Key Insights

The Poland Data Center Networking market is experiencing robust growth, projected to reach a substantial size by 2033. Driven by the increasing adoption of cloud computing, the burgeoning digital economy, and government initiatives promoting digital infrastructure development, the market shows strong potential. Key drivers include the expanding need for high-speed connectivity, enhanced data security, and improved network management within data centers across various sectors. Significant investments in modernizing IT infrastructure, particularly within the IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), and Government sectors, are fueling market expansion. The market is segmented by component (hardware such as network switches, routers, and other networking equipment, and services including implementation, maintenance, and support), and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, and others). Competition is intense, with major players like Cisco, HP, IBM, Juniper Networks, and Arista Networks vying for market share. While the market faces challenges such as high initial investment costs and the complexities of integrating new technologies, the overall outlook remains positive, with a considerable growth trajectory anticipated throughout the forecast period.

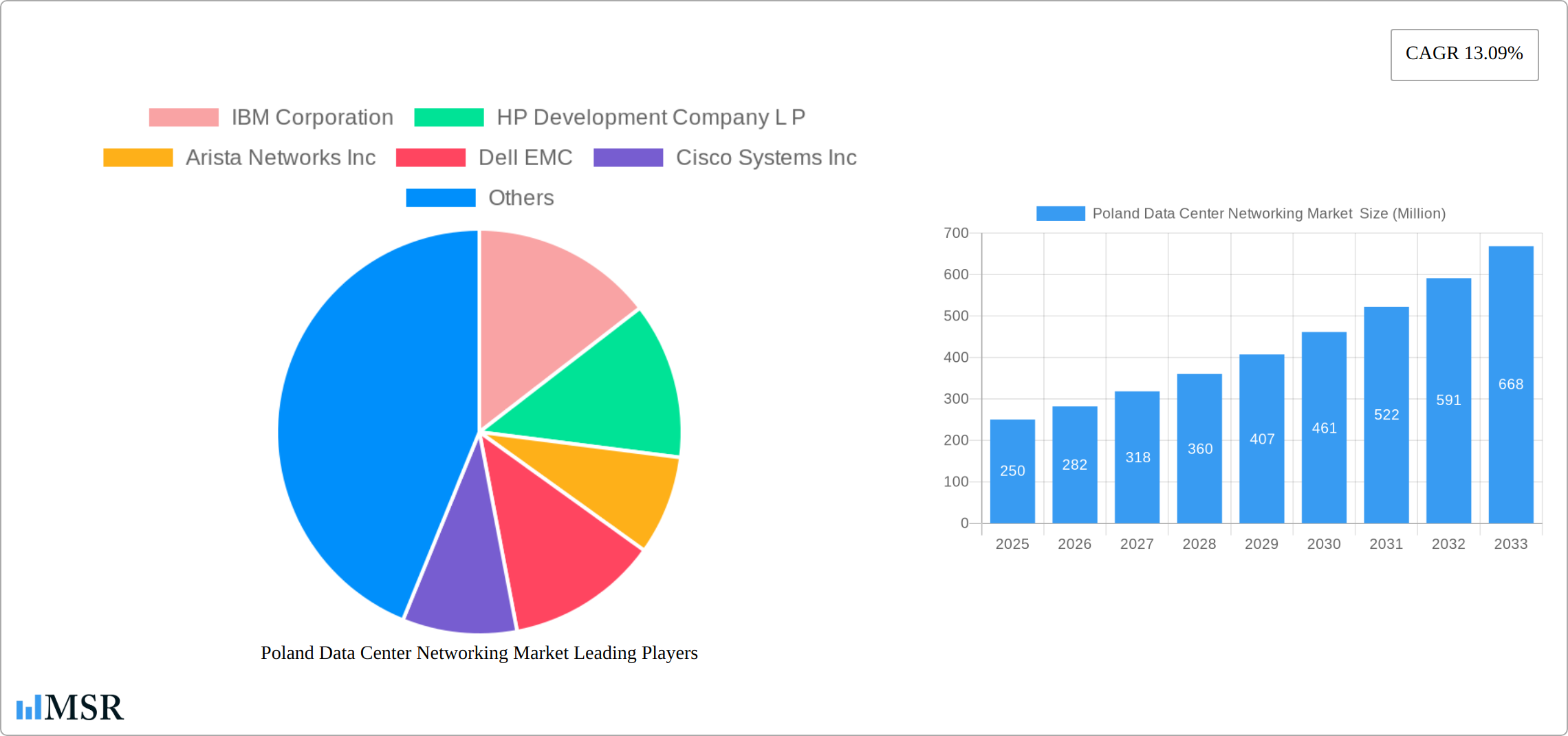

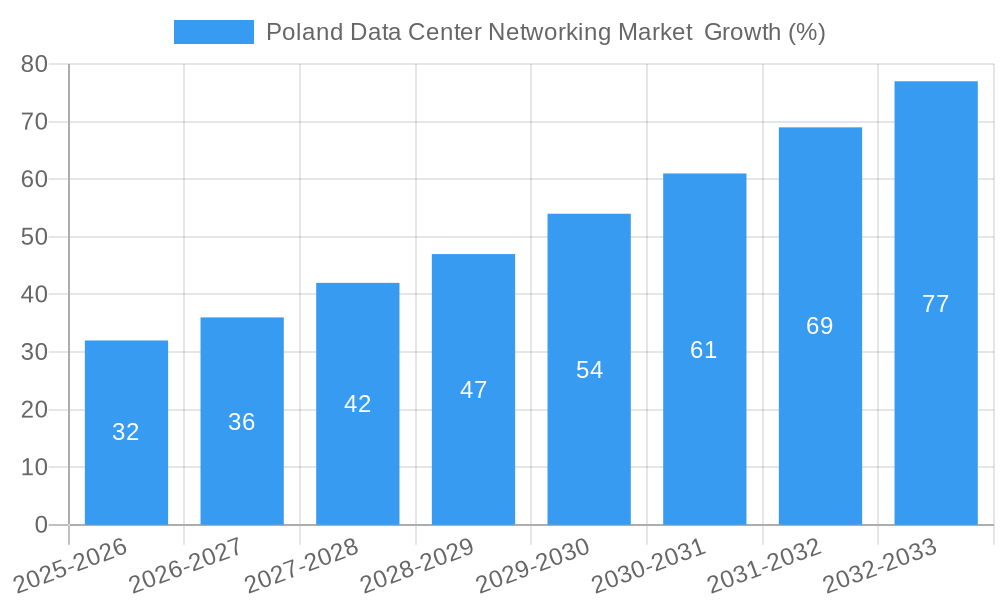

The substantial CAGR of 13.09% suggests a consistently expanding market. While the precise current market size is not provided, a reasonable estimation can be made based on typical market sizes for similar economies and the provided CAGR. Using industry benchmarks and extrapolating backwards from 2025 projected value (assuming a relatively stable value over the historical period to calculate a starting point), a logical projection is feasible. The consistent adoption of advanced networking technologies and the increasing digitization across various sectors in Poland contribute significantly to the upward trend. This growth is further supported by evolving data center architectures that require greater networking capabilities to accommodate increasing demands and ensure optimal performance. The market will likely see intensified competition amongst established players and the emergence of innovative solutions, particularly in software-defined networking (SDN) and network function virtualization (NFV).

Poland Data Center Networking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland Data Center Networking Market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The Poland Data Center Networking market is poised for significant expansion, driven by factors such as increasing digitalization, cloud adoption, and the burgeoning AI sector. This report is essential for strategic decision-making, investment planning, and competitive analysis within this rapidly evolving landscape.

Poland Data Center Networking Market Market Concentration & Dynamics

The Poland Data Center Networking Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share distribution among these players is dynamic, influenced by factors like technological innovation, M&A activities, and evolving end-user demands. While precise market share figures for each player are unavailable at this time, estimates suggest that Cisco Systems Inc, Dell EMC, and Huawei Technologies Co Ltd are amongst the leading players, holding a combined market share of approximately xx%. This concentration is further influenced by the presence of strong international and local players.

Several factors contribute to the market's dynamics. Innovation plays a critical role, with continuous advancements in networking technologies, such as software-defined networking (SDN) and network function virtualization (NFV), shaping competitive strategies. The regulatory framework, while generally supportive of digital growth in Poland, still presents minor compliance challenges. Substitute products, mainly legacy systems, are gradually being replaced by newer, more efficient networking solutions. End-user trends reveal a clear preference towards cloud-based solutions and higher bandwidth capabilities. M&A activity within the Poland Data Center Networking Market has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. These deals primarily involve smaller players consolidating or larger players acquiring specialized technologies.

Poland Data Center Networking Market Industry Insights & Trends

The Poland Data Center Networking Market experienced significant growth during the historical period (2019-2024), reaching a market size of xx Million in 2024. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million by 2033.

Several factors are driving this market expansion. The increasing adoption of cloud computing and data center virtualization is a key catalyst, alongside a rising demand for high-speed internet and improved network infrastructure across various sectors. Technological disruptions, primarily through advancements in 5G, edge computing, and AI, are significantly impacting market dynamics. Evolving consumer behavior, which favors seamless connectivity and high data throughput, further fuels demand. This growth trajectory is anticipated to continue, though economic conditions and global technological shifts will play a role in shaping the future.

Key Markets & Segments Leading Poland Data Center Networking Market

The Poland Data Center Networking Market is segmented by component (hardware and software), product (switches, routers, and other networking equipment), services (managed services, consulting, and support), and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users).

Dominant Segments:

- By Component: Hardware segment holds a larger market share, owing to the need for physical infrastructure.

- By Product: Switches and routers dominate, representing the backbone of most networks. Other networking equipment shows steady growth, driven by specialized needs.

- By Services: Managed services are gaining traction as organizations increasingly outsource network management.

- By End-User: The IT & Telecommunication sector currently represents the largest end-user segment, followed by BFSI and Government. This is driven by their large-scale infrastructure needs and data management requirements.

Drivers for Leading Segments:

- IT & Telecommunication: Rapid digital transformation, increasing demand for high-bandwidth connections, and the expansion of 5G networks.

- BFSI: Stringent regulatory requirements for data security, increasing digital banking adoption, and the need for reliable transaction processing.

- Government: Investments in digital infrastructure, e-governance initiatives, and improved public service delivery.

The IT & Telecommunication sector's dominance stems from its heavy reliance on robust and advanced networking infrastructure to support its operations.

Poland Data Center Networking Market Product Developments

Recent product developments reflect a strong emphasis on software-defined networking (SDN), network function virtualization (NFV), and improved security features. Vendors are increasingly offering integrated solutions that combine hardware and software to streamline network management and enhance operational efficiency. The integration of AI and machine learning into networking solutions is becoming more prevalent, enabling improved network optimization and predictive maintenance. This focus on innovation ensures that new products offer competitive advantages by providing enhanced performance, scalability, and security.

Challenges in the Poland Data Center Networking Market Market

The Poland Data Center Networking Market faces certain challenges. Regulatory hurdles, although not overly restrictive, can impact market entry and expansion. Supply chain disruptions, particularly concerning hardware components, can affect product availability and pricing. Intense competition from established players and the emergence of new competitors presents significant pressure. These combined challenges impact overall market growth.

Forces Driving Poland Data Center Networking Market Growth

The Poland Data Center Networking Market's growth is driven by several factors: the increasing adoption of cloud computing, the expansion of 5G networks, the growing demand for high-bandwidth connections, and governmental initiatives promoting digital transformation. These trends are consistently increasing demand for advanced networking solutions.

Long-Term Growth Catalysts in the Poland Data Center Networking Market

Long-term growth will be fueled by continuous innovation in areas like SDN, NFV, and AI-powered network management. Strategic partnerships between technology providers and end-users will facilitate the adoption of advanced networking solutions. Expansion into new market segments, particularly within the expanding SME sector, will unlock further growth potential.

Emerging Opportunities in Poland Data Center Networking Market

Emerging opportunities lie in the growing adoption of edge computing, the increasing demand for cybersecurity solutions, and the expanding use of AI-powered network optimization tools. New market segments, such as the IoT and smart city initiatives, offer significant growth potential for networking solutions. These provide new avenues for expansion and revenue streams.

Leading Players in the Poland Data Center Networking Market Sector

- IBM Corporation

- HP Development Company L P

- Arista Networks Inc

- Dell EMC

- Cisco Systems Inc

- Juniper Networks Inc

- Extreme Networks Inc

- NEC Corporation

- Huawei Technologies Co Ltd

- VMware Inc

Key Milestones in Poland Data Center Networking Market Industry

- October 2022: Kyndryl, in partnership with Dell Technologies and Microsoft Corporation, launched an integrated hybrid cloud solution, accelerating cloud adoption.

- August 2022: NVIDIA and Dell Technologies introduced a cutting-edge data center solution for AI, boosting AI infrastructure adoption.

Strategic Outlook for Poland Data Center Networking Market Market

The Poland Data Center Networking Market presents significant growth potential driven by ongoing technological advancements and increasing digitalization across various sectors. Strategic opportunities exist for companies focusing on innovative solutions, strong partnerships, and effective market penetration strategies. Focusing on niche markets and providing specialized services will provide a competitive advantage. The market's future is bright, with considerable scope for expansion and value creation.

Poland Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Router

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Poland Data Center Networking Market Segmentation By Geography

- 1. Poland

Poland Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.09% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals is Hindering the Market Demand

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Router

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HP Development Company L P

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Extreme Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Poland Data Center Networking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Data Center Networking Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Poland Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Poland Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Poland Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Poland Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 7: Poland Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Poland Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Data Center Networking Market ?

The projected CAGR is approximately 13.09%.

2. Which companies are prominent players in the Poland Data Center Networking Market ?

Key companies in the market include IBM Corporation, HP Development Company L P , Arista Networks Inc, Dell EMC, Cisco Systems Inc, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, Huawei Technologies Co Ltd, VMware Inc.

3. What are the main segments of the Poland Data Center Networking Market ?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals is Hindering the Market Demand.

8. Can you provide examples of recent developments in the market?

October 2022: Kyndryl, in partnership with Dell Technologies and Microsoft Corporation, unveiled an innovative integrated hybrid cloud solution. This offering empowers clients operating in diverse environments, including data centers, remote locations, and mainframes, to accelerate their cloud transformation endeavors. Leveraging Dell infrastructure, Kyndryl's managed services, and the extensive capabilities of Microsoft Azure, clients can significantly bolster their cloud transformation efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Data Center Networking Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Data Center Networking Market ?

To stay informed about further developments, trends, and reports in the Poland Data Center Networking Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence