Key Insights

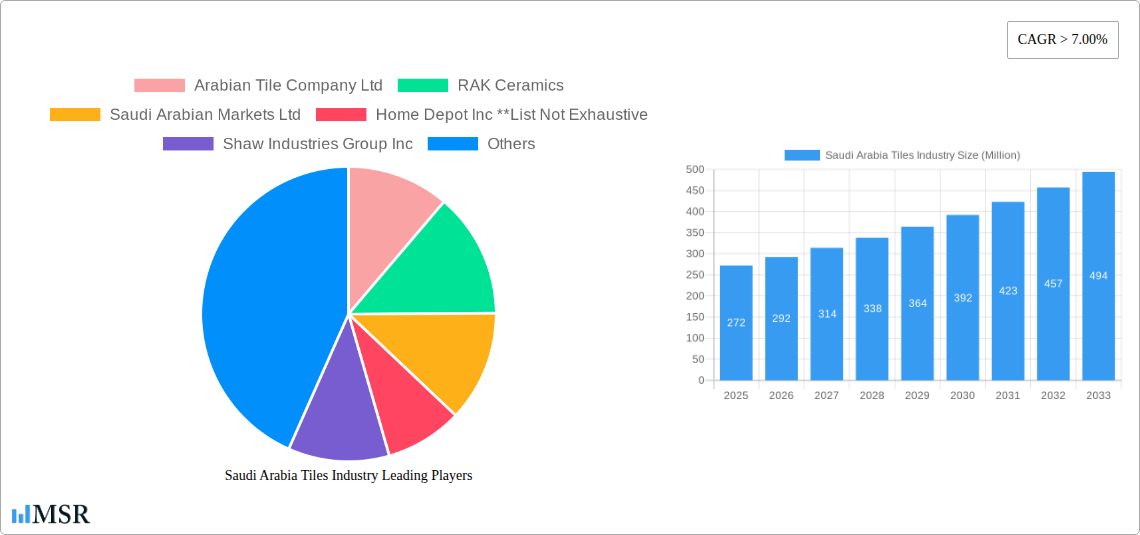

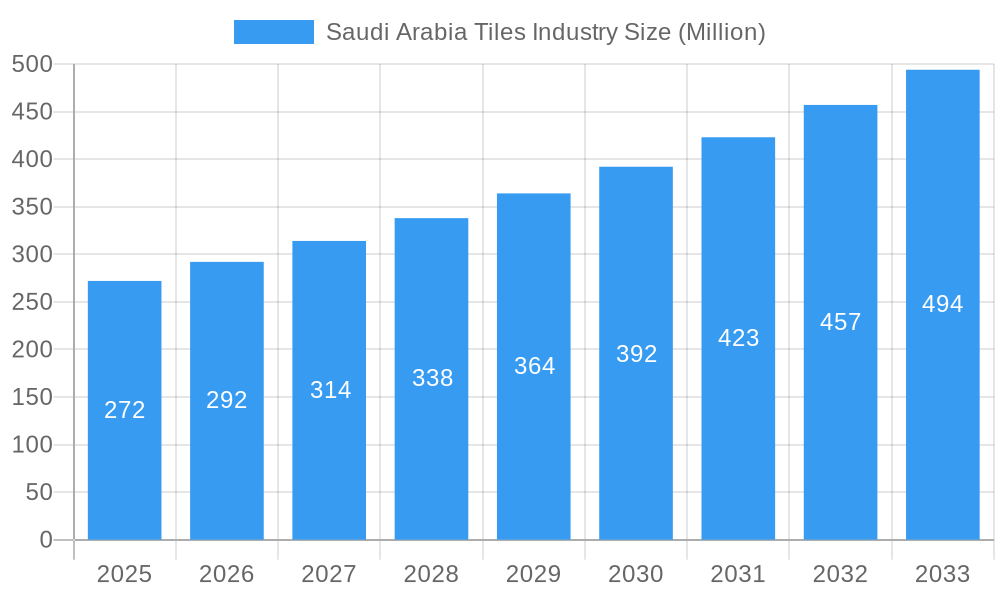

The Saudi Arabian tiles market, valued at $272 million in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 7% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant infrastructure development projects across the Kingdom, including residential and commercial construction, are driving considerable demand for tiles. Secondly, a rising preference for aesthetically pleasing and durable flooring solutions among Saudi consumers is boosting market growth. The increasing adoption of modern architectural designs also contributes to this trend. Furthermore, government initiatives aimed at boosting the construction sector further stimulate demand. The market is segmented by tile type (carpet and area rugs, non-resilient flooring, stone flooring, resilient flooring), end-user (residential, commercial, builder), and distribution channel (home centers, specialty stores, online, other). Major players like Arabian Tile Company Ltd, RAK Ceramics, and Mohawk Industries Inc. are vying for market share, leveraging diverse distribution channels to reach their target customers. While challenges like fluctuating raw material prices and competition from imported tiles exist, the overall market outlook remains positive, indicating strong growth prospects in the coming years.

Saudi Arabia Tiles Industry Market Size (In Million)

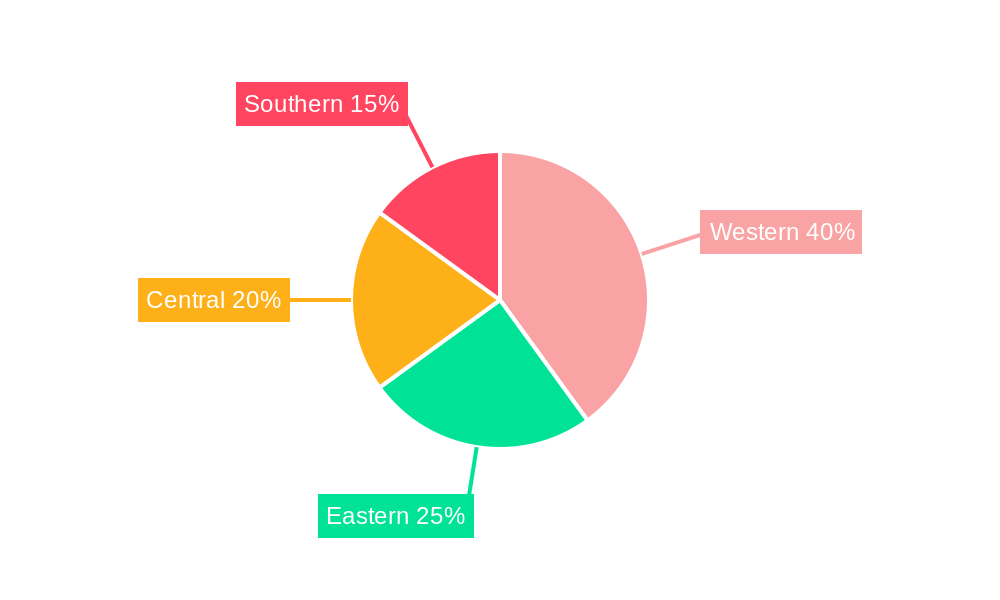

The segmentation analysis reveals that the residential segment currently holds the largest market share, driven by a growing population and rising disposable incomes. However, the commercial sector shows promising growth potential due to increasing investment in infrastructure projects such as malls, hospitals, and hotels. Online distribution channels are emerging as significant players, offering convenient access and broader reach to consumers. The geographic segmentation within Saudi Arabia, encompassing Central, Eastern, Western, and Southern regions, indicates varying growth rates depending on the level of development and construction activity within each area. The Western region, with its concentration of major cities and ongoing urbanization, is likely to experience faster growth compared to other regions. Competition is expected to intensify as both domestic and international players seek to consolidate their position in this expanding market. Strategic partnerships, product innovation, and efficient supply chain management will be crucial for achieving sustainable growth in the Saudi Arabian tiles industry.

Saudi Arabia Tiles Industry Company Market Share

Saudi Arabia Tiles Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia tiles industry, covering market dynamics, key segments, leading players, and future growth prospects. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The market size in 2025 is estimated at $XX Million. The Compound Annual Growth Rate (CAGR) for the forecast period is projected at XX%.

Saudi Arabia Tiles Industry Market Concentration & Dynamics

The Saudi Arabia tiles market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Arabian Tile Company Ltd, RAK Ceramics, and Saudi Ceramics represent key players, while other significant contributors include Mohawk Industries Inc, Shaw Industries Group Inc, and Home Depot Inc. However, a considerable number of smaller, regional players also contribute to the overall market volume. The market exhibits moderate innovation, primarily focused on improving product aesthetics, durability, and functionality. The regulatory framework is generally supportive of industry growth, although certain environmental regulations influence manufacturing practices. Substitute products, such as resilient flooring and carpet, exert competitive pressure on tile sales, primarily within the residential segment. End-user trends show a growing preference for durable, aesthetically pleasing tiles in both residential and commercial projects, driven by rising disposable incomes and construction activity. M&A activity within the period 2019-2024 saw approximately XX deals, mostly focused on consolidating distribution networks and expanding product portfolios. Market share data indicates that the top three players command approximately XX% of the total market.

Saudi Arabia Tiles Industry Industry Insights & Trends

The Saudi Arabia tiles market has experienced robust growth over the past few years, driven by several key factors. Construction activity, fueled by government infrastructure projects and a growing population, is a primary growth driver. Rising disposable incomes and increased urbanization have also boosted demand for higher-quality tiles in both residential and commercial applications. Technological advancements in tile manufacturing, including the introduction of advanced materials and digital printing technologies, have broadened product variety and enhanced aesthetic appeal. Changing consumer preferences, a shift toward larger format tiles, and the rising popularity of specific design styles contribute significantly to the growth trajectory. The market size in 2024 was approximately $XX Million, reflecting the overall growth trend. Government initiatives focused on sustainable construction practices are influencing the demand for eco-friendly tiles, presenting both opportunities and challenges for manufacturers.

Key Markets & Segments Leading Saudi Arabia Tiles Industry

The residential segment currently dominates the Saudi Arabia tiles market, accounting for approximately XX% of total market share. However, the commercial segment displays a high growth rate and is poised for significant expansion in the coming years, driven by government infrastructure projects and rising private sector investments. Within product types, resilient flooring is experiencing the highest growth, followed closely by stone flooring.

- Key Drivers for Growth:

- Rapid infrastructure development across the country.

- Robust construction activities related to residential and commercial projects.

- Rising disposable incomes in Saudi Arabia, enhancing consumer spending on home improvement.

- Government initiatives promoting sustainable construction and development.

Dominance analysis shows that the home centers distribution channel holds the largest market share, benefiting from widespread accessibility and established retail networks. However, the online channel is growing rapidly, representing an emerging segment with significant future potential. The Riyadh and Jeddah regions represent the most dominant geographical markets within Saudi Arabia.

Saudi Arabia Tiles Industry Product Developments

Recent years have witnessed significant product innovations in the Saudi Arabia tiles market. Manufacturers are increasingly focusing on developing durable, water-resistant, and aesthetically diverse tiles. Technological advancements, particularly in digital printing techniques, enable the creation of highly realistic and intricate tile designs. This allows manufacturers to cater to a wider range of consumer preferences and achieve a competitive edge in the market. The introduction of larger format tiles, particularly in stone flooring, is another noticeable trend, reflecting evolving design trends and construction practices.

Challenges in the Saudi Arabia Tiles Industry Market

The Saudi Arabia tiles market faces several challenges, including fluctuations in raw material prices, which directly impact manufacturing costs. Supply chain disruptions, particularly felt during periods of global economic uncertainty, can hinder production and distribution. Intense competition from both domestic and international players creates pressure on pricing and profitability. Regulatory compliance requirements related to environmental standards and product safety add further complexity for manufacturers. These challenges contribute to the need for efficient operations and strategic cost management.

Forces Driving Saudi Arabia Tiles Industry Growth

Several factors contribute to the long-term growth of the Saudi Arabia tiles industry. The government's Vision 2030 initiative, promoting economic diversification and infrastructure development, significantly boosts demand for construction materials. Increasing urbanization and population growth further fuel demand for housing and commercial spaces. Technological innovations in tile manufacturing processes improve efficiency, expand design possibilities, and enhance the quality of products. The growing awareness of eco-friendly materials creates opportunities for sustainable tile manufacturers.

Challenges in the Saudi Arabia Tiles Industry Market

Long-term growth hinges on addressing key challenges. The industry must adapt to fluctuating raw material prices and develop strategies to mitigate supply chain risks. Continuous investment in research and development is critical to innovating and developing new product offerings that meet evolving consumer demands. Sustainable manufacturing practices will play a crucial role in securing the industry’s long-term success. Strategic collaborations and partnerships will also be beneficial in navigating challenges and capitalizing on growth opportunities.

Emerging Opportunities in Saudi Arabia Tiles Industry

Emerging trends point toward significant opportunities. The rising demand for sustainable and eco-friendly tiles presents a lucrative market segment. The increasing popularity of large-format tiles and customized designs offers manufacturers the chance to expand their product portfolios. Expanding into new geographical markets within Saudi Arabia and exploring export potential to neighboring countries are promising avenues for growth. Focus on digital marketing and e-commerce platforms can provide access to a wider consumer base.

Leading Players in the Saudi Arabia Tiles Industry Sector

- Arabian Tile Company Ltd

- RAK Ceramics

- Saudi Arabian Markets Ltd

- Home Depot Inc

- Shaw Industries Group Inc

- Saudi Ceramics

- Mohawk Industries Inc

- Prime Floor KSA

- Armstrong Flooring

- Saudi Industrial Flooring Co

- Khalid Saad

- Gerflor Group

Key Milestones in Saudi Arabia Tiles Industry Industry

- June 2023: Saudi Ceramics expands its sales channels domestically and internationally, establishing 50 showrooms and exporting to over 80 countries. This significantly boosts market reach and brand visibility.

- April 2023: Surya's acquisition of Global Views expands its presence in the upscale home décor market, impacting the overall demand for high-end tiles.

Strategic Outlook for Saudi Arabia Tiles Industry Market

The Saudi Arabia tiles market presents strong long-term growth potential, driven by ongoing construction activity, rising consumer spending, and government support. Strategic focus on product innovation, sustainable manufacturing, and effective distribution strategies will be vital for success. Companies that successfully adapt to evolving consumer preferences and effectively leverage technological advancements will be best positioned to capitalize on this dynamic market’s opportunities. Further expansion into the e-commerce space and targeted marketing efforts are crucial in reaching a wider customer base.

Saudi Arabia Tiles Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Tiles Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Tiles Industry Regional Market Share

Geographic Coverage of Saudi Arabia Tiles Industry

Saudi Arabia Tiles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Construction Sector is Driving the Market; Rapid Industrialization and Commercial Expansion

- 3.3. Market Restrains

- 3.3.1. Cost Sensitivity and Economic Volatility; Violatile Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Rise in Construction Activities Propelling Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arabian Tile Company Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RAK Ceramics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saudi Arabian Markets Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Home Depot Inc **List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shaw Industries Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Ceramics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mohawk Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Prime Floor KSA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Armstrong Flooring

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saudi Industrial Flooring Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Khalid Saad

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gerflor Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Arabian Tile Company Ltd

List of Figures

- Figure 1: Saudi Arabia Tiles Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Tiles Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Tiles Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Saudi Arabia Tiles Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Saudi Arabia Tiles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Saudi Arabia Tiles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Saudi Arabia Tiles Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Saudi Arabia Tiles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Tiles Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Saudi Arabia Tiles Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Saudi Arabia Tiles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Saudi Arabia Tiles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Saudi Arabia Tiles Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Saudi Arabia Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Tiles Industry?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Saudi Arabia Tiles Industry?

Key companies in the market include Arabian Tile Company Ltd, RAK Ceramics, Saudi Arabian Markets Ltd, Home Depot Inc **List Not Exhaustive, Shaw Industries Group Inc, Saudi Ceramics, Mohawk Industries Inc, Prime Floor KSA, Armstrong Flooring, Saudi Industrial Flooring Co, Khalid Saad, Gerflor Group.

3. What are the main segments of the Saudi Arabia Tiles Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 272 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Construction Sector is Driving the Market; Rapid Industrialization and Commercial Expansion.

6. What are the notable trends driving market growth?

Rise in Construction Activities Propelling Growth.

7. Are there any restraints impacting market growth?

Cost Sensitivity and Economic Volatility; Violatile Raw Material Prices.

8. Can you provide examples of recent developments in the market?

June 2023: Saudi Ceramics broadened its sales channels both domestically and internationally. With a network of 50 showrooms, the company established a strong presence within the country. It successfully exported products to over 80 countries worldwide, further expanding its global reach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Tiles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Tiles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Tiles Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Tiles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence