Key Insights

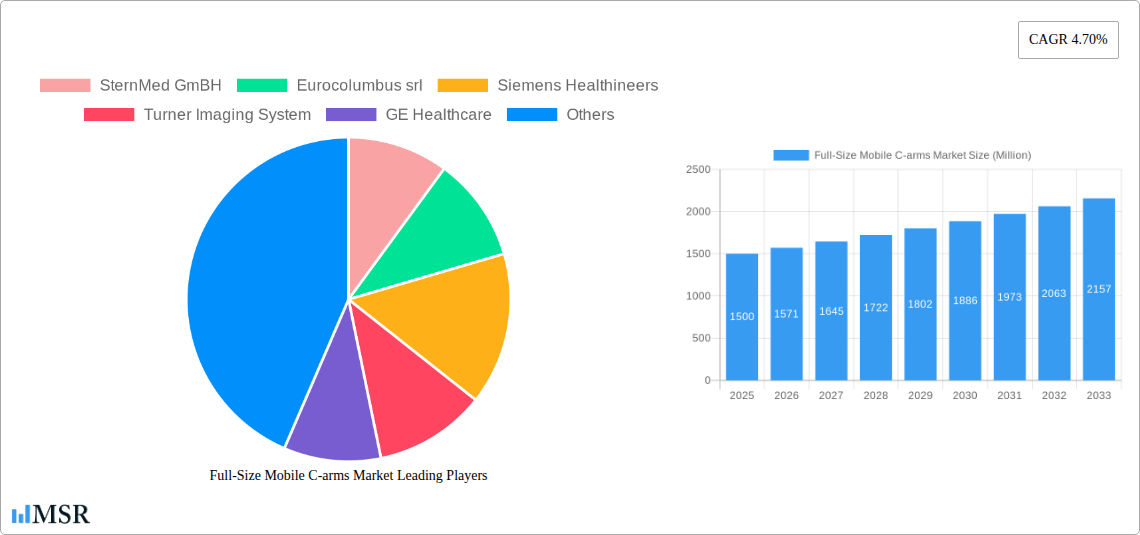

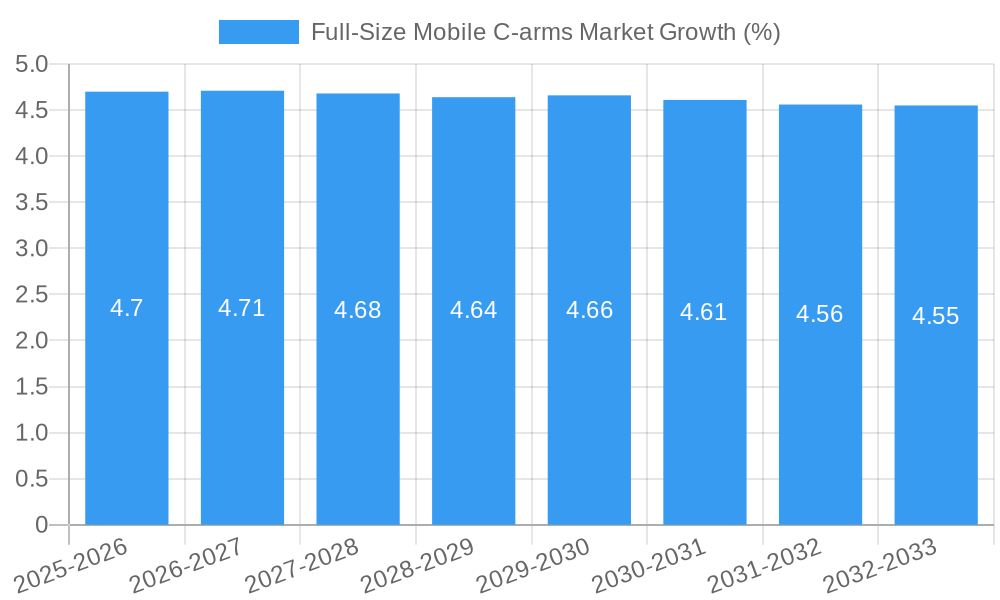

The global market for Full-Size Mobile C-arms is poised for steady growth, driven by increasing demand for advanced diagnostic imaging in minimally invasive procedures across various medical specialties. The market is projected to reach approximately USD 1.50 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.70% expected throughout the forecast period of 2025-2033. This expansion is underpinned by several critical factors. The rising prevalence of chronic diseases, particularly cardiovascular and orthopedic conditions, necessitates the adoption of sophisticated imaging technologies for accurate diagnosis and targeted treatment. Furthermore, the growing preference for minimally invasive surgeries over traditional open procedures significantly bolsters the demand for C-arms, offering enhanced precision, reduced patient recovery times, and improved outcomes. Technological advancements, including the integration of artificial intelligence (AI) for image enhancement and workflow optimization, are also key enablers of market growth, making C-arms more versatile and efficient for medical professionals.

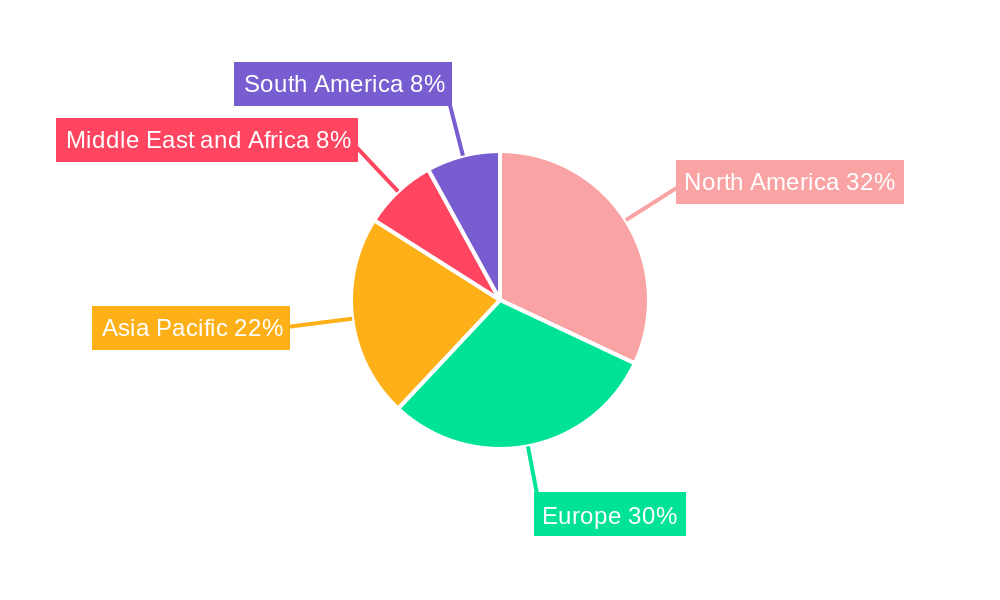

The market is segmented across product types and applications, with Full-Size C-arms representing a significant portion due to their versatility and suitability for a wide range of complex procedures. Cardiology and Orthopedics and Trauma are anticipated to be the dominant application segments, reflecting the high incidence of conditions requiring detailed intraoperative imaging. Geographically, North America and Europe are expected to lead the market share, owing to well-established healthcare infrastructures, high adoption rates of advanced medical technologies, and significant healthcare expenditure. However, the Asia Pacific region presents substantial growth opportunities, fueled by expanding healthcare access, increasing medical tourism, and rising investments in healthcare facilities. Key players like Siemens Healthineers, GE Healthcare, and Koninklijke Philips NV are continuously innovating, focusing on developing more compact, user-friendly, and feature-rich C-arm systems to meet evolving clinical needs and maintain a competitive edge.

This comprehensive report offers an in-depth analysis of the global Full-Size Mobile C-arms Market, providing crucial insights into market dynamics, growth drivers, challenges, and future opportunities. Spanning the Study Period of 2019–2033, with a Base Year and Estimated Year of 2025 and a Forecast Period of 2025–2033, this research meticulously examines historical trends from 2019–2024 to project the market's trajectory. We explore the competitive landscape, key market segments including Mini C-arms, Full Size C-arms, and Others (Compact C-arms, Super C-arms), and their applications in Cardiology, Gastroenterology, Neurology, Orthopedics and Trauma, Oncology, and Other Applications. This report is an indispensable resource for medical device manufacturers, distributors, healthcare providers, investors, and industry stakeholders seeking to understand and capitalize on the burgeoning mobile fluoroscopy market.

Full-Size Mobile C-arms Market Market Concentration & Dynamics

The Full-Size Mobile C-arms Market exhibits a moderate to high level of market concentration, dominated by a few key players. The innovation ecosystem is vibrant, with significant investment in research and development focused on enhancing image quality, portability, and user-friendliness of mobile imaging solutions. Regulatory frameworks, such as FDA approvals and CE marking, play a critical role in market entry and product lifecycle management, ensuring patient safety and device efficacy. The threat of substitute products, while present, is mitigated by the unique advantages of C-arms in specific interventional procedures. End-user trends are leaning towards minimally invasive techniques, driving demand for advanced intraoperative imaging systems. Mergers and acquisitions (M&A) activities are strategically employed by leading companies to expand their product portfolios, geographical reach, and technological capabilities. M&A deal counts are anticipated to remain significant as companies seek to consolidate their market positions. The market share of leading companies like GE Healthcare and Siemens Healthineers underscores the competitive intensity.

- Market Concentration: Moderate to High

- Innovation Ecosystem: Strong focus on image clarity, AI integration, and workflow optimization.

- Regulatory Frameworks: Stringent but crucial for market access and quality assurance.

- Substitute Products: Limited direct substitutes for specialized mobile C-arm applications.

- End-User Trends: Increasing adoption of minimally invasive surgery and outpatient procedures.

- M&A Activities: Strategic consolidation to enhance market presence and technological prowess.

Full-Size Mobile C-arms Market Industry Insights & Trends

The Full-Size Mobile C-arms Market is poised for substantial growth, projected to reach an estimated market size of XX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Several key factors are propelling this expansion. The increasing prevalence of chronic diseases and an aging global population are driving the demand for a wide array of medical interventions, many of which rely heavily on mobile fluoroscopy. Advances in medical technology, including the development of high-resolution detectors, advanced imaging software, and AI-powered image analysis, are significantly improving diagnostic accuracy and procedural efficiency. The growing preference for minimally invasive surgical techniques over traditional open surgeries further fuels the adoption of mobile C-arms, as they offer superior visualization during these procedures, leading to reduced patient recovery times and hospital stays. Furthermore, the expanding healthcare infrastructure in emerging economies, coupled with increased healthcare expenditure, is creating new market opportunities. The development of more compact, lightweight, and user-friendly mobile C-arm systems is also contributing to their wider adoption across various healthcare settings, including smaller clinics and remote areas. The integration of advanced features such as pulsed fluoroscopy for dose reduction, real-time image processing, and wireless connectivity enhances the overall utility and appeal of these devices, making them indispensable tools for modern surgical and diagnostic imaging.

Key Markets & Segments Leading Full-Size Mobile C-arms Market

The Full-Size Mobile C-arms Market is characterized by significant regional variations and segment-specific growth dynamics. North America currently leads the market, driven by a well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and a substantial volume of complex surgical procedures. The United States, in particular, accounts for a dominant share due to extensive research and development activities and a strong presence of key market players. Europe follows closely, with countries like Germany, the UK, and France demonstrating significant demand for mobile imaging solutions fueled by robust reimbursement policies and a commitment to improving patient care.

The Full Size C-arms segment is the largest within the product type classification, as these systems offer the versatility and imaging capabilities required for a broad spectrum of complex interventional procedures. Mini C-arms, while a smaller segment, are experiencing steady growth due to their utility in smaller, outpatient settings and specific orthopedic applications. The "Others" category, including compact and super C-arms, caters to niche requirements, with specialized features that drive adoption in specific medical sub-specialties.

In terms of applications, Orthopedics and Trauma represent the largest and fastest-growing segment. The increasing incidence of fractures, sports injuries, and degenerative bone conditions necessitates precise intraoperative guidance, making mobile C-arms indispensable for fracture fixation, joint replacements, and spinal surgeries. Cardiology is another significant application area, where mobile fluoroscopy is crucial for diagnostic procedures like angiography and interventional treatments such as angioplasty and stenting. Gastroenterology and Neurology also represent substantial markets, with mobile C-arms employed in minimally invasive procedures like endoscopic retrograde cholangiopancreatography (ERCP) and neurovascular interventions.

- Dominant Region: North America (especially the United States)

- Drivers: Advanced healthcare infrastructure, high R&D investment, strong reimbursement, high volume of complex procedures.

- Leading Product Type Segment: Full Size C-arms

- Drivers: Versatility for diverse surgical needs, superior imaging capabilities.

- Leading Application Segment: Orthopedics and Trauma

- Drivers: Rising incidence of injuries and degenerative conditions, demand for precise intraoperative guidance, growth in minimally invasive orthopedic procedures.

- Key Growth Drivers in Other Segments:

- Cardiology: Increasing cardiovascular disease prevalence, growth in minimally invasive cardiac interventions.

- Gastroenterology: Growing demand for endoscopic procedures, advancements in ERCP techniques.

- Neurology: Expansion of neurointerventional procedures, demand for advanced brain imaging during surgery.

Full-Size Mobile C-arms Market Product Developments

Product developments in the Full-Size Mobile C-arms Market are characterized by a relentless pursuit of enhanced imaging performance, improved ergonomics, and seamless integration with digital healthcare ecosystems. Manufacturers are focusing on incorporating advanced detector technologies for superior image clarity and reduced radiation dose, alongside sophisticated image processing software that leverages AI for automated measurements and anomaly detection. The introduction of wireless connectivity and advanced user interfaces is streamlining workflows and improving intraoperative decision-making. Innovations such as dual-detectors for simultaneous imaging, 3D imaging capabilities, and extended reach are expanding the application scope of mobile C-arms. These advancements not only improve procedural outcomes but also contribute to greater patient safety and operator comfort, solidifying the competitive edge of leading companies in this dynamic market.

Challenges in the Full-Size Mobile C-arms Market Market

Despite the robust growth trajectory, the Full-Size Mobile C-arms Market faces several challenges. High upfront costs associated with advanced mobile imaging systems can be a barrier for smaller healthcare facilities, particularly in price-sensitive emerging markets. Stringent regulatory approval processes, while essential for patient safety, can lead to extended product launch timelines and increased development costs. Supply chain disruptions, exacerbated by global events, can impact the availability of critical components and delay production schedules. Intense competition among established players and the emergence of new entrants necessitate continuous innovation and competitive pricing strategies, which can put pressure on profit margins.

- High Acquisition Costs: Restricts adoption in resource-limited settings.

- Stringent Regulatory Hurdles: Can prolong market entry and increase R&D expenditure.

- Supply Chain Volatility: Potential for component shortages and production delays.

- Intense Market Competition: Drives down prices and requires continuous innovation.

Forces Driving Full-Size Mobile C-arms Market Growth

The Full-Size Mobile C-arms Market is propelled by a confluence of powerful growth drivers. The escalating global burden of orthopedic injuries, cardiovascular diseases, and oncological conditions necessitates advanced diagnostic and interventional imaging capabilities, where mobile C-arms play a pivotal role. Technological advancements, including the development of ultra-high-resolution detectors, AI-driven image enhancement, and sophisticated dose reduction techniques, are enhancing procedural efficacy and patient safety. The growing emphasis on minimally invasive surgical procedures, driven by patient demand for faster recovery and reduced complications, directly fuels the demand for flexible and precise intraoperative imaging. Government initiatives promoting healthcare infrastructure development, particularly in emerging economies, and increasing healthcare expenditure by both governments and individuals further contribute to market expansion.

Challenges in the Full-Size Mobile C-arms Market Market

Long-term growth catalysts for the Full-Size Mobile C-arms Market are firmly rooted in continuous innovation and strategic market expansion. The ongoing integration of artificial intelligence and machine learning algorithms into mobile imaging systems promises to revolutionize diagnostic capabilities, enabling predictive analytics and enhanced surgical planning. Further miniaturization and improved portability of C-arms will unlock new applications in point-of-care settings and remote healthcare delivery models. Strategic partnerships between C-arm manufacturers and software providers, as exemplified by recent collaborations, are crucial for developing integrated solutions that enhance workflow efficiency and patient outcomes. Expansion into untapped geographical markets with growing healthcare needs will also be a significant long-term growth driver.

Emerging Opportunities in Full-Size Mobile C-arms Market

The Full-Size Mobile C-arms Market presents several emerging opportunities. The increasing adoption of telehealth and remote patient monitoring creates potential for integrating mobile C-arm imaging data into remote diagnostic platforms, facilitating expert consultations from afar. The development of cost-effective and feature-rich mobile C-arm solutions tailored for emerging markets offers significant growth potential. Furthermore, the expanding field of interventional oncology, particularly for image-guided biopsies and tumor ablations, presents a burgeoning application area. The growing demand for specialized mobile imaging in veterinary medicine also represents an untapped niche market.

Leading Players in the Full-Size Mobile C-arms Market Sector

- SternMed GmBH

- Eurocolumbus srl

- Siemens Healthineers

- Turner Imaging System

- GE Healthcare

- DMS Group

- Recorders & Medicare Systems Pvt Ltd (RMS)

- FUJIFILM Holdings Corporation

- Ziehm Imaging GmbH

- Koninklijke Philips NV

- Genoray

- Hologic Corporation

- Shimadzu Corporation

Key Milestones in Full-Size Mobile C-arms Market Industry

- May 2022: PrecisionOS and Siemens Healthineers signed a partnership to offer immersive virtual reality (VR) training modules for surgeons and technicians to practice using Siemens Healthineers' mobile 3D C-arm Cios Spin for intraoperative quality control and surgical workflow guidance. This initiative enhances user proficiency and adoption of advanced mobile imaging technologies.

- January 2022: Philips signed a strategic partnership agreement with Cydar to integrate cloud-based AI and 3D mapping into its Mobile C-arm System Series - Zenition. This integration aims to enhance workflow efficiency and improve endovascular treatment outcomes, highlighting the trend towards AI-driven fluoroscopy solutions.

Strategic Outlook for Full-Size Mobile C-arms Market Market

- May 2022: PrecisionOS and Siemens Healthineers signed a partnership to offer immersive virtual reality (VR) training modules for surgeons and technicians to practice using Siemens Healthineers' mobile 3D C-arm Cios Spin for intraoperative quality control and surgical workflow guidance. This initiative enhances user proficiency and adoption of advanced mobile imaging technologies.

- January 2022: Philips signed a strategic partnership agreement with Cydar to integrate cloud-based AI and 3D mapping into its Mobile C-arm System Series - Zenition. This integration aims to enhance workflow efficiency and improve endovascular treatment outcomes, highlighting the trend towards AI-driven fluoroscopy solutions.

Strategic Outlook for Full-Size Mobile C-arms Market Market

The strategic outlook for the Full-Size Mobile C-arms Market is characterized by a focus on innovation, strategic collaborations, and market expansion. Companies are investing heavily in R&D to develop next-generation mobile imaging systems with enhanced AI capabilities, improved portability, and reduced radiation doses. Strategic partnerships, like those observed between technology providers and medical device manufacturers, are crucial for developing integrated solutions that address specific clinical needs and improve workflow efficiency. Expanding into emerging economies with growing healthcare demands presents a significant opportunity for market penetration. The continued growth in minimally invasive procedures and the increasing demand for advanced diagnostic tools will further fuel the market's upward trajectory, making mobile C-arms an indispensable component of modern healthcare delivery.

Full-Size Mobile C-arms Market Segmentation

-

1. Product Type

- 1.1. Mini C-arms

- 1.2. Full Size C-arms

- 1.3. Others (Compact C-arms, Super C-arms)

-

2. Application

- 2.1. Cardiology

- 2.2. Gastroenterology

- 2.3. Neurology

- 2.4. Orthopedics and Trauma

- 2.5. Oncology

- 2.6. Other Applications

Full-Size Mobile C-arms Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Full-Size Mobile C-arms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Burden of Chronic Diseases

- 3.2.2 Road Injuries Coupled With Rising Geriatric Population; Technological Advancements in the Imaging Capabilities

- 3.3. Market Restrains

- 3.3.1. High Procedural and Equipment Cost; Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Mini C-arms Segment of the Market Is Expected to Show Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Mini C-arms

- 5.1.2. Full Size C-arms

- 5.1.3. Others (Compact C-arms, Super C-arms)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Gastroenterology

- 5.2.3. Neurology

- 5.2.4. Orthopedics and Trauma

- 5.2.5. Oncology

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Mini C-arms

- 6.1.2. Full Size C-arms

- 6.1.3. Others (Compact C-arms, Super C-arms)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiology

- 6.2.2. Gastroenterology

- 6.2.3. Neurology

- 6.2.4. Orthopedics and Trauma

- 6.2.5. Oncology

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Mini C-arms

- 7.1.2. Full Size C-arms

- 7.1.3. Others (Compact C-arms, Super C-arms)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiology

- 7.2.2. Gastroenterology

- 7.2.3. Neurology

- 7.2.4. Orthopedics and Trauma

- 7.2.5. Oncology

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Mini C-arms

- 8.1.2. Full Size C-arms

- 8.1.3. Others (Compact C-arms, Super C-arms)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiology

- 8.2.2. Gastroenterology

- 8.2.3. Neurology

- 8.2.4. Orthopedics and Trauma

- 8.2.5. Oncology

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Mini C-arms

- 9.1.2. Full Size C-arms

- 9.1.3. Others (Compact C-arms, Super C-arms)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cardiology

- 9.2.2. Gastroenterology

- 9.2.3. Neurology

- 9.2.4. Orthopedics and Trauma

- 9.2.5. Oncology

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Mini C-arms

- 10.1.2. Full Size C-arms

- 10.1.3. Others (Compact C-arms, Super C-arms)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Cardiology

- 10.2.2. Gastroenterology

- 10.2.3. Neurology

- 10.2.4. Orthopedics and Trauma

- 10.2.5. Oncology

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Full-Size Mobile C-arms Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SternMed GmBH

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Eurocolumbus srl

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Siemens Healthineers

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Turner Imaging System

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 GE Healthcare

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 DMS Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Recorders & Medicare Systems Pvt Ltd (RMS)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 FUJIFILM Holdings Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Ziehm Imaging GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Koninklijke Philips NV

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Genoray

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Hologic Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Shimadzu Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 SternMed GmBH

List of Figures

- Figure 1: Global Full-Size Mobile C-arms Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Full-Size Mobile C-arms Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Full-Size Mobile C-arms Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Full-Size Mobile C-arms Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Full-Size Mobile C-arms Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Full-Size Mobile C-arms Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Full-Size Mobile C-arms Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Full-Size Mobile C-arms Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Full-Size Mobile C-arms Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Full-Size Mobile C-arms Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Full-Size Mobile C-arms Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Full-Size Mobile C-arms Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Full-Size Mobile C-arms Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Full-Size Mobile C-arms Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Middle East and Africa Full-Size Mobile C-arms Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East and Africa Full-Size Mobile C-arms Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Middle East and Africa Full-Size Mobile C-arms Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Middle East and Africa Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Full-Size Mobile C-arms Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: South America Full-Size Mobile C-arms Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: South America Full-Size Mobile C-arms Market Revenue (Million), by Application 2024 & 2032

- Figure 39: South America Full-Size Mobile C-arms Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: South America Full-Size Mobile C-arms Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Full-Size Mobile C-arms Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 47: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Full-Size Mobile C-arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Full-Size Mobile C-arms Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Full-Size Mobile C-arms Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Full-Size Mobile C-arms Market?

Key companies in the market include SternMed GmBH, Eurocolumbus srl, Siemens Healthineers, Turner Imaging System, GE Healthcare, DMS Group, Recorders & Medicare Systems Pvt Ltd (RMS), FUJIFILM Holdings Corporation, Ziehm Imaging GmbH, Koninklijke Philips NV, Genoray, Hologic Corporation, Shimadzu Corporation.

3. What are the main segments of the Full-Size Mobile C-arms Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic Diseases. Road Injuries Coupled With Rising Geriatric Population; Technological Advancements in the Imaging Capabilities.

6. What are the notable trends driving market growth?

Mini C-arms Segment of the Market Is Expected to Show Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Procedural and Equipment Cost; Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

In May 2022, PrecisionOS and Seimens Healthineers signed a partnership to offer immersive virtual reality (VR) training. The module helps surgeons and technicians to practice the use of Siemens Healthineers' mobile 3D C-arm Cios Spin for intraoperative quality control and surgical workflow guidance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Full-Size Mobile C-arms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Full-Size Mobile C-arms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Full-Size Mobile C-arms Market?

To stay informed about further developments, trends, and reports in the Full-Size Mobile C-arms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence