Key Insights

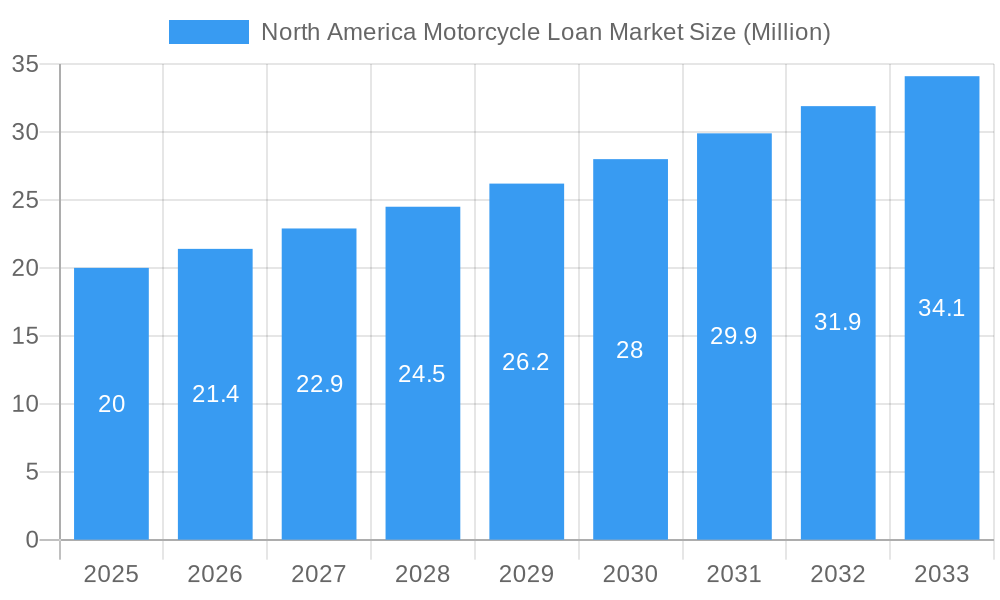

The North American motorcycle loan market, valued at $20 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing popularity of motorcycles as a preferred mode of transportation and leisure activity, particularly among younger demographics, is boosting demand. Secondly, favorable financing options offered by banks, Non-Banking Financial Companies (NBFCs), Original Equipment Manufacturers (OEMs), and fintech companies are making motorcycle ownership more accessible. The market is segmented by loan provider type, percentage of sanctioned amount, loan tenure, and geographic location within North America (USA, Canada, and Rest of North America). Competition is intense, with established players like Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, and Ally Financial Inc. vying for market share alongside other significant banks and emerging fintech lenders. The increasing penetration of digital lending platforms and streamlined application processes further contribute to market growth. However, factors like economic downturns and fluctuations in interest rates could potentially restrain market expansion. Longer-term loans (3-5 years and more than 5 years) are likely to witness higher growth due to affordability concerns. The US market is expected to dominate, given its larger motorcycle ownership base and developed financial sector.

North America Motorcycle Loan Market Market Size (In Million)

The segmentation of the market reveals crucial insights. The 'More than 75%' sanctioned amount segment likely indicates higher-value motorcycles, potentially attracting specialized financing options and contributing significantly to the overall market value. The breakdown by loan tenure provides understanding of consumer preferences and risk appetite. Analyzing the performance across different regions within North America—USA, Canada, and Rest of North America—will pinpoint growth hotspots and inform strategic market entry decisions. Understanding the competitive landscape among banks, NBFCs, OEMs, and fintechs is vital for businesses seeking to establish or expand their presence within this dynamic market. Future research should focus on analyzing consumer behavior, technological advancements in lending platforms, and the impact of regulatory changes on the market's trajectory.

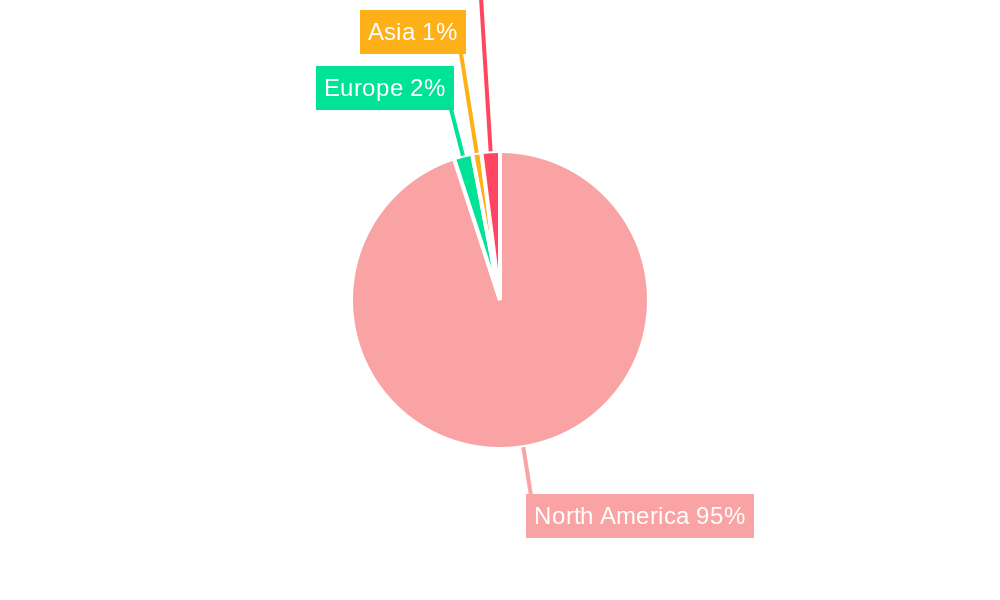

North America Motorcycle Loan Market Company Market Share

North America Motorcycle Loan Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America motorcycle loan market, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report delves into market segmentation by provider type (Banks, NBFCs, OEMs, Fintechs), loan amount sanctioned (Less than 25%, 25-50%, 51-75%, More than 75%), loan tenure (Less than 3 Years, 3-5 Years, More than 5 Years), and country (USA, Canada, Rest of North America). Key players analyzed include Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, Ally Financial Inc, JPMorgan Chase, Honda Financial Services, Bank of America Corporation, Wells Fargo, TD Bank, Yamaha Motor Finance Corporation, Mountain America Credit Union, and others. This in-depth study provides actionable insights for stakeholders, investors, and industry professionals seeking to navigate this dynamic market.

North America Motorcycle Loan Market Concentration & Dynamics

The North American motorcycle loan market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the rise of fintech companies and increased competition from traditional banks and NBFCs are shaping the competitive dynamics. The market is influenced by various factors, including:

Market Share: While precise market share data for individual players is proprietary, Harley-Davidson Financial Services, Ally Financial, and JPMorgan Chase are anticipated to hold leading positions based on their extensive lending networks and brand recognition. OEM financing arms like Honda Financial Services and Kawasaki Motors Finance Corporation also hold substantial shares within their respective brands' customer bases. NBFCs and smaller regional banks are also playing a role in niche segments.

Innovation Ecosystems: The increasing adoption of digital lending platforms and technological advancements in risk assessment are driving innovation within the market. Fintech companies are introducing disruptive solutions, challenging established players.

Regulatory Frameworks: Compliance with lending regulations and consumer protection laws plays a crucial role in the market's operational dynamics. Changes in regulations can significantly impact lending practices and the overall market size.

Substitute Products: Alternative financing options, such as leasing or personal loans, pose some level of competition. However, the specialized nature of motorcycle financing, particularly for larger or more specialized vehicles, limits the impact of substitutes.

End-User Trends: The growing popularity of motorcycles, particularly among younger demographics, is a key market driver. Changing consumer preferences toward specific motorcycle types (e.g., adventure bikes, electric motorcycles) influence loan demand.

M&A Activities: The number of significant M&A deals in this sector is relatively low, but strategic acquisitions by larger financial institutions could reshape the market's competitive landscape in the coming years. We estimate approximately xx M&A deals occurred in the historical period (2019-2024).

North America Motorcycle Loan Market Industry Insights & Trends

The North America motorcycle loan market is experiencing steady growth, driven by a resurgence in motorcycle popularity, particularly among younger riders. The market size in 2024 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033, reaching an estimated $xx Million by 2033. This growth is fuelled by:

Increased Motorcycle Sales: Rising disposable incomes and a preference for personalized transportation experiences are driving sales of both new and used motorcycles.

Favorable Economic Conditions: Periods of economic stability and growth generally translate into increased consumer spending on discretionary items like motorcycles and associated financing.

Technological Advancements: The introduction of electric motorcycles and advanced motorcycle technologies is fostering innovation and attracting new segments of buyers.

Evolving Consumer Behavior: Online lending platforms and digital financing options are becoming increasingly popular, enhancing convenience and accessibility for borrowers. Consumers are also increasingly prioritizing personalized financial services and flexible repayment options.

Marketing and Promotional Strategies: OEMs and financial institutions are utilizing innovative marketing strategies to attract new customers and promote motorcycle financing options.

Key Markets & Segments Leading North America Motorcycle Loan Market

The United States dominates the North American motorcycle loan market, accounting for approximately xx% of the total market value. Canada contributes a significant share as well, while the “Rest of North America” segment remains comparatively smaller.

Key Market Drivers:

Economic Growth: Strong economic growth in the US and Canada directly impacts consumer spending on discretionary purchases like motorcycles.

Infrastructure Development: Improved road infrastructure and designated motorcycle lanes encourage motorcycle usage.

Tourism and Leisure Activities: Motorcycling is a popular leisure activity, particularly in areas with scenic routes.

Dominant Segments:

By Provider Type: Banks and OEM financing arms currently hold the largest market share, leveraging their established networks and brand loyalty. However, NBFCs and fintech companies are expected to gain traction over the forecast period.

By Percentage of Amount Sanctioned: The 25-50% and 51-75% segments are likely the most dominant due to the balance between affordability and financing needs.

By Tenure: Loans with tenures of 3-5 years are anticipated to dominate, offering a balance between affordability and manageable repayment schedules.

North America Motorcycle Loan Market Product Developments

Recent developments in the market include the integration of digital lending platforms, the use of advanced data analytics for credit scoring, and the emergence of specialized financing options for electric motorcycles. These innovations are streamlining the lending process, improving risk assessment, and catering to the growing demand for eco-friendly transportation options. Companies are also offering bundled financing options to incorporate insurance and maintenance into the loan package.

Challenges in the North America Motorcycle Loan Market Market

The market faces challenges such as fluctuations in interest rates, potential economic downturns impacting consumer spending, and intense competition among lenders. Regulatory changes could also introduce compliance costs and alter lending practices. Supply chain disruptions in the motorcycle industry may indirectly affect the loan market by influencing vehicle availability and price fluctuations. These factors could lead to a xx% reduction in the market growth rate in certain periods if not managed effectively.

Forces Driving North America Motorcycle Loan Market Growth

Technological advancements, specifically in digital lending and risk assessment, are driving market growth by enhancing efficiency and accessibility. Government initiatives supporting the motorcycle industry could boost sales and financing needs. Economic growth fuels consumer confidence, leading to increased demand for recreational vehicles, including motorcycles. The growing popularity of electric motorcycles creates new market segments and opportunities for specialized financing.

Challenges in the North America Motorcycle Loan Market Market (Long-term Growth Catalysts)

Long-term growth will depend on strategic partnerships between financial institutions and motorcycle manufacturers, leading to innovative financing packages. Expansion into new market segments, such as electric motorcycle financing, can broaden the market base. Continual technological advancements in the lending process will ensure competitiveness and efficiency.

Emerging Opportunities in North America Motorcycle Loan Market

The increasing adoption of electric motorcycles creates an opportunity for specialized financing products tailored to their unique characteristics. Expansion into underserved markets through strategic partnerships with regional banks and credit unions can tap into untapped consumer segments. Offering flexible and personalized financing solutions, such as balloon payments or extended repayment periods, can attract a broader customer base.

Leading Players in the North America Motorcycle Loan Market Sector

- Harley-Davidson Financial Services

- Kawasaki Motors Finance Corporation

- Ally Financial Inc

- JPMorgan Chase

- Honda Financial Services

- Bank of America Corporation

- Wells Fargo

- TD Bank

- Yamaha Motor Finance Corporation

- Mountain America Credit Union

Key Milestones in North America Motorcycle Loan Market Industry

- April 2022: Harley-Davidson raised USD 550 Million in ABS, highlighting the significant capital invested in motorcycle financing.

- June 2023: Stark Future secured a €20 Million loan to boost motocross bike production, showcasing the investment in the industry's growth.

Strategic Outlook for North America Motorcycle Loan Market Market

The North American motorcycle loan market holds significant potential for growth, driven by technological advancements, expanding consumer demand, and the emergence of new market segments like electric motorcycles. Strategic partnerships, innovative product offerings, and a focus on digitalization will be crucial for success in this competitive landscape. Expanding into niche markets and offering personalized financial services are essential for capitalizing on the long-term growth opportunities.

North America Motorcycle Loan Market Segmentation

-

1. Provider Type

- 1.1. Banks

- 1.2. NBFCs (Non-Banking Financial Services)

- 1.3. OEM (Original Equipment Manufacturer)

- 1.4. Others (Fintech Companies)

-

2. Percentage of Amount Sanctioned

- 2.1. Less than 25%

- 2.2. 25-50%

- 2.3. 51-75%

- 2.4. More than 75%

-

3. Tenure

- 3.1. Less than 3 Years

- 3.2. 3-5 Years

- 3.3. More than 5 Years

North America Motorcycle Loan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Motorcycle Loan Market Regional Market Share

Geographic Coverage of North America Motorcycle Loan Market

North America Motorcycle Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Banks are the Major Source for Financing in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Banks

- 5.1.2. NBFCs (Non-Banking Financial Services)

- 5.1.3. OEM (Original Equipment Manufacturer)

- 5.1.4. Others (Fintech Companies)

- 5.2. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 5.2.1. Less than 25%

- 5.2.2. 25-50%

- 5.2.3. 51-75%

- 5.2.4. More than 75%

- 5.3. Market Analysis, Insights and Forecast - by Tenure

- 5.3.1. Less than 3 Years

- 5.3.2. 3-5 Years

- 5.3.3. More than 5 Years

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Harley-Davidson Financial Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kawasaki Motors Finance Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ally Financial Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JPMorgan Chase

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honda Financial Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank of American Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wells Fargo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TD Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamaha motor finance corporation **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mountain America Credit Union

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Harley-Davidson Financial Services

List of Figures

- Figure 1: North America Motorcycle Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Motorcycle Loan Market Share (%) by Company 2025

List of Tables

- Table 1: North America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 2: North America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 3: North America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 4: North America Motorcycle Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 6: North America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 7: North America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 8: North America Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Motorcycle Loan Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the North America Motorcycle Loan Market?

Key companies in the market include Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, Ally Financial Inc, JPMorgan Chase, Honda Financial Services, Bank of American Corporation, Wells Fargo, TD Bank, Yamaha motor finance corporation **List Not Exhaustive, Mountain America Credit Union.

3. What are the main segments of the North America Motorcycle Loan Market?

The market segments include Provider Type, Percentage of Amount Sanctioned, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Banks are the Major Source for Financing in United States.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

June 2023: Barcelona-based Stark Future bags €20M loan to scale up production of powerful motocross bike.it has signed a €20M loan agreement with Banco Santander.The funding will enable Stark Future to scale up its production capabilities, streamline manufacturing processes, and bolster research and development efforts related to the Stark VARG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Motorcycle Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Motorcycle Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Motorcycle Loan Market?

To stay informed about further developments, trends, and reports in the North America Motorcycle Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence