Key Insights

The global Cardiovascular Drugs market is projected to reach $157.8 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.5%. This growth is driven by the rising incidence of cardiovascular diseases (CVDs), an aging global population, and continuous innovation in pharmaceutical R&D, leading to more effective therapies. Key therapeutic areas include anti-hyperlipidemics and anti-hypertensives, supported by increasing diagnoses of hypertension, hyperlipidemia, and coronary artery disease. Expanding access through hospital and retail pharmacies, coupled with evolving healthcare in emerging economies, further bolsters market expansion.

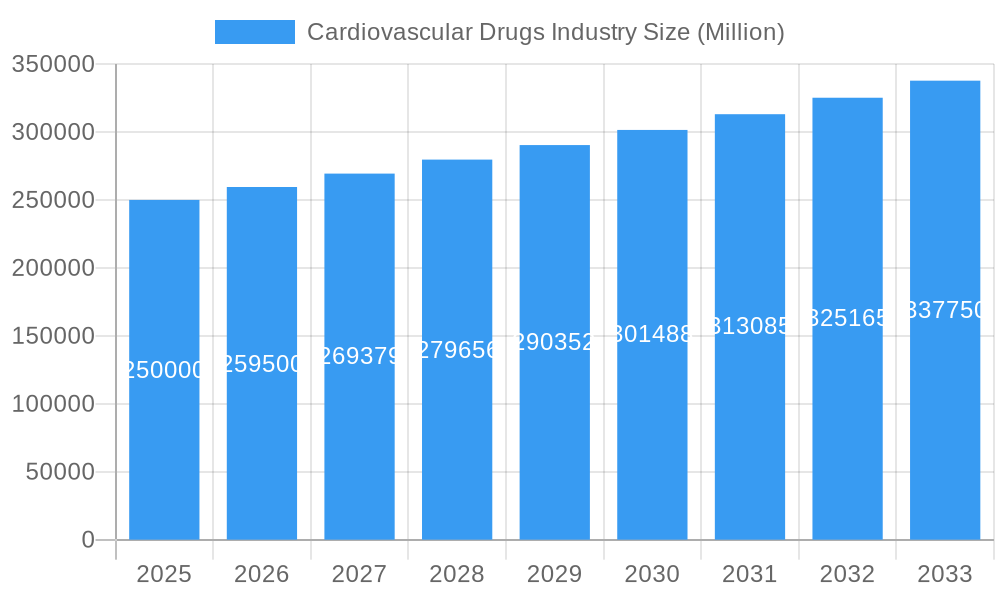

Cardiovascular Drugs Industry Market Size (In Billion)

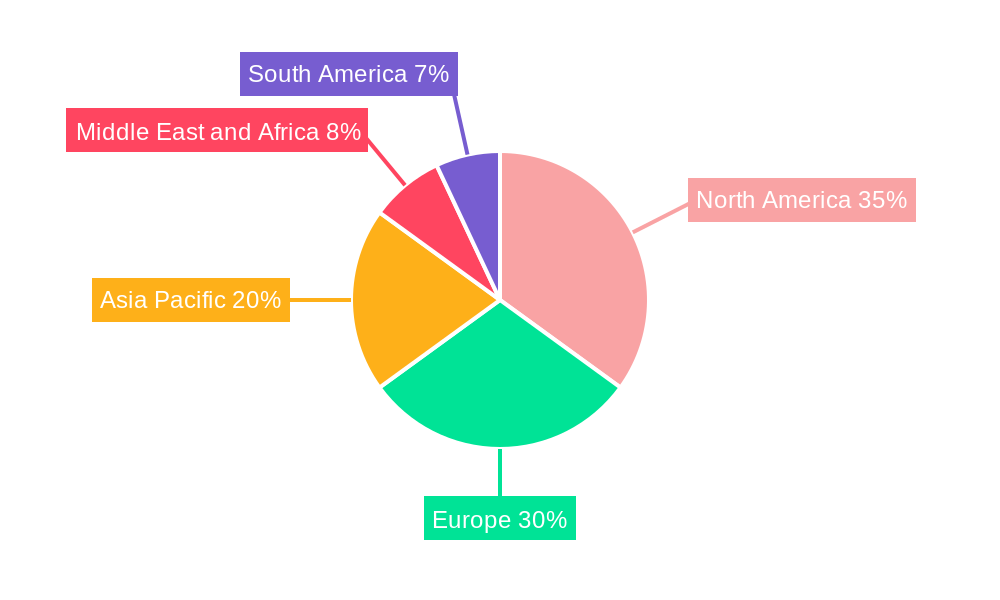

Challenges such as stringent regulatory pathways, high R&D expenses, and healthcare cost containment pressures exist. However, emerging trends like novel drug delivery systems, personalized medicine, and a focus on preventive cardiology are set to transform the market. Leading companies are investing in next-generation cardiovascular treatments. While North America and Europe currently lead, the Asia Pacific region is anticipated to experience the most rapid growth due to increased healthcare spending, rising disposable incomes, and heightened cardiovascular health awareness.

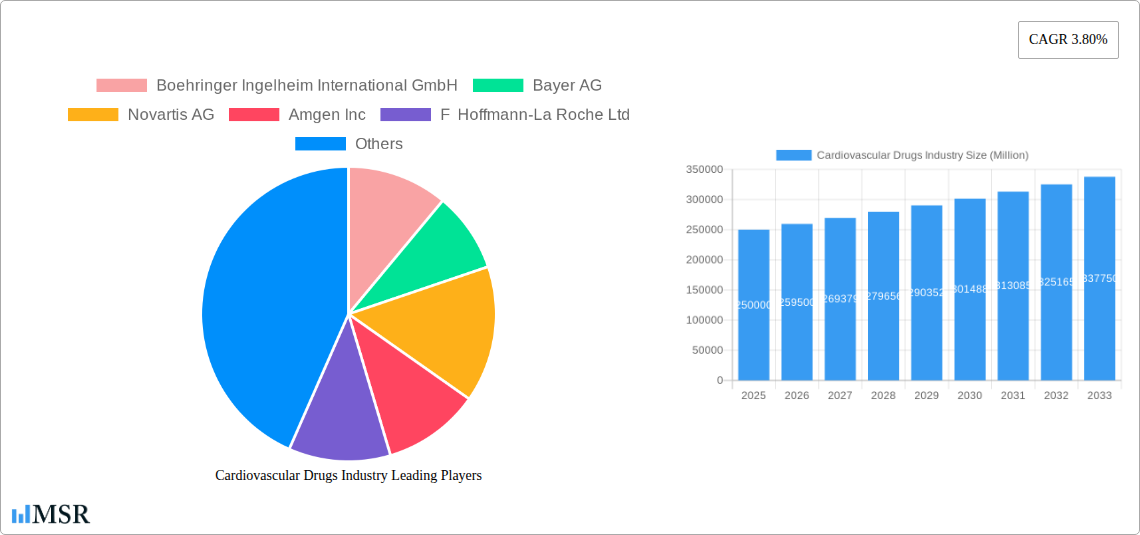

Cardiovascular Drugs Industry Company Market Share

Unlocking the Future of Heart Health: Comprehensive Cardiovascular Drugs Industry Report

This in-depth report provides critical insights into the global Cardiovascular Drugs Market, a dynamic sector projected to reach xx Million by 2033. Covering the study period 2019–2033, with a base year of 2025, this analysis delves into market dynamics, key trends, dominant segments, product innovations, challenges, growth drivers, and emerging opportunities. Gain a strategic advantage with detailed information on leading companies, pivotal industry developments, and a forward-looking outlook for this multi-billion dollar cardiovascular health sector.

Cardiovascular Drugs Industry Market Concentration & Dynamics

The cardiovascular drugs industry exhibits a moderate to high market concentration, with major pharmaceutical giants dominating a significant share of the market. Innovation ecosystems are robust, driven by substantial R&D investments focused on novel drug discovery for conditions like hypertension and hyperlipidemia. Regulatory frameworks, overseen by bodies like the FDA and EMA, play a crucial role in market entry and product approval, influencing the pace of innovation and competitive landscape. The threat of substitute products, while present in the form of lifestyle modifications and medical devices, remains limited for severe cardiovascular ailments. End-user trends are increasingly leaning towards personalized medicine and preventative care, demanding more effective and targeted therapies. Merger and acquisition (M&A) activities are significant, with xx deals recorded historically, indicating a strategic consolidation to enhance market reach and R&D capabilities. Key players are actively pursuing M&A to acquire promising drug pipelines and expand their portfolios in high-demand therapeutic areas.

- Market Share Concentration: Dominated by a few key players, but with growing opportunities for specialized and generic manufacturers.

- Innovation Ecosystem: Fueled by significant R&D spending, focusing on unmet needs in heart failure and complex arrhythmias.

- Regulatory Impact: Stringent approval processes drive quality but can also create market entry barriers.

- Substitute Threats: Primarily lifestyle changes, but less impactful for advanced cardiovascular diseases requiring pharmacological intervention.

- M&A Activity: Strategic acquisitions to bolster portfolios and gain market share.

Cardiovascular Drugs Industry Industry Insights & Trends

The cardiovascular drugs industry is poised for substantial growth, driven by a confluence of factors including an aging global population, increasing prevalence of cardiovascular diseases, and rising healthcare expenditure. The market size was estimated at xx Million in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period 2025–2033. Technological disruptions, such as advancements in genomics and personalized medicine, are enabling the development of more targeted and effective treatments for conditions like hypertension and hyperlipidemia. Evolving consumer behaviors, characterized by greater health consciousness and demand for preventative healthcare solutions, are also shaping market trends. The increasing adoption of digital health tools and remote patient monitoring is further influencing treatment adherence and management of chronic cardiovascular conditions. The focus is shifting towards combination therapies and novel drug formulations to improve patient outcomes and address complex disease pathways. The persistent rise in risk factors such as obesity, diabetes, and sedentary lifestyles continues to fuel the demand for effective cardiovascular drugs.

Key Markets & Segments Leading Cardiovascular Drugs Industry

The Cardiovascular Drugs Industry is led by several key markets and segments, reflecting global health trends and access to advanced healthcare.

Dominant Regions: North America currently leads the market due to high disease prevalence, robust R&D infrastructure, and significant healthcare spending. Asia Pacific is the fastest-growing region, driven by increasing healthcare awareness, improving economies, and a large, aging population susceptible to cardiovascular ailments.

Leading Drug Classes:

- Anti-hyperlipidemics: This segment is a significant revenue generator due to the widespread prevalence of high cholesterol and its link to heart disease.

- Anti-hypertensives: Driven by the global epidemic of hypertension, this class remains a cornerstone of cardiovascular treatment.

- Anti-coagulants: Essential for preventing stroke and other thromboembolic events, this segment sees consistent demand.

- Anti-arrhythmics: Crucial for managing irregular heartbeats, with ongoing innovation to improve efficacy and reduce side effects.

Dominant Indications:

- Hypertension: The most prevalent cardiovascular condition, making anti-hypertensive drugs a primary market driver.

- Hyperlipidemia: Directly linked to cardiovascular risk, driving demand for lipid-lowering therapies.

- Coronary Artery Disease (CAD): A major cause of mortality, necessitating a range of cardiovascular medications.

- Heart Failure (HF): A growing area of focus with recent therapeutic advancements, as evidenced by product launches for sacubitril/valsartan combinations.

Key Distribution Channels:

- Hospitals: Remain a primary channel, especially for acute cardiovascular conditions and specialized treatments.

- Pharmacies: Critical for the long-term management of chronic cardiovascular diseases, with a significant share of the market for outpatient prescriptions.

Cardiovascular Drugs Industry Product Developments

The cardiovascular drugs industry is witnessing rapid product development, focusing on enhanced efficacy, reduced side effects, and novel therapeutic approaches. Innovations are centered on targeting specific molecular pathways for conditions like hypertension and hyperlipidemia, as well as developing advanced anti-coagulant and anti-arrhythmic therapies. The advent of combination drugs, such as those indicated for heart failure, exemplifies the trend towards more comprehensive treatment regimens. Furthermore, advancements in drug delivery systems and formulations are improving patient adherence and therapeutic outcomes. The industry is keenly observing developments in biologics and gene therapies for rare cardiovascular disorders, promising a new era of personalized and precision medicine.

Challenges in the Cardiovascular Drugs Industry Market

The Cardiovascular Drugs Industry Market faces several significant challenges that can impact growth and profitability. These include the rigorous and lengthy regulatory approval processes, which can delay market entry for innovative treatments and increase R&D costs. Supply chain vulnerabilities, exacerbated by global events, pose a risk to the consistent availability of essential medications. Intense competition, particularly from generic drug manufacturers, can lead to price erosion and reduced profit margins for branded drugs. Furthermore, the increasing burden of chronic diseases and the need for long-term treatment regimens place a significant strain on healthcare systems and patient affordability.

- Regulatory Hurdles: Stringent approval pathways increase R&D timelines and costs.

- Supply Chain Disruptions: Global events can impact manufacturing and distribution, leading to shortages.

- Intense Competition: The presence of numerous generic alternatives drives down prices.

- Affordability Concerns: The cost of chronic treatment can be a barrier for patients and healthcare systems.

Forces Driving Cardiovascular Drugs Industry Growth

The Cardiovascular Drugs Industry is propelled by powerful growth forces. The escalating global burden of cardiovascular diseases, driven by an aging population and lifestyle factors like obesity and diabetes, directly fuels demand for effective treatments. Continuous innovation in pharmaceutical R&D leads to the development of more potent and targeted therapies for conditions such as hypertension, hyperlipidemia, and heart failure. Government initiatives and healthcare policies aimed at improving cardiovascular health outcomes and expanding access to treatments also act as significant catalysts. Moreover, the increasing disposable income in emerging economies and rising healthcare expenditure are expanding the market reach for these essential drugs. The development of novel drug classes and combination therapies further invigorates the market by offering improved patient care.

Challenges in the Cardiovascular Drugs Industry Market

Long-term growth catalysts in the Cardiovascular Drugs Industry Market are anchored in overcoming existing challenges and leveraging scientific advancements. The persistent rise in cardiovascular disease prevalence, especially in aging populations and developing nations, presents a sustained demand. Advancements in precision medicine and personalized therapies, identifying specific genetic predispositions or treatment responses, are poised to create highly effective, niche markets. Strategic partnerships between pharmaceutical companies, research institutions, and technology providers are accelerating the discovery and development of novel drug candidates. Furthermore, expanding market access in underserved regions through innovative pricing models and distribution strategies will unlock substantial future growth.

Emerging Opportunities in Cardiovascular Drugs Industry

Emerging opportunities in the Cardiovascular Drugs Industry are ripe for exploration. The increasing focus on preventative cardiology and the development of pharmacogenomic solutions offer avenues for highly targeted and personalized treatments. The burgeoning market for digital therapeutics and remote patient monitoring tools presents opportunities for integrated care models that enhance treatment adherence and patient outcomes for hypertension and other chronic conditions. Furthermore, the growing prevalence of cardiovascular comorbidities in conjunction with other diseases, such as diabetes and kidney disease, creates demand for multi-target therapies. Exploration of novel drug targets and delivery mechanisms, including biologics and gene therapies for rare cardiovascular disorders, also signifies significant future growth potential.

Leading Players in the Cardiovascular Drugs Industry Sector

- Boehringer Ingelheim International GmbH

- Bayer AG

- Novartis AG

- Amgen Inc

- F Hoffmann-La Roche Ltd

- Baxter

- Lupin

- Merck & Co Inc (MSD)

- Johnson & Johnson

- Sanofi S A

- Gilead Sciences Inc

- Pfizer Inc

Key Milestones in Cardiovascular Drugs Industry Industry

- January 2023: Lupin Pharmaceuticals, a global player in drug discovery, launched the generic version of the combination drug in India following the patent expiry of Novartis' blockbuster heart drug Sacubitril and Valsartan, which will be marketed under two brand names, Valentas and Arnipin indicated for patients with Heart Failure (HF).

- January 2023: Glenmark Pharmaceuticals, a global pharmaceutical company, launched the sacubitril + valsartan prescription-only tablets in India for the treatment of HF, marketed under the brand name 'Sacu V.'.

Strategic Outlook for Cardiovascular Drugs Industry Market

The strategic outlook for the Cardiovascular Drugs Industry Market is characterized by continued growth driven by a robust pipeline of innovative therapies and increasing global demand. Key growth accelerators include the development of advanced treatments for heart failure, personalized medicine approaches to manage hypertension and hyperlipidemia, and the expansion of market access in emerging economies. Pharmaceutical companies are expected to focus on strategic collaborations and acquisitions to strengthen their portfolios and leverage cutting-edge technologies. The industry's ability to address unmet medical needs and adapt to evolving healthcare landscapes will be crucial for sustained success and profitability in the coming years.

Cardiovascular Drugs Industry Segmentation

-

1. Drug Class

- 1.1. Anti-hyperlipidemics

- 1.2. Anti-hypertensives

- 1.3. Anti-coagulants

- 1.4. Anti-arrhythmics

- 1.5. Other Drug Classes

-

2. Indication

- 2.1. Hypertension

- 2.2. Hyperlipidemia

- 2.3. Coronary Artery Disease

- 2.4. Arrhythmia

- 2.5. Other Indications

-

3. Distribution Channel

- 3.1. Hospitals

- 3.2. Pharmacies

- 3.3. Other Distribution Channels

Cardiovascular Drugs Industry Segmentation By Geography

-

1. North America

- 1.1. United states

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cardiovascular Drugs Industry Regional Market Share

Geographic Coverage of Cardiovascular Drugs Industry

Cardiovascular Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cardiovascular Diseases (CVDs) Globally; Growing R&D Investments in Efficient Drug Development; Increasing Reimbursement Policies

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework and Highly Expensive Drugs; Adoption of Advanced Medical Devices

- 3.4. Market Trends

- 3.4.1. Hypertension Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cardiovascular Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Anti-hyperlipidemics

- 5.1.2. Anti-hypertensives

- 5.1.3. Anti-coagulants

- 5.1.4. Anti-arrhythmics

- 5.1.5. Other Drug Classes

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Hypertension

- 5.2.2. Hyperlipidemia

- 5.2.3. Coronary Artery Disease

- 5.2.4. Arrhythmia

- 5.2.5. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospitals

- 5.3.2. Pharmacies

- 5.3.3. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Cardiovascular Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Anti-hyperlipidemics

- 6.1.2. Anti-hypertensives

- 6.1.3. Anti-coagulants

- 6.1.4. Anti-arrhythmics

- 6.1.5. Other Drug Classes

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Hypertension

- 6.2.2. Hyperlipidemia

- 6.2.3. Coronary Artery Disease

- 6.2.4. Arrhythmia

- 6.2.5. Other Indications

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospitals

- 6.3.2. Pharmacies

- 6.3.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Cardiovascular Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Anti-hyperlipidemics

- 7.1.2. Anti-hypertensives

- 7.1.3. Anti-coagulants

- 7.1.4. Anti-arrhythmics

- 7.1.5. Other Drug Classes

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Hypertension

- 7.2.2. Hyperlipidemia

- 7.2.3. Coronary Artery Disease

- 7.2.4. Arrhythmia

- 7.2.5. Other Indications

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospitals

- 7.3.2. Pharmacies

- 7.3.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Cardiovascular Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Anti-hyperlipidemics

- 8.1.2. Anti-hypertensives

- 8.1.3. Anti-coagulants

- 8.1.4. Anti-arrhythmics

- 8.1.5. Other Drug Classes

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Hypertension

- 8.2.2. Hyperlipidemia

- 8.2.3. Coronary Artery Disease

- 8.2.4. Arrhythmia

- 8.2.5. Other Indications

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospitals

- 8.3.2. Pharmacies

- 8.3.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Cardiovascular Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Anti-hyperlipidemics

- 9.1.2. Anti-hypertensives

- 9.1.3. Anti-coagulants

- 9.1.4. Anti-arrhythmics

- 9.1.5. Other Drug Classes

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Hypertension

- 9.2.2. Hyperlipidemia

- 9.2.3. Coronary Artery Disease

- 9.2.4. Arrhythmia

- 9.2.5. Other Indications

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospitals

- 9.3.2. Pharmacies

- 9.3.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Cardiovascular Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Anti-hyperlipidemics

- 10.1.2. Anti-hypertensives

- 10.1.3. Anti-coagulants

- 10.1.4. Anti-arrhythmics

- 10.1.5. Other Drug Classes

- 10.2. Market Analysis, Insights and Forecast - by Indication

- 10.2.1. Hypertension

- 10.2.2. Hyperlipidemia

- 10.2.3. Coronary Artery Disease

- 10.2.4. Arrhythmia

- 10.2.5. Other Indications

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospitals

- 10.3.2. Pharmacies

- 10.3.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim International GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amgen Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F Hoffmann-La Roche Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baxter

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lupin

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merck & Co Inc (MSD)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sanofi S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gilead Sciences Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim International GmbH

List of Figures

- Figure 1: Global Cardiovascular Drugs Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Cardiovascular Drugs Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Cardiovascular Drugs Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 4: North America Cardiovascular Drugs Industry Volume (K Units), by Drug Class 2025 & 2033

- Figure 5: North America Cardiovascular Drugs Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 6: North America Cardiovascular Drugs Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 7: North America Cardiovascular Drugs Industry Revenue (billion), by Indication 2025 & 2033

- Figure 8: North America Cardiovascular Drugs Industry Volume (K Units), by Indication 2025 & 2033

- Figure 9: North America Cardiovascular Drugs Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 10: North America Cardiovascular Drugs Industry Volume Share (%), by Indication 2025 & 2033

- Figure 11: North America Cardiovascular Drugs Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 12: North America Cardiovascular Drugs Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 13: North America Cardiovascular Drugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Cardiovascular Drugs Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Cardiovascular Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Cardiovascular Drugs Industry Volume (K Units), by Country 2025 & 2033

- Figure 17: North America Cardiovascular Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Cardiovascular Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Cardiovascular Drugs Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 20: Europe Cardiovascular Drugs Industry Volume (K Units), by Drug Class 2025 & 2033

- Figure 21: Europe Cardiovascular Drugs Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 22: Europe Cardiovascular Drugs Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 23: Europe Cardiovascular Drugs Industry Revenue (billion), by Indication 2025 & 2033

- Figure 24: Europe Cardiovascular Drugs Industry Volume (K Units), by Indication 2025 & 2033

- Figure 25: Europe Cardiovascular Drugs Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 26: Europe Cardiovascular Drugs Industry Volume Share (%), by Indication 2025 & 2033

- Figure 27: Europe Cardiovascular Drugs Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 28: Europe Cardiovascular Drugs Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 29: Europe Cardiovascular Drugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Cardiovascular Drugs Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Europe Cardiovascular Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Cardiovascular Drugs Industry Volume (K Units), by Country 2025 & 2033

- Figure 33: Europe Cardiovascular Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Cardiovascular Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Cardiovascular Drugs Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 36: Asia Pacific Cardiovascular Drugs Industry Volume (K Units), by Drug Class 2025 & 2033

- Figure 37: Asia Pacific Cardiovascular Drugs Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 38: Asia Pacific Cardiovascular Drugs Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 39: Asia Pacific Cardiovascular Drugs Industry Revenue (billion), by Indication 2025 & 2033

- Figure 40: Asia Pacific Cardiovascular Drugs Industry Volume (K Units), by Indication 2025 & 2033

- Figure 41: Asia Pacific Cardiovascular Drugs Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 42: Asia Pacific Cardiovascular Drugs Industry Volume Share (%), by Indication 2025 & 2033

- Figure 43: Asia Pacific Cardiovascular Drugs Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Asia Pacific Cardiovascular Drugs Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Cardiovascular Drugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Cardiovascular Drugs Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Cardiovascular Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Cardiovascular Drugs Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: Asia Pacific Cardiovascular Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Cardiovascular Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Cardiovascular Drugs Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 52: Middle East and Africa Cardiovascular Drugs Industry Volume (K Units), by Drug Class 2025 & 2033

- Figure 53: Middle East and Africa Cardiovascular Drugs Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 54: Middle East and Africa Cardiovascular Drugs Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 55: Middle East and Africa Cardiovascular Drugs Industry Revenue (billion), by Indication 2025 & 2033

- Figure 56: Middle East and Africa Cardiovascular Drugs Industry Volume (K Units), by Indication 2025 & 2033

- Figure 57: Middle East and Africa Cardiovascular Drugs Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 58: Middle East and Africa Cardiovascular Drugs Industry Volume Share (%), by Indication 2025 & 2033

- Figure 59: Middle East and Africa Cardiovascular Drugs Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 60: Middle East and Africa Cardiovascular Drugs Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 61: Middle East and Africa Cardiovascular Drugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East and Africa Cardiovascular Drugs Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East and Africa Cardiovascular Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East and Africa Cardiovascular Drugs Industry Volume (K Units), by Country 2025 & 2033

- Figure 65: Middle East and Africa Cardiovascular Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Cardiovascular Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Cardiovascular Drugs Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 68: South America Cardiovascular Drugs Industry Volume (K Units), by Drug Class 2025 & 2033

- Figure 69: South America Cardiovascular Drugs Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 70: South America Cardiovascular Drugs Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 71: South America Cardiovascular Drugs Industry Revenue (billion), by Indication 2025 & 2033

- Figure 72: South America Cardiovascular Drugs Industry Volume (K Units), by Indication 2025 & 2033

- Figure 73: South America Cardiovascular Drugs Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 74: South America Cardiovascular Drugs Industry Volume Share (%), by Indication 2025 & 2033

- Figure 75: South America Cardiovascular Drugs Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 76: South America Cardiovascular Drugs Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 77: South America Cardiovascular Drugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: South America Cardiovascular Drugs Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: South America Cardiovascular Drugs Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: South America Cardiovascular Drugs Industry Volume (K Units), by Country 2025 & 2033

- Figure 81: South America Cardiovascular Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Cardiovascular Drugs Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 2: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Drug Class 2020 & 2033

- Table 3: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Indication 2020 & 2033

- Table 4: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Indication 2020 & 2033

- Table 5: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 10: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Drug Class 2020 & 2033

- Table 11: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Indication 2020 & 2033

- Table 12: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Indication 2020 & 2033

- Table 13: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United states Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United states Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 24: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Drug Class 2020 & 2033

- Table 25: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Indication 2020 & 2033

- Table 26: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Indication 2020 & 2033

- Table 27: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Germany Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: France Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: France Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Italy Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Spain Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Spain Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 44: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Drug Class 2020 & 2033

- Table 45: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Indication 2020 & 2033

- Table 46: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Indication 2020 & 2033

- Table 47: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 48: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 49: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 51: China Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: China Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Japan Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: India Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: India Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Australia Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Australia Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: South Korea Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 64: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Drug Class 2020 & 2033

- Table 65: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Indication 2020 & 2033

- Table 66: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Indication 2020 & 2033

- Table 67: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 71: GCC Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: GCC Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: South Africa Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 78: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Drug Class 2020 & 2033

- Table 79: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Indication 2020 & 2033

- Table 80: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Indication 2020 & 2033

- Table 81: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 82: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 83: Global Cardiovascular Drugs Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 84: Global Cardiovascular Drugs Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 85: Brazil Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Brazil Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: Argentina Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: Argentina Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Cardiovascular Drugs Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Cardiovascular Drugs Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cardiovascular Drugs Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Cardiovascular Drugs Industry?

Key companies in the market include Boehringer Ingelheim International GmbH, Bayer AG, Novartis AG, Amgen Inc, F Hoffmann-La Roche Ltd, Baxter, Lupin, Merck & Co Inc (MSD), Johnson & Johnson, Sanofi S A, Gilead Sciences Inc, Pfizer Inc.

3. What are the main segments of the Cardiovascular Drugs Industry?

The market segments include Drug Class, Indication, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 157.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cardiovascular Diseases (CVDs) Globally; Growing R&D Investments in Efficient Drug Development; Increasing Reimbursement Policies.

6. What are the notable trends driving market growth?

Hypertension Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework and Highly Expensive Drugs; Adoption of Advanced Medical Devices.

8. Can you provide examples of recent developments in the market?

January 2023: Lupin Pharmaceuticals, a global player in drug discovery, launched the generic version of the combination drug in India following the patent expiry of Novartis' blockbuster heart drug Sacubitril and Valsartan, which will be marketed under two brand names, Valentas and Arnipin indicated for patients with Heart Failure (HF).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cardiovascular Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cardiovascular Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cardiovascular Drugs Industry?

To stay informed about further developments, trends, and reports in the Cardiovascular Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence