Key Insights

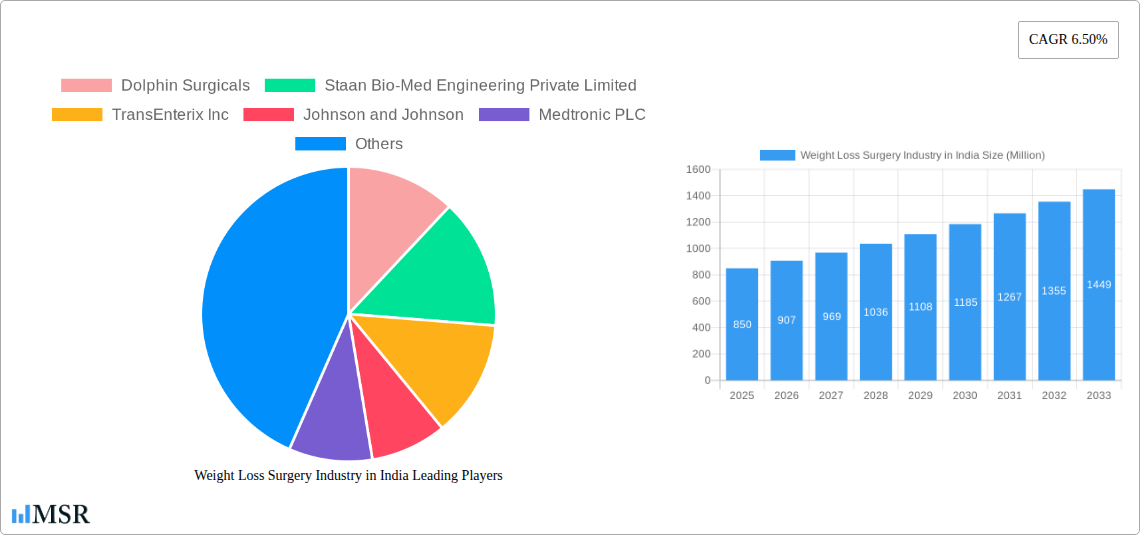

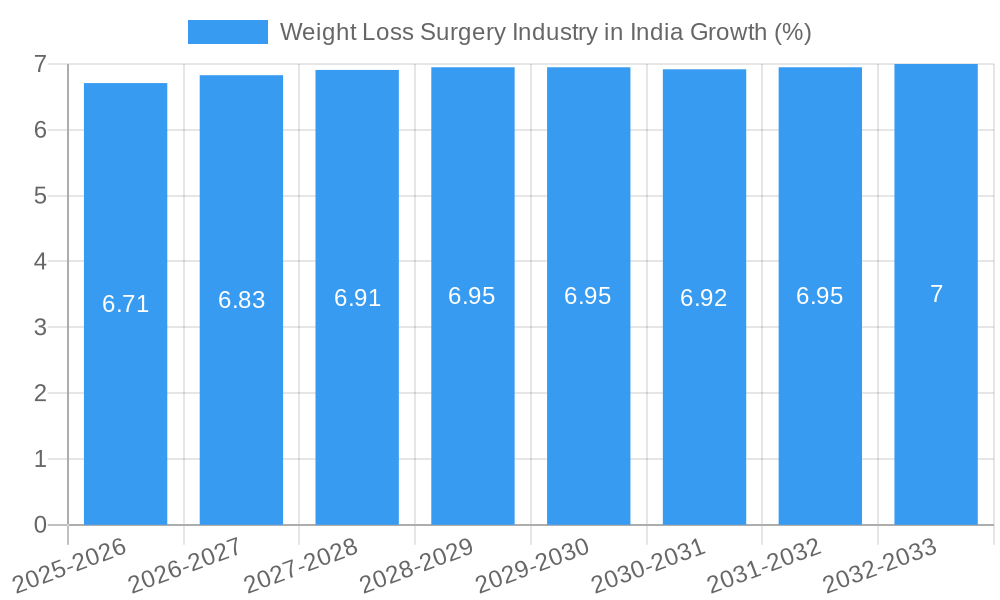

The Indian weight loss surgery market is poised for significant expansion, projected to reach an estimated USD 850 million by 2025, driven by a compelling compound annual growth rate (CAGR) of 6.50%. This robust growth is underpinned by a confluence of escalating public awareness regarding obesity-related health issues, increased disposable incomes, and a growing preference for minimally invasive surgical procedures. The surge in bariatric surgeries, including gastric bypass and sleeve gastrectomy, reflects a societal shift towards proactive health management and a desire for sustainable weight loss solutions. Furthermore, advancements in surgical technology, leading to improved patient outcomes and reduced recovery times, are also contributing to the market's upward trajectory. The increasing prevalence of lifestyle diseases like diabetes, hypertension, and cardiovascular conditions, directly linked to obesity, further amplifies the demand for effective weight management interventions, positioning weight loss surgery as a critical medical solution.

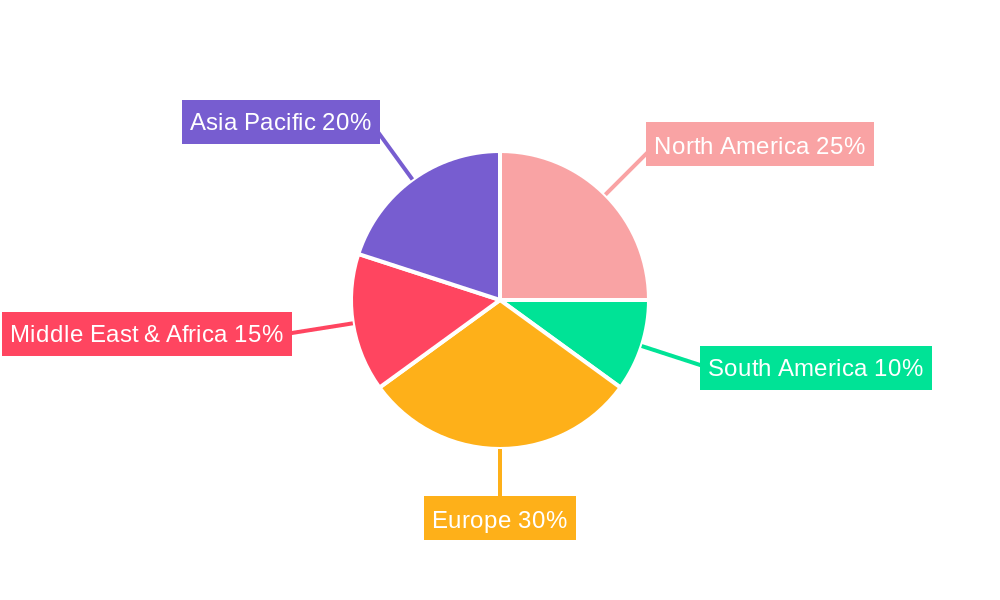

The market is segmented across various device categories, with Assisting Devices expected to capture a substantial share, encompassing suturing devices, closure devices, and stapling devices, crucial for performing these complex procedures efficiently. Implantable Devices also represent a growing segment as innovative solutions gain traction. Geographically, Asia Pacific, led by China and India, is anticipated to be a dominant force, fueled by the burgeoning healthcare infrastructure and a large patient pool grappling with obesity. However, the market is not without its challenges. High treatment costs, a lack of widespread insurance coverage for bariatric procedures in some regions, and a scarcity of highly specialized surgeons can act as restraints. Nevertheless, the long-term outlook remains exceptionally positive, with continuous technological innovation and expanding access to healthcare services expected to propel the Indian weight loss surgery market to new heights in the coming years.

Gain deep insights into the rapidly expanding Indian weight loss surgery market, a lucrative sector projected to reach multi-million dollar valuations. This report offers a detailed analysis of market dynamics, key trends, leading players, and future opportunities for industry stakeholders. Covering the study period of 2019–2033, with a base year of 2025, this analysis is crucial for understanding the trajectory of bariatric surgery in India.

Weight Loss Surgery Industry in India Market Concentration & Dynamics

The Indian weight loss surgery industry is characterized by a growing concentration of key players, fostering an innovative ecosystem driven by technological advancements and increasing accessibility. Regulatory frameworks, overseen by bodies like the CDSCO, are maturing, ensuring patient safety and ethical practices, which in turn bolsters market confidence. While substitute products exist, the effectiveness and long-term results of bariatric surgery are increasingly recognized by end-users seeking sustainable weight management solutions. M&A activities are anticipated to accelerate as larger global players seek to expand their footprint in this high-growth market. Current market share distribution is dynamic, with leading companies continuously vying for dominance. The number of strategic partnerships and acquisitions is projected to increase significantly throughout the forecast period, reflecting the industry's consolidation phase and the pursuit of synergistic growth.

Weight Loss Surgery Industry in India Industry Insights & Trends

The Indian weight loss surgery market is experiencing robust growth, driven by a confluence of factors including rising obesity rates, increasing disposable incomes, and a growing awareness of bariatric procedures as effective solutions for morbid obesity and related comorbidities. The market size is projected to reach $XXX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Technological disruptions are at the forefront, with advancements in minimally invasive techniques and robotic surgery significantly improving patient outcomes, reducing recovery times, and enhancing patient comfort. The adoption of innovative devices and surgical equipment plays a pivotal role in this evolution. Evolving consumer behaviors are also a significant driver; as individuals become more proactive about their health and well-being, the demand for comprehensive weight management strategies, including surgical interventions, is escalating. This shift is further amplified by increasing media attention and celebrity endorsements, normalizing and destigmatizing bariatric surgery. The economic landscape of India, with its burgeoning middle class, is creating a larger addressable market for these procedures. Furthermore, government initiatives aimed at promoting public health and tackling the rising burden of non-communicable diseases indirectly support the growth of the weight loss surgery sector by encouraging proactive health management. The integration of digital health technologies, such as remote patient monitoring and AI-driven pre- and post-operative care, is also poised to transform patient experience and procedural efficiency.

Key Markets & Segments Leading Weight Loss Surgery Industry in India

The Assisting Devices segment, particularly Stapling Devices and Closure Devices, is currently the dominant force in the Indian weight loss surgery market. This dominance is fueled by their widespread application in common bariatric procedures, their established efficacy, and the continuous innovation by key manufacturers. The economic growth across major metropolitan areas and tier-1 cities is a primary driver, leading to increased healthcare expenditure and a higher demand for advanced surgical solutions. Furthermore, the robust healthcare infrastructure development in these regions, coupled with a higher concentration of skilled bariatric surgeons, contributes significantly to the market's momentum.

Assisting Devices:

- Stapling Devices: Essential for creating secure gastrointestinal anastomoses and resections, these devices have seen significant advancements in terms of reloadable cartridges and ergonomic designs, making them indispensable for surgeons.

- Closure Devices: Crucial for minimizing leaks and ensuring optimal wound healing, advanced closure devices offer greater precision and efficiency, further solidifying their market leadership.

- Suturing Devices: While also important, the adoption of advanced stapling and closure technologies has led to a slightly lower growth trajectory compared to the former.

- Other Assisting Devices: This category encompasses instruments like retractors and dissecting tools, which, while necessary, are not primary growth drivers in themselves.

Implantable Devices: This segment, including adjustable gastric bands, is witnessing moderate growth. While effective, their market share is gradually being influenced by the increasing popularity of minimally invasive procedures that often rely more on advanced assisting devices. However, ongoing research into biocompatible materials and improved implant designs could reignite growth in this segment.

Other Devices: This broad category includes diagnostic tools and patient monitoring systems that support the overall bariatric surgery ecosystem. While crucial for comprehensive patient care, their direct market share is less significant compared to the surgical devices themselves.

The increasing patient preference for less invasive procedures and the continuous refinement of surgical techniques are expected to maintain the strong leadership of assisting devices. The accessibility of these devices in major urban centers, coupled with targeted marketing efforts by companies like Dolphin Surgicals and Johnson and Johnson, is further cementing their market dominance.

Weight Loss Surgery Industry in India Product Developments

Product innovation in the Indian weight loss surgery sector is rapidly advancing, focusing on enhancing surgical precision, patient safety, and recovery times. Companies are developing next-generation stapling devices with improved reloadable cartridges and ergonomic designs for greater control and reduced tissue trauma. The emergence of advanced closure devices, utilizing novel materials and sealing technologies, is significantly minimizing leakage risks and improving wound healing outcomes. The integration of smart technology into surgical instruments, offering real-time feedback to surgeons, is a key development, exemplified by the advancements seen in robotic-assisted surgery platforms. These innovations are crucial for the competitive edge, allowing manufacturers to cater to the evolving needs of bariatric surgeons and improve patient satisfaction.

Challenges in the Weight Loss Surgery Industry in India Market

The Indian weight loss surgery market faces several challenges that could temper its growth trajectory. High procedural costs remain a significant barrier for a substantial portion of the population, limiting accessibility. The lack of universal health insurance coverage for bariatric procedures exacerbates this issue. Regulatory hurdles, while crucial for safety, can sometimes lead to prolonged approval processes for new devices and technologies. Supply chain disruptions, particularly for specialized imported components, can impact the availability and cost of essential surgical equipment. Furthermore, a shortage of highly trained bariatric surgeons in semi-urban and rural areas poses a challenge to wider adoption.

Forces Driving Weight Loss Surgery Industry in India Growth

Several key factors are propelling the growth of the weight loss surgery industry in India. The escalating prevalence of obesity and related comorbidities like diabetes and hypertension is a primary driver, creating a pressing need for effective medical interventions. Increasing disposable incomes and a growing middle class are translating into higher healthcare spending and greater willingness to invest in life-changing procedures. Technological advancements in minimally invasive surgery, including robotic surgery, are enhancing procedure safety and patient outcomes, making bariatric surgery more appealing. Furthermore, a growing awareness and acceptance of bariatric surgery as a viable and effective solution for long-term weight management are reducing the stigma associated with these procedures.

Challenges in the Weight Loss Surgery Industry in India Market

Looking ahead, long-term growth catalysts for the Indian weight loss surgery market lie in continued technological innovation and broader market penetration. The development of more affordable and accessible bariatric solutions, potentially through further advancements in non-invasive or less invasive techniques, will be crucial. Partnerships between technology providers and healthcare institutions to expand training programs for surgeons in emerging regions will be vital for increasing capacity. Market expansions into tier-2 and tier-3 cities, supported by government initiatives and private sector investment, can unlock significant untapped potential. Fostering a robust ecosystem of patient support groups and post-operative care providers will also contribute to sustained success and positive patient outcomes, thereby encouraging wider adoption.

Emerging Opportunities in Weight Loss Surgery Industry in India

Emerging opportunities in the Indian weight loss surgery market are diverse and promising. The growing demand for patient-specific solutions presents an opportunity for personalized bariatric approaches. The rise of integrated healthcare models, combining surgical intervention with comprehensive lifestyle management programs, is a significant trend. Furthermore, the increasing adoption of telehealth and remote monitoring for pre- and post-operative care can enhance patient engagement and adherence, opening new avenues for service delivery. The development of innovative financing models and partnerships with insurance providers to increase affordability is another key area of opportunity. The exploration of new patient populations beyond the traditionally obese, such as those with metabolic syndrome, also represents a growing frontier.

Leading Players in the Weight Loss Surgery Industry in India Sector

- Dolphin Surgicals

- Staan Bio-Med Engineering Private Limited

- TransEnterix Inc

- Johnson and Johnson

- Medtronic PLC

- Apollo Endosurgery Inc

- AbbVie (Allergan)

- Intuitive Surgical Inc

- Conmed Corporation

- B Braun SE

Key Milestones in Weight Loss Surgery Industry in India Industry

- September 2022: Allurion launched its swallowable gastric balloon capsule for weight loss in India. It is the only medical weight-loss device fully approved by the Central Drugs Standard Control Organisation (CDSCO).

- January 2022: Apollo Hospital, Hyderabad, performed the first Complete Robotic Bariatric surgery, a first-of-its-kind operation in the Telugu states.

Strategic Outlook for Weight Loss Surgery Industry in India Market

- September 2022: Allurion launched its swallowable gastric balloon capsule for weight loss in India. It is the only medical weight-loss device fully approved by the Central Drugs Standard Control Organisation (CDSCO).

- January 2022: Apollo Hospital, Hyderabad, performed the first Complete Robotic Bariatric surgery, a first-of-its-kind operation in the Telugu states.

Strategic Outlook for Weight Loss Surgery Industry in India Market

The strategic outlook for the Indian weight loss surgery market remains highly optimistic, driven by sustained demand and continuous innovation. Key growth accelerators include the increasing focus on value-based care models, which will incentivize better patient outcomes and cost-effectiveness. Strategic collaborations between device manufacturers, hospitals, and insurance providers will be crucial for expanding access and affordability. Furthermore, the continued advancements in minimally invasive and robotic surgical technologies will further enhance the appeal and safety of bariatric procedures. The market is poised for significant expansion as awareness grows and technological adoption accelerates, positioning India as a leading destination for weight loss surgery.

Weight Loss Surgery Industry in India Segmentation

-

1. Device

-

1.1. Assisting Devices

- 1.1.1. Suturing Device

- 1.1.2. Closure Device

- 1.1.3. Stapling Device

- 1.1.4. Other Assisting Devices

- 1.2. Implantable Devices

- 1.3. Other Devices

-

1.1. Assisting Devices

Weight Loss Surgery Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Weight Loss Surgery Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Obesity in India; Increasing Prevalence Rate of Type 2 Diabetes and Heart Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of Surgery; Lack of Knowledge and Awareness

- 3.4. Market Trends

- 3.4.1. Stapling Devices Segment are Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Assisting Devices

- 5.1.1.1. Suturing Device

- 5.1.1.2. Closure Device

- 5.1.1.3. Stapling Device

- 5.1.1.4. Other Assisting Devices

- 5.1.2. Implantable Devices

- 5.1.3. Other Devices

- 5.1.1. Assisting Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Assisting Devices

- 6.1.1.1. Suturing Device

- 6.1.1.2. Closure Device

- 6.1.1.3. Stapling Device

- 6.1.1.4. Other Assisting Devices

- 6.1.2. Implantable Devices

- 6.1.3. Other Devices

- 6.1.1. Assisting Devices

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. South America Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Assisting Devices

- 7.1.1.1. Suturing Device

- 7.1.1.2. Closure Device

- 7.1.1.3. Stapling Device

- 7.1.1.4. Other Assisting Devices

- 7.1.2. Implantable Devices

- 7.1.3. Other Devices

- 7.1.1. Assisting Devices

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Europe Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Assisting Devices

- 8.1.1.1. Suturing Device

- 8.1.1.2. Closure Device

- 8.1.1.3. Stapling Device

- 8.1.1.4. Other Assisting Devices

- 8.1.2. Implantable Devices

- 8.1.3. Other Devices

- 8.1.1. Assisting Devices

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Middle East & Africa Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Assisting Devices

- 9.1.1.1. Suturing Device

- 9.1.1.2. Closure Device

- 9.1.1.3. Stapling Device

- 9.1.1.4. Other Assisting Devices

- 9.1.2. Implantable Devices

- 9.1.3. Other Devices

- 9.1.1. Assisting Devices

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Asia Pacific Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. Assisting Devices

- 10.1.1.1. Suturing Device

- 10.1.1.2. Closure Device

- 10.1.1.3. Stapling Device

- 10.1.1.4. Other Assisting Devices

- 10.1.2. Implantable Devices

- 10.1.3. Other Devices

- 10.1.1. Assisting Devices

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. North India Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Weight Loss Surgery Industry in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Dolphin Surgicals

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Staan Bio-Med Engineering Private Limited

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 TransEnterix Inc

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Johnson and Johnson

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Medtronic PLC

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Apollo Endosurgery Inc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 AbbVie (Allergan)

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Intuitive Surgical Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Conmed Corporation

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 B Braun SE

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Dolphin Surgicals

List of Figures

- Figure 1: Global Weight Loss Surgery Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Weight Loss Surgery Industry in India Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: India Weight Loss Surgery Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 4: India Weight Loss Surgery Industry in India Volume (K Unit), by Country 2024 & 2032

- Figure 5: India Weight Loss Surgery Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 6: India Weight Loss Surgery Industry in India Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Weight Loss Surgery Industry in India Revenue (Million), by Device 2024 & 2032

- Figure 8: North America Weight Loss Surgery Industry in India Volume (K Unit), by Device 2024 & 2032

- Figure 9: North America Weight Loss Surgery Industry in India Revenue Share (%), by Device 2024 & 2032

- Figure 10: North America Weight Loss Surgery Industry in India Volume Share (%), by Device 2024 & 2032

- Figure 11: North America Weight Loss Surgery Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Weight Loss Surgery Industry in India Volume (K Unit), by Country 2024 & 2032

- Figure 13: North America Weight Loss Surgery Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Weight Loss Surgery Industry in India Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Weight Loss Surgery Industry in India Revenue (Million), by Device 2024 & 2032

- Figure 16: South America Weight Loss Surgery Industry in India Volume (K Unit), by Device 2024 & 2032

- Figure 17: South America Weight Loss Surgery Industry in India Revenue Share (%), by Device 2024 & 2032

- Figure 18: South America Weight Loss Surgery Industry in India Volume Share (%), by Device 2024 & 2032

- Figure 19: South America Weight Loss Surgery Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Weight Loss Surgery Industry in India Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Weight Loss Surgery Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Weight Loss Surgery Industry in India Volume Share (%), by Country 2024 & 2032

- Figure 23: Europe Weight Loss Surgery Industry in India Revenue (Million), by Device 2024 & 2032

- Figure 24: Europe Weight Loss Surgery Industry in India Volume (K Unit), by Device 2024 & 2032

- Figure 25: Europe Weight Loss Surgery Industry in India Revenue Share (%), by Device 2024 & 2032

- Figure 26: Europe Weight Loss Surgery Industry in India Volume Share (%), by Device 2024 & 2032

- Figure 27: Europe Weight Loss Surgery Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 28: Europe Weight Loss Surgery Industry in India Volume (K Unit), by Country 2024 & 2032

- Figure 29: Europe Weight Loss Surgery Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 30: Europe Weight Loss Surgery Industry in India Volume Share (%), by Country 2024 & 2032

- Figure 31: Middle East & Africa Weight Loss Surgery Industry in India Revenue (Million), by Device 2024 & 2032

- Figure 32: Middle East & Africa Weight Loss Surgery Industry in India Volume (K Unit), by Device 2024 & 2032

- Figure 33: Middle East & Africa Weight Loss Surgery Industry in India Revenue Share (%), by Device 2024 & 2032

- Figure 34: Middle East & Africa Weight Loss Surgery Industry in India Volume Share (%), by Device 2024 & 2032

- Figure 35: Middle East & Africa Weight Loss Surgery Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 36: Middle East & Africa Weight Loss Surgery Industry in India Volume (K Unit), by Country 2024 & 2032

- Figure 37: Middle East & Africa Weight Loss Surgery Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East & Africa Weight Loss Surgery Industry in India Volume Share (%), by Country 2024 & 2032

- Figure 39: Asia Pacific Weight Loss Surgery Industry in India Revenue (Million), by Device 2024 & 2032

- Figure 40: Asia Pacific Weight Loss Surgery Industry in India Volume (K Unit), by Device 2024 & 2032

- Figure 41: Asia Pacific Weight Loss Surgery Industry in India Revenue Share (%), by Device 2024 & 2032

- Figure 42: Asia Pacific Weight Loss Surgery Industry in India Volume Share (%), by Device 2024 & 2032

- Figure 43: Asia Pacific Weight Loss Surgery Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 44: Asia Pacific Weight Loss Surgery Industry in India Volume (K Unit), by Country 2024 & 2032

- Figure 45: Asia Pacific Weight Loss Surgery Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 46: Asia Pacific Weight Loss Surgery Industry in India Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Device 2019 & 2032

- Table 4: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Device 2019 & 2032

- Table 5: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: North India Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: South India Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: East India Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: West India Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Device 2019 & 2032

- Table 18: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Device 2019 & 2032

- Table 19: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: United States Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Canada Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Mexico Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mexico Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Device 2019 & 2032

- Table 28: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Device 2019 & 2032

- Table 29: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Brazil Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Brazil Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Argentina Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Rest of South America Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of South America Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Device 2019 & 2032

- Table 38: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Device 2019 & 2032

- Table 39: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: United Kingdom Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Germany Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: France Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Italy Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Spain Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Russia Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Russia Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Benelux Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Benelux Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Nordics Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Nordics Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Rest of Europe Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Device 2019 & 2032

- Table 60: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Device 2019 & 2032

- Table 61: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Country 2019 & 2032

- Table 63: Turkey Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Israel Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Israel Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: GCC Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: GCC Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: North Africa Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: South Africa Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Device 2019 & 2032

- Table 76: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Device 2019 & 2032

- Table 77: Global Weight Loss Surgery Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Global Weight Loss Surgery Industry in India Volume K Unit Forecast, by Country 2019 & 2032

- Table 79: China Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: China Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: India Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: India Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: Japan Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Japan Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: South Korea Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: South Korea Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: ASEAN Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: ASEAN Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Oceania Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Oceania Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Rest of Asia Pacific Weight Loss Surgery Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Rest of Asia Pacific Weight Loss Surgery Industry in India Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Weight Loss Surgery Industry in India?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Weight Loss Surgery Industry in India?

Key companies in the market include Dolphin Surgicals, Staan Bio-Med Engineering Private Limited, TransEnterix Inc, Johnson and Johnson, Medtronic PLC, Apollo Endosurgery Inc, AbbVie (Allergan), Intuitive Surgical Inc, Conmed Corporation, B Braun SE.

3. What are the main segments of the Weight Loss Surgery Industry in India?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Obesity in India; Increasing Prevalence Rate of Type 2 Diabetes and Heart Diseases.

6. What are the notable trends driving market growth?

Stapling Devices Segment are Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Surgery; Lack of Knowledge and Awareness.

8. Can you provide examples of recent developments in the market?

September 2022: Allurion launched its swallowable gastric balloon capsule for weight loss in India. It is the only medical weight-loss device fully approved by the Central Drugs Standard Control Organisation (CDSCO).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Weight Loss Surgery Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Weight Loss Surgery Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Weight Loss Surgery Industry in India?

To stay informed about further developments, trends, and reports in the Weight Loss Surgery Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence