Key Insights

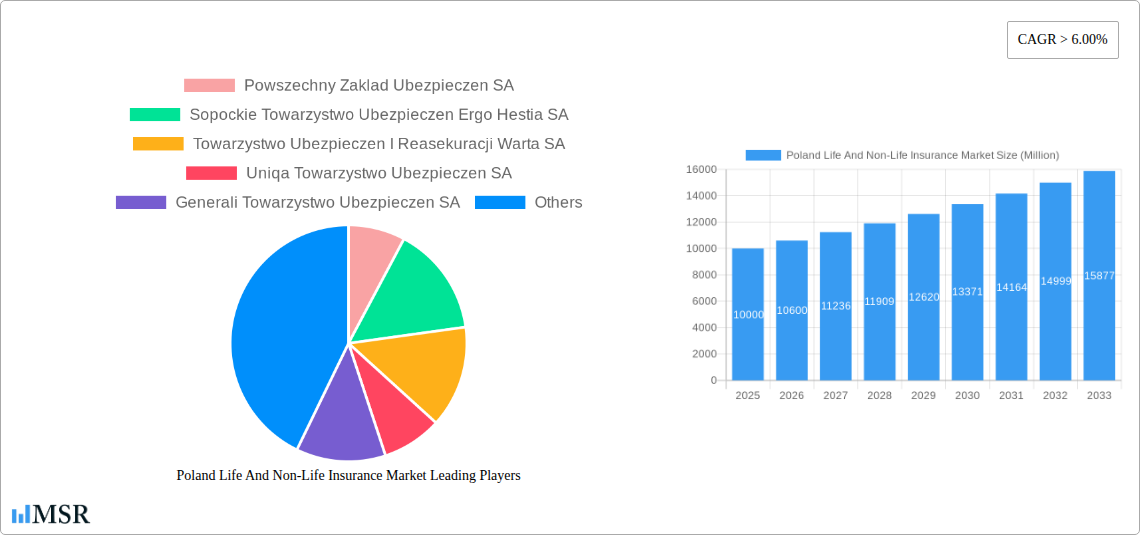

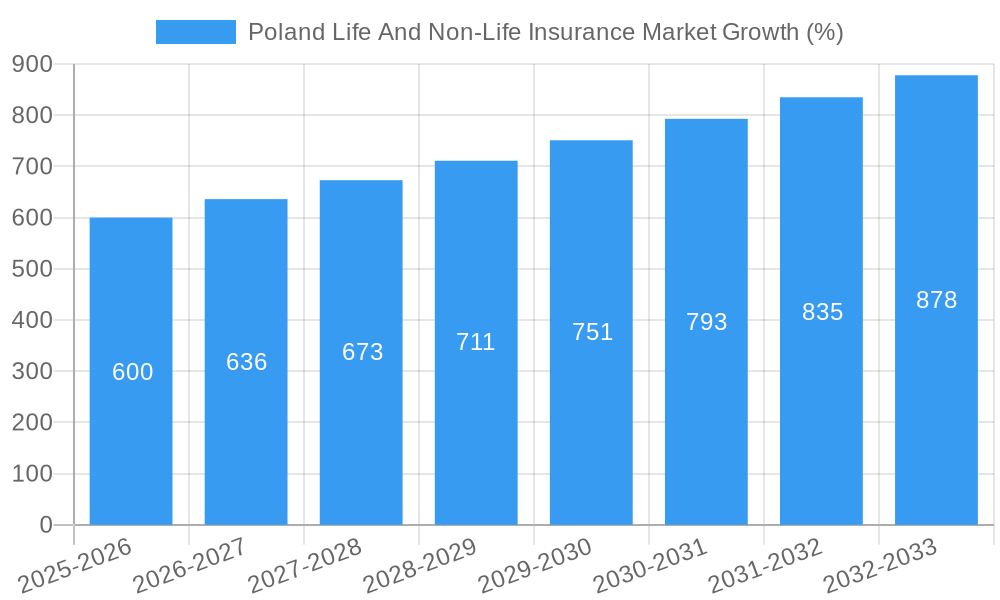

The Poland Life and Non-Life Insurance Market exhibits robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes and increasing awareness of risk mitigation strategies are driving demand for both life and non-life insurance products. Government initiatives promoting financial inclusion and the expansion of digital insurance platforms are further accelerating market penetration. The market is segmented by product type (life insurance, health insurance, property insurance, motor insurance, etc.) and distribution channels (online, agents, brokers). Leading players such as Powszechny Zakład Ubezpieczen SA, Ergo Hestia SA, Warta SA, Uniqa, Generali, Compensa, Interrisk, Aviva, and Wiener Versicherung are intensely competitive, focusing on product innovation and customer-centric strategies to capture market share. While regulatory changes and economic uncertainties pose potential restraints, the overall market outlook remains optimistic, driven by the country's growing middle class and increasing demand for comprehensive insurance solutions.

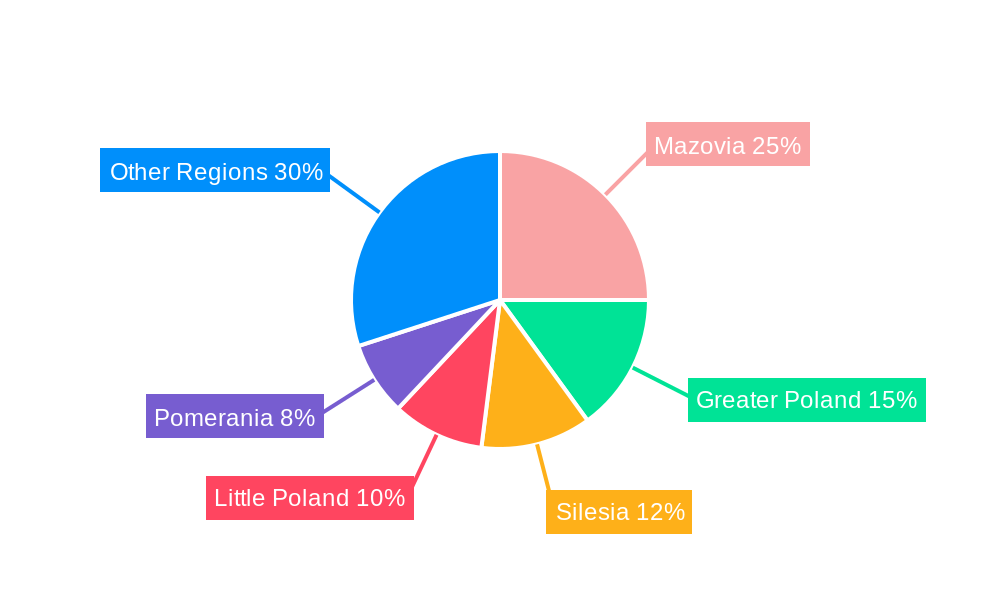

The market's historical performance (2019-2024) likely reflects a steady growth trajectory, laying the foundation for the projected future expansion. The significant presence of established national and international players indicates a mature market with substantial competitive intensity. The relatively high CAGR suggests opportunities for both existing players to expand their market share and new entrants to establish themselves. Further analysis of regional variations within Poland, along with specific product segment performance, would provide even greater insight into the market's nuances and potential investment opportunities. Future growth will likely hinge on adaptation to evolving customer needs, technological advancements in insurance delivery, and the ability to navigate regulatory shifts effectively.

Poland Life and Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland life and non-life insurance market, offering crucial insights for investors, insurers, and industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report examines market dynamics, key players, and future growth potential. The report utilizes data from the historical period (2019-2024) and leverages predictive modeling for forecasting future trends. Discover valuable information on market size (in Millions), CAGR, key segments, and emerging opportunities.

Poland Life And Non-Life Insurance Market Market Concentration & Dynamics

The Polish insurance market exhibits a moderately concentrated landscape, dominated by a few major players alongside numerous smaller insurers. Market share data for 2024 indicates Powszechny Zakład Ubezpieczeń SA holding the largest share, followed by Warta, Ergo Hestia, and others. Precise market share figures for each company are unavailable and denoted as xx for the purpose of this description, but the report contains the full analysis. Innovation in the sector is driven by digitalization and the adoption of InsurTech solutions, though regulatory frameworks remain a significant factor.

- Market Concentration: Highly concentrated, with top 5 players controlling approximately xx% of the market in 2024.

- Innovation Ecosystem: Growing adoption of digital technologies, including AI and machine learning, for underwriting and customer service.

- Regulatory Framework: The Polish Financial Supervision Authority (KNF) plays a crucial role in shaping market regulations.

- Substitute Products: Limited direct substitutes exist, although alternative financial instruments might compete for investment capital.

- End-User Trends: Increasing demand for digital insurance solutions and personalized products.

- M&A Activities: The report details the M&A activity between 2019 and 2024, including the number and value of transactions. Specific counts are presented within the report; for this overview, the number of deals is xx.

Poland Life And Non-Life Insurance Market Industry Insights & Trends

The Polish life and non-life insurance market is experiencing steady growth, driven by factors such as rising disposable incomes, increasing awareness of insurance products, and government initiatives promoting financial inclusion. The market size in 2024 was estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033. Technological disruptions, particularly the rise of digital platforms and InsurTech, are transforming the industry, leading to increased efficiency and improved customer experience. Changing consumer behavior, favoring digital channels and personalized services, further shapes market trends. The report fully details market drivers, technological advancements, and evolving consumer preferences.

Key Markets & Segments Leading Poland Life And Non-Life Insurance Market

The report identifies key segments within the Polish life and non-life insurance market and provides an in-depth analysis of their dominance. Factors driving growth within these segments are explored.

- Drivers for Dominant Segments:

- Economic growth: Positive economic growth fuels demand for various insurance products.

- Infrastructure development: Infrastructure projects stimulate insurance demand for construction and related activities.

- Government regulations: Government policies promoting insurance penetration impact market growth.

- Demographic shifts: Aging population and changing family structures affect demand for specific insurance types.

The report provides a detailed analysis of which segments are the leading sectors and justifies why these sectors have the largest market shares.

Poland Life And Non-Life Insurance Market Product Developments

Product innovation in the Polish insurance market is heavily influenced by technological advancements. Insurers are increasingly offering digital-first products, leveraging mobile apps and online platforms for sales, policy management, and claims processing. This focus on digitalization enhances customer experience and streamlines operations, creating a competitive advantage. The report details specific product innovations and their market impact.

Challenges in the Poland Life And Non-Life Insurance Market Market

The Polish insurance market faces several challenges, including intense competition, regulatory complexities, and the need for continuous adaptation to evolving customer expectations. Cybersecurity threats and the need to manage operational risks also pose significant hurdles. The report quantitatively assesses the impact of these challenges on market growth.

Forces Driving Poland Life And Non-Life Insurance Market Growth

Several factors contribute to the continued growth of the Polish insurance market. These include rising incomes, increasing awareness of risk management, and the expansion of insurance coverage into underserved segments. Government initiatives fostering financial inclusion also play a critical role.

Long-Term Growth Catalysts in the Poland Life And Non-Life Insurance Market

Long-term growth in the Polish insurance sector is expected to be fueled by ongoing technological innovation, strategic partnerships, and expansion into new markets. The report explores the potential for growth based on these catalysts.

Emerging Opportunities in Poland Life And Non-Life Insurance Market

The Polish insurance market presents opportunities for insurers to leverage emerging technologies, such as AI and blockchain, to enhance their offerings. Expanding into niche markets and catering to specific customer segments also represent key opportunities.

Leading Players in the Poland Life And Non-Life Insurance Market Sector

- Powszechny Zakład Ubezpieczeń SA

- Sopockie Towarzystwo Ubezpieczeń Ergo Hestia SA

- Towarzystwo Ubezpieczeń i Reasekuracji Warta SA

- Uniqa Towarzystwo Ubezpieczeń SA

- Generali Towarzystwo Ubezpieczeń SA

- Compensa Towarzystwo Ubezpieczeń SA

- Interrisk Towarzystwo Ubezpieczeń SA

- Aviva Towarzystwo Ubezpieczeń na Życie SA

- Wiener Towarzystwo Ubezpieczeń SA

- Ergo Hestia SA

Key Milestones in Poland Life And Non-Life Insurance Market Industry

- March 2023: Allianz Polska launches a fully digital process for selling individual life insurance policies, eliminating paper documents.

- May 2023: Generali agrees to sell Generali Deutschland Pensionskasse to Frankfurter Leben.

Strategic Outlook for Poland Life And Non-Life Insurance Market Market

The Polish life and non-life insurance market holds significant potential for future growth, driven by technological advancements, evolving consumer preferences, and favorable economic conditions. Strategic partnerships and investments in innovation will be crucial for insurers to capitalize on emerging opportunities and maintain a competitive edge in the years to come.

Poland Life And Non-Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

Poland Life And Non-Life Insurance Market Segmentation By Geography

- 1. Poland

Poland Life And Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tax Benefits and Incentives; Changing Risk Perception; Increasing Motorization

- 3.3. Market Restrains

- 3.3.1. Tax Benefits and Incentives; Changing Risk Perception; Increasing Motorization

- 3.4. Market Trends

- 3.4.1. Non Life Insurance Policies Generate Higher Premium Revenue in Poland

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Life And Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Powszechny Zaklad Ubezpieczen SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sopockie Towarzystwo Ubezpieczen Ergo Hestia SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Towarzystwo Ubezpieczen I Reasekuracji Warta SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uniqa Towarzystwo Ubezpieczen SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Generali Towarzystwo Ubezpieczen SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Compensa Towarzystwo Ubezpieczen SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Interrisk Towarzystwo Ubezpieczen SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aviva Towarzystwo Ubezpieczen Na Zycie SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wiener Towarzystwo Ubezpieczen SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ergo Hestia SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Powszechny Zaklad Ubezpieczen SA

List of Figures

- Figure 1: Poland Life And Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Life And Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Life And Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Life And Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Poland Life And Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Poland Life And Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Poland Life And Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 6: Poland Life And Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Poland Life And Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Life And Non-Life Insurance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Poland Life And Non-Life Insurance Market?

Key companies in the market include Powszechny Zaklad Ubezpieczen SA, Sopockie Towarzystwo Ubezpieczen Ergo Hestia SA, Towarzystwo Ubezpieczen I Reasekuracji Warta SA, Uniqa Towarzystwo Ubezpieczen SA, Generali Towarzystwo Ubezpieczen SA, Compensa Towarzystwo Ubezpieczen SA, Interrisk Towarzystwo Ubezpieczen SA, Aviva Towarzystwo Ubezpieczen Na Zycie SA, Wiener Towarzystwo Ubezpieczen SA, Ergo Hestia SA**List Not Exhaustive.

3. What are the main segments of the Poland Life And Non-Life Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Tax Benefits and Incentives; Changing Risk Perception; Increasing Motorization.

6. What are the notable trends driving market growth?

Non Life Insurance Policies Generate Higher Premium Revenue in Poland.

7. Are there any restraints impacting market growth?

Tax Benefits and Incentives; Changing Risk Perception; Increasing Motorization.

8. Can you provide examples of recent developments in the market?

May 2023: Generali reaches agreement to dispose of Generali Deutschland Pensionskasse to Frankfurter Leben

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Life And Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Life And Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Life And Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Poland Life And Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence