Key Insights

The global Trachoma Treatment Market is projected to reach 0.6 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 6.24% through 2033. This expansion is propelled by intensified global eradication efforts, governmental and NGO initiatives, and improved treatment access. Heightened disease awareness and its economic impact are driving investment in diagnostics and therapeutics. Oral macrolides and tetracyclines, alongside topical anti-infectives, are the primary treatment modalities. Asia Pacific and Africa are key growth regions due to trachoma prevalence and large-scale treatment needs. Ongoing R&D for advanced treatments and healthcare infrastructure development will further fuel market growth.

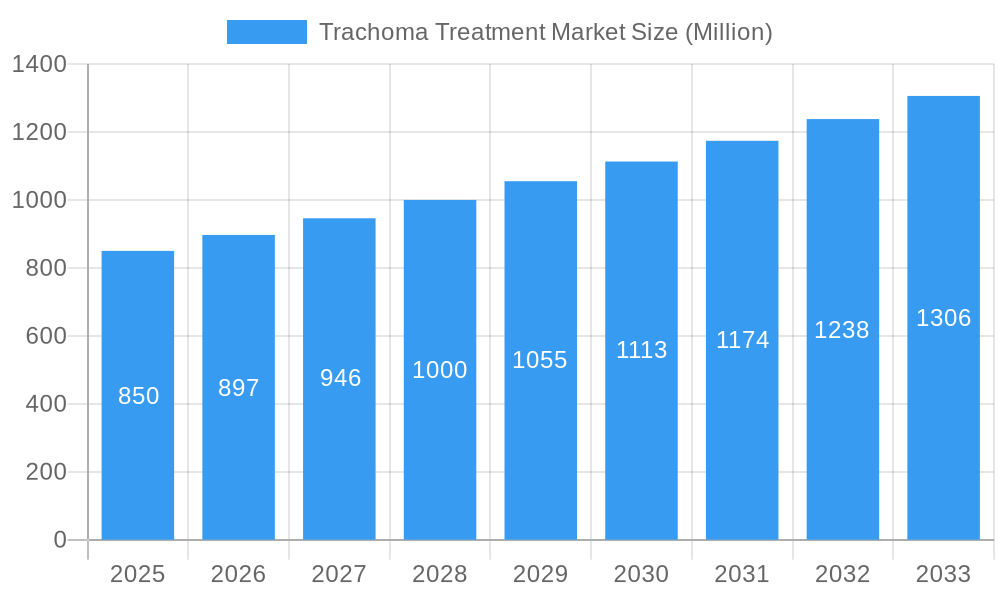

Trachoma Treatment Market Market Size (In Million)

The Trachoma Treatment Market is influenced by trends such as integrated control programs combining antibiotics with hygiene and environmental improvements, focusing on sustainable elimination and reinfection prevention. Market restraints include challenges in remote drug accessibility, potential antibiotic resistance, and the need for sustained funding. The competitive landscape features major pharmaceutical companies including Pfizer Inc., Merck & Co. Inc., and Allergan (AbbVie Inc.), alongside generic and specialized ophthalmic firms. Emerging markets present significant expansion opportunities due to unmet needs and public health focus. Advanced drug delivery systems and combination therapies are expected to enhance efficacy and patient compliance.

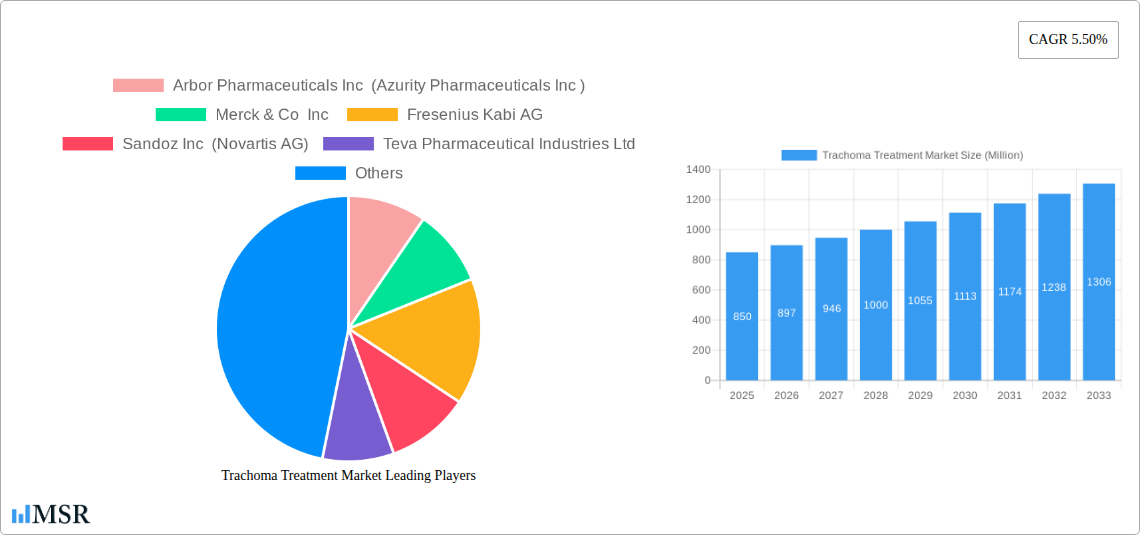

Trachoma Treatment Market Company Market Share

Trachoma Treatment Market: Global Forecast to 2033 - Unveiling Opportunities in Infectious Disease Control

This comprehensive report offers an in-depth analysis of the global trachoma treatment market, a critical segment within infectious disease management. With a study period spanning 2019–2033, a base year of 2025, and a forecast period from 2025–2033, this report leverages historical data from 2019–2024 to provide actionable insights for stakeholders. The trachoma treatment market size is projected to reach substantial figures, driven by a growing awareness of neglected tropical diseases (NTDs) and strategic public health initiatives. This report is essential for pharmaceutical companies, research institutions, NGOs, and investors seeking to understand the evolving dynamics, key growth drivers, and emerging opportunities in the trachoma treatment market. We meticulously analyze trachoma treatment market trends, trachoma drug market, and azithromycin for trachoma, providing a detailed outlook on trachoma prevention strategies and ophthalmic anti-infective market.

Trachoma Treatment Market Market Concentration & Dynamics

The trachoma treatment market exhibits a moderate level of concentration, with key players like Pfizer Inc., Merck & Co. Inc., and Allergan (AbbVie Inc.) holding significant market share due to established product portfolios and strong distribution networks. The trachoma treatment market share is influenced by the availability and affordability of azithromycin, the cornerstone of treatment under the WHO's S.A.F.E. strategy. Innovation ecosystems are characterized by ongoing research into novel drug delivery systems and combination therapies aimed at improving treatment efficacy and reducing recurrence rates. Regulatory frameworks, primarily guided by organizations like the World Health Organization (WHO), play a pivotal role in shaping market access and drug approvals, especially in endemic regions. While direct competitors offering specific trachoma treatments are limited, the market faces indirect competition from broader ophthalmic anti-infectives and alternative approaches to eye health. End-user trends are dominated by public health programs and government initiatives focused on mass drug administration and surgical interventions in low-income countries. Mergers and acquisitions (M&A) activities are less frequent but can significantly impact market dynamics by consolidating R&D capabilities and expanding geographical reach. The M&A deal count is expected to remain low, with strategic partnerships and licensing agreements being more prevalent for expanding access to treatments.

- Key Players' Market Share Influence: Pfizer Inc. (Zithromax) and Merck & Co. Inc. are dominant due to established donation programs.

- Innovation Focus: Development of more effective and sustainable treatment regimens, potentially involving topical applications.

- Regulatory Impact: WHO guidelines significantly dictate treatment protocols and market access.

- End-User Preferences: Emphasis on accessible and cost-effective mass drug administration programs.

- M&A Landscape: Predominantly characterized by strategic alliances and licensing rather than outright acquisitions.

Trachoma Treatment Market Industry Insights & Trends

The trachoma treatment market is experiencing robust growth, propelled by increased global efforts to eradicate neglected tropical diseases. The trachoma treatment market size is estimated to be in the hundreds of millions of dollars and is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, driven by enhanced public health initiatives and rising awareness. A significant growth driver is the continued commitment from pharmaceutical giants and international health organizations to provide essential medicines, particularly azithromycin, to affected populations in endemic regions. The WHO's S.A.F.E. strategy (Surgery, Antibiotics, Facial cleanliness, and Environmental improvement) remains the primary treatment paradigm, with the antibiotic component forming a substantial part of the market. Technological disruptions, while not as pronounced as in other pharmaceutical sectors, are gradually emerging. These include advancements in drug formulation for improved patient compliance, such as single-dose regimens and potentially longer-acting topical applications, reducing the burden of repeated administration. Evolving consumer behaviors, within the context of public health, are characterized by increased demand for accessible and affordable treatment options in remote and underserved communities. Governments and NGOs are prioritizing these treatments, leading to sustained demand. The increasing prevalence of trachoma in specific geographical pockets, particularly in sub-Saharan Africa, Asia, and Latin America, continues to fuel the demand for effective trachoma medications. Furthermore, the ongoing research into the long-term sequelae of trachoma and the development of strategies to prevent blindness are contributing to market expansion. The market also benefits from increased funding for NTD control programs by both governmental and non-governmental organizations, ensuring a steady supply chain and distribution network for essential treatments. The trachoma treatment market trends indicate a shift towards more integrated approaches that combine medical interventions with community-based education and improved sanitation, ultimately driving the demand for a consistent supply of ophthalmic anti-infectives.

Key Markets & Segments Leading Trachoma Treatment Market

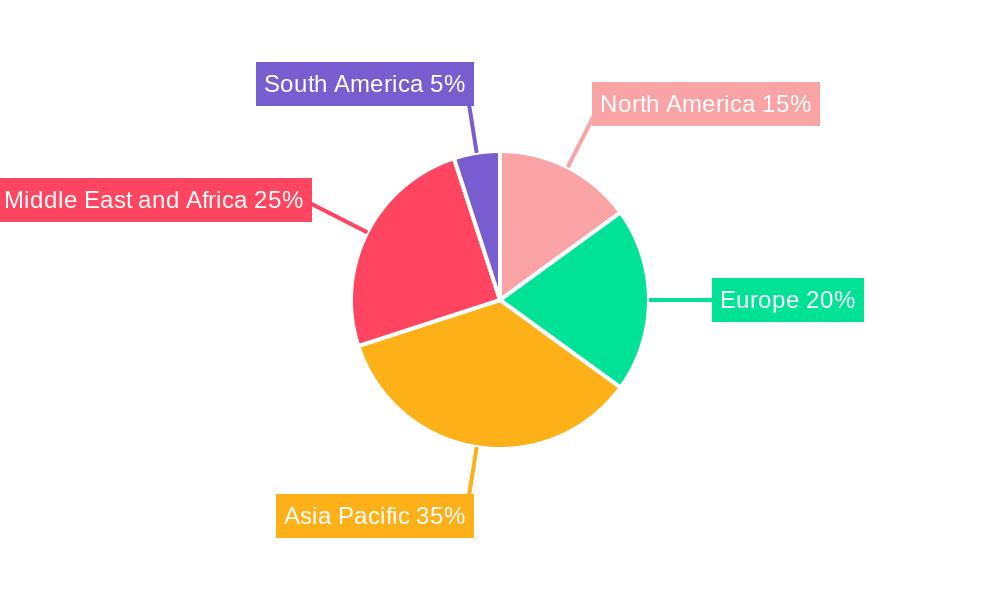

The trachoma treatment market is significantly influenced by key regions and specific therapeutic segments. Geographically, sub-Saharan Africa emerges as the dominant region, grappling with the highest burden of trachoma and receiving substantial international aid for disease control. Countries like Ethiopia, Nigeria, and Tanzania are critical markets due to their large populations residing in endemic areas and ongoing large-scale treatment campaigns. The economic growth and infrastructure development in these regions, though still developing, facilitate the distribution of essential medicines.

Within the Route of Administration segment, Oral administration remains the most prevalent and impactful method for trachoma treatment, primarily through the use of oral azithromycin. This approach is favored for mass drug administration (MDA) programs due to its efficiency in reaching large populations. While Topical applications are also utilized, they are typically for more advanced stages or specific ocular infections related to trachoma, and thus contribute a smaller but significant portion to the overall market value.

The Drug Class segment is largely dominated by Macrolides, with azithromycin being the undisputed leader. Its broad-spectrum activity and favorable safety profile for mass treatment make it indispensable. Tetracycline antibiotics, such as doxycycline, also play a role, particularly in specific treatment regimens or where macrolide resistance is a concern, though their usage has declined in favor of azithromycin for MDA. Ophthalmic Anti-infectives as a broader category encompass treatments for secondary bacterial eye infections that can arise from trachoma. While not directly treating the Chlamydia trachomatis infection, they are crucial for managing complications and preventing further vision loss. Sulfonamides, though historically significant, now hold a minor share in direct trachoma treatment compared to macrolides.

- Dominant Region: Sub-Saharan Africa, driven by high endemicity and extensive public health programs.

- Drivers: High prevalence rates, government commitment to NTD control, international donor funding, and large at-risk populations.

- Route of Administration Dominance: Oral administration of azithromycin for mass drug administration.

- Drivers: Cost-effectiveness, ease of administration to large populations, and widespread adoption by public health bodies.

- Drug Class Leadership: Macrolides (Azithromycin) as the primary treatment modality.

- Drivers: WHO recommendations, proven efficacy in MDA, and established donation programs from key manufacturers.

Trachoma Treatment Market Product Developments

Product developments in the trachoma treatment market are strategically focused on enhancing the accessibility and efficacy of existing treatments. While groundbreaking new drug discoveries are limited, advancements in formulation and delivery systems are gaining traction. This includes exploring more stable oral formulations for challenging climates and investigating novel topical ophthalmic preparations that could potentially offer sustained release of anti-infective agents, reducing the frequency of application and improving patient adherence. The market relevance of these developments lies in their ability to streamline treatment protocols, particularly within resource-limited settings where logistical challenges are significant. The competitive edge is gained by manufacturers who can offer more patient-friendly, cost-effective, and logistically manageable treatment solutions.

Challenges in the Trachoma Treatment Market Market

The trachoma treatment market faces several significant challenges that can hinder its progress. Regulatory hurdles in some regions, particularly concerning the approval and distribution of essential medicines, can cause delays. Supply chain complexities in remote and underdeveloped areas, including issues with storage and transportation of temperature-sensitive medications, remain a persistent problem. Competitive pressures, although less intense than in broader pharmaceutical markets, exist in terms of securing funding and achieving equitable distribution. Quantifiable impacts include potential stockouts in critical regions, leading to interruptions in treatment programs and the risk of disease resurgence.

- Regulatory Delays: Slow approval processes and varying registration requirements across countries.

- Supply Chain Vulnerabilities: Challenges in last-mile delivery, cold chain maintenance, and counterfeit drug prevention.

- Funding Dependence: Reliance on donor funding for mass drug administration programs, which can be subject to fluctuations.

Forces Driving Trachoma Treatment Market Growth

Several key forces are propelling the growth of the trachoma treatment market. The unwavering commitment from global health organizations like the WHO and national governments to combat NTDs is a primary driver, leading to sustained investment in trachoma control programs. Technological advancements, particularly in oral drug delivery systems, are enhancing the effectiveness and ease of mass drug administration. Economic factors, such as increasing per capita income in endemic regions and improved healthcare infrastructure, are also contributing to better access to treatments. Furthermore, the ongoing research highlighting the economic and social burden of trachoma-induced blindness is spurring greater advocacy and resource allocation for its eradication.

Challenges in the Trachoma Treatment Market Market

Long-term growth catalysts for the trachoma treatment market are intrinsically linked to advancements in public health strategies and global collaboration. Continued innovation in drug development, even incremental improvements in existing therapies, can significantly impact treatment outcomes and reduce the prevalence of the disease. Strategic partnerships between pharmaceutical manufacturers, NGOs, and governments are crucial for ensuring sustained access to affordable medicines and implementing comprehensive elimination programs. Market expansions will likely involve reaching the last mile of affected populations, requiring tailored distribution strategies and community engagement initiatives to overcome geographical and socio-economic barriers.

Emerging Opportunities in Trachoma Treatment Market

Emerging opportunities in the trachoma treatment market are diverse and promising. The increasing focus on integrated NTD control strategies presents an avenue for developing combination therapies that address trachoma alongside other prevalent tropical diseases, potentially increasing funding streams and simplifying healthcare delivery. Advancements in diagnostic tools could lead to earlier and more accurate identification of cases, enabling targeted interventions. Furthermore, the growing interest in telemedicine and digital health solutions offers a novel approach to monitoring treatment adherence and managing follow-up care in remote areas. Consumer preferences, while driven by public health needs, are shifting towards more sustainable and less burdensome treatment regimens, creating demand for innovative formulations.

Leading Players in the Trachoma Treatment Market Sector

- Arbor Pharmaceuticals Inc (Azurity Pharmaceuticals Inc )

- Merck & Co Inc

- Fresenius Kabi AG

- Sandoz Inc (Novartis AG)

- Teva Pharmaceutical Industries Ltd

- Allergan (AbbVie Inc )

- Apotex

- Pfizer Inc

Key Milestones in Trachoma Treatment Market Industry

- January 2023: Pfizer Inc. and the International Trachoma Initiative (ITI), a program of the independent nonprofit Task Force for Global Health, announced the donation of the one billionth Zithromax (azithromycin) dose as part of WHO's recommended S.A.F.E. strategy to help prevent and treat trachoma. This monumental milestone underscores the long-standing commitment to combating trachoma and highlights the critical role of public-private partnerships in achieving global health goals.

- January 2023: The World Health Organization (WHO) called for greater investment in combating neglected tropical diseases (NTDs), which left more than 1.6 billion people, often in least-developed countries, requiring treatment in 2021. This call to action signifies an increased global focus on NTDs, including trachoma, and signals potential for enhanced funding and expanded treatment programs in the coming years.

Strategic Outlook for Trachoma Treatment Market Market

The strategic outlook for the trachoma treatment market is highly positive, driven by sustained global commitment and evolving healthcare landscapes. Growth accelerators will be fueled by continued investment in mass drug administration programs, alongside innovation in therapeutic delivery systems that enhance patient compliance and logistical efficiency. The market is poised for expansion as international health organizations and governments prioritize the elimination of NTDs, creating a stable demand for trachoma treatment drugs. Strategic opportunities lie in forging stronger collaborations, leveraging digital health for enhanced monitoring, and exploring novel approaches to address the socioeconomic determinants of trachoma prevalence. The focus on sustainable interventions and the integration of trachoma control within broader public health frameworks will be key to achieving long-term eradication goals and ensuring the market's continued growth and impact.

Trachoma Treatment Market Segmentation

-

1. Route of Administration

- 1.1. Oral

- 1.2. Topical

-

2. Drug Class

- 2.1. Macrolides

- 2.2. Tetracycline

- 2.3. Ophthalmic Anti-infective

- 2.4. Sulfonamides

Trachoma Treatment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Trachoma Treatment Market Regional Market Share

Geographic Coverage of Trachoma Treatment Market

Trachoma Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence and Prevalence of Trachoma; Favourable Government Initiative

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About Trachoma; Side Effects Associated with the Drugs

- 3.4. Market Trends

- 3.4.1. Oral Route of Administration is Expected to Hold a Significant Share of the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trachoma Treatment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral

- 5.1.2. Topical

- 5.2. Market Analysis, Insights and Forecast - by Drug Class

- 5.2.1. Macrolides

- 5.2.2. Tetracycline

- 5.2.3. Ophthalmic Anti-infective

- 5.2.4. Sulfonamides

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. North America Trachoma Treatment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6.1.1. Oral

- 6.1.2. Topical

- 6.2. Market Analysis, Insights and Forecast - by Drug Class

- 6.2.1. Macrolides

- 6.2.2. Tetracycline

- 6.2.3. Ophthalmic Anti-infective

- 6.2.4. Sulfonamides

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7. Europe Trachoma Treatment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7.1.1. Oral

- 7.1.2. Topical

- 7.2. Market Analysis, Insights and Forecast - by Drug Class

- 7.2.1. Macrolides

- 7.2.2. Tetracycline

- 7.2.3. Ophthalmic Anti-infective

- 7.2.4. Sulfonamides

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8. Asia Pacific Trachoma Treatment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8.1.1. Oral

- 8.1.2. Topical

- 8.2. Market Analysis, Insights and Forecast - by Drug Class

- 8.2.1. Macrolides

- 8.2.2. Tetracycline

- 8.2.3. Ophthalmic Anti-infective

- 8.2.4. Sulfonamides

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9. Middle East and Africa Trachoma Treatment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9.1.1. Oral

- 9.1.2. Topical

- 9.2. Market Analysis, Insights and Forecast - by Drug Class

- 9.2.1. Macrolides

- 9.2.2. Tetracycline

- 9.2.3. Ophthalmic Anti-infective

- 9.2.4. Sulfonamides

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10. South America Trachoma Treatment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10.1.1. Oral

- 10.1.2. Topical

- 10.2. Market Analysis, Insights and Forecast - by Drug Class

- 10.2.1. Macrolides

- 10.2.2. Tetracycline

- 10.2.3. Ophthalmic Anti-infective

- 10.2.4. Sulfonamides

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arbor Pharmaceuticals Inc (Azurity Pharmaceuticals Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck & Co Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fresenius Kabi AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sandoz Inc (Novartis AG)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teva Pharmaceutical Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allergan (AbbVie Inc )

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Apotex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pfizer Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Arbor Pharmaceuticals Inc (Azurity Pharmaceuticals Inc )

List of Figures

- Figure 1: Global Trachoma Treatment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Trachoma Treatment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Trachoma Treatment Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 4: North America Trachoma Treatment Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 5: North America Trachoma Treatment Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 6: North America Trachoma Treatment Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 7: North America Trachoma Treatment Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 8: North America Trachoma Treatment Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 9: North America Trachoma Treatment Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 10: North America Trachoma Treatment Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 11: North America Trachoma Treatment Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Trachoma Treatment Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Trachoma Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Trachoma Treatment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Trachoma Treatment Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 16: Europe Trachoma Treatment Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 17: Europe Trachoma Treatment Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 18: Europe Trachoma Treatment Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 19: Europe Trachoma Treatment Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 20: Europe Trachoma Treatment Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 21: Europe Trachoma Treatment Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 22: Europe Trachoma Treatment Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 23: Europe Trachoma Treatment Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Trachoma Treatment Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Trachoma Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Trachoma Treatment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Trachoma Treatment Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 28: Asia Pacific Trachoma Treatment Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 29: Asia Pacific Trachoma Treatment Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 30: Asia Pacific Trachoma Treatment Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 31: Asia Pacific Trachoma Treatment Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 32: Asia Pacific Trachoma Treatment Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 33: Asia Pacific Trachoma Treatment Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 34: Asia Pacific Trachoma Treatment Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 35: Asia Pacific Trachoma Treatment Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Trachoma Treatment Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Trachoma Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Trachoma Treatment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Trachoma Treatment Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 40: Middle East and Africa Trachoma Treatment Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 41: Middle East and Africa Trachoma Treatment Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 42: Middle East and Africa Trachoma Treatment Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 43: Middle East and Africa Trachoma Treatment Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 44: Middle East and Africa Trachoma Treatment Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 45: Middle East and Africa Trachoma Treatment Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 46: Middle East and Africa Trachoma Treatment Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 47: Middle East and Africa Trachoma Treatment Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Trachoma Treatment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Trachoma Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Trachoma Treatment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Trachoma Treatment Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 52: South America Trachoma Treatment Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 53: South America Trachoma Treatment Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 54: South America Trachoma Treatment Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 55: South America Trachoma Treatment Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 56: South America Trachoma Treatment Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 57: South America Trachoma Treatment Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 58: South America Trachoma Treatment Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 59: South America Trachoma Treatment Market Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Trachoma Treatment Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Trachoma Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Trachoma Treatment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Trachoma Treatment Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 2: Global Trachoma Treatment Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 3: Global Trachoma Treatment Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 4: Global Trachoma Treatment Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 5: Global Trachoma Treatment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Trachoma Treatment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Trachoma Treatment Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 8: Global Trachoma Treatment Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 9: Global Trachoma Treatment Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 10: Global Trachoma Treatment Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 11: Global Trachoma Treatment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Trachoma Treatment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Trachoma Treatment Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 20: Global Trachoma Treatment Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 21: Global Trachoma Treatment Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 22: Global Trachoma Treatment Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 23: Global Trachoma Treatment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Trachoma Treatment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Trachoma Treatment Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 38: Global Trachoma Treatment Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 39: Global Trachoma Treatment Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 40: Global Trachoma Treatment Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 41: Global Trachoma Treatment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Trachoma Treatment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Trachoma Treatment Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 56: Global Trachoma Treatment Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 57: Global Trachoma Treatment Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 58: Global Trachoma Treatment Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 59: Global Trachoma Treatment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Trachoma Treatment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Trachoma Treatment Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 68: Global Trachoma Treatment Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 69: Global Trachoma Treatment Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 70: Global Trachoma Treatment Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 71: Global Trachoma Treatment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Trachoma Treatment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Trachoma Treatment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Trachoma Treatment Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Trachoma Treatment Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Trachoma Treatment Market?

Key companies in the market include Arbor Pharmaceuticals Inc (Azurity Pharmaceuticals Inc ), Merck & Co Inc , Fresenius Kabi AG, Sandoz Inc (Novartis AG), Teva Pharmaceutical Industries Ltd, Allergan (AbbVie Inc ), Apotex, Pfizer Inc.

3. What are the main segments of the Trachoma Treatment Market?

The market segments include Route of Administration, Drug Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence and Prevalence of Trachoma; Favourable Government Initiative.

6. What are the notable trends driving market growth?

Oral Route of Administration is Expected to Hold a Significant Share of the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness About Trachoma; Side Effects Associated with the Drugs.

8. Can you provide examples of recent developments in the market?

January 2023: Pfizer Inc. and the International Trachoma Initiative (ITI), a program of the independent nonprofit Task Force for Global Health, announced the donation of the one billionth Zithromax (azithromycin) dose as part of WHO's recommended S.A.F.E. strategy to help prevent and treat trachoma.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Trachoma Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Trachoma Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Trachoma Treatment Market?

To stay informed about further developments, trends, and reports in the Trachoma Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence