Key Insights

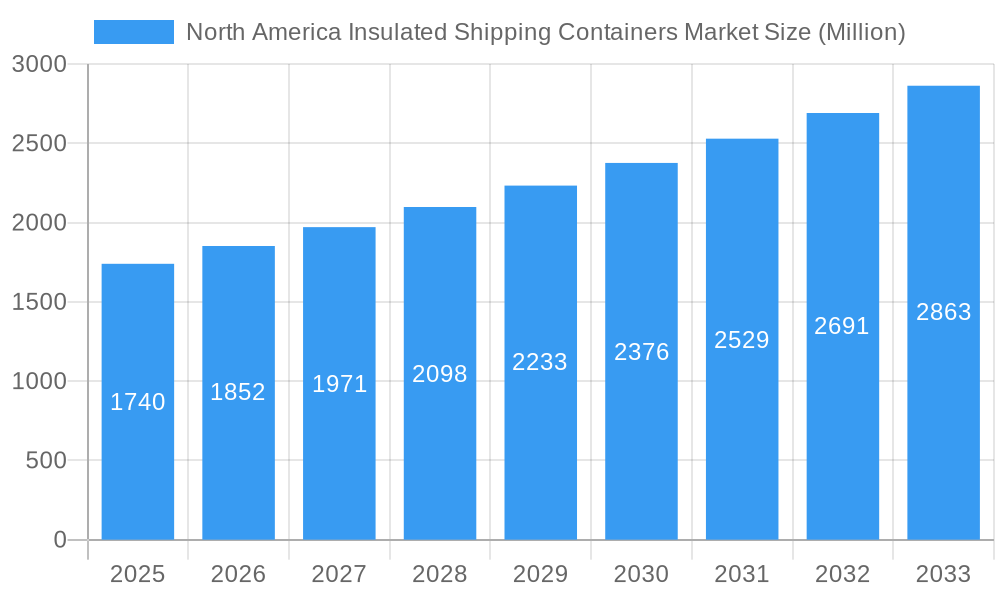

The North American insulated shipping containers market, valued at $1.74 billion in 2025, is projected to experience robust growth, driven by the increasing demand for temperature-sensitive goods across various sectors. The market's Compound Annual Growth Rate (CAGR) of 6.46% from 2019-2033 indicates a significant expansion over the forecast period (2025-2033). Key drivers include the burgeoning e-commerce sector, the expansion of the food and beverage industry, particularly pre-cooked and frozen food, and the growing need for efficient and safe transportation of pharmaceuticals and life sciences products. The rising consumer demand for fresh produce and the increasing focus on maintaining the cold chain throughout the supply chain further fuel market growth. While material costs and potential supply chain disruptions could pose some challenges, the overall market outlook remains positive, with significant opportunities for growth in specialized containers designed for specific applications like transporting pharmaceuticals under strict temperature control or for sustainable materials like EPP (Expanded Polypropylene). The segmentation by material type (EPS, PU, EPP) and end-user application (food, pharmaceuticals, etc.) allows for a granular understanding of the market dynamics and helps in identifying key growth segments. The focus on North America reflects the region's strong economic performance and advanced logistics infrastructure. Canada and the United States will be the dominant markets within this region, reflecting their established cold chain infrastructure and growing e-commerce penetration.

North America Insulated Shipping Containers Market Market Size (In Billion)

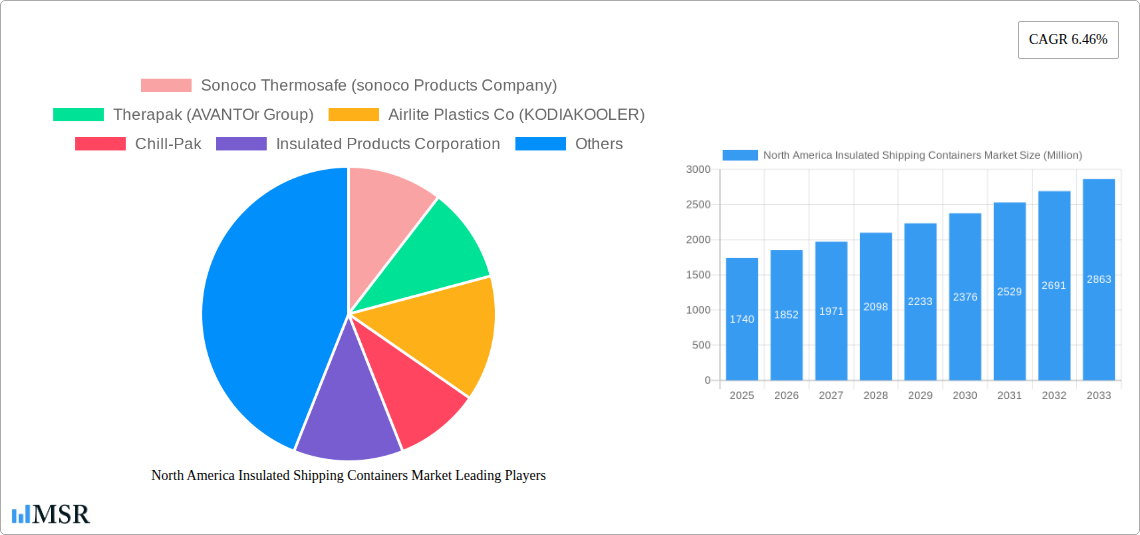

The competitive landscape is characterized by a mix of established players and emerging companies focusing on innovation in materials, design, and sustainability. Major players like Sonoco Thermosafe, Therapak, and Chill-Pak are leveraging their expertise and market presence to cater to the growing demand. Smaller companies are focusing on niche applications and providing specialized solutions. Future growth will likely be fueled by advancements in insulation materials, the adoption of reusable and recyclable containers, and a greater focus on monitoring and tracking the temperature of shipments using technology such as IoT (Internet of Things) sensors. The integration of these technologies into the supply chain will be key to further improving the efficiency and reliability of temperature-sensitive goods transportation.

North America Insulated Shipping Containers Market Company Market Share

North America Insulated Shipping Containers Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Insulated Shipping Containers Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, trends, and opportunities across various segments and geographies. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Insulated Shipping Containers Market Concentration & Dynamics

The North American insulated shipping containers market exhibits a moderately consolidated structure, with several key players holding significant market share. However, the market also features a number of smaller, specialized companies catering to niche segments. Market concentration is influenced by factors such as economies of scale, technological capabilities, and brand recognition. The market’s innovation ecosystem is dynamic, driven by ongoing research and development in materials science, insulation technologies, and sustainable packaging solutions. Regulatory frameworks, particularly concerning food safety and environmental regulations, significantly impact material selection and manufacturing processes. Substitute products, such as reusable containers and alternative cooling methods, present competitive challenges, while evolving end-user preferences—including increased demand for sustainable and eco-friendly options—shape market demand. Mergers and acquisitions (M&A) activity has been moderate, with companies focusing on expanding their product portfolios and geographic reach. For example, in 2022, TemperPack secured USD 140 Million in equity financing, demonstrating investor confidence in the market's growth potential. This deal, along with other less publicized activities, contributes to an estimated xx M&A deals annually within the North American Insulated Shipping Containers market. The average market share held by the top 5 players in the region currently sits at approximately xx%.

North America Insulated Shipping Containers Market Industry Insights & Trends

The North American insulated shipping containers market is experiencing robust growth, propelled by several key factors. The expanding e-commerce sector and the increasing demand for temperature-sensitive goods, including pharmaceuticals, food products, and perishable items, are significant drivers. Technological advancements, including the development of innovative insulation materials like Expanded Polypropylene (EPP) and advanced cooling technologies, are improving the efficiency and performance of shipping containers. Changing consumer preferences are also shaping the market, with a rising emphasis on sustainability and environmentally friendly packaging options. The market size in 2025 is estimated at xx Million, indicating a significant increase from the xx Million recorded in 2019. This growth trajectory is expected to continue, driven by technological advancements, sustainability concerns, and the ongoing expansion of the e-commerce sector. The market demonstrates a significant growth potential, with a projected value of xx Million by 2033.

Key Markets & Segments Leading North America Insulated Shipping Containers Market

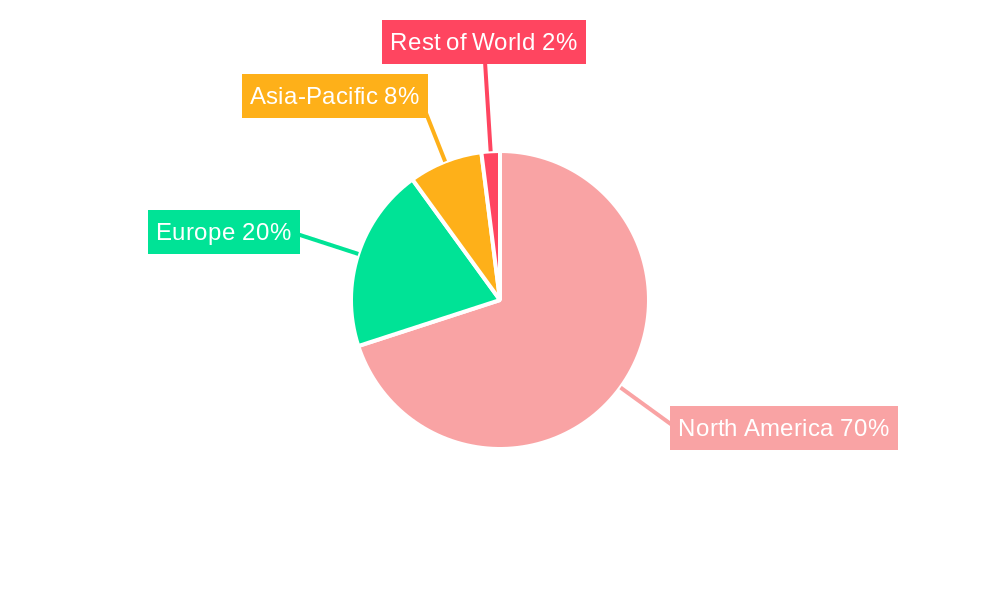

Dominant Region/Country: The United States dominates the North American market due to its large and diverse economy, extensive e-commerce sector, and high demand for temperature-sensitive products. Canada also contributes significantly, experiencing steady growth aligned with its expanding logistics and e-commerce sectors.

Dominant Material Type: Expanded Polystyrene (EPS) currently holds the largest market share due to its cost-effectiveness and good insulation properties. However, the adoption of more sustainable materials like Expanded Polypropylene (EPP) and Polyurethane Foam (PU) is increasing, driven by environmental concerns.

Dominant End-User Application: The lifesciences and pharmaceutical sector is a key driver, demanding high-performance containers for the safe transport of temperature-sensitive medications. Pre-cooked and frozen food also represent a substantial segment.

Drivers for Growth (Bullet Points):

- Economic growth in North America

- Expansion of e-commerce and online grocery delivery

- Rising demand for temperature-sensitive products across various sectors

- Growing emphasis on cold chain logistics

- Increasing investments in cold chain infrastructure

- Technological advancements in insulation materials and cooling technologies

- Stringent regulations regarding food safety and pharmaceutical transportation

The United States' dominance is attributed to its robust economy, advanced logistics network, and high consumption of temperature-sensitive goods. While Canada represents a significant market, the US significantly surpasses it in terms of market size and overall demand due to its larger population and more developed e-commerce infrastructure.

North America Insulated Shipping Containers Market Product Developments

Recent years have witnessed significant advancements in insulated shipping container technology. New materials, such as biodegradable and recyclable alternatives to traditional polystyrene, are being introduced to address environmental concerns. Improved insulation designs and integrated cooling systems are enhancing the efficiency and reliability of these containers, extending the shelf life of temperature-sensitive goods. These innovations are driving increased market adoption and providing manufacturers with a competitive edge. The integration of smart sensors and data tracking capabilities further enhances supply chain visibility and improves product safety.

Challenges in the North America Insulated Shipping Containers Market Market

The North American insulated shipping containers market faces several challenges. Fluctuations in raw material prices, particularly for petroleum-based materials, impact production costs and profitability. Supply chain disruptions, exacerbated by global events, can lead to delays and shortages. Stringent environmental regulations require manufacturers to adopt more sustainable materials and processes, increasing production complexity and costs. Furthermore, intense competition among established and emerging players creates pressure on pricing and margins. These factors, combined, could result in a xx% reduction in overall market growth in the worst-case scenario.

Forces Driving North America Insulated Shipping Containers Market Growth

The North American market experiences growth due to the expansion of the e-commerce sector and increased demand for temperature-sensitive goods in pharmaceuticals and food. Technological advancements in insulation and cooling, as well as government regulations favoring sustainable materials, are additional catalysts. The rise of cold chain logistics and investments in infrastructure further contribute. Economic growth in the region and rising disposable incomes also stimulate market expansion.

Challenges in the North America Insulated Shipping Containers Market Market

Long-term growth is supported by ongoing innovations in sustainable materials and packaging design. Strategic partnerships between manufacturers and logistics providers enhance supply chain efficiency. Market expansion into emerging sectors like cosmetics and beverages, and the growing adoption of reusable containers, are also positive indicators.

Emerging Opportunities in North America Insulated Shipping Containers Market

Emerging opportunities include the growing demand for sustainable and eco-friendly packaging, creating potential for biodegradable and recyclable materials. The increasing integration of smart technology and data tracking offers enhanced supply chain visibility and efficiency. Expanding into new end-user markets, like the cosmetics industry, and the exploration of new insulation technologies with enhanced thermal performance, presents significant potential for market growth.

Leading Players in the North America Insulated Shipping Containers Market Sector

- Sonoco Thermosafe (sonoco Products Company)

- Therapak (AVANTOr Group)

- Airlite Plastics Co (KODIAKOOLER)

- Chill-Pak

- Insulated Products Corporation

- Polar Tech Industries

- Softbox Systems Ltd (CSAFE Global)

- Custom Pack Inc

- Sofrigam

- Intelsius (A DGP Company)

- Thermal Shipping Solution

- Cascades Inc

- Temperpack

Key Milestones in North America Insulated Shipping Containers Market Industry

June 2022: Cascades Inc. launched its innovative isothermal packaging technology, north box XTEND, expanding its production capabilities across North America. This significantly impacts market competitiveness through increased efficiency and sustainability.

March 2022: TemperPack secured USD 140 Million in equity financing, enabling expansion of its capacity and geographic reach. This boosts market competition and innovation.

Strategic Outlook for North America Insulated Shipping Containers Market Market

The North American insulated shipping containers market exhibits promising long-term growth potential, fueled by a confluence of factors. Continued innovation in materials science, the adoption of sustainable solutions, and the integration of smart technologies are key accelerators. Strategic partnerships and market expansions into new sectors will significantly impact future market dynamics. The ongoing growth of the e-commerce sector and the increasing demand for temperature-sensitive products across various industries will provide sustained growth opportunities for market players.

North America Insulated Shipping Containers Market Segmentation

-

1. Material Type

- 1.1. Expanded Polystyrene (EPS)

- 1.2. Polyurethane Foam (PU)

- 1.3. Expanded Polypropylene (EPP)

- 1.4. Other Material Types

-

2. End-user Application

- 2.1. Pre-cooked Food and Frozen Food

- 2.2. Life Sciences and Pharmaceutical

- 2.3. Fresh Meat

- 2.4. Fresh Produce

- 2.5. Bakery, Plants, and Flowers

- 2.6. Other En

North America Insulated Shipping Containers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Insulated Shipping Containers Market Regional Market Share

Geographic Coverage of North America Insulated Shipping Containers Market

North America Insulated Shipping Containers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Pharmaceutical and Healthcare Sector to Boost the Market; Increasing Consumer Demand for Perishable Food

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs; Growing Usage of Substitute Products (Plastic)

- 3.4. Market Trends

- 3.4.1. Lifesciences and Pharmaceutical Segment Holds Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Insulated Shipping Containers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Expanded Polystyrene (EPS)

- 5.1.2. Polyurethane Foam (PU)

- 5.1.3. Expanded Polypropylene (EPP)

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Pre-cooked Food and Frozen Food

- 5.2.2. Life Sciences and Pharmaceutical

- 5.2.3. Fresh Meat

- 5.2.4. Fresh Produce

- 5.2.5. Bakery, Plants, and Flowers

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Thermosafe (sonoco Products Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Therapak (AVANTOr Group)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airlite Plastics Co (KODIAKOOLER)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chill-Pak

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Insulated Products Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Polar Tech Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Softbox Systems Ltd (CSAFE Global)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Custom Pack Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sofrigam

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intelsius (A DGP Company)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Thermal Shipping Solution*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cascades Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Temperpack

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Sonoco Thermosafe (sonoco Products Company)

List of Figures

- Figure 1: North America Insulated Shipping Containers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Insulated Shipping Containers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Insulated Shipping Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Insulated Shipping Containers Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 3: North America Insulated Shipping Containers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Insulated Shipping Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: North America Insulated Shipping Containers Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 6: North America Insulated Shipping Containers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Insulated Shipping Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Insulated Shipping Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Insulated Shipping Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Insulated Shipping Containers Market?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the North America Insulated Shipping Containers Market?

Key companies in the market include Sonoco Thermosafe (sonoco Products Company), Therapak (AVANTOr Group), Airlite Plastics Co (KODIAKOOLER), Chill-Pak, Insulated Products Corporation, Polar Tech Industries, Softbox Systems Ltd (CSAFE Global), Custom Pack Inc, Sofrigam, Intelsius (A DGP Company), Thermal Shipping Solution*List Not Exhaustive, Cascades Inc, Temperpack.

3. What are the main segments of the North America Insulated Shipping Containers Market?

The market segments include Material Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Pharmaceutical and Healthcare Sector to Boost the Market; Increasing Consumer Demand for Perishable Food.

6. What are the notable trends driving market growth?

Lifesciences and Pharmaceutical Segment Holds Significant Share.

7. Are there any restraints impacting market growth?

Rising Operational Costs; Growing Usage of Substitute Products (Plastic).

8. Can you provide examples of recent developments in the market?

June 2022 - Cascades launched an innovative isothermal packaging technology, north box XTEND, by improving its line of the north box while the composition of the box creates a moisture barrier that keeps the insulation rigid and expands a new production site across North America which includes the installation of the highly automated packaging line for the production of its isothermal boxes, including the new north box XTEND.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Insulated Shipping Containers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Insulated Shipping Containers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Insulated Shipping Containers Market?

To stay informed about further developments, trends, and reports in the North America Insulated Shipping Containers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence