Key Insights

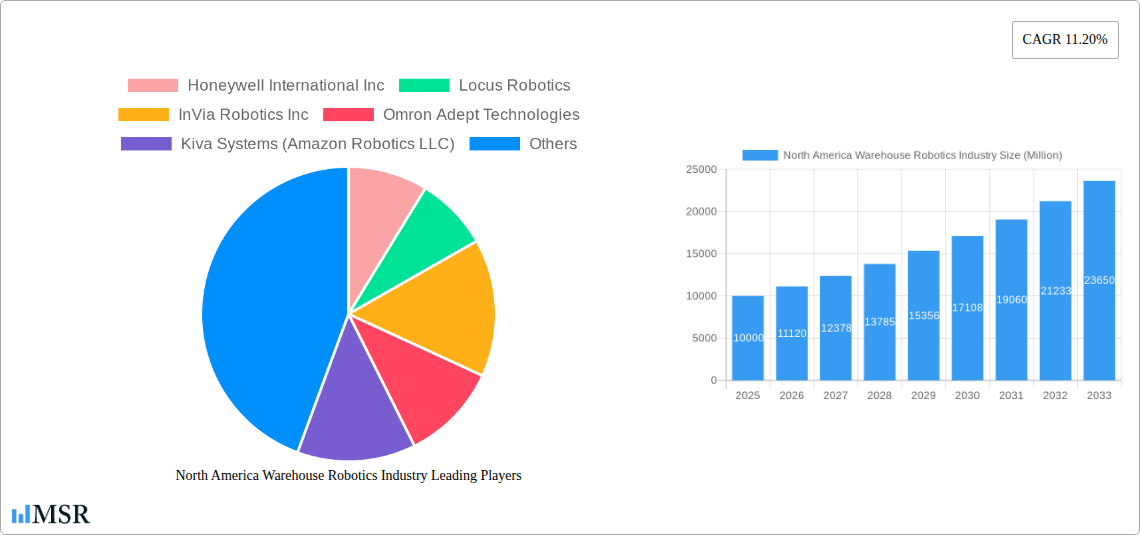

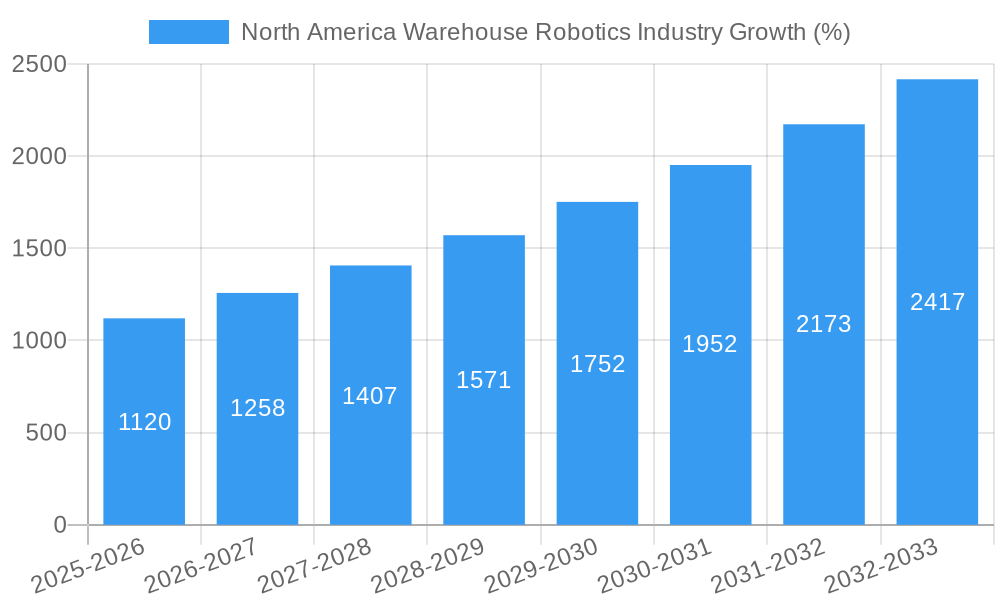

The North American warehouse robotics market, valued at approximately $X billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.2% from 2025 to 2033. This surge is driven by several key factors. E-commerce's relentless expansion necessitates faster order fulfillment, pushing businesses to automate warehousing operations. Simultaneously, labor shortages and rising wages incentivize companies to adopt robotic solutions for tasks like picking, packing, and sorting. Furthermore, technological advancements in areas such as artificial intelligence (AI), computer vision, and machine learning are enabling more sophisticated and efficient robotic systems, further fueling market growth. The integration of warehouse management systems (WMS) with robotic systems enhances overall operational efficiency and data-driven decision-making, adding to the appeal of warehouse automation.

Within the North American market, segments like automated storage and retrieval systems (ASRS), mobile robots (AGVs and AMRs), and sortation systems are exhibiting particularly strong growth. The food and beverage, automotive, and e-commerce sectors are leading adopters, reflecting their high-volume operations and demand for speed and accuracy. While initial investments in robotic systems can be substantial, the long-term return on investment (ROI) through increased productivity, reduced labor costs, and minimized errors is a compelling driver for adoption. However, challenges remain, including the need for skilled labor to integrate and maintain these systems, alongside concerns about potential job displacement and the complexities of integrating new technologies into existing infrastructure. Nonetheless, the overall market trajectory points towards continued expansion, particularly as technological advancements continue to address existing limitations and enhance the overall efficiency and affordability of warehouse robotics.

North America Warehouse Robotics Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the North America warehouse robotics industry, offering invaluable insights for stakeholders across the supply chain. Covering the period from 2019 to 2033, with a base year of 2025, this study forecasts market trends and identifies key opportunities for growth. The report meticulously examines market concentration, technological advancements, key players, and emerging trends, providing a clear roadmap for navigating this dynamic sector. Key segments analyzed include industrial robots, sortation systems, conveyors, palletizers, ASRS, mobile robots (AGVs and AMRs), and applications across food & beverage, automotive, retail, electronics, and pharmaceuticals in the United States and Canada. The report's detailed analysis of market size (reaching xx Million by 2033), CAGR, and market share helps businesses make informed strategic decisions.

North America Warehouse Robotics Industry Market Concentration & Dynamics

The North American warehouse robotics market exhibits a moderately concentrated landscape, with key players like Honeywell International Inc, Locus Robotics, InVia Robotics Inc, Omron Adept Technologies, Kiva Systems (Amazon Robotics LLC), and Fetch Robotics Inc holding significant market share. However, the presence of numerous smaller players and startups indicates a competitive environment. The market's dynamics are shaped by several factors:

- Innovation Ecosystems: Robust R&D efforts and collaborations between robotics companies, technology providers, and end-users fuel innovation in automation technologies.

- Regulatory Frameworks: Regulations related to workplace safety and data privacy influence the adoption and deployment of warehouse robots.

- Substitute Products: Traditional manual labor remains a competing solution, although its cost-effectiveness is increasingly challenged by automation's efficiency gains.

- End-User Trends: E-commerce growth and the rising demand for faster delivery times drive the adoption of automation solutions.

- M&A Activities: Consolidation through mergers and acquisitions is expected to continue, leading to a more concentrated market. Between 2019 and 2024, approximately xx M&A deals occurred, resulting in a xx% increase in market concentration.

North America Warehouse Robotics Industry Industry Insights & Trends

The North American warehouse robotics market is experiencing significant growth, driven by several key factors. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This growth is fueled by several factors:

The increasing adoption of e-commerce and the need for faster and more efficient order fulfillment are significant drivers. Rising labor costs and the shortage of skilled warehouse workers further incentivize automation. Technological advancements such as AI, machine learning, and improved sensor technologies enhance robotic capabilities, leading to increased efficiency and accuracy. Consumer demand for faster delivery times and same-day delivery options also fuels the demand for automated warehouse solutions. Furthermore, the increasing focus on optimizing supply chain operations and reducing operational costs pushes companies to invest in warehouse robotics. The ongoing advancements in mobile robotics (AMRs and AGVs) are particularly impactful.

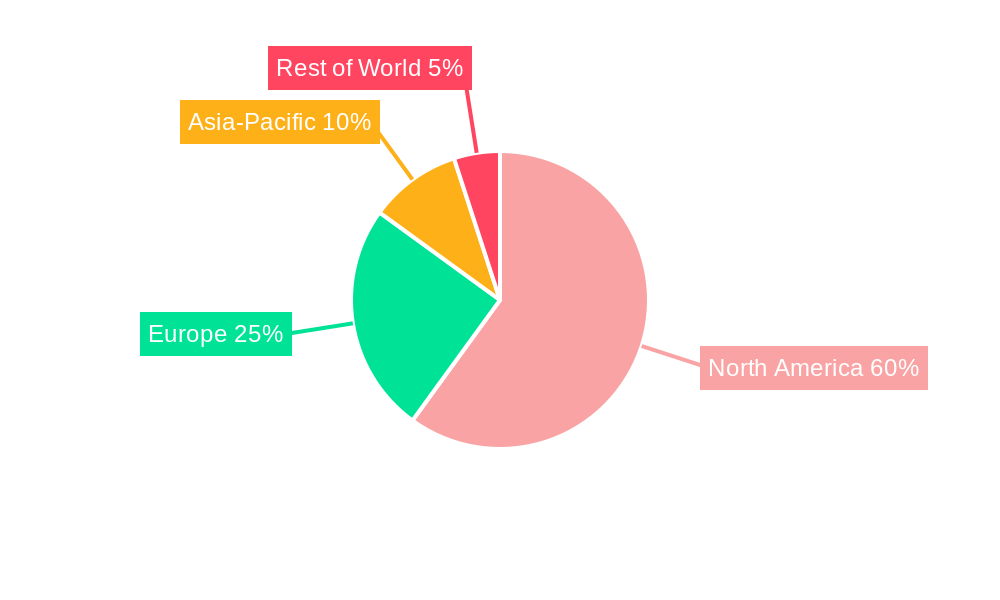

Key Markets & Segments Leading North America Warehouse Robotics Industry

The United States dominates the North American warehouse robotics market, accounting for the largest share of revenue. This is driven by factors including:

- Economic Growth: Strong economic growth in the US fuels investments in automation technologies.

- Advanced Infrastructure: Well-developed logistics and transportation infrastructure supports the seamless integration of warehouse robotics.

- High Technological Adoption: The US is a leader in technology adoption, fostering the widespread implementation of automation solutions.

Dominant Segments:

- Type: Mobile robots (AMRs and AGVs) are experiencing the fastest growth due to their flexibility and adaptability.

- Function: Storage and packaging applications account for the largest market share due to high demand.

- End-User: The e-commerce and retail sectors are the primary drivers of market growth, followed by food and beverage and pharmaceutical industries.

Within these segments, certain applications are exhibiting particularly strong growth trajectories, including those focused on increasing efficiency in high-volume order fulfillment and improved inventory management. The rise of specialized robots for delicate handling also represents a significant segment.

North America Warehouse Robotics Industry Product Developments

Recent years have witnessed significant advancements in warehouse robotics, including the development of more sophisticated software, improved sensor integration, and the emergence of collaborative robots (cobots). These advancements enhance the functionality, efficiency, and safety of robotic systems, enabling them to handle more complex tasks. The integration of AI and machine learning is further enhancing robotic decision-making and adaptability, improving overall warehouse efficiency.

Challenges in the North America Warehouse Robotics Industry Market

The North American warehouse robotics market faces several challenges, including the high initial investment costs associated with implementing robotic systems. Supply chain disruptions can impact the availability of components and increase lead times. The integration of robotic systems into existing warehouse infrastructure may also present technical challenges, while intense competition amongst existing vendors and potential new entrants exerts downward pricing pressure. Furthermore, concerns regarding job displacement and the need for workforce retraining represent significant hurdles for broader adoption.

Forces Driving North America Warehouse Robotics Industry Growth

Several factors are driving the growth of the North American warehouse robotics market. Technological advancements, such as improved navigation systems and AI-powered decision-making, enhance the capabilities and efficiency of robots. Economic factors, such as rising labor costs and the need to improve productivity, incentivize companies to invest in automation. Regulatory changes that support automation adoption also contribute to market growth. For example, government initiatives promoting automation in the logistics sector are driving increased investments.

Long-Term Growth Catalysts in the North America Warehouse Robotics Industry

Long-term growth is driven by continuing technological innovation, strategic partnerships between robotics companies and logistics providers, and expansion into new geographic markets and applications within the sector. The development of more sophisticated and adaptable robots for handling diverse materials will play a crucial role. New business models such as robotics-as-a-service (RaaS) are likely to emerge, allowing smaller businesses access to automation technologies.

Emerging Opportunities in North America Warehouse Robotics Industry

Emerging opportunities include the expansion of warehouse robotics into new sectors such as healthcare and agriculture. The development of more specialized robots for specific tasks and the increased integration of robotics with other technologies like IoT and cloud computing present significant opportunities. The growing demand for automation in last-mile delivery will also drive market expansion.

Leading Players in the North America Warehouse Robotics Industry Sector

- Honeywell International Inc

- Locus Robotics

- InVia Robotics Inc

- Omron Adept Technologies

- Kiva Systems (Amazon Robotics LLC)

- Fetch Robotics Inc

- List Not Exhaustive

Key Milestones in North America Warehouse Robotics Industry Industry

- 2020: Increased adoption of AMRs driven by e-commerce surge.

- 2021: Significant investments in warehouse automation from major retailers.

- 2022: Launch of several new robotic solutions with advanced AI capabilities.

- 2023: Several mergers and acquisitions consolidate market share.

- 2024: Growing focus on collaborative robots for increased workplace safety.

Strategic Outlook for North America Warehouse Robotics Industry Market

The future of the North American warehouse robotics market appears bright. Continued technological advancements, coupled with increasing demand for efficient order fulfillment and cost optimization, will propel market growth. Strategic partnerships and the development of new business models will expand market access, leading to sustained expansion in the coming decade. The integration of warehouse robotics with broader supply chain management solutions will open up significant opportunities for further growth.

North America Warehouse Robotics Industry Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

-

2. Function

- 2.1. Storage

- 2.2. Plastic Bottles

- 2.3. Packaging

- 2.4. Trans-shipments

- 2.5. Other Functions

-

3. End User

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End Users

North America Warehouse Robotics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Warehouse Robotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number of SKUs; Growth of E-commerce in Developing Countries

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness and Budget to Deploy INS in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Growth of E-commerce in Developing Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Plastic Bottles

- 5.2.3. Packaging

- 5.2.4. Trans-shipments

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Locus Robotics

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 InVia Robotics Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Omron Adept Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kiva Systems (Amazon Robotics LLC)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fetch Robotics Inc *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Warehouse Robotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Warehouse Robotics Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Warehouse Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Warehouse Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Warehouse Robotics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 4: North America Warehouse Robotics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: North America Warehouse Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Warehouse Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Warehouse Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Warehouse Robotics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 13: North America Warehouse Robotics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: North America Warehouse Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Warehouse Robotics Industry?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the North America Warehouse Robotics Industry?

Key companies in the market include Honeywell International Inc, Locus Robotics, InVia Robotics Inc, Omron Adept Technologies, Kiva Systems (Amazon Robotics LLC), Fetch Robotics Inc *List Not Exhaustive.

3. What are the main segments of the North America Warehouse Robotics Industry?

The market segments include Type, Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number of SKUs; Growth of E-commerce in Developing Countries.

6. What are the notable trends driving market growth?

Growth of E-commerce in Developing Countries.

7. Are there any restraints impacting market growth?

; Lack of Awareness and Budget to Deploy INS in Emerging Economies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Warehouse Robotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Warehouse Robotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Warehouse Robotics Industry?

To stay informed about further developments, trends, and reports in the North America Warehouse Robotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence