Key Insights

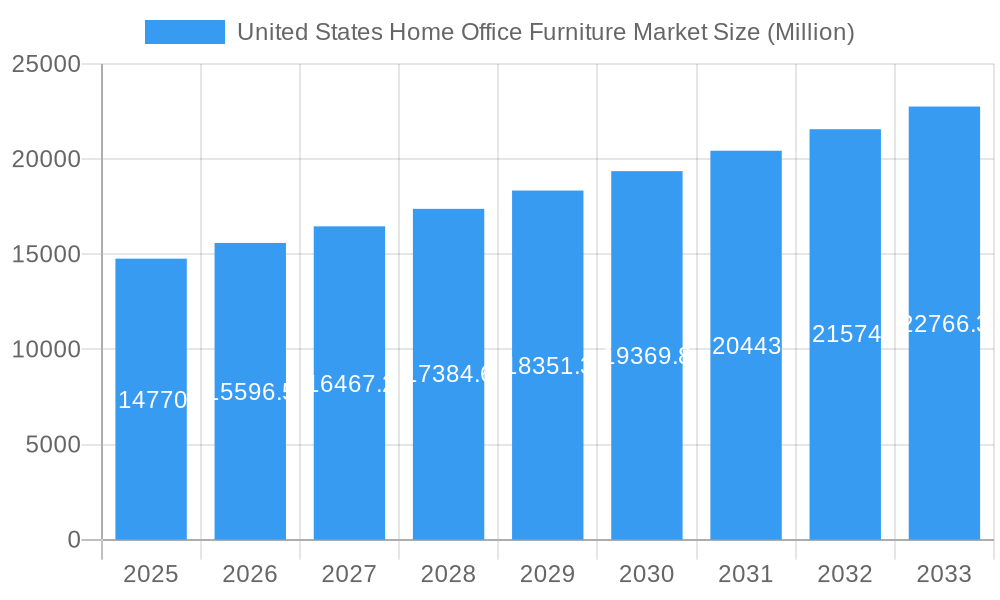

The United States home office furniture market, valued at approximately $14.77 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing prevalence of remote work and hybrid work models, accelerated by the COVID-19 pandemic, has fueled significant demand for ergonomic chairs, functional desks, and efficient storage solutions for home offices. This trend is expected to continue, particularly among professionals seeking to create comfortable and productive workspaces at home. Furthermore, the rising disposable incomes and increasing urbanization are contributing to the market's expansion, as more individuals seek to upgrade their home office setups. The market is segmented by product type (seating, storage units, desks and tables, and other furniture) and distribution channel (flagship stores, specialty stores, online, and other channels). Online sales are experiencing substantial growth, driven by the convenience and wide selection offered by e-commerce platforms. Competition is intense, with major players like Knoll, Herman Miller, Steelcase, and IKEA vying for market share through innovation in design, material, and functionality. While supply chain disruptions and inflationary pressures present some challenges, the long-term outlook for the US home office furniture market remains positive, with a projected Compound Annual Growth Rate (CAGR) of 5.34% from 2025 to 2033.

United States Home Office Furniture Market Market Size (In Billion)

The market's future success hinges on adapting to evolving consumer preferences and technological advancements. This includes a greater emphasis on sustainable and eco-friendly materials, smart home integration capabilities, and adaptable furniture that caters to flexible work arrangements. Companies are investing heavily in research and development to create innovative products that meet these demands. Growth is expected to be strongest in segments offering ergonomic and customizable solutions, reflecting a growing awareness of health and wellness in the workplace, even within the confines of the home. The continued expansion of e-commerce will also present opportunities for businesses to reach a wider customer base and enhance their online presence. However, maintaining competitive pricing strategies and managing logistics effectively will be crucial for navigating economic fluctuations and ensuring sustained market success.

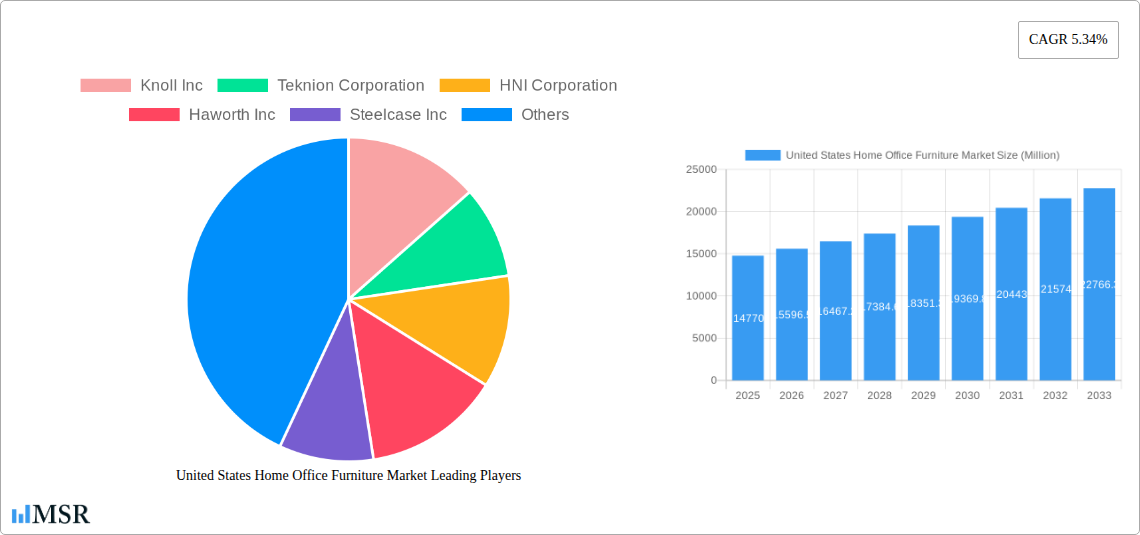

United States Home Office Furniture Market Company Market Share

United States Home Office Furniture Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States home office furniture market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025-2033, analyzing historical data from 2019-2024. The market is segmented by product (Seating, Storage Units, Desks and Tables, Other Home Office Furniture) and distribution channel (Flagship Stores, Specialty Stores, Online, Other Distribution Channels). Key players analyzed include Knoll Inc, Teknion Corporation, HNI Corporation, Haworth Inc, Steelcase Inc, Ashley Home Stores Ltd, IKEA, Krueger International Inc, Herman Miller Inc, and Kimball International. The market size in 2025 is estimated at xx Million.

United States Home Office Furniture Market Concentration & Dynamics

The US home office furniture market exhibits a moderately concentrated landscape, with a handful of established players holding significant market share. Steelcase Inc, Herman Miller Inc, and Knoll Inc, among others, dominate the premium segment, while Ashley Home Stores Ltd and IKEA cater to broader consumer bases. The market share of the top 5 players is estimated at xx%. Innovation is driven by ergonomic designs, smart furniture incorporating technology, and sustainable materials. Regulatory frameworks, particularly concerning safety and environmental standards, influence material sourcing and manufacturing processes. Substitute products, including repurposed household items and multifunctional designs, pose a competitive challenge. End-user trends show increasing preference for adaptable and customizable home office solutions. M&A activity in the sector has been relatively moderate in recent years, with an estimated xx M&A deals recorded between 2019-2024.

- Market Concentration: Top 5 players hold approximately xx% of market share.

- Innovation: Focus on ergonomics, smart technology integration, and sustainable materials.

- Regulatory Landscape: Safety and environmental standards impact material selection and manufacturing.

- Substitute Products: Competition from repurposed household items and multifunctional designs.

- End-User Trends: Growing demand for customizable and adaptable home office solutions.

- M&A Activity: Approximately xx M&A deals from 2019-2024.

United States Home Office Furniture Market Industry Insights & Trends

The US home office furniture market is experiencing robust growth, driven by several key factors. The increasing prevalence of remote and hybrid work models, fueled by technological advancements and evolving work culture, significantly boosts demand for comfortable and functional home office setups. The market is further propelled by rising disposable incomes among the target demographic, enabling investment in premium furniture. Technological disruptions manifest through smart furniture integration and the adoption of e-commerce platforms, enhancing customer experience and streamlining purchasing processes. Consumer behavior shifts towards a preference for personalized, aesthetically pleasing, and health-conscious furniture. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033.

Key Markets & Segments Leading United States Home Office Furniture Market

The online distribution channel is witnessing the fastest growth, driven by enhanced e-commerce accessibility and customer convenience. The desks and tables segment holds the largest market share, reflecting the fundamental need for a workspace in home offices. Seating is another dominant segment, emphasizing the importance of ergonomic comfort and postural support for extended periods of work.

- Dominant Region: Nationwide distribution with concentration in urban areas.

- Dominant Segment (Product): Desks and Tables, followed by Seating.

- Dominant Segment (Distribution Channel): Online, due to increased accessibility and convenience.

Drivers for Growth:

- Increasing Remote/Hybrid Work: Significant increase in demand for home office furniture.

- Rising Disposable Incomes: Greater affordability for premium home office furniture.

- Technological Advancements: Integration of smart features and enhanced online purchasing.

- Evolving Consumer Preferences: Demand for personalized, aesthetically pleasing, and ergonomic designs.

United States Home Office Furniture Market Product Developments

Recent product innovations highlight a focus on ergonomic design, multi-functionality, and sustainable materials. Companies are incorporating smart technology, such as adjustable height desks and integrated power solutions, enhancing functionality and user experience. The emphasis on sustainability is driven by environmental awareness, with manufacturers increasingly utilizing recycled and eco-friendly materials. These advancements provide significant competitive advantages, attracting consumers seeking comfort, convenience, and environmentally responsible products.

Challenges in the United States Home Office Furniture Market Market

Significant challenges include supply chain disruptions impacting manufacturing and delivery timelines, leading to increased costs and potential stock shortages. Intense competition among established players and emerging brands increases pricing pressures and necessitates continuous innovation to maintain market share. Regulatory changes concerning materials and safety standards require ongoing compliance, adding to operational costs. These factors contribute to overall market volatility and require strategic adaptation by companies.

Forces Driving United States Home Office Furniture Market Growth

Key growth drivers include the sustained rise in remote and hybrid work models, amplified by ongoing technological advancements and evolving work culture preferences. Furthermore, increasing disposable incomes allow for greater investment in high-quality home office furniture, driving demand across diverse market segments. The growing adoption of e-commerce further accelerates market expansion.

Challenges in the United States Home Office Furniture Market Market

Long-term growth catalysts involve strategic partnerships and collaborations for technological advancements and market expansions. Continuous innovation in ergonomic design and smart furniture integration provides a competitive edge and strengthens market positioning. Exploring new markets and consumer segments, including expanding into niche areas of home office furniture, promises sustained growth potential.

Emerging Opportunities in United States Home Office Furniture Market

Emerging trends include a strong interest in modular and customizable furniture, allowing for flexible workspace adaptations. The increasing demand for sustainable and eco-friendly materials presents lucrative opportunities for companies emphasizing responsible sourcing and manufacturing. Moreover, the integration of advanced technology like AI-powered ergonomics and smart home integration enhances the overall value proposition of home office furniture.

Leading Players in the United States Home Office Furniture Market Sector

Key Milestones in United States Home Office Furniture Market Industry

- August 2023: Herman Miller launched the Fuld Nesting Chair, a minimalist design promoting flexible workspace configurations. This launch showcases the ongoing focus on ergonomic and adaptable furniture.

- April 2023: IKEA US launched its Business Network loyalty program, targeting small businesses and emphasizing improved workplace quality of life. This initiative reflects the growing focus on supporting the needs of remote and hybrid work environments.

Strategic Outlook for United States Home Office Furniture Market Market

The US home office furniture market displays immense growth potential, driven by persistent trends in remote and hybrid work models, evolving consumer preferences, and technological advancements. Companies that strategically invest in ergonomic designs, sustainable materials, smart furniture integration, and personalized customer experiences are poised to capture significant market share. Expansion into emerging segments, focusing on niche markets and catering to specific customer needs, presents further opportunities for sustainable growth.

United States Home Office Furniture Market Segmentation

-

1. Product

- 1.1. Seating

- 1.2. Storage Units

- 1.3. Desks and Tables

- 1.4. Other Home Office Furniture

-

2. Distribution Channel

- 2.1. Flagship Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

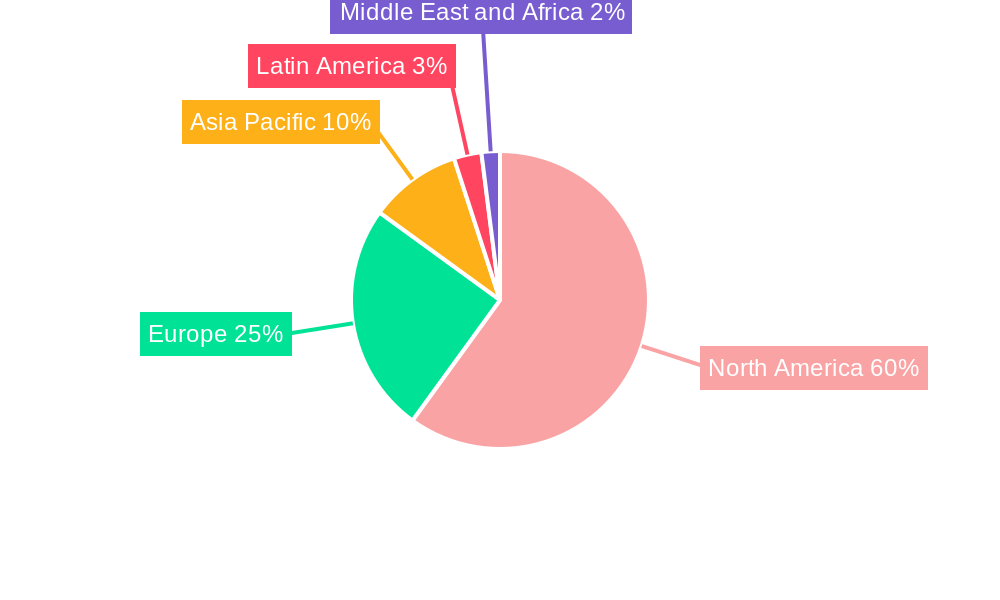

United States Home Office Furniture Market Segmentation By Geography

- 1. United States

United States Home Office Furniture Market Regional Market Share

Geographic Coverage of United States Home Office Furniture Market

United States Home Office Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tech-Integrated Furniture are Helping to Grow the Market

- 3.3. Market Restrains

- 3.3.1. Raw Material Cost Barrier to Growth

- 3.4. Market Trends

- 3.4.1. Desks and Chairs Furniture Industry Expanding Continuously

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Home Office Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Seating

- 5.1.2. Storage Units

- 5.1.3. Desks and Tables

- 5.1.4. Other Home Office Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Flagship Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Knoll Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teknion Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HNI Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haworth Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Steelcase Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ashley Home Stores Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IKEA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Krueger International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Herman Miller Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kimball International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Knoll Inc

List of Figures

- Figure 1: United States Home Office Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Home Office Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: United States Home Office Furniture Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Home Office Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: United States Home Office Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Home Office Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: United States Home Office Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Home Office Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: United States Home Office Furniture Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: United States Home Office Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: United States Home Office Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United States Home Office Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: United States Home Office Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Home Office Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Home Office Furniture Market?

The projected CAGR is approximately 5.34%.

2. Which companies are prominent players in the United States Home Office Furniture Market?

Key companies in the market include Knoll Inc, Teknion Corporation, HNI Corporation, Haworth Inc, Steelcase Inc, Ashley Home Stores Ltd, IKEA, Krueger International Inc, Herman Miller Inc, Kimball International.

3. What are the main segments of the United States Home Office Furniture Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Tech-Integrated Furniture are Helping to Grow the Market.

6. What are the notable trends driving market growth?

Desks and Chairs Furniture Industry Expanding Continuously.

7. Are there any restraints impacting market growth?

Raw Material Cost Barrier to Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Herman Miller introduced a Fuld Nesting Chair designed in collaboration with Stefan Diez's sleek, it is a minimalist design that enables flexible configurations for workspaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Home Office Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Home Office Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Home Office Furniture Market?

To stay informed about further developments, trends, and reports in the United States Home Office Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence