Key Insights

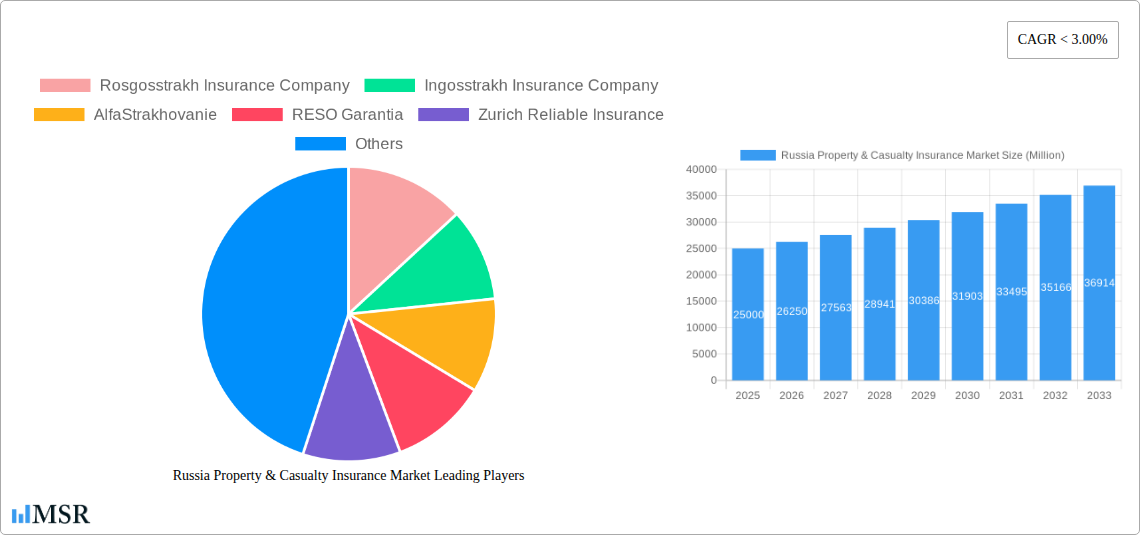

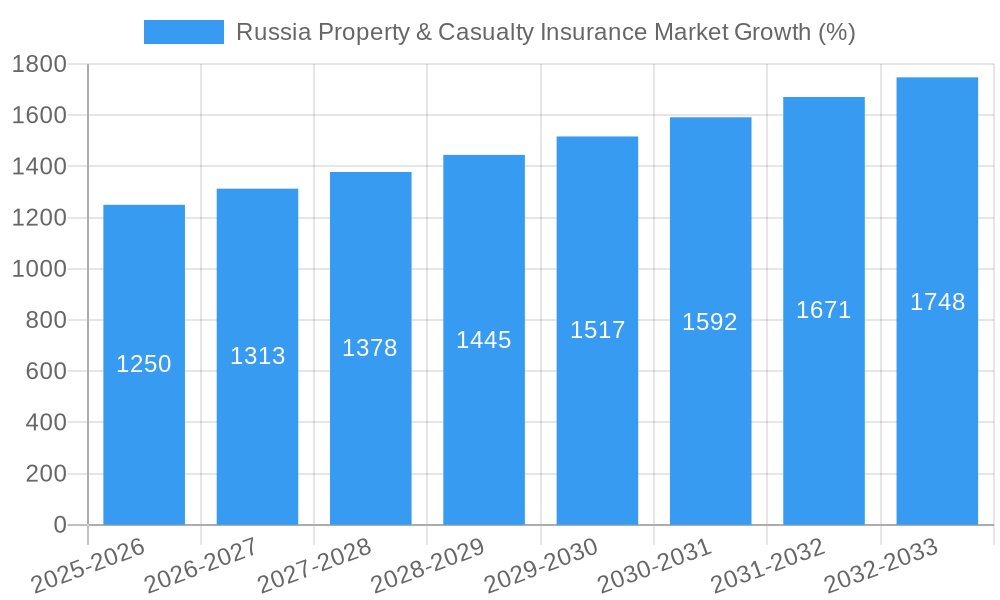

The Russia Property & Casualty (P&C) insurance market, while facing geopolitical challenges, presents a complex and evolving landscape. The period between 2019 and 2024 likely witnessed moderate growth, influenced by factors such as economic fluctuations, regulatory changes, and the increasing penetration of insurance products within the Russian population. The base year of 2025 provides a snapshot of the market's size after navigating these previous years. While precise figures are unavailable, a reasonable estimation, considering global P&C market trends and Russia's economic indicators, places the 2025 market size at approximately $25 billion USD. This figure assumes a gradual recovery from previous economic downturns and reflects growing awareness of risk management and insurance products amongst businesses and individuals. Looking ahead to 2033, a conservative Compound Annual Growth Rate (CAGR) of 5% is projected. This reflects the ongoing uncertainties within the Russian economy but anticipates a steady, albeit cautious, expansion driven by increasing insurance awareness and a potential for growth in sectors like construction and automotive.

The forecast period (2025-2033) for the Russia P&C insurance market suggests a promising trajectory, albeit one contingent on macroeconomic stability and regulatory support. Factors such as infrastructure development, rising disposable incomes (in certain segments), and government initiatives promoting financial inclusion could drive further market expansion. However, challenges remain, including sanctions, geopolitical risks, and potential inflation, which could impact consumer spending on insurance and investor confidence. A diverse range of insurance products, including motor, property, and liability coverage, are key market segments. The relative growth within each segment will depend on economic activity and consumer preferences; for example, robust economic activity will likely fuel growth in commercial property insurance. Further analysis should consider the impact of technological advancements, such as Insurtech solutions, which have the potential to disrupt the market in the coming years.

Russia Property & Casualty Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Russia Property & Casualty Insurance Market, covering market dynamics, industry trends, key players, and future growth prospects. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market size is estimated at xx Million in 2025, with a CAGR of xx% projected for the forecast period.

Russia Property & Casualty Insurance Market Market Concentration & Dynamics

The Russian property & casualty insurance market exhibits a moderately concentrated landscape, dominated by several large players like Rosgosstrakh Insurance Company, Ingosstrakh Insurance Company, AlfaStrakhovanie, and RESO Garantia. These companies collectively hold a significant market share, exceeding xx%, as of 2024. However, the market also includes numerous smaller insurers, fostering competition and innovation.

- Market Concentration: The top 5 players hold approximately xx% of the market share, indicating a moderate level of concentration.

- Innovation Ecosystems: Technological advancements, particularly in digital insurance solutions, are driving innovation. Recent investments in low-code platforms and digital customer engagement tools (e.g., VSK Insurance's Telegram bot) underscore this trend.

- Regulatory Frameworks: The regulatory environment plays a crucial role, influencing market stability and insurer operations. Changes in regulations can significantly impact market dynamics and player strategies.

- Substitute Products: Alternative risk management solutions, such as self-insurance, are present but generally hold a smaller market share compared to traditional insurance products.

- End-User Trends: Growing awareness of insurance needs and increasing digital adoption among consumers are shaping demand patterns.

- M&A Activities: The number of M&A deals in the Russian property & casualty insurance sector has fluctuated over the past five years, averaging xx deals annually during the period 2019-2024.

Russia Property & Casualty Insurance Market Industry Insights & Trends

The Russian property & casualty insurance market is projected to experience substantial growth during the forecast period, driven by several key factors. Rising disposable incomes, increasing urbanization, and the expansion of the middle class are contributing to higher demand for insurance products. Technological advancements, such as the adoption of telematics and AI-driven risk assessment, are improving efficiency and customer experience. However, macroeconomic uncertainties and regulatory changes pose potential challenges to sustained market growth. The market size is estimated to be xx Million in 2025, with a CAGR of xx% projected from 2025 to 2033. The increased adoption of digital platforms and a growing awareness of insurance benefits among the population contribute significantly to this positive growth trend. The ongoing development and implementation of innovative insurance products tailored to specific customer needs are also expected to play a major role in driving future expansion within the market.

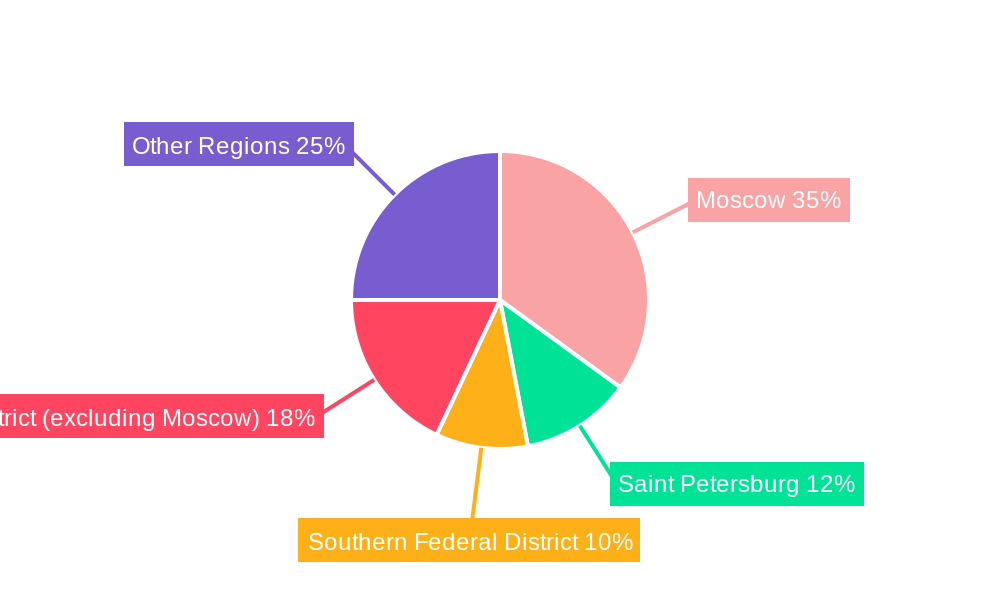

Key Markets & Segments Leading Russia Property & Casualty Insurance Market

While data on regional breakdown is limited, the market is expected to be dominated by major urban centers due to higher population density and economic activity. The Moscow and St. Petersburg regions are likely to be significant contributors to market growth.

- Growth Drivers:

- Rapid economic growth in certain regions.

- Development of robust infrastructure projects.

- Expanding industrial and commercial sectors.

- Increasing government initiatives supporting insurance penetration.

- Dominance Analysis: Major cities with high concentrations of businesses and individuals are projected to contribute a substantial percentage of the overall market revenue. The segments showing greatest potential for growth are likely to be those linked to technological innovation and the development of specialized insurance products in response to emerging societal needs.

Russia Property & Casualty Insurance Market Product Developments

Recent years have witnessed significant product innovation in the Russian property & casualty insurance market, driven primarily by the adoption of technology. Insurers are increasingly leveraging digital platforms, mobile applications, and telematics to offer personalized and convenient insurance products and services. This includes the use of low-code platforms for faster product development and improved customer service functionalities, as seen with Ingosstrakh Insurance Company’s technology investment. The integration of AI-powered tools for risk assessment and fraud detection is also enhancing operational efficiency and risk management capabilities. This focus on digitalization and technological innovation has led to the development of more competitive and customer-centric insurance offerings.

Challenges in the Russia Property & Casualty Insurance Market Market

The Russian property & casualty insurance market faces several challenges including macroeconomic volatility and regulatory uncertainty. These factors can influence consumer spending patterns and investor confidence, impacting market growth. Furthermore, intense competition among insurers necessitates continuous innovation and cost optimization to maintain profitability. The impact of geopolitical factors and sanctions also presents a substantial challenge to the market's stability and long-term growth trajectory. These combined issues have the potential to suppress market expansion by xx% annually.

Forces Driving Russia Property & Casualty Insurance Market Growth

Several factors are driving growth in the Russian property & casualty insurance market. Economic growth, particularly in urban areas, fuels increased demand for insurance. Government regulations promoting insurance penetration further stimulate market expansion. Technological advancements, leading to more efficient operations and innovative product offerings, are key contributors to growth. These technological developments include advancements in data analytics and artificial intelligence which contribute significantly to risk management and underwriting efficiency.

Long-Term Growth Catalysts in Russia Property & Casualty Insurance Market

Long-term growth will be driven by continued technological innovation, strategic partnerships, and market expansion into underserved regions. Investment in digital infrastructure and the development of new insurance products tailored to specific customer segments will be critical for future success. The expansion of insurance coverage to previously underserved populations, through tailored products and enhanced accessibility, also presents significant opportunities for market expansion.

Emerging Opportunities in Russia Property & Casualty Insurance Market

Emerging opportunities lie in leveraging technological advancements such as AI and big data analytics for risk management and personalized insurance products. Expanding into underserved rural markets and developing specialized insurance solutions for emerging industries offer significant growth potential. A focus on customer experience through improved digital platforms and personalized communication will be essential to attracting and retaining customers.

Leading Players in the Russia Property & Casualty Insurance Market Sector

- Rosgosstrakh Insurance Company

- Ingosstrakh Insurance Company

- AlfaStrakhovanie

- RESO Garantia

- Zurich Reliable Insurance

- Sberbank Insurance

- VSK Insurance

- Sogaz Insurance

- VTB Insurance

- Soglaise Insurance

List Not Exhaustive

Key Milestones in Russia Property & Casualty Insurance Market Industry

- January 2022: Ingosstrakh Insurance Company purchased a low-code technology platform, enhancing its product development and service delivery capabilities. This investment is likely to increase the company’s market competitiveness.

- March 2022: VSK Insurance launched a Telegram channel and smart bot, improving customer engagement and service accessibility. This initiative improved customer service and satisfaction which may lead to increased market share.

Strategic Outlook for Russia Property & Casualty Insurance Market Market

The Russia property & casualty insurance market presents significant long-term growth potential. Strategic opportunities for insurers involve investing in technology, focusing on customer experience, and expanding into underserved market segments. By leveraging digital technologies and adapting to evolving consumer preferences, insurers can capture a larger share of the growing market and contribute to improved financial stability and risk management within the Russian economy.

Russia Property & Casualty Insurance Market Segmentation

-

1. Product Type

- 1.1. Motor Insurance

- 1.2. Personal Property Insurance

- 1.3. Property Insurance of Legal Entities

- 1.4. Other P&C

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Agents

- 2.3. Brokers

- 2.4. Banks

- 2.5. Online

- 2.6. Other Distribution Channel

Russia Property & Casualty Insurance Market Segmentation By Geography

- 1. Russia

Russia Property & Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Motor Insurance had the Stagnant Performance due to Pandemic

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Motor Insurance

- 5.1.2. Personal Property Insurance

- 5.1.3. Property Insurance of Legal Entities

- 5.1.4. Other P&C

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Agents

- 5.2.3. Brokers

- 5.2.4. Banks

- 5.2.5. Online

- 5.2.6. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rosgosstrakh Insurance Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ingosstrakh Insurance Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AlfaStrakhovanie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RESO Garantia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zurich Reliable Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sberbank Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VSK Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sogaz Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VTB Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Soglaise Insurance**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rosgosstrakh Insurance Company

List of Figures

- Figure 1: Russia Property & Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Property & Casualty Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Property & Casualty Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Russia Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Russia Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Property & Casualty Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: Russia Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Russia Property & Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Property & Casualty Insurance Market?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Russia Property & Casualty Insurance Market?

Key companies in the market include Rosgosstrakh Insurance Company, Ingosstrakh Insurance Company, AlfaStrakhovanie, RESO Garantia, Zurich Reliable Insurance, Sberbank Insurance, VSK Insurance, Sogaz Insurance, VTB Insurance, Soglaise Insurance**List Not Exhaustive.

3. What are the main segments of the Russia Property & Casualty Insurance Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Motor Insurance had the Stagnant Performance due to Pandemic.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2022, Ingosstrakh Insurance Company Purchased a Technology Low-Code Platform. The software suite includes monitoring, automatic documentation, and a cloud administration interface and is licensed to Ingosstrakh Insurance Company. The purchased platform includes all the tools needed for service creation and integration, allowing the organization to produce goods and divide jobs more effectively across specialists.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Property & Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Property & Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Property & Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Russia Property & Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence