Key Insights

The United Kingdom's cardiovascular devices market is projected for substantial growth, estimated to reach $19.07 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.6%. This expansion is driven by key segments: Diagnostic & Monitoring Devices and Therapeutic & Surgical Devices. Within diagnostic and monitoring, Electrocardiogram (ECG) devices and remote cardiac monitoring are gaining traction due to technological progress and a focus on preventative care. The therapeutic and surgical segment is propelled by innovations in cardiac assist devices, rhythm management, and implants like stents, grafts, and heart valves, addressing the rising prevalence of cardiovascular conditions. Leading companies, including Medtronic Plc, Abbott Laboratories, and Siemens Healthineers AG, are actively involved in R&D to introduce new products and strengthen their market positions.

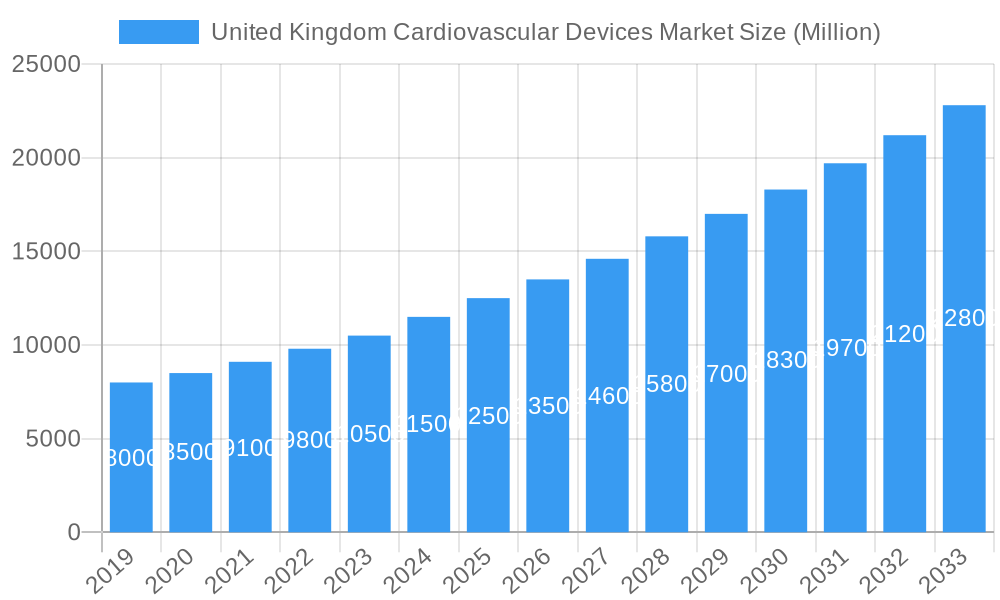

United Kingdom Cardiovascular Devices Market Market Size (In Billion)

Market expansion is supported by several factors: the increasing incidence of cardiovascular diseases in the UK and an aging demographic are driving demand for advanced diagnostic and treatment options. Government initiatives supporting healthcare infrastructure and early heart condition detection are also significant market enablers. Technological advancements such as device miniaturization, improved remote monitoring analytics, and minimally invasive surgical techniques are crucial growth drivers. Potential market restraints include stringent regulatory approvals and the high cost of certain advanced cardiovascular devices. Nevertheless, the market is anticipated to maintain its upward trajectory, fueled by ongoing innovation and the commitment to meeting patient and healthcare provider needs in the UK.

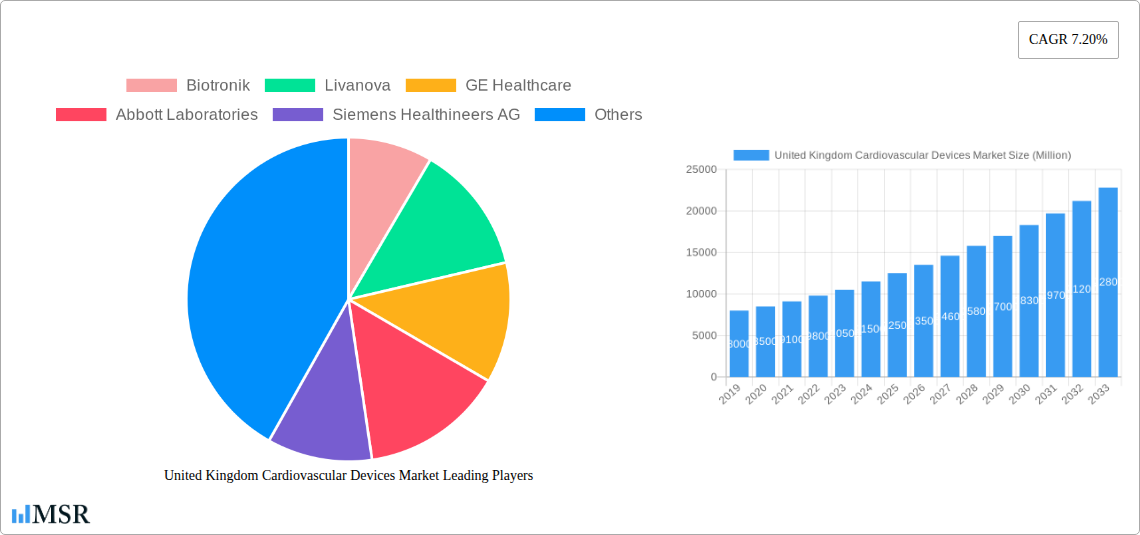

United Kingdom Cardiovascular Devices Market Company Market Share

United Kingdom Cardiovascular Devices Market: Comprehensive Insights and Forecasts (2019–2033)

This in-depth report offers a definitive analysis of the United Kingdom Cardiovascular Devices Market, providing critical insights and actionable strategies for industry stakeholders. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, industry trends, segment-specific performance, product developments, challenges, growth drivers, and emerging opportunities. It equips businesses with the necessary intelligence to navigate this dynamic sector, focusing on key segments like Diagnostic and Monitoring Devices and Therapeutic and Surgical Devices, including Electrocardiogram (ECG), Remote Cardiac Monitoring, Cardiac Assist Devices, Cardiac Rhythm Management Devices, Catheters, Grafts, Heart Valves, and Stents. Gain a competitive edge with unparalleled data and strategic outlooks for the UK's vital cardiovascular health landscape.

United Kingdom Cardiovascular Devices Market Market Concentration & Dynamics

The United Kingdom Cardiovascular Devices Market exhibits a moderately concentrated landscape, characterized by a blend of multinational corporations and specialized domestic players. Innovation ecosystems are robust, driven by significant investment in R&D and a strong academic-medical research interface. The UK's stringent regulatory frameworks, overseen by bodies like the Medicines and Healthcare products Regulatory Agency (MHRA), ensure high product quality and safety standards, though they can also present considerable hurdles for new entrants. Substitute products, while present in some lower-acuity areas, are largely outpaced by the advanced capabilities of dedicated cardiovascular devices. End-user trends indicate a strong preference for minimally invasive procedures, remote monitoring solutions, and personalized treatment approaches, fueled by an aging population and increasing prevalence of cardiovascular diseases. Merger and acquisition (M&A) activities are strategically driven, focusing on consolidating market share, acquiring innovative technologies, and expanding product portfolios. Key M&A deals in recent years have aimed to strengthen offerings in areas such as cardiac rhythm management and interventional cardiology. The market share distribution reflects the dominance of established players, with smaller companies carving out niches through specialized innovation. The dynamic interplay between these factors shapes the competitive environment and influences strategic decision-making for all participants.

United Kingdom Cardiovascular Devices Market Industry Insights & Trends

The United Kingdom Cardiovascular Devices Market is poised for substantial growth, projected to reach USD 15,000 Million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This upward trajectory is underpinned by several compelling market growth drivers. An aging demographic, coupled with the rising incidence of lifestyle-related cardiovascular diseases such as hypertension, coronary artery disease, and heart failure, significantly amplifies the demand for advanced diagnostic, monitoring, and therapeutic cardiovascular devices. Technological disruptions are at the forefront of this expansion. Innovations in areas like artificial intelligence (AI) for predictive diagnostics, miniaturization of implantable devices, and the development of novel biomaterials for grafts and valves are revolutionizing patient care and treatment outcomes. The increasing adoption of remote cardiac monitoring solutions, facilitated by advancements in wireless connectivity and wearable technology, is transforming patient management by enabling continuous data collection and early intervention, thereby reducing hospital readmissions and improving overall patient quality of life. Evolving consumer behaviors are also playing a crucial role. Patients are becoming more informed and actively engaged in their healthcare decisions, seeking less invasive and more personalized treatment options. This demand is driving the market towards innovative interventional cardiology devices, sophisticated cardiac rhythm management systems, and advanced cardiac assist devices. Furthermore, the UK's robust healthcare infrastructure, including its National Health Service (NHS), provides a vast market and a structured framework for the adoption and reimbursement of innovative cardiovascular technologies. Government initiatives aimed at improving cardiovascular health outcomes and reducing the burden of chronic diseases also contribute to a favorable market environment. The historical period (2019–2024) has laid the groundwork for this accelerated growth, characterized by steady advancements and increasing adoption rates. The estimated year of 2025 signifies a critical juncture where these trends are expected to fully mature, propelling the market into its next phase of expansion.

Key Markets & Segments Leading United Kingdom Cardiovascular Devices Market

The Therapeutic and Surgical Devices segment is the dominant force within the United Kingdom Cardiovascular Devices Market, driven by its direct impact on patient treatment and recovery. Within this broad category, Cardiac Rhythm Management Devices and Stents emerge as particularly strong sub-segments, experiencing high demand due to the increasing prevalence of arrhythmias and coronary artery disease, respectively.

Cardiac Rhythm Management Devices:

- Drivers: Aging population with a higher incidence of atrial fibrillation and bradycardia; advancements in leadless pacemakers and implantable cardioverter-defibrillators (ICDs) offering improved patient outcomes and reduced complications; strong reimbursement policies for these life-saving devices within the NHS.

- Dominance Analysis: The growing burden of arrhythmias necessitates continuous monitoring and intervention. Innovations in remote monitoring capabilities for pacemakers and ICDs further enhance their appeal, allowing for proactive management of patient conditions and reducing the need for frequent in-person follow-ups. This segment consistently sees significant investment and adoption rates.

Stents:

- Drivers: High prevalence of coronary artery disease and the ongoing demand for minimally invasive procedures like angioplasty and stenting; development of drug-eluting stents (DES) with improved efficacy and reduced restenosis rates; technological advancements in stent design, such as bioresorbable scaffolds, offering potential for natural healing.

- Dominance Analysis: Coronary artery disease remains a leading cause of mortality in the UK, making stenting a cornerstone of treatment. The continuous refinement of stent technology, focusing on patient safety and long-term outcomes, ensures sustained market demand. The shift towards complex interventions and patient-specific solutions further solidifies the market position of advanced stenting solutions.

The Diagnostic and Monitoring Devices segment, particularly Remote Cardiac Monitoring, is also experiencing significant growth and is crucial for early detection and ongoing patient management.

- Remote Cardiac Monitoring:

- Drivers: Increasing focus on preventative healthcare and proactive disease management; integration of AI and machine learning for advanced data analysis and anomaly detection; growing acceptance and adoption of wearable and implantable monitoring devices by both patients and clinicians; cost-effectiveness in reducing hospitalizations.

- Dominance Analysis: The ability to continuously monitor patients outside traditional healthcare settings is transforming cardiovascular care. This segment facilitates early identification of potential cardiac events, allowing for timely intervention and personalized treatment adjustments. The push towards telehealth and home-based care further amplifies the importance and demand for sophisticated remote monitoring solutions.

While Electrocardiogram (ECG) devices remain fundamental, the market's dynamism is increasingly driven by advanced therapeutic interventions and sophisticated, continuous monitoring technologies. The overall market's growth is a synergistic interplay of these segments, addressing the multifaceted needs of cardiovascular patient care in the United Kingdom.

United Kingdom Cardiovascular Devices Market Product Developments

The United Kingdom Cardiovascular Devices Market is a hotbed of innovation, with companies consistently introducing cutting-edge products that redefine patient care. Recent developments include the launch of advanced cardiac rhythm management devices with enhanced AI-powered diagnostics and improved battery longevity, alongside novel stents engineered with bioresorbable materials to minimize long-term complications. The push for remote patient management is evident in the evolution of remote cardiac monitoring systems, which now offer real-time data transmission and sophisticated analytical capabilities for early detection of critical events. Furthermore, advancements in catheters are enabling more precise and minimally invasive surgical interventions, reducing patient recovery times. These product developments are crucial for maintaining a competitive edge and addressing the evolving needs of the UK's healthcare system.

Challenges in the United Kingdom Cardiovascular Devices Market Market

Navigating the United Kingdom Cardiovascular Devices Market presents several formidable challenges for stakeholders. Regulatory hurdles, specifically the rigorous approval processes by the MHRA, can lead to extended time-to-market for new innovations. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of critical components, affecting production timelines and profitability. Intense competitive pressures from both established global players and agile domestic innovators demand continuous investment in R&D and strategic market positioning. The high cost of advanced medical devices can also be a barrier to widespread adoption within budget-constrained healthcare systems, necessitating strong evidence of cost-effectiveness.

Forces Driving United Kingdom Cardiovascular Devices Market Growth

The United Kingdom Cardiovascular Devices Market is propelled by powerful growth forces that ensure its sustained expansion. A primary driver is the increasing prevalence of cardiovascular diseases, directly linked to an aging population and lifestyle factors. Technological advancements are central, with innovations in areas like minimally invasive surgical techniques and advanced diagnostic imaging enhancing treatment efficacy and patient outcomes. The growing demand for personalized medicine is fueling the development of tailored therapeutic solutions. Furthermore, favorable reimbursement policies within the NHS for innovative cardiovascular devices provide crucial financial support for their adoption. Government initiatives aimed at improving public health and reducing the burden of chronic diseases also act as significant catalysts for market growth.

Challenges in the United Kingdom Cardiovascular Devices Market Market

The long-term growth catalysts for the United Kingdom Cardiovascular Devices Market are deeply intertwined with continuous innovation and strategic market evolution. A key catalyst is the ongoing development of novel therapeutic approaches, such as advanced gene therapies and regenerative medicine for cardiac repair, which promise to revolutionize treatment paradigms. Strategic partnerships between medical device manufacturers, research institutions, and healthcare providers are crucial for accelerating the translation of research into clinical practice. Market expansion through the development of cost-effective solutions for emerging markets within the UK and exploring export opportunities will also contribute significantly. Furthermore, the increasing integration of digital health technologies, including AI-driven predictive analytics and sophisticated telehealth platforms, will create new avenues for growth and improved patient care.

Emerging Opportunities in United Kingdom Cardiovascular Devices Market

Emerging opportunities in the United Kingdom Cardiovascular Devices Market are abundant, driven by technological advancements and shifting healthcare priorities. The burgeoning field of remote patient monitoring and telehealth presents a significant avenue for growth, offering scalable solutions for chronic disease management and early intervention. Advancements in AI and machine learning are opening doors for predictive diagnostics and personalized treatment planning, creating demand for integrated device-and-software solutions. The development of bioresorbable medical devices, such as stents and scaffolds, offers a pathway to reduce long-term complications and improve patient outcomes. Furthermore, a growing focus on preventative cardiology and wellness technologies is creating opportunities for wearable devices and innovative diagnostics that empower individuals to proactively manage their heart health.

Leading Players in the United Kingdom Cardiovascular Devices Market Sector

- Biotronik

- Livanova

- GE Healthcare

- Abbott Laboratories

- Siemens Healthineers AG

- Cardinal Health

- Medtronic Plc

- Boston Scientific Corporation

- B Braun SE

- W L Gore & Associates Inc

Key Milestones in United Kingdom Cardiovascular Devices Market Industry

- July 2022: Novartis Pharmaceuticals United Kingdom launched the Novartis Biome UK Heart Health Catalyst 2022 in a world-first investor partnership with Medtronic Ltd., RYSE Asset Management, and Chelsea and Westminster Hospital NHS Foundation Trust and its official charity, CW+. The initiative aims to identify and implement solutions that empower patients to improve their heart health and help prevent future heart attacks or strokes through home-based digital solutions.

- February 2022: Ceryx Medical Limited, with scientists at the Auckland Bioengineering Institute (ABI) and the Universities of Bath and Bristol, developed Cysoni. This bionic device paces the heart with real-time respiratory modulation. The innovation stems from the idea that heart rate increases and decreases with each breath in normal physiology, termed "respiratory sinus arrhythmia" (RSA).

Strategic Outlook for United Kingdom Cardiovascular Devices Market Market

The strategic outlook for the United Kingdom Cardiovascular Devices Market is exceptionally positive, driven by a confluence of factors that promise accelerated growth and innovation. The market is characterized by a strong commitment to adopting advanced technologies, including AI-powered diagnostics, remote monitoring solutions, and minimally invasive therapeutic devices. The ongoing investment in research and development by leading players, coupled with strategic partnerships between industry and academic institutions, will continue to fuel product innovation. The NHS's focus on improving cardiovascular health outcomes and managing the burden of chronic diseases provides a stable and substantial market for these devices. Companies that can demonstrate clear clinical efficacy and cost-effectiveness will be best positioned to capitalize on emerging opportunities. Strategic focus areas will include expanding the adoption of telehealth solutions, developing next-generation implantable devices with enhanced functionality, and leveraging data analytics to personalize patient care. This forward-looking approach will solidify the UK's position as a leader in cardiovascular device innovation and application.

United Kingdom Cardiovascular Devices Market Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Market

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Devices

- 1.2.3. Catheters

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Market

United Kingdom Cardiovascular Devices Market Segmentation By Geography

- 1. United Kingdom

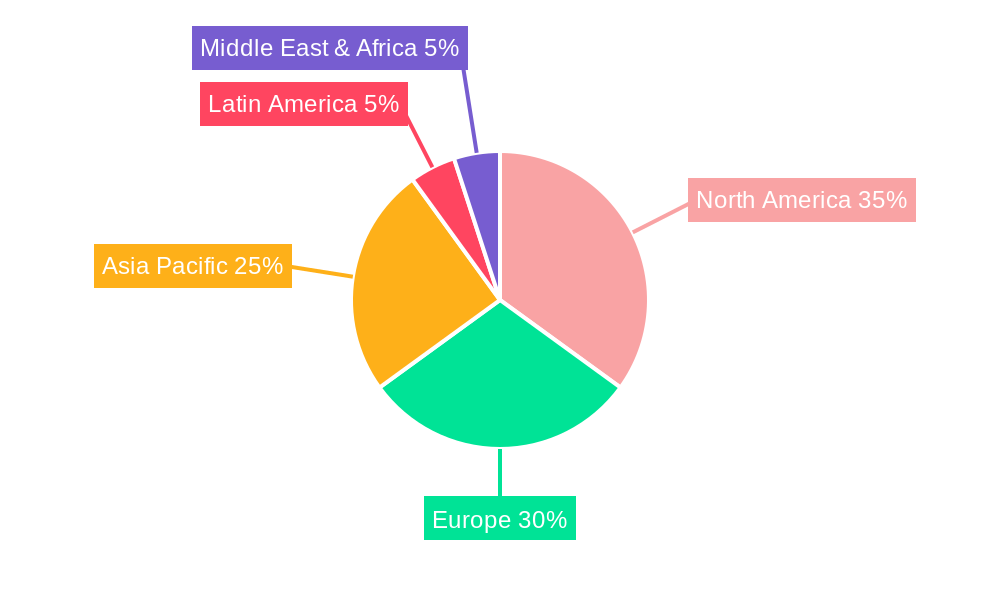

United Kingdom Cardiovascular Devices Market Regional Market Share

Geographic Coverage of United Kingdom Cardiovascular Devices Market

United Kingdom Cardiovascular Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Cardiovascular Diseases; Technological Advancement in the Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Cardiac Rhythm Management Devices Segment is Expected to Hold a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Market

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Devices

- 5.1.2.3. Catheters

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Market

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Biotronik

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Livanova

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Healthineers AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cardinal Health

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B Braun SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 W L Gore & Associates Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Biotronik

List of Figures

- Figure 1: United Kingdom Cardiovascular Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Cardiovascular Devices Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 2: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 6: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Cardiovascular Devices Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the United Kingdom Cardiovascular Devices Market?

Key companies in the market include Biotronik, Livanova, GE Healthcare, Abbott Laboratories, Siemens Healthineers AG, Cardinal Health, Medtronic Plc, Boston Scientific Corporation, B Braun SE, W L Gore & Associates Inc.

3. What are the main segments of the United Kingdom Cardiovascular Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Cardiovascular Diseases; Technological Advancement in the Devices.

6. What are the notable trends driving market growth?

Cardiac Rhythm Management Devices Segment is Expected to Hold a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

July 2022: Novartis Pharmaceuticals United Kingdom launched the Novartis Biome UK Heart Health Catalyst 2022 in a world-first investor partnership with Medtronic Ltd., RYSE Asset Management, and Chelsea and Westminster Hospital NHS Foundation Trust and its official charity, CW+. The initiative aims to identify and implement solutions that empower patients to improve their heart health and help prevent future heart attacks or strokes through home-based digital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Cardiovascular Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Cardiovascular Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Cardiovascular Devices Market?

To stay informed about further developments, trends, and reports in the United Kingdom Cardiovascular Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence