Key Insights

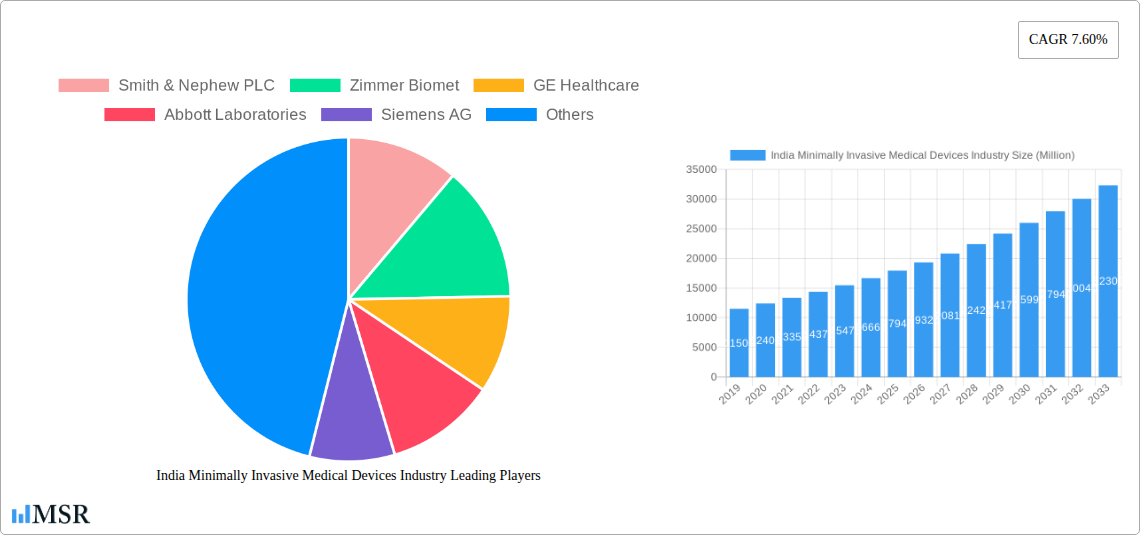

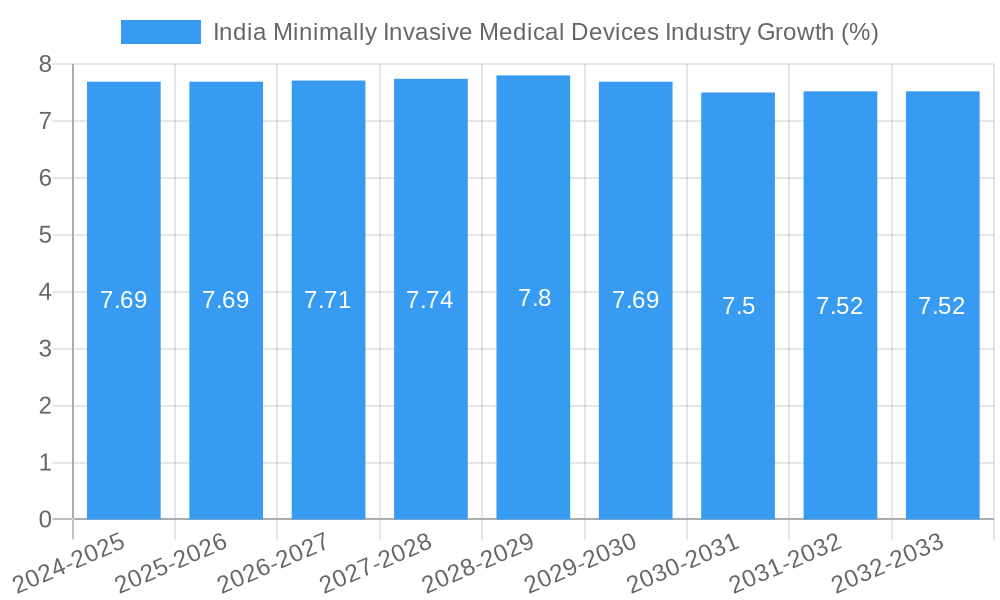

The Indian Minimally Invasive Medical Devices Market is poised for substantial growth, projected to reach a significant market size of approximately ₹20,000 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.60% expected to propel it through 2033. This impressive expansion is fueled by a confluence of favorable factors, including the escalating prevalence of chronic diseases, a growing emphasis on patient-centric care and reduced hospital stays, and the increasing affordability and accessibility of advanced medical technologies. Key drivers encompass the rising disposable incomes, a burgeoning healthcare infrastructure, and government initiatives aimed at promoting medical tourism and domestic manufacturing of medical devices. The trend towards adopting less invasive procedures across a wide spectrum of applications, from cardiovascular and orthopedic surgeries to gastrointestinal and gynecological interventions, is a major growth catalyst. Furthermore, the increasing integration of robotics and advanced imaging technologies in surgical settings is enhancing precision and improving patient outcomes, thereby driving demand for sophisticated minimally invasive devices.

Despite the promising outlook, certain restraints could temper the pace of growth. These include the high cost of some advanced minimally invasive devices, potential challenges in skilled workforce availability for complex procedures, and the need for continuous technological upgrades to keep pace with global innovations. However, the market is actively addressing these challenges through strategic investments in research and development, collaborations between domestic and international players, and the establishment of specialized training programs. The market is segmented across a diverse range of product categories, including handheld instruments, guiding devices, electrosurgical devices, endoscopic devices, robotic-assisted surgical systems, and ablation devices, catering to a broad array of applications such as aesthetic, cardiovascular, gastrointestinal, gynecological, orthopedic, and urological procedures. Leading companies like Smith & Nephew PLC, Zimmer Biomet, GE Healthcare, Abbott Laboratories, Siemens AG, Medtronic PLC, Koninklijke Philips NV, Stryker Corporation, and Olympus Corporation are actively participating in this dynamic market, contributing to innovation and market expansion in India.

India Minimally Invasive Medical Devices Industry Market Analysis and Forecast (2019–2033)

This comprehensive report delves into the India Minimally Invasive Medical Devices Industry, providing an in-depth analysis of market dynamics, key segments, growth drivers, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report offers actionable insights for industry stakeholders, investors, and policymakers. We examine critical aspects including market concentration, technological advancements, regulatory landscapes, and the strategic initiatives of leading players.

India Minimally Invasive Medical Devices Industry Market Concentration & Dynamics

The India Minimally Invasive Medical Devices Market exhibits a moderately concentrated landscape, with a few global giants and a growing number of domestic players vying for market share. Innovation ecosystems are rapidly evolving, driven by increased R&D investments and a focus on developing cost-effective solutions tailored to the Indian healthcare context. Regulatory frameworks are becoming more streamlined, though adherence to global standards remains a key consideration. The availability of substitute products, while present in some categories, is increasingly being outweighed by the advantages of MIS procedures, including faster recovery times and reduced patient trauma. End-user trends are strongly leaning towards minimally invasive techniques due to their perceived benefits, leading to higher adoption rates. Merger and acquisition (M&A) activities are anticipated to increase as larger players seek to expand their product portfolios and market reach within India. The number of M&A deals is projected to grow by approximately 15% over the forecast period. Key companies such as Smith & Nephew PLC, Zimmer Biomet, GE Healthcare, Abbott Laboratories, Siemens AG, Medtronic PLC, Koninklijke Philips NV, Stryker Corporation, and Olympus Corporation are key influencers in this dynamic market.

India Minimally Invasive Medical Devices Industry Industry Insights & Trends

The Indian Medical Devices Market is experiencing robust growth, significantly propelled by the expanding adoption of minimally invasive surgical (MIS) techniques. This surge is underpinned by several interconnected factors. Firstly, a growing and aging population, coupled with an increasing prevalence of chronic diseases such as cardiovascular conditions, gastrointestinal disorders, and orthopedic ailments, is driving demand for effective and less intrusive treatment options. The market size for minimally invasive medical devices in India was estimated at 1,200 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 15% during the forecast period of 2025–2033. Technological disruptions are at the forefront of this expansion, with advancements in robotics, artificial intelligence, and advanced imaging enhancing the precision and efficacy of MIS procedures. The development of smaller, more sophisticated devices, coupled with improved surgical techniques, is making these procedures accessible for a wider range of conditions. Evolving consumer behaviors, influenced by greater health awareness and a desire for faster recovery and reduced pain, are also contributing significantly. Patients are actively seeking out minimally invasive alternatives to traditional open surgeries. Government initiatives aimed at improving healthcare infrastructure and promoting medical tourism further bolster the market. The increasing disposable income among the Indian populace also translates to a greater ability to afford advanced medical treatments, including those involving MIS devices. Furthermore, the focus on cost-effectiveness within the Indian healthcare system is driving innovation in developing affordable yet high-quality MIS solutions, making them more accessible across different socioeconomic strata. The integration of telemedicine and remote monitoring technologies also plays a role in expanding the reach and effectiveness of MIS interventions.

Key Markets & Segments Leading India Minimally Invasive Medical Devices Industry

The Orthopedic application segment is a dominant force in the India Minimally Invasive Medical Devices Market, driven by the rising incidence of osteoarthritis, sports injuries, and an aging population seeking joint replacements and spinal procedures. Economic growth and improved healthcare infrastructure in tier-1 and tier-2 cities facilitate the adoption of advanced orthopedic MIS devices.

- Drivers for Orthopedic Dominance:

- Increasing prevalence of degenerative joint diseases.

- Growing awareness and preference for minimally invasive surgical options.

- Technological advancements in orthopedic implants and instrumentation.

- Government focus on improving orthopedic care access.

The Cardiovascular application segment is another significant contributor, fueled by the escalating burden of heart disease and the increasing preference for less invasive interventions like angioplasty and stenting.

- Drivers for Cardiovascular Dominance:

- High prevalence of cardiovascular diseases in India.

- Advancements in interventional cardiology devices.

- Government programs focusing on cardiovascular health.

Within product segments, Endoscopic Devices and Guiding Devices are leading the market. Endoscopic devices are crucial for diagnostic and therapeutic procedures across various specialties, including gastrointestinal and pulmonary. Guiding devices, such as catheters and guidewires, are indispensable for interventional procedures, particularly in cardiovascular and neurological applications.

Drivers for Endoscopic Devices:

- Increasing use in diagnosis and treatment of GI and respiratory conditions.

- Technological advancements in high-definition imaging and miniaturization.

Drivers for Guiding Devices:

- Essential for complex interventional procedures.

- Continuous innovation in material science and design for better navigation.

The Robotic Assisted Surgical Systems segment, while currently smaller, is poised for substantial growth due to its precision and potential for better patient outcomes, especially in complex surgeries like urology and gynecology.

India Minimally Invasive Medical Devices Industry Product Developments

Recent product developments in the Indian Medical Devices Market are revolutionizing patient care. Innovations are focused on miniaturization, enhanced imaging capabilities, and improved precision. For instance, advanced Endoscopic Devices with high-definition visualization and maneuverability are transforming gastrointestinal diagnostics and interventions. The introduction of novel Robotic Assisted Surgical Systems is enhancing surgical accuracy and enabling more complex procedures to be performed minimally invasively, leading to faster recovery times. Furthermore, the development of smarter Guiding Devices with advanced coatings and steerability is improving procedural success rates in interventional cardiology and neurology. These technological advancements are crucial for maintaining a competitive edge and addressing unmet clinical needs within the Indian healthcare landscape.

Challenges in the India Minimally Invasive Medical Devices Industry Market

Despite the promising growth trajectory, the India Minimally Invasive Medical Devices Industry faces several challenges. High import duties on certain raw materials and finished goods can increase the cost of devices, impacting affordability. Stringent regulatory approval processes, although improving, can still lead to delays in product launches. Furthermore, inadequate healthcare infrastructure in remote and rural areas limits access to advanced MIS procedures. Intense competition from both global and domestic players, coupled with pricing pressures, also poses a significant challenge for manufacturers. The need for specialized training for surgeons to effectively utilize complex MIS technologies presents another hurdle.

Forces Driving India Minimally Invasive Medical Devices Industry Growth

The growth of the India Minimally Invasive Medical Devices Market is significantly driven by a confluence of factors. A rapidly increasing disposable income and a growing middle class are enhancing patient affordability for advanced medical treatments. Government initiatives like "Make in India" and increased healthcare spending are fostering a more conducive environment for domestic manufacturing and innovation. The rising awareness among the Indian population about the benefits of minimally invasive procedures, such as reduced pain and faster recovery, is a critical demand-side driver. Furthermore, the expanding network of well-equipped hospitals and specialized medical centers across the country is facilitating the adoption of these advanced technologies.

Challenges in the India Minimally Invasive Medical Devices Industry Market

The long-term growth catalysts for the Indian Medical Devices Market are rooted in continuous innovation and strategic market expansion. Investment in research and development for next-generation MIS technologies, including AI-powered surgical assistance and advanced biomaterials, will be crucial. Partnerships between domestic manufacturers and global leaders can facilitate technology transfer and accelerate product development cycles. Expanding the reach of MIS procedures into tier-2 and tier-3 cities through improved infrastructure and training programs will unlock new market potential. Government policies that incentivize local manufacturing and R&D, such as tax benefits and funding support, will further propel long-term growth.

Emerging Opportunities in India Minimally Invasive Medical Devices Industry

Emerging opportunities in the India Minimally Invasive Medical Devices Sector lie in leveraging technological advancements and addressing unmet clinical needs. The increasing demand for home healthcare solutions presents an opportunity for developing portable and user-friendly MIS devices for chronic disease management. The burgeoning medical tourism sector in India also offers a significant avenue for growth, requiring high-quality, globally competitive MIS devices. Furthermore, the development of cost-effective, disposable MIS instruments tailored for the Indian market can address the affordability challenge. The untapped potential in specialized fields like neurosurgery and advanced interventional radiology also presents promising growth avenues.

Leading Players in the India Minimally Invasive Medical Devices Industry Sector

- Smith & Nephew PLC

- Zimmer Biomet

- GE Healthcare

- Abbott Laboratories

- Siemens AG

- Medtronic PLC

- Koninklijke Philips NV

- Stryker Corporation

- Olympus Corporation

Key Milestones in India Minimally Invasive Medical Devices Industry Industry

- June 2022: Medtronic India launched a CE-marked fourth-generation flow diverter, Pipeline Vantage, with Shield Technology for the endovascular treatment of brain aneurysms in India.

- May 2022: Argon Medical, the market leader in specialty medical devices such as guide wires, IVC filters and retrievals, bone and soft tissue biopsy needles, and other products, and Terumo India, the Indian division of Terumo Corporation, signed a collaboration agreement.

Strategic Outlook for India Minimally Invasive Medical Devices Industry Market

The strategic outlook for the India Minimally Invasive Medical Devices Market is overwhelmingly positive, driven by a sustained demand for advanced healthcare solutions. Growth accelerators include aggressive product innovation, particularly in areas like robotic surgery and AI integration, and strategic collaborations with research institutions. Expanding manufacturing capabilities within India, supported by favorable government policies, will be critical for reducing import reliance and enhancing cost-competitiveness. Furthermore, a concerted effort to improve healthcare infrastructure in semi-urban and rural areas will unlock significant untapped market potential, driving wider adoption of MIS technologies and solidifying India's position as a key global player in this dynamic sector.

India Minimally Invasive Medical Devices Industry Segmentation

-

1. Product

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic Devices

- 1.5. Robotic Assisted Surgical Systems

- 1.6. Ablation Devices

- 1.7. Other MIS Devices

-

2. Application

- 2.1. Aesthetic

- 2.2. Cardiovascular

- 2.3. Gastrointestinal

- 2.4. Gynecological

- 2.5. Orthopedic

- 2.6. Urological

- 2.7. Other Applications

India Minimally Invasive Medical Devices Industry Segmentation By Geography

- 1. India

India Minimally Invasive Medical Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Minimally-invasive Surgeries Over Traditional Surgeries; Rising Prevalence of Lifestyle-related and Chronic Disorders

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Aesthetic Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Minimally Invasive Medical Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic Devices

- 5.1.5. Robotic Assisted Surgical Systems

- 5.1.6. Ablation Devices

- 5.1.7. Other MIS Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic

- 5.2.2. Cardiovascular

- 5.2.3. Gastrointestinal

- 5.2.4. Gynecological

- 5.2.5. Orthopedic

- 5.2.6. Urological

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. India India Minimally Invasive Medical Devices Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. North India India Minimally Invasive Medical Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. South India India Minimally Invasive Medical Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. East India India Minimally Invasive Medical Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. West India India Minimally Invasive Medical Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Smith & Nephew PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zimmer Biomet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medtronic PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke Philips NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stryker Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Olympus Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Smith & Nephew PLC

List of Figures

- Figure 1: India Minimally Invasive Medical Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Minimally Invasive Medical Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 20: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 21: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 23: India Minimally Invasive Medical Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Minimally Invasive Medical Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Minimally Invasive Medical Devices Industry?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the India Minimally Invasive Medical Devices Industry?

Key companies in the market include Smith & Nephew PLC, Zimmer Biomet, GE Healthcare, Abbott Laboratories, Siemens AG, Medtronic PLC, Koninklijke Philips NV, Stryker Corporation, Olympus Corporation.

3. What are the main segments of the India Minimally Invasive Medical Devices Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Minimally-invasive Surgeries Over Traditional Surgeries; Rising Prevalence of Lifestyle-related and Chronic Disorders.

6. What are the notable trends driving market growth?

Aesthetic Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

June 2022: Medtronic India launched a CE-marked fourth-generation flow diverter, Pipeline Vantage, with Shield Technology for the endovascular treatment of brain aneurysms in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Minimally Invasive Medical Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Minimally Invasive Medical Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Minimally Invasive Medical Devices Industry?

To stay informed about further developments, trends, and reports in the India Minimally Invasive Medical Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence