Key Insights

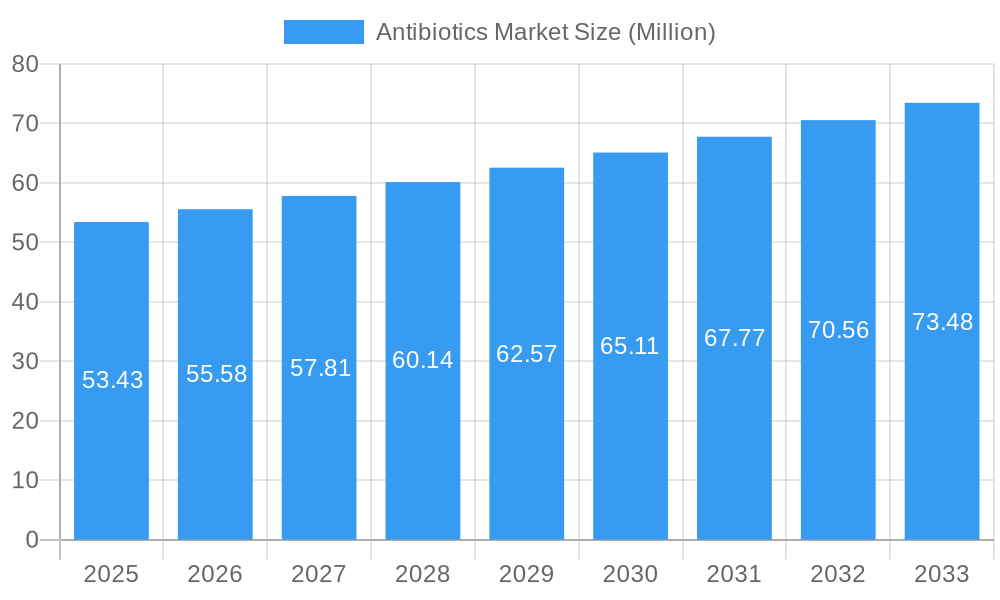

The global Antibiotics Market is poised for robust growth, estimated at a substantial USD 53.43 million in the base year of 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of 4.07% through 2033. This expansion is fueled by an increasing prevalence of infectious diseases, a growing understanding of antibiotic resistance, and ongoing research and development efforts to combat evolving pathogens. Key drivers include the rising global population, increased access to healthcare in developing regions, and the continuous need for effective treatments against a wide spectrum of bacterial infections. The market's dynamism is further shaped by significant investment in novel antibiotic discovery and the development of next-generation antimicrobials to overcome resistance mechanisms.

Antibiotics Market Market Size (In Million)

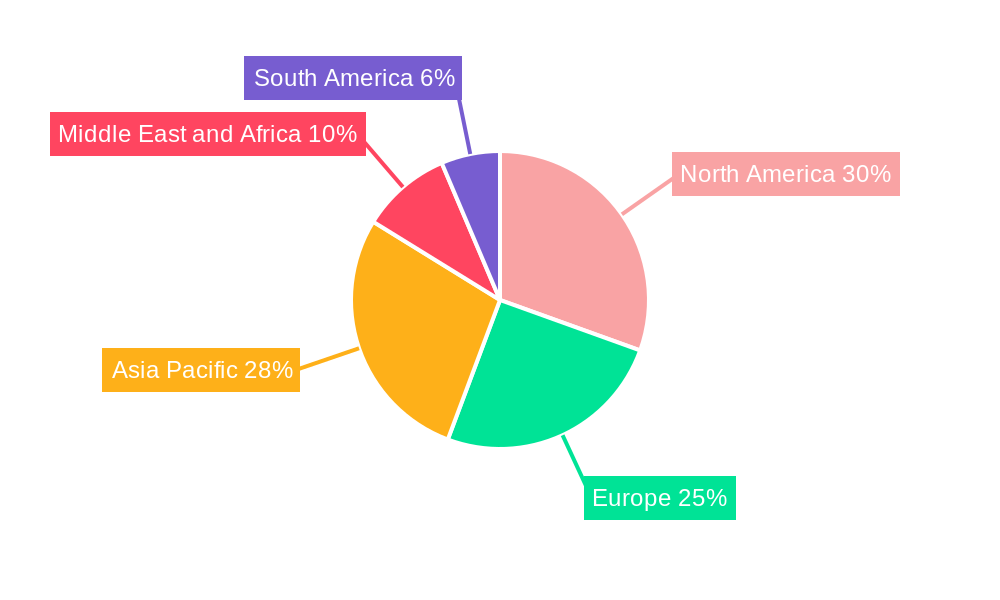

The market is segmented across diverse product types, with Cephalosporins, Penicillins, and Fluoroquinolones leading the charge due to their broad efficacy and established presence. However, the emergence of antibiotic resistance is a critical factor shaping market trends, necessitating innovation in drug development and a focus on stewardship programs to ensure responsible use. Restraints such as the lengthy and expensive drug development process, coupled with regulatory hurdles and the economic challenges of developing antibiotics that may be used sparingly to preserve efficacy, present ongoing obstacles. Nevertheless, the persistent threat of antimicrobial resistance and the demand for effective solutions are expected to drive sustained market expansion, with significant opportunities in regions like Asia Pacific and North America experiencing rapid advancements in healthcare infrastructure and research capabilities.

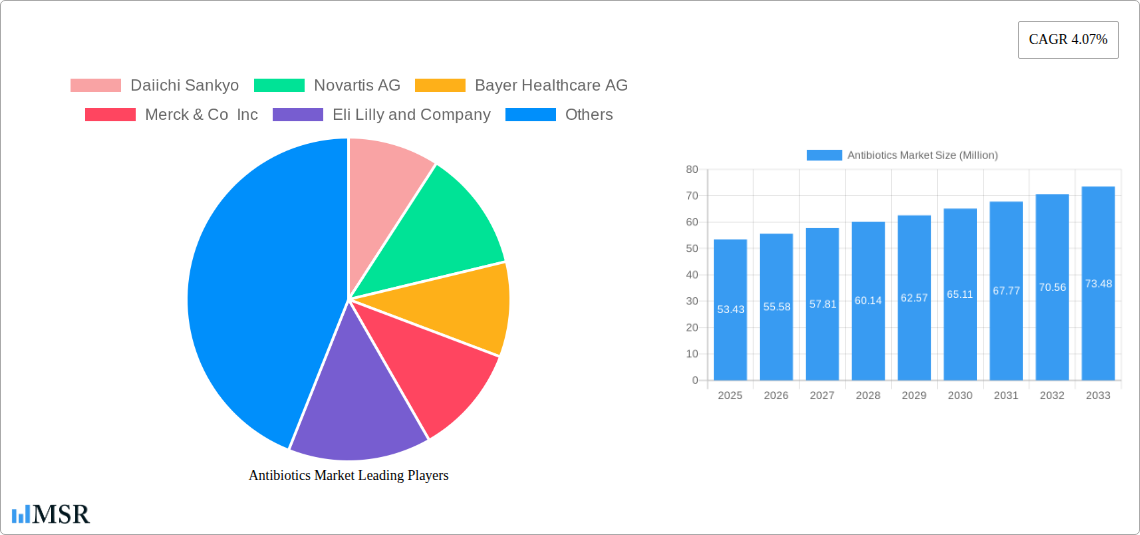

Antibiotics Market Company Market Share

Antibiotics Market Analysis Report: Unlocking Growth and Innovation in the Global Pharmaceutical Landscape (2019-2033)

This comprehensive report offers an in-depth analysis of the global antibiotics market, providing critical insights into its dynamics, growth trajectory, and future potential. Covering a study period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for pharmaceutical companies, investors, policymakers, and other industry stakeholders seeking to navigate this vital sector. We delve into market size, segmentation by product type (Cephalosporins, Penicillins, Fluroquinilones, Macrolides, Carbapenems, Aminoglycosides, Sulfonamides, Other Product Types) and spectrum (Broad-spectrum Antibiotics, Narrow-spectrum Antibiotics), key market drivers, emerging challenges, and strategic opportunities.

Antibiotics Market Market Concentration & Dynamics

The global antibiotics market exhibits a moderate to high concentration, with a significant portion of market share held by a few dominant players. Innovation remains a crucial driver, with companies investing heavily in R&D to combat rising antimicrobial resistance (AMR) and develop novel antibiotic therapies. Regulatory frameworks, while evolving to encourage innovation, also present hurdles, particularly concerning the pricing and market access of new drugs. The threat of substitute products, though less pronounced in primary antibiotic applications, is growing with the advent of alternative infection control strategies. End-user trends, influenced by increasing healthcare expenditure and a greater understanding of infectious diseases, are pushing demand for effective and accessible antibiotic treatments. Merger and acquisition (M&A) activities are strategic maneuvers employed by key players to consolidate market presence, acquire promising technologies, and expand their product portfolios. The market is characterized by a dynamic interplay of established pharmaceutical giants and agile biotechnology firms vying for dominance in this essential therapeutic area. M&A deal counts are projected to increase as companies seek to strengthen their positions against the backdrop of growing antibiotic resistance.

Antibiotics Market Industry Insights & Trends

The antibiotics market is experiencing robust growth, projected to reach approximately XXX Million by 2033, with a compound annual growth rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is primarily fueled by the escalating global burden of infectious diseases, coupled with a growing awareness of the critical need for effective antibacterial agents. Technological disruptions, including advancements in drug discovery platforms, genetic sequencing, and antimicrobial stewardship programs, are playing a pivotal role in shaping market trends. Evolving consumer behaviors, influenced by an aging global population and increased susceptibility to infections, are also contributing to the sustained demand for antibiotics. The continuous emergence of drug-resistant bacteria, a significant public health concern, necessitates ongoing research and development of new and improved antibiotic formulations. Furthermore, government initiatives aimed at combating antimicrobial resistance and promoting responsible antibiotic use are creating a favorable environment for market growth. The increasing prevalence of chronic diseases, which often require long-term treatment and can make patients more vulnerable to infections, further bolsters the demand for antibiotics. The market size in the base year 2025 is estimated at XXX Million, underscoring the substantial current value of this sector.

Key Markets & Segments Leading Antibiotics Market

The antibiotics market is segmented by Product Type, with Cephalosporins and Penicillins currently holding the largest market share due to their established efficacy and broad applicability in treating a wide range of bacterial infections. Fluroquinilones and Macrolides also represent significant segments, driven by their effectiveness against specific pathogens and expanding therapeutic uses.

- Dominant Product Type Segments and Their Drivers:

- Cephalosporins: Their broad-spectrum activity and relatively favorable safety profiles make them a cornerstone in hospital settings and community-acquired infections. Economic growth in emerging economies translates to increased access to these essential medicines.

- Penicillins: As one of the oldest classes of antibiotics, their continued relevance is due to their affordability and effectiveness against many common bacterial strains. Infrastructure development in healthcare systems further supports their widespread use.

- Fluroquinilones: Their efficacy against difficult-to-treat infections and growing applications in respiratory and urinary tract infections drive their market dominance.

- Macrolides: Their utility in treating respiratory infections and penicillin-allergic patients contributes to their substantial market share.

The Spectrum of antibiotics also dictates market leadership, with Broad-spectrum Antibiotics currently dominating due to their versatility in treating empirical infections and in hospital environments where the specific pathogen is unknown.

- Dominant Spectrum Segment and Its Drivers:

- Broad-spectrum Antibiotics: Their ability to target a wide range of bacteria makes them indispensable for initial treatment regimens and in situations where rapid intervention is crucial. Increased prevalence of hospital-acquired infections (HAIs) further propels their demand.

Geographically, North America and Europe represent the largest markets for antibiotics, driven by advanced healthcare infrastructure, high R&D spending, and robust regulatory frameworks that support the development and adoption of new antibiotic therapies. However, the Asia-Pacific region is witnessing the fastest growth, fueled by a large and growing population, increasing prevalence of infectious diseases, and a rising middle class with improved access to healthcare.

Antibiotics Market Product Developments

The antibiotics market is continuously evolving with significant product developments aimed at addressing the escalating challenge of antimicrobial resistance (AMR) and improving patient outcomes. Innovations are focused on developing novel classes of antibiotics, repurposing existing drugs, and creating combination therapies to overcome resistance mechanisms. Advances in drug delivery systems are also enhancing efficacy and patient compliance. These developments are crucial for maintaining a competitive edge and meeting the growing global demand for effective treatments against bacterial infections.

Challenges in the Antibiotics Market Market

The antibiotics market faces several significant challenges that impede its growth and innovation.

- Antimicrobial Resistance (AMR): The rise of drug-resistant bacteria is a paramount concern, rendering existing treatments ineffective and demanding continuous innovation.

- Pricing and Reimbursement Pressures: Stringent regulatory approvals and market access challenges, coupled with pressure to keep drug prices low, can disincentivize R&D investment in new antibiotics.

- Declining R&D Productivity: The inherent difficulty and high failure rate in antibiotic drug discovery contribute to a decline in research and development productivity.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and affordability of essential antibiotics, especially in low-resource settings.

- Regulatory Hurdles: Navigating complex and lengthy regulatory approval processes adds to the cost and time required to bring new antibiotics to market.

Forces Driving Antibiotics Market Growth

Several key forces are driving the growth of the antibiotics market.

- Increasing Incidence of Infectious Diseases: The global rise in bacterial infections, exacerbated by factors like aging populations and increased global travel, directly fuels demand for antibiotics.

- Growing Prevalence of Antimicrobial Resistance (AMR): This critical health crisis necessitates the continuous development of new and more effective antibiotic agents.

- Advancements in Healthcare Infrastructure: Expanding healthcare access and improving diagnostic capabilities in emerging economies lead to increased antibiotic consumption.

- Government Initiatives and Funding: Increased government focus and funding for AMR research and development are encouraging innovation.

- Technological Innovations in Drug Discovery: New technologies in genomics, proteomics, and artificial intelligence are accelerating the discovery and development of novel antibiotics.

Challenges in the Antibiotics Market Market

Long-term growth catalysts in the antibiotics market are rooted in sustained innovation and strategic market expansion. The continuous emergence of novel pathogens and the persistent threat of antimicrobial resistance will necessitate ongoing research and development of next-generation antibiotics. Partnerships between academic institutions, biotechnology firms, and large pharmaceutical companies will be crucial for fostering collaborative R&D efforts. Furthermore, expanding access to essential antibiotics in underserved regions through sustainable pricing models and strategic distribution networks will unlock significant market potential.

Emerging Opportunities in Antibiotics Market

Emerging opportunities in the antibiotics market are diverse and promising. The development of novel antibiotic classes that target previously untreatable resistant strains presents a significant avenue for growth. The repurposing of existing antibiotics for new indications and the exploration of bacteriophage therapy offer innovative solutions. Growing consumer preference for preventative healthcare measures could also drive demand for prophylactic antibiotic use in specific high-risk populations. Furthermore, the increasing adoption of digital health solutions and AI-powered diagnostics can optimize antibiotic prescribing practices and identify new therapeutic targets.

Leading Players in the Antibiotics Market Sector

- Daiichi Sankyo

- Novartis AG

- Bayer Healthcare AG

- Merck & Co Inc

- Eli Lilly and Company

- Abbott Laboratories

- F Hoffmann-La Roche AG

- Johnson & Johnson Inc

- Otsuka Pharmaceutical Co Ltd

- Astellas Pharma

- Pfizer Inc

Key Milestones in Antibiotics Market Industry

- October 2021: Otsuka received approval for an additional pediatric indication in Europe. Otsuka has been working on expanding access to DELTYBA worldwide in support of that effort.

- October 2021: Sandoz, a Novartis division, acquired GSK's cephalosporin antibiotics business. It now has the rights to three well-known brands (Zinnat, Zinacef, and Fortum) in more than 100 markets, strengthening its position as the world's leading antibiotics company.

Strategic Outlook for Antibiotics Market Market

The strategic outlook for the antibiotics market is one of continued growth and innovation, driven by the persistent global health threat of infectious diseases and antimicrobial resistance. Key growth accelerators include substantial investments in R&D for novel antibiotic therapies, the strategic acquisition of promising drug candidates and technologies, and the expansion of market reach into emerging economies with increasing healthcare needs. The development of antibiotics that target multi-drug resistant organisms and the exploration of alternative therapeutic approaches will be critical for sustained market leadership. Furthermore, favorable regulatory environments and increased government support for antibiotic stewardship programs will foster a more conducive landscape for both innovation and market penetration.

Antibiotics Market Segmentation

-

1. Product Type

- 1.1. Cephalosporins

- 1.2. Penicillins

- 1.3. Fluroquinilones

- 1.4. Macrolides

- 1.5. Carbapenems

- 1.6. Aminoglycosides

- 1.7. Sulfonamides

- 1.8. Other Product Types

-

2. Spectrum

- 2.1. Broad-spectrum Antibiotics

- 2.2. Narrow-spectrum Antibiotics

Antibiotics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Antibiotics Market Regional Market Share

Geographic Coverage of Antibiotics Market

Antibiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Anti-MRSA/VRE Drugs; Increasing Burden of Infectious Diseases; Vulnerable Aging Population

- 3.3. Market Restrains

- 3.3.1. Antibiotic Resistance; Fewer Companies Involved in Active Research

- 3.4. Market Trends

- 3.4.1. Cephalosporins is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cephalosporins

- 5.1.2. Penicillins

- 5.1.3. Fluroquinilones

- 5.1.4. Macrolides

- 5.1.5. Carbapenems

- 5.1.6. Aminoglycosides

- 5.1.7. Sulfonamides

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Spectrum

- 5.2.1. Broad-spectrum Antibiotics

- 5.2.2. Narrow-spectrum Antibiotics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cephalosporins

- 6.1.2. Penicillins

- 6.1.3. Fluroquinilones

- 6.1.4. Macrolides

- 6.1.5. Carbapenems

- 6.1.6. Aminoglycosides

- 6.1.7. Sulfonamides

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Spectrum

- 6.2.1. Broad-spectrum Antibiotics

- 6.2.2. Narrow-spectrum Antibiotics

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cephalosporins

- 7.1.2. Penicillins

- 7.1.3. Fluroquinilones

- 7.1.4. Macrolides

- 7.1.5. Carbapenems

- 7.1.6. Aminoglycosides

- 7.1.7. Sulfonamides

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Spectrum

- 7.2.1. Broad-spectrum Antibiotics

- 7.2.2. Narrow-spectrum Antibiotics

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cephalosporins

- 8.1.2. Penicillins

- 8.1.3. Fluroquinilones

- 8.1.4. Macrolides

- 8.1.5. Carbapenems

- 8.1.6. Aminoglycosides

- 8.1.7. Sulfonamides

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Spectrum

- 8.2.1. Broad-spectrum Antibiotics

- 8.2.2. Narrow-spectrum Antibiotics

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cephalosporins

- 9.1.2. Penicillins

- 9.1.3. Fluroquinilones

- 9.1.4. Macrolides

- 9.1.5. Carbapenems

- 9.1.6. Aminoglycosides

- 9.1.7. Sulfonamides

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Spectrum

- 9.2.1. Broad-spectrum Antibiotics

- 9.2.2. Narrow-spectrum Antibiotics

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cephalosporins

- 10.1.2. Penicillins

- 10.1.3. Fluroquinilones

- 10.1.4. Macrolides

- 10.1.5. Carbapenems

- 10.1.6. Aminoglycosides

- 10.1.7. Sulfonamides

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Spectrum

- 10.2.1. Broad-spectrum Antibiotics

- 10.2.2. Narrow-spectrum Antibiotics

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Daiichi Sankyo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novartis AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bayer Healthcare AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck & Co Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly and Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 F Hoffmann-La Roche AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson & Johnson Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Otsuka Pharmaceutical Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Astellas Pharma*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Daiichi Sankyo

List of Figures

- Figure 1: Global Antibiotics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Antibiotics Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Antibiotics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Antibiotics Market Volume (K Tons), by Product Type 2025 & 2033

- Figure 5: North America Antibiotics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Antibiotics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Antibiotics Market Revenue (Million), by Spectrum 2025 & 2033

- Figure 8: North America Antibiotics Market Volume (K Tons), by Spectrum 2025 & 2033

- Figure 9: North America Antibiotics Market Revenue Share (%), by Spectrum 2025 & 2033

- Figure 10: North America Antibiotics Market Volume Share (%), by Spectrum 2025 & 2033

- Figure 11: North America Antibiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Antibiotics Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: North America Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Antibiotics Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Antibiotics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Antibiotics Market Volume (K Tons), by Product Type 2025 & 2033

- Figure 17: Europe Antibiotics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Antibiotics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Antibiotics Market Revenue (Million), by Spectrum 2025 & 2033

- Figure 20: Europe Antibiotics Market Volume (K Tons), by Spectrum 2025 & 2033

- Figure 21: Europe Antibiotics Market Revenue Share (%), by Spectrum 2025 & 2033

- Figure 22: Europe Antibiotics Market Volume Share (%), by Spectrum 2025 & 2033

- Figure 23: Europe Antibiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Antibiotics Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Antibiotics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Antibiotics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Antibiotics Market Volume (K Tons), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Antibiotics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Antibiotics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Antibiotics Market Revenue (Million), by Spectrum 2025 & 2033

- Figure 32: Asia Pacific Antibiotics Market Volume (K Tons), by Spectrum 2025 & 2033

- Figure 33: Asia Pacific Antibiotics Market Revenue Share (%), by Spectrum 2025 & 2033

- Figure 34: Asia Pacific Antibiotics Market Volume Share (%), by Spectrum 2025 & 2033

- Figure 35: Asia Pacific Antibiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Antibiotics Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Asia Pacific Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Antibiotics Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Antibiotics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 40: Middle East and Africa Antibiotics Market Volume (K Tons), by Product Type 2025 & 2033

- Figure 41: Middle East and Africa Antibiotics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East and Africa Antibiotics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa Antibiotics Market Revenue (Million), by Spectrum 2025 & 2033

- Figure 44: Middle East and Africa Antibiotics Market Volume (K Tons), by Spectrum 2025 & 2033

- Figure 45: Middle East and Africa Antibiotics Market Revenue Share (%), by Spectrum 2025 & 2033

- Figure 46: Middle East and Africa Antibiotics Market Volume Share (%), by Spectrum 2025 & 2033

- Figure 47: Middle East and Africa Antibiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Antibiotics Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: Middle East and Africa Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Antibiotics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Antibiotics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: South America Antibiotics Market Volume (K Tons), by Product Type 2025 & 2033

- Figure 53: South America Antibiotics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: South America Antibiotics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: South America Antibiotics Market Revenue (Million), by Spectrum 2025 & 2033

- Figure 56: South America Antibiotics Market Volume (K Tons), by Spectrum 2025 & 2033

- Figure 57: South America Antibiotics Market Revenue Share (%), by Spectrum 2025 & 2033

- Figure 58: South America Antibiotics Market Volume Share (%), by Spectrum 2025 & 2033

- Figure 59: South America Antibiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Antibiotics Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: South America Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Antibiotics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Antibiotics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Antibiotics Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Global Antibiotics Market Revenue Million Forecast, by Spectrum 2020 & 2033

- Table 4: Global Antibiotics Market Volume K Tons Forecast, by Spectrum 2020 & 2033

- Table 5: Global Antibiotics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Antibiotics Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Antibiotics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Antibiotics Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Global Antibiotics Market Revenue Million Forecast, by Spectrum 2020 & 2033

- Table 10: Global Antibiotics Market Volume K Tons Forecast, by Spectrum 2020 & 2033

- Table 11: Global Antibiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Antibiotics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United States Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Antibiotics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Antibiotics Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 21: Global Antibiotics Market Revenue Million Forecast, by Spectrum 2020 & 2033

- Table 22: Global Antibiotics Market Volume K Tons Forecast, by Spectrum 2020 & 2033

- Table 23: Global Antibiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Antibiotics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Germany Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: France Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Italy Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Spain Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Global Antibiotics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Antibiotics Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 39: Global Antibiotics Market Revenue Million Forecast, by Spectrum 2020 & 2033

- Table 40: Global Antibiotics Market Volume K Tons Forecast, by Spectrum 2020 & 2033

- Table 41: Global Antibiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Antibiotics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: China Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Japan Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: India Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Australia Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: South Korea Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Global Antibiotics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 56: Global Antibiotics Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 57: Global Antibiotics Market Revenue Million Forecast, by Spectrum 2020 & 2033

- Table 58: Global Antibiotics Market Volume K Tons Forecast, by Spectrum 2020 & 2033

- Table 59: Global Antibiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Antibiotics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: GCC Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: South Africa Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 67: Global Antibiotics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 68: Global Antibiotics Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 69: Global Antibiotics Market Revenue Million Forecast, by Spectrum 2020 & 2033

- Table 70: Global Antibiotics Market Volume K Tons Forecast, by Spectrum 2020 & 2033

- Table 71: Global Antibiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Antibiotics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 73: Brazil Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: Argentina Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Antibiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Antibiotics Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antibiotics Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Antibiotics Market?

Key companies in the market include Daiichi Sankyo, Novartis AG, Bayer Healthcare AG, Merck & Co Inc, Eli Lilly and Company, Abbott Laboratories, F Hoffmann-La Roche AG, Johnson & Johnson Inc, Otsuka Pharmaceutical Co Ltd, Astellas Pharma*List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the Antibiotics Market?

The market segments include Product Type, Spectrum.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Anti-MRSA/VRE Drugs; Increasing Burden of Infectious Diseases; Vulnerable Aging Population.

6. What are the notable trends driving market growth?

Cephalosporins is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Antibiotic Resistance; Fewer Companies Involved in Active Research.

8. Can you provide examples of recent developments in the market?

October 2021- Otsuka received approval for an additional pediatric indication in Europe. Otsuka has been working on expanding access to DELTYBA worldwide in support of that effort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antibiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antibiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antibiotics Market?

To stay informed about further developments, trends, and reports in the Antibiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence