Key Insights

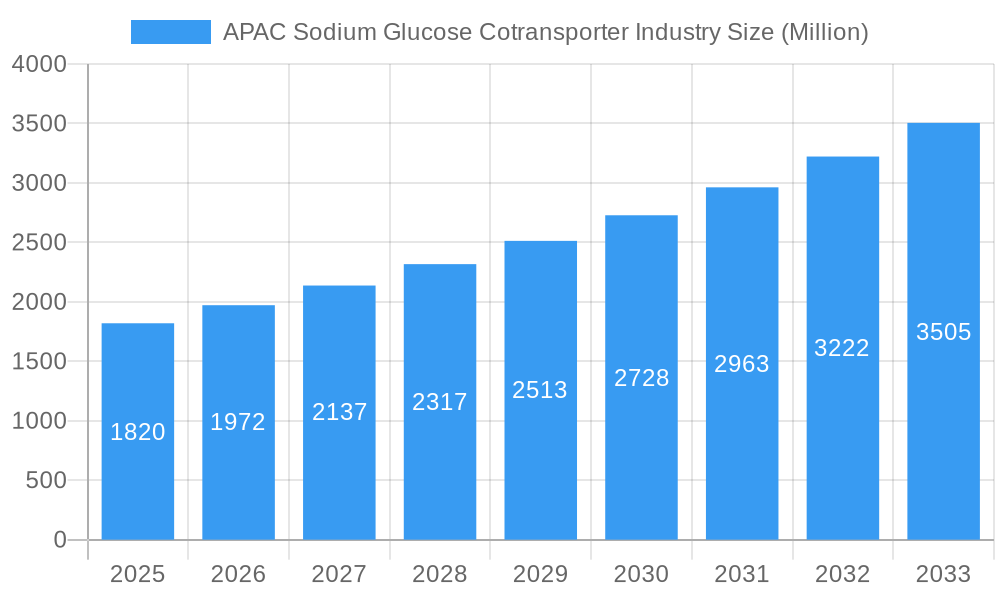

The APAC Sodium Glucose Cotransporter (SGLT) Inhibitor market is poised for robust expansion, projected to reach an estimated USD 1.82 billion in the base year 2025. Driven by a significant compound annual growth rate (CAGR) of 8.35%, the market is anticipated to witness sustained development through 2033. This growth is primarily fueled by the escalating prevalence of type 2 diabetes across the Asia-Pacific region, a consequence of evolving lifestyles, dietary changes, and increasing rates of obesity. SGLT inhibitors, offering a novel mechanism for glucose control by promoting urinary glucose excretion, represent a crucial advancement in diabetes management. Their demonstrated efficacy in reducing blood glucose levels, coupled with potential cardiovascular and renal benefits, further bolsters their adoption by healthcare professionals and patients alike. The market's dynamism is further shaped by increasing healthcare expenditure, rising disposable incomes, and a growing awareness among the populace regarding the management of chronic diseases. Pharmaceutical companies are actively investing in research and development to introduce next-generation SGLT inhibitors with improved efficacy and safety profiles, contributing to market vibrancy.

APAC Sodium Glucose Cotransporter Industry Market Size (In Billion)

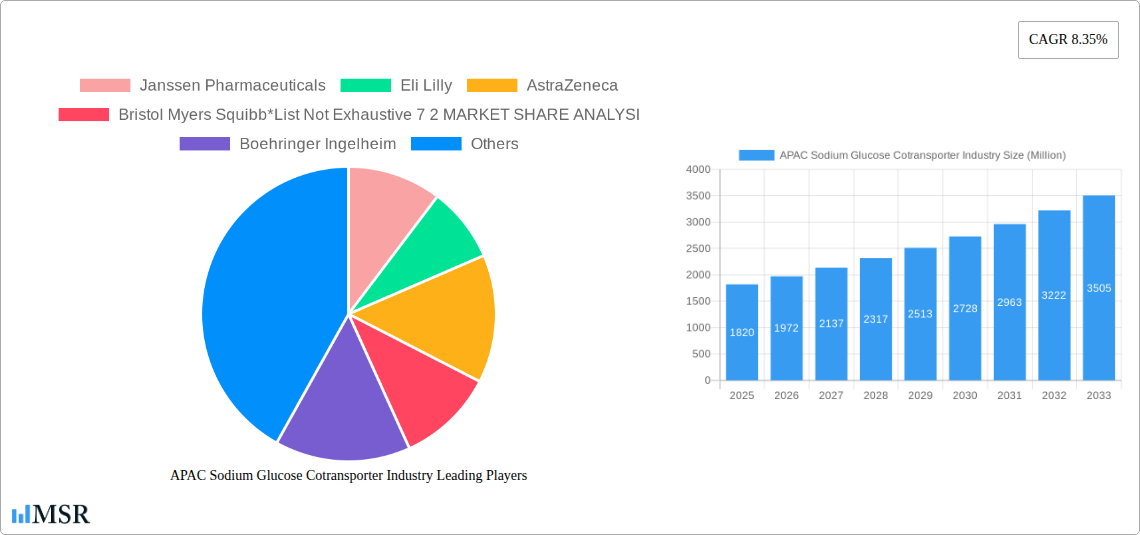

The competitive landscape of the APAC SGLT inhibitor market is characterized by the presence of leading global pharmaceutical players, including Janssen Pharmaceuticals (a Johnson & Johnson company), Eli Lilly, AstraZeneca, Bristol Myers Squibb, and Boehringer Ingelheim. These companies are actively engaged in strategic collaborations, product launches, and expanding their market reach across key geographies such as Japan, South Korea, China, India, Australia, Vietnam, Malaysia, Indonesia, the Philippines, and Thailand. The market is segmented by key SGLT inhibitors, with Invokana (Canagliflozin), Jardiance (Empagliflozin), and Farxiga/Forxiga (Dapagliflozin) holding significant market share due to their established clinical profiles and widespread physician acceptance. Emerging markets within the APAC region, such as China and India, present substantial growth opportunities owing to their large patient populations and increasing access to advanced healthcare solutions. Conversely, factors such as the high cost of these medications and the need for greater patient and physician education regarding their benefits and potential side effects may pose certain restraints to market expansion. Nevertheless, the overall outlook for the APAC SGLT inhibitor market remains highly positive, underscoring its critical role in addressing the growing diabetes epidemic in the region.

APAC Sodium Glucose Cotransporter Industry Company Market Share

APAC Sodium Glucose Cotransporter (SGLT) Inhibitors Market Report: Growth, Trends, and Key Players 2019-2033

This comprehensive report delivers an in-depth analysis of the APAC Sodium Glucose Cotransporter Inhibitor (SGLT Inhibitors) market, providing critical insights for industry stakeholders. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, growth drivers, challenges, and opportunities within the Asia-Pacific region. Our analysis leverages the latest data and expert projections to offer actionable intelligence for pharmaceutical manufacturers, investors, and healthcare providers.

APAC Sodium Glucose Cotransporter Industry Market Concentration & Dynamics

The APAC Sodium Glucose Cotransporter (SGLT) Inhibitor market is characterized by a moderate level of concentration, with several key players vying for dominance. Innovation ecosystems are rapidly evolving, driven by significant R&D investments in novel formulations and therapeutic indications for SGLT inhibitors, particularly in managing type 2 diabetes and associated cardiovascular and renal comorbidities. Regulatory frameworks across APAC countries are increasingly aligning with global standards, facilitating market entry and expansion, though nuanced variations persist. Substitute products, primarily traditional antidiabetic medications and other drug classes, continue to exert competitive pressure, necessitating continuous innovation and value demonstration by SGLT inhibitor manufacturers. End-user trends are shifting towards proactive disease management and the adoption of combination therapies, with a growing emphasis on patient outcomes beyond glycemic control. Mergers and acquisitions (M&A) activities, while not at a peak, are anticipated to play a crucial role in consolidating market share and expanding product portfolios in the coming years. The overall market share analysis reveals a dynamic landscape with established global players and emerging regional contenders. M&A deal counts are projected to rise as companies seek to strengthen their presence in this high-growth region.

APAC Sodium Glucose Cotransporter Industry Industry Insights & Trends

The APAC Sodium Glucose Cotransporter (SGLT) Inhibitor industry is experiencing robust growth, projected to reach a market size of XX Billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is primarily fueled by the escalating prevalence of type 2 diabetes across the region, driven by factors such as aging populations, sedentary lifestyles, and changing dietary habits. Technological disruptions are at the forefront, with ongoing research into new SGLT inhibitor mechanisms of action and their expanded therapeutic applications beyond glycemic control, including heart failure and chronic kidney disease. Evolving consumer behaviors, particularly increased health awareness and a greater demand for innovative and effective diabetes management solutions, are further stimulating market growth. The introduction of next-generation SGLT inhibitors with improved safety profiles and enhanced efficacy continues to reshape the competitive landscape. Furthermore, growing healthcare expenditure and the increasing accessibility of advanced medical treatments across emerging economies within APAC are critical growth catalysts. The market is witnessing a strategic shift towards patient-centric care models, emphasizing personalized treatment regimens and improved quality of life. The market size for SGLT Inhibitors in APAC is estimated to be XX Billion in 2025. The CAGR for the forecast period (2025-2033) is predicted to be XX%.

Key Markets & Segments Leading APAC Sodium Glucose Cotransporter Industry

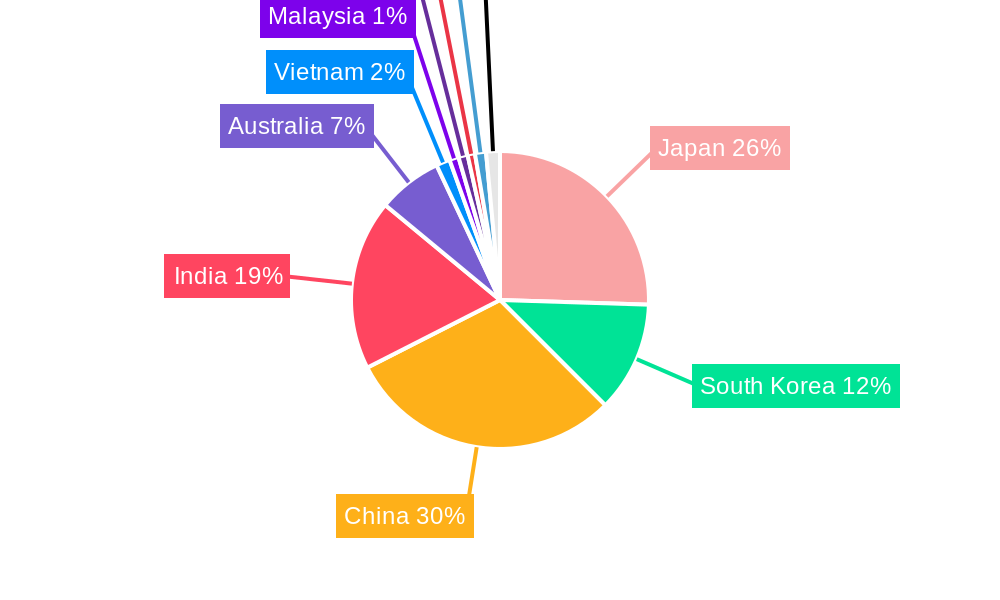

Japan currently leads the APAC Sodium Glucose Cotransporter (SGLT) Inhibitor market, driven by its advanced healthcare infrastructure, high prevalence of chronic diseases, and a well-established regulatory environment that encourages the adoption of innovative pharmaceuticals.

- Dominant Regions & Countries:

- Japan: High patient awareness, strong reimbursement policies, and a significant elderly population predisposed to diabetes and its complications.

- South Korea: Rapidly growing healthcare sector, increasing adoption of advanced therapies, and a focus on preventative healthcare.

- China: The largest market in terms of population and diabetes prevalence, offering immense growth potential despite regulatory complexities.

- India: A rapidly expanding market with a burgeoning middle class and a significant burden of diabetes, driving demand for effective treatments.

- Australia: Mature healthcare system with high adoption rates of new drug classes and a focus on evidence-based medicine.

Market Share by Segment:

- Invokana (Canagliflozin): A significant player, benefiting from its established efficacy and broad approval indications.

- Jardiance (Empagliflozin): Showing strong market momentum, particularly with its expanded cardiovascular and renal benefits, and recent pediatric approvals.

- Farxiga/Forxiga (Dapagliflozin): A key contender, with demonstrated benefits in heart failure and chronic kidney disease, further bolstering its market position.

- Suglat (Ipragliflozin): Holds a notable share, especially in specific Asian markets where it has gained traction.

Drivers of Segment Dominance:

- Clinical Efficacy & Safety: Proven track record in managing type 2 diabetes and reducing cardiovascular and renal risks.

- Therapeutic Breadth: Expanding indications beyond glycemic control, including heart failure and kidney disease.

- Regulatory Approvals: Timely and comprehensive approvals in key APAC markets.

- Marketing & Sales Strategies: Effective engagement with healthcare professionals and patient outreach programs.

- Healthcare Infrastructure & Reimbursement: Favorable policies in leading markets that support access and affordability.

The dominance of certain segments is further amplified by ongoing clinical trials and real-world evidence showcasing their long-term benefits, influencing prescribing patterns and market penetration across the Rest of Asia-Pacific, including countries like Vietnam, Malaysia, Indonesia, Philippines, and Thailand, which represent high-growth frontiers for SGLT inhibitors.

APAC Sodium Glucose Cotransporter Industry Product Developments

Product development in the APAC Sodium Glucose Cotransporter (SGLT) Inhibitor industry is characterized by a focus on enhancing therapeutic benefits and expanding applications. Innovations are centered on formulations that improve patient adherence and optimize pharmacokinetic profiles. Companies are actively exploring the synergistic effects of SGLT inhibitors in combination therapies, particularly with other antidiabetic agents and cardiovascular medications, to achieve superior patient outcomes. Furthermore, significant R&D efforts are dedicated to investigating SGLT inhibitors for non-diabetic indications, such as non-alcoholic fatty liver disease (NAFLD) and certain types of cancer, unlocking new market potential. The competitive edge in this segment is increasingly defined by the ability to demonstrate broad clinical utility and provide comprehensive data supporting safety and efficacy across diverse patient populations, driving market relevance and adoption.

Challenges in the APAC Sodium Glucose Cotransporter Industry Market

The APAC Sodium Glucose Cotransporter (SGLT) Inhibitor market faces several challenges that can impact growth and accessibility. These include the varying regulatory landscapes across different countries, leading to potential delays in product approvals and market entry. High drug costs can be a significant barrier, particularly in emerging economies where affordability is a major concern, limiting market penetration. Intense competition from established generic antidiabetic drugs and other novel therapeutic classes also poses a restraint. Supply chain complexities and ensuring consistent product availability across a vast and diverse region present logistical hurdles. Furthermore, a lack of comprehensive awareness among healthcare professionals and patients regarding the full spectrum of benefits offered by SGLT inhibitors can slow down adoption rates.

Forces Driving APAC Sodium Glucose Cotransporter Industry Growth

Several key forces are propelling the growth of the APAC Sodium Glucose Cotransporter (SGLT) Inhibitor industry. The rapidly increasing prevalence of type 2 diabetes, fueled by lifestyle changes and an aging demographic, is the primary demand driver. Technological advancements leading to the development of more effective and safer SGLT inhibitors are expanding treatment options. Growing healthcare expenditure across the region, coupled with government initiatives to improve diabetes management, further bolsters market expansion. The demonstrable cardiovascular and renal benefits of SGLT inhibitors, beyond glycemic control, are significantly influencing prescribing patterns and driving market adoption. Increasing patient and physician awareness of these multifaceted benefits is also a crucial growth accelerator.

Challenges in the APAC Sodium Glucose Cotransporter Industry Market

The long-term growth catalysts for the APAC Sodium Glucose Cotransporter (SGLT) Inhibitor market are rooted in continuous innovation and strategic market expansion. The ongoing discovery of novel therapeutic applications for SGLT inhibitors, extending beyond diabetes to encompass conditions like heart failure, chronic kidney disease, and potentially obesity, represents a significant growth avenue. Partnerships and collaborations between pharmaceutical companies, research institutions, and healthcare providers will be crucial for accelerating clinical research and market penetration. Furthermore, strategic market expansions into underserved emerging economies within APAC, coupled with efforts to enhance market access through flexible pricing models and patient support programs, will sustain long-term growth.

Emerging Opportunities in APAC Sodium Glucose Cotransporter Industry

Emerging opportunities in the APAC Sodium Glucose Cotransporter (SGLT) Inhibitor industry are multifaceted. The untapped potential in emerging markets such as Vietnam, Indonesia, and the Philippines presents significant growth prospects due to their large populations and rising healthcare needs. The development of next-generation SGLT inhibitors with enhanced efficacy, improved safety profiles, and novel delivery mechanisms offers a competitive edge. Growing patient preferences for oral medications and combination therapies that simplify treatment regimens are creating new market demands. Furthermore, the increasing focus on personalized medicine and the identification of specific patient subgroups that benefit most from SGLT inhibitors will drive targeted marketing and treatment strategies.

Leading Players in the APAC Sodium Glucose Cotransporter Industry Sector

- Janssen Pharmaceuticals

- Eli Lilly

- AstraZeneca

- Bristol Myers Squibb

- Boehringer Ingelheim

Key Milestones in APAC Sodium Glucose Cotransporter Industry Industry

- June 2023: The U.S. Food and Drug Administration approved Jardiance (empagliflozin) and Synjardy (empagliflozin and metformin hydrochloride) as additions to diet and exercise to improve blood sugar control in children 10 years and older with type 2 diabetes. These approvals provide a new class of medicines taken by mouth to treat pediatric type 2 diabetes.

- November 2022: AstraZeneca announced new findings from a pre-specified DELIVER Phase III trial data analysis. It shows that Farxiga (dapagliflozin) improved symptom burden and health-related quality of life in patients with heart failure and mildly reduced or preserved ejection fraction compared with a placebo.

Strategic Outlook for APAC Sodium Glucose Cotransporter Industry Market

The strategic outlook for the APAC Sodium Glucose Cotransporter (SGLT) Inhibitor market is highly positive, driven by a confluence of factors including rising diabetes prevalence, expanding therapeutic indications, and increasing healthcare investments. Growth accelerators include the continued exploration of SGLT inhibitors for cardiovascular and renal protection, alongside potential applications in other metabolic disorders. Strategic opportunities lie in leveraging real-world evidence to further solidify the value proposition of these drugs and in tailoring market access strategies to the unique economic and healthcare landscapes of various APAC nations. Collaborations with local health authorities and key opinion leaders will be crucial for navigating regulatory pathways and fostering widespread adoption.

Report Period:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

APAC Sodium Glucose Cotransporter Industry Segmentation

- 1. Invokana (Canagliflozin)

- 2. Jardiance (Empagliflozin)

- 3. Farxiga/Forxiga (Dapagliflozin)

- 4. Suglat (Ipragliflozin)

-

5. Geography

- 5.1. Japan

- 5.2. South Korea

- 5.3. China

- 5.4. India

- 5.5. Australia

- 5.6. Vietnam

- 5.7. Malaysia

- 5.8. Indonesia

- 5.9. Philippines

- 5.10. Thailand

- 5.11. Rest of Asia-Pacific

APAC Sodium Glucose Cotransporter Industry Segmentation By Geography

- 1. Japan

- 2. South Korea

- 3. China

- 4. India

- 5. Australia

- 6. Vietnam

- 7. Malaysia

- 8. Indonesia

- 9. Philippines

- 10. Thailand

- 11. Rest of Asia Pacific

APAC Sodium Glucose Cotransporter Industry Regional Market Share

Geographic Coverage of APAC Sodium Glucose Cotransporter Industry

APAC Sodium Glucose Cotransporter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Genitourinary Disorders; Increasing Number of Pipeline Products

- 3.3. Market Restrains

- 3.3.1. Lack of Therapy Compliance; Increasing Advent of Counterfeit Drugs

- 3.4. Market Trends

- 3.4.1. Jardiance Segment holds the highest market share in the Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 5.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 5.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 5.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Japan

- 5.5.2. South Korea

- 5.5.3. China

- 5.5.4. India

- 5.5.5. Australia

- 5.5.6. Vietnam

- 5.5.7. Malaysia

- 5.5.8. Indonesia

- 5.5.9. Philippines

- 5.5.10. Thailand

- 5.5.11. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Japan

- 5.6.2. South Korea

- 5.6.3. China

- 5.6.4. India

- 5.6.5. Australia

- 5.6.6. Vietnam

- 5.6.7. Malaysia

- 5.6.8. Indonesia

- 5.6.9. Philippines

- 5.6.10. Thailand

- 5.6.11. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 6. Japan APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 6.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 6.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 6.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Japan

- 6.5.2. South Korea

- 6.5.3. China

- 6.5.4. India

- 6.5.5. Australia

- 6.5.6. Vietnam

- 6.5.7. Malaysia

- 6.5.8. Indonesia

- 6.5.9. Philippines

- 6.5.10. Thailand

- 6.5.11. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 7. South Korea APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 7.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 7.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 7.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Japan

- 7.5.2. South Korea

- 7.5.3. China

- 7.5.4. India

- 7.5.5. Australia

- 7.5.6. Vietnam

- 7.5.7. Malaysia

- 7.5.8. Indonesia

- 7.5.9. Philippines

- 7.5.10. Thailand

- 7.5.11. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 8. China APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 8.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 8.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 8.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Japan

- 8.5.2. South Korea

- 8.5.3. China

- 8.5.4. India

- 8.5.5. Australia

- 8.5.6. Vietnam

- 8.5.7. Malaysia

- 8.5.8. Indonesia

- 8.5.9. Philippines

- 8.5.10. Thailand

- 8.5.11. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 9. India APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 9.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 9.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 9.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. Japan

- 9.5.2. South Korea

- 9.5.3. China

- 9.5.4. India

- 9.5.5. Australia

- 9.5.6. Vietnam

- 9.5.7. Malaysia

- 9.5.8. Indonesia

- 9.5.9. Philippines

- 9.5.10. Thailand

- 9.5.11. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 10. Australia APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 10.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 10.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 10.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. Japan

- 10.5.2. South Korea

- 10.5.3. China

- 10.5.4. India

- 10.5.5. Australia

- 10.5.6. Vietnam

- 10.5.7. Malaysia

- 10.5.8. Indonesia

- 10.5.9. Philippines

- 10.5.10. Thailand

- 10.5.11. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 11. Vietnam APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 11.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 11.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 11.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 11.5. Market Analysis, Insights and Forecast - by Geography

- 11.5.1. Japan

- 11.5.2. South Korea

- 11.5.3. China

- 11.5.4. India

- 11.5.5. Australia

- 11.5.6. Vietnam

- 11.5.7. Malaysia

- 11.5.8. Indonesia

- 11.5.9. Philippines

- 11.5.10. Thailand

- 11.5.11. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 12. Malaysia APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 12.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 12.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 12.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 12.5. Market Analysis, Insights and Forecast - by Geography

- 12.5.1. Japan

- 12.5.2. South Korea

- 12.5.3. China

- 12.5.4. India

- 12.5.5. Australia

- 12.5.6. Vietnam

- 12.5.7. Malaysia

- 12.5.8. Indonesia

- 12.5.9. Philippines

- 12.5.10. Thailand

- 12.5.11. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 13. Indonesia APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 13.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 13.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 13.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 13.5. Market Analysis, Insights and Forecast - by Geography

- 13.5.1. Japan

- 13.5.2. South Korea

- 13.5.3. China

- 13.5.4. India

- 13.5.5. Australia

- 13.5.6. Vietnam

- 13.5.7. Malaysia

- 13.5.8. Indonesia

- 13.5.9. Philippines

- 13.5.10. Thailand

- 13.5.11. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 14. Philippines APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 14.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 14.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 14.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 14.5. Market Analysis, Insights and Forecast - by Geography

- 14.5.1. Japan

- 14.5.2. South Korea

- 14.5.3. China

- 14.5.4. India

- 14.5.5. Australia

- 14.5.6. Vietnam

- 14.5.7. Malaysia

- 14.5.8. Indonesia

- 14.5.9. Philippines

- 14.5.10. Thailand

- 14.5.11. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 15. Thailand APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 15.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 15.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 15.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 15.5. Market Analysis, Insights and Forecast - by Geography

- 15.5.1. Japan

- 15.5.2. South Korea

- 15.5.3. China

- 15.5.4. India

- 15.5.5. Australia

- 15.5.6. Vietnam

- 15.5.7. Malaysia

- 15.5.8. Indonesia

- 15.5.9. Philippines

- 15.5.10. Thailand

- 15.5.11. Rest of Asia-Pacific

- 15.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 16. Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 16.2. Market Analysis, Insights and Forecast - by Jardiance (Empagliflozin)

- 16.3. Market Analysis, Insights and Forecast - by Farxiga/Forxiga (Dapagliflozin)

- 16.4. Market Analysis, Insights and Forecast - by Suglat (Ipragliflozin)

- 16.5. Market Analysis, Insights and Forecast - by Geography

- 16.5.1. Japan

- 16.5.2. South Korea

- 16.5.3. China

- 16.5.4. India

- 16.5.5. Australia

- 16.5.6. Vietnam

- 16.5.7. Malaysia

- 16.5.8. Indonesia

- 16.5.9. Philippines

- 16.5.10. Thailand

- 16.5.11. Rest of Asia-Pacific

- 16.1. Market Analysis, Insights and Forecast - by Invokana (Canagliflozin)

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2025

- 17.2. Company Profiles

- 17.2.1 Janssen Pharmaceuticals

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Eli Lilly

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 AstraZeneca

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Bristol Myers Squibb*List Not Exhaustive 7 2 MARKET SHARE ANALYSI

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Boehringer Ingelheim

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.1 Janssen Pharmaceuticals

List of Figures

- Figure 1: Global APAC Sodium Glucose Cotransporter Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Japan APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 3: Japan APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 4: Japan APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 5: Japan APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 6: Japan APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 7: Japan APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 8: Japan APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 9: Japan APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 10: Japan APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: Japan APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Japan APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Japan APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South Korea APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 15: South Korea APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 16: South Korea APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 17: South Korea APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 18: South Korea APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 19: South Korea APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 20: South Korea APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 21: South Korea APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 22: South Korea APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: South Korea APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: South Korea APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South Korea APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: China APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 27: China APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 28: China APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 29: China APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 30: China APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 31: China APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 32: China APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 33: China APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 34: China APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 35: China APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 36: China APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: China APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: India APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 39: India APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 40: India APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 41: India APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 42: India APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 43: India APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 44: India APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 45: India APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 46: India APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 47: India APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: India APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: India APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 51: Australia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 52: Australia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 53: Australia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 54: Australia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 55: Australia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 56: Australia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 57: Australia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 58: Australia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 59: Australia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Australia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Australia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 63: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 64: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 65: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 66: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 67: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 68: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 69: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 70: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 71: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 72: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 73: Vietnam APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 75: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 76: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 77: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 78: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 79: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 80: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 81: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 82: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 83: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 84: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 85: Malaysia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 86: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 87: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 88: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 89: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 90: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 91: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 92: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 93: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 94: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 95: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 96: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 97: Indonesia APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Philippines APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 99: Philippines APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 100: Philippines APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 101: Philippines APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 102: Philippines APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 103: Philippines APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 104: Philippines APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 105: Philippines APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 106: Philippines APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 107: Philippines APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 108: Philippines APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 109: Philippines APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 110: Thailand APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 111: Thailand APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 112: Thailand APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 113: Thailand APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 114: Thailand APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 115: Thailand APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 116: Thailand APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 117: Thailand APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 118: Thailand APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 119: Thailand APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 120: Thailand APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 121: Thailand APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 122: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Invokana (Canagliflozin) 2025 & 2033

- Figure 123: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Invokana (Canagliflozin) 2025 & 2033

- Figure 124: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 125: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Jardiance (Empagliflozin) 2025 & 2033

- Figure 126: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 127: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Farxiga/Forxiga (Dapagliflozin) 2025 & 2033

- Figure 128: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 129: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Suglat (Ipragliflozin) 2025 & 2033

- Figure 130: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Geography 2025 & 2033

- Figure 131: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 132: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue (Million), by Country 2025 & 2033

- Figure 133: Rest of Asia Pacific APAC Sodium Glucose Cotransporter Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 2: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 3: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 4: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 5: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 8: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 9: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 10: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 11: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 14: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 15: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 16: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 17: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 20: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 21: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 22: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 23: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 26: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 27: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 28: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 29: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 32: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 33: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 34: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 35: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 36: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 38: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 39: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 40: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 41: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 42: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 44: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 45: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 46: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 47: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 49: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 50: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 51: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 52: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 53: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 55: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 56: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 57: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 58: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 59: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 60: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 61: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 62: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 63: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 64: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 65: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 66: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 67: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Invokana (Canagliflozin) 2020 & 2033

- Table 68: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Jardiance (Empagliflozin) 2020 & 2033

- Table 69: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Farxiga/Forxiga (Dapagliflozin) 2020 & 2033

- Table 70: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Suglat (Ipragliflozin) 2020 & 2033

- Table 71: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 72: Global APAC Sodium Glucose Cotransporter Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Sodium Glucose Cotransporter Industry?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the APAC Sodium Glucose Cotransporter Industry?

Key companies in the market include Janssen Pharmaceuticals, Eli Lilly, AstraZeneca, Bristol Myers Squibb*List Not Exhaustive 7 2 MARKET SHARE ANALYSI, Boehringer Ingelheim.

3. What are the main segments of the APAC Sodium Glucose Cotransporter Industry?

The market segments include Invokana (Canagliflozin), Jardiance (Empagliflozin), Farxiga/Forxiga (Dapagliflozin), Suglat (Ipragliflozin), Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Genitourinary Disorders; Increasing Number of Pipeline Products.

6. What are the notable trends driving market growth?

Jardiance Segment holds the highest market share in the Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market in the current year.

7. Are there any restraints impacting market growth?

Lack of Therapy Compliance; Increasing Advent of Counterfeit Drugs.

8. Can you provide examples of recent developments in the market?

June 2023: the U.S. Food and Drug Administration approved Jardiance (empagliflozin) and Synjardy (empagliflozin and metformin hydrochloride) as additions to diet and exercise to improve blood sugar control in children 10 years and older with type 2 diabetes. These approvals provide a new class of medicines taken by mouth to treat pediatric type 2 diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Sodium Glucose Cotransporter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Sodium Glucose Cotransporter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Sodium Glucose Cotransporter Industry?

To stay informed about further developments, trends, and reports in the APAC Sodium Glucose Cotransporter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence