Key Insights

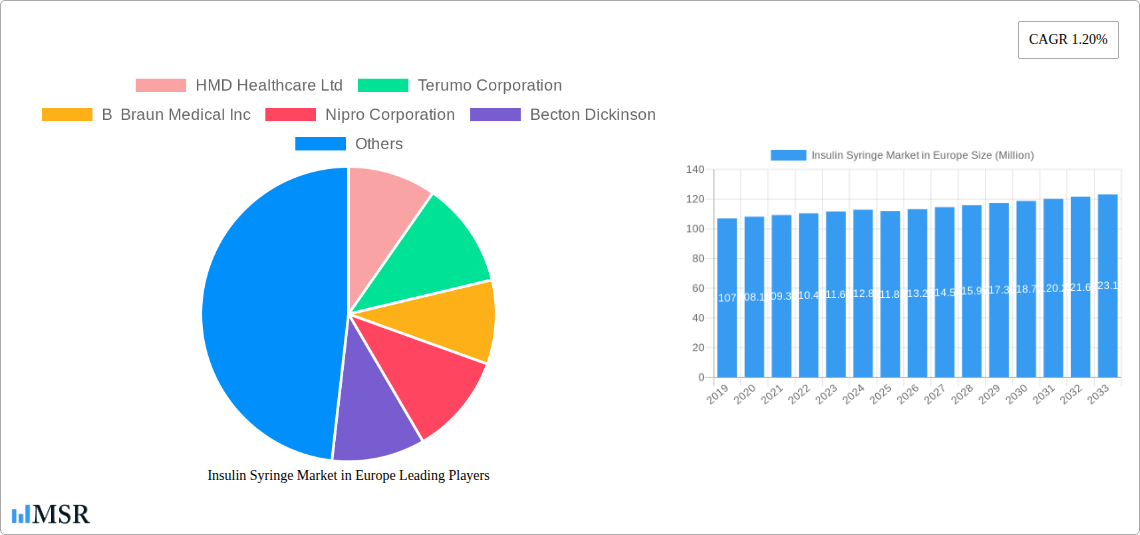

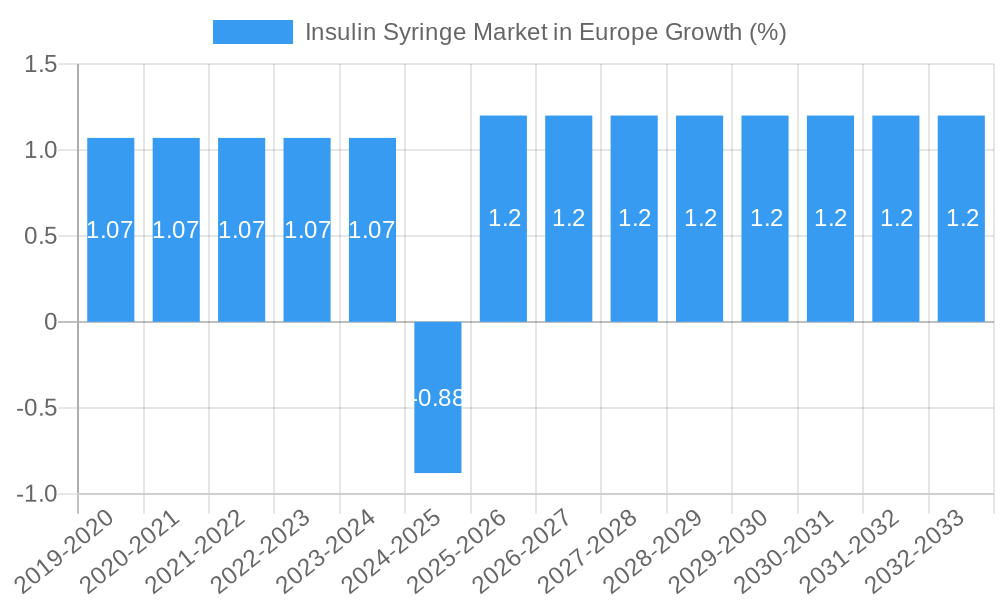

The European Insulin Syringe Market is poised for steady, albeit modest, expansion, projecting a market size of approximately USD 111.88 million in 2025. With a Compound Annual Growth Rate (CAGR) of 1.20% anticipated between 2025 and 2033, the market's trajectory indicates a sustained demand for these essential diabetes management tools. This growth is primarily fueled by the increasing prevalence of diabetes across Europe, driven by aging populations, sedentary lifestyles, and evolving dietary habits. The growing awareness among patients and healthcare providers regarding the importance of precise insulin delivery for effective diabetes control further reinforces this upward trend. Furthermore, technological advancements leading to improved syringe designs, enhanced safety features, and greater user comfort contribute to market expansion by promoting adoption and patient compliance.

Despite the projected growth, the insulin syringe market faces certain headwinds. Restraints such as the increasing adoption of insulin pens and pumps, which offer greater convenience and potentially more accurate dosing, pose a competitive challenge. These alternative delivery systems are gaining traction, especially among younger patient demographics and those seeking more integrated diabetes management solutions. However, the cost-effectiveness and widespread availability of traditional insulin syringes ensure their continued relevance, particularly in certain market segments and regions. The market is characterized by the presence of established global players like HMD Healthcare Ltd, Terumo Corporation, B Braun Medical Inc, Nipro Corporation, and Becton Dickinson, alongside Cardinal Health, who compete on product quality, innovation, and distribution networks to capture market share.

Here's an SEO-optimized and engaging report description for the Insulin Syringe Market in Europe, designed to drive search visibility and attract industry stakeholders, without requiring further modification.

This comprehensive report delivers an in-depth analysis of the European insulin syringe market, a critical segment within the broader diabetes care landscape. Spanning the historical period of 2019-2024, the base year of 2025, and projecting through the forecast period of 2025-2033, this study provides invaluable insights for manufacturers, distributors, healthcare providers, and investors navigating this dynamic industry. We meticulously examine market concentration, competitive landscapes, technological advancements, regulatory shifts, and end-user demands, offering actionable intelligence to capitalize on emerging opportunities and overcome prevailing challenges. Discover the key drivers shaping the European diabetes device market, the innovative product developments that are redefining patient care, and the strategic imperatives for sustained growth in this essential sector.

Insulin Syringe Market in Europe Market Concentration & Dynamics

The European insulin syringe market exhibits a moderate to high concentration, with a few dominant players holding significant market share. Key companies such as HMD Healthcare Ltd, Terumo Corporation, B Braun Medical Inc, Nipro Corporation, Becton Dickinson, and Cardinal Health are actively shaping the competitive environment through continuous innovation and strategic partnerships. The market’s innovation ecosystem is fueled by a growing demand for user-friendly, accurate, and safe insulin delivery devices. Regulatory frameworks, primarily governed by the European Medicines Agency (EMA) and national health authorities, ensure product safety and efficacy, influencing market entry and product approvals. Substitute products, including insulin pens and pumps, present a competitive challenge, but traditional syringes remain a cost-effective and widely adopted solution, particularly in certain demographics and regions. End-user trends highlight a growing preference for smaller gauge needles for reduced pain and improved patient comfort, alongside a demand for integrated features that enhance adherence and tracking. Merger and acquisition (M&A) activities, while not consistently high, are strategic moves aimed at expanding product portfolios, market reach, and technological capabilities. The market's dynamics are characterized by a continuous pursuit of enhanced product performance, cost-effectiveness, and patient-centric design, ensuring its resilience and adaptability.

Insulin Syringe Market in Europe Industry Insights & Trends

The European insulin syringe market is poised for robust growth, driven by a confluence of escalating diabetes prevalence, advancements in insulin therapy, and an increasing focus on home-based diabetes management. The market size, estimated at approximately €1.5 Billion in the base year of 2025, is projected to expand at a compelling Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period of 2025-2033. This expansion is underpinned by the rising incidence of Type 1 and Type 2 diabetes across Europe, necessitating a consistent and reliable supply of insulin delivery devices. Technological disruptions are playing a pivotal role, with innovations focusing on finer gauge needles for enhanced patient comfort, improved plunger tip designs for accurate dosing, and sterile, single-use syringes to mitigate infection risks. Evolving consumer behaviors are also a significant catalyst; patients are increasingly empowered and seeking convenient, discreet, and user-friendly solutions for their daily insulin regimens. The growing awareness of the importance of proper injection techniques and adherence to treatment plans further fuels the demand for high-quality insulin syringes. The push towards digital health integration, though more prominent in advanced insulin delivery systems, also influences the perception and expectations for traditional syringes, encouraging manufacturers to explore ways to enhance the overall patient experience. Economic factors, including healthcare spending and reimbursement policies across European nations, also contribute to the market's trajectory. The ongoing research and development into novel insulin formulations and delivery methods will continue to create new avenues for market penetration and growth for insulin syringe manufacturers.

Key Markets & Segments Leading Insulin Syringe Market in Europe

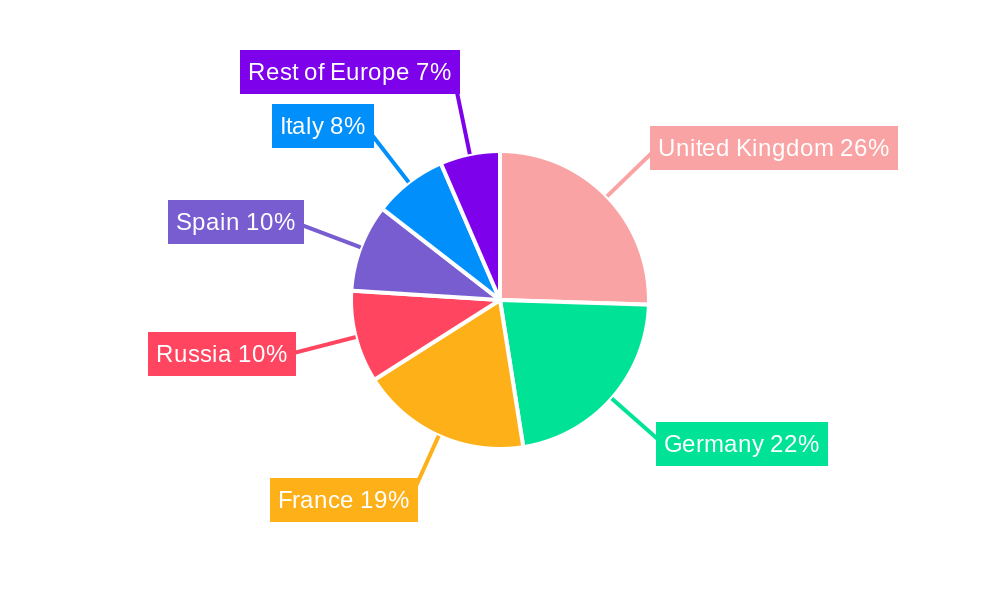

The Insulin Syringe: segment is a dominant force within the broader European diabetes care market, consistently leading in terms of volume and value. Among the key markets, Germany emerges as a frontrunner, demonstrating sustained leadership due to its robust healthcare infrastructure, high diabetes prevalence, and significant disposable income allocated to healthcare. Economic growth in Germany has translated into increased access to advanced medical devices, including high-quality insulin syringes. Furthermore, government initiatives focused on chronic disease management and preventative healthcare contribute to the strong demand. Other significant markets include the United Kingdom, France, and Italy, each with unique drivers.

- Drivers of Dominance in Key Markets:

- High Diabetes Prevalence: Nations with larger aging populations and higher incidences of lifestyle-related diseases exhibit a greater need for insulin therapy.

- Developed Healthcare Infrastructure: Well-established healthcare systems with comprehensive insurance coverage facilitate wider adoption of medical devices.

- Technological Adoption Rates: Countries with a higher propensity to embrace new medical technologies often drive demand for innovative insulin delivery solutions.

- Favorable Reimbursement Policies: Government and private insurance policies that adequately cover insulin syringes encourage patient access and market growth.

- Awareness and Education Initiatives: Public health campaigns promoting diabetes awareness and proper management techniques directly impact the demand for essential tools like insulin syringes.

The dominance of the Insulin Syringe: segment is further reinforced by its accessibility and cost-effectiveness compared to more advanced delivery systems, making it the preferred choice for a substantial portion of the diabetic population across Europe.

Insulin Syringe Market in Europe Product Developments

Recent product developments in the European insulin syringe market underscore a commitment to enhanced patient outcomes and user experience. Innovations are focusing on finer needle gauges (e.g., 30G, 31G, 32G) to minimize injection discomfort and reduce the risk of lipohypertrophy. Manufacturers are also concentrating on ergonomic designs for improved grip and control during administration, along with advanced plunger tips that ensure precise insulin dosage, minimizing wastage and maximizing therapeutic efficacy. The integration of advanced materials for syringe barrels and plungers aims to ensure compatibility with various insulin formulations and prevent leakage. The emphasis on sterile, single-use devices remains paramount to prevent cross-contamination and infections, a critical concern in diabetes management. These advancements collectively contribute to a safer, more comfortable, and more effective insulin delivery experience for patients.

Challenges in the Insulin Syringe Market in Europe Market

Despite positive growth prospects, the European insulin syringe market faces several challenges. Intense competition among established players and new entrants can lead to price erosion, impacting profit margins. Evolving regulatory landscapes, while ensuring safety, can also impose stringent compliance costs and lengthy approval processes for new products. The increasing adoption of alternative insulin delivery methods, such as insulin pens and smart insulin pumps, poses a significant threat as they offer enhanced convenience and data tracking capabilities, potentially displacing traditional syringes in certain patient segments. Furthermore, supply chain disruptions, exacerbated by geopolitical events and global health crises, can lead to stockouts and affect the availability of essential raw materials, impacting production timelines and costs. Navigating these complexities requires strategic foresight and adaptability from market participants.

Forces Driving Insulin Syringe Market in Europe Growth

The European insulin syringe market is propelled by a multifaceted array of growth drivers. The escalating global epidemic of diabetes, characterized by increasing rates of both Type 1 and Type 2 diabetes, remains the primary impetus, directly correlating with the demand for insulin therapy. Technological advancements in needle design, such as ultra-fine gauges and advanced lubrication, are significantly enhancing patient comfort, thereby boosting adoption. Furthermore, the growing awareness among healthcare providers and patients regarding the importance of accurate insulin dosing for optimal glycemic control is a critical factor. Government initiatives promoting diabetes management and preventative healthcare strategies across various European nations further support market expansion by increasing access to essential diabetes care products. The cost-effectiveness of insulin syringes compared to more advanced delivery systems also ensures their sustained relevance, particularly in cost-sensitive healthcare environments and among specific patient demographics.

Challenges in the Insulin Syringe Market in Europe Market

Long-term growth catalysts for the European insulin syringe market are rooted in continuous innovation and strategic market expansion. The development of syringes with integrated safety features, such as retractable needles, will address concerns regarding needlestick injuries and improve patient safety. Partnerships between insulin syringe manufacturers and pharmaceutical companies developing novel insulin formulations could lead to synergistic product development, creating tailored delivery solutions. Furthermore, exploring emerging markets within Europe that have a growing diabetic population but less established healthcare infrastructure presents a significant opportunity for market penetration. The potential for smart syringe technology integration, offering basic adherence tracking capabilities at a lower cost point than full smart pens, could also serve as a long-term growth catalyst by bridging the gap between traditional and advanced delivery systems.

Emerging Opportunities in Insulin Syringe Market in Europe

Emerging opportunities in the European insulin syringe market are shaped by evolving patient needs and technological advancements. The growing demand for patient-centric solutions presents an opportunity for manufacturers to develop syringes with enhanced ergonomic designs for easier handling by individuals with reduced dexterity, such as the elderly or those with neuropathy. The increasing focus on self-management of chronic diseases in Europe also creates a demand for user-friendly devices that empower patients. Furthermore, the integration of basic connectivity features, such as QR codes or NFC tags on syringe packaging, could enable simple adherence tracking through companion mobile applications, catering to a segment of the market seeking more data without the full cost of smart devices. Exploring novel materials that are more environmentally sustainable could also resonate with a growing segment of conscious consumers and healthcare providers.

Leading Players in the Insulin Syringe Market in Europe Sector

- HMD Healthcare Ltd

- Terumo Corporation

- B Braun Medical Inc

- Nipro Corporation

- Becton Dickinson

- Cardinal Health

Key Milestones in Insulin Syringe Market in Europe Industry

- November 2023: Terumo India launched a new Insulin Syringe designed to meet the daily injection needs of diabetic patients managing their condition. This launch signifies a commitment to improving diabetes care accessibility.

- October 2022: Becton, Dickinson, and Company (BD) and Biocorp announced an agreement to integrate Biocorp's Injay technology with BD's UltraSafe Plus Passive Needle Guard. This collaboration aims to leverage connected technology for tracking adherence to self-administered drug therapies, particularly beneficial for biopharmaceutical companies seeking to enhance patient outcomes with injectable drugs.

- October 2022: Terumo Pharmaceutical Solutions (TPS), a division of Terumo Corporation, introduced a ready-to-fill polymer syringe, the PLAJEX 2.25 mL with a tapered needle. This innovation is specifically developed for challenging biotech products requiring larger volume injections, demonstrating advancements in polymer syringe technology for specialized applications.

Strategic Outlook for Insulin Syringe Market in Europe Market

- November 2023: Terumo India launched a new Insulin Syringe designed to meet the daily injection needs of diabetic patients managing their condition. This launch signifies a commitment to improving diabetes care accessibility.

- October 2022: Becton, Dickinson, and Company (BD) and Biocorp announced an agreement to integrate Biocorp's Injay technology with BD's UltraSafe Plus Passive Needle Guard. This collaboration aims to leverage connected technology for tracking adherence to self-administered drug therapies, particularly beneficial for biopharmaceutical companies seeking to enhance patient outcomes with injectable drugs.

- October 2022: Terumo Pharmaceutical Solutions (TPS), a division of Terumo Corporation, introduced a ready-to-fill polymer syringe, the PLAJEX 2.25 mL with a tapered needle. This innovation is specifically developed for challenging biotech products requiring larger volume injections, demonstrating advancements in polymer syringe technology for specialized applications.

Strategic Outlook for Insulin Syringe Market in Europe Market

The strategic outlook for the European insulin syringe market is one of sustained growth and adaptation. Manufacturers must continue to invest in research and development to introduce syringes with finer gauges and improved ergonomic designs, directly addressing patient comfort and ease of use. The integration of cost-effective digital features, such as basic adherence tracking capabilities through companion apps, presents a significant opportunity to capture a broader market segment seeking enhanced monitoring without the premium cost of fully automated systems. Strategic partnerships with pharmaceutical companies and healthcare providers will be crucial for developing integrated solutions and gaining market access. Furthermore, focusing on supply chain resilience and sustainable manufacturing practices will be key to navigating global uncertainties and appealing to environmentally conscious stakeholders, ensuring long-term market leadership and profitability.

Insulin Syringe Market in Europe Segmentation

- 1. Insulin Syringe

Insulin Syringe Market in Europe Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

Insulin Syringe Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Burden of Chronic Diseases; Growing Biotech Industry and Research in Cell Biology

- 3.3. Market Restrains

- 3.3.1. High Cost of Cell Analysis; Complex Regulatory Scenario

- 3.4. Market Trends

- 3.4.1. Increasing diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. Germany

- 5.2.3. France

- 5.2.4. Russia

- 5.2.5. Spain

- 5.2.6. Italy

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 6. United Kingdom Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 6.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 7. Germany Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 7.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 8. France Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 8.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 9. Russia Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 9.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 10. Spain Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 10.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 11. Italy Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 11.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 12. Rest of Europe Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 12.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 13. Germany Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 14. France Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 15. Italy Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Insulin Syringe Market in Europe Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 HMD Healthcare Ltd

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Terumo Corporation

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 B Braun Medical Inc

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Nipro Corporation

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Becton Dickinson

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Cardinal Health*List Not Exhaustive 7 2 Company Share Analysi

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.1 HMD Healthcare Ltd

List of Figures

- Figure 1: Insulin Syringe Market in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Insulin Syringe Market in Europe Share (%) by Company 2024

List of Tables

- Table 1: Insulin Syringe Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 3: Insulin Syringe Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Insulin Syringe Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Insulin Syringe Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Insulin Syringe Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Insulin Syringe Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Insulin Syringe Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Insulin Syringe Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Insulin Syringe Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 13: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 15: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 17: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 19: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 21: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 23: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Insulin Syringe Market in Europe Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 25: Insulin Syringe Market in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insulin Syringe Market in Europe?

The projected CAGR is approximately 1.20%.

2. Which companies are prominent players in the Insulin Syringe Market in Europe?

Key companies in the market include HMD Healthcare Ltd, Terumo Corporation, B Braun Medical Inc, Nipro Corporation, Becton Dickinson, Cardinal Health*List Not Exhaustive 7 2 Company Share Analysi.

3. What are the main segments of the Insulin Syringe Market in Europe?

The market segments include Insulin Syringe.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Burden of Chronic Diseases; Growing Biotech Industry and Research in Cell Biology.

6. What are the notable trends driving market growth?

Increasing diabetes prevalence.

7. Are there any restraints impacting market growth?

High Cost of Cell Analysis; Complex Regulatory Scenario.

8. Can you provide examples of recent developments in the market?

November 2023: Terumo India launched new Insulin Syringe for diabetic patients who need daily injections to control their condition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insulin Syringe Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insulin Syringe Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insulin Syringe Market in Europe?

To stay informed about further developments, trends, and reports in the Insulin Syringe Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence