Key Insights

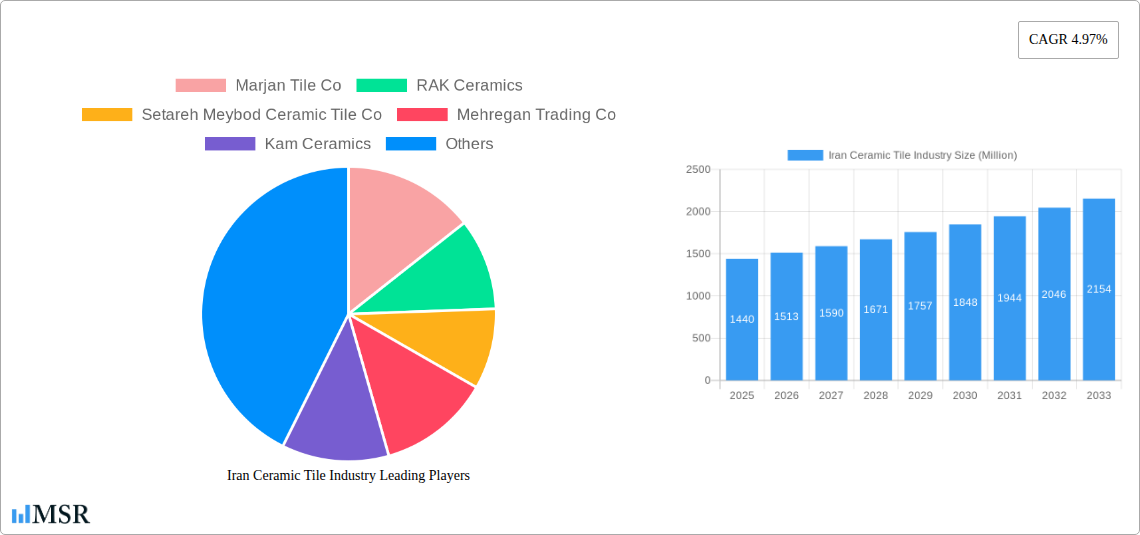

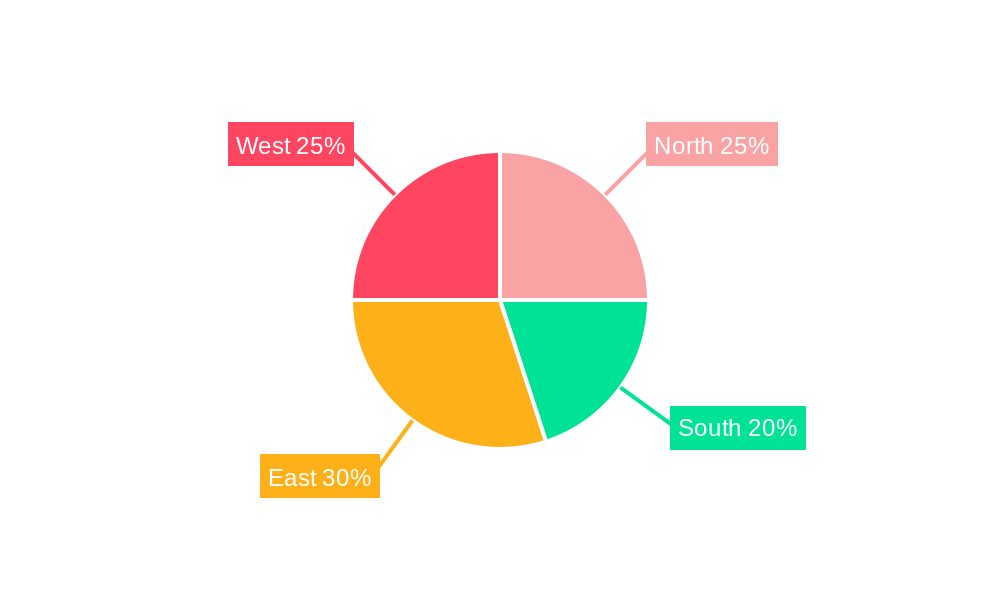

The Iranian ceramic tile industry, valued at $1.44 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.97% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a burgeoning construction sector, particularly in residential and commercial building projects, creates significant demand for tiles. Secondly, increasing urbanization and rising disposable incomes are boosting consumer spending on home improvements and renovations, further fueling the market. The preference for aesthetically pleasing and durable glazed and porcelain tiles is also driving market segmentation within the industry. However, the market faces challenges such as fluctuations in raw material prices and potential economic instability. Competition among domestic players like Marjan Tile Co, RAK Ceramics, and Setareh Meybod Ceramic Tile Co, alongside the influence of import/export dynamics, shapes the market landscape. The industry is segmented by end-user (residential, commercial), product type (glazed, porcelain, scratch-free, others), application (floor, wall, other tiles), and construction type (new construction, renovation/replacement). Regional variations in demand exist across Iran's North, South, East, and West regions, with varying levels of construction activity and economic development impacting consumption patterns. The forecast period suggests a continued upward trajectory, albeit potentially moderated by macroeconomic conditions and government policies.

Iran Ceramic Tile Industry Market Size (In Billion)

The consistent growth is expected to continue over the forecast period (2025-2033), albeit with potential fluctuations based on economic factors and governmental regulations. The market segments show promise, with the glazed and porcelain tile types experiencing the strongest growth, driven by their aesthetic appeal and durability. The residential segment consistently dominates, reflecting the ongoing growth in housing construction and renovation projects within Iran. Furthermore, strategic investments in advanced manufacturing technologies and marketing initiatives by key players should maintain a competitive landscape and help sustain this upward trend. However, careful attention to raw material sourcing and pricing volatility will be crucial for sustained profitability. The geographic segmentation shows potential for regional disparities and opportunities for targeted marketing efforts.

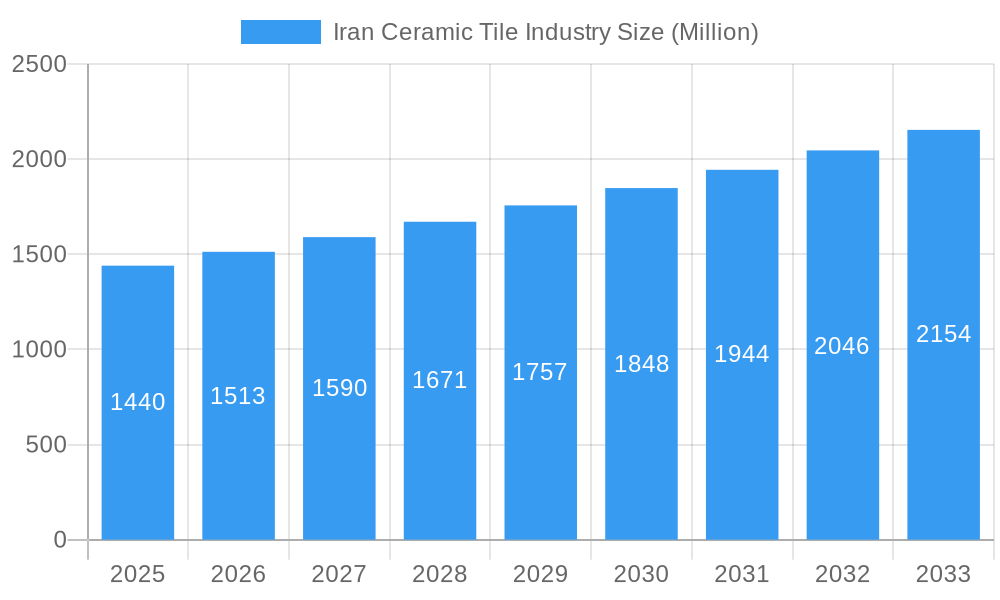

Iran Ceramic Tile Industry Company Market Share

Iran Ceramic Tile Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Iranian ceramic tile industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market dynamics, key players, emerging trends, and future growth potential. The market size is estimated at xx Million USD in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033.

Iran Ceramic Tile Industry Market Concentration & Dynamics

This section examines the competitive landscape of the Iranian ceramic tile market, analyzing market concentration, innovation, regulations, and industry activity. The industry exhibits a moderately concentrated structure, with several major players holding significant market share. Key players include Marjan Tile Co, RAK Ceramics, Setareh Meybod Ceramic Tile Co, Mehregan Trading Co, Kam Ceramics, Sina Tile and Ceramic co, Ardakan Industrial Ceramics Co, Saba Tile, and Ceramara Co. However, a large number of smaller players also contribute to the market.

- Market Share: RAK Ceramics holds an estimated xx% market share, while Marjan Tile Co. holds approximately xx%. The remaining market share is distributed among other players. Precise figures are unavailable due to data limitations.

- M&A Activity: The number of mergers and acquisitions (M&A) in the Iranian ceramic tile industry during the historical period (2019-2024) has been relatively low, with approximately xx deals recorded. However, future activity could increase given industry consolidation trends.

- Innovation Ecosystem: While innovation is present, it's relatively limited compared to global industry leaders due to economic and political factors.

- Regulatory Framework: Government regulations concerning construction and building materials impact the industry, creating both opportunities and challenges for market players.

- Substitute Products: Other flooring materials, such as wood, vinyl, and laminate, compete with ceramic tiles, affecting overall market growth.

- End-User Trends: Increasing urbanization and rising disposable incomes are driving demand for high-quality ceramic tiles in residential and commercial spaces.

Iran Ceramic Tile Industry Industry Insights & Trends

The Iranian ceramic tile market is characterized by fluctuating growth driven by multiple factors. The historical period (2019-2024) witnessed a xx Million USD market size, significantly impacted by economic fluctuations and sanctions. The base year (2025) presents an estimated market size of xx Million USD. This growth is projected to continue, albeit at a varied pace due to geopolitical factors. The market size in 2033 is estimated at xx Million USD. Technological advancements, such as the adoption of digital printing techniques, are improving product quality and design options. Consumer preferences are shifting towards sustainable and eco-friendly products, influencing the industry to develop more sustainable manufacturing processes. The ongoing construction boom in Iran is a significant driver for increased demand. However, the impact of sanctions and economic instability creates uncertainty in forecasting precise growth.

Key Markets & Segments Leading Iran Ceramic Tile Industry

The Iranian ceramic tile market is segmented by end-user type (residential, commercial), product type (glazed, porcelain, scratch-free, others), application (floor tiles, wall tiles, other tiles), and construction type (new construction, replacement & renovation).

Dominant Segment: The residential segment constitutes the largest market share, driven by the growing housing demand in urban centers. New construction projects, particularly in high-rise buildings, significantly contribute to this segment's dominance.

Drivers:

- Economic Growth: Economic growth, though fluctuating, fuels construction activity and boosts demand for ceramic tiles.

- Infrastructure Development: Government investments in infrastructure projects, such as new roads and public buildings, create significant demand for ceramic tiles.

- Urbanization: The ongoing urbanization trend leads to a higher demand for housing, further driving the market.

The porcelain tile segment demonstrates strong growth due to its durability and aesthetic appeal. Floor tiles remain the dominant application, followed by wall tiles.

Iran Ceramic Tile Industry Product Developments

Recent product developments focus on enhanced durability, aesthetic appeal, and sustainability. Technological advancements, such as the adoption of digital printing and advanced glazing techniques, are key factors. This allows manufacturers to offer a wider range of designs and finishes. The growing demand for eco-friendly and sustainable products has driven the development of tiles with reduced environmental impact. Companies like RAK Ceramics are actively investing in sustainable manufacturing processes.

Challenges in the Iran Ceramic Tile Industry Market

Several challenges affect the Iranian ceramic tile industry. These include:

- Sanctions and Economic Instability: Sanctions and economic uncertainty lead to supply chain disruptions and fluctuations in raw material costs. This has been estimated to decrease the overall market growth by approximately xx% during the period of significant sanctions.

- Regulatory Hurdles: Strict government regulations and bureaucratic processes can increase costs and complicate business operations.

- Competition: Intense competition from both domestic and international players puts pressure on profit margins.

Forces Driving Iran Ceramic Tile Industry Growth

Key growth drivers include:

- Government Initiatives: Government support for infrastructure projects and housing development fosters market growth.

- Technological Advancements: The adoption of advanced technologies leads to better quality, design, and sustainable products.

- Rising Disposable Incomes: Increased disposable incomes among a growing middle class enhances consumer spending on home improvement.

Long-Term Growth Catalysts in the Iran Ceramic Tile Industry Market

Long-term growth depends on overcoming current challenges and capitalizing on opportunities. Strategic partnerships, focusing on R&D, and expanding into new markets (both domestically and internationally, once sanctions are lifted) are crucial for sustaining growth. Innovations in sustainable manufacturing, particularly reducing carbon emissions, will also be key.

Emerging Opportunities in Iran Ceramic Tile Industry

Emerging opportunities include the increasing demand for large-format tiles, specialized tiles for specific applications (e.g., anti-bacterial tiles), and the growing focus on sustainable and eco-friendly products. The development of innovative designs and the expansion into the export market (post-sanctions) present significant potential for growth.

Leading Players in the Iran Ceramic Tile Industry Sector

- Marjan Tile Co

- RAK Ceramics

- Setareh Meybod Ceramic Tile Co

- Mehregan Trading Co

- Kam Ceramics

- Sina Tile and Ceramic co

- Ardakan Industrial Ceramics Co

- Saba Tile

- Ceramara Co

Key Milestones in Iran Ceramic Tile Industry Industry

- May 2023: Durst and Altadia Group's collaboration to advance ceramic sector innovation, leveraging cutting-edge digital glazing and printing technology at Esmalglass's technology center. This highlights a potential shift towards more technologically advanced manufacturing processes within the Iranian industry, albeit indirectly.

- August 2022: RAK Ceramics' USD 1.23 Million investment in advanced manufacturing and sustainability programs demonstrates a focus on enhancing production efficiency and meeting growing demand for sustainable ceramic tiles.

Strategic Outlook for Iran Ceramic Tile Industry Market

The Iranian ceramic tile market presents significant long-term growth potential. Overcoming current challenges, such as sanctions and economic instability, is critical. Focusing on innovation, sustainability, and strategic partnerships will be key to capitalizing on future opportunities and achieving sustained growth within this dynamic and potentially lucrative market.

Iran Ceramic Tile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Ceramic Tile Industry Segmentation By Geography

- 1. Iran

Iran Ceramic Tile Industry Regional Market Share

Geographic Coverage of Iran Ceramic Tile Industry

Iran Ceramic Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending on Home Renovations and Luxury Bathroom Fittings Driving the Market Growth; Increasing Government Spending on Infrastructure Projects including Residential and Commercial Buildings Boosting the Market

- 3.3. Market Restrains

- 3.3.1. Highly Competitive Market with Numerous Local and International Players; Volatility in the Prices of Raw Materials Used in the Production of Ceramic Tiles

- 3.4. Market Trends

- 3.4.1. Rising Construction Activity is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Ceramic Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marjan Tile Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RAK Ceramics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Setareh Meybod Ceramic Tile Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mehregan Trading Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kam Ceramics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sina Tile and Ceramic co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ardakan Industrial Ceramics Co**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saba Tile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ceramara Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Marjan Tile Co

List of Figures

- Figure 1: Iran Ceramic Tile Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Iran Ceramic Tile Industry Share (%) by Company 2025

List of Tables

- Table 1: Iran Ceramic Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Iran Ceramic Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Iran Ceramic Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Iran Ceramic Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Iran Ceramic Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Iran Ceramic Tile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Iran Ceramic Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Iran Ceramic Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Iran Ceramic Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Iran Ceramic Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Iran Ceramic Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Iran Ceramic Tile Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Ceramic Tile Industry?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the Iran Ceramic Tile Industry?

Key companies in the market include Marjan Tile Co, RAK Ceramics, Setareh Meybod Ceramic Tile Co, Mehregan Trading Co, Kam Ceramics, Sina Tile and Ceramic co, Ardakan Industrial Ceramics Co**List Not Exhaustive, Saba Tile, Ceramara Co.

3. What are the main segments of the Iran Ceramic Tile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending on Home Renovations and Luxury Bathroom Fittings Driving the Market Growth; Increasing Government Spending on Infrastructure Projects including Residential and Commercial Buildings Boosting the Market.

6. What are the notable trends driving market growth?

Rising Construction Activity is Driving the Market.

7. Are there any restraints impacting market growth?

Highly Competitive Market with Numerous Local and International Players; Volatility in the Prices of Raw Materials Used in the Production of Ceramic Tiles.

8. Can you provide examples of recent developments in the market?

In May 2023, Durst and Altadia Group have recently unveiled a strategic collaboration aimed at spearheading product innovation in the ceramic sector. In a notable move, Durst is set to deploy its cutting-edge technology, including the Gamma DG digital glazing machine and the Durst Gamma XD digital tile printer, at Esmalglass's technology center in Sassuolo. Esmalglass, a global leader in frits, glazes, colors, and inks for the ceramic industry, owns the center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Ceramic Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Ceramic Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Ceramic Tile Industry?

To stay informed about further developments, trends, and reports in the Iran Ceramic Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence