Key Insights

The Saudi Arabian e-commerce eyewear market is experiencing significant growth, driven by increasing internet penetration, smartphone adoption, and a young, fashion-forward demographic. While precise market size data is limited, projections indicate a substantial market value. The market is forecast to reach $632.6 million by 2033, with a compound annual growth rate (CAGR) of 7.89% from the base year 2025. Key growth drivers include rising disposable incomes, the convenience of online purchasing, and a widening array of eyewear options from both international and local brands. Strategic marketing efforts and advancements in logistics and payment infrastructure are further accelerating market expansion.

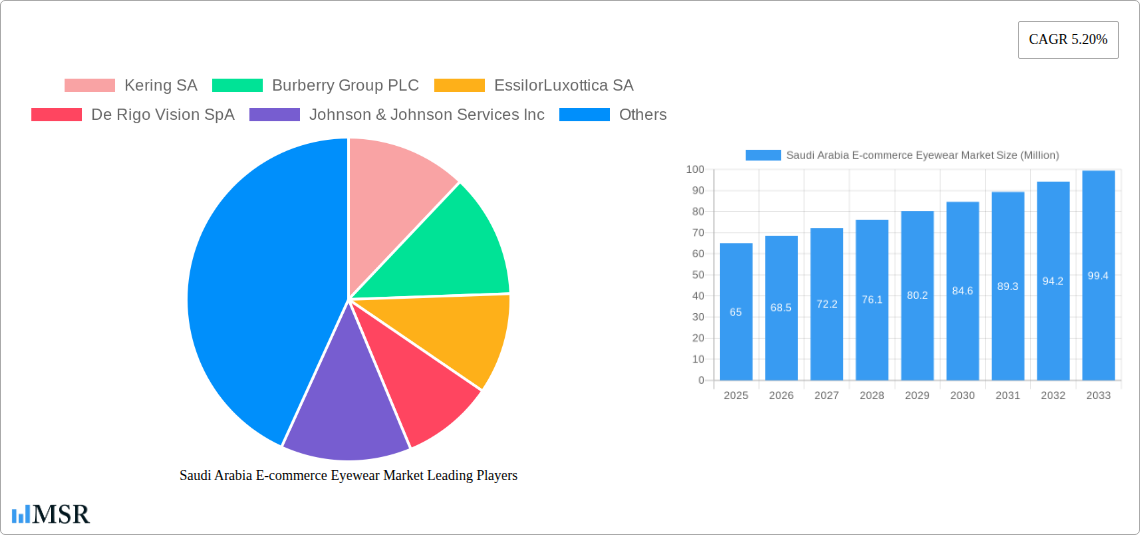

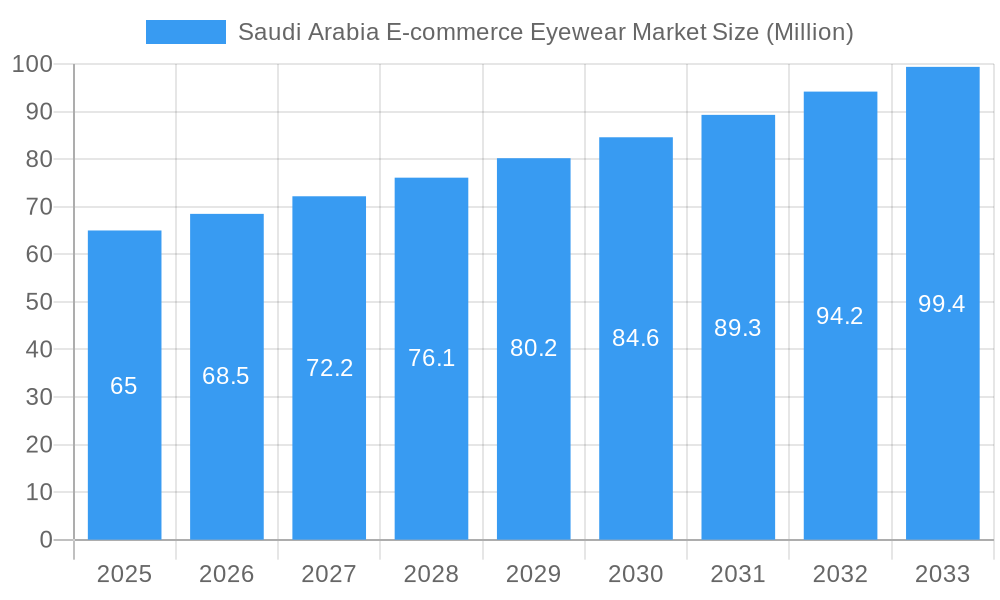

Saudi Arabia E-commerce Eyewear Market Market Size (In Million)

Challenges such as product authenticity concerns, the need for effective return policies for fitting issues, and intermittent internet access in some regions persist. The market is segmented by product type, with spectacles and sunglasses dominating, while contact lenses represent a growing segment. A diverse range of brands, from luxury to affordable, caters to varied consumer preferences. Demand is relatively balanced between male and female consumers.

Saudi Arabia E-commerce Eyewear Market Company Market Share

The competitive arena features global leaders like EssilorLuxottica SA, Johnson & Johnson, and LVMH, alongside prominent regional and niche players. Strategic collaborations with local e-commerce platforms are crucial for expanding market reach. Future growth will be shaped by government support for e-commerce, retailers' adaptation to local consumer needs, and enhanced digital customer service. Building consumer trust and navigating regulatory frameworks are essential for sustained success.

Saudi Arabia E-commerce Eyewear Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Saudi Arabia e-commerce eyewear market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. From market size and growth projections to key players and emerging trends, this report equips you with the knowledge to make informed business decisions. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024.

Saudi Arabia E-commerce Eyewear Market Market Concentration & Dynamics

The Saudi Arabia e-commerce eyewear market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is witnessing increased competition from both established international brands and emerging local players. Innovation is a key driver, with companies investing heavily in technological advancements such as virtual try-on tools and personalized recommendations to enhance the online shopping experience. The regulatory framework is generally supportive of e-commerce growth, although specific regulations concerning online sales of eyewear may exist and should be considered. Substitute products, such as over-the-counter reading glasses, pose a competitive threat to the higher-priced prescription eyewear segment. Consumer trends indicate a rising preference for online purchasing due to convenience and wider selection. M&A activity has been moderate in recent years, with xx major deals recorded between 2019 and 2024. This suggests a consolidation trend among market players. Market share data for key players is currently being collected but is expected to reveal a relatively even distribution amongst the top players.

Saudi Arabia E-commerce Eyewear Market Industry Insights & Trends

The Saudi Arabia e-commerce eyewear market is experiencing robust growth, driven by factors such as increasing internet penetration, rising disposable incomes, and a growing preference for online shopping convenience. The market size in 2025 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by technological disruptions, such as the adoption of augmented reality (AR) for virtual try-ons and the rise of personalized eyewear recommendations based on individual facial features and preferences. Furthermore, evolving consumer behaviors, particularly among younger demographics, demonstrate a strong preference for online shopping and the diverse product selection offered through e-commerce platforms. The increasing adoption of smartphones and improved logistics infrastructure also contribute significantly to the market expansion. This ongoing digital transformation significantly impacts the market landscape by making it highly accessible to new customers. Additionally, growing health awareness is driving sales of contact lenses and vision correction products.

Key Markets & Segments Leading Saudi Arabia E-commerce Eyewear Market

Dominant Segment: The sunglasses segment is currently the leading product category within the Saudi Arabia e-commerce eyewear market, driven by factors such as fashion trends and the country's climate. The unisex segment also shows strong growth, reflecting the changing consumer preferences.

Drivers for Growth:

- Rising Disposable Incomes: Increased purchasing power among consumers fuels demand for higher-quality and branded eyewear.

- Expanding E-commerce Infrastructure: Improvements in logistics and delivery networks facilitate efficient online sales.

- Young and Growing Population: A significant portion of the population falls within age groups that are more likely to adopt online shopping behaviors.

- Fashion Trends: Evolving fashion trends significantly influence the demand for diverse styles of eyewear, especially sunglasses.

- Increased Smartphone Penetration: Easy access to the internet and online shopping through mobile devices boosts sales.

The dominance of sunglasses is largely attributed to their fashion appeal and suitability for the region’s climate. However, the spectacles segment shows considerable potential for growth due to the rising prevalence of vision problems and the convenience of online ordering. Men and women contribute almost equally to the market, with a slightly higher percentage from the women's segment.

Saudi Arabia E-commerce Eyewear Market Product Developments

Recent product innovations focus on incorporating advanced technologies such as personalized lens designs, improved materials for enhanced comfort and durability, and integrated features like blue light filtering. The integration of virtual try-on tools is enhancing the online shopping experience, providing consumers with a more interactive and convenient way to choose eyewear before purchasing. These advancements create competitive advantages for brands offering innovative and technologically superior products.

Challenges in the Saudi Arabia E-commerce Eyewear Market Market

The market faces challenges such as concerns around the authenticity of products sold online and the complexities of ensuring accurate prescription fulfillment. Supply chain disruptions can impact product availability and pricing. Intense competition from both established and emerging players requires continuous innovation and effective marketing strategies. These factors combined can impact market growth by potentially reducing consumer trust.

Forces Driving Saudi Arabia E-commerce Eyewear Market Growth

Technological advancements like AR and AI-powered virtual try-on tools are significantly boosting market growth. The supportive government policies aimed at fostering e-commerce in the country contribute to the overall market expansion. The increasing adoption of online payment systems and enhanced logistics infrastructure further facilitate the growth of the e-commerce eyewear sector. These factors collectively contribute to the growth of the Saudi Arabia e-commerce eyewear market.

Long-Term Growth Catalysts in the Saudi Arabia E-commerce Eyewear Market

Strategic partnerships between online retailers and eyewear brands enhance market reach and access to a wider consumer base. The continued development and adoption of innovative technologies in eyewear manufacturing and online sales create long-term growth potential. Furthermore, expansion into untapped market segments like specialized sports eyewear or niche designs, holds significant future growth potential.

Emerging Opportunities in Saudi Arabia E-commerce Eyewear Market

The growing popularity of personalized eyewear, offering customized designs and lens specifications, creates a significant opportunity. The integration of health-focused features into eyewear, such as blue light filtering and anti-glare coatings, further expands the market potential. Focusing on sustainable and ethically sourced materials also represents a growing area of opportunity within the market.

Leading Players in the Saudi Arabia E-commerce Eyewear Market Sector

- Kering SA

- Burberry Group PLC

- EssilorLuxottica SA

- De Rigo Vision SpA

- Johnson & Johnson Services Inc

- Alcon Laboratories Inc

- LVMH Moët Hennessy Louis Vuitton

- Safilo Group S p A

- Charmant Group

- Bausch Health Companies Inc

Key Milestones in Saudi Arabia E-commerce Eyewear Market Industry

- November 2022: Ray-Ban launched its first-ever Middle East-exclusive product, the Ray-Ban Legacy sunglasses, showcasing a localized marketing approach.

- July 2022: Lenskart's partnership with noon.com significantly expanded its reach within the Middle East, highlighting the importance of strategic alliances.

- February 2021: Safilo Group's Lunar New Year launch of Jimmy Choo sunglasses demonstrated the influence of global events and targeted marketing on market dynamics.

Strategic Outlook for Saudi Arabia E-commerce Eyewear Market Market

The Saudi Arabia e-commerce eyewear market is poised for sustained growth, driven by technological innovation, evolving consumer preferences, and a supportive regulatory environment. Companies that embrace digitalization, prioritize personalized experiences, and focus on strategic partnerships are best positioned to capitalize on the significant market opportunities presented in the coming years. The market's future potential is strong, with continuous growth expected as the adoption of online shopping accelerates further.

Saudi Arabia E-commerce Eyewear Market Segmentation

-

1. Product Category

- 1.1. Spectacles

- 1.2. Sunglasses

- 1.3. Contact Lenses

- 1.4. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Unisex

Saudi Arabia E-commerce Eyewear Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-commerce Eyewear Market Regional Market Share

Geographic Coverage of Saudi Arabia E-commerce Eyewear Market

Saudi Arabia E-commerce Eyewear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Booming Online Retail Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-commerce Eyewear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 5.1.1. Spectacles

- 5.1.2. Sunglasses

- 5.1.3. Contact Lenses

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kering SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Burberry Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EssilorLuxottica SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 De Rigo Vision SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alcon Laboratories Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moët Hennessy Louis Vuitton

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safilo Group S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charmant Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bausch Health Companies Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kering SA

List of Figures

- Figure 1: Saudi Arabia E-commerce Eyewear Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-commerce Eyewear Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Product Category 2020 & 2033

- Table 2: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Product Category 2020 & 2033

- Table 5: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-commerce Eyewear Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the Saudi Arabia E-commerce Eyewear Market?

Key companies in the market include Kering SA, Burberry Group PLC, EssilorLuxottica SA, De Rigo Vision SpA, Johnson & Johnson Services Inc, Alcon Laboratories Inc *List Not Exhaustive, LVMH Moët Hennessy Louis Vuitton, Safilo Group S p A, Charmant Group, Bausch Health Companies Inc.

3. What are the main segments of the Saudi Arabia E-commerce Eyewear Market?

The market segments include Product Category, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 632.6 million as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Booming Online Retail Industry.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Ray-Ban launched its first-ever Middle East-exclusive product, the Ray-Ban Legacy. The sunglasses came in a classic black, featuring gold detailing on the temples and a gold Ray-Ban logo. The sunglasses are a mix of modernity and ancestry, and their pair came in a custom-designed box showcasing the symbolic "shemagh" print, with the intricate packaging highlighting the brand's first Middle East exclusive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-commerce Eyewear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-commerce Eyewear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-commerce Eyewear Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-commerce Eyewear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence