Key Insights

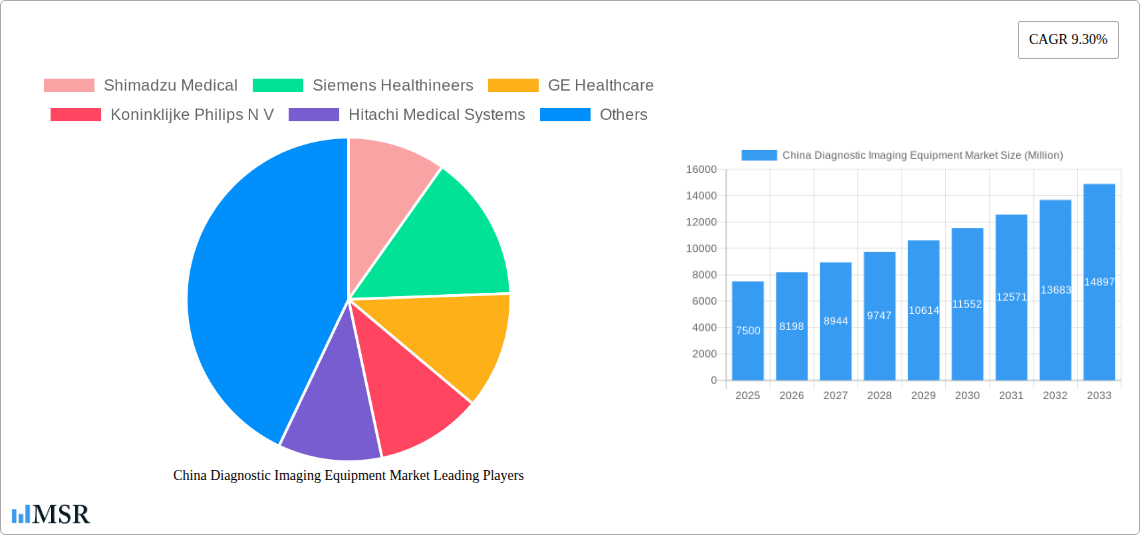

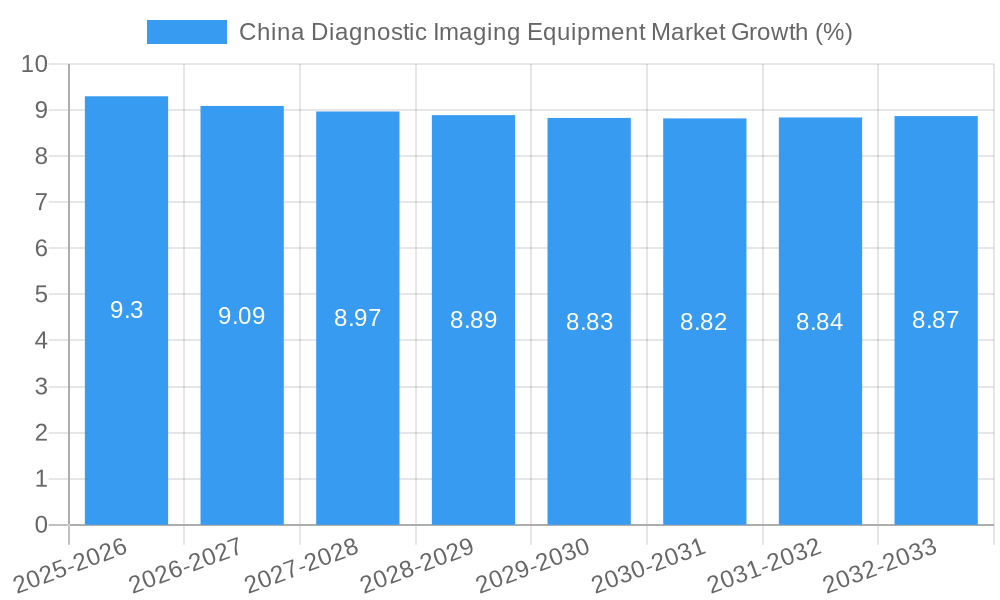

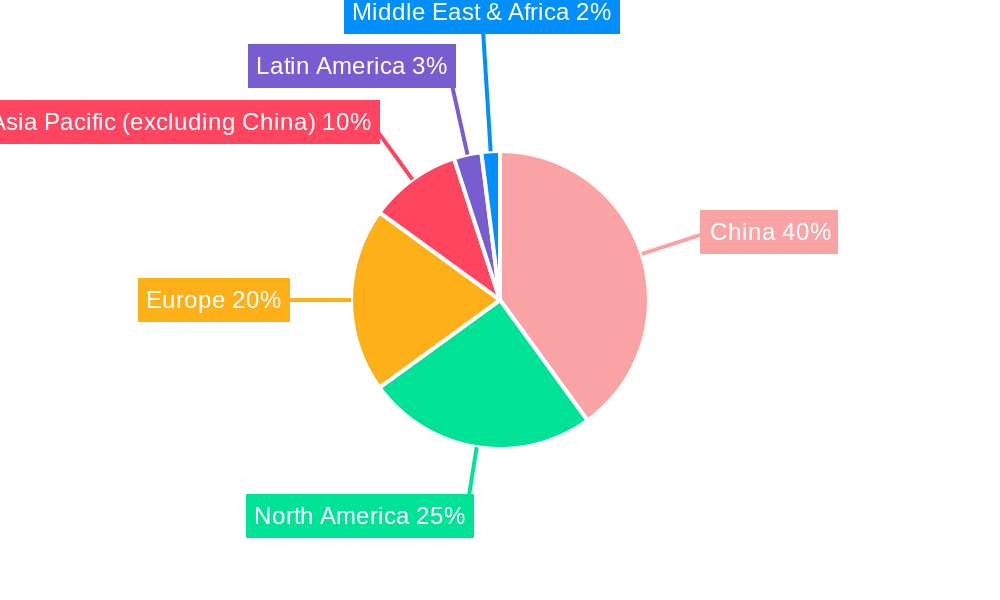

The China Diagnostic Imaging Equipment Market is experiencing robust growth, projected to reach a substantial market size by 2033. Fueled by a CAGR of 9.30%, this expansion is primarily driven by the escalating prevalence of chronic diseases, an aging population, and increasing healthcare expenditure across the nation. Technological advancements in imaging modalities, such as AI-integrated systems and portable diagnostic devices, are further stimulating market demand. The government's continued focus on enhancing healthcare infrastructure and accessibility, particularly in underserved regions, also plays a crucial role in driving the adoption of advanced diagnostic imaging solutions. The market segments are diversified, with Computed Tomography (CT) and Magnetic Resonance Imaging (MRI) leading in revenue contribution, owing to their widespread use in diagnosing a multitude of conditions. Ultrasound also holds a significant share, driven by its cost-effectiveness and broad applications in various medical specialties.

The competitive landscape is dynamic, characterized by the presence of global giants like Siemens Healthineers, GE Healthcare, and Koninklijke Philips N.V., alongside strong domestic players. These companies are heavily investing in research and development to introduce innovative products that cater to the evolving needs of Chinese healthcare providers and patients. Key trends include the increasing demand for minimally invasive diagnostic procedures, the integration of AI and machine learning for enhanced image analysis and workflow optimization, and the growing preference for hybrid imaging systems that combine multiple modalities. While the market exhibits strong growth prospects, potential restraints such as high initial investment costs for advanced equipment and the need for skilled personnel to operate and interpret complex imaging data may pose challenges. However, the sustained government support and the sheer volume of the Chinese healthcare market are expected to outweigh these limitations, ensuring continued expansion.

China Diagnostic Imaging Equipment Market: Comprehensive Growth & Investment Insights (2019-2033)

This in-depth report provides a critical analysis of the China Diagnostic Imaging Equipment Market, a rapidly expanding sector driven by technological advancements, increasing healthcare expenditure, and a growing demand for advanced medical diagnostics. Covering the study period of 2019–2033, with a base year of 2025, this report offers unparalleled insights into market dynamics, key trends, competitive landscapes, and future growth trajectories. Discover the immense potential of China's medical imaging technology market, radiology equipment China, and healthcare diagnostics China.

China Diagnostic Imaging Equipment Market Market Concentration & Dynamics

The China Diagnostic Imaging Equipment Market exhibits a moderate to high concentration, with a few global giants holding significant market share, yet with growing influence from domestic players. Key players like Siemens Healthineers, GE Healthcare, Koninklijke Philips N.V., Shimadzu Medical, and FUJIFILM Holdings Corporation dominate the market through their comprehensive portfolios and established distribution networks. Innovation is a key differentiator, with significant investments in research and development leading to advanced imaging modalities. The regulatory landscape, while evolving, is increasingly focused on quality standards and accessibility, influencing product approvals and market entry. Substitute products, while present in basic diagnostic imaging, are largely being outpaced by the sophistication and diagnostic accuracy of advanced equipment. End-user trends are leaning towards integrated diagnostic solutions, AI-powered analytics, and portable imaging devices. Merger and acquisition (M&A) activities, though not as frequent as in more mature markets, are anticipated to increase as companies seek to expand their technological capabilities and market reach. For instance, recent years have seen a few strategic alliances aimed at consolidating market presence or acquiring niche technologies.

China Diagnostic Imaging Equipment Market Industry Insights & Trends

The China Diagnostic Imaging Equipment Market is poised for substantial growth, projected to reach an estimated market size of USD 15,000 Million by 2025, with a compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily fueled by a burgeoning population, an increasing prevalence of chronic diseases like cardiovascular ailments, neurological disorders, and cancer, and a robust government push towards enhancing healthcare infrastructure and accessibility across the nation. The escalating disposable income among the Chinese populace has also led to greater demand for advanced medical diagnostics and preventative healthcare services, directly benefiting the diagnostic imaging equipment sector. Furthermore, technological disruptions, including the integration of Artificial Intelligence (AI) for image analysis, the development of more portable and cost-effective imaging solutions, and the advancement of hybrid imaging techniques, are reshaping the market. The digital transformation of healthcare, with a focus on remote diagnostics and telemedicine, is also creating new avenues for growth. The increasing adoption of MRI machines in China, CT scanners China, and ultrasound devices China reflects the growing sophistication of medical practices. The aging demographic further amplifies the need for advanced imaging to manage age-related conditions. The government’s ongoing initiatives to upgrade existing medical facilities and establish new ones, particularly in underserved rural areas, are significant market drivers. The market is also witnessing a trend towards value-based healthcare, where the focus is on delivering effective diagnostics and treatment at competitive costs, pushing manufacturers to innovate in terms of both technology and pricing.

Key Markets & Segments Leading China Diagnostic Imaging Equipment Market

The China Diagnostic Imaging Equipment Market is characterized by strong growth across several key segments.

Dominant Segments by Product:

- Computed Tomography (CT): The CT segment is a significant revenue generator, driven by its widespread use in emergency care, trauma assessment, and the diagnosis of a wide range of conditions, including oncological and neurological diseases. The demand for higher resolution, faster scanning times, and lower radiation exposure continues to fuel innovation and market penetration.

- Magnetic Resonance Imaging (MRI): MRI holds a crucial position, particularly in neurology and oncology, offering excellent soft tissue contrast without ionizing radiation. Advancements in superconductivity and gradient technology are leading to more powerful and versatile MRI systems.

- Ultrasound: The ultrasound segment continues to see robust growth due to its portability, affordability, and versatility, making it indispensable in obstetrics, cardiology, and general diagnostic imaging.

- X-Ray: While a mature technology, X-ray remains a fundamental diagnostic tool, especially in radiography and fluoroscopy. The market is experiencing upgrades to digital radiography (DR) systems for improved efficiency and image quality.

Dominant Segments by Application:

- Cardiology: The rising incidence of cardiovascular diseases makes cardiology a leading application area, driving demand for advanced cardiac imaging solutions, including CT angiography and cardiac MRI.

- Oncology: With China facing a significant cancer burden, oncology remains a primary driver for diagnostic imaging equipment, including PET-CT, MRI, and advanced CT scanners for diagnosis, staging, and treatment monitoring.

- Neurology: The increasing prevalence of neurological disorders such as stroke, Alzheimer's, and Parkinson's fuels the demand for sophisticated neuroimaging techniques like MRI and advanced CT.

Dominant Segments by End-User:

- Hospitals: As the primary healthcare providers, hospitals represent the largest end-user segment, investing heavily in state-of-the-art diagnostic imaging equipment to offer comprehensive patient care.

- Diagnostic Centers: The growing number of specialized diagnostic centers, catering to specific imaging needs, also contributes significantly to market demand.

Drivers of Dominance:

- Economic Growth and Rising Healthcare Expenditure: China's sustained economic development has led to increased healthcare spending, enabling greater investment in advanced medical technologies.

- Increasing Disease Burden: The high prevalence of chronic diseases necessitates advanced diagnostic capabilities.

- Government Initiatives: The "Healthy China 2030" initiative and other government programs are promoting the upgrade of healthcare infrastructure and the adoption of advanced medical technologies.

- Technological Advancements: Continuous innovation in imaging modalities, AI integration, and improved image processing are enhancing diagnostic accuracy and efficiency.

China Diagnostic Imaging Equipment Market Product Developments

Recent product developments in the China Diagnostic Imaging Equipment Market are characterized by miniaturization, AI integration, and enhanced imaging capabilities. Manufacturers are focusing on developing more compact and portable devices, such as handheld ultrasound machines and mobile X-ray units, to improve accessibility and reduce costs. The integration of Artificial Intelligence (AI) into imaging software is a significant trend, enabling faster and more accurate image analysis, aiding in early disease detection, and optimizing workflow for radiologists. Advancements in detector technology for CT and X-ray are leading to reduced radiation doses without compromising image quality. Furthermore, innovations in MRI technology, including higher field strengths and faster scanning sequences, are expanding its diagnostic applications in complex neurological and oncological cases. These product innovations are crucial for maintaining competitive advantage and meeting the evolving demands of the Chinese healthcare sector.

Challenges in the China Diagnostic Imaging Equipment Market Market

Despite the robust growth, the China Diagnostic Imaging Equipment Market faces several challenges. High initial investment costs for advanced imaging equipment can be a barrier for smaller healthcare facilities. Stringent regulatory approval processes for new medical devices, while ensuring safety and efficacy, can lead to prolonged market entry timelines. Intense price competition, especially from domestic manufacturers, can put pressure on profit margins for global players. Furthermore, the shortage of skilled radiologists and imaging technicians across the country can hinder the optimal utilization of sophisticated equipment. Supply chain disruptions, as evidenced in recent global events, can also impact product availability and pricing.

Forces Driving China Diagnostic Imaging Equipment Market Growth

Several key forces are propelling the growth of the China Diagnostic Imaging Equipment Market. Technological advancements in areas like AI, miniaturization, and multi-modality imaging are making diagnostics more precise, accessible, and efficient. Increasing healthcare expenditure, both from the government and private sectors, is providing the financial impetus for healthcare institutions to invest in advanced equipment. The growing prevalence of chronic diseases, such as cardiovascular diseases, cancer, and neurological disorders, is creating a sustained demand for diagnostic imaging solutions. Furthermore, favorable government policies aimed at modernizing healthcare infrastructure and improving patient outcomes are creating a conducive environment for market expansion. The rising awareness and demand for early disease detection among the Chinese population also act as a significant catalyst.

Challenges in the China Diagnostic Imaging Equipment Market Market

Long-term growth catalysts for the China Diagnostic Imaging Equipment Market are rooted in ongoing technological innovation and strategic market expansions. The continuous development of more affordable, user-friendly, and AI-integrated imaging systems will broaden market access. Partnerships and collaborations between international and domestic companies are fostering knowledge transfer and accelerating the localization of advanced technologies. The expansion of healthcare services into tier-3 and tier-4 cities and rural areas presents significant untapped potential. Furthermore, the growing emphasis on preventative healthcare and personalized medicine will drive demand for sophisticated imaging techniques. The development of robust after-sales service networks and training programs will also be crucial for sustaining long-term growth and customer satisfaction in this dynamic market.

Emerging Opportunities in China Diagnostic Imaging Equipment Market

Emerging opportunities in the China Diagnostic Imaging Equipment Market are abundant, driven by new technologies and shifting consumer preferences. The rapid development of Artificial Intelligence (AI) in medical imaging, particularly for automated detection and quantitative analysis, presents a significant growth area. The increasing adoption of telemedicine and remote diagnostics opens up avenues for portable and connected imaging devices. The growing focus on early cancer screening and cardiovascular health management will drive demand for specialized imaging modalities. Furthermore, the demand for point-of-care diagnostics and integrated imaging solutions is on the rise. Opportunities also exist in providing solutions for aging populations and in addressing the healthcare needs of emerging economies within China.

Leading Players in the China Diagnostic Imaging Equipment Market Sector

- Shimadzu Medical

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips N.V.

- Hitachi Medical Systems

- Canon Medical Systems Corporation

- FUJIFILM Holdings Corporation

- Carestream Health Inc

- Hologic Corporation

Key Milestones in China Diagnostic Imaging Equipment Market Industry

- 2019/2020: Increased adoption of AI-powered imaging analysis software for faster diagnosis and improved accuracy in oncology and neurology.

- 2021: Significant government investment in upgrading provincial and municipal hospital imaging departments, focusing on CT and MRI.

- 2022: Launch of advanced portable ultrasound devices tailored for remote healthcare and primary care settings.

- 2023: Growing trend of partnerships between domestic AI companies and international imaging equipment manufacturers to localize advanced software solutions.

- 2024: Introduction of next-generation CT scanners with enhanced dose reduction technologies and faster imaging speeds.

Strategic Outlook for China Diagnostic Imaging Equipment Market Market

The strategic outlook for the China Diagnostic Imaging Equipment Market is highly positive, characterized by sustained growth fueled by innovation and expanding healthcare access. Key growth accelerators include the continued integration of AI for enhanced diagnostic capabilities, the development of more affordable and portable imaging solutions, and strategic partnerships to address unmet clinical needs. Manufacturers focusing on high-demand applications like oncology and cardiology, while also catering to the burgeoning demand in neurology and orthopedics, are well-positioned for success. The expansion into lower-tier cities and rural areas presents significant market penetration opportunities. A focus on delivering value-added services, robust after-sales support, and localized solutions will be crucial for capitalizing on the immense future potential of this dynamic market.

China Diagnostic Imaging Equipment Market Segmentation

-

1. Product

- 1.1. MRI

- 1.2. Computed Tomography

- 1.3. Ultrasound

- 1.4. X-Ray

- 1.5. Nuclear Imaging

- 1.6. Fluroscopy

- 1.7. Mamography

- 1.8. Others

-

2. Application

- 2.1. Cardiology

- 2.2. Oncology

- 2.3. Neurology

- 2.4. Orthopedics

- 2.5. Gastroentrology

- 2.6. Gynecology

- 2.7. Other Application

-

3. End-User

- 3.1. Hospitals

- 3.2. Diagnostic Centers

- 3.3. Others

China Diagnostic Imaging Equipment Market Segmentation By Geography

- 1. China

China Diagnostic Imaging Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing aging population; Increased adoption of diagnostic imaging by the medical industry; Increased incidence of chronic diseases

- 3.3. Market Restrains

- 3.3.1. ; Expensive procedures and equipment

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Holds the Largest Share in the China Diagnostic Imaging Equipment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Diagnostic Imaging Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. MRI

- 5.1.2. Computed Tomography

- 5.1.3. Ultrasound

- 5.1.4. X-Ray

- 5.1.5. Nuclear Imaging

- 5.1.6. Fluroscopy

- 5.1.7. Mamography

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Oncology

- 5.2.3. Neurology

- 5.2.4. Orthopedics

- 5.2.5. Gastroentrology

- 5.2.6. Gynecology

- 5.2.7. Other Application

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Diagnostic Centers

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shimadzu Medical

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Healthineers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Medical Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carestream Health Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FUJIFILM Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Canon Medical Systems Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carestream Health Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hologic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shimadzu Medical

List of Figures

- Figure 1: China Diagnostic Imaging Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Diagnostic Imaging Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 9: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 15: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 18: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 19: China Diagnostic Imaging Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Diagnostic Imaging Equipment Market?

The projected CAGR is approximately 9.30%.

2. Which companies are prominent players in the China Diagnostic Imaging Equipment Market?

Key companies in the market include Shimadzu Medical, Siemens Healthineers, GE Healthcare, Koninklijke Philips N V, Hitachi Medical Systems, Carestream Health Inc, FUJIFILM Holdings Corporation, Canon Medical Systems Corporation, Carestream Health Inc, Hologic Corporation.

3. What are the main segments of the China Diagnostic Imaging Equipment Market?

The market segments include Product, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing aging population; Increased adoption of diagnostic imaging by the medical industry; Increased incidence of chronic diseases.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Holds the Largest Share in the China Diagnostic Imaging Equipment Market.

7. Are there any restraints impacting market growth?

; Expensive procedures and equipment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Diagnostic Imaging Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Diagnostic Imaging Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Diagnostic Imaging Equipment Market?

To stay informed about further developments, trends, and reports in the China Diagnostic Imaging Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence