Key Insights

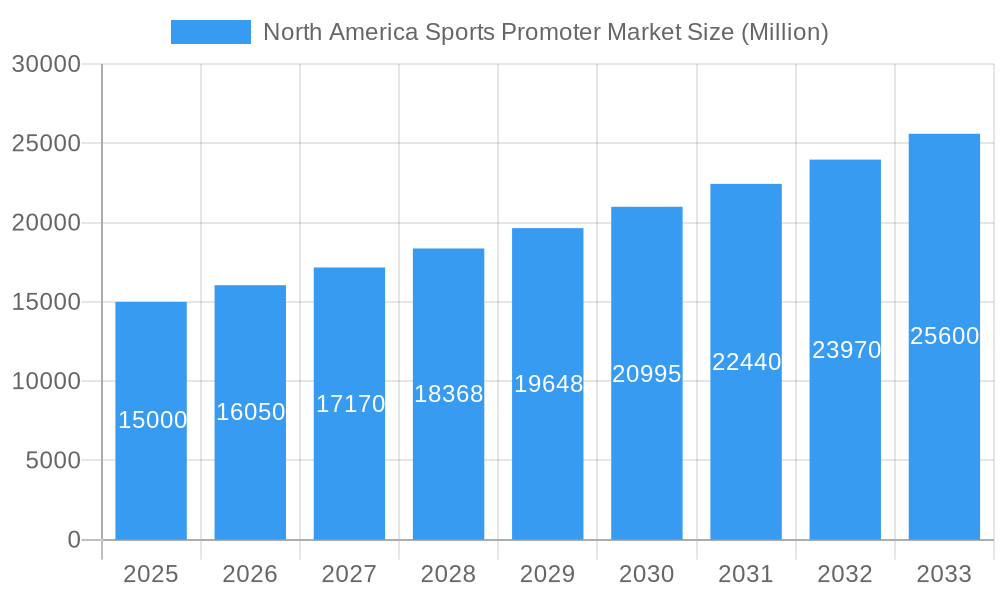

The North American sports promoter market is poised for significant expansion, driven by increasing media exposure and the growing popularity of fantasy and esports. This dynamic sector is projected to reach a market size of $9.5 billion by 2025, with a projected compound annual growth rate (CAGR) of 6.5% from 2025-2033. Enhanced media coverage across streaming services and social platforms is broadening audience reach and amplifying sponsorship potential. Key industry leaders, including USA Football, MLB, NBA, and prominent agencies like Wasserman and CAA, highlight the market's competitive landscape. Strategic collaborations among promoters, leagues, brands, and media entities are fostering innovative campaigns, elevating fan experiences, and boosting revenue streams. The adoption of data analytics further refines marketing strategies, optimizing return on investment for promoters.

North America Sports Promoter Market Market Size (In Billion)

Despite strong growth prospects, the market contends with challenges such as rising talent acquisition costs and increasing competition for premium advertising space. Sustained innovation and strategic alliances are crucial for promoters to maintain their competitive advantage. Economic fluctuations can also influence sponsorship activities and overall market performance. While established players contribute to market stability, emerging promoters must strategically differentiate themselves. Market segmentation by sport, promotional type, and target audience reveals diverse opportunities for niche growth. The forecast period offers substantial potential, particularly with the ongoing integration of new technologies and evolving fan engagement strategies.

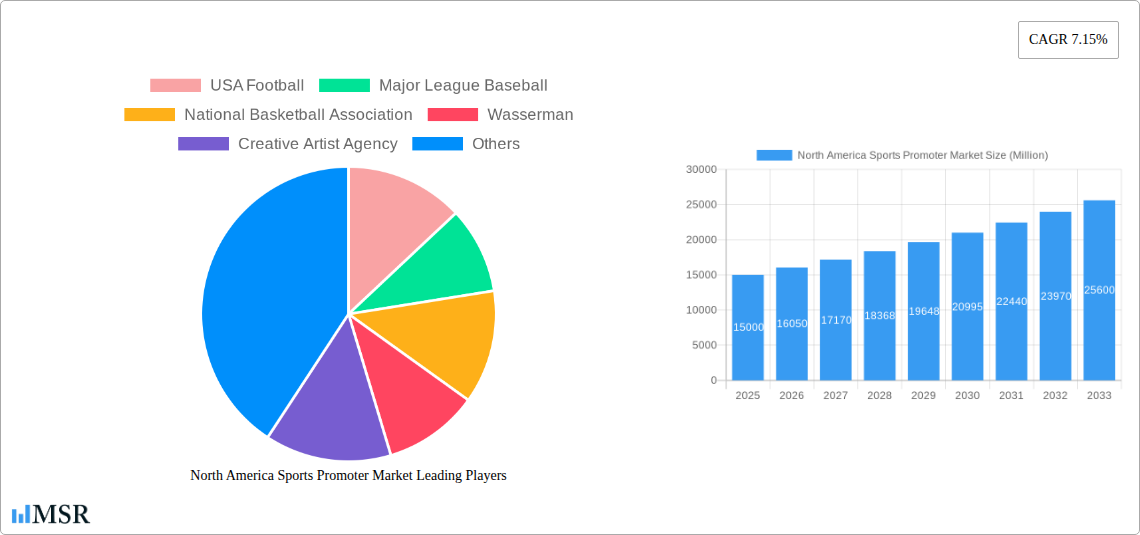

North America Sports Promoter Market Company Market Share

North America Sports Promoter Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America sports promoter market, encompassing historical data (2019-2024), the current state (2025), and future projections (2025-2033). The study covers key market dynamics, leading players, emerging trends, and strategic opportunities, equipping stakeholders with actionable insights for informed decision-making. With a market size estimated at $xx Million in 2025, and a projected CAGR of xx% during the forecast period, understanding the competitive landscape and growth drivers is critical.

North America Sports Promoter Market Concentration & Dynamics

The North America sports promoter market exhibits a moderately concentrated structure, with a few major players holding significant market share. Companies like Major League Baseball, National Basketball Association, USA Football, Wasserman, Creative Artist Agency, Nike, ESPN, Adidas, Under Armour, and Fanatics dominate the landscape. However, the market also accommodates numerous smaller, specialized agencies.

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, indicating a dynamic and consolidating market. This activity is expected to continue, driven by the need for scale and diversification.

- Innovation Ecosystems: The market is characterized by strong innovation, fueled by technological advancements in data analytics, digital marketing, and fan engagement strategies.

- Regulatory Framework: The regulatory landscape is relatively stable but subject to evolving privacy and antitrust concerns.

- Substitute Products/Services: Limited direct substitutes exist, but alternative marketing channels and sponsorship opportunities present indirect competition.

- End-User Trends: The increasing demand for personalized experiences, digital engagement, and experiential marketing significantly influences market growth.

North America Sports Promoter Market Industry Insights & Trends

The North America sports promoter market is experiencing robust growth, propelled by several key factors. The rising popularity of various sports, coupled with increased media consumption and investment in sports broadcasting rights, are major drivers. Technological advancements, such as immersive fan experiences through virtual and augmented reality, are revolutionizing fan engagement. Changing consumer behavior, with a heightened preference for personalized and digital content, further fuels market expansion. The market size is estimated at $xx Million in 2025, demonstrating significant growth from $xx Million in 2019. This growth trajectory is projected to continue, with a CAGR of xx% from 2025 to 2033. The increasing investment by corporations in sports sponsorships and the rise of esports also contribute significantly to market expansion. Technological disruptions, such as the increasing use of data analytics for targeted marketing and personalized fan experiences, are transforming the industry.

Key Markets & Segments Leading North America Sports Promoter Market

The United States represents the dominant market within North America, accounting for approximately xx% of the total market value in 2025. This dominance stems from several factors:

- Strong Sports Culture: A deeply ingrained sports culture fuels high participation rates and viewership, creating lucrative promotional opportunities.

- High Disposable Income: A high per capita disposable income allows for substantial spending on sports entertainment and related services.

- Advanced Infrastructure: Extensive and well-developed sports infrastructure (stadiums, arenas, media networks) facilitates large-scale promotional events.

- Media Consumption: High media consumption rates, including digital and traditional platforms, provide extensive reach for promotional campaigns.

Canada represents a secondary but growing market, driven by its robust sporting community and increasing disposable incomes. The market segmentation primarily includes professional sports leagues, collegiate sports, and individual athletes, each with varying promotional needs and strategies.

North America Sports Promoter Market Product Developments

Recent product developments focus on leveraging technology to enhance fan engagement and create personalized experiences. These include the use of AI-powered data analytics for targeted advertising, mobile applications providing personalized content and ticketing, and the development of interactive digital platforms fostering community building among fans. Such innovations offer significant competitive advantages, particularly for companies capable of integrating these technologies seamlessly into their promotional strategies.

Challenges in the North America Sports Promoter Market Market

The market faces several challenges, including increasing competition, rising costs of acquiring broadcasting rights, and the evolving regulatory landscape. Maintaining brand loyalty in an increasingly fragmented media environment poses a significant hurdle, as does the need for continuous innovation to meet evolving consumer expectations. These issues, combined with potential economic downturns, could impact market growth in the future. Furthermore, securing and retaining talent within the promotion sector is becoming increasingly competitive.

Forces Driving North America Sports Promoter Market Growth

Several factors are driving market growth. These include the rise of digital platforms, increased media rights revenue, and the expanding reach of social media. The increasing investment by corporations in sponsorships, particularly from global brands seeking to tap into diverse fan bases, is also a substantial catalyst for growth. Favorable regulatory environments in certain regions further facilitate market expansion.

Long-Term Growth Catalysts in the North America Sports Promoter Market

Long-term growth will be fueled by continued innovation in fan engagement technology, strategic partnerships, and international market expansion. The adoption of new technologies, such as virtual and augmented reality, offers significant potential for enhancing the fan experience and opening up new revenue streams. Strategic alliances with technology companies and media giants will further fuel growth.

Emerging Opportunities in North America Sports Promoter Market

Emerging opportunities include expanding into niche sports, leveraging esports, and developing sustainable promotional practices. The growing popularity of esports creates substantial opportunities for promoters, while the increasing focus on sustainability presents a pathway for differentiation and enhanced brand image. Exploring new markets within and beyond North America presents a crucial avenue for growth.

Leading Players in the North America Sports Promoter Market Sector

- USA Football

- Major League Baseball

- National Basketball Association

- Wasserman

- Creative Artist Agency

- Nike

- ESPN

- Adidas

- Under Armour

- Fanatics

- (List Not Exhaustive)

Key Milestones in North America Sports Promoter Market Industry

- August 2023: FOX Sports secured US broadcasting rights for the Saudi Pro League, significantly impacting the US sports media landscape and creating new revenue opportunities for involved parties.

- July 2023: AT&T's multiyear sponsorship extension with Major League Soccer, FMF, and Leagues Cup underscores the enduring value of strategic partnerships in the sports promotion sector. This demonstrates the continued strong interest from large corporations in investing in sports-related sponsorships and the potential for substantial growth within the market.

Strategic Outlook for North America Sports Promoter Market Market

The North America sports promoter market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and strategic partnerships. Companies that effectively leverage data analytics, personalized marketing, and innovative fan engagement strategies will be best positioned to capitalize on future opportunities. The market's long-term potential remains significant, particularly for those companies that can adapt to the dynamic nature of the industry and cultivate strong relationships with their clients.

North America Sports Promoter Market Segmentation

-

1. type

- 1.1. Football

- 1.2. Basketball

- 1.3. Baseball

- 1.4. Hockey

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

-

3. End User

- 3.1. Individual

- 3.2. Companies

North America Sports Promoter Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

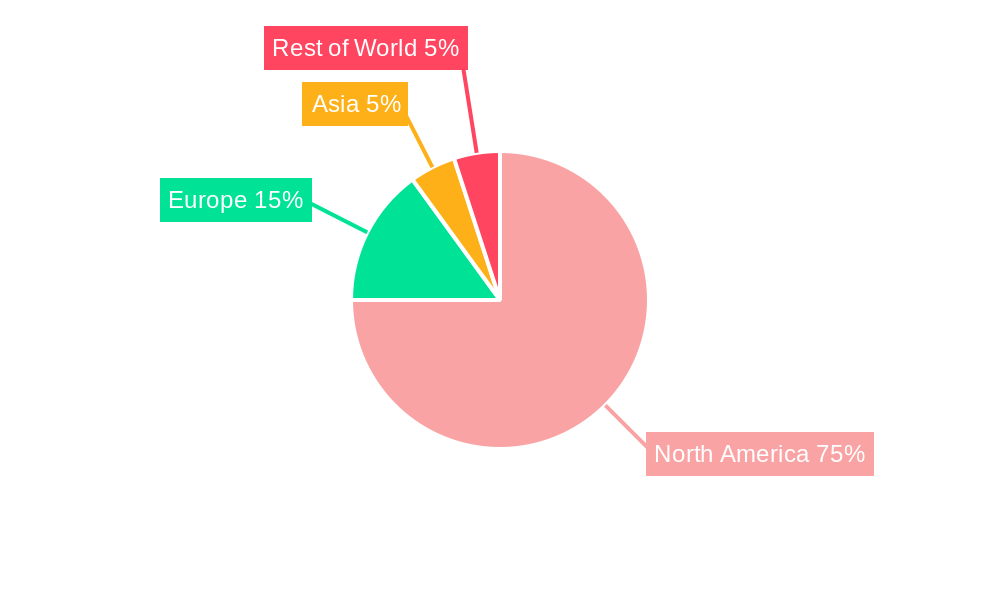

North America Sports Promoter Market Regional Market Share

Geographic Coverage of North America Sports Promoter Market

North America Sports Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues

- 3.3. Market Restrains

- 3.3.1. Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues

- 3.4. Market Trends

- 3.4.1. Increasing Number Of Digital Channels Raising Market Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sports Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by type

- 5.1.1. Football

- 5.1.2. Basketball

- 5.1.3. Baseball

- 5.1.4. Hockey

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Individual

- 5.3.2. Companies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 USA Football

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Major League Baseball

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Basketball Association

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wasserman

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Creative Artist Agency

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nike

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ESPN

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adidas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Under Armour

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fanatics**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 USA Football

List of Figures

- Figure 1: North America Sports Promoter Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Sports Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sports Promoter Market Revenue billion Forecast, by type 2020 & 2033

- Table 2: North America Sports Promoter Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: North America Sports Promoter Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: North America Sports Promoter Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Sports Promoter Market Revenue billion Forecast, by type 2020 & 2033

- Table 6: North America Sports Promoter Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 7: North America Sports Promoter Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: North America Sports Promoter Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Sports Promoter Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Sports Promoter Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Sports Promoter Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sports Promoter Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the North America Sports Promoter Market?

Key companies in the market include USA Football, Major League Baseball, National Basketball Association, Wasserman, Creative Artist Agency, Nike, ESPN, Adidas, Under Armour, Fanatics**List Not Exhaustive.

3. What are the main segments of the North America Sports Promoter Market?

The market segments include type, Revenue Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues.

6. What are the notable trends driving market growth?

Increasing Number Of Digital Channels Raising Market Size.

7. Are there any restraints impacting market growth?

Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues.

8. Can you provide examples of recent developments in the market?

August 2023: FOX Sports successfully secured the US broadcasting rights for the Saudi Pro League; with this deal, FOX Sports will likely be the official broadcaster of the Saudi Pro League in the United States for the entirety of the season, with rights ending in May 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sports Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sports Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sports Promoter Market?

To stay informed about further developments, trends, and reports in the North America Sports Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence