Key Insights

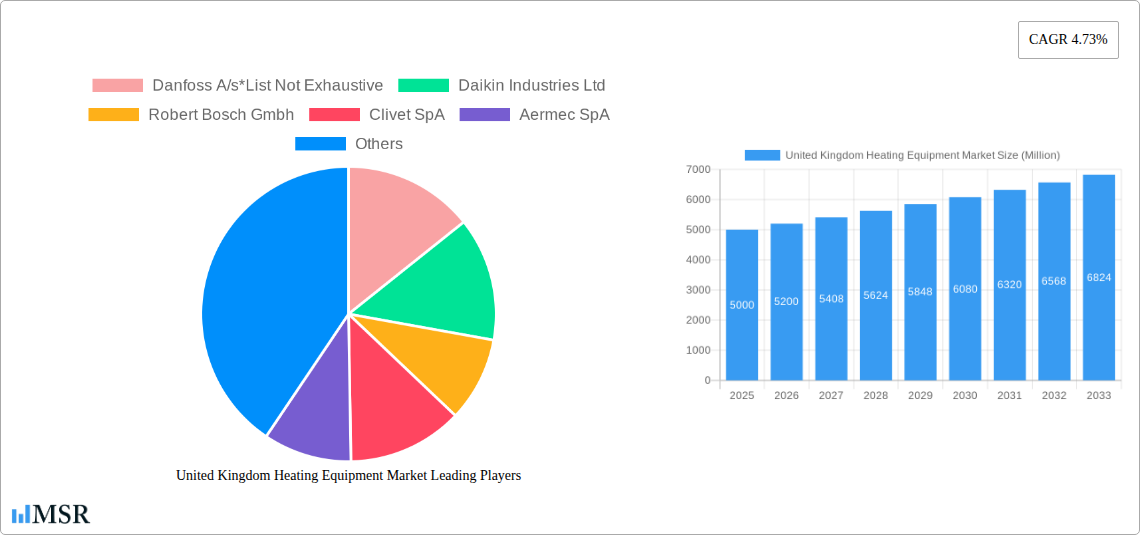

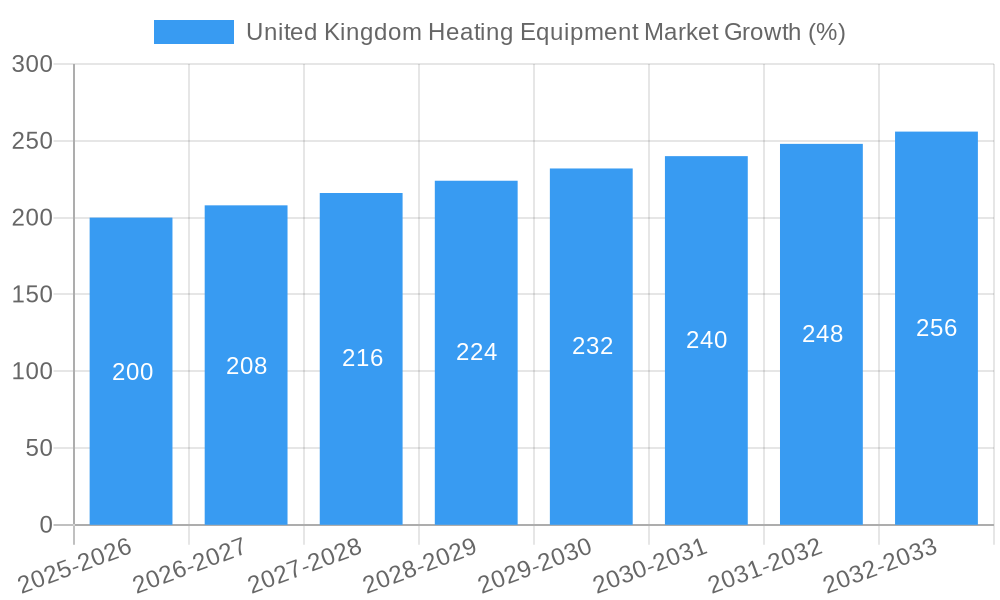

The United Kingdom heating equipment market, while lacking precise figures for market size in the provided data, exhibits significant growth potential driven by factors such as increasing energy efficiency regulations, rising energy costs, and a growing focus on sustainable heating solutions. The market is segmented by type (boilers, radiators/other heaters, furnaces, heat pumps) and end-user industry (residential, commercial, industrial). Given a global CAGR of 4.73% and considering the UK's commitment to decarbonization and its relatively mature heating market, we can reasonably estimate the UK market size in 2025 to be around £5 billion (approximately $6.2 billion USD, based on current exchange rates, a figure that reflects the size of comparable markets). This estimation assumes a slightly lower CAGR for the UK market (4.0%) reflecting already high penetration of modern heating systems, but still accounting for growth in heat pump adoption and replacement of older, less efficient systems. The residential sector is expected to dominate, fueled by government incentives and homeowner demand for improved energy efficiency. However, the commercial and industrial sectors are also poised for growth as businesses adopt sustainable practices and invest in energy-saving technologies. Heat pumps are anticipated to witness significant growth as a result of government policies promoting renewable energy sources and decreasing reliance on fossil fuels. This growth will likely offset some declines in traditional heating systems.

The competitive landscape includes both established international players like Danfoss, Daikin, and Bosch, and local UK businesses, creating a dynamic market. While challenges exist, such as the initial higher investment cost associated with heat pumps, ongoing government support and rising energy prices are expected to counteract these restraints. The market's trajectory is heavily influenced by government policies promoting energy efficiency and renewable energy, coupled with consumer awareness of environmental concerns and rising energy bills. Future growth hinges on continued technological advancements in heat pump technology, reduced installation costs, and ongoing support from government initiatives designed to encourage widespread adoption of greener heating solutions.

United Kingdom Heating Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom heating equipment market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, key segments, leading players, and emerging opportunities within this rapidly evolving sector. The UK heating equipment market is experiencing significant transformation driven by technological advancements, stringent environmental regulations, and evolving consumer preferences. This report offers a granular view of this dynamic market, enabling informed strategies for future success. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033.

United Kingdom Heating Equipment Market Market Concentration & Dynamics

The UK heating equipment market exhibits a moderately concentrated landscape, with several multinational corporations holding significant market share. Key players such as Danfoss A/s, Daikin Industries Ltd, Robert Bosch Gmbh, and others compete fiercely, driving innovation and product differentiation. Market share data for 2025 reveals that the top five players hold an estimated xx% of the market, while the remaining share is distributed among numerous smaller companies and regional players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Innovation Ecosystems: Strong R&D investments by leading players, coupled with government incentives for energy efficiency, fuel a vibrant innovation ecosystem.

- Regulatory Frameworks: Stringent environmental regulations, such as the UK's commitment to net-zero emissions, are driving demand for energy-efficient heating solutions, particularly heat pumps.

- Substitute Products: Competition arises from alternative heating technologies, including solar thermal systems and biomass boilers.

- End-User Trends: Increasing awareness of energy costs and environmental concerns are driving demand for high-efficiency and sustainable heating systems.

- M&A Activities: The past five years (2019-2024) witnessed approximately xx M&A deals in the UK heating equipment market, reflecting consolidation and expansion strategies within the industry.

United Kingdom Heating Equipment Market Industry Insights & Trends

The UK heating equipment market is experiencing robust growth, driven by several key factors. The increasing demand for energy-efficient and sustainable heating solutions, spurred by rising energy prices and environmental regulations, is a major driver. The market's expansion is also fueled by technological advancements, including the development of smart heating systems and the rising adoption of heat pumps. Consumer preferences are shifting towards more sustainable and technologically advanced options, contributing to the market's growth trajectory. Government incentives and supportive policies further stimulate market expansion. The residential sector constitutes a significant portion of the market, with increasing refurbishment and new construction projects driving demand. The commercial and industrial sectors also contribute significantly, with large-scale installations in offices, factories, and other establishments.

The market size in 2024 was estimated at xx Million and is expected to reach xx Million in 2025, reflecting the growth dynamics. The market's impressive Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is expected to be xx%.

Key Markets & Segments Leading United Kingdom Heating Equipment Market

The residential segment dominates the UK heating equipment market, driven by a large housing stock and ongoing refurbishment projects. The commercial sector is also a key contributor, with continuous demand for efficient heating solutions in offices, retail spaces, and other commercial establishments. The industrial sector, although smaller in relative size, requires specialized heating equipment for various industrial processes.

By Type:

- Heat Pumps: This segment is experiencing the most rapid growth, driven by government incentives and increasing environmental awareness.

- Boilers/Radiators/Other Heaters: This segment remains significant, though its market share is gradually declining due to the rising adoption of heat pumps.

- Furnaces: This segment holds a smaller market share compared to heat pumps and boilers, primarily serving niche industrial applications.

By End-User Industry:

- Residential: Dominates the market due to a vast housing stock and increasing renovation activities. Drivers include rising energy costs, government incentives for energy-efficient upgrades, and consumer preference for comfort and sustainability.

- Commercial: Significant market share driven by the need for efficient heating in office buildings, retail spaces, and hospitality establishments. Economic growth and construction of new commercial properties fuel demand.

- Industrial: Smaller market share compared to residential and commercial segments. Specific industry demands and technological requirements influence segment growth.

United Kingdom Heating Equipment Market Product Developments

Recent product innovations focus on enhanced energy efficiency, smart functionalities, and integration with renewable energy sources. Heat pumps with advanced inverter technology and integrated controls are gaining popularity. Smart thermostats and remote monitoring capabilities are becoming standard features, offering users greater control and convenience. The integration of heat pumps with solar thermal systems and other renewable energy sources enhances efficiency and reduces reliance on fossil fuels. These advancements provide competitive edges for manufacturers by meeting the growing demand for sustainable and intelligent heating solutions.

Challenges in the United Kingdom Heating Equipment Market Market

The UK heating equipment market faces several challenges. Supply chain disruptions, particularly those related to semiconductor components crucial for smart technologies, impact production capacity and lead times. Rising raw material costs, primarily for metals and plastics, increase manufacturing costs and put pressure on profit margins. Intense competition among manufacturers necessitates continuous innovation and differentiation to secure market share. Furthermore, the complexity of installing certain technologies, such as heat pumps, may present a barrier to widespread adoption. Finally, the regulatory landscape surrounding building codes and energy efficiency standards evolves frequently, posing challenges for manufacturers to remain compliant. Quantifiable impact of these challenges is a reduction in forecasted growth by approximately xx% over the next three years.

Forces Driving United Kingdom Heating Equipment Market Growth

Several factors drive growth in the UK heating equipment market. Stringent government regulations aimed at reducing carbon emissions, coupled with ambitious net-zero targets, are propelling demand for low-carbon heating solutions like heat pumps. Increasing energy prices make energy efficiency a priority for both consumers and businesses, leading to higher demand for advanced heating systems. Technological advancements result in more efficient, cost-effective, and user-friendly heating products. The increasing focus on smart home technologies integrates heating systems into broader automation and energy management systems. Government incentives and financial support schemes for energy efficiency improvements further stimulate market growth.

Challenges in the United Kingdom Heating Equipment Market Market

Long-term growth hinges on continued technological innovation, focusing on enhanced efficiency, integration with renewable energy sources, and smart functionalities. Strategic partnerships between manufacturers and installers are essential to overcome barriers to adoption, such as the complexity of heat pump installations. Market expansion into underserved segments, such as the social housing sector, presents a significant opportunity for growth. Addressing supply chain vulnerabilities and mitigating the impact of fluctuating raw material costs are crucial for sustained market expansion.

Emerging Opportunities in United Kingdom Heating Equipment Market

Emerging trends highlight significant growth opportunities. The integration of heat pumps with solar PV systems and battery storage provides a pathway toward self-sufficient and sustainable heating solutions. Demand for smart heating systems with remote monitoring and control capabilities is expanding, creating opportunities for advanced technology integration. The growing interest in heat network technology offers potential for large-scale heating solutions in urban areas. Expansion into the retrofitting market, particularly for older buildings, presents a significant opportunity.

Leading Players in the United Kingdom Heating Equipment Market Sector

- Danfoss A/s

- Daikin Industries Ltd

- Robert Bosch Gmbh

- Clivet SpA

- Aermec SpA

- Mitsubishi Electric Europe BV (Mitsubishi Electric Corporation)

- Trane Inc

- Rhoss SpA

- Swegon Group AB

- Finn Geotherm UK Limited

- Systemair AB

Key Milestones in United Kingdom Heating Equipment Market Industry

- May 2022: FortisBC Energy Inc. announced a pilot program installing high-efficiency home and water heating equipment in 20 residential homes, demonstrating the potential for up to 50% energy savings and reduced GHG emissions. This highlights the growing focus on energy efficiency and sustainability.

- March 2022: UK researchers announced the development of a modular, multi-vector energy system for new and existing buildings, integrating solar power with heat storage. This signifies the advancement of innovative, sustainable heating solutions.

Strategic Outlook for United Kingdom Heating Equipment Market Market

The UK heating equipment market holds significant long-term growth potential, driven by factors such as stringent environmental regulations, rising energy costs, and technological advancements. Strategic opportunities lie in investing in R&D for energy-efficient and sustainable heating technologies, expanding into the retrofitting market, and forging strategic partnerships to address installation challenges. Focus on integrating smart technologies and providing comprehensive energy management solutions will be crucial for success. The market's trajectory is positive, with considerable opportunities for companies that can effectively leverage technological innovation, sustainable practices, and strategic partnerships to meet the evolving demands of the UK market.

United Kingdom Heating Equipment Market Segmentation

-

1. Type

- 1.1. Boilers/Radiators/Other Heaters

- 1.2. Furnaces

- 1.3. Heat Pumps

-

2. End-User Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

United Kingdom Heating Equipment Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Heating Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Replacement Of Existing Equipment With Better Performing Ones

- 3.3. Market Restrains

- 3.3.1. High Installation Cost of Heat Pumps

- 3.4. Market Trends

- 3.4.1. Supportive Government Regulations is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Heating Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Boilers/Radiators/Other Heaters

- 5.1.2. Furnaces

- 5.1.3. Heat Pumps

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United Kingdom Heating Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 7. Europe United Kingdom Heating Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Spain

- 7.1.2 France

- 7.1.3 Italy

- 7.1.4 Germany

- 7.1.5 Netherlands

- 8. Asia United Kingdom Heating Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 South Korea

- 9. Australia and New Zealand United Kingdom Heating Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America United Kingdom Heating Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa United Kingdom Heating Equipment Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Danfoss A/s*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Daikin Industries Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Robert Bosch Gmbh

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Clivet SpA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aermec SpA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Mitsubishi Electric Europe BV (Mitsubishi Electric Corporation)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Trane Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rhoss SpA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Swegon Group AB

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Finn Geotherm UK Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Systemair AB

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Danfoss A/s*List Not Exhaustive

List of Figures

- Figure 1: United Kingdom Heating Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Heating Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Heating Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Heating Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United Kingdom Heating Equipment Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: United Kingdom Heating Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Kingdom Heating Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Heating Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Spain United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Heating Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Heating Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Heating Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Heating Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom Heating Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Kingdom Heating Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: United Kingdom Heating Equipment Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 27: United Kingdom Heating Equipment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Heating Equipment Market?

The projected CAGR is approximately 4.73%.

2. Which companies are prominent players in the United Kingdom Heating Equipment Market?

Key companies in the market include Danfoss A/s*List Not Exhaustive, Daikin Industries Ltd, Robert Bosch Gmbh, Clivet SpA, Aermec SpA, Mitsubishi Electric Europe BV (Mitsubishi Electric Corporation), Trane Inc, Rhoss SpA, Swegon Group AB, Finn Geotherm UK Limited, Systemair AB.

3. What are the main segments of the United Kingdom Heating Equipment Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Replacement Of Existing Equipment With Better Performing Ones.

6. What are the notable trends driving market growth?

Supportive Government Regulations is Driving the Market Growth.

7. Are there any restraints impacting market growth?

High Installation Cost of Heat Pumps.

8. Can you provide examples of recent developments in the market?

May 2022 - FortisBC Energy Inc. announced it is installing the next generation of high-efficiency home and water heating equipment in 20 residential homes as part of a FortisBC pilot program, With the potential to cut the energy needed for space and water heating by up to 50 percent and lower greenhouse gas (GHG) emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Heating Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Heating Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Heating Equipment Market?

To stay informed about further developments, trends, and reports in the United Kingdom Heating Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence