Key Insights

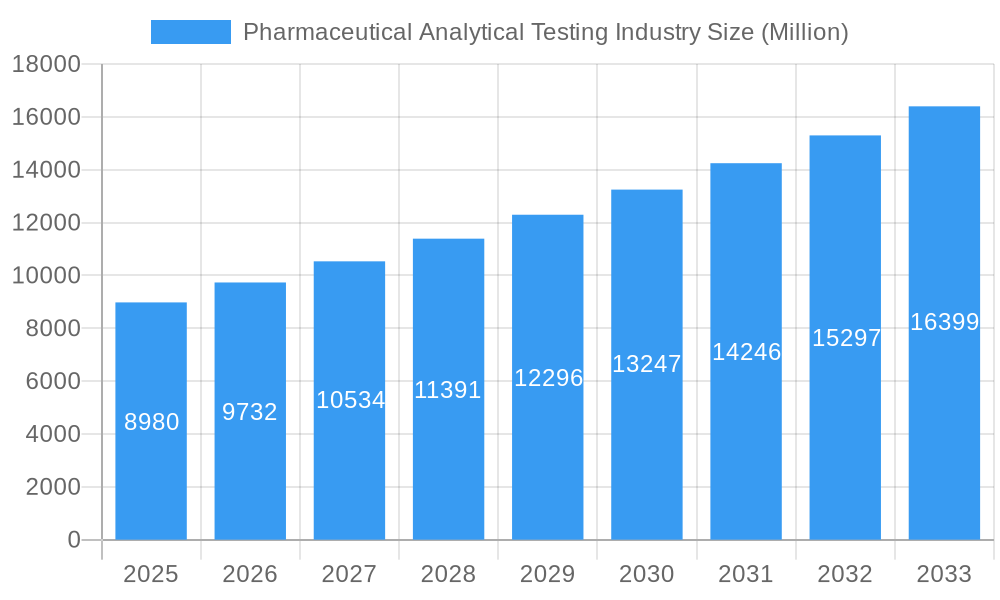

The Pharmaceutical Analytical Testing Industry is poised for significant expansion, currently valued at approximately \$8.98 billion in 2025. This robust growth trajectory is underpinned by a projected Compound Annual Growth Rate (CAGR) of 8.41% from 2025 to 2033, indicating a dynamic and expanding market. The primary drivers fueling this expansion include the increasing complexity of drug development, stringent regulatory requirements worldwide, and the growing demand for high-quality pharmaceutical products. The industry's vital role in ensuring drug safety, efficacy, and quality throughout the entire lifecycle, from raw material testing to finished product release and post-market surveillance, positions it as an indispensable component of the global healthcare ecosystem. Furthermore, the continuous innovation in analytical techniques and technologies, such as advanced chromatography, mass spectrometry, and spectroscopy, contributes to enhanced accuracy, efficiency, and sensitivity in testing, thereby supporting the development of novel therapeutics and biosimilars.

Pharmaceutical Analytical Testing Industry Market Size (In Billion)

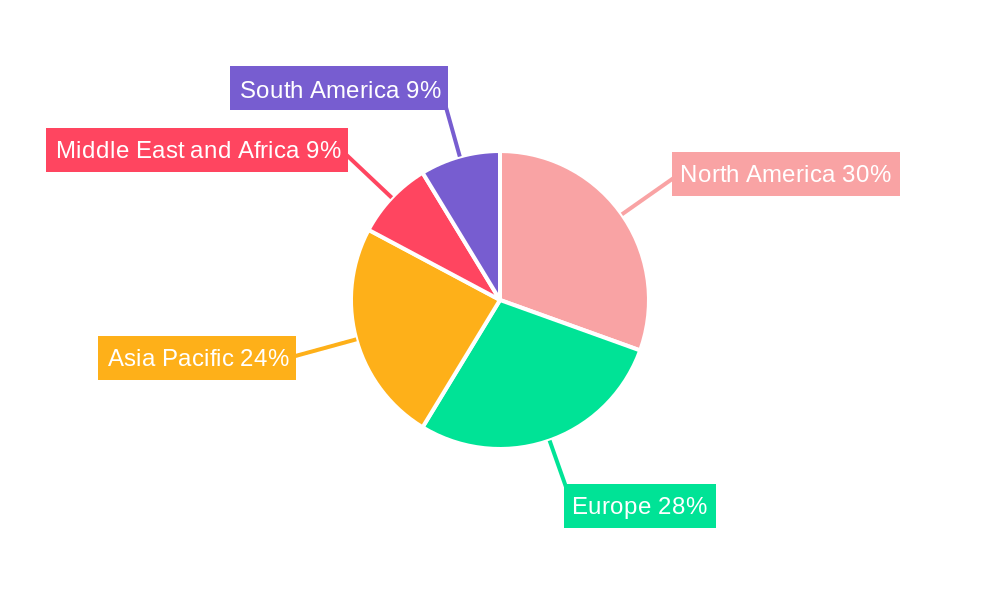

The market segmentation reveals a diverse landscape with Bioanalytical Testing, Method Development & Validation, and Stability Testing emerging as key service areas. The increasing focus on personalized medicine and biologics necessitates sophisticated bioanalytical capabilities, while regulatory mandates drive the demand for rigorous method development and validation. Stability testing remains critical for ensuring product shelf-life and integrity, directly impacting patient safety. Geographically, North America and Europe are expected to maintain their dominant market positions, driven by established pharmaceutical hubs, strong regulatory frameworks, and significant R&D investments. However, the Asia Pacific region is anticipated to witness the fastest growth, fueled by expanding pharmaceutical manufacturing capabilities, a burgeoning generic drug market, and increasing healthcare expenditure. Restraints such as high operational costs and the need for skilled personnel are present, but the overarching demand for drug safety and quality, coupled with ongoing technological advancements, is set to propel the market forward.

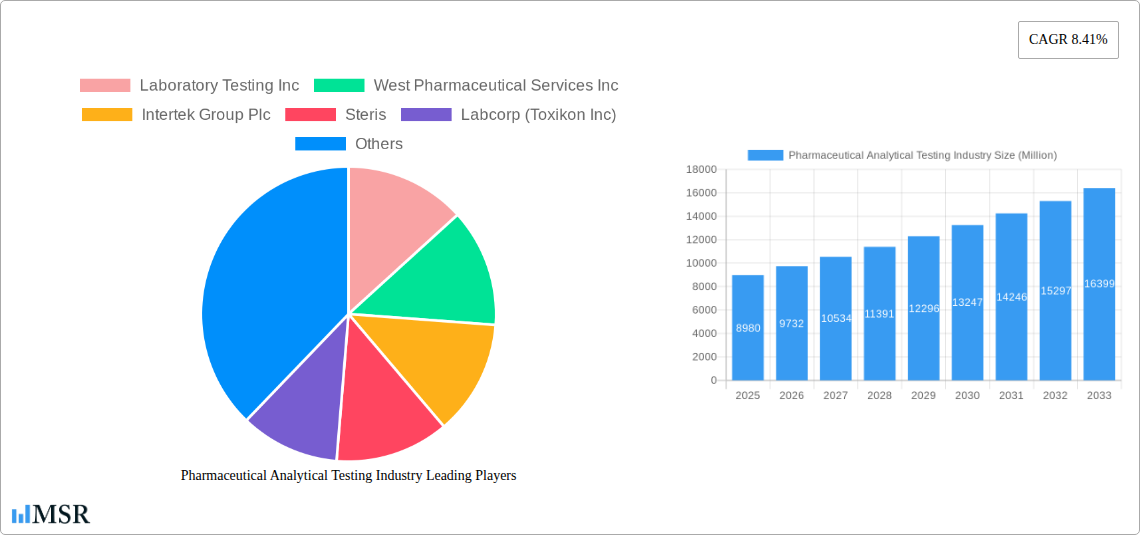

Pharmaceutical Analytical Testing Industry Company Market Share

Pharmaceutical Analytical Testing Industry Market Concentration & Dynamics

This comprehensive report delves into the intricate market concentration and dynamics of the Pharmaceutical Analytical Testing Industry. With a projected market size of USD XX Million by 2033, the industry is characterized by a moderate level of concentration, with key players such as Laboratory Testing Inc, West Pharmaceutical Services Inc, Intertek Group Plc, Steris, Labcorp (Toxikon Inc), Eurofins Scientific, SGS SA, Boston Analytical, and Pace Analytical Services holding significant market share. The innovation ecosystem thrives on continuous R&D investments, driving advancements in analytical methodologies and technologies. Robust regulatory frameworks, including those from the FDA and EMA, dictate stringent quality control and compliance standards, influencing market entry and operational strategies. The report analyzes the impact of substitute products and evolving end-user trends, particularly the increasing demand for personalized medicine and biologics, which necessitate sophisticated analytical solutions. Furthermore, a thorough examination of Merger & Acquisition (M&A) activities, with XX reported deals during the historical period, reveals strategic consolidations and partnerships aimed at expanding service portfolios and geographical reach. This section provides actionable insights into the competitive landscape, key strategic alliances, and the overarching influence of regulatory bodies on market behavior.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Ecosystem: Driven by R&D and technological advancements.

- Regulatory Frameworks: Strict compliance with FDA, EMA, and other global health authorities.

- Substitute Products: Advancements in in-line and at-line testing methods as potential substitutes for traditional laboratory testing.

- End-User Trends: Growing demand for biologics, gene therapies, and personalized medicine.

- M&A Activities: XX reported deals in the historical period, indicating consolidation and expansion strategies.

Pharmaceutical Analytical Testing Industry Industry Insights & Trends

The Pharmaceutical Analytical Testing Industry is poised for significant growth, driven by a confluence of factors and exhibiting robust market expansion. The global market size for pharmaceutical analytical testing is estimated at USD XX Million in the base year 2025 and is projected to reach an impressive USD XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This substantial growth is fueled by an escalating demand for stringent quality control and assurance throughout the drug development lifecycle, from early-stage research to post-market surveillance. The increasing complexity of pharmaceutical products, including novel biologics, biosimilars, and advanced drug delivery systems, necessitates sophisticated and highly specialized analytical testing services. Furthermore, the growing pipeline of drug candidates and the continuous need for regulatory compliance worldwide are paramount drivers. Technological disruptions are revolutionizing the sector, with the adoption of advanced analytical techniques such as high-throughput screening, mass spectrometry, genomics, proteomics, and sophisticated chromatography methods enabling faster, more accurate, and comprehensive analysis. The integration of artificial intelligence (AI) and machine learning (ML) in data analysis and predictive modeling is also emerging as a transformative trend, optimizing testing processes and accelerating drug discovery. Evolving consumer behaviors, characterized by a heightened awareness of drug safety and efficacy, further underscore the critical role of reliable analytical testing. The expansion of the global pharmaceutical market, particularly in emerging economies, coupled with increasing healthcare expenditure, directly translates into a higher demand for analytical services. The pharmaceutical outsourcing trend, where companies increasingly rely on specialized third-party providers for analytical testing, also contributes significantly to market expansion. The dynamic nature of the industry, marked by continuous innovation and a proactive approach to regulatory changes, ensures its sustained growth trajectory.

Key Markets & Segments Leading Pharmaceutical Analytical Testing Industry

The Pharmaceutical Analytical Testing Industry is dominated by several key markets and segments, each contributing significantly to its overall growth and evolution. North America currently holds the leading position, driven by its well-established pharmaceutical R&D infrastructure, high healthcare spending, and a robust presence of major pharmaceutical and biotechnology companies. The region's stringent regulatory environment, enforced by the FDA, necessitates comprehensive analytical testing, further bolstering market demand. Asia Pacific is emerging as a rapidly growing market, propelled by expanding pharmaceutical manufacturing hubs in countries like China and India, increasing investments in drug discovery and development, and a growing generic drug market.

Within the service type segmentation, Bioanalytical Testing is a cornerstone, encompassing the analysis of biological samples for drug concentration, metabolism, and pharmacokinetic studies. This segment is critical for the development of biologics and complex therapies, experiencing robust growth due to the expanding pipeline of biopharmaceutical products.

Method Development & Validation represents another pivotal segment. This involves creating and confirming the reliability and accuracy of analytical methods used for testing drug substances and products. The increasing complexity of new molecular entities and the constant need for regulatory compliance ensure sustained demand for these specialized services.

Stability Testing is crucial for determining the shelf-life and optimal storage conditions for pharmaceutical products. With global supply chains becoming more complex and the demand for extended shelf-life products rising, this segment is experiencing consistent growth.

Drug Substances Testing focuses on the analysis of raw materials and active pharmaceutical ingredients (APIs). Ensuring the purity, potency, and quality of these foundational components is paramount, making this a consistently high-demand service.

Other Service Types, encompassing areas like extractables and leachables testing, impurity profiling, and particulate matter analysis, are also critical. These specialized services are gaining prominence with the introduction of novel drug delivery systems and parenteral formulations.

- North America Dominance: Strong R&D, high healthcare spending, strict FDA regulations.

- Economic Growth: Sustained investment in pharmaceutical innovation.

- Infrastructure: Advanced analytical laboratories and skilled workforce.

- Regulatory Landscape: Proactive adoption of new analytical technologies to meet regulatory demands.

- Asia Pacific Growth: Expanding manufacturing hubs, increasing R&D investments, growing generic drug market.

- Manufacturing Advancements: Government initiatives promoting pharmaceutical production.

- Cost-Effectiveness: Attractive outsourcing destination for analytical services.

- Emerging Markets: Increasing access to healthcare and drug consumption.

Pharmaceutical Analytical Testing Industry Product Developments

Recent product developments in the Pharmaceutical Analytical Testing Industry highlight a strong focus on enhancing efficiency, accuracy, and the scope of analytical capabilities. Innovations are centered around advanced spectroscopic techniques, high-resolution mass spectrometry, and automated sample preparation systems, enabling faster turnaround times and the detection of trace impurities. The development of novel software solutions integrated with AI and machine learning algorithms is revolutionizing data interpretation, predictive analytics, and method optimization. Furthermore, there is a growing emphasis on portable and point-of-care analytical devices, facilitating real-time monitoring and in-field testing. These advancements not only improve the quality and safety of pharmaceutical products but also streamline the drug development process, offering a significant competitive edge to companies that adopt them.

Challenges in the Pharmaceutical Analytical Testing Industry Market

The Pharmaceutical Analytical Testing Industry faces several significant challenges that impact its growth and operational efficiency. These include increasingly stringent and evolving regulatory requirements across different global markets, demanding continuous adaptation and investment in compliance. The high cost of advanced analytical instrumentation and specialized personnel can be a substantial barrier, particularly for smaller contract research organizations (CROs) and emerging companies. Supply chain disruptions for critical reagents and consumables can lead to delays and increased operational costs. Moreover, intense competition among established players and new entrants drives down profit margins, necessitating innovative business models and service offerings.

Forces Driving Pharmaceutical Analytical Testing Industry Growth

Several potent forces are driving the substantial growth of the Pharmaceutical Analytical Testing Industry. The escalating complexity of new drug molecules, particularly biologics and advanced therapies, necessitates highly sophisticated and specialized analytical testing. A robust global pipeline of pharmaceutical research and development activities, coupled with increasing investments in drug discovery and clinical trials, directly translates into a higher demand for analytical services. Stringent regulatory mandates worldwide, ensuring drug safety, efficacy, and quality, are a fundamental growth catalyst, requiring comprehensive testing at every stage of the drug lifecycle. The growing trend of pharmaceutical outsourcing, where companies delegate analytical tasks to specialized third-party providers to reduce costs and enhance focus on core competencies, also fuels market expansion.

Challenges in the Pharmaceutical Analytical Testing Industry Market

Long-term growth catalysts in the Pharmaceutical Analytical Testing Industry are intrinsically linked to ongoing technological advancements and strategic market expansions. The continuous evolution of analytical instrumentation, coupled with the integration of digital technologies like AI and IoT for data management and predictive analytics, offers immense potential for improved efficiency and insight generation. Strategic partnerships and collaborations between analytical service providers, pharmaceutical companies, and academic institutions foster innovation and accelerate the development of cutting-edge testing solutions. Furthermore, the expanding global pharmaceutical market, particularly in emerging economies with growing healthcare needs and increasing access to medicines, presents significant opportunities for market penetration and service diversification. The development of specialized testing services for niche therapeutic areas, such as rare diseases and personalized medicine, will also be a key growth driver.

Emerging Opportunities in Pharmaceutical Analytical Testing Industry

Emerging opportunities within the Pharmaceutical Analytical Testing Industry are ripe for exploitation by forward-thinking stakeholders. The burgeoning field of cell and gene therapies presents a significant demand for specialized analytical techniques to characterize and ensure the safety and efficacy of these complex biological products. The growing focus on real-world evidence (RWE) generation necessitates advanced analytical approaches to interpret large datasets from diverse sources, including patient registries and electronic health records. The increasing regulatory scrutiny on impurities, including nitrosamines and genotoxic impurities, is driving demand for highly sensitive and specific analytical methods. Furthermore, the expansion of the biologics market, including biosimilars and novel antibody-based drugs, requires specialized bioanalytical and characterization services. The digitalization of laboratory operations, through the adoption of LIMS, AI-powered data analysis, and automation, presents an opportunity to enhance efficiency, reduce costs, and improve the overall customer experience.

Leading Players in the Pharmaceutical Analytical Testing Industry Sector

- Laboratory Testing Inc

- West Pharmaceutical Services Inc

- Intertek Group Plc

- Steris

- Labcorp (Toxikon Inc)

- Eurofins Scientific

- SGS SA

- Boston Analytical

- Pace Analytical Services

Key Milestones in Pharmaceutical Analytical Testing Industry Industry

- March 2024: LGM Pharma invested over USD 2 million to expand its analytical testing services and include drug delivery suppository manufacturing capabilities by 50% in its facility in Rosenburg, Texas, demonstrating strategic investment in expanding integrated service offerings.

- January 2024: Kindeva Drug Delivery increased its analytical service capabilities by launching a new global business unit, which provides integrated and stand-alone analytical support to pharmaceutical, biopharmaceutical, and medical device companies, signaling a strategic move to enhance its comprehensive service portfolio and market reach.

Strategic Outlook for Pharmaceutical Analytical Testing Industry Market

The strategic outlook for the Pharmaceutical Analytical Testing Industry is exceptionally positive, driven by a confluence of sustained innovation and expanding market frontiers. Future growth will be significantly accelerated by the increasing demand for advanced analytical solutions tailored for complex biologics, personalized medicines, and novel drug delivery systems. The industry is expected to witness further consolidation through strategic M&A activities as larger players seek to broaden their service portfolios and geographical footprints. Investment in digital transformation, including the adoption of AI, machine learning, and advanced data analytics, will be crucial for enhancing operational efficiency, predictive capabilities, and regulatory compliance. Furthermore, the growing emphasis on quality by design (QbD) principles and the development of robust analytical control strategies will shape the future landscape, offering significant opportunities for service providers that can adeptly navigate these evolving paradigms. The industry's ability to adapt to emerging scientific advancements and evolving regulatory expectations will be paramount in capitalizing on its substantial future potential.

Pharmaceutical Analytical Testing Industry Segmentation

-

1. Service Type

- 1.1. Bioanalytical Testing

- 1.2. Method Development & Validation

- 1.3. Stability Testing

- 1.4. Drug Substances Testing

- 1.5. Other Service Types

Pharmaceutical Analytical Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pharmaceutical Analytical Testing Industry Regional Market Share

Geographic Coverage of Pharmaceutical Analytical Testing Industry

Pharmaceutical Analytical Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Clinical Trials; Focus on Analytical Testing of Biologics and Biosimilars; Increased Trend of Outsourcing Laboratory Testing Services

- 3.3. Market Restrains

- 3.3.1. Complex Regulatory Framework for Maintaining Laboratories; Challenges in the Development of Proper Analytical Techniques

- 3.4. Market Trends

- 3.4.1. Stability Testing Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Bioanalytical Testing

- 5.1.2. Method Development & Validation

- 5.1.3. Stability Testing

- 5.1.4. Drug Substances Testing

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Bioanalytical Testing

- 6.1.2. Method Development & Validation

- 6.1.3. Stability Testing

- 6.1.4. Drug Substances Testing

- 6.1.5. Other Service Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Bioanalytical Testing

- 7.1.2. Method Development & Validation

- 7.1.3. Stability Testing

- 7.1.4. Drug Substances Testing

- 7.1.5. Other Service Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Bioanalytical Testing

- 8.1.2. Method Development & Validation

- 8.1.3. Stability Testing

- 8.1.4. Drug Substances Testing

- 8.1.5. Other Service Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East and Africa Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Bioanalytical Testing

- 9.1.2. Method Development & Validation

- 9.1.3. Stability Testing

- 9.1.4. Drug Substances Testing

- 9.1.5. Other Service Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. South America Pharmaceutical Analytical Testing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Bioanalytical Testing

- 10.1.2. Method Development & Validation

- 10.1.3. Stability Testing

- 10.1.4. Drug Substances Testing

- 10.1.5. Other Service Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Laboratory Testing Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 West Pharmaceutical Services Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Steris

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Labcorp (Toxikon Inc)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurofins Scientific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SGS SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boston Analytical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pace Analytical Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Laboratory Testing Inc

List of Figures

- Figure 1: Global Pharmaceutical Analytical Testing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 7: Europe Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: Europe Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Pharmaceutical Analytical Testing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 19: South America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: South America Pharmaceutical Analytical Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Pharmaceutical Analytical Testing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: GCC Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 30: Global Pharmaceutical Analytical Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Pharmaceutical Analytical Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Analytical Testing Industry?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Pharmaceutical Analytical Testing Industry?

Key companies in the market include Laboratory Testing Inc, West Pharmaceutical Services Inc, Intertek Group Plc, Steris, Labcorp (Toxikon Inc), Eurofins Scientific, SGS SA, Boston Analytical, Pace Analytical Services.

3. What are the main segments of the Pharmaceutical Analytical Testing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Clinical Trials; Focus on Analytical Testing of Biologics and Biosimilars; Increased Trend of Outsourcing Laboratory Testing Services.

6. What are the notable trends driving market growth?

Stability Testing Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Complex Regulatory Framework for Maintaining Laboratories; Challenges in the Development of Proper Analytical Techniques.

8. Can you provide examples of recent developments in the market?

March 2024: LGM Pharma invested over USD 2 million to expand its analytical testing services and include drug delivery suppository manufacturing capabilities by 50% in its facility in Rosenburg, Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Analytical Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Analytical Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Analytical Testing Industry?

To stay informed about further developments, trends, and reports in the Pharmaceutical Analytical Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence