Key Insights

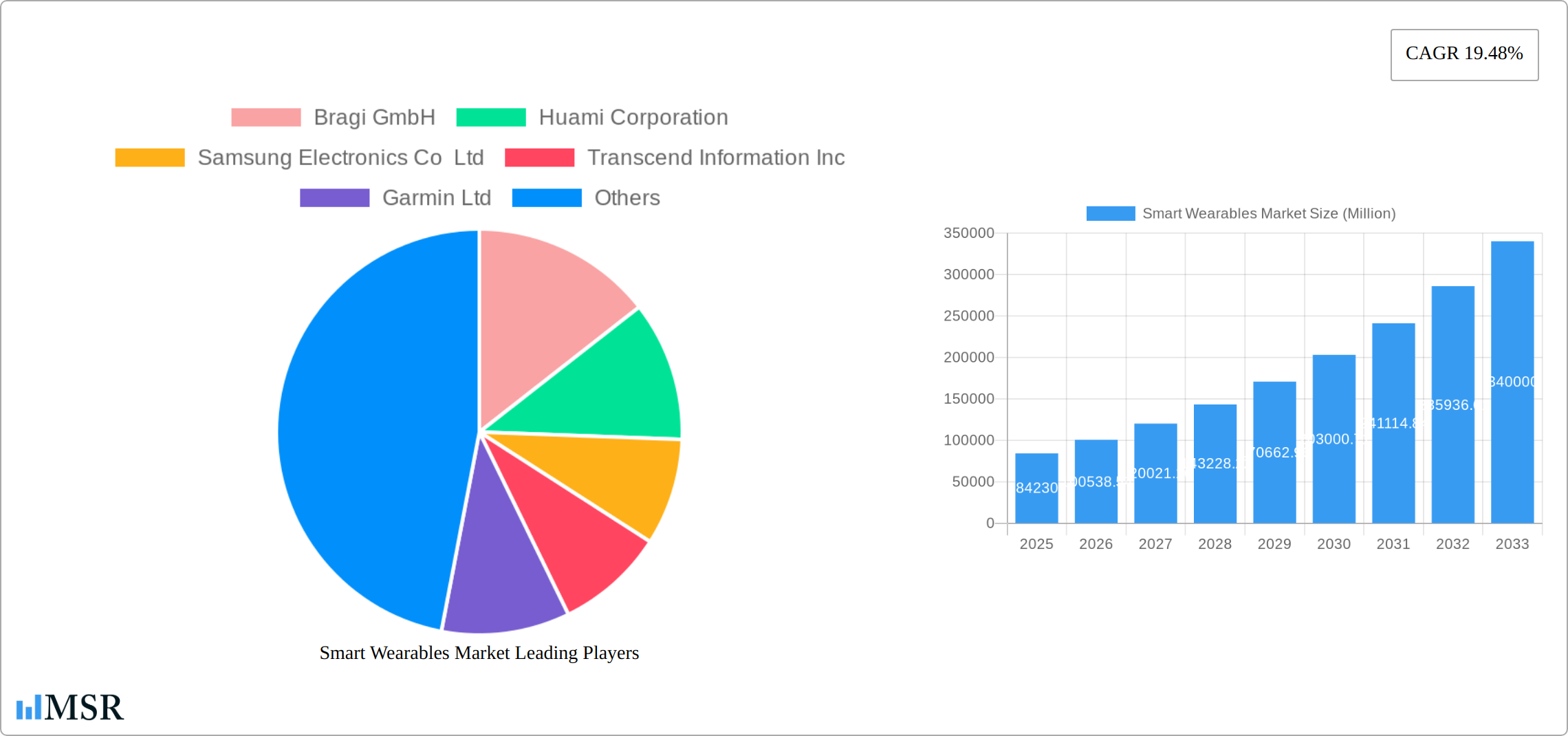

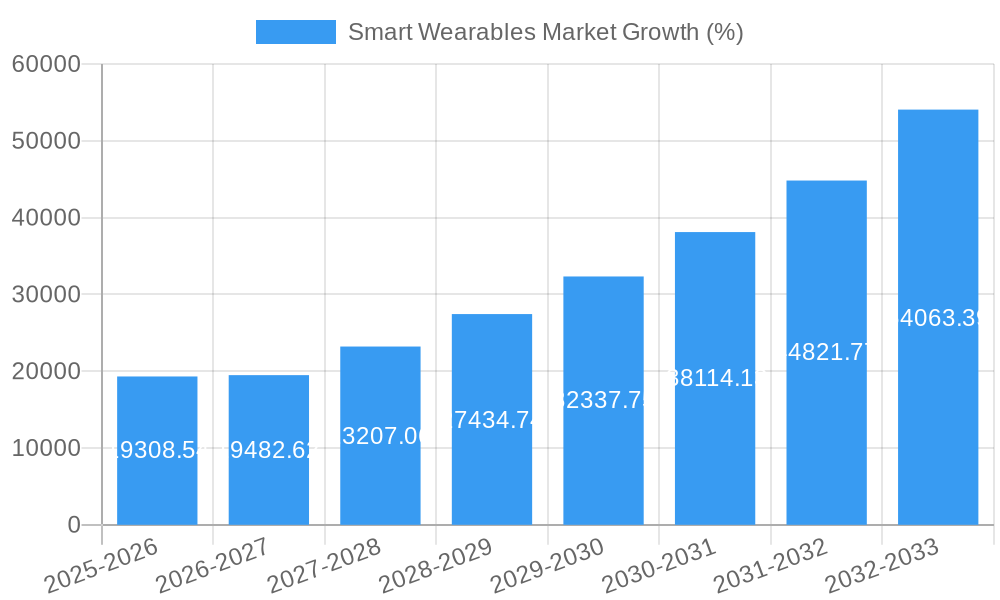

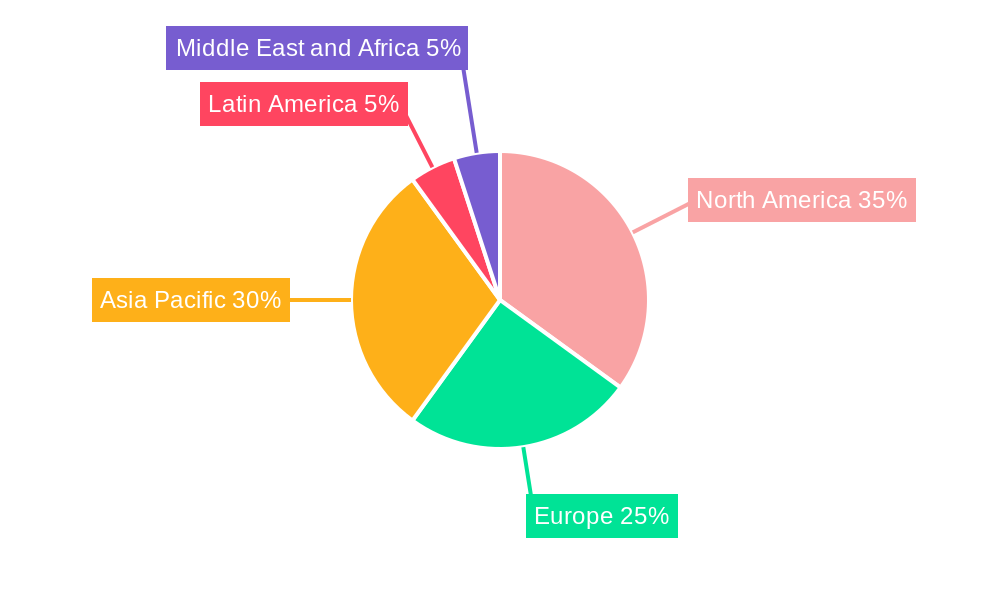

The global smart wearables market, valued at $84.23 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of fitness trackers and smartwatches, fueled by health and wellness consciousness, is a major contributor. Technological advancements, such as improved battery life, enhanced sensor capabilities, and seamless integration with smartphones, are further accelerating market expansion. The rising demand for personalized healthcare solutions and remote patient monitoring is also significantly impacting growth, particularly within the medical devices segment. Furthermore, the integration of smart wearables into various industries, including manufacturing and logistics for enhanced worker safety and efficiency, presents a lucrative avenue for expansion. The market is segmented by product type, encompassing smartwatches, head-mounted displays, smart clothing, ear-worn devices, fitness trackers, body-worn cameras, exoskeletons, and medical devices. Competition is fierce, with established players like Apple, Samsung, and Fitbit alongside emerging innovators in niche areas. Geographical distribution showcases strong performance in North America and Asia Pacific, with Europe and other regions exhibiting steady growth potential. While challenges remain, including data privacy concerns and the need for improved device durability and user experience, the overall outlook for the smart wearables market remains highly positive.

Continued innovation is expected to shape the market's trajectory. The development of more sophisticated health monitoring features, the integration of artificial intelligence for personalized health insights, and the expansion of wearable technology into new applications (e.g., augmented reality experiences) will drive future growth. Regional variations will likely persist, reflecting differences in technological adoption rates, economic development, and healthcare infrastructure. However, the global interconnectedness and the increasing accessibility of technology are predicted to contribute to a more evenly distributed market in the coming years. Companies will need to focus on developing unique value propositions, building robust ecosystems around their products, and addressing consumer concerns regarding data security to maintain a competitive edge in this rapidly evolving landscape. The forecast period of 2025-2033 promises significant opportunities for market expansion and diversification.

Smart Wearables Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global smart wearables market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages data from the historical period (2019-2024) to project future market trends, providing a xx Million valuation for the market in 2025 and forecasting a CAGR of xx% during the forecast period. This report delves into market segmentation by product type (smartwatches, head-mounted displays, smart clothing, ear-worn devices, fitness trackers, body-worn cameras, exoskeletons, and medical devices), revealing key market dynamics and growth opportunities. Leading players like Apple Inc, Samsung Electronics Co Ltd, and Fitbit Inc, are analyzed, alongside emerging companies shaping the future of the smart wearables landscape.

Smart Wearables Market Market Concentration & Dynamics

The global smart wearables market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is also characterized by a dynamic competitive environment with ongoing innovation and mergers and acquisitions (M&A) activity. Apple Inc, Samsung Electronics Co Ltd, and Fitbit Inc currently hold a significant portion of the market, estimated at xx%, xx%, and xx% respectively in 2025. Smaller players are actively competing through product differentiation and niche market targeting.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Innovation Ecosystems: A robust ecosystem of startups, research institutions, and established technology companies drives innovation in areas such as sensor technology, materials science, and data analytics.

- Regulatory Frameworks: Regulations concerning data privacy and health information security are becoming increasingly significant, impacting product development and market access.

- Substitute Products: Traditional fitness trackers and wearable health monitoring devices present some degree of substitution, though the functionality and integration of smart wearables offer a key competitive advantage.

- End-User Trends: Growing consumer demand for health and fitness tracking, seamless connectivity, and personalized experiences are driving market growth. Increased adoption of wearables for both fitness and health monitoring, even in remote areas, is significantly boosting market expansion.

- M&A Activities: The number of M&A deals in the smart wearables market has averaged approximately xx per year over the past five years, demonstrating ongoing consolidation and expansion within the sector.

Smart Wearables Market Industry Insights & Trends

The global smart wearables market is experiencing robust growth, driven by several key factors. Technological advancements such as improved sensor technology, longer battery life, and enhanced data analytics capabilities are significantly impacting market expansion. Furthermore, evolving consumer preferences, particularly a focus on health and wellness, are fueling demand for smart wearables. The increasing affordability of smartwatches and other wearables coupled with rising penetration of smartphones and internet access worldwide is accelerating market adoption, with the market projected to reach xx Million by 2033. The integration of smart wearables into various aspects of daily life (fitness, healthcare, entertainment, and even workplace productivity) is further accelerating market growth.

Key Markets & Segments Leading Smart Wearables Market

The smartwatches segment is currently the dominant product category within the smart wearables market, representing a significant market share of approximately xx% in 2025. This dominance is attributed to their versatile functionality, user-friendly interface, and broad appeal across various demographics.

- Dominant Region: North America currently holds the largest market share, driven by high consumer spending, advanced technology adoption, and a strong focus on health and wellness.

- Dominant Segment (By Product): Smartwatches

- Drivers:

- High consumer demand for fashion-forward and technologically advanced watches

- Increased adoption among fitness enthusiasts and health-conscious individuals

- Improved functionalities like seamless smartphone integration, contactless payments, and health tracking features.

- Drivers:

- Other key segments: Fitness trackers, smart clothing, and medical devices are also experiencing significant growth, driven by their specific applications in health monitoring, rehabilitation, and patient care. Growth is supported by increasing technological advancements, growing consumer awareness of personal well-being, and increasing technological sophistication and consumer acceptance in the broader health and medical technology sectors.

Smart Wearables Market Product Developments

Recent product innovations have focused on enhanced health monitoring capabilities, improved battery life, more stylish designs, and better integration with other smart devices. For instance, the integration of advanced sensors for improved heart rate monitoring and sleep tracking are gaining prominence. Companies are also increasingly focusing on developing wearables with longer battery life and more user-friendly interfaces. The integration of artificial intelligence (AI) and machine learning (ML) for personalized health insights and predictive analytics is also a significant development area, further enhancing the value proposition of smart wearables in the market.

Challenges in the Smart Wearables Market Market

The smart wearables market faces several challenges, including:

- Regulatory hurdles: Data privacy concerns and health regulations vary across different regions, creating complexities in product development and market access.

- Supply chain issues: Global supply chain disruptions can impact the availability of components, causing delays and increasing production costs. This is especially true given the global nature of manufacturing in the electronics and wearable industries.

- Competitive pressures: Intense competition among established players and new entrants creates pressure on pricing and necessitates continuous innovation.

Forces Driving Smart Wearables Market Growth

Several factors contribute to the growth of the smart wearables market:

- Technological advancements: Miniaturization of components, improved sensor technology, and longer battery life are key drivers.

- Increased health awareness: Growing consumer focus on health and fitness fuels demand for wearables with advanced health monitoring capabilities.

- Government initiatives: Government support for digital health initiatives and telehealth services accelerates market expansion. This includes policies promoting health tech adoption and data sharing, especially in markets with established national health systems.

Long-Term Growth Catalysts in Smart Wearables Market

Long-term growth will be fueled by innovations in materials science leading to more comfortable and durable devices. Strategic partnerships between technology companies and healthcare providers will expand applications in remote patient monitoring and personalized medicine. Market expansion into emerging economies with growing smartphone penetration will create significant opportunities. Overall, continued improvement in sensor technology, and the implementation of machine learning in these devices, are key long-term catalysts.

Emerging Opportunities in Smart Wearables Market

Emerging opportunities include the integration of smart wearables into enterprise solutions for employee health and safety. New markets are opening up in the areas of sports and athletic training, where customized training and recovery solutions are becoming popular. New applications in assisted living and elderly care are also creating promising opportunities. Advancements in augmented reality (AR) and virtual reality (VR) integration offer exciting possibilities for enhanced user experience and interaction.

Leading Players in the Smart Wearables Market Sector

- Apple Inc

- Samsung Electronics Co Ltd

- Fitbit Inc

- Bragi GmbH

- Huami Corporation

- Transcend Information Inc

- Garmin Ltd

- AIQ Smart Clothing Inc

- Microsoft Corporation

- GoPro Inc

- Medtronic PLC

- Withings

- Ekso Bionics Holdings Inc

- Cyberdyne Inc

- Huawei Technologies Co Ltd

- Omron Healthcare Inc

- Sensoria Inc

- Fossil Group Inc

- Sony Corporation

- Nuheara Limited

Key Milestones in Smart Wearables Market Industry

- October 2022: Garmin launched the Venu SQ 2 and nu SQ 2 Music Edition smartwatches in India, expanding its market reach and offering enhanced fitness and health tracking features.

- February 2022: Samsung Electronics Co., Ltd. introduced the Sleep Coaching feature on its Galaxy Watch 4, enhancing its sleep tracking capabilities and providing personalized sleep improvement programs.

Strategic Outlook for Smart Wearables Market Market

The smart wearables market is poised for continued strong growth, driven by technological innovations, increasing consumer demand, and expanding applications across various sectors. Strategic partnerships, focusing on new product development and improved user interface design, represent significant opportunities. Expansion into new geographic markets, particularly in developing economies, and a focus on niche applications like personalized health management offer substantial growth potential for market participants.

Smart Wearables Market Segmentation

-

1. Product

- 1.1. Smartwatches

- 1.2. Head-mounted Displays

- 1.3. Smart Clothing

- 1.4. Ear Worn

- 1.5. Fitness Trackers

- 1.6. Body-worn Camera

- 1.7. Exoskeleton

- 1.8. Medical Devices

Smart Wearables Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Smart Wearables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Incremental Technological Advancements Aiding the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost and Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Head-Mounted Displays is Expected to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Smartwatches

- 5.1.2. Head-mounted Displays

- 5.1.3. Smart Clothing

- 5.1.4. Ear Worn

- 5.1.5. Fitness Trackers

- 5.1.6. Body-worn Camera

- 5.1.7. Exoskeleton

- 5.1.8. Medical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Smartwatches

- 6.1.2. Head-mounted Displays

- 6.1.3. Smart Clothing

- 6.1.4. Ear Worn

- 6.1.5. Fitness Trackers

- 6.1.6. Body-worn Camera

- 6.1.7. Exoskeleton

- 6.1.8. Medical Devices

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Smartwatches

- 7.1.2. Head-mounted Displays

- 7.1.3. Smart Clothing

- 7.1.4. Ear Worn

- 7.1.5. Fitness Trackers

- 7.1.6. Body-worn Camera

- 7.1.7. Exoskeleton

- 7.1.8. Medical Devices

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Smartwatches

- 8.1.2. Head-mounted Displays

- 8.1.3. Smart Clothing

- 8.1.4. Ear Worn

- 8.1.5. Fitness Trackers

- 8.1.6. Body-worn Camera

- 8.1.7. Exoskeleton

- 8.1.8. Medical Devices

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia and New Zealand Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Smartwatches

- 9.1.2. Head-mounted Displays

- 9.1.3. Smart Clothing

- 9.1.4. Ear Worn

- 9.1.5. Fitness Trackers

- 9.1.6. Body-worn Camera

- 9.1.7. Exoskeleton

- 9.1.8. Medical Devices

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Latin America Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Smartwatches

- 10.1.2. Head-mounted Displays

- 10.1.3. Smart Clothing

- 10.1.4. Ear Worn

- 10.1.5. Fitness Trackers

- 10.1.6. Body-worn Camera

- 10.1.7. Exoskeleton

- 10.1.8. Medical Devices

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Middle East and Africa Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Smartwatches

- 11.1.2. Head-mounted Displays

- 11.1.3. Smart Clothing

- 11.1.4. Ear Worn

- 11.1.5. Fitness Trackers

- 11.1.6. Body-worn Camera

- 11.1.7. Exoskeleton

- 11.1.8. Medical Devices

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. North America Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 France

- 13.1.4 Rest of Europe

- 14. Asia Pacific Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Rest of Asia Pacific

- 15. Latin America Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Smart Wearables Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Bragi GmbH

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Huami Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Samsung Electronics Co Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Transcend Information Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Garmin Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 AIQ Smart Clothing Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Microsoft Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 GoPro Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Medtronic PLC

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Fitbit Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Withings

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Ekso Bionics Holdings Inc

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Cyberdyne Inc

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Huawei Technologies Co Ltd

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 Omron Healthcare Inc

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.16 Sensoria Inc

- 17.2.16.1. Overview

- 17.2.16.2. Products

- 17.2.16.3. SWOT Analysis

- 17.2.16.4. Recent Developments

- 17.2.16.5. Financials (Based on Availability)

- 17.2.17 Fossil Group Inc

- 17.2.17.1. Overview

- 17.2.17.2. Products

- 17.2.17.3. SWOT Analysis

- 17.2.17.4. Recent Developments

- 17.2.17.5. Financials (Based on Availability)

- 17.2.18 Sony Corporation

- 17.2.18.1. Overview

- 17.2.18.2. Products

- 17.2.18.3. SWOT Analysis

- 17.2.18.4. Recent Developments

- 17.2.18.5. Financials (Based on Availability)

- 17.2.19 Nuheara Limited

- 17.2.19.1. Overview

- 17.2.19.2. Products

- 17.2.19.3. SWOT Analysis

- 17.2.19.4. Recent Developments

- 17.2.19.5. Financials (Based on Availability)

- 17.2.20 Apple Inc

- 17.2.20.1. Overview

- 17.2.20.2. Products

- 17.2.20.3. SWOT Analysis

- 17.2.20.4. Recent Developments

- 17.2.20.5. Financials (Based on Availability)

- 17.2.1 Bragi GmbH

List of Figures

- Figure 1: Global Smart Wearables Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Smart Wearables Market Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Smart Wearables Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Smart Wearables Market Revenue (Million), by Product 2024 & 2032

- Figure 17: Europe Smart Wearables Market Revenue Share (%), by Product 2024 & 2032

- Figure 18: Europe Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Smart Wearables Market Revenue (Million), by Product 2024 & 2032

- Figure 21: Asia Smart Wearables Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Asia Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Australia and New Zealand Smart Wearables Market Revenue (Million), by Product 2024 & 2032

- Figure 25: Australia and New Zealand Smart Wearables Market Revenue Share (%), by Product 2024 & 2032

- Figure 26: Australia and New Zealand Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Australia and New Zealand Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Latin America Smart Wearables Market Revenue (Million), by Product 2024 & 2032

- Figure 29: Latin America Smart Wearables Market Revenue Share (%), by Product 2024 & 2032

- Figure 30: Latin America Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Latin America Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East and Africa Smart Wearables Market Revenue (Million), by Product 2024 & 2032

- Figure 33: Middle East and Africa Smart Wearables Market Revenue Share (%), by Product 2024 & 2032

- Figure 34: Middle East and Africa Smart Wearables Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Smart Wearables Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Wearables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Smart Wearables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Germany Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Smart Wearables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Smart Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Smart Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 25: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Smart Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 27: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Smart Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 29: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Smart Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 31: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Smart Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Smart Wearables Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Wearables Market?

The projected CAGR is approximately 19.48%.

2. Which companies are prominent players in the Smart Wearables Market?

Key companies in the market include Bragi GmbH, Huami Corporation, Samsung Electronics Co Ltd, Transcend Information Inc, Garmin Ltd, AIQ Smart Clothing Inc, Microsoft Corporation, GoPro Inc, Medtronic PLC, Fitbit Inc, Withings, Ekso Bionics Holdings Inc, Cyberdyne Inc, Huawei Technologies Co Ltd, Omron Healthcare Inc, Sensoria Inc, Fossil Group Inc, Sony Corporation, Nuheara Limited, Apple Inc.

3. What are the main segments of the Smart Wearables Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Incremental Technological Advancements Aiding the Market Growth.

6. What are the notable trends driving market growth?

Head-Mounted Displays is Expected to Drive the Market Demand.

7. Are there any restraints impacting market growth?

High Cost and Data Security Concerns.

8. Can you provide examples of recent developments in the market?

October 2022 - Garmin announced the launch of two new wearables, Venu SQ 2 and nu SQ 2 Music Edition, in the Indian market. Both smartwatches will be equipped with all-day fitness tracking, health monitoring, and connected features for all Indian consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Wearables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Wearables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Wearables Market?

To stay informed about further developments, trends, and reports in the Smart Wearables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence