Key Insights

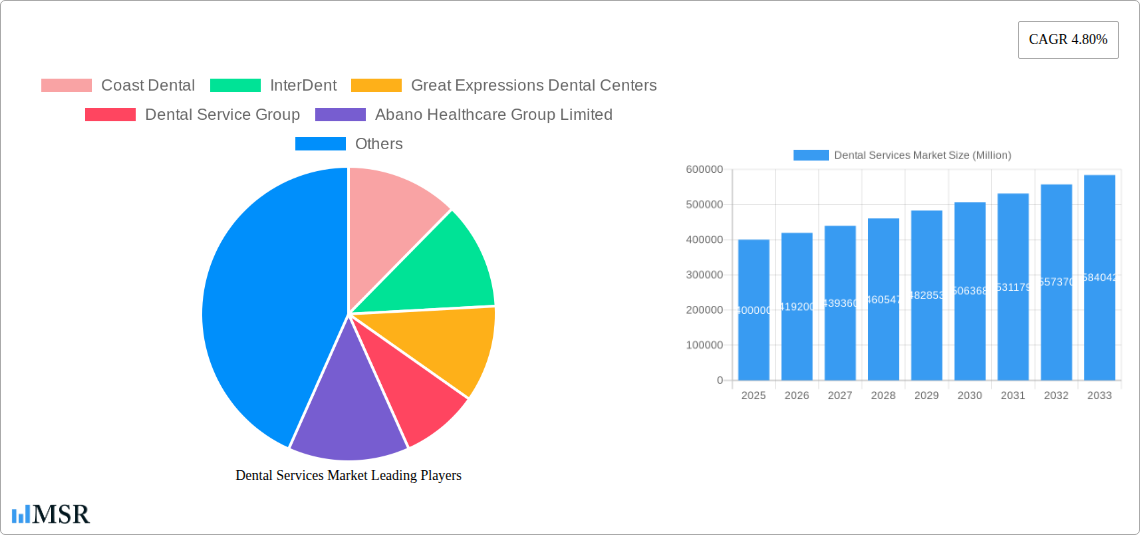

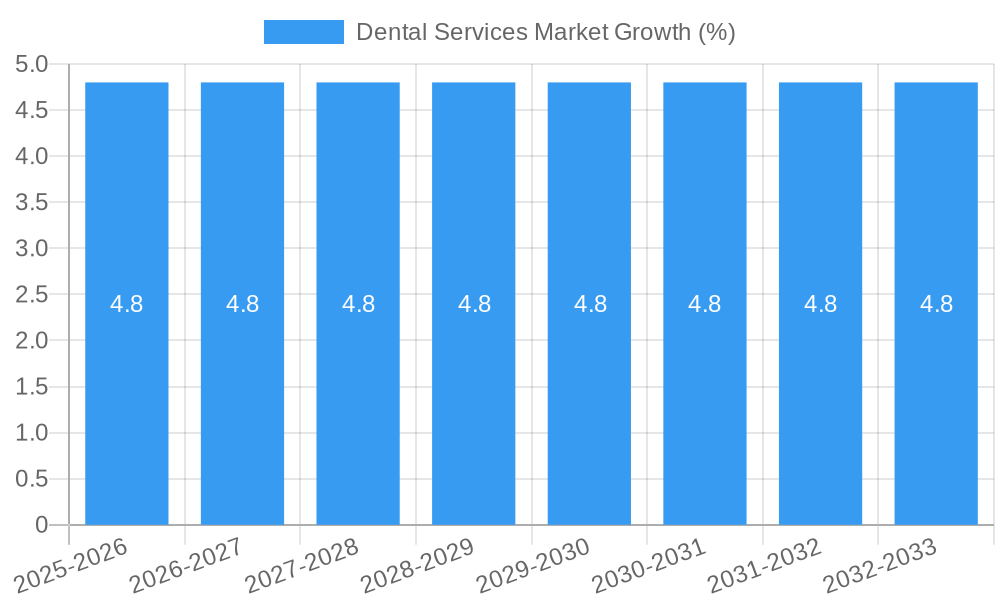

The global Dental Services Market is projected for robust growth, demonstrating a significant Compound Annual Growth Rate (CAGR) of 4.80%. This expansion is driven by an increasing emphasis on oral hygiene, growing awareness of the link between oral health and overall well-being, and advancements in dental technologies. The market, estimated at USD 400,000 million (assuming a logical estimate for market size based on CAGR and typical industry values), is witnessing a surge in demand across various service types. Dental implants, endodontics, and cosmetic dentistry are leading segments, fueled by an aging population seeking restorative solutions and a growing aesthetic consciousness among consumers. The rise in disposable incomes in developing economies further propels this demand, making advanced dental treatments more accessible. Furthermore, preventive dental care is gaining traction, with individuals increasingly investing in regular check-ups and treatments to avoid more complex and costly procedures down the line. This proactive approach by consumers, coupled with a strong emphasis from dental professionals, underpins the sustained market trajectory.

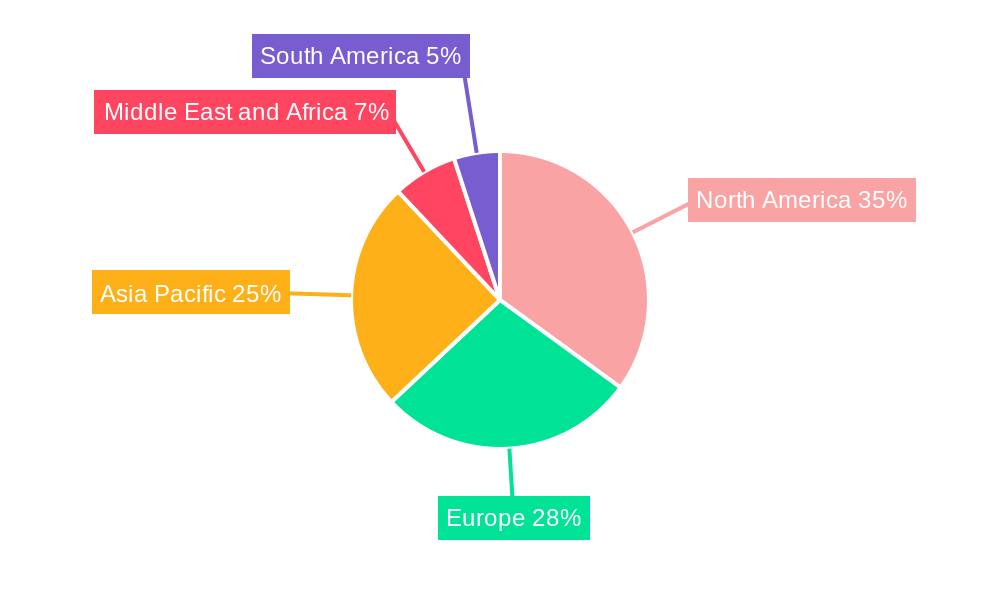

The competitive landscape is characterized by the presence of both large corporate dental groups and independent practitioners. Key players such as Pacific Dental Services, Aspen Dental Management Inc., and Apollo White Dental are actively expanding their reach through strategic acquisitions and service diversification, aiming to capture a larger market share. The market is segmented by service type, including Dental Implants, Endodontics, Periodontics, Orthodontics, Dentures, Cosmetic Dentistry, and Others, and by end-user, predominantly Hospitals and Dental Clinics. Geographically, North America, with the United States leading, currently holds a substantial market share due to advanced healthcare infrastructure and high consumer spending. However, the Asia Pacific region is anticipated to exhibit the fastest growth, driven by increasing healthcare expenditure, a burgeoning middle class, and a rising prevalence of dental ailments in countries like China and India. Restraints such as the high cost of some advanced dental procedures and limited insurance coverage in certain regions might temper growth, but the overarching trend of increased oral health consciousness and technological innovation points towards a dynamic and expanding market throughout the forecast period of 2025-2033.

Comprehensive Dental Services Market Report: Growth, Trends, and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global dental services market, covering its historical performance, current dynamics, and future trajectory. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study offers critical insights for industry stakeholders seeking to capitalize on the burgeoning dental care industry. Explore key market segments, technological advancements, competitive landscapes, and strategic opportunities within this essential healthcare sector.

Dental Services Market Market Concentration & Dynamics

The dental services market exhibits a moderately fragmented landscape, with a mix of large consolidators and independent practices. Key players like Pacific Dental Services, Aspen Dental Management Inc., and InterDent are actively pursuing growth through strategic acquisitions and the expansion of their clinic networks. The innovation ecosystem is rapidly evolving, driven by advancements in digital dentistry, AI-powered diagnostics, and minimally invasive treatment options. Regulatory frameworks, while generally supportive of patient care, can vary significantly across regions, impacting market entry and operational standards. Substitute products and services, such as over-the-counter oral care solutions, continue to cater to basic needs, but the demand for professional dental treatments remains robust. End-user trends point towards an increasing demand for cosmetic dentistry, preventive care, and advanced restorative procedures, fueled by greater awareness of oral health's impact on overall well-being and the desire for aesthetic improvements. Mergers and acquisitions (M&A) activities are a significant driver of market consolidation, with numerous deals aimed at expanding geographic reach, integrating new technologies, and enhancing service offerings. For instance, the dental implants segment is witnessing significant M&A as companies seek to bolster their positions in this high-growth area. The market share distribution reflects the strategic maneuvers of these key entities, with larger organizations gradually increasing their dominance. The continuous influx of new technologies and evolving patient preferences necessitates a dynamic approach to market strategy, ensuring agility and responsiveness to changing demands in the dental practice management sector.

Dental Services Market Industry Insights & Trends

The dental services market is poised for substantial growth, propelled by an escalating awareness of oral hygiene, a growing geriatric population requiring specialized dental care, and increasing disposable incomes across emerging economies. The global dental market size is projected to reach an estimated $650,000 Million by 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. Technological disruptions are revolutionizing dental care delivery. The integration of Artificial Intelligence (AI) in diagnostics, such as AI-powered X-ray analysis, is enhancing accuracy and efficiency in identifying oral diseases. Digital impression systems and 3D printing are streamlining the production of crowns, bridges, and dental prosthetics, leading to quicker patient turnaround times and improved treatment outcomes. The rise of telehealth and teledentistry platforms is expanding access to dental consultations, particularly for individuals in remote areas or with mobility issues. Evolving consumer behaviors are characterized by a greater emphasis on preventive dentistry, regular check-ups, and a growing interest in aesthetic treatments like teeth whitening and cosmetic dentistry. Patients are increasingly seeking personalized treatment plans and convenient appointment scheduling options. The demand for less invasive procedures is also on the rise, driving innovation in areas like laser dentistry and guided bone regeneration for dental implants. Furthermore, the increasing prevalence of oral health issues linked to lifestyle factors, such as poor diet and smoking, underscores the critical role of accessible and comprehensive dental care services. The focus on early detection and intervention is a significant trend, contributing to the overall expansion of the dental clinic market. The endodontics and periodontics segments are experiencing steady demand due to the aging population and increasing incidence of conditions like root canal issues and gum disease. The orthodontics segment, fueled by aesthetic concerns and the availability of advanced, discreet treatment options like clear aligners, is also a key growth area within the dental services sector. The dentures market, while mature, continues to see demand from the elderly population, and advancements in materials are enhancing comfort and aesthetics. Overall, the confluence of demographic shifts, technological advancements, and changing consumer preferences creates a dynamic and expanding dental services market.

Key Markets & Segments Leading Dental Services Market

The dental services market is experiencing significant leadership from dental clinics, which represent the primary point of service delivery for a vast majority of patients. Within the service type segmentation, dental implants are emerging as a dominant and rapidly growing segment, driven by an aging global population seeking permanent tooth replacement solutions, advancements in implant materials and surgical techniques, and increasing patient awareness of their benefits. The projected market size for dental implants alone is substantial, contributing significantly to the overall dental services market value.

- Dominance of Dental Clinics: Dental clinics, ranging from small independent practices to large corporate chains, are the bedrock of the dental services market. Their dominance is attributed to their accessibility, comprehensive service offerings, and established patient relationships. Factors like the increasing number of dental professionals, investment in modern equipment, and a focus on patient convenience further solidify their leading position. The economic growth in various regions fuels disposable income, allowing more individuals to access regular dental care.

- Growth Drivers for Dental Implants:

- Aging Population: Increased longevity leads to a higher incidence of tooth loss, driving demand for long-term solutions like dental implants.

- Technological Advancements: Innovations in materials (e.g., zirconia implants) and surgical techniques (e.g., computer-guided surgery) improve success rates and patient outcomes.

- Aesthetic Appeal and Functionality: Dental implants offer a natural look and feel, closely mimicking natural teeth, which is highly desirable for patients.

- Increased Awareness and Affordability: Greater patient education and the availability of financing options are making dental implants more accessible.

- Dominance of Dental Implants: The dental implants market is a significant contributor to the overall dental services market growth. The increasing adoption of digital dentistry in implant planning and placement, coupled with the rising demand for full-mouth rehabilitation, further propels this segment. The market's robust growth is also fueled by strategic partnerships between implant manufacturers and dental service organizations, aiming to integrate implant services more seamlessly into dental clinic offerings.

- Other Leading Segments:

- Cosmetic Dentistry: Fueled by a global emphasis on aesthetics, cosmetic dental procedures like teeth whitening, veneers, and smile makeovers are experiencing robust demand, particularly among younger demographics.

- Orthodontics: The increasing acceptance of orthodontic treatments for both functional and aesthetic reasons, coupled with the popularity of discreet options like clear aligners, makes this a consistently strong segment.

- Endodontics and Periodontics: These segments are driven by the rising prevalence of conditions like root canal issues and gum disease, often associated with aging populations and lifestyle factors.

- Regional Dominance: While a global market, North America currently leads the dental services market due to high healthcare expenditure, advanced technological adoption, and a strong emphasis on preventive care. However, the Asia-Pacific region is emerging as a key growth driver, propelled by improving economic conditions, expanding healthcare infrastructure, and a growing middle class with increasing access to dental services.

Dental Services Market Product Developments

Product developments in the dental services market are primarily focused on enhancing patient comfort, improving treatment efficacy, and streamlining clinical workflows. Innovations in digital dentistry, including advanced intraoral scanners and AI-powered diagnostic software, are revolutionizing diagnosis and treatment planning, leading to more precise and personalized patient care. The development of novel biomaterials for dental implants and bone grafting is improving osseointegration and reducing healing times. Furthermore, advancements in minimally invasive surgical techniques and biodegradable materials are transforming the landscape of periodontics and endodontics. The market relevance of these developments lies in their ability to improve patient outcomes, reduce treatment costs, and enhance the overall patient experience, driving demand and competitive advantage for forward-thinking dental practices and manufacturers.

Challenges in the Dental Services Market Market

The dental services market faces several challenges that can impede its growth and accessibility. Regulatory hurdles, including varying licensing requirements for dental professionals and differing approval processes for new dental technologies across jurisdictions, can create market entry barriers. Supply chain disruptions for essential dental materials and equipment, exacerbated by global events, can lead to increased costs and service delays. Intense competition among dental providers, especially in saturated urban markets, puts pressure on pricing and profitability. Moreover, the significant out-of-pocket expenditure associated with many dental procedures, particularly advanced ones like dental implants and comprehensive cosmetic treatments, remains a substantial barrier for a segment of the population, limiting market penetration. The ongoing shortage of skilled dental professionals in certain regions also poses a significant constraint on service expansion and capacity.

Forces Driving Dental Services Market Growth

Several key forces are driving the remarkable growth of the dental services market. Technological innovation is paramount, with advancements in AI, 3D printing, and digital imaging revolutionizing diagnosis, treatment planning, and the creation of prosthetics, leading to more efficient and precise dental care. The increasing global awareness of the link between oral health and overall well-being is a significant catalyst, prompting individuals to prioritize preventive care and regular dental check-ups. Economic factors, including rising disposable incomes in emerging economies and a growing middle class, are making dental treatments more accessible. Government initiatives and public health programs aimed at improving oral health outcomes also contribute to market expansion. The aesthetic revolution, with a heightened consumer desire for attractive smiles, is fueling demand for cosmetic dentistry and orthodontics. Furthermore, the aging global population necessitates increased demand for restorative and prosthetic dental services, including dentures and dental implants.

Challenges in the Dental Services Market Market

While the dental services market is experiencing robust growth, several long-term challenges warrant attention. The high cost of advanced dental technology and specialized training can be a barrier for smaller practices, potentially widening the gap in service quality. The persistent issue of dental anxiety and phobia among a significant portion of the population continues to deter some individuals from seeking necessary dental treatments. Ensuring equitable access to quality dental care services across all socioeconomic strata and geographical locations remains a critical challenge. The increasing burden of chronic diseases, often linked to oral health, requires a more integrated approach to healthcare, which the dental industry is still actively developing. Moreover, the ethical considerations surrounding direct-to-consumer dental aligner products and their potential impact on patient safety and the role of the dentist require ongoing dialogue and regulatory oversight to maintain the integrity of dental practice management and patient care.

Emerging Opportunities in Dental Services Market

The dental services market presents a wealth of emerging opportunities for growth and innovation. The increasing demand for personalized and convenient dental care is driving the expansion of teledentistry platforms, enabling remote consultations and follow-ups, thereby improving accessibility, particularly for underserved populations. The integration of AI in diagnostics and treatment planning offers significant potential for enhancing accuracy, efficiency, and patient outcomes. The growing interest in oral health as a crucial component of overall well-being is creating a greater market for preventive dental services and wellness-focused oral care products. The continuous advancements in dental implant technology, including minimally invasive techniques and novel biomaterials, are opening up new treatment possibilities and expanding the patient base. Furthermore, the burgeoning market in developing economies, driven by economic growth and increasing healthcare expenditure, represents a significant untapped opportunity for expanding dental clinic networks and service offerings. The focus on aesthetic dentistry is also creating new avenues for specialized treatments and patient-centric solutions.

Leading Players in the Dental Services Market Sector

- Coast Dental

- InterDent

- Great Expressions Dental Centers

- Dental Service Group

- Abano Healthcare Group Limited

- Pacific Dental Services

- Aspen Dental Management Inc.

- Smile

- Integrated Dental Holdings

- Apollo White Dental

Key Milestones in Dental Services Market Industry

- November 2022: Platinum Dental Services partnered with Overjet with the aim to introduce AI-powered X-ray analysis and clinical insights to all of its clinics, enhancing diagnostic capabilities and patient care.

- July 2022: Aspen Dental Management, Inc. collaborated with ClearChoice Dental Implant Centers and inaugurated a colocation under one roof in Mexico with an aim to offer a range of services from preventive care to treatment of advanced oral diseases, expanding service integration and accessibility.

Strategic Outlook for Dental Services Market Market

The strategic outlook for the dental services market is exceptionally positive, driven by a confluence of sustained demand, technological innovation, and evolving consumer preferences. Growth accelerators include the continued integration of AI and digital dentistry for enhanced diagnostics and treatment planning, the expansion of teledentistry to improve access to care, and the rising demand for cosmetic and preventive dental procedures. Strategic opportunities lie in expanding service offerings to cater to the growing needs of an aging population, particularly in areas like dental implants and dentures, and in leveraging partnerships to penetrate underserved markets. Investments in advanced training for dental professionals and a focus on patient-centric care models will be crucial for maintaining a competitive edge. The market is expected to witness further consolidation through strategic acquisitions and collaborations, as organizations seek to achieve economies of scale and broaden their service portfolios within the dynamic dental care industry.

Dental Services Market Segmentation

-

1. Service Type

- 1.1. Dental Implants

- 1.2. Endodontics

- 1.3. Periodontics

- 1.4. Orthodontics

- 1.5. Dentures

- 1.6. Cosmetic Dentistry

- 1.7. Others

-

2. End-User

- 2.1. Hospitals

- 2.2. Dental Clinics

Dental Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Dental Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Dental Disease Rate; Increasing Awareness on Dental Health

- 3.3. Market Restrains

- 3.3.1. Limited Insurance Coverage for High Priced Dental Practices in the Developing Countries

- 3.4. Market Trends

- 3.4.1. The dental Implants Segment is Anticipated to Hold a Significant Market Share During the Study Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Dental Implants

- 5.1.2. Endodontics

- 5.1.3. Periodontics

- 5.1.4. Orthodontics

- 5.1.5. Dentures

- 5.1.6. Cosmetic Dentistry

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals

- 5.2.2. Dental Clinics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Dental Implants

- 6.1.2. Endodontics

- 6.1.3. Periodontics

- 6.1.4. Orthodontics

- 6.1.5. Dentures

- 6.1.6. Cosmetic Dentistry

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Hospitals

- 6.2.2. Dental Clinics

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Dental Implants

- 7.1.2. Endodontics

- 7.1.3. Periodontics

- 7.1.4. Orthodontics

- 7.1.5. Dentures

- 7.1.6. Cosmetic Dentistry

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Hospitals

- 7.2.2. Dental Clinics

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Dental Implants

- 8.1.2. Endodontics

- 8.1.3. Periodontics

- 8.1.4. Orthodontics

- 8.1.5. Dentures

- 8.1.6. Cosmetic Dentistry

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Hospitals

- 8.2.2. Dental Clinics

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East and Africa Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Dental Implants

- 9.1.2. Endodontics

- 9.1.3. Periodontics

- 9.1.4. Orthodontics

- 9.1.5. Dentures

- 9.1.6. Cosmetic Dentistry

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Hospitals

- 9.2.2. Dental Clinics

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. South America Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Dental Implants

- 10.1.2. Endodontics

- 10.1.3. Periodontics

- 10.1.4. Orthodontics

- 10.1.5. Dentures

- 10.1.6. Cosmetic Dentistry

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Hospitals

- 10.2.2. Dental Clinics

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. North America Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Europe Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Asia Pacific Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. Middle East and Africa Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. South America Dental Services Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Coast Dental

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 InterDent

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Great Expressions Dental Centers

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Dental Service Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Abano Healthcare Group Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Pacific Dental Services

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Aspen Dental Management Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Smile

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Integrated Dental Holdings

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Apollo White Dental

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Coast Dental

List of Figures

- Figure 1: Global Dental Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Dental Services Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: Middle East and Africa Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Dental Services Market Revenue (Million), by Service Type 2024 & 2032

- Figure 24: North America Dental Services Market Volume (K Unit), by Service Type 2024 & 2032

- Figure 25: North America Dental Services Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 26: North America Dental Services Market Volume Share (%), by Service Type 2024 & 2032

- Figure 27: North America Dental Services Market Revenue (Million), by End-User 2024 & 2032

- Figure 28: North America Dental Services Market Volume (K Unit), by End-User 2024 & 2032

- Figure 29: North America Dental Services Market Revenue Share (%), by End-User 2024 & 2032

- Figure 30: North America Dental Services Market Volume Share (%), by End-User 2024 & 2032

- Figure 31: North America Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Dental Services Market Revenue (Million), by Service Type 2024 & 2032

- Figure 36: Europe Dental Services Market Volume (K Unit), by Service Type 2024 & 2032

- Figure 37: Europe Dental Services Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 38: Europe Dental Services Market Volume Share (%), by Service Type 2024 & 2032

- Figure 39: Europe Dental Services Market Revenue (Million), by End-User 2024 & 2032

- Figure 40: Europe Dental Services Market Volume (K Unit), by End-User 2024 & 2032

- Figure 41: Europe Dental Services Market Revenue Share (%), by End-User 2024 & 2032

- Figure 42: Europe Dental Services Market Volume Share (%), by End-User 2024 & 2032

- Figure 43: Europe Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 44: Europe Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 45: Europe Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Europe Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 47: Asia Pacific Dental Services Market Revenue (Million), by Service Type 2024 & 2032

- Figure 48: Asia Pacific Dental Services Market Volume (K Unit), by Service Type 2024 & 2032

- Figure 49: Asia Pacific Dental Services Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 50: Asia Pacific Dental Services Market Volume Share (%), by Service Type 2024 & 2032

- Figure 51: Asia Pacific Dental Services Market Revenue (Million), by End-User 2024 & 2032

- Figure 52: Asia Pacific Dental Services Market Volume (K Unit), by End-User 2024 & 2032

- Figure 53: Asia Pacific Dental Services Market Revenue Share (%), by End-User 2024 & 2032

- Figure 54: Asia Pacific Dental Services Market Volume Share (%), by End-User 2024 & 2032

- Figure 55: Asia Pacific Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 56: Asia Pacific Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 57: Asia Pacific Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East and Africa Dental Services Market Revenue (Million), by Service Type 2024 & 2032

- Figure 60: Middle East and Africa Dental Services Market Volume (K Unit), by Service Type 2024 & 2032

- Figure 61: Middle East and Africa Dental Services Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 62: Middle East and Africa Dental Services Market Volume Share (%), by Service Type 2024 & 2032

- Figure 63: Middle East and Africa Dental Services Market Revenue (Million), by End-User 2024 & 2032

- Figure 64: Middle East and Africa Dental Services Market Volume (K Unit), by End-User 2024 & 2032

- Figure 65: Middle East and Africa Dental Services Market Revenue Share (%), by End-User 2024 & 2032

- Figure 66: Middle East and Africa Dental Services Market Volume Share (%), by End-User 2024 & 2032

- Figure 67: Middle East and Africa Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 68: Middle East and Africa Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 69: Middle East and Africa Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: Middle East and Africa Dental Services Market Volume Share (%), by Country 2024 & 2032

- Figure 71: South America Dental Services Market Revenue (Million), by Service Type 2024 & 2032

- Figure 72: South America Dental Services Market Volume (K Unit), by Service Type 2024 & 2032

- Figure 73: South America Dental Services Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 74: South America Dental Services Market Volume Share (%), by Service Type 2024 & 2032

- Figure 75: South America Dental Services Market Revenue (Million), by End-User 2024 & 2032

- Figure 76: South America Dental Services Market Volume (K Unit), by End-User 2024 & 2032

- Figure 77: South America Dental Services Market Revenue Share (%), by End-User 2024 & 2032

- Figure 78: South America Dental Services Market Volume Share (%), by End-User 2024 & 2032

- Figure 79: South America Dental Services Market Revenue (Million), by Country 2024 & 2032

- Figure 80: South America Dental Services Market Volume (K Unit), by Country 2024 & 2032

- Figure 81: South America Dental Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: South America Dental Services Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Dental Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Global Dental Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 5: Global Dental Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Global Dental Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Global Dental Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Dental Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Dental Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: Global Dental Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 21: Global Dental Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: Global Dental Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 23: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Global Dental Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 32: Global Dental Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 33: Global Dental Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 34: Global Dental Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 35: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Germany Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: United Kingdom Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: France Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Italy Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Italy Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Spain Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Spain Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Rest of Europe Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Global Dental Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 50: Global Dental Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 51: Global Dental Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 52: Global Dental Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 53: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: China Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: China Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Japan Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: India Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: India Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Australia Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Australia Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: South Korea Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Korea Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Rest of Asia Pacific Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Asia Pacific Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Global Dental Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 68: Global Dental Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 69: Global Dental Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 70: Global Dental Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 71: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 73: GCC Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: GCC Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: South Africa Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: South Africa Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Rest of Middle East and Africa Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of Middle East and Africa Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Global Dental Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 80: Global Dental Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 81: Global Dental Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 82: Global Dental Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 83: Global Dental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 84: Global Dental Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 85: Brazil Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Brazil Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Argentina Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Argentina Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Rest of South America Dental Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Rest of South America Dental Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Services Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Dental Services Market?

Key companies in the market include Coast Dental, InterDent, Great Expressions Dental Centers, Dental Service Group, Abano Healthcare Group Limited, Pacific Dental Services, Aspen Dental Management Inc, Smile, Integrated Dental Holdings, Apollo White Dental.

3. What are the main segments of the Dental Services Market?

The market segments include Service Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Dental Disease Rate; Increasing Awareness on Dental Health.

6. What are the notable trends driving market growth?

The dental Implants Segment is Anticipated to Hold a Significant Market Share During the Study Period..

7. Are there any restraints impacting market growth?

Limited Insurance Coverage for High Priced Dental Practices in the Developing Countries.

8. Can you provide examples of recent developments in the market?

November 2022: Platinum Dental Services partnered with Overjet with the aim to introduce AI-powered X-ray analysis and clinical insights to all of its clinics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Services Market?

To stay informed about further developments, trends, and reports in the Dental Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence