Key Insights

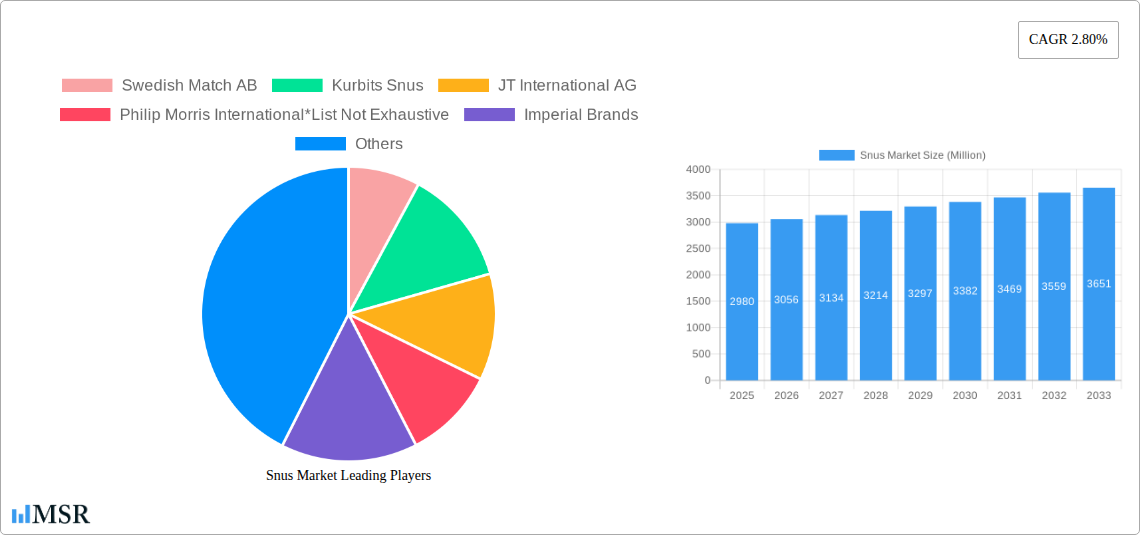

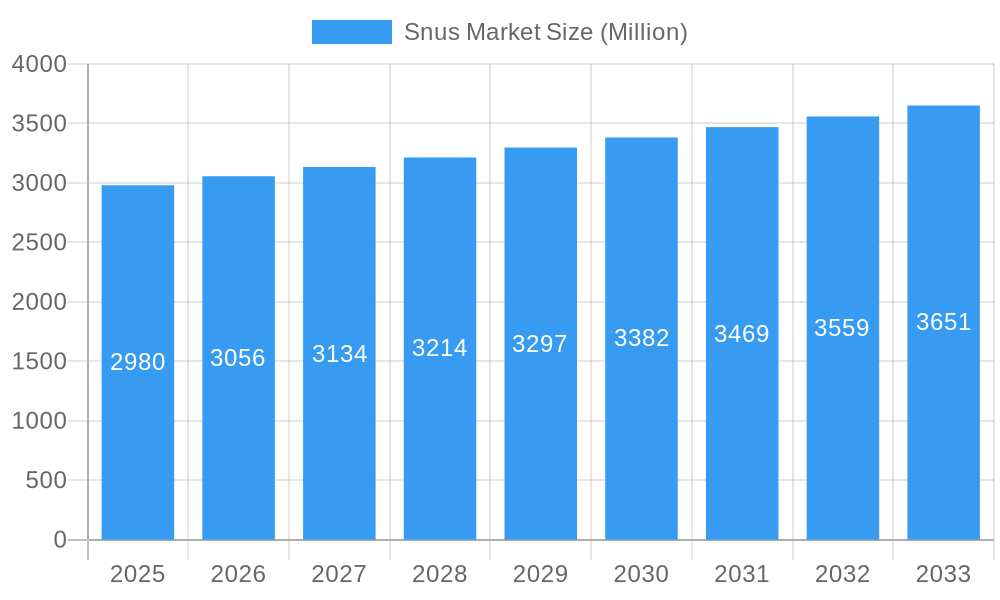

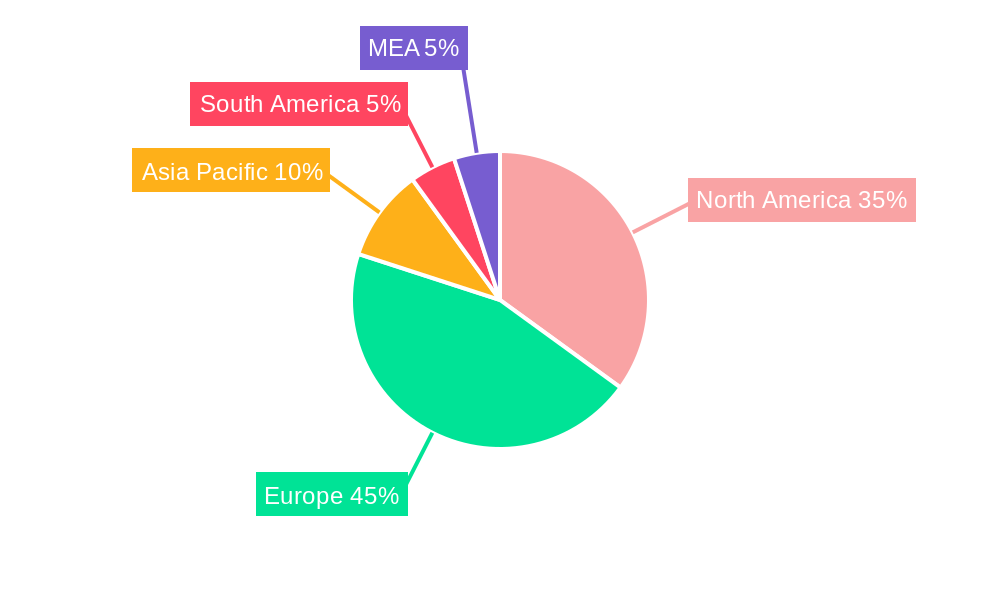

The global snus market, valued at $2.98 billion in 2025, is projected to experience steady growth, driven primarily by increasing consumer preference for smokeless tobacco alternatives and a growing awareness of the relatively lower health risks compared to traditional cigarettes. The market's Compound Annual Growth Rate (CAGR) of 2.80% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. This growth is fueled by several key factors. The rising popularity of portion snus, offering a more discreet and convenient consumption method, is significantly impacting market dynamics. Furthermore, the expansion of online retail channels provides increased accessibility, particularly for younger demographics. While regulatory changes and public health campaigns pose restraints, the evolving consumer preferences and the introduction of innovative snus products with varied flavors and nicotine strengths are expected to offset these challenges and maintain market momentum. The North American and European markets currently hold significant shares, with the Nordic region remaining a key driver due to established snus consumption patterns. However, emerging markets in Asia-Pacific and South America present lucrative growth opportunities, as increasing disposable incomes and changing lifestyle choices lead to a gradual shift towards alternative tobacco products. Competitive landscape includes established players like Swedish Match AB and Philip Morris International, alongside emerging regional brands.

Snus Market Market Size (In Billion)

The segmentation of the snus market into loose snus and portion snus, alongside distribution channels including tobacco stores, convenience stores, and online retailers, allows for a targeted approach by manufacturers. Future growth will depend on strategic product diversification, focusing on developing innovative product offerings tailored to diverse consumer preferences and regional regulations. Marketing strategies emphasizing the relative harm reduction aspects of snus compared to cigarettes are likely to play a critical role in market expansion. Furthermore, the success of new market entries will hinge on effectively navigating the complex regulatory landscape and meeting specific regional demands. The continued focus on research and development, particularly in the areas of reduced-risk products, will be key to unlocking further growth opportunities within this evolving market.

Snus Market Company Market Share

Snus Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Snus market, offering invaluable insights for industry stakeholders, investors, and market entrants. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The study forecasts a market size of xx Million by 2033, showcasing a Compound Annual Growth Rate (CAGR) of xx%.

Snus Market Concentration & Dynamics

The global snus market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. Swedish Match AB, Philip Morris International, and British American Tobacco are key players, though smaller regional players and emerging brands contribute to market dynamism. Market share data (2024): Swedish Match AB (xx%), Philip Morris International (xx%), British American Tobacco (xx%), Others (xx%).

The snus market is shaped by several factors:

- Innovation Ecosystems: Constant innovation in product formats (e.g., portion snus, loose snus), flavors, and nicotine delivery systems drives competition.

- Regulatory Frameworks: Varying regulations across countries significantly influence market access and product offerings. Stricter regulations in some regions limit growth, while more lenient ones foster expansion.

- Substitute Products: The market faces competition from other nicotine products like vaping devices and chewing tobacco.

- End-User Trends: Consumer preferences, shifting demographics, and health concerns affect demand patterns.

- M&A Activities: The recent acquisition of Swedish Match by Philip Morris International highlights the strategic importance of the snus market and the high level of consolidation. Over the historical period (2019-2024), at least 3 major M&A deals were recorded.

Snus Market Industry Insights & Trends

The global snus market has demonstrated robust growth over the historical period (2019-2024), driven by increasing consumer preference for smokeless tobacco alternatives. Market size reached xx Million in 2024. Several factors are contributing to this expansion:

- Rising Disposable Incomes: Increased purchasing power in key markets fuels demand for premium snus products.

- Health Consciousness: Snus is often perceived as a less harmful alternative to smoking, attracting health-conscious consumers.

- Technological Advancements: Innovations in nicotine delivery systems and flavor profiles cater to evolving consumer preferences.

- Changing Consumer Behavior: Younger generations are embracing snus as a fashionable and discreet nicotine consumption method.

The forecast period (2025-2033) anticipates sustained growth, though at a potentially moderated pace due to regulatory pressures in certain regions. The market is projected to reach xx Million by 2033.

Key Markets & Segments Leading Snus Market

The Scandinavian region, particularly Sweden, remains the dominant market for snus, owing to established consumption patterns and high per capita consumption. However, increasing penetration in other regions is anticipated.

Dominant Segments:

- Product Type: Portion snus holds a larger market share compared to loose snus, due to its convenience and portability.

- Distribution Channel: Tobacco stores continue to dominate, but convenience stores and online retail stores are witnessing increasing sales, particularly for younger demographics. Online retail provides a new growth avenue with growing market penetration.

Key Drivers:

- Strong Economic Growth: Economic prosperity in key markets positively correlates with snus consumption.

- Developed Infrastructure: Efficient distribution networks are crucial for widespread market access.

- Favorable Regulatory Environment: Countries with less stringent regulations experience faster market growth.

Snus Market Product Developments

Recent product innovations focus on enhanced flavor profiles, improved nicotine delivery, and more discreet pouch designs. Technological advancements in manufacturing processes have improved product quality and reduced manufacturing costs. The introduction of CBD-infused snus presents a potentially disruptive new category.

Challenges in the Snus Market Market

The snus market faces several challenges:

- Stringent Regulations: Increasingly restrictive regulations on tobacco and nicotine products pose a significant hurdle to market expansion. This includes limitations on advertising, distribution, and product composition.

- Supply Chain Disruptions: Global supply chain complexities can affect the availability of raw materials and finished products.

- Intense Competition: The presence of established players and emerging brands creates intense competitive pressure.

Forces Driving Snus Market Growth

- Technological Advancements: Innovations in product design and nicotine delivery systems drive demand.

- Economic Growth: Increased purchasing power fuels higher consumption, especially in developing economies.

- Shifting Consumer Preferences: Growing demand for smokeless tobacco alternatives is a major growth catalyst.

Long-Term Growth Catalysts

Continued innovation in product formats, flavors, and nicotine delivery mechanisms will play a crucial role in long-term growth. Strategic partnerships and market expansions into new geographical regions will further fuel market expansion.

Emerging Opportunities in Snus Market

The rise of CBD-infused snus presents a substantial opportunity for market expansion. Moreover, exploration of new markets with less stringent regulations and targeting specific consumer segments (e.g., younger adult populations) offer significant potential for growth.

Leading Players in the Snus Market Sector

- Swedish Match AB

- Kurbits Snus

- JT International AG

- Philip Morris International

- Imperial Brands

- GN Tobacco Sweden AB

- Mac Baren

- Dholakia Tobacco Pvt Ltd

- British American Tobacco

- Altria Group Inc

Key Milestones in Snus Market Industry

- January 2023: Cannadips Europe partners with Snushus AG to launch CBD snus pouches.

- November 2022: Philip Morris International acquires Swedish Match.

- May 2021: Philip Morris International acquires AG Snus Aktieselskab.

Strategic Outlook for Snus Market Market

The snus market holds significant potential for future growth, driven by ongoing product innovation, strategic acquisitions, and expansion into new markets. Companies that successfully adapt to evolving consumer preferences and navigate regulatory challenges will be best positioned to capitalize on these opportunities.

Snus Market Segmentation

-

1. Product Type

- 1.1. Loose Snus

- 1.2. Portion Snus

-

2. Distribution Channel

- 2.1. Tobacco Stores

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Snus Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Rest of North America

-

2. Europe

- 2.1. Sweden

- 2.2. Norway

- 2.3. Rest of Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Snus Market Regional Market Share

Geographic Coverage of Snus Market

Snus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus

- 3.4. Market Trends

- 3.4.1. Increase in the Adoption of Snus Among the Young Generation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Snus Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Loose Snus

- 5.1.2. Portion Snus

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Tobacco Stores

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Snus Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Loose Snus

- 6.1.2. Portion Snus

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Tobacco Stores

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Snus Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Loose Snus

- 7.1.2. Portion Snus

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Tobacco Stores

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Snus Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Loose Snus

- 8.1.2. Portion Snus

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Tobacco Stores

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Snus Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Loose Snus

- 9.1.2. Portion Snus

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Tobacco Stores

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Snus Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Loose Snus

- 10.1.2. Portion Snus

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Tobacco Stores

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Swedish Match AB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kurbits Snus

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JT International AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Philip Morris International*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Imperial Brands

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GN Tobacco Sweden AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mac Baren

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dholakia Tobacco Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 British American Tobacco

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Altria Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Swedish Match AB

List of Figures

- Figure 1: Global Snus Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Snus Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Snus Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Snus Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Snus Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Snus Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Snus Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Snus Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Snus Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Snus Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Snus Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Snus Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Snus Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Snus Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Snus Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Snus Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Snus Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Snus Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Snus Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Snus Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Snus Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Snus Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Snus Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Snus Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Snus Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Snus Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Snus Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Snus Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Snus Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Snus Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Snus Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Snus Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Snus Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Snus Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Snus Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Snus Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Snus Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Snus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Snus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Snus Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Snus Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Snus Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Sweden Snus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Snus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Snus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Snus Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Global Snus Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Snus Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Snus Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 19: Global Snus Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Snus Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Snus Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Snus Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Snus Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Snus Market?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the Snus Market?

Key companies in the market include Swedish Match AB, Kurbits Snus, JT International AG, Philip Morris International*List Not Exhaustive, Imperial Brands, GN Tobacco Sweden AB, Mac Baren, Dholakia Tobacco Pvt Ltd, British American Tobacco, Altria Group Inc.

3. What are the main segments of the Snus Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors.

6. What are the notable trends driving market growth?

Increase in the Adoption of Snus Among the Young Generation.

7. Are there any restraints impacting market growth?

Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus.

8. Can you provide examples of recent developments in the market?

In January 2023, Cannadips Europe, a SpectrunLeaf brand offering premium CBD products in the European market, partnered with Snushus AG to launch all-natural CBD snus pouches and to offer the core collection in-store.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Snus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Snus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Snus Market?

To stay informed about further developments, trends, and reports in the Snus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence