Key Insights

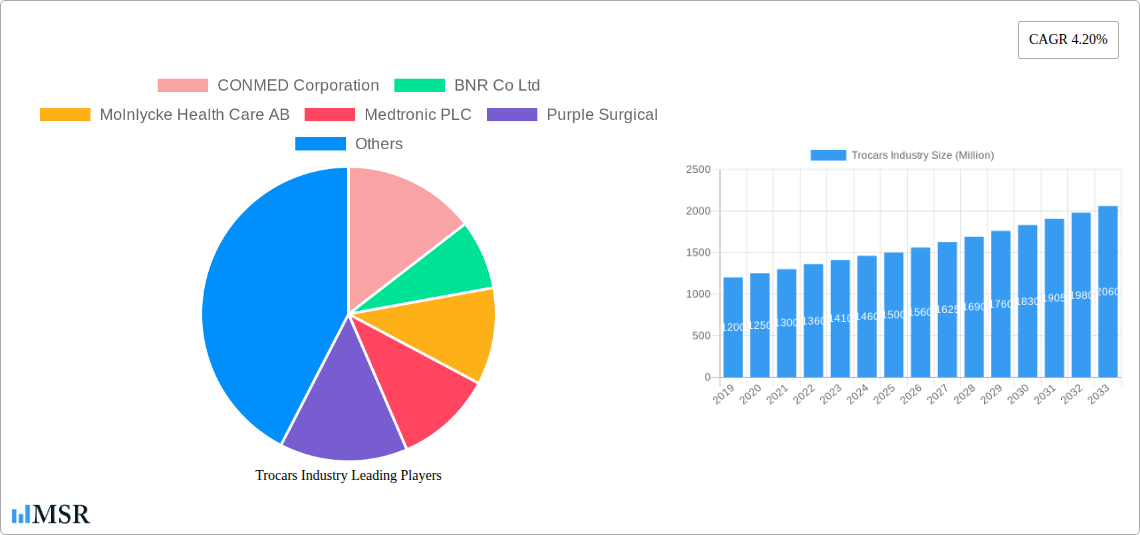

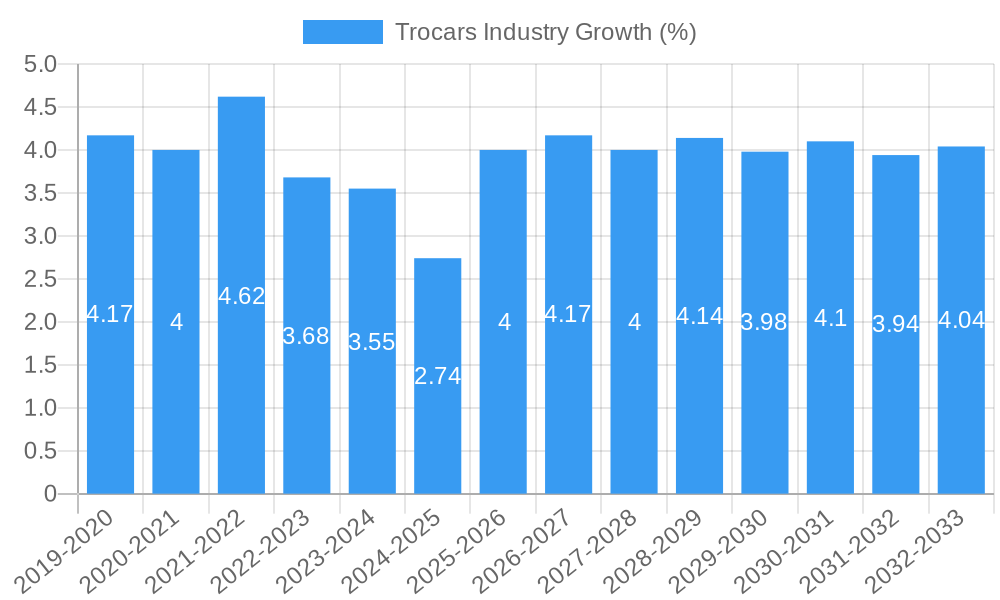

The global Trocars market is poised for significant expansion, projected to reach an estimated market size of USD 1,500 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.20% from 2019 to 2033. This growth is primarily fueled by the increasing prevalence of minimally invasive surgeries (MIS) across various medical disciplines, including general surgery, gynecology, and urology. Advances in trocar technology, leading to the development of bladeless and optical designs that enhance surgeon precision and patient safety, are significant drivers. The rising demand for disposable trocars, driven by infection control concerns and a preference for single-use devices in hospital settings, is also a key contributor to market value. Furthermore, the expanding healthcare infrastructure in emerging economies and the growing adoption of advanced surgical techniques are creating new avenues for market penetration.

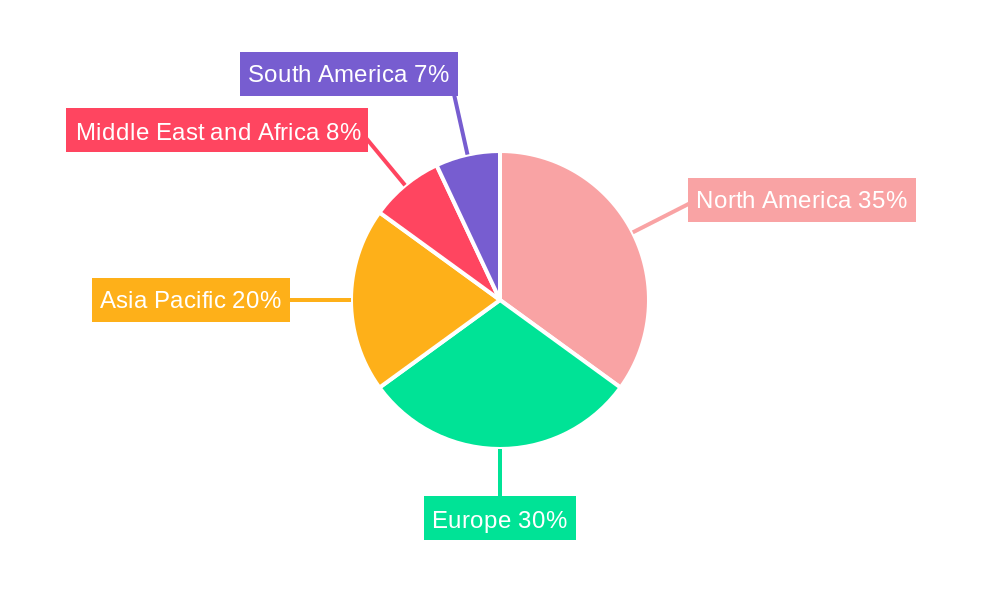

The market landscape is characterized by fierce competition among established players and emerging innovators. Key companies such as Medtronic PLC, Johnson & Johnson, and B. Braun Melsungen AG are at the forefront, continually investing in research and development to introduce next-generation trocar solutions. The market is segmented by product type, tip type, and application, offering diverse opportunities. While the market exhibits strong growth, certain restraints such as the high cost of reusable trocars and the potential for surgical site infections, despite advancements, need to be addressed. However, the overall trend points towards a sustained upward trajectory, driven by the undeniable benefits of MIS and the continuous evolution of surgical instrumentation. North America and Europe currently dominate the market share, owing to advanced healthcare systems and early adoption of MIS, but the Asia Pacific region is expected to witness the fastest growth due to increasing healthcare expenditure and a burgeoning patient population undergoing surgical procedures.

Trocars Industry: Comprehensive Market Analysis Report (2019-2033)

This in-depth report provides a detailed analysis of the global Trocars Industry, encompassing market dynamics, key trends, competitive landscape, and future outlook. With an estimated market size of $2,500 Million in the base year 2025 and a projected Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period (2025-2033), the trocars market is poised for significant expansion. This report is essential for medical device manufacturers, surgical instrument suppliers, distributors, investors, and healthcare professionals seeking to understand the intricate workings of this vital surgical segment.

Trocars Industry Market Concentration & Dynamics

The Trocars Industry exhibits a moderate to high market concentration, with a mix of large multinational corporations and specialized players driving innovation and competition. Key players like Johnson & Johnson, Medtronic PLC, and B Braun Melsungen AG hold substantial market shares, benefiting from extensive product portfolios, robust R&D capabilities, and established distribution networks. However, a growing number of agile companies, including Purple Surgical and Genicon Inc., are carving out niches through specialized product offerings and competitive pricing. The innovation ecosystem is characterized by a continuous pursuit of less invasive surgical techniques, leading to advancements in bladeless and optical trocar designs. Regulatory frameworks, governed by bodies like the FDA and EMA, are stringent, emphasizing patient safety and product efficacy, which influences product development cycles. Substitute products, though limited in direct replacement for basic trocar functions, are emerging in the form of advanced port systems and single-use integrated devices that aim to reduce procedure time and complication rates. End-user trends are heavily influenced by the demand for minimally invasive surgery (MIS), driven by improved patient outcomes, shorter recovery times, and reduced healthcare costs. Mergers and acquisitions (M&A) activities, with an estimated 15 M&A deals in the historical period (2019-2024), have played a crucial role in consolidating market share and expanding geographical reach.

Trocars Industry Industry Insights & Trends

The Trocars Industry is experiencing robust growth, fueled by several interconnected factors. The increasing global prevalence of chronic diseases and the subsequent rise in surgical procedures, particularly in general surgery, gynaecological surgery, and urological surgery, are primary market growth drivers. The market size was estimated at $2,100 Million in 2019 and is projected to reach $3,800 Million by 2033, growing at a CAGR of 6.8% during the forecast period. Technological disruptions are central to the market's evolution. The shift towards single-use, or disposable trocars, is a significant trend, driven by concerns regarding surgical site infections and the associated costs of reprocessing reusable instruments. Innovations in bladeless and optical trocar designs are enhancing surgeon visualization and precision, thereby minimizing tissue trauma and improving patient safety. Evolving consumer behaviors, in this context, refer to the increasing demand from hospitals and surgical centers for cost-effective, user-friendly, and technologically advanced surgical tools that contribute to better patient outcomes and operational efficiency. The development of advanced materials and ergonomic designs further contributes to surgeon comfort and procedural success. The growing adoption of minimally invasive surgical techniques across various specialties is creating a sustained demand for sophisticated trocar systems.

Key Markets & Segments Leading Trocars Industry

The global Trocars Industry is segmented across various product types, tip types, and applications, with a significant concentration of market leadership.

Dominant Regions and Countries:

- North America currently leads the market, driven by a high adoption rate of minimally invasive surgical procedures, advanced healthcare infrastructure, and substantial R&D investments. The United States, in particular, represents a significant market due to its large patient population and the presence of leading medical device manufacturers.

- Europe follows closely, with countries like Germany, the UK, and France showing strong demand for advanced surgical instruments, supported by well-established healthcare systems and increasing awareness of the benefits of MIS.

- Asia Pacific is emerging as a high-growth region, propelled by rapid economic development, expanding healthcare access, and a growing number of skilled surgeons adopting new technologies.

Product Type Dominance:

- Disposable Trocars: This segment is experiencing substantial growth and is projected to dominate the market.

- Drivers: Enhanced patient safety, reduced risk of surgical site infections, elimination of reprocessing costs, and convenience for surgical teams.

- Market Dominance Analysis: The increasing preference for single-use devices in sterile environments, coupled with the rising number of laparoscopic procedures, solidifies the dominance of disposable trocars. Manufacturers are focusing on offering cost-effective disposable solutions without compromising on performance.

- Reusable Trocars: While still significant, this segment's growth is relatively slower compared to disposables.

- Drivers: Lower initial investment costs for healthcare facilities, established protocols for reprocessing.

- Market Dominance Analysis: Reusable trocars remain a viable option for certain procedures and in regions where cost considerations are paramount. However, the trend towards disposables is gradually impacting their market share.

Tip Type Dominance:

- Bladeless Trocars: These are gaining significant traction and are expected to lead the market.

- Drivers: Reduced risk of internal organ injury during insertion, leading to safer procedures.

- Market Dominance Analysis: The emphasis on patient safety and minimizing complications in MIS procedures strongly favors the adoption of bladeless trocar technology.

- Optical Trocars: These offer improved visualization during insertion.

- Drivers: Enhanced precision and reduced risk of blind insertion injuries.

- Market Dominance Analysis: Their ability to provide a clear view of the abdominal wall layers during insertion makes them highly sought after for complex procedures.

- Blunt Trocars: Known for their safety profile.

- Drivers: Lower risk of accidental tissue damage compared to bladed counterparts.

- Market Dominance Analysis: Preferred in situations where minimizing trauma is a primary concern.

- Bladed Trocars: While historically dominant, their market share is gradually decreasing.

- Drivers: Lower cost of manufacturing, established familiarity among some surgeons.

- Market Dominance Analysis: Their use is becoming more specialized due to the inherent risks associated with bladed instruments.

Application Dominance:

- General Surgery: This remains the largest application segment for trocars.

- Drivers: High volume of laparoscopic procedures for conditions like appendicitis, cholecystectomy, and hernia repair.

- Market Dominance Analysis: The widespread applicability of MIS techniques in general surgery ensures a consistent and growing demand for trocars.

- Gynaecological Surgery: This segment is a significant contributor and shows strong growth.

- Drivers: Increasing adoption of laparoscopic hysterectomies, myomectomies, and other procedures.

- Market Dominance Analysis: MIS offers faster recovery times and reduced scarring, making it a preferred choice for gynaecological interventions.

- Urological Surgery: A rapidly expanding segment.

- Drivers: Growing use of laparoscopic and robotic-assisted procedures for conditions such as prostatectomy and nephrectomy.

- Market Dominance Analysis: The precision offered by advanced trocar systems in complex urological surgeries is driving their adoption.

- Other Surgeries: This includes specialties like cardiothoracic, orthopedic, and bariatric surgery, which are also witnessing increased use of trocars.

Trocars Industry Product Developments

Product innovation in the trocars industry is primarily focused on enhancing safety, efficacy, and user experience. Companies are investing heavily in R&D to develop trocars with advanced features such as improved sealing mechanisms to maintain pneumoperitoneum, enhanced visualization capabilities, and ergonomic designs for surgeon comfort. The development of specialized trocars for robotic-assisted surgery, which require precise maneuverability and compatibility with robotic instruments, is a key trend. Furthermore, the integration of antimicrobial coatings and novel materials aims to further reduce the risk of infection and improve biocompatibility. The market is witnessing a surge in the introduction of intelligent trocars with integrated sensors or feedback systems, offering real-time data to surgeons.

Challenges in the Trocars Industry Market

The Trocars Industry faces several challenges that could impact its growth trajectory. Stringent regulatory approvals and the associated lengthy timelines for new product launches can hinder innovation. Intense price competition, particularly in the disposable trocar segment, puts pressure on profit margins for manufacturers. Supply chain disruptions, as evidenced by recent global events, can impact the availability of raw materials and finished goods, potentially leading to shortages and increased costs. The high initial cost of adopting advanced robotic surgery systems, which often utilize specialized trocars, can limit adoption in resource-constrained healthcare settings. Lastly, surgeon training and familiarity with new trocar technologies can pose a barrier to widespread adoption.

Forces Driving Trocars Industry Growth

Several powerful forces are propelling the Trocars Industry forward. The increasing demand for minimally invasive surgical (MIS) procedures is a primary catalyst, driven by patient preference for faster recovery times, reduced pain, and minimal scarring. Technological advancements in trocar design, including the development of bladeless, optical, and single-use systems, are enhancing surgical precision and safety. The growing global burden of chronic diseases and an aging population are leading to a higher incidence of surgical interventions. Favorable reimbursement policies for MIS procedures in many developed countries also encourage their adoption. Furthermore, government initiatives promoting healthcare access and technological adoption in emerging economies are opening up new market opportunities.

Challenges in the Trocars Industry Market

Long-term growth in the Trocars Industry will be shaped by sustained innovation and strategic market navigation. The continuous evolution of surgical techniques, particularly in areas like single-port access surgery and natural orifice transluminal endoscopic surgery (NOTES), will necessitate the development of even more advanced and specialized trocar systems. Strategic partnerships and collaborations between trocar manufacturers, robotic surgery platform providers, and academic institutions will be crucial for driving synergistic innovation. Market expansion into underserved regions with improving healthcare infrastructure presents significant long-term growth potential. Furthermore, the development of smart or connected trocars that can provide real-time data feedback to surgeons and integrate with other surgical technologies will be a key driver of future growth.

Emerging Opportunities in Trocars Industry

The Trocars Industry is ripe with emerging opportunities. The increasing adoption of robotic-assisted surgery is creating a demand for specialized, high-precision trocars. The growing market for single-use surgical devices presents a substantial opportunity for manufacturers focusing on cost-effective and sterile disposable trocar solutions. The expansion of healthcare infrastructure and surgical capabilities in emerging economies like India and China offers significant untapped market potential. Furthermore, the development of miniaturized trocars for pediatric surgery and novel trocar designs for specialized laparoscopic procedures in fields such as neurosurgery and cardiac surgery represent niche but promising avenues for growth. The increasing focus on patient safety and infection prevention will continue to drive demand for advanced and sterile trocar solutions.

Leading Players in the Trocars Industry Sector

- CONMED Corporation

- BNR Co Ltd

- Molnlycke Health Care AB

- Medtronic PLC

- Purple Surgical

- Conmed Corp

- Genicon Inc.

- Johnson & Johnson

- B Braun Melsungen AG

- Teleflex Incorporated

- LaproSurge

- Ackermann Instrumente GmbH

- The Cooper Companies Inc

Key Milestones in Trocars Industry Industry

- April 2021: DORC launched the new EVA AVETA trocar cannula system, featuring an improved flow rate, a smaller working size, and a more stable intra-operative IOP, enhancing procedural efficiency and patient safety.

- July 2020: Oertli Instrumente AG introduced a single-packed trocar with an inbuilt lock membrane, effectively preventing BSS, air, and oil leakage for stable intra-operative IOP. The Caliburn trocar system offered enhanced safety and comfort through strong holding power and optimal shaft length, with a flexible infusion tube that could be repositioned at any point during surgery.

Strategic Outlook for Trocars Industry Market

The strategic outlook for the Trocars Industry remains exceptionally positive, driven by an unwavering demand for minimally invasive surgical solutions. The market is expected to witness continued growth through a combination of technological innovation, market expansion, and strategic collaborations. Focus will remain on developing next-generation bladeless and optical trocars that offer superior visualization and tissue protection. The increasing integration of trocars with robotic surgery platforms will be a key growth accelerator. Furthermore, strategic penetration into emerging markets, coupled with the development of cost-effective disposable solutions, will be crucial for capturing market share. Companies that can effectively address the evolving needs of surgeons, focusing on safety, efficiency, and patient outcomes, will be well-positioned for sustained success in this dynamic market. The estimated market size of $2,500 Million in the base year 2025, with a projected CAGR of 7.5%, underscores the significant future potential.

Trocars Industry Segmentation

-

1. Product Type

- 1.1. Disposable Trocars

- 1.2. Reusable Trocars

-

2. Tip Type

- 2.1. Bladeless Trocars

- 2.2. Optical Trocars

- 2.3. Blunt Trocars

- 2.4. Bladed Trocars

-

3. Application

- 3.1. General Surgery

- 3.2. Gynaecological Surgery

- 3.3. Urological Surgery

- 3.4. Other Surgeries

Trocars Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Trocars Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Minimally-Invasive Surgery; Rising Prevalence of Chronic Diseases and Obesity; Technological Advancements in the Field of Laparoscopy

- 3.3. Market Restrains

- 3.3.1. Complications Associated With the Use of Trocars

- 3.4. Market Trends

- 3.4.1. Urological Surgery is Expected to Exhibit Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Disposable Trocars

- 5.1.2. Reusable Trocars

- 5.2. Market Analysis, Insights and Forecast - by Tip Type

- 5.2.1. Bladeless Trocars

- 5.2.2. Optical Trocars

- 5.2.3. Blunt Trocars

- 5.2.4. Bladed Trocars

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. General Surgery

- 5.3.2. Gynaecological Surgery

- 5.3.3. Urological Surgery

- 5.3.4. Other Surgeries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Disposable Trocars

- 6.1.2. Reusable Trocars

- 6.2. Market Analysis, Insights and Forecast - by Tip Type

- 6.2.1. Bladeless Trocars

- 6.2.2. Optical Trocars

- 6.2.3. Blunt Trocars

- 6.2.4. Bladed Trocars

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. General Surgery

- 6.3.2. Gynaecological Surgery

- 6.3.3. Urological Surgery

- 6.3.4. Other Surgeries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Disposable Trocars

- 7.1.2. Reusable Trocars

- 7.2. Market Analysis, Insights and Forecast - by Tip Type

- 7.2.1. Bladeless Trocars

- 7.2.2. Optical Trocars

- 7.2.3. Blunt Trocars

- 7.2.4. Bladed Trocars

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. General Surgery

- 7.3.2. Gynaecological Surgery

- 7.3.3. Urological Surgery

- 7.3.4. Other Surgeries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Disposable Trocars

- 8.1.2. Reusable Trocars

- 8.2. Market Analysis, Insights and Forecast - by Tip Type

- 8.2.1. Bladeless Trocars

- 8.2.2. Optical Trocars

- 8.2.3. Blunt Trocars

- 8.2.4. Bladed Trocars

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. General Surgery

- 8.3.2. Gynaecological Surgery

- 8.3.3. Urological Surgery

- 8.3.4. Other Surgeries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Disposable Trocars

- 9.1.2. Reusable Trocars

- 9.2. Market Analysis, Insights and Forecast - by Tip Type

- 9.2.1. Bladeless Trocars

- 9.2.2. Optical Trocars

- 9.2.3. Blunt Trocars

- 9.2.4. Bladed Trocars

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. General Surgery

- 9.3.2. Gynaecological Surgery

- 9.3.3. Urological Surgery

- 9.3.4. Other Surgeries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Disposable Trocars

- 10.1.2. Reusable Trocars

- 10.2. Market Analysis, Insights and Forecast - by Tip Type

- 10.2.1. Bladeless Trocars

- 10.2.2. Optical Trocars

- 10.2.3. Blunt Trocars

- 10.2.4. Bladed Trocars

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. General Surgery

- 10.3.2. Gynaecological Surgery

- 10.3.3. Urological Surgery

- 10.3.4. Other Surgeries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Trocars Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 CONMED Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 BNR Co Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Molnlycke Health Care AB

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Medtronic PLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Purple Surgical

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Conmed Corp *List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Genicon Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Johnson & Johnson

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 B Braun Melsungen AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Teleflex Incorporated

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 LaproSurge

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Ackermann Instrumente GmbH

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 The Cooper Companies Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 CONMED Corporation

List of Figures

- Figure 1: Global Trocars Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Trocars Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Trocars Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Trocars Industry Revenue (Million), by Tip Type 2024 & 2032

- Figure 15: North America Trocars Industry Revenue Share (%), by Tip Type 2024 & 2032

- Figure 16: North America Trocars Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Trocars Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Trocars Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe Trocars Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe Trocars Industry Revenue (Million), by Tip Type 2024 & 2032

- Figure 23: Europe Trocars Industry Revenue Share (%), by Tip Type 2024 & 2032

- Figure 24: Europe Trocars Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Trocars Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Trocars Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Trocars Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Trocars Industry Revenue (Million), by Tip Type 2024 & 2032

- Figure 31: Asia Pacific Trocars Industry Revenue Share (%), by Tip Type 2024 & 2032

- Figure 32: Asia Pacific Trocars Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Trocars Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Trocars Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East and Africa Trocars Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East and Africa Trocars Industry Revenue (Million), by Tip Type 2024 & 2032

- Figure 39: Middle East and Africa Trocars Industry Revenue Share (%), by Tip Type 2024 & 2032

- Figure 40: Middle East and Africa Trocars Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Middle East and Africa Trocars Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East and Africa Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Trocars Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Trocars Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 45: South America Trocars Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: South America Trocars Industry Revenue (Million), by Tip Type 2024 & 2032

- Figure 47: South America Trocars Industry Revenue Share (%), by Tip Type 2024 & 2032

- Figure 48: South America Trocars Industry Revenue (Million), by Application 2024 & 2032

- Figure 49: South America Trocars Industry Revenue Share (%), by Application 2024 & 2032

- Figure 50: South America Trocars Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Trocars Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Trocars Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Trocars Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Trocars Industry Revenue Million Forecast, by Tip Type 2019 & 2032

- Table 4: Global Trocars Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Trocars Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Trocars Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 33: Global Trocars Industry Revenue Million Forecast, by Tip Type 2019 & 2032

- Table 34: Global Trocars Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Trocars Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Trocars Industry Revenue Million Forecast, by Tip Type 2019 & 2032

- Table 41: Global Trocars Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Trocars Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Global Trocars Industry Revenue Million Forecast, by Tip Type 2019 & 2032

- Table 51: Global Trocars Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Trocars Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 60: Global Trocars Industry Revenue Million Forecast, by Tip Type 2019 & 2032

- Table 61: Global Trocars Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Trocars Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 67: Global Trocars Industry Revenue Million Forecast, by Tip Type 2019 & 2032

- Table 68: Global Trocars Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 69: Global Trocars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Trocars Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Trocars Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Trocars Industry?

Key companies in the market include CONMED Corporation, BNR Co Ltd, Molnlycke Health Care AB, Medtronic PLC, Purple Surgical, Conmed Corp *List Not Exhaustive, Genicon Inc, Johnson & Johnson, B Braun Melsungen AG, Teleflex Incorporated, LaproSurge, Ackermann Instrumente GmbH, The Cooper Companies Inc.

3. What are the main segments of the Trocars Industry?

The market segments include Product Type, Tip Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Minimally-Invasive Surgery; Rising Prevalence of Chronic Diseases and Obesity; Technological Advancements in the Field of Laparoscopy.

6. What are the notable trends driving market growth?

Urological Surgery is Expected to Exhibit Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Complications Associated With the Use of Trocars.

8. Can you provide examples of recent developments in the market?

In April 2021, DORC launched a new EVA AVETA trocar cannula system with an improved flow rate, a smaller working size, and a more stable intra-operative IOP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Trocars Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Trocars Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Trocars Industry?

To stay informed about further developments, trends, and reports in the Trocars Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence