Key Insights

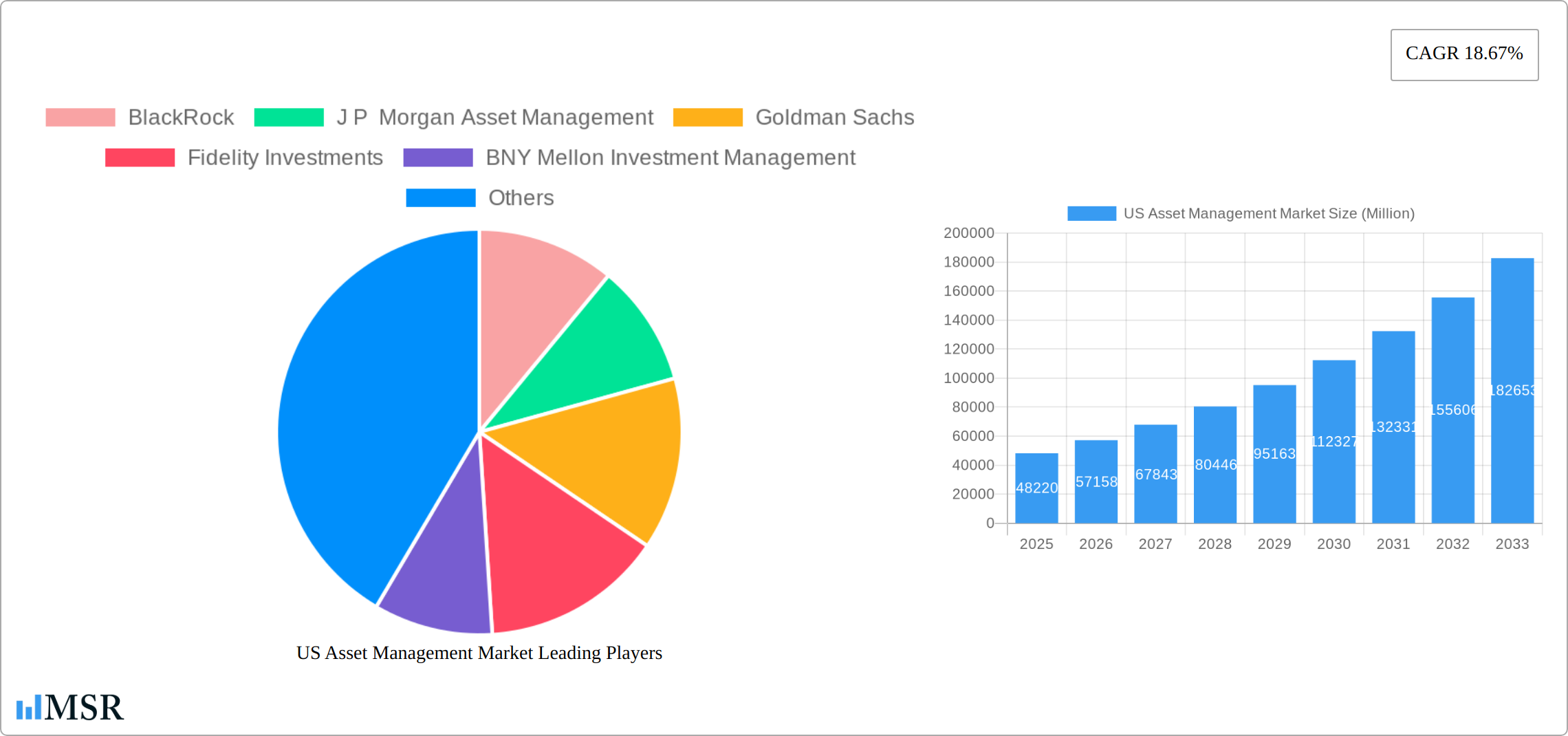

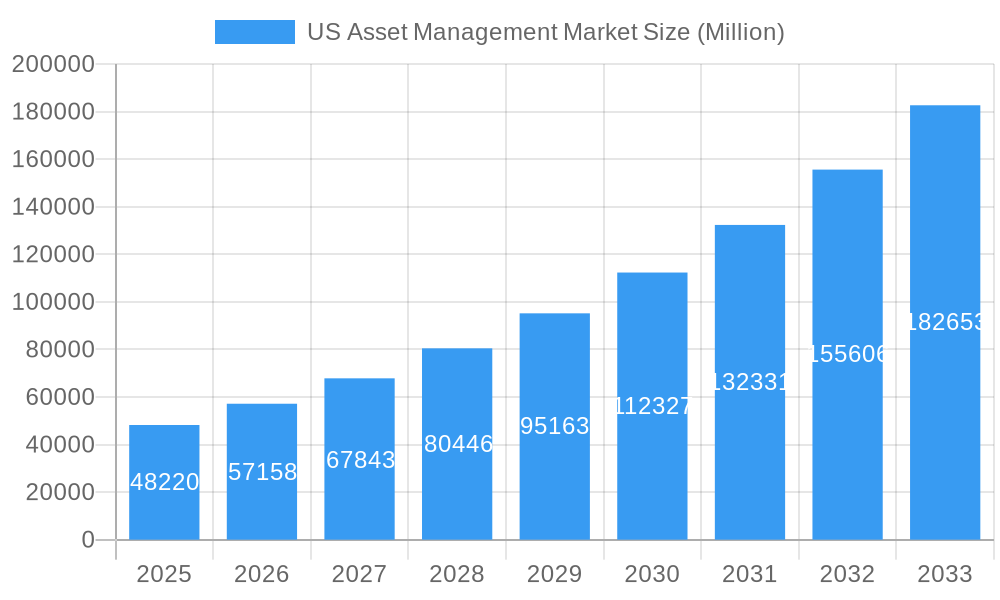

The US asset management market is a robust and rapidly expanding sector, projected to reach a market size of $48.22 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 18.67% from 2019 to 2033. This significant growth is fueled by several key factors. Increased individual investor participation, driven by factors like rising disposable incomes and greater financial literacy, is a major contributor. Furthermore, the expanding retirement savings market, including 401(k) plans and individual retirement accounts (IRAs), significantly boosts demand for asset management services. Technological advancements, such as the rise of robo-advisors and algorithmic trading, are also streamlining operations and driving down costs, making investment management more accessible to a wider range of investors. The market’s growth is also underpinned by institutional investors, including pension funds, endowments, and sovereign wealth funds, which consistently seek professional asset management to optimize their portfolios. Competition is fierce, with major players such as BlackRock, JPMorgan Asset Management, and Fidelity Investments vying for market share through innovative product offerings and strategic acquisitions.

US Asset Management Market Market Size (In Billion)

Despite the positive growth trajectory, the US asset management market faces certain challenges. Regulatory changes and increasing compliance costs pose ongoing pressure on margins. Furthermore, geopolitical uncertainty and fluctuating market conditions can impact investor sentiment and investment flows. The ongoing evolution of technology necessitates continuous adaptation and investment in innovative solutions to maintain a competitive edge. However, the long-term outlook for the US asset management market remains optimistic, driven by consistent growth in investable assets, increasing demand for sophisticated investment strategies, and the ongoing development of innovative financial technologies. The market segmentation, while not explicitly detailed, likely includes various asset classes (equities, fixed income, alternatives), service models (active vs. passive management), and client segments (institutional vs. retail). The robust growth forecast suggests a substantial opportunity for established players and new entrants alike to capitalize on the market's expansion.

US Asset Management Market Company Market Share

US Asset Management Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the US Asset Management Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report delivers a robust understanding of market dynamics, growth drivers, and emerging opportunities. The report meticulously analyzes market size, CAGR, and key segments, providing actionable intelligence for informed strategic planning. Leading players such as BlackRock, J P Morgan Asset Management, Goldman Sachs, Fidelity Investments, and others are profiled, highlighting their market share and competitive strategies.

US Asset Management Market Concentration & Dynamics

The US asset management market exhibits a high degree of concentration, with a few dominant players commanding significant market share. BlackRock, Vanguard, and Fidelity Investments consistently rank among the top firms, holding a collective share estimated at xx% in 2025. However, the market is characterized by ongoing M&A activity, with approximately xx deals recorded in the historical period (2019-2024), indicating a dynamic competitive landscape.

- Market Concentration: High, with top players holding significant market share.

- Innovation Ecosystems: Strong presence of fintech startups driving innovation in areas like robo-advisory and alternative investments.

- Regulatory Frameworks: Stringent regulations impacting investment strategies and operational practices.

- Substitute Products: Competition from alternative investment vehicles and direct investment options.

- End-User Trends: Increasing demand for ESG (Environmental, Social, and Governance) investing and personalized investment solutions.

- M&A Activity: High levels of mergers and acquisitions, particularly in the fintech and private equity segments. The recent acquisitions of Kreos by BlackRock and Shoobx by Fidelity Investments exemplify this trend.

US Asset Management Market Industry Insights & Trends

The US asset management market is projected to experience significant growth during the forecast period (2025-2033), with an estimated CAGR of xx%. This growth is driven by several factors, including increasing household wealth, rising demand for professional investment management services, the expansion of alternative investments, and technological advancements. The market size is projected to reach xx Million by 2033. Technological disruptions, such as the rise of robo-advisors and AI-powered investment platforms, are transforming the industry, leading to increased efficiency and accessibility for investors. Evolving consumer behaviors, including a preference for personalized financial advice and ESG-conscious investing, are also reshaping the landscape. The increasing adoption of digital channels and the growing demand for personalized financial advice are key drivers of market growth. Regulatory changes also play a significant role, impacting investment strategies and compliance measures.

Key Markets & Segments Leading US Asset Management Market

The US asset management market remains a dynamic landscape, with active management strategies continuing to hold a significant portion of the market share despite the rising popularity of passive investment approaches. While passive investments have experienced substantial growth, particularly in index funds and ETFs, active management retains its dominance due to several key factors.

- Drivers of Active Management Dominance:

- Higher Fee Structures: Active management strategies typically command higher fees compared to passive alternatives, contributing significantly to revenue streams for asset managers.

- Potential for Outperformance: Many investors believe that skilled active managers can consistently outperform market benchmarks, although this is not always the case and requires careful consideration of long-term performance and risk-adjusted returns.

- Specialized Expertise: Active managers often possess specialized knowledge and expertise in specific market segments (e.g., emerging markets, private equity) and investment styles (e.g., value investing, growth investing), enabling them to cater to niche investor needs.

- Tailored Investment Strategies: Active managers can create customized portfolios tailored to individual investor goals, risk tolerance, and time horizons, offering a level of personalization often lacking in passive strategies.

- Regional Distribution and Growth: While major financial hubs like New York, Boston, and San Francisco remain central to the industry, technological advancements and remote work trends are fostering geographic diversification. The expansion of online platforms and digital asset management tools is making services increasingly accessible to clients across various regions.

US Asset Management Market Product Developments

Innovation is a key driver of the US asset management market's evolution. Recent product developments are characterized by a strong emphasis on technological advancements and client-centric service enhancements. The adoption of innovative technologies is transforming how investment products are offered and managed:

- Robo-Advisors and Algorithmic Trading: Automated investment platforms and algorithmic trading tools are increasing efficiency and accessibility, allowing for lower-cost portfolio management and personalized investment strategies for a wider range of clients.

- AI-Driven Portfolio Management: Artificial intelligence is increasingly used to analyze vast datasets, identify market trends, and optimize portfolio allocations, enhancing risk management and potentially boosting returns.

- ESG Integration: The integration of Environmental, Social, and Governance (ESG) factors into investment strategies is rapidly gaining traction, reflecting the growing importance of sustainable and responsible investing among both investors and regulators.

- Alternative Investments: The market is witnessing increasing interest in alternative investment strategies, including private equity, hedge funds, and real estate, as investors seek diversification and potentially higher returns.

Challenges in the US Asset Management Market Market

The US asset management market faces several challenges including increased regulatory scrutiny, intense competition, and evolving client expectations. These factors place pressure on margins and necessitate continuous innovation to maintain market share. Cybersecurity threats and the need to comply with data privacy regulations present further challenges. The impact of these challenges on profitability and market growth is substantial, requiring proactive risk management and adaptation strategies.

Forces Driving US Asset Management Market Growth

Key growth drivers include:

- Technological advancements: AI, machine learning, and blockchain technology are revolutionizing investment strategies and operational efficiency.

- Economic growth: Expansion of the economy fuels increased household wealth, leading to higher demand for asset management services.

- Favorable regulatory environment: While regulatory scrutiny exists, a supportive framework encourages innovation and market expansion.

Long-Term Growth Catalysts in the US Asset Management Market

Long-term growth will be fueled by innovations in alternative investment strategies, strategic partnerships, and international expansion. The increasing focus on personalization and the adoption of advanced technologies will also play a significant role in driving future growth.

Emerging Opportunities in US Asset Management Market

Emerging opportunities include:

- Growth in alternative investments: Private equity, hedge funds, and real estate present significant growth potential.

- Demand for ESG investing: Sustainable and responsible investment strategies are gaining traction, creating new market niches.

- Expansion into underserved markets: Reaching out to a broader demographic of investors opens up new revenue streams.

Leading Players in the US Asset Management Market Sector

Key Milestones in US Asset Management Market Industry

- August 2023: BlackRock's acquisition of Kreos signifies a strategic expansion into the private markets, highlighting the increasing importance of alternative investments.

- January 2023: Fidelity Investments' acquisition of Shoobx strengthens its technological capabilities in equity management and financing, reflecting the ongoing digital transformation of the industry.

- [Add other relevant recent milestones here – Include dates and brief descriptions]

Strategic Outlook for US Asset Management Market Market

The US asset management market is projected to experience continued growth, fueled by several key factors: the ongoing adoption of technology, evolving investor preferences towards personalized and sustainable investment solutions, and the expanding role of alternative investments. Firms that successfully adapt to these trends and demonstrate a commitment to innovation will be best positioned for success.

- Technological Advancement: Firms that effectively leverage technology to enhance operational efficiency, personalize client experiences, and develop sophisticated risk management systems will gain a competitive advantage.

- ESG Integration: Meeting the growing demand for ESG-integrated investment strategies will be critical for attracting and retaining clients increasingly concerned about sustainability and responsible investing.

- Client Focus: Providing superior client service and personalized investment solutions tailored to individual needs will be crucial for building trust and loyalty.

- Regulatory Compliance: Navigating a complex and evolving regulatory landscape will be paramount for maintaining operational integrity and ensuring client protection.

The future success of firms within this market hinges on their ability to deliver superior risk-adjusted returns while adapting to the evolving demands of a dynamic and competitive environment.

US Asset Management Market Segmentation

-

1. Client Type

- 1.1. Retail

- 1.2. Pension Fund

- 1.3. Insurance Companies

- 1.4. Banks

- 1.5. Other Client Types

-

2. Asset Class

- 2.1. Equity

- 2.2. Fixed Income

- 2.3. Cash/Money Market

- 2.4. Alternative Investments

- 2.5. Other Asset Classes

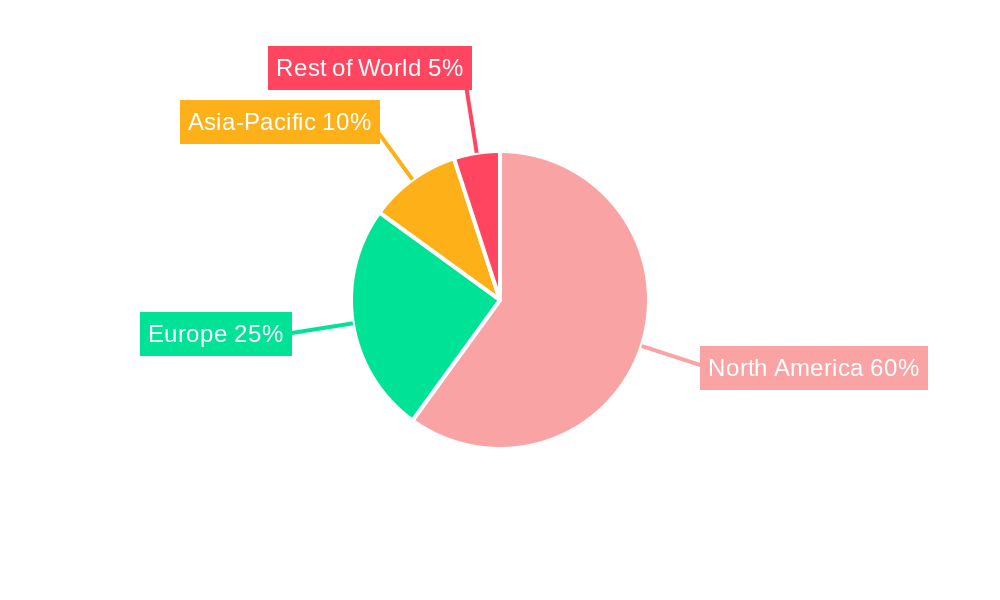

US Asset Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Asset Management Market Regional Market Share

Geographic Coverage of US Asset Management Market

US Asset Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rapid Growth in Advanced Technologies such as AI

- 3.2.2 IoT

- 3.2.3 Etc.

- 3.2.4 ; Increase in Wealth of HNI's is Driving the Market

- 3.3. Market Restrains

- 3.3.1 Rapid Growth in Advanced Technologies such as AI

- 3.3.2 IoT

- 3.3.3 Etc.

- 3.3.4 ; Increase in Wealth of HNI's is Driving the Market

- 3.4. Market Trends

- 3.4.1. US Portfolio Management Systems Market Set for Robust Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. Retail

- 5.1.2. Pension Fund

- 5.1.3. Insurance Companies

- 5.1.4. Banks

- 5.1.5. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Asset Class

- 5.2.1. Equity

- 5.2.2. Fixed Income

- 5.2.3. Cash/Money Market

- 5.2.4. Alternative Investments

- 5.2.5. Other Asset Classes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. North America US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. Retail

- 6.1.2. Pension Fund

- 6.1.3. Insurance Companies

- 6.1.4. Banks

- 6.1.5. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Asset Class

- 6.2.1. Equity

- 6.2.2. Fixed Income

- 6.2.3. Cash/Money Market

- 6.2.4. Alternative Investments

- 6.2.5. Other Asset Classes

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. South America US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. Retail

- 7.1.2. Pension Fund

- 7.1.3. Insurance Companies

- 7.1.4. Banks

- 7.1.5. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Asset Class

- 7.2.1. Equity

- 7.2.2. Fixed Income

- 7.2.3. Cash/Money Market

- 7.2.4. Alternative Investments

- 7.2.5. Other Asset Classes

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. Europe US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. Retail

- 8.1.2. Pension Fund

- 8.1.3. Insurance Companies

- 8.1.4. Banks

- 8.1.5. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Asset Class

- 8.2.1. Equity

- 8.2.2. Fixed Income

- 8.2.3. Cash/Money Market

- 8.2.4. Alternative Investments

- 8.2.5. Other Asset Classes

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. Middle East & Africa US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. Retail

- 9.1.2. Pension Fund

- 9.1.3. Insurance Companies

- 9.1.4. Banks

- 9.1.5. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Asset Class

- 9.2.1. Equity

- 9.2.2. Fixed Income

- 9.2.3. Cash/Money Market

- 9.2.4. Alternative Investments

- 9.2.5. Other Asset Classes

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Asia Pacific US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. Retail

- 10.1.2. Pension Fund

- 10.1.3. Insurance Companies

- 10.1.4. Banks

- 10.1.5. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Asset Class

- 10.2.1. Equity

- 10.2.2. Fixed Income

- 10.2.3. Cash/Money Market

- 10.2.4. Alternative Investments

- 10.2.5. Other Asset Classes

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BlackRock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 J P Morgan Asset Management

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fidelity Investments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BNY Mellon Investment Management

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Vanguard Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 State Street Global Advisors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pacific Investment Management Company LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Franklin Templeton Investments

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wellington Management Company LLC**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BlackRock

List of Figures

- Figure 1: Global US Asset Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Asset Management Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 4: North America US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 5: North America US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 6: North America US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 7: North America US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 8: North America US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 9: North America US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 10: North America US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 11: North America US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 16: South America US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 17: South America US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 18: South America US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 19: South America US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 20: South America US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 21: South America US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 22: South America US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 23: South America US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 24: South America US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 28: Europe US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 29: Europe US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 30: Europe US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 31: Europe US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 32: Europe US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 33: Europe US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 34: Europe US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 35: Europe US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 40: Middle East & Africa US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 41: Middle East & Africa US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 42: Middle East & Africa US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 43: Middle East & Africa US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 44: Middle East & Africa US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 45: Middle East & Africa US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 46: Middle East & Africa US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 47: Middle East & Africa US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 52: Asia Pacific US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 53: Asia Pacific US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 54: Asia Pacific US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 55: Asia Pacific US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 56: Asia Pacific US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 57: Asia Pacific US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 58: Asia Pacific US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 59: Asia Pacific US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific US Asset Management Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 4: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 5: Global US Asset Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US Asset Management Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 9: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 10: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 11: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 20: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 21: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 22: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 23: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 32: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 33: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 34: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 35: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 56: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 57: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 58: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 59: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 74: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 75: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 76: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 77: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Asset Management Market?

The projected CAGR is approximately 18.67%.

2. Which companies are prominent players in the US Asset Management Market?

Key companies in the market include BlackRock, J P Morgan Asset Management, Goldman Sachs, Fidelity Investments, BNY Mellon Investment Management, The Vanguard Group, State Street Global Advisors, Pacific Investment Management Company LLC, Franklin Templeton Investments, Wellington Management Company LLC**List Not Exhaustive.

3. What are the main segments of the US Asset Management Market?

The market segments include Client Type, Asset Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth in Advanced Technologies such as AI. IoT. Etc.. ; Increase in Wealth of HNI's is Driving the Market.

6. What are the notable trends driving market growth?

US Portfolio Management Systems Market Set for Robust Growth.

7. Are there any restraints impacting market growth?

Rapid Growth in Advanced Technologies such as AI. IoT. Etc.. ; Increase in Wealth of HNI's is Driving the Market.

8. Can you provide examples of recent developments in the market?

In August 2023, BlackRock Inc., a prominent international credit asset manager, acquired Kreos. Kreos, renowned for its specialization in growth and risk-based financing for technology and healthcare enterprises, enhances BlackRock's market presence. This acquisition aligns with BlackRock's strategic objective of broadening its private-market investment portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Asset Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Asset Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Asset Management Market?

To stay informed about further developments, trends, and reports in the US Asset Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence