Key Insights

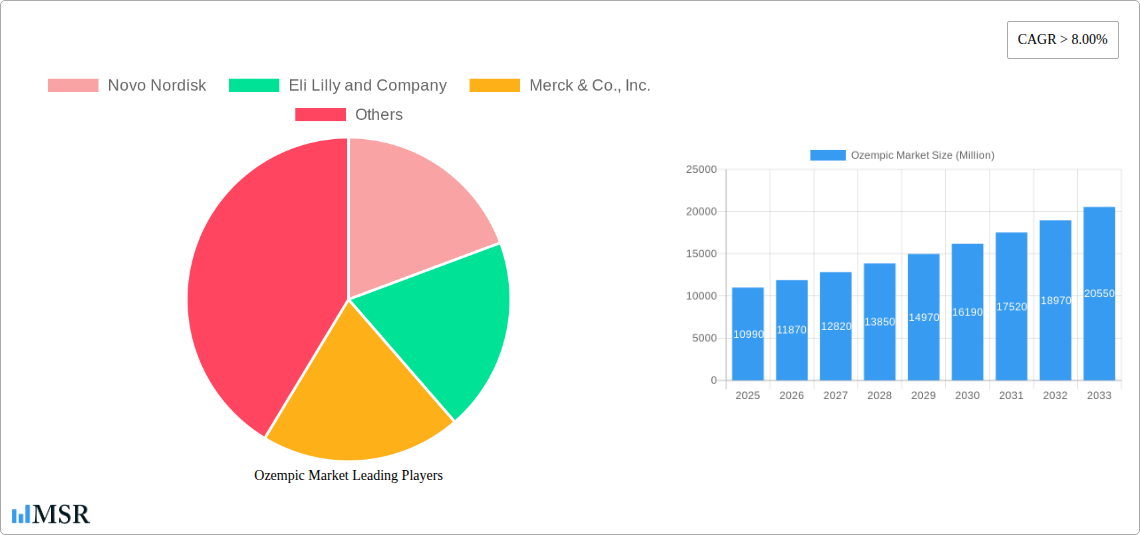

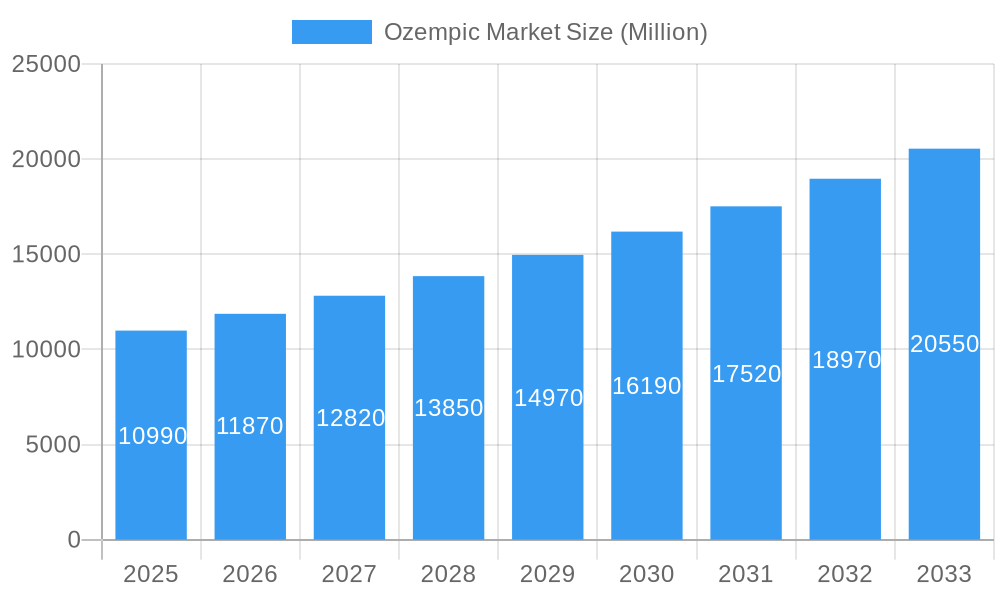

The global Ozempic market is experiencing robust expansion, projected to reach an estimated USD 10.99 billion in 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) exceeding 8.00%, indicating a dynamic and expanding landscape. The primary drivers for this surge are the increasing prevalence of type 2 diabetes worldwide, a growing awareness of GLP-1 receptor agonists' efficacy in glycemic control and weight management, and ongoing advancements in therapeutic applications beyond diabetes, particularly in the cardiovascular and obesity segments. These factors are creating a substantial demand for Ozempic, positioning it as a leading therapeutic option. The market is characterized by a focus on research and development to further enhance treatment outcomes and explore new indications, alongside strategic partnerships and collaborations aimed at expanding market reach and patient access.

Ozempic Market Market Size (In Billion)

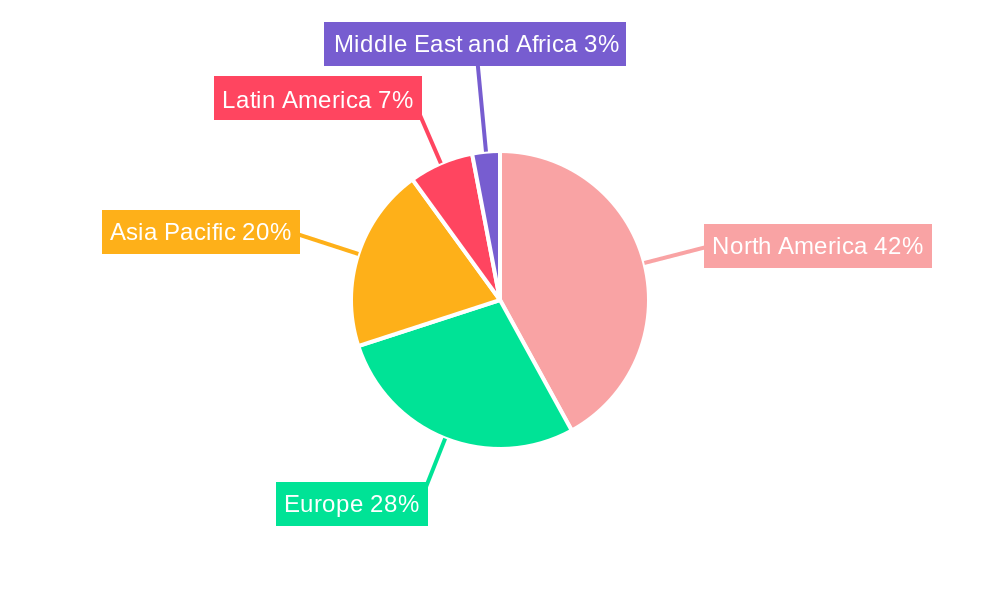

The Ozempic market exhibits significant segmentation, with Novo Nordisk holding a dominant position as a key player, alongside formidable competitors like Eli Lilly and Company and Merck & Co., Inc. North America, led by the United States and Canada, is expected to remain the largest regional market due to high healthcare expenditure, advanced research infrastructure, and a significant patient population suffering from chronic diseases. Europe and the Asia Pacific region are also poised for substantial growth, driven by an aging population, increasing disposable incomes, and rising healthcare standards. Restraints in the market may include the high cost of treatment and potential for adverse side effects, which could impact patient adoption and reimbursement policies. However, the sustained innovation and expanding therapeutic scope for Ozempic are likely to outweigh these challenges, ensuring continued market expansion and a positive outlook for the forecast period of 2025-2033.

Ozempic Market Company Market Share

Ozempic Market: Navigating Supply Chain Dynamics, Off-Label Demand, and Global Shortages

This comprehensive Ozempic market report provides an in-depth analysis of the global Ozempic market from 2019–2033, with a base and estimated year of 2025. Delve into critical market dynamics, industry insights, key regional dominance, product innovations, and the strategic landscape shaping the future of this pivotal GLP-1 receptor agonist. Gain actionable intelligence on market concentration, growth drivers, challenges, emerging opportunities, and the leading players. Our analysis covers market size, CAGR, and M&A activities, offering a strategic outlook for industry stakeholders.

Ozempic Market Market Concentration & Dynamics

The Ozempic market exhibits a high degree of market concentration, primarily dominated by Novo Nordisk, the originator of Ozempic. Eli Lilly and Company, with its competing GLP-1 receptor agonists, and Merck & Co., Inc., are significant players in the broader diabetes and weight management landscape, although their direct Ozempic market share is nil as it is a branded product. Innovation within the Ozempic market is largely driven by Novo Nordisk's ongoing research into new formulations and indications for semaglutide, the active ingredient. Regulatory frameworks, particularly concerning off-label use and export restrictions, play a crucial role in shaping market dynamics. Substitute products, including other GLP-1 receptor agonists and emerging weight-loss medications, present a competitive challenge, though Ozempic's established efficacy and brand recognition remain strong. End-user trends are increasingly influenced by the drug's perceived weight-loss benefits, leading to significant off-label demand that strains global supply. Mergers and acquisitions (M&A) activity in the broader pharmaceutical sector, particularly those focused on metabolic diseases and obesity, could indirectly impact the Ozempic market by consolidating R&D capabilities and market presence. The market share of Ozempic, specifically for its approved indications, remains substantial, but the off-label surge has led to complex supply chain dynamics and increased scrutiny. M&A deal counts in the GLP-1 space are expected to rise as companies seek to expand their portfolios in the lucrative obesity market.

Ozempic Market Industry Insights & Trends

The Ozempic market is experiencing unprecedented growth driven by a confluence of factors, with its efficacy in glycemic control for Type 2 diabetes and its remarkable weight-loss benefits at the forefront. Market size is projected to reach billions, with a significant compound annual growth rate (CAGR) throughout the forecast period (2025–2033). Technological disruptions, including advancements in drug delivery systems and personalized medicine approaches, are enhancing treatment outcomes and patient adherence. Evolving consumer behaviors, particularly the growing awareness and desire for effective weight management solutions, have propelled Ozempic beyond its initial therapeutic indications. The "off-label" prescribing phenomenon, as evidenced by supply constraints experienced in late 2023, underscores the intense demand stemming from its weight-loss attributes. This surge in demand, especially for lower-dose formulations (0.25/0.5 mg), has created significant supply chain challenges, prompting regulatory bodies to consider measures such as export bans to safeguard domestic supply. The global Ozempic market is a testament to the increasing prevalence of metabolic diseases and the pharmaceutical industry's capacity to develop innovative treatments that address unmet medical needs while also capitalizing on emerging therapeutic avenues. The continued investment in research and development for semaglutide-based therapies promises further market expansion and the exploration of new indications.

Key Markets & Segments Leading Ozempic Market

The Ozempic market is experiencing significant leadership from North America and Europe, driven by a combination of factors that underpin their dominant positions.

North America (United States and Canada):

- Economic Growth: High disposable incomes and robust healthcare spending enable greater access to innovative treatments like Ozempic.

- Healthcare Infrastructure: Well-established healthcare systems and a high prevalence of Type 2 diabetes and obesity contribute to substantial demand.

- Awareness and Acceptance: Strong public awareness of new treatment options and a willingness to adopt them, particularly for weight management.

- Regulatory Environment: While stringent, the regulatory framework in the US has historically facilitated the rapid adoption of groundbreaking therapies once approved.

Europe:

- Prevalence of Chronic Diseases: High rates of Type 2 diabetes and increasing rates of obesity across key European markets like Germany, the UK, and France.

- Healthcare System Integration: National health services in many European countries are actively seeking cost-effective and high-efficacy treatments for chronic conditions.

- Off-Label Use Scrutiny: While demand for weight loss is high, regulatory bodies like Germany's BfArM are actively monitoring and, in some cases, considering interventions due to supply shortages.

- Market Access: Favorable reimbursement policies for established indications in many European countries, albeit with ongoing discussions around access for off-label uses.

The Ozempic: segment itself is leading the market's current trajectory. The drug's approved indications for Type 2 diabetes management are substantial drivers. However, the explosion of off-label prescribing for weight loss has dramatically reshaped market demand and supply dynamics. This dual demand profile has positioned Ozempic at the forefront of pharmaceutical innovation and market discussion. The low-dose versions (0.25mg and 0.5mg) are particularly sought after for this off-label use, highlighting a significant shift in the drug's primary market drivers. The market's leadership is thus characterized by the sustained demand for its core therapeutic benefits alongside a rapidly growing, albeit often scrutinized, demand for its weight-management capabilities.

Ozempic Market Product Developments

Product developments in the Ozempic market are primarily focused on enhancing the efficacy and accessibility of semaglutide. Novo Nordisk continues to invest in research for new formulations and delivery methods, aiming to improve patient convenience and expand therapeutic applications. Advancements in understanding the full spectrum of semaglutide's benefits, beyond diabetes and weight management, are also being explored. The competitive edge for Ozempic lies in its proven clinical profile, established safety data, and the ongoing pipeline of related semaglutide-based products that aim to address various unmet medical needs in metabolic health.

Challenges in the Ozempic Market Market

The Ozempic market faces significant challenges, predominantly centered around supply chain disruptions and the intense demand stemming from off-label use. The German regulator BfArM's consideration of banning Ozempic exports in November 2023, due to shortages impacting Europe's health systems, exemplifies the gravity of this issue. Novo Nordisk's September 2023 advisory to the TGA and the Ozempic Medicine Shortage Action Group, indicating limited supply throughout 2023 and 2024, directly highlights the acceleration of demand, particularly for low-dose versions used off-label. Regulatory scrutiny of off-label prescribing, alongside manufacturing capacity limitations, poses substantial barriers to meeting global demand and ensuring equitable access for approved indications.

Forces Driving Ozempic Market Growth

Several key forces are driving the Ozempic market growth. The escalating global prevalence of Type 2 diabetes and obesity represents a foundational driver for demand. Technological advancements in the development of GLP-1 receptor agonists, like semaglutide, offer highly effective treatment options with significant benefits beyond glycemic control. The increasing patient and physician awareness of these comprehensive benefits, particularly regarding weight loss, has fueled a surge in prescribing. Furthermore, favorable economic conditions in key markets and supportive regulatory pathways for innovative diabetes and weight management therapies, once approved, contribute to market expansion.

Challenges in the Ozempic Market Market

Long-term growth catalysts in the Ozempic market are intrinsically linked to continued innovation and strategic market expansion. Novo Nordisk's ongoing research into new indications for semaglutide, such as cardiovascular risk reduction, will unlock significant new patient populations and further solidify market dominance. Partnerships with healthcare providers and payers to ensure broad access and reimbursement for approved indications will be crucial. Moreover, efforts to expand manufacturing capacity and optimize supply chain logistics are essential to address current shortages and meet projected future demand. Pharmaceutical companies that can effectively navigate evolving regulatory landscapes and demonstrate the long-term economic and health benefits of these treatments will experience sustained growth.

Emerging Opportunities in Ozempic Market

Emerging opportunities in the Ozempic market lie in the exploration of new therapeutic frontiers and underserved patient populations. Research into semaglutide's potential applications in conditions beyond diabetes and obesity, such as non-alcoholic steatohepatitis (NASH) and sleep apnea, presents substantial growth avenues. The expanding pharmaceutical market in emerging economies, with increasing diagnoses of metabolic diseases, offers a significant opportunity for market penetration. Furthermore, the development of novel drug delivery systems, including oral formulations and longer-acting injectables, can enhance patient convenience and adherence, thereby expanding the accessible patient base. Consumer preferences are increasingly shifting towards proactive health management, creating a fertile ground for therapies that offer comprehensive health benefits.

Leading Players in the Ozempic Market Sector

- Novo Nordisk

- Eli Lilly and Company

- Merck & Co., Inc.

Key Milestones in Ozempic Market Industry

- November 2023: German regulator BfArM is considering banning Ozempic exports as Europe's health systems struggle with a shortage of the diabetes drug, which is in high demand for its weight-loss benefits. This highlights significant supply chain pressures and the impact of off-label demand on regional availability.

- September 2023: Novo Nordisk advised the Therapeutic Goods Administration and the Ozempic Medicine Shortage Action Group that supply throughout the rest of 2023 and 2024 will be limited. Novo Nordisk advised that demand had accelerated in recent months, particularly for the low-dose (0.25/0.5 mg) version. This additional demand is caused mainly by a rapid increase in prescribing for ‘off-label’ use (prescriptions to treat conditions other than those approved by the TGA). This event underscores the unprecedented demand surge and its drivers.

Strategic Outlook for Ozempic Market Market

The strategic outlook for the Ozempic market is characterized by sustained growth, driven by the ongoing unmet need for effective treatments for Type 2 diabetes and obesity. The market's future trajectory will be shaped by the ability of manufacturers to scale production to meet burgeoning global demand, particularly in light of the significant off-label use. Strategic investments in expanding manufacturing capacity and diversifying supply chains are paramount to mitigating current shortages and ensuring future availability. Furthermore, continued research into new indications and the development of next-generation GLP-1 receptor agonists will be critical for maintaining a competitive edge and capturing a larger share of the expanding metabolic health market. Collaborations with regulatory bodies and healthcare providers to ensure responsible prescribing and equitable access will also be key to long-term market sustainability and growth.

Ozempic Market Segmentation

- 1. Ozempic

Ozempic Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Philippines

- 3.10. Vietnam

- 3.11. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Oman

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

Ozempic Market Regional Market Share

Geographic Coverage of Ozempic Market

Ozempic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Effective and Accurate Drugs; Exponential Rise in the Incidence of Diseases like Cancer; Rising Global Agricultural Activities and Pharmaceutical Establishments

- 3.3. Market Restrains

- 3.3.1. Patent Expirations of Enzyme Inhibitor Drugs; Low-cost Generic Drugs

- 3.4. Market Trends

- 3.4.1. Rising obesity and diabetes prevalence globally is likely to drive the market over forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ozempic

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Ozempic

- 6. North America Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ozempic

- 6.1. Market Analysis, Insights and Forecast - by Ozempic

- 7. Europe Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ozempic

- 7.1. Market Analysis, Insights and Forecast - by Ozempic

- 8. Asia Pacific Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ozempic

- 8.1. Market Analysis, Insights and Forecast - by Ozempic

- 9. Latin America Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ozempic

- 9.1. Market Analysis, Insights and Forecast - by Ozempic

- 10. Middle East and Africa Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ozempic

- 10.1. Market Analysis, Insights and Forecast - by Ozempic

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Novo Nordisk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eli Lilly and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co. Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Novo Nordisk

List of Figures

- Figure 1: Global Ozempic Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 3: North America Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 4: North America Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 7: Europe Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 8: Europe Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 11: Asia Pacific Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 12: Asia Pacific Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 15: Latin America Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 16: Latin America Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 19: Middle East and Africa Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 20: Middle East and Africa Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Ozempic Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 2: Global Ozempic Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 4: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 9: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 18: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Japan Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Malaysia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Thailand Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Philippines Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 31: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Mexico Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 36: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South Africa Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oman Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Egypt Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Iran Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ozempic Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Ozempic Market?

Key companies in the market include Novo Nordisk , Eli Lilly and Company , Merck & Co., Inc..

3. What are the main segments of the Ozempic Market?

The market segments include Ozempic.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Effective and Accurate Drugs; Exponential Rise in the Incidence of Diseases like Cancer; Rising Global Agricultural Activities and Pharmaceutical Establishments.

6. What are the notable trends driving market growth?

Rising obesity and diabetes prevalence globally is likely to drive the market over forecast period.

7. Are there any restraints impacting market growth?

Patent Expirations of Enzyme Inhibitor Drugs; Low-cost Generic Drugs.

8. Can you provide examples of recent developments in the market?

November 2023: German regulator BfArM is considering banning Ozempic exports as Europe's health systems struggle with a shortage of the diabetes drug, which is in high demand for its weight-loss benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ozempic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ozempic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ozempic Market?

To stay informed about further developments, trends, and reports in the Ozempic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence