Key Insights

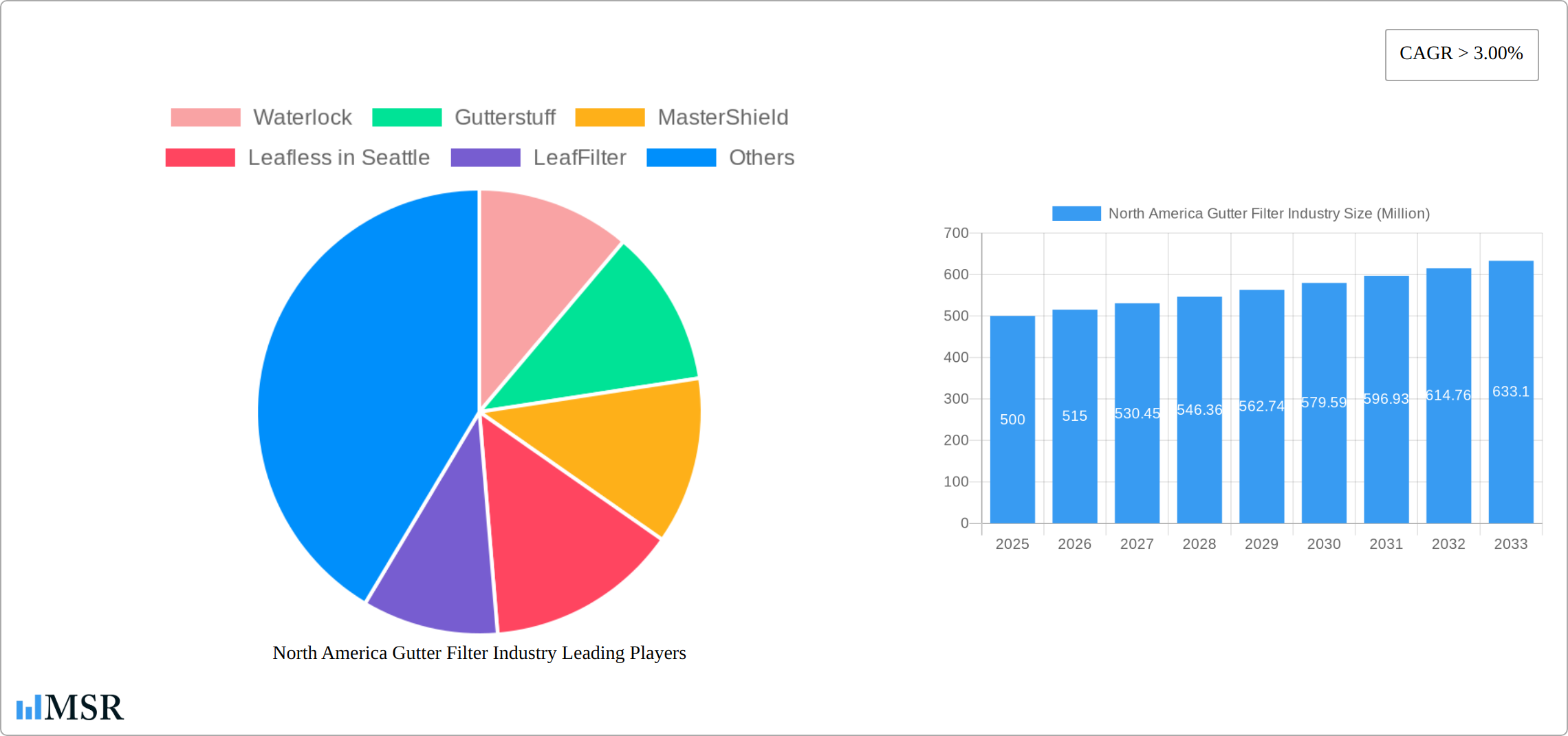

The North American gutter filter market, valued at approximately $500 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This growth is fueled by several key drivers. Increasing homeowner awareness of the benefits of gutter protection, such as preventing costly roof and foundation damage from water accumulation, is a significant factor. Furthermore, the rising prevalence of extreme weather events, including heavy rainfall and ice storms, underscores the necessity of effective gutter maintenance and protection. The convenience and efficiency offered by gutter filters, compared to traditional gutter cleaning methods, also contributes to market expansion. The market is segmented by product type (meshes and screens, hoods and covers, plastic frames and bristles) and application (residential and commercial). The residential segment dominates, reflecting the high number of single-family homes in North America. However, the commercial segment is projected to see faster growth due to increasing demand for reliable gutter protection in large buildings and complexes. Leading players like LeafFilter, Gutterglove, and Waterlock are driving innovation through product diversification and strategic marketing initiatives, further stimulating market growth.

North America Gutter Filter Industry Market Size (In Million)

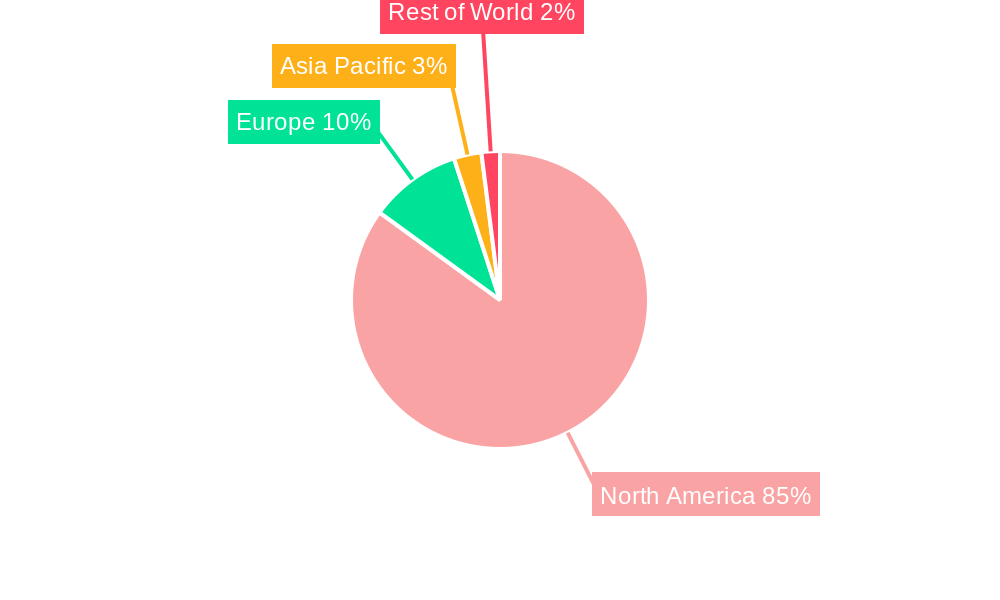

While the market outlook is positive, certain restraints exist. High initial installation costs may deter some homeowners from adopting gutter filter systems. Furthermore, the effectiveness of different gutter filter types varies depending on climate conditions and debris types, which can influence consumer purchasing decisions. However, the increasing availability of financing options and improved product designs are mitigating these restraints. Future growth is anticipated to be driven by technological advancements leading to more durable, efficient, and aesthetically pleasing gutter protection systems. The continued focus on environmentally friendly solutions will also influence product development and market adoption. The United States represents the largest segment within North America, followed by Canada and Mexico, with the US market expected to maintain its dominance due to its large housing stock and higher disposable income levels.

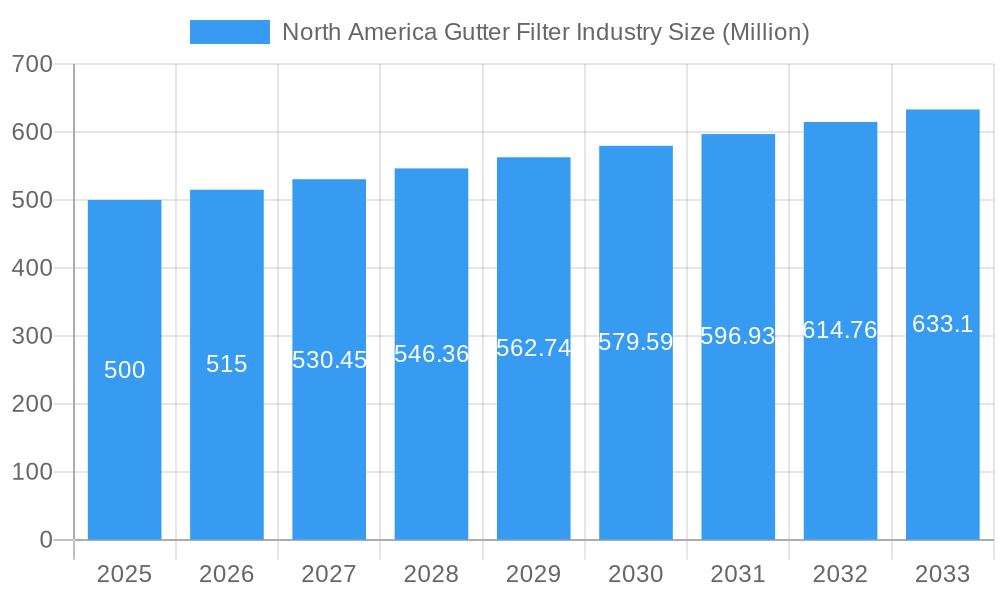

North America Gutter Filter Industry Company Market Share

North America Gutter Filter Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America gutter filter industry, covering market size, segmentation, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for industry stakeholders, investors, and anyone seeking to understand the dynamics of this growing market. Key players analyzed include Waterlock, Gutterstuff, MasterShield, Leafless in Seattle, LeafFilter, Gutterglove, Raptor, Amerimax, Gutter Guards America, and Homecraft Gutter Protection.

North America Gutter Filter Industry Market Concentration & Dynamics

The North American gutter filter market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for each company are proprietary, LeafFilter and Gutterglove are estimated to be among the leading brands, commanding a combined share of approximately xx%. The industry is characterized by a dynamic innovation ecosystem, with ongoing research and development focused on improving filter efficiency, durability, and ease of installation. Regulatory frameworks, primarily at the local level, influence product standards and installation practices. Substitute products, such as professional gutter cleaning services, exist but face challenges in competing with the convenience and long-term cost-effectiveness of gutter filters. End-user trends show a growing preference for DIY-friendly solutions and longer-lasting, high-performance products. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded during the historical period (2019-2024), indicating potential for further consolidation.

- Market Concentration: Moderately concentrated, with top players holding xx% combined market share.

- Innovation: Focus on improved efficiency, durability, and ease of installation.

- Regulations: Primarily local, impacting product standards and installation.

- Substitutes: Professional gutter cleaning, less convenient and potentially costlier.

- End-User Trends: Growing demand for DIY options and high-performance products.

- M&A Activity: xx deals recorded between 2019 and 2024.

North America Gutter Filter Industry Industry Insights & Trends

The North American gutter filter market is experiencing robust growth, driven by several factors. Increasing homeowner awareness of the benefits of gutter protection, such as preventing water damage and maintaining curb appeal, is a key driver. The market size was estimated at $xx Million in 2025 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, such as the development of more durable and efficient filter materials, are further fueling market expansion. Evolving consumer behavior, particularly a preference for convenient and long-lasting solutions, also significantly contributes to market growth. Rising disposable incomes and increasing homeownership rates in key markets enhance market expansion. The market is also witnessing disruptions from innovative product designs and business models, like Gutterglove's successful launch of low-cost DIY gutter guards in 2021.

Key Markets & Segments Leading North America Gutter Filter Industry

The residential segment dominates the North American gutter filter market, accounting for approximately xx% of the total market value in 2025. This dominance is driven by the large number of single-family homes and the increasing homeowner awareness of gutter protection. While the commercial segment holds a smaller share, it shows potential for growth, particularly with the increasing emphasis on building maintenance and property preservation. Among product types, mesh and screen filters currently hold the largest market share, followed by hoods and covers. Plastic frames and bristles represent a smaller, yet growing, segment, driven by their affordability and ease of installation.

- Residential Segment Drivers: High homeowner awareness, large single-family home base, rising disposable incomes.

- Commercial Segment Drivers: Increased focus on building maintenance, property preservation, and long-term cost savings.

- Meshes and Screens Dominance: Established technology, wide availability, and relative affordability.

- Hoods and Covers Market Share: Strong performance, effective protection, aesthetic appeal.

- Plastic Frames and Bristles Growth: Affordability, ease of installation, appeal to DIY homeowners.

North America Gutter Filter Industry Product Developments

The North American gutter filter market is experiencing a wave of innovation, driven by a focus on durability, efficiency, and aesthetics. Manufacturers are leveraging advanced materials like micro-mesh technology and incorporating self-cleaning mechanisms to enhance filter performance and longevity. The rise of DIY-friendly designs, exemplified by the successful 2021 launch of Gutterglove, reflects a growing consumer preference for easy installation and reduced professional installation costs. This trend towards user-friendly products, combined with improvements in overall filter performance, is significantly expanding market adoption. Furthermore, the integration of smart technology, including automated cleaning systems and remote monitoring capabilities, represents a significant frontier for future product development and a key differentiator in a competitive marketplace. These advancements are not only improving the functionality of gutter filters but also elevating their overall value proposition for homeowners.

Challenges in the North America Gutter Filter Industry Market

Despite robust growth potential, the North American gutter filter market faces considerable challenges. Supply chain volatility, particularly concerning the availability of raw materials, directly impacts production capacity, pricing strategies, and overall market stability. The industry's competitive landscape, characterized by both established players and emerging competitors, exerts significant pressure on pricing and profitability, demanding continuous innovation and efficient cost management. Furthermore, navigating diverse local regulations and ensuring product compliance across different jurisdictions presents a significant hurdle for market entry and expansion. Finally, the inherently seasonal nature of gutter cleaning and filter installation necessitates strategic inventory management and effective marketing campaigns to mitigate sales fluctuations and maximize profitability throughout the year.

Forces Driving North America Gutter Filter Industry Growth

Several key factors are fueling the growth trajectory of the North American gutter filter industry. Significant technological advancements, particularly the development of self-cleaning filters and the utilization of superior materials, are enhancing product performance and consumer appeal. A growing awareness among homeowners of the numerous benefits of gutter protection, coupled with a robust housing market and rising homeownership rates, translates directly into increased demand for these products. Favorable economic conditions and higher disposable incomes further contribute to elevated spending on home improvement projects, including gutter protection systems. Additionally, government initiatives promoting sustainable building practices and water conservation indirectly support market growth by highlighting the environmental benefits of effective gutter management.

Challenges in the North America Gutter Filter Industry Market

Despite robust growth potential, the North American gutter filter market faces considerable challenges. Supply chain volatility, particularly concerning the availability of raw materials, directly impacts production capacity, pricing strategies, and overall market stability. The industry's competitive landscape, characterized by both established players and emerging competitors, exerts significant pressure on pricing and profitability, demanding continuous innovation and efficient cost management. Furthermore, navigating diverse local regulations and ensuring product compliance across different jurisdictions presents a significant hurdle for market entry and expansion. Finally, the inherently seasonal nature of gutter cleaning and filter installation necessitates strategic inventory management and effective marketing campaigns to mitigate sales fluctuations and maximize profitability throughout the year.

Emerging Opportunities in North America Gutter Filter Industry

The most promising emerging opportunities lie in the development and marketing of smart gutter filter systems incorporating remote monitoring and automated cleaning features. Expanding into the commercial sector, focusing on large building complexes and multi-family dwellings, presents a significant untapped market segment. Developing specialized filters designed to withstand and perform optimally in high-rainfall or other extreme weather conditions offers a compelling value proposition and a competitive edge. Finally, prioritizing the use of sustainable and environmentally friendly materials aligns with growing consumer demand and fosters a positive brand image.

Leading Players in the North America Gutter Filter Industry Sector

- Waterlock

- Gutterstuff

- MasterShield

- Leafless in Seattle

- LeafFilter

- Gutterglove

- Raptor

- Amerimax

- Gutter Guards America

- Homecraft Gutter Protection

Key Milestones in North America Gutter Filter Industry Industry

- 2021: Gutterglove launches DIY gutter guards, offering low-cost, pro-quality options with a 40-year limited parts warranty and the ability to withstand 150 inches of rain per hour. This significantly expanded market access and spurred interest in the DIY segment.

Strategic Outlook for North America Gutter Filter Industry Market

The North America gutter filter market possesses substantial future growth potential. Continuous product innovation, strategic partnerships, and market expansion into commercial and specialized sectors will be key drivers. Meeting the evolving consumer demand for convenient, high-performance, and sustainable solutions will be critical for market leadership. The focus on technological advancements and addressing market challenges will ensure continued growth and profitability in this dynamic industry.

North America Gutter Filter Industry Segmentation

-

1. Product

- 1.1. Meshes and Screens

- 1.2. Hoods and Covers

- 1.3. Plastic Frames and Bristles

-

2. Market

- 2.1. Residential

- 2.2. Commercial

-

3. Geography

- 3.1. United States

- 3.2. Canada

North America Gutter Filter Industry Segmentation By Geography

- 1. United States

- 2. Canada

North America Gutter Filter Industry Regional Market Share

Geographic Coverage of North America Gutter Filter Industry

North America Gutter Filter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Customization and Personalization; Increasing Home Improvement and Renovation Trends

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise Restraining the Market; The Cost of the Materials can be a Significant Restraint

- 3.4. Market Trends

- 3.4.1. Hip Roofs slope will drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gutter Filter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Meshes and Screens

- 5.1.2. Hoods and Covers

- 5.1.3. Plastic Frames and Bristles

- 5.2. Market Analysis, Insights and Forecast - by Market

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Gutter Filter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Meshes and Screens

- 6.1.2. Hoods and Covers

- 6.1.3. Plastic Frames and Bristles

- 6.2. Market Analysis, Insights and Forecast - by Market

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Gutter Filter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Meshes and Screens

- 7.1.2. Hoods and Covers

- 7.1.3. Plastic Frames and Bristles

- 7.2. Market Analysis, Insights and Forecast - by Market

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Waterlock

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Gutterstuff

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 MasterShield

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Leafless in Seattle

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 LeafFilter

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Gutterglove

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Raptor

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Amerimax

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Gutter guards America

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Homecraft Gutter Protection

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Waterlock

List of Figures

- Figure 1: North America Gutter Filter Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Gutter Filter Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Gutter Filter Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: North America Gutter Filter Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: North America Gutter Filter Industry Revenue Million Forecast, by Market 2020 & 2033

- Table 4: North America Gutter Filter Industry Volume K Unit Forecast, by Market 2020 & 2033

- Table 5: North America Gutter Filter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Gutter Filter Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: North America Gutter Filter Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Gutter Filter Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Gutter Filter Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 10: North America Gutter Filter Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: North America Gutter Filter Industry Revenue Million Forecast, by Market 2020 & 2033

- Table 12: North America Gutter Filter Industry Volume K Unit Forecast, by Market 2020 & 2033

- Table 13: North America Gutter Filter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: North America Gutter Filter Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: North America Gutter Filter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Gutter Filter Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: North America Gutter Filter Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: North America Gutter Filter Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: North America Gutter Filter Industry Revenue Million Forecast, by Market 2020 & 2033

- Table 20: North America Gutter Filter Industry Volume K Unit Forecast, by Market 2020 & 2033

- Table 21: North America Gutter Filter Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Gutter Filter Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: North America Gutter Filter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Gutter Filter Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gutter Filter Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the North America Gutter Filter Industry?

Key companies in the market include Waterlock, Gutterstuff, MasterShield, Leafless in Seattle, LeafFilter, Gutterglove, Raptor, Amerimax, Gutter guards America, Homecraft Gutter Protection.

3. What are the main segments of the North America Gutter Filter Industry?

The market segments include Product, Market, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Customization and Personalization; Increasing Home Improvement and Renovation Trends.

6. What are the notable trends driving market growth?

Hip Roofs slope will drive the market.

7. Are there any restraints impacting market growth?

Lack of Expertise Restraining the Market; The Cost of the Materials can be a Significant Restraint.

8. Can you provide examples of recent developments in the market?

In 2021, Gutterglove started DIY gutter guards, which was made available at low prices and pro-installed gutter guards. This new trend of DIY gutter guards can withstand 150 inches of rain per hour and also has 40 years limited parts of warranty.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gutter Filter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gutter Filter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gutter Filter Industry?

To stay informed about further developments, trends, and reports in the North America Gutter Filter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence