Key Insights

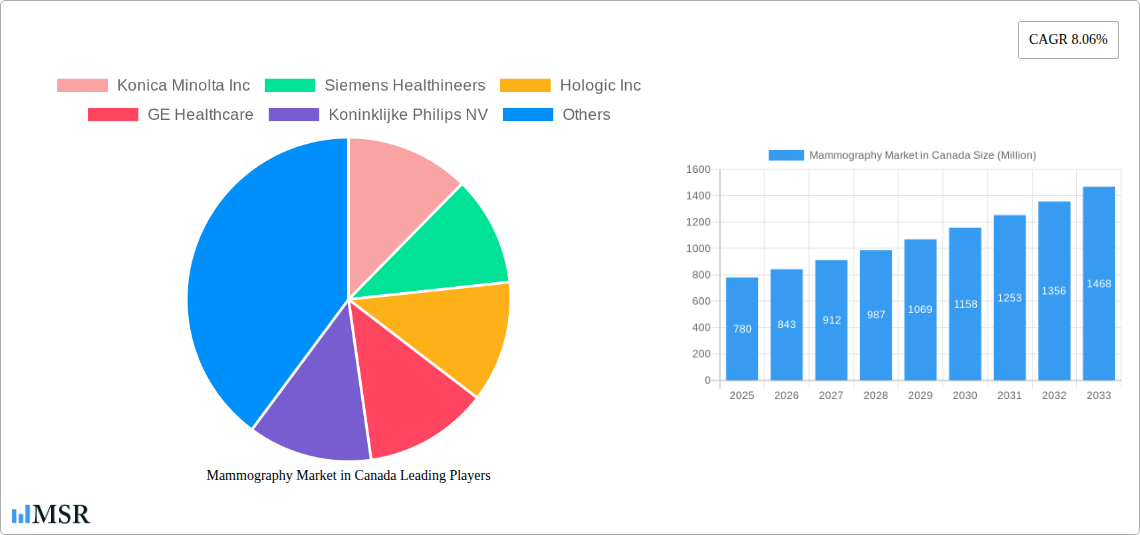

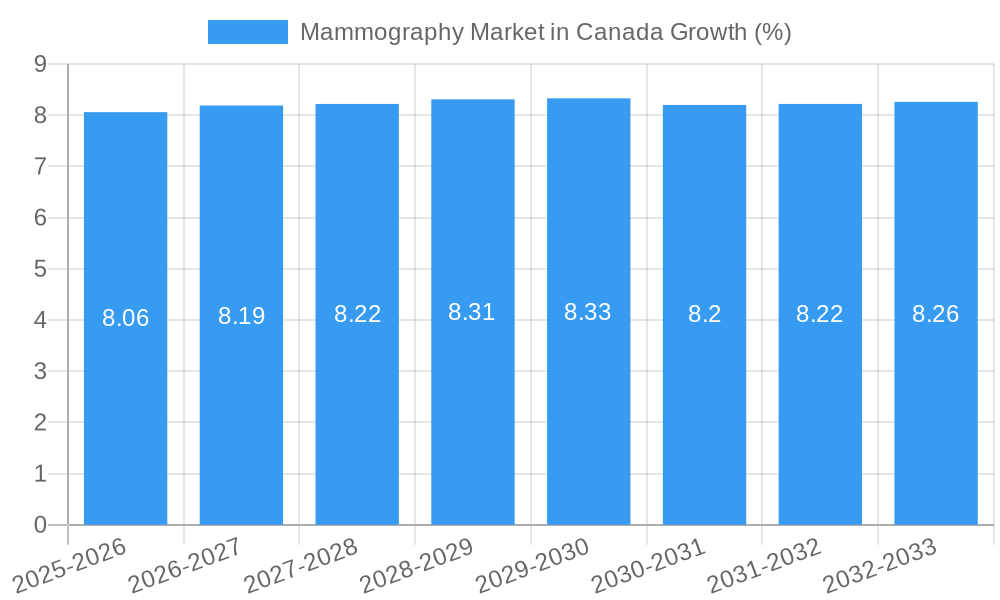

The Canadian mammography market is poised for significant expansion, projected to reach approximately $1.5 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.06% from its 2025 estimated value. This growth is underpinned by an increasing emphasis on early cancer detection and a rising incidence of breast cancer, particularly among aging populations. Technological advancements, including the widespread adoption of digital mammography systems and the burgeoning interest in breast tomosynthesis (3D mammography), are key drivers. These advanced systems offer superior image clarity and reduce false positives, thereby enhancing diagnostic accuracy and patient outcomes. Furthermore, government initiatives and healthcare policies focused on improving women's health and screening programs are also contributing to market expansion. The demand for these advanced imaging solutions is further fueled by an aging demographic and increasing awareness campaigns promoting regular mammography screenings.

The market dynamics in Canada are shaped by the interplay of increasing demand for sophisticated diagnostic tools and the evolving healthcare infrastructure. While the adoption of digital systems is now mainstream, the shift towards tomosynthesis represents a significant trend, offering enhanced diagnostic capabilities. Hospitals and large diagnostic centers remain the primary end-users, leveraging these technologies for comprehensive breast health services. However, specialty clinics are also increasingly investing in advanced mammography equipment to cater to a growing patient base seeking focused diagnostic care. Restraints such as the high initial cost of advanced equipment and the need for skilled personnel to operate and interpret these systems are present. Nevertheless, the continuous innovation by leading companies like Siemens Healthineers, Hologic Inc., and GE Healthcare, coupled with favorable reimbursement policies for advanced imaging in Canada, are expected to mitigate these challenges and drive sustained market growth throughout the forecast period.

Unlock critical insights into Canada's evolving mammography market. This comprehensive report delves deep into market concentration, industry trends, key segment dominance, product innovations, and strategic outlook, covering the period from 2019 to 2033, with 2025 as the base and estimated year. Explore the dynamic landscape of digital mammography systems, breast tomosynthesis, and the growing impact of AI in radiology. This report is your essential guide to understanding market drivers, challenges, and emerging opportunities within the Canadian medical imaging sector, offering actionable intelligence for stakeholders seeking to capitalize on advancements in breast cancer screening and diagnostics.

Mammography Market in Canada Market Concentration & Dynamics

The mammography market in Canada exhibits a moderate concentration, characterized by the presence of established global players alongside emerging domestic innovators. Key companies like Siemens Healthineers, Hologic Inc, GE Healthcare, and Koninklijke Philips NV hold significant market share, driven by their extensive product portfolios and robust distribution networks. However, the market is dynamic, with continuous innovation ecosystems fostering growth. Regulatory frameworks established by Health Canada play a crucial role in shaping market entry and product approvals, ensuring patient safety and efficacy for mammography devices. The trend towards digital mammography and 3D mammography (breast tomosynthesis) is reshaping the competitive landscape, pushing analog systems towards obsolescence. End-user preferences are increasingly driven by efficiency, accuracy, and patient comfort, influencing purchasing decisions in hospitals, specialty clinics, and diagnostic centers. Merger and acquisition (M&A) activities, though not a dominant feature, can occur to consolidate market presence or acquire specific technological capabilities. The market is characterized by a proactive approach to early breast cancer detection, supported by government initiatives and rising awareness.

Mammography Market in Canada Industry Insights & Trends

The mammography market in Canada is poised for significant expansion, projected to reach a substantial market size by 2033. The Compound Annual Growth Rate (CAGR) is expected to remain robust, fueled by a confluence of factors including an aging population, increasing prevalence of breast cancer, and a heightened focus on preventative healthcare. Technological disruptions are at the forefront of market growth, with the widespread adoption of digital mammography systems and the increasing integration of breast tomosynthesis (3D mammography) revolutionizing diagnostic accuracy and reducing recall rates. The AI in radiology segment is a transformative force, with solutions like Lunit INSIGHT MMG receiving commercial approval in Canada, promising enhanced detection capabilities and improved radiologist workflow. Evolving consumer behaviors, driven by greater health awareness and a demand for less invasive screening methods, are pushing healthcare providers to invest in advanced mammography equipment. Furthermore, government initiatives aimed at improving breast cancer screening accessibility and early diagnosis are creating a favorable market environment. The shift from analog to digital imaging, coupled with advancements in detector technology and image processing, ensures that the Canadian mammography market remains at the forefront of medical imaging innovation. The focus is shifting towards personalized screening protocols and more comfortable patient experiences, further stimulating demand for sophisticated mammography solutions.

Key Markets & Segments Leading Mammography Market in Canada

The mammography market in Canada is largely dominated by Digital Systems within the Product Type segment. This dominance is a direct reflection of the global trend towards superior image quality, reduced radiation exposure, and enhanced diagnostic capabilities offered by digital mammography machines. The inherent advantages of digital mammography, such as instant image availability and digital archiving, have made them the preferred choice over traditional analog systems.

Drivers for Digital Systems Dominance:

- Technological Superiority: High-resolution imaging, digital post-processing, and the ability to manipulate images for better visualization of subtle abnormalities.

- Reduced Radiation Dose: Digital systems generally deliver a lower radiation dose compared to analog counterparts, enhancing patient safety.

- Workflow Efficiency: Faster image acquisition and immediate availability for review streamline radiologist workflows.

- Interoperability: Seamless integration with Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHRs).

Within the End User segment, Hospitals represent the largest share of the market. This is attributed to their comprehensive healthcare infrastructure, higher patient volumes, and the financial resources to invest in advanced mammography technology. Diagnostic Centers follow closely, as specialized imaging facilities often prioritize state-of-the-art equipment for their core services. Specialty Clinics, while smaller in scope, also contribute to the market, particularly those focused on women's health and oncology.

Drivers for Hospital Dominance:

- Comprehensive Patient Care: Hospitals provide a full spectrum of diagnostic and treatment services, necessitating advanced imaging capabilities.

- Capital Investment Capacity: Hospitals typically have larger budgets for acquiring and upgrading expensive medical equipment.

- Referral Networks: Strong referral networks from primary care physicians and other specialists drive patient volume to hospital-based mammography services.

- Research and Development: Academic medical centers within hospitals often lead in adopting and evaluating new mammography technologies.

The breast tomosynthesis sub-segment within Product Type is experiencing the most rapid growth, often referred to as 3D mammography. Its ability to create layered images of breast tissue significantly improves the detection of invasive cancers and reduces false positives, making it increasingly sought after. The Canadian market's commitment to early and accurate detection strongly favors the adoption of this advanced technology, positioning it as a critical component of modern breast cancer screening programs.

Mammography Market in Canada Product Developments

The mammography market in Canada is characterized by continuous product innovation focused on enhancing diagnostic accuracy and patient experience. Key developments include the widespread adoption and refinement of digital mammography systems with improved detector technology and image processing algorithms, leading to clearer images and reduced radiation doses. The integration of breast tomosynthesis (3D mammography) is a significant advancement, enabling radiologists to visualize breast tissue in thin slices, thereby improving the detection of subtle abnormalities and reducing recall rates. Furthermore, the market is witnessing the emergence of AI-powered mammography solutions, such as Lunit INSIGHT MMG, which assist radiologists in identifying suspicious lesions with greater speed and precision. These advancements collectively aim to improve early breast cancer detection, minimize invasive procedures, and optimize workflow efficiency for healthcare providers across Canada.

Challenges in the Mammography Market in Canada Market

The mammography market in Canada faces several challenges that can impact growth and adoption. High acquisition costs for advanced digital mammography systems and breast tomosynthesis equipment can be a significant barrier for smaller clinics and hospitals with limited budgets. Regulatory hurdles and the lengthy approval processes for new medical devices can slow down the introduction of cutting-edge technologies. Supply chain disruptions and the availability of skilled technicians for installation, maintenance, and operation of complex mammography machines can also pose challenges. Furthermore, increasing competition among manufacturers necessitates continuous investment in research and development, putting pressure on profit margins.

Forces Driving Mammography Market in Canada Growth

Several key forces are driving the growth of the mammography market in Canada. The rising incidence of breast cancer, particularly among an aging population, creates a persistent demand for effective screening and diagnostic tools. Technological advancements, such as the proliferation of digital mammography and the increasing adoption of breast tomosynthesis (3D mammography), are enhancing diagnostic accuracy and patient outcomes, thereby stimulating market expansion. Government initiatives and public health campaigns promoting breast cancer awareness and early detection further bolster demand. The growing integration of AI in radiology solutions offers enhanced capabilities for early detection and improved workflow efficiency, acting as a significant growth catalyst. Economic growth and increased healthcare spending also contribute to the market's positive trajectory, enabling greater investment in advanced mammography equipment.

Challenges in the Mammography Market in Canada Market

Long-term growth catalysts in the mammography market in Canada are rooted in ongoing technological innovation and strategic market expansion. The continued development and widespread adoption of AI-powered mammography solutions promise to revolutionize early detection and diagnostic accuracy, driving demand for advanced systems. Innovations in detector technology and image compression further enhance the performance and cost-effectiveness of digital mammography. Partnerships between technology providers and healthcare institutions are crucial for driving adoption and tailoring solutions to specific clinical needs. Moreover, potential market expansions into underserved regions and a focus on improving accessibility to breast cancer screening for diverse populations will foster sustainable long-term growth. The increasing emphasis on preventative healthcare and personalized medicine will also create new avenues for growth in the Canadian medical imaging sector.

Emerging Opportunities in Mammography Market in Canada

Emerging opportunities in the mammography market in Canada are abundant and diverse. The integration of artificial intelligence (AI) into mammography workflows presents a significant opportunity for enhanced diagnostic accuracy, reduced false positives, and improved radiologist efficiency. Advancements in portable and low-dose mammography systems could expand access to screening in remote areas and for specific patient populations. The growing demand for 3D mammography (breast tomosynthesis) continues to offer substantial growth potential as it becomes the standard of care. Furthermore, the development of advanced software for image analysis and risk stratification, coupled with the increasing focus on personalized breast cancer screening protocols, presents exciting avenues for innovation and market penetration within the Canadian healthcare sector.

Leading Players in the Mammography Market in Canada Sector

- Konica Minolta Inc

- Siemens Healthineers

- Hologic Inc

- GE Healthcare

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- Planmed Oy

- Carestream Health Inc

- Analogic Corporation

- Fujifilm Holdings Corporation

Key Milestones in Mammography Market in Canada Industry

- January 2023: The Queen Elizabeth Hospital in Charlottetown purchased a new digital mammography machine. This acquisition is expected to significantly reduce the need for invasive biopsies and enhance the early detection of breast cancers by radiologists, allowing for better visualization of abnormalities with less radiation delivered to the breast.

- June 2022: Lunit received commercial approval in Canada for Lunit INSIGHT, the company's AI solution suite for radiology. The Canadian medical device regulator, Health Canada, issued class 2 medical licenses for Lunit's AI solutions, including 'Lunit INSIGHT CXR' for chest x-rays and 'Lunit INSIGHT MMG,' an AI solution specifically designed for mammography, marking a significant step in AI integration in Canadian diagnostic imaging.

Strategic Outlook for Mammography Market in Canada Market

- January 2023: The Queen Elizabeth Hospital in Charlottetown purchased a new digital mammography machine. This acquisition is expected to significantly reduce the need for invasive biopsies and enhance the early detection of breast cancers by radiologists, allowing for better visualization of abnormalities with less radiation delivered to the breast.

- June 2022: Lunit received commercial approval in Canada for Lunit INSIGHT, the company's AI solution suite for radiology. The Canadian medical device regulator, Health Canada, issued class 2 medical licenses for Lunit's AI solutions, including 'Lunit INSIGHT CXR' for chest x-rays and 'Lunit INSIGHT MMG,' an AI solution specifically designed for mammography, marking a significant step in AI integration in Canadian diagnostic imaging.

Strategic Outlook for Mammography Market in Canada Market

The strategic outlook for the mammography market in Canada is exceptionally promising, driven by a clear trajectory towards enhanced diagnostic precision and patient-centric care. The accelerated adoption of AI-powered mammography solutions will continue to be a primary growth accelerator, transforming how breast cancer is detected and managed. Further advancements in breast tomosynthesis (3D mammography), including improved reconstruction algorithms and workflow integration, will solidify its position as a standard of care. Investments in upgrading existing digital mammography infrastructure and exploring opportunities in mobile screening units are expected to broaden access and address regional disparities. Strategic collaborations between technology vendors, healthcare providers, and research institutions will be crucial for fostering innovation and ensuring that Canadian women benefit from the most advanced and effective breast cancer screening technologies available.

Mammography Market in Canada Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Other Product Types

-

2. End User

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

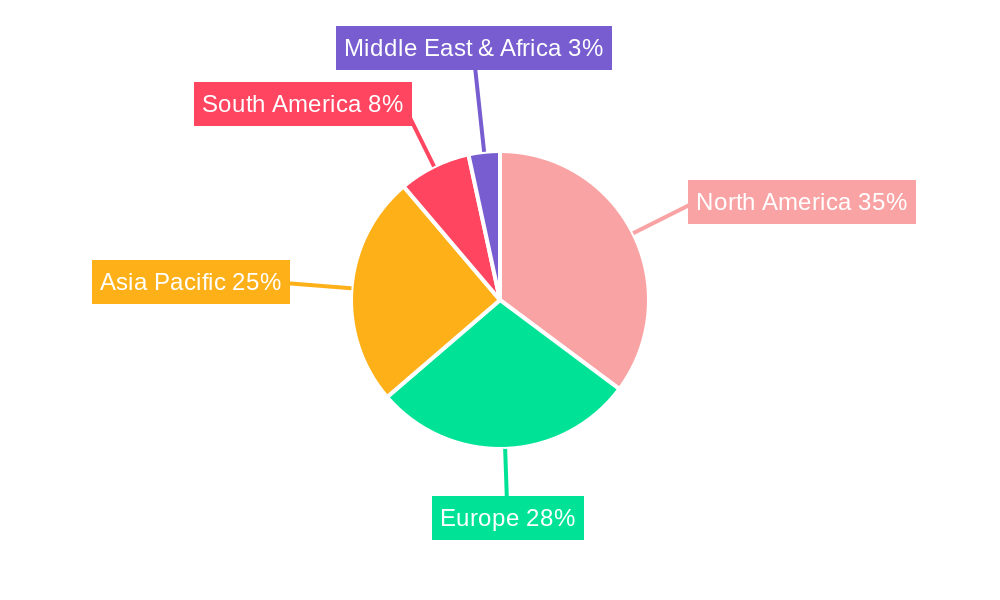

Mammography Market in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mammography Market in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure

- 3.4. Market Trends

- 3.4.1. Digital System are Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Digital Systems

- 9.1.2. Analog Systems

- 9.1.3. Breast Tomosynthesis

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Specialty Clinics

- 9.2.3. Diagnostic Centers

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Digital Systems

- 10.1.2. Analog Systems

- 10.1.3. Breast Tomosynthesis

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Specialty Clinics

- 10.2.3. Diagnostic Centers

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Eastern Canada Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 12. Western Canada Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 13. Central Canada Mammography Market in Canada Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Konica Minolta Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Siemens Healthineers

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Hologic Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 GE Healthcare

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Koninklijke Philips NV

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Canon Medical Systems Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Planmed Oy

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Carestream Health Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Analogic Corporation*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Fujifilm Holdings Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Global Mammography Market in Canada Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Mammography Market in Canada Volume Breakdown (Piece, %) by Region 2024 & 2032

- Figure 3: Canada Mammography Market in Canada Revenue (Million), by Country 2024 & 2032

- Figure 4: Canada Mammography Market in Canada Volume (Piece), by Country 2024 & 2032

- Figure 5: Canada Mammography Market in Canada Revenue Share (%), by Country 2024 & 2032

- Figure 6: Canada Mammography Market in Canada Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Mammography Market in Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 8: North America Mammography Market in Canada Volume (Piece), by Product Type 2024 & 2032

- Figure 9: North America Mammography Market in Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 10: North America Mammography Market in Canada Volume Share (%), by Product Type 2024 & 2032

- Figure 11: North America Mammography Market in Canada Revenue (Million), by End User 2024 & 2032

- Figure 12: North America Mammography Market in Canada Volume (Piece), by End User 2024 & 2032

- Figure 13: North America Mammography Market in Canada Revenue Share (%), by End User 2024 & 2032

- Figure 14: North America Mammography Market in Canada Volume Share (%), by End User 2024 & 2032

- Figure 15: North America Mammography Market in Canada Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Mammography Market in Canada Volume (Piece), by Country 2024 & 2032

- Figure 17: North America Mammography Market in Canada Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Mammography Market in Canada Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Mammography Market in Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 20: South America Mammography Market in Canada Volume (Piece), by Product Type 2024 & 2032

- Figure 21: South America Mammography Market in Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: South America Mammography Market in Canada Volume Share (%), by Product Type 2024 & 2032

- Figure 23: South America Mammography Market in Canada Revenue (Million), by End User 2024 & 2032

- Figure 24: South America Mammography Market in Canada Volume (Piece), by End User 2024 & 2032

- Figure 25: South America Mammography Market in Canada Revenue Share (%), by End User 2024 & 2032

- Figure 26: South America Mammography Market in Canada Volume Share (%), by End User 2024 & 2032

- Figure 27: South America Mammography Market in Canada Revenue (Million), by Country 2024 & 2032

- Figure 28: South America Mammography Market in Canada Volume (Piece), by Country 2024 & 2032

- Figure 29: South America Mammography Market in Canada Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Mammography Market in Canada Volume Share (%), by Country 2024 & 2032

- Figure 31: Europe Mammography Market in Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 32: Europe Mammography Market in Canada Volume (Piece), by Product Type 2024 & 2032

- Figure 33: Europe Mammography Market in Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 34: Europe Mammography Market in Canada Volume Share (%), by Product Type 2024 & 2032

- Figure 35: Europe Mammography Market in Canada Revenue (Million), by End User 2024 & 2032

- Figure 36: Europe Mammography Market in Canada Volume (Piece), by End User 2024 & 2032

- Figure 37: Europe Mammography Market in Canada Revenue Share (%), by End User 2024 & 2032

- Figure 38: Europe Mammography Market in Canada Volume Share (%), by End User 2024 & 2032

- Figure 39: Europe Mammography Market in Canada Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Mammography Market in Canada Volume (Piece), by Country 2024 & 2032

- Figure 41: Europe Mammography Market in Canada Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Mammography Market in Canada Volume Share (%), by Country 2024 & 2032

- Figure 43: Middle East & Africa Mammography Market in Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 44: Middle East & Africa Mammography Market in Canada Volume (Piece), by Product Type 2024 & 2032

- Figure 45: Middle East & Africa Mammography Market in Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Middle East & Africa Mammography Market in Canada Volume Share (%), by Product Type 2024 & 2032

- Figure 47: Middle East & Africa Mammography Market in Canada Revenue (Million), by End User 2024 & 2032

- Figure 48: Middle East & Africa Mammography Market in Canada Volume (Piece), by End User 2024 & 2032

- Figure 49: Middle East & Africa Mammography Market in Canada Revenue Share (%), by End User 2024 & 2032

- Figure 50: Middle East & Africa Mammography Market in Canada Volume Share (%), by End User 2024 & 2032

- Figure 51: Middle East & Africa Mammography Market in Canada Revenue (Million), by Country 2024 & 2032

- Figure 52: Middle East & Africa Mammography Market in Canada Volume (Piece), by Country 2024 & 2032

- Figure 53: Middle East & Africa Mammography Market in Canada Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East & Africa Mammography Market in Canada Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Mammography Market in Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 56: Asia Pacific Mammography Market in Canada Volume (Piece), by Product Type 2024 & 2032

- Figure 57: Asia Pacific Mammography Market in Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 58: Asia Pacific Mammography Market in Canada Volume Share (%), by Product Type 2024 & 2032

- Figure 59: Asia Pacific Mammography Market in Canada Revenue (Million), by End User 2024 & 2032

- Figure 60: Asia Pacific Mammography Market in Canada Volume (Piece), by End User 2024 & 2032

- Figure 61: Asia Pacific Mammography Market in Canada Revenue Share (%), by End User 2024 & 2032

- Figure 62: Asia Pacific Mammography Market in Canada Volume Share (%), by End User 2024 & 2032

- Figure 63: Asia Pacific Mammography Market in Canada Revenue (Million), by Country 2024 & 2032

- Figure 64: Asia Pacific Mammography Market in Canada Volume (Piece), by Country 2024 & 2032

- Figure 65: Asia Pacific Mammography Market in Canada Revenue Share (%), by Country 2024 & 2032

- Figure 66: Asia Pacific Mammography Market in Canada Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mammography Market in Canada Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mammography Market in Canada Volume Piece Forecast, by Region 2019 & 2032

- Table 3: Global Mammography Market in Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Mammography Market in Canada Volume Piece Forecast, by Product Type 2019 & 2032

- Table 5: Global Mammography Market in Canada Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Mammography Market in Canada Volume Piece Forecast, by End User 2019 & 2032

- Table 7: Global Mammography Market in Canada Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Mammography Market in Canada Volume Piece Forecast, by Region 2019 & 2032

- Table 9: Global Mammography Market in Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Mammography Market in Canada Volume Piece Forecast, by Country 2019 & 2032

- Table 11: Eastern Canada Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Canada Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 13: Western Canada Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Canada Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 15: Central Canada Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Central Canada Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 17: Global Mammography Market in Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Global Mammography Market in Canada Volume Piece Forecast, by Product Type 2019 & 2032

- Table 19: Global Mammography Market in Canada Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global Mammography Market in Canada Volume Piece Forecast, by End User 2019 & 2032

- Table 21: Global Mammography Market in Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Mammography Market in Canada Volume Piece Forecast, by Country 2019 & 2032

- Table 23: United States Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 25: Canada Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 27: Mexico Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Mexico Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 29: Global Mammography Market in Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Global Mammography Market in Canada Volume Piece Forecast, by Product Type 2019 & 2032

- Table 31: Global Mammography Market in Canada Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global Mammography Market in Canada Volume Piece Forecast, by End User 2019 & 2032

- Table 33: Global Mammography Market in Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Mammography Market in Canada Volume Piece Forecast, by Country 2019 & 2032

- Table 35: Brazil Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Brazil Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 37: Argentina Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 41: Global Mammography Market in Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 42: Global Mammography Market in Canada Volume Piece Forecast, by Product Type 2019 & 2032

- Table 43: Global Mammography Market in Canada Revenue Million Forecast, by End User 2019 & 2032

- Table 44: Global Mammography Market in Canada Volume Piece Forecast, by End User 2019 & 2032

- Table 45: Global Mammography Market in Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Mammography Market in Canada Volume Piece Forecast, by Country 2019 & 2032

- Table 47: United Kingdom Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: United Kingdom Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 49: Germany Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Germany Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 51: France Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 53: Italy Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Italy Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 55: Spain Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Spain Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 57: Russia Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Russia Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 59: Benelux Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Benelux Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 61: Nordics Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Nordics Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 63: Rest of Europe Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Europe Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 65: Global Mammography Market in Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 66: Global Mammography Market in Canada Volume Piece Forecast, by Product Type 2019 & 2032

- Table 67: Global Mammography Market in Canada Revenue Million Forecast, by End User 2019 & 2032

- Table 68: Global Mammography Market in Canada Volume Piece Forecast, by End User 2019 & 2032

- Table 69: Global Mammography Market in Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Global Mammography Market in Canada Volume Piece Forecast, by Country 2019 & 2032

- Table 71: Turkey Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Turkey Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 73: Israel Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Israel Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 75: GCC Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: GCC Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 77: North Africa Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: North Africa Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 79: South Africa Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: South Africa Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 81: Rest of Middle East & Africa Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Rest of Middle East & Africa Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 83: Global Mammography Market in Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 84: Global Mammography Market in Canada Volume Piece Forecast, by Product Type 2019 & 2032

- Table 85: Global Mammography Market in Canada Revenue Million Forecast, by End User 2019 & 2032

- Table 86: Global Mammography Market in Canada Volume Piece Forecast, by End User 2019 & 2032

- Table 87: Global Mammography Market in Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 88: Global Mammography Market in Canada Volume Piece Forecast, by Country 2019 & 2032

- Table 89: China Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: China Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 91: India Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: India Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 93: Japan Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Japan Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 95: South Korea Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: South Korea Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 97: ASEAN Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: ASEAN Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 99: Oceania Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Oceania Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

- Table 101: Rest of Asia Pacific Mammography Market in Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Rest of Asia Pacific Mammography Market in Canada Volume (Piece) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mammography Market in Canada?

The projected CAGR is approximately 8.06%.

2. Which companies are prominent players in the Mammography Market in Canada?

Key companies in the market include Konica Minolta Inc, Siemens Healthineers, Hologic Inc, GE Healthcare, Koninklijke Philips NV, Canon Medical Systems Corporation, Planmed Oy, Carestream Health Inc, Analogic Corporation*List Not Exhaustive, Fujifilm Holdings Corporation.

3. What are the main segments of the Mammography Market in Canada?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging.

6. What are the notable trends driving market growth?

Digital System are Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure.

8. Can you provide examples of recent developments in the market?

January 2023: The Queen Elizabeth Hospital in Charlottetown purchased a new digital mammography machine to reduce the need for invasive biopsies and for early detection of breast cancers by radiologists to see breast cancers with less radiation delivered to the breast.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Piece.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mammography Market in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mammography Market in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mammography Market in Canada?

To stay informed about further developments, trends, and reports in the Mammography Market in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence