Key Insights

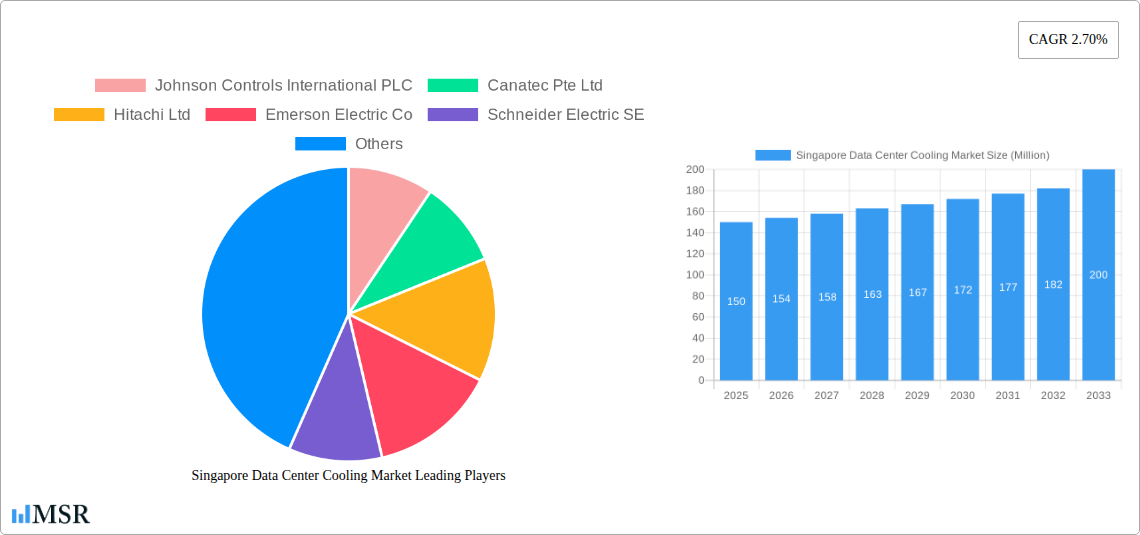

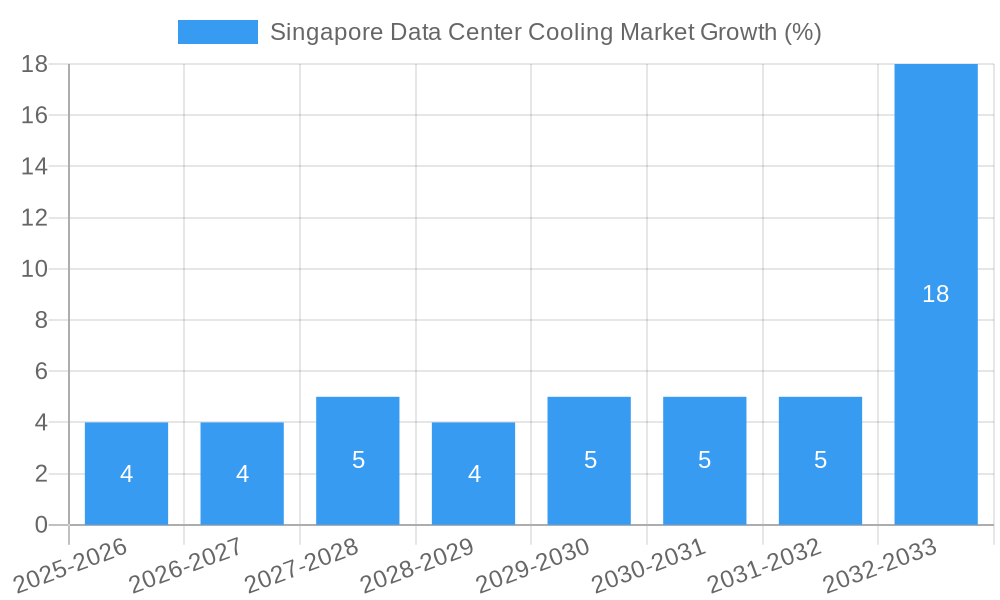

The Singapore data center cooling market, valued at approximately $150 million in 2025, is poised for steady growth, projected to reach approximately $200 million by 2033, driven by a compound annual growth rate (CAGR) of 2.70%. This expansion is fueled by the burgeoning IT and telecommunication sector in Singapore, necessitating robust and efficient cooling solutions for increasingly powerful data centers. The growing adoption of cloud computing and the increasing demand for digital services further contribute to this market growth. While air-based cooling remains the dominant technology due to its cost-effectiveness, liquid-based and evaporative cooling systems are gaining traction, driven by their higher efficiency in managing the heat generated by modern high-density server deployments. The BFSI, government, and media & entertainment sectors are also significant contributors, adopting advanced cooling technologies to ensure data center uptime and operational efficiency. However, factors such as the high initial investment costs associated with advanced cooling systems and the potential for increased energy consumption could act as restraints on market growth. Leading players such as Johnson Controls, Hitachi, and Schneider Electric are actively shaping the market through innovation and strategic partnerships, further fueling competition and driving technological advancements in data center cooling.

The competitive landscape is characterized by a mix of established international players and local companies. The market is witnessing a significant shift toward sustainable and energy-efficient cooling solutions, aligning with Singapore's broader environmental sustainability goals. This trend is expected to drive the adoption of innovative cooling technologies like free-cooling and AI-driven solutions which optimize energy consumption and enhance cooling efficiency. Future growth will hinge on the continued expansion of the data center infrastructure in Singapore, coupled with advancements in cooling technology and the increasing focus on sustainable practices within the data center industry. Government initiatives promoting digital transformation and attracting foreign investment in the tech sector further bolster the positive outlook for the Singapore data center cooling market.

Singapore Data Center Cooling Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Singapore data center cooling market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. Covering the period 2019-2033, with a focus on 2025, this report leverages rigorous data analysis and expert insights to unveil market trends, growth drivers, and emerging opportunities. The report also highlights key players like Johnson Controls, Schneider Electric, and Vertiv, and examines technological advancements shaping the future of data center cooling in Singapore. Expect detailed segmentation analysis across cooling technologies (air-based, liquid-based, evaporative) and end-user sectors (IT & Telecommunication, BFSI, Government, Media & Entertainment, and Others). Discover crucial data on market size (Million), CAGR, and market concentration, alongside an assessment of regulatory frameworks and competitive dynamics.

Singapore Data Center Cooling Market Concentration & Dynamics

The Singapore data center cooling market exhibits a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. However, the presence of several regional players and specialized niche providers contributes to a dynamic competitive environment. Innovation ecosystems are thriving, with ongoing R&D in advanced cooling technologies driving market evolution. Stringent regulatory frameworks focusing on energy efficiency and environmental sustainability are shaping market strategies. Substitute products, while limited, include alternative cooling methods and optimization techniques. End-user trends show a clear preference for energy-efficient and sustainable solutions. M&A activities have been moderate, with a focus on strategic acquisitions aimed at enhancing technological capabilities and expanding market reach. In 2024, approximately xx M&A deals were recorded, leading to a xx% market share consolidation. The market's concentration ratio (CR4) is estimated at xx% in 2025, reflecting a moderately consolidated market.

Singapore Data Center Cooling Market Industry Insights & Trends

The Singapore data center cooling market is experiencing robust growth, driven by the nation's burgeoning digital economy and increasing data center deployments. The market size reached approximately XX Million in 2024 and is projected to reach XX Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of liquid immersion cooling and AI-powered optimization systems, are transforming the industry. Evolving consumer behaviors, including a heightened focus on sustainability and reduced carbon footprint, are compelling vendors to offer eco-friendly solutions. Government initiatives promoting digitalization and smart nation strategies further fuel market expansion. Data center operators are prioritizing solutions that minimize energy consumption and maximize operational efficiency. This is further augmented by increasing regulatory pressure to adopt greener solutions, creating a strong market for sustainable cooling technologies. The market is witnessing the adoption of advanced technologies like AI and machine learning for predictive maintenance and optimization of cooling systems, which is expected to significantly influence the market's growth in the coming years.

Key Markets & Segments Leading Singapore Data Center Cooling Market

Dominant Region/Segment: The IT & Telecommunication sector constitutes the largest end-user segment, followed by the BFSI sector. Air-based cooling remains the dominant cooling technology due to its established presence and relatively lower initial investment costs, although liquid-based and evaporative cooling technologies are gaining traction.

Drivers for Air-based Cooling: Mature technology, relatively low cost, and established infrastructure.

Drivers for Liquid-based Cooling: Growing demand for high-density data centers, increased energy efficiency, and ability to handle higher heat loads.

Drivers for Evaporative Cooling: Cost-effectiveness, water conservation benefits (in certain implementations), and suitability for specific climate conditions.

Drivers for IT & Telecommunication: Rapid growth of the digital economy and increasing demand for cloud services.

Drivers for BFSI: Stringent data security and compliance requirements, necessitating reliable and robust cooling systems.

Drivers for Government: Government initiatives to develop digital infrastructure and promote smart nation initiatives.

The dominance of air-based cooling is likely to decrease over the forecast period due to the increasing adoption of liquid-based cooling, especially in high-density data centers where efficiency and heat dissipation are paramount. The IT and Telecommunication segment will continue to be the leading end-user, fueled by the growth in data consumption and cloud computing.

Singapore Data Center Cooling Market Product Developments

Recent advancements in data center cooling technologies have focused on enhancing efficiency, sustainability, and scalability. Immersion cooling, utilizing dielectric fluids, is gaining traction for its superior heat transfer capabilities compared to traditional air-cooling methods. AI-driven predictive maintenance and optimization tools are improving system reliability and reducing operational costs. Modular and scalable cooling solutions are gaining popularity, addressing the demands of rapidly evolving data center environments. These innovations are creating a competitive edge for vendors offering advanced and sustainable cooling solutions. The market is also witnessing the adoption of free cooling techniques to reduce reliance on energy-intensive mechanical cooling systems, especially in areas with favorable climate conditions.

Challenges in the Singapore Data Center Cooling Market Market

The Singapore data center cooling market faces challenges such as high initial investment costs for advanced cooling technologies, potential regulatory hurdles related to water usage and environmental impact, and supply chain disruptions affecting component availability. Increased competition and pricing pressures are also significant factors. These factors, although affecting growth, are expected to be minimized in the long run by technology advancements and market stabilization. It is estimated these challenges reduce the market growth rate by approximately xx% annually.

Forces Driving Singapore Data Center Cooling Market Growth

Key growth drivers include rising demand for data centers fueled by the burgeoning digital economy, increasing adoption of cloud computing and big data analytics, and government initiatives supporting digital infrastructure development. Technological advancements, such as liquid immersion cooling and AI-powered solutions, are further driving market growth. Stringent energy efficiency regulations are compelling data center operators to adopt advanced cooling technologies that minimize energy consumption and reduce their carbon footprint. The increasing focus on sustainability in the IT sector is also boosting the demand for environmentally friendly cooling solutions.

Long-Term Growth Catalysts in Singapore Data Center Cooling Market

Long-term growth is fueled by continued investments in advanced cooling technologies, strategic partnerships between technology providers and data center operators, and expansion into new markets like edge computing. The increasing adoption of sustainable and efficient cooling solutions is expected to further drive market growth in the long term. Innovation in cooling technologies will continue to be a primary driver, alongside a focus on reducing energy consumption and environmental impact.

Emerging Opportunities in Singapore Data Center Cooling Market

Emerging opportunities lie in the adoption of innovative cooling technologies, such as two-phase immersion cooling and direct-to-chip cooling, catering to the increasing demand for high-density computing environments. The market for AI-powered predictive maintenance and optimization of cooling systems presents significant growth potential. Furthermore, the growing awareness of sustainability and the need for carbon emission reduction presents a major opportunity for vendors offering energy-efficient and eco-friendly cooling solutions. The increasing demand for edge computing is also expected to create new opportunities for specialized cooling solutions.

Leading Players in the Singapore Data Center Cooling Market Sector

- Johnson Controls International PLC

- Canatec Pte Ltd

- Hitachi Ltd

- Emerson Electric Co

- Schneider Electric SE

- Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- Fujitsu General Limited

- Alfa Laval Corporate AB

- Stulz GmbH

- Vertiv Group Corp

- Rittal GMBH & Co KG

- Aggreko plc

Key Milestones in Singapore Data Center Cooling Market Industry

March 2023: Interactive launched its Immersion Data Center Cooling solution with Vertiv, utilizing Green Revolution cooling tanks, significantly improving HPC capabilities. This marks a substantial shift towards advanced cooling technologies.

March 2023: LiquidStack secured investment from Trane Technologies, accelerating the development and adoption of liquid immersion cooling technology, underscoring the industry's commitment to sustainability and efficiency. This indicates a strong investor confidence in sustainable data center cooling solutions.

Strategic Outlook for Singapore Data Center Cooling Market Market

The Singapore data center cooling market is poised for sustained growth driven by technological advancements, increasing data center deployments, and a strong focus on sustainability. Strategic opportunities exist for companies offering innovative, energy-efficient, and environmentally friendly cooling solutions. Partnerships and collaborations are key to success in this market, enabling access to new technologies and expanding market reach. The long-term outlook remains positive, with the market expected to witness continuous expansion and innovation in the years to come.

Singapore Data Center Cooling Market Segmentation

-

1. Cooling Technology

- 1.1. Air-based Cooling

- 1.2. Liquid-based Cooling

- 1.3. Evaporative Cooling

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Singapore Data Center Cooling Market Segmentation By Geography

- 1. Singapore

Singapore Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of IT Infrastructure in the Region; Emergence of Green Data Centers

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Liquid-based Cooling is the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.2. Liquid-based Cooling

- 5.1.3. Evaporative Cooling

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Canatec Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emerson Electric Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujitsu General Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alfa Laval Corporate AB*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stulz GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rittal GMBH & Co KG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Aggreko plc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: Singapore Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Singapore Data Center Cooling Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Singapore Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Singapore Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Singapore Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 7: Singapore Data Center Cooling Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Singapore Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Data Center Cooling Market?

The projected CAGR is approximately 2.70%.

2. Which companies are prominent players in the Singapore Data Center Cooling Market?

Key companies in the market include Johnson Controls International PLC, Canatec Pte Ltd, Hitachi Ltd, Emerson Electric Co, Schneider Electric SE, Mitsubishi Electric Hydronics & IT Cooling Systems S p A, Fujitsu General Limited, Alfa Laval Corporate AB*List Not Exhaustive, Stulz GmbH, Vertiv Group Corp, Rittal GMBH & Co KG, Aggreko plc.

3. What are the main segments of the Singapore Data Center Cooling Market?

The market segments include Cooling Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Development of IT Infrastructure in the Region; Emergence of Green Data Centers.

6. What are the notable trends driving market growth?

Liquid-based Cooling is the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

March 2023: Interactive, a managed service provider, introduced its groundbreaking Immersion Data Center Cooling solution aimed at enhancing high-performance computing (HPC) capabilities for its clientele. Collaborating closely with digital infrastructure provider Vertiv, Interactive has incorporated Green Revolution cooling tanks into its system. These tanks employ a single-phase, non-conductive coolant known for its electrical component safety and impressive heat transfer capacity, which surpasses that of air by a factor of 1200.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Singapore Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence