, with a few dominant players holding significant market share. Galderma (Nestle Skin Health) and AbbVie Inc (Allergan Plc) are prominent leaders, their extensive product portfolios and strong brand recognition contributing to their substantial influence. The innovation ecosystem is driven by continuous R&D investments, particularly in dermal fillers and botulinum toxin, aimed at enhancing efficacy, safety, and patient experience. France's robust regulatory framework, aligned with EU directives, ensures high standards for device approval and clinical practice, fostering patient confidence. Substitute products, such as advanced skincare and non-invasive cosmetic treatments, present some competition, but are largely complementary to device-based procedures. End-user trends reveal a growing preference for minimally invasive treatments and a rising demand among younger demographics. Merger and acquisition (M&A) activities, while not consistently high, have occurred, indicating strategic consolidation to gain market access and technological capabilities. We project a market share distribution where leading companies collectively hold over 60% of the market value. Limited data on specific M&A deal counts makes precise quantification challenging, but the trend indicates strategic moves to bolster portfolios and expand reach.

Aesthetic Devices Market in France Industry Insights & Trends

The French aesthetic devices market is experiencing robust growth, propelled by a confluence of societal, economic, and technological factors. The market size is projected to reach XXX Million in 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% throughout the forecast period (2025-2033). This expansion is fundamentally driven by an increasing societal acceptance of aesthetic procedures, no longer viewed as taboo but rather as integral components of self-care and well-being. Advancements in minimally invasive technologies have significantly reduced downtime and recovery periods, making treatments more accessible and appealing to a broader demographic, including working professionals and younger individuals seeking preventative aesthetic solutions. Technological disruptions are at the forefront, with innovations in dermal filler formulations offering enhanced longevity and natural-looking results, alongside the development of advanced botulinum toxin products providing more precise and sustained wrinkle reduction. The rise of sophisticated energy-based devices for skin rejuvenation, body contouring, and hair removal further diversifies the market's offerings. Evolving consumer behaviors are characterized by a greater emphasis on personalized treatments and a demand for natural-looking outcomes. Patients are increasingly informed, actively seeking out treatments based on peer reviews, expert opinions, and social media influence. This heightened awareness fuels the demand for high-quality, safe, and effective aesthetic interventions. Furthermore, the aging population in France contributes significantly to the demand for anti-aging treatments, underpinning the sustained growth of the aesthetic devices market. The economic stability and disposable income within certain segments of the French population also play a crucial role, enabling individuals to invest in these elective procedures. The integration of digital technologies, such as AI-powered facial analysis and virtual consultations, is also beginning to influence patient decision-making and treatment planning, pointing towards a more personalized and technologically integrated future for aesthetic medicine in France.

Key Markets & Segments Leading Aesthetic Devices Market in France

The French aesthetic devices market is a dynamic landscape, with specific segments demonstrating exceptional growth and dominance. The Botulinum Toxin segment is a significant revenue generator, driven by its widespread use in treating dynamic wrinkles and its growing application in medical aesthetics beyond purely cosmetic purposes. The Dermal Filler segment, encompassing both Absorbable Dermal Fillers and Non-absorbable Dermal Fillers, is another powerhouse. Absorbable fillers, particularly hyaluronic acid-based ones, lead the market due to their safety profile, reversibility, and natural integration with facial tissues. The increasing sophistication in formulations has led to longer-lasting and more versatile absorbable filler options. The Other Products segment, which includes a range of innovative devices for skin rejuvenation and body contouring, is also showing considerable growth potential.

The primary End User segment dominating the market is Aesthetic Clinics. These specialized centers are equipped with advanced technology and staffed by experienced practitioners who cater directly to the demands for aesthetic procedures.

Drivers for Dominance:

- Technological Advancements: Continuous innovation in filler materials, botulinum toxin formulations, and energy-based devices directly fuels the growth of these key segments.

- Increasing Consumer Awareness & Demand: A well-informed French populace, influenced by social media and a greater acceptance of aesthetic treatments, actively seeks these procedures.

- Minimally Invasive Nature: The preference for procedures with minimal downtime and recovery periods strongly favors botulinum toxin and dermal fillers.

- Aging Population: The demographic trend of an aging population in France directly translates to higher demand for anti-aging solutions provided by these devices.

- Practitioner Expertise: The availability of skilled dermatologists and plastic surgeons in aesthetic clinics ensures high-quality service delivery and patient satisfaction, driving repeat business and referrals.

- Brand Reputation and Trust: Established brands within the botulinum toxin and dermal filler categories have cultivated strong patient trust, leading to consistent market penetration.

The dominance of these segments is further solidified by their alignment with prevailing consumer preferences for effective, safe, and relatively non-invasive solutions that deliver natural-looking results, making them the bedrock of the French aesthetic devices market.

Aesthetic Devices Market in France Product Developments

Product innovation remains a cornerstone of the French aesthetic devices market. Recent developments focus on enhancing Botulinum Toxin efficacy and duration, with new formulations offering smoother onset and reduced diffusion. In the Dermal Filler segment, advancements in hyaluronic acid cross-linking technologies are yielding fillers with improved viscoelastic properties, enabling more precise contouring and longer-lasting results. The emergence of novel bio-stimulatory fillers, designed to stimulate the body's natural collagen production, represents a significant technological leap. Furthermore, energy-based devices are witnessing advancements in targeting specific tissue depths and offering multi-functional capabilities for skin tightening, resurfacing, and fat reduction. These ongoing product developments are crucial for maintaining a competitive edge and meeting the evolving demands of both practitioners and patients for safer, more effective, and natural-looking aesthetic outcomes.

Challenges in the Aesthetic Devices Market in France Market

Despite its robust growth, the French aesthetic devices market faces several challenges. Stringent regulatory approvals and evolving compliance requirements can lead to extended market entry timelines and increased development costs. The high cost of advanced aesthetic devices can be a barrier for smaller clinics and some consumer segments, potentially limiting market penetration. Intense competition from both established global players and emerging local manufacturers necessitates continuous innovation and competitive pricing strategies. Furthermore, potential supply chain disruptions, as seen in recent global events, can impact the availability and cost of raw materials and finished products. The public perception and ethical considerations surrounding aesthetic procedures, though improving, still present a hurdle in certain demographics, requiring ongoing education and responsible marketing.

Forces Driving Aesthetic Devices Market in France Growth

The French aesthetic devices market is propelled by several key growth drivers. Technological advancements are paramount, with continuous innovation in product formulations and device engineering leading to safer, more effective, and less invasive treatments. Increasing disposable income and a growing middle class in France enable a larger segment of the population to afford elective aesthetic procedures. Growing societal acceptance and de-stigmatization of cosmetic treatments are transforming them from a niche concern to a mainstream aspect of personal care and well-being. The aging demographic profile of France directly fuels the demand for anti-aging solutions. Moreover, the emphasis on aesthetic appeal in professional and social settings, amplified by media and social platforms, encourages individuals to invest in enhancing their appearance.

Challenges in the Aesthetic Devices Market in France Market

Long-term growth catalysts for the French aesthetic devices market hinge on several strategic factors. Continued investment in research and development is crucial to stay ahead of the curve in innovation, addressing unmet patient needs and creating new treatment paradigms. Strategic partnerships and collaborations between device manufacturers, research institutions, and clinical practitioners can accelerate product development and market adoption. Expanding into underserved geographic regions within France and targeting specific demographic groups with tailored offerings can unlock new avenues for growth. The development and promotion of combination therapies that leverage multiple aesthetic device modalities are likely to enhance treatment outcomes and patient satisfaction, driving repeat procedures and market expansion. Furthermore, fostering a strong emphasis on post-market surveillance and data collection will build trust and provide valuable insights for future product iterations and market strategies.

Emerging Opportunities in Aesthetic Devices Market in France

Emerging opportunities in the French aesthetic devices market are abundant. The growing interest in preventative aesthetics among younger demographics presents a significant untapped market for early intervention treatments. The increasing demand for male aesthetic procedures is an expanding segment requiring targeted product development and marketing strategies. Advancements in combination devices that offer multiple treatment modalities in a single unit, like integrated laser and radiofrequency systems, create new possibilities for efficient and comprehensive patient care. The integration of artificial intelligence (AI) and machine learning in diagnostics, treatment planning, and outcome prediction offers substantial potential for personalization and improved patient results. Furthermore, the development of sustainable and eco-friendly aesthetic devices and consumables aligns with growing consumer environmental consciousness.

Leading Players in the Aesthetic Devices Market in France Sector

- Galderma

- AbbVie Inc

- Laboratories Vivacy

- Johnson & Johnson

- Dermaceutic Laboratoire

- Bioxis Pharmaceuticals

- Laboratoires Filorga

- Merz Pharma GmbH & Co KGaA

- Sinclair Pharma PLC

- Teoxane Laboratories

- Ipsen Pharma

Key Milestones in Aesthetic Devices Market in France Industry

- January 2022: The European Union's (EU's) Heads of Medicines Agencies (HMA) issued a positive opinion on the approval of Hugel's Letybo, a product containing botulinum toxin (BTX) for the treatment of wrinkles on the forehead. This milestone signifies increased competition and innovation in the BTX market within Europe, potentially impacting market share dynamics and pricing strategies for existing players.

- June 2021: Galderma announced that Alluzience® completed its European decentralized procedure, resulting in a positive decision for the first ready-to-use neuromodulator, a wrinkle-relaxing injection, in Europe. This development highlights Galderma's commitment to innovation in the neuromodulator space and offers practitioners a convenient and efficient treatment option, potentially influencing market preference and adoption rates for ready-to-use formulations.

Strategic Outlook for Aesthetic Devices Market in France Market

The strategic outlook for the French aesthetic devices market is exceptionally positive, characterized by sustained growth and evolving opportunities. Key growth accelerators include the ongoing embrace of minimally invasive procedures, driven by technological advancements and increased patient comfort. The expanding demand for personalized treatments, fueled by AI and advanced diagnostic tools, will create a premium market for tailored solutions. Manufacturers and suppliers should focus on developing innovative products that offer superior efficacy, safety, and patient experience, particularly in the dermal filler and neuromodulator segments. Strategic partnerships and acquisitions aimed at broadening product portfolios and expanding market reach within France and potentially other European countries will be crucial for maintaining a competitive edge. Furthermore, a commitment to continuous education for practitioners and transparent communication with consumers will be vital in navigating regulatory landscapes and fostering long-term market confidence and expansion.

Aesthetic Devices Market in France Segmentation

-

1. Product

- 1.1. Botulinum Toxin

-

1.2. Dermal Filler

- 1.2.1. Absorbable Dermal Filler

- 1.2.2. Non-absorbable Dermal Filler

- 1.3. Chemical Peel

- 1.4. Microdermabrasion

- 1.5. Other Products

-

2. End User

- 2.1. Aesthetic Clinics

- 2.2. Hospitals

- 2.3. Other End Users

Aesthetic Devices Market in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

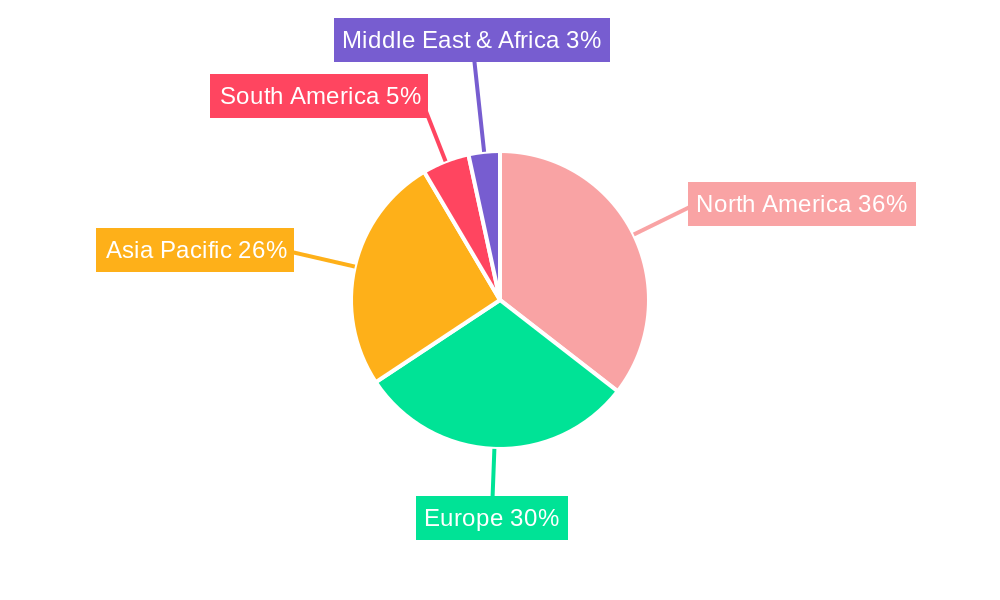

Aesthetic Devices Market in France Regional Market Share

Geographic Coverage of Aesthetic Devices Market in France

Aesthetic Devices Market in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness and Adoption of Non- and Minimally-Invasive Aesthetic Procedures; Availability of Technologically Advanced & User-friendly Products

- 3.3. Market Restrains

- 3.3.1. Stringent Safety Regulations for Aesthetic Procedures; Risk of Side Effects

- 3.4. Market Trends

- 3.4.1. Dermal Filler is Expected to Have a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aesthetic Devices Market in France Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Botulinum Toxin

- 5.1.2. Dermal Filler

- 5.1.2.1. Absorbable Dermal Filler

- 5.1.2.2. Non-absorbable Dermal Filler

- 5.1.3. Chemical Peel

- 5.1.4. Microdermabrasion

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Aesthetic Clinics

- 5.2.2. Hospitals

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Aesthetic Devices Market in France Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Botulinum Toxin

- 6.1.2. Dermal Filler

- 6.1.2.1. Absorbable Dermal Filler

- 6.1.2.2. Non-absorbable Dermal Filler

- 6.1.3. Chemical Peel

- 6.1.4. Microdermabrasion

- 6.1.5. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Aesthetic Clinics

- 6.2.2. Hospitals

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Aesthetic Devices Market in France Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Botulinum Toxin

- 7.1.2. Dermal Filler

- 7.1.2.1. Absorbable Dermal Filler

- 7.1.2.2. Non-absorbable Dermal Filler

- 7.1.3. Chemical Peel

- 7.1.4. Microdermabrasion

- 7.1.5. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Aesthetic Clinics

- 7.2.2. Hospitals

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Aesthetic Devices Market in France Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Botulinum Toxin

- 8.1.2. Dermal Filler

- 8.1.2.1. Absorbable Dermal Filler

- 8.1.2.2. Non-absorbable Dermal Filler

- 8.1.3. Chemical Peel

- 8.1.4. Microdermabrasion

- 8.1.5. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Aesthetic Clinics

- 8.2.2. Hospitals

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Aesthetic Devices Market in France Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Botulinum Toxin

- 9.1.2. Dermal Filler

- 9.1.2.1. Absorbable Dermal Filler

- 9.1.2.2. Non-absorbable Dermal Filler

- 9.1.3. Chemical Peel

- 9.1.4. Microdermabrasion

- 9.1.5. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Aesthetic Clinics

- 9.2.2. Hospitals

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Aesthetic Devices Market in France Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Botulinum Toxin

- 10.1.2. Dermal Filler

- 10.1.2.1. Absorbable Dermal Filler

- 10.1.2.2. Non-absorbable Dermal Filler

- 10.1.3. Chemical Peel

- 10.1.4. Microdermabrasion

- 10.1.5. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Aesthetic Clinics

- 10.2.2. Hospitals

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Galderma(Nestle Skin Health)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AbbVie Inc (AlLergan Plc)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Laboratories Vivacy*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Johnson & Johnson

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dermaceutic Laboratoire

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bioxis Pharmaceuticals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Laboratoires Filorga

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merz Pharma GmbH & Co KGaA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sinclair Pharma PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Teoxane Laboratories

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ipsen Pharma

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Galderma(Nestle Skin Health)

List of Figures

- Figure 1: Global Aesthetic Devices Market in France Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aesthetic Devices Market in France Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Aesthetic Devices Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Aesthetic Devices Market in France Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Aesthetic Devices Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Aesthetic Devices Market in France Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aesthetic Devices Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Aesthetic Devices Market in France Revenue (Million), by Product 2025 & 2033

- Figure 9: South America Aesthetic Devices Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Aesthetic Devices Market in France Revenue (Million), by End User 2025 & 2033

- Figure 11: South America Aesthetic Devices Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America Aesthetic Devices Market in France Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Aesthetic Devices Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Aesthetic Devices Market in France Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe Aesthetic Devices Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Aesthetic Devices Market in France Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Aesthetic Devices Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Aesthetic Devices Market in France Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Aesthetic Devices Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Aesthetic Devices Market in France Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa Aesthetic Devices Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Aesthetic Devices Market in France Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa Aesthetic Devices Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa Aesthetic Devices Market in France Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Aesthetic Devices Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Aesthetic Devices Market in France Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific Aesthetic Devices Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Aesthetic Devices Market in France Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific Aesthetic Devices Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Aesthetic Devices Market in France Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Aesthetic Devices Market in France Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Aesthetic Devices Market in France Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aesthetic Devices Market in France?

The projected CAGR is approximately 10.66%.

2. Which companies are prominent players in the Aesthetic Devices Market in France?

Key companies in the market include Galderma(Nestle Skin Health), AbbVie Inc (AlLergan Plc), Laboratories Vivacy*List Not Exhaustive, Johnson & Johnson, Dermaceutic Laboratoire, Bioxis Pharmaceuticals, Laboratoires Filorga, Merz Pharma GmbH & Co KGaA, Sinclair Pharma PLC, Teoxane Laboratories, Ipsen Pharma.

3. What are the main segments of the Aesthetic Devices Market in France?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 506.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness and Adoption of Non- and Minimally-Invasive Aesthetic Procedures; Availability of Technologically Advanced & User-friendly Products.

6. What are the notable trends driving market growth?

Dermal Filler is Expected to Have a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Safety Regulations for Aesthetic Procedures; Risk of Side Effects.

8. Can you provide examples of recent developments in the market?

January 2022: The European Union's (EU's) Heads of Medicines Agencies (HMA) issued a positive opinion on the approval of Hugel's Letybo, a product containing botulinum toxin (BTX) for the treatment of wrinkles on the forehead.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aesthetic Devices Market in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aesthetic Devices Market in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aesthetic Devices Market in France?

To stay informed about further developments, trends, and reports in the Aesthetic Devices Market in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence