Key Insights

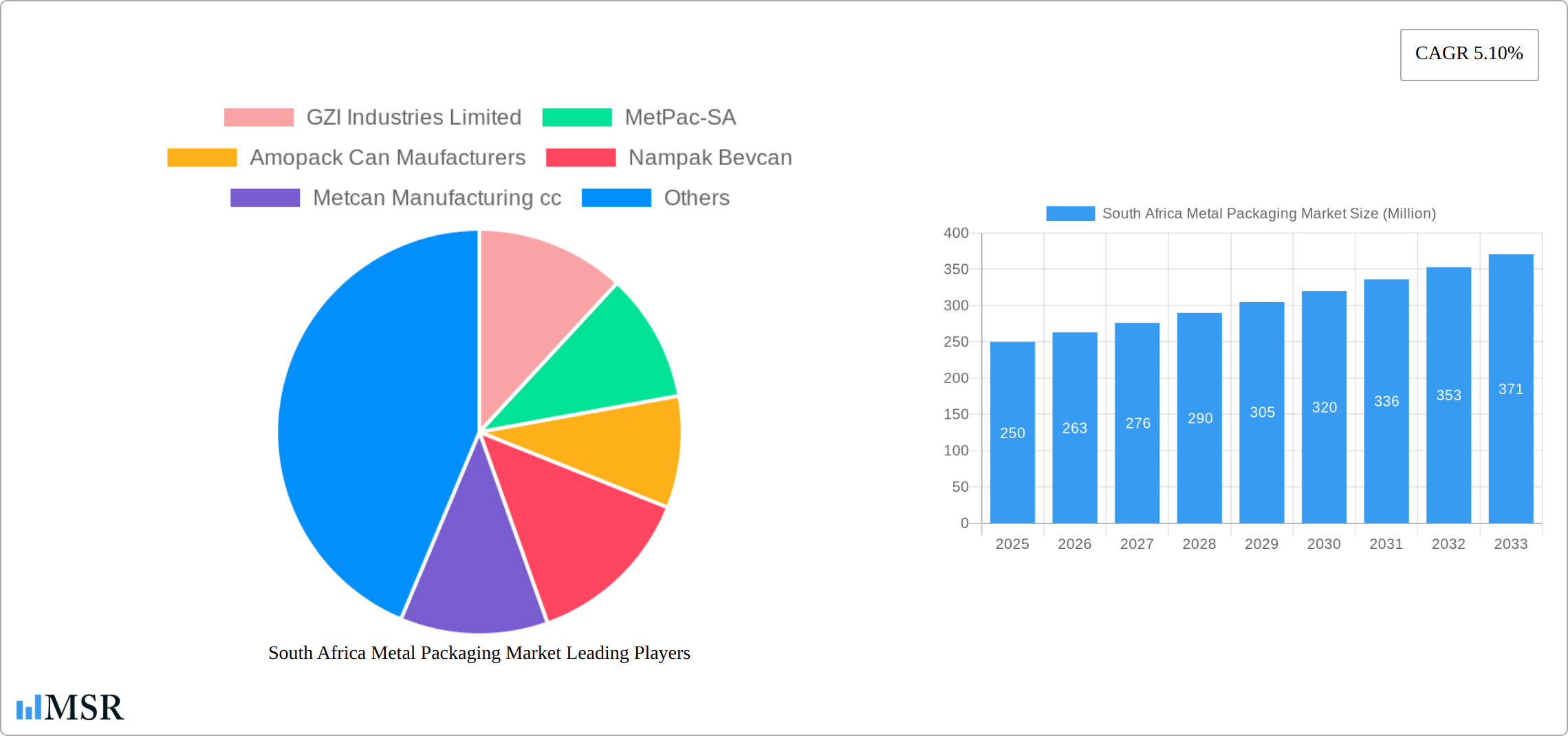

The South African metal packaging market, while lacking precise figures for specific years, shows significant potential for growth. The overall GCC region, including South Africa, exhibits a Compound Annual Growth Rate (CAGR) of 5.10%, indicating a steadily expanding market. Driving this growth are several factors: increasing demand from the food and beverage sector, particularly for canned goods and beverages; the growing popularity of convenient, shelf-stable products; and the inherent advantages of metal packaging in terms of durability, recyclability, and protection against contamination. Trends point towards a rise in sustainable packaging solutions, with increased focus on recycled metal content and environmentally friendly manufacturing practices. While precise market size data for South Africa specifically is unavailable, we can reasonably infer a substantial contribution to the broader GCC market, considering South Africa's robust manufacturing sector and established consumer goods market. The market is segmented by material type (primarily focusing on various metal alloys), product type (cans, closures, and potentially other specialized containers), and end-user industries (food, beverages, pharmaceuticals, and personal care products). Considering South Africa's established economy and its significant role in the African metal packaging landscape, the market is likely to maintain a steady growth trajectory throughout the forecast period (2025-2033), experiencing fluctuations influenced by economic conditions and consumer demand shifts.

The presence of established players like Nampak Bevcan and Hulamin Limited within South Africa suggests a competitive landscape with varying levels of market share. While precise market share data for individual companies is unavailable, these established players likely dominate the market, possibly alongside smaller, regional metal packaging manufacturers. Future growth will be influenced by factors like government regulations promoting sustainable packaging, technological advancements in metal packaging production, and fluctuating metal prices. The overall outlook for the South African metal packaging market remains positive, propelled by consumer preference, industry trends, and the inherent benefits of metal as a robust and sustainable packaging material. The market is expected to continue its expansion and attract both domestic and international investment. Further analysis requiring precise market sizing for South Africa would need more detailed market research.

South Africa Metal Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa metal packaging market, encompassing market size, growth drivers, key players, and future trends. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. The analysis includes detailed segmentation by material type (plastic, paper, metal), product type (bags and pouches, films and wraps, other product types), end-user industry (food, beverage, pharmaceutical and medical, household and personal care, other end-user industries), and geographic coverage focusing on South Africa with comparisons to Saudi Arabia, United Arab Emirates, Qatar, and the Rest of GCC.

South Africa Metal Packaging Market Concentration & Dynamics

The South Africa metal packaging market exhibits a moderately concentrated landscape, with key players like Nampak Bevcan and GZI Industries Limited holding significant market share. However, the presence of several smaller players, including MetPac-SA, Amopack Can Manufacturers, Metcan Manufacturing cc, and Hulamin Limited, ensures a competitive environment. Innovation in sustainable packaging materials and manufacturing processes is driving market dynamics. Stringent regulatory frameworks focused on environmental sustainability and food safety influence packaging choices. Substitute products like plastic and paper packaging pose a challenge, but metal's inherent properties (durability, recyclability) maintain its relevance. The market has witnessed a moderate level of M&A activity in recent years, with approximately xx deals recorded between 2019 and 2024, primarily driven by consolidation efforts and expansion strategies. End-user trends, particularly a growing preference for convenient and sustainable packaging, significantly shape the market's evolution.

- Market Share: Nampak Bevcan holds an estimated xx% market share, followed by GZI Industries Limited with xx%.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024.

- Regulatory Framework: Stringent regulations on material recyclability and food safety.

- Substitute Products: Growing competition from plastic and paper-based packaging.

South Africa Metal Packaging Market Industry Insights & Trends

The South Africa metal packaging market is projected to experience robust growth during the forecast period (2025-2033). The market size in 2025 is estimated at USD xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by factors such as the increasing demand for canned food and beverages, rising disposable incomes, and expanding retail sectors. Technological disruptions, including advancements in printing techniques and the development of lightweight, sustainable metal packaging solutions, are impacting the market. Consumers' growing awareness of environmental sustainability and their preference for eco-friendly packaging solutions are shaping the demand for recyclable metal packaging.

Key Markets & Segments Leading South Africa Metal Packaging Market

The metal segment dominates the South Africa metal packaging market, driven by its superior properties in terms of durability, recyclability, and barrier protection. The food and beverage sector constitutes the largest end-user industry, benefiting from the metal packaging's ability to preserve product quality and extend shelf life.

- Dominant Segment: Metal packaging by material type; Food & Beverage by end-user industry.

- Growth Drivers:

- Increasing demand for canned food and beverages.

- Rising disposable incomes leading to increased consumer spending.

- Expansion of organized retail sector and improved logistics infrastructure.

- Government initiatives promoting sustainable packaging.

Within the GCC region, Saudi Arabia represents the largest market for metal packaging, followed by the UAE and Qatar. Growth in these markets is fueled by population growth, economic expansion, and increasing demand for packaged goods. The Rest of GCC region demonstrates slower growth, influenced by economic conditions and market maturity.

South Africa Metal Packaging Market Product Developments

Recent innovations have focused on lightweighting metal packaging to reduce material costs and environmental impact. Advancements in printing technology have enhanced the aesthetic appeal of metal packaging, improving brand visibility and shelf appeal. These developments enhance the competitive edge of metal packaging by addressing environmental concerns and consumer preferences for visually appealing products.

Challenges in the South Africa Metal Packaging Market

The South Africa metal packaging market faces challenges such as fluctuating raw material prices, increasing transportation costs, and intense competition from substitute packaging materials. Regulatory changes relating to environmental sustainability can also impact manufacturers' operations. These factors collectively constrain market expansion, resulting in an estimated xx% reduction in potential growth during the forecast period.

Forces Driving South Africa Metal Packaging Market Growth

Technological advancements in sustainable metal packaging solutions are driving market growth. Economic growth, particularly increased disposable incomes, fuels higher demand for packaged goods. Favorable government regulations promoting sustainable packaging materials further boost market expansion. The increasing preference for convenient and easy-to-store packaged food and beverage products also contributes to growth.

Long-Term Growth Catalysts in the South Africa Metal Packaging Market

Long-term growth will be fueled by continued innovation in sustainable packaging solutions, strategic partnerships between packaging manufacturers and brand owners, and expansion into new geographical markets. The development of lightweight and recyclable metal packaging solutions will be a key driver of future growth.

Emerging Opportunities in South Africa Metal Packaging Market

Emerging opportunities exist in the development of eco-friendly metal packaging solutions and customized packaging for niche markets. Growing demand for sustainable and convenient packaging presents opportunities for innovative product development and market expansion. Targeting consumers increasingly conscious of environmental issues will open further growth prospects.

Leading Players in the South Africa Metal Packaging Market Sector

- GZI Industries Limited

- MetPac-SA

- Amopack Can Manufacturers

- Nampak Bevcan

- Metcan Manufacturing cc

- Hulamin Limited

- Ardgh Group S

- Can It

Key Milestones in South Africa Metal Packaging Market Industry

- December 2022: Oceana's sales increased by double digits due to strong demand for canned fish (Lucky Star brand), demonstrating robust market performance in the food segment. Sales rose 11% to SAR 8.44 billion (USD 480 Million).

- November 2022: South Africa benefited from a poor peach harvest in Greece, leading to increased canned fruit exports by RFG Holdings, signifying market opportunities for filling supply gaps.

Strategic Outlook for South Africa Metal Packaging Market

The South Africa metal packaging market presents significant growth potential driven by innovation in sustainable packaging, expanding consumer base, and favorable economic conditions. Strategic partnerships, focusing on sustainable solutions and efficient supply chains, will be crucial for achieving long-term success in this competitive market. Companies focusing on environmentally conscious manufacturing and product development are poised to capture significant market share in the coming years.

South Africa Metal Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Metal Packaging Market Segmentation By Geography

- 1. South Africa

South Africa Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food and Beverage Industry in South Africa; Convenience and Lower Price Offered by Canned Food

- 3.3. Market Restrains

- 3.3.1. Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Food and Baverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 GZI Industries Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 MetPac-SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Amopack Can Maufacturers

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nampak Bevcan

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Metcan Manufacturing cc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Hulamin Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ardgh Group S

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Can It

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 GZI Industries Limited

List of Figures

- Figure 1: South Africa Metal Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Metal Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Metal Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Metal Packaging Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: South Africa Metal Packaging Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: South Africa Metal Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: South Africa Metal Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: South Africa Metal Packaging Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: South Africa Metal Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa Metal Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: South Africa Metal Packaging Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: South Africa Metal Packaging Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: South Africa Metal Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: South Africa Metal Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: South Africa Metal Packaging Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: South Africa Metal Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Metal Packaging Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the South Africa Metal Packaging Market?

Key companies in the market include GZI Industries Limited, MetPac-SA, Amopack Can Maufacturers, Nampak Bevcan, Metcan Manufacturing cc, Hulamin Limited, Ardgh Group S, Can It.

3. What are the main segments of the South Africa Metal Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Food and Beverage Industry in South Africa; Convenience and Lower Price Offered by Canned Food.

6. What are the notable trends driving market growth?

Growing Food and Baverage Industry.

7. Are there any restraints impacting market growth?

Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: Sales at Oceana, which owns the canned fish brand Lucky Star, have increased in South Africa. The strong demand for canned fish enabled a lift of Oceana's sales by double digits in the second part of the year. Sales for the global fishing company rose 11% to SAR 8.44 billion (USD 480 million), with operating profit rising 4% to SAR 1.25 billion (USD 71.0 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Metal Packaging Market?

To stay informed about further developments, trends, and reports in the South Africa Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence